Post-effective Amendment Filed Solely to Add Exhibits to a Registration Statement (pos Ex)

April 28 2017 - 4:27PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on April 28, 2017

Registration No. 333-215606

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective Amendment No. 2

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Alcoa Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

3334

|

|

81-1789115

|

|

(State or other jurisdiction

of incorporation)

|

|

(Primary Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

390 Park Avenue

New York, New York 10022-4608

(212) 518-5400

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jeffrey D.

Heeter

Executive Vice President, General Counsel and Secretary

201 Isabella Street, Suite 500

Pittsburgh, Pennsylvania 15212-5858

(412) 315-2900

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

|

|

|

|

Craig B. Brod

Sung K. Kang

Cleary

Gottlieb Steen & Hamilton LLP

One Liberty Plaza

New York, New York 10006

(212) 225-2000

|

|

Andrew J. Pitts

D. Scott Bennett

Cravath,

Swaine & Moore LLP

Worldwide Plaza

825 Eighth Avenue

New

York, New York 10019

(212) 474-1000

|

Approximate date of commencement of proposed sale to the public:

From time to time after the effectiveness of this registration

statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for

an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☐

|

|

Accelerated filer

|

|

☐

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☒ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☐

|

This Post-Effective Amendment shall become effective upon filing with the Securities and Exchange Commission in accordance with Rule 462(d)

under the Securities Act of 1933, as amended.

EXPLANATORY NOTE

This Post-Effective Amendment No.2 (this “Amendment”) to the Registration Statement on Form S-1 (File No. 333-215606) (the

“Registration Statement”) of Alcoa Corporation is being filed pursuant to Rule 462(d) under the Securities Act of 1933, as amended (the “Securities Act”), solely to add an exhibit to the previously effective Registration

Statement by removing the previously filed Exhibit 1.1 and replace it with Exhibit 1.1 filed herewith. Accordingly, this Amendment consists only of a facing page, this explanatory note and Part II Item 16(a) of the Registration Statement on

Form S-1 setting forth the exhibits to the Registration Statement. This Amendment does not modify any other part of the Registration Statement. Pursuant to Rule 462(d), this Amendment shall become effective immediately upon filing with the

Securities and Exchange Commission.

1

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

|

Item 16.

|

Exhibits and Financial Statement Schedules.

|

The list of exhibits is set forth under “Exhibit Index” at the end

of this registration statement and is incorporated herein by reference.

|

(b)

|

Financial Statement Schedules

|

Financial Statement schedules have been omitted because

they are not applicable, not required or the required information is included in the Consolidated Financial Statements or notes thereto, incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant has duly caused this registration statement to be signed on its

behalf by the undersigned, thereunto duly authorized in the City of New York, State of New York, on April 28, 2017.

|

|

|

|

|

|

|

ALCOA CORPORATION

|

|

|

|

|

By:

|

|

/s/ Roy C. Harvey

|

|

|

|

Name:

|

|

Roy C. Harvey

|

|

|

|

Title:

|

|

Chief Executive Officer

|

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed

by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ Roy C.

Harvey

|

|

Chief Executive Officer and Director

(Principal Executive Officer)

|

|

April 28, 2017

|

|

Roy C. Harvey

|

|

|

|

|

|

|

|

|

/s/ William F.

Oplinger

|

|

Executive Vice President and Chief Financial

Officer (Principal Financial Officer)

|

|

April 28, 2017

|

|

William F. Oplinger

|

|

|

|

|

|

|

|

|

/s/ Molly S. Beerman

|

|

Vice President and Controller (Principal Accounting Officer)

|

|

April 28, 2017

|

|

Molly S. Beerman

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

April 28, 2017

|

|

Mary Anne Citrino

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

April 28, 2017

|

|

Timothy P. Flynn

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

April 28, 2017

|

|

Kathryn S. Fuller

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

April 28, 2017

|

|

James A. Hughes

|

|

|

|

|

|

|

|

|

|

*

|

|

Chairman of the Board

|

|

April 28, 2017

|

|

Michael G. Morris

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

April 28, 2017

|

|

James E. Nevels

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

April 28, 2017

|

|

James W. Owens

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

April 28, 2017

|

|

Carol L. Roberts

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

April 28, 2017

|

|

Suzanne Sitherwood

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

April 28, 2017

|

|

Steven W. Williams

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

April 28, 2017

|

|

Ernesto Zedillo

|

|

|

|

|

|

|

|

|

|

/s/ Jeffrey D. Heeter

|

|

By: Attorney-in-fact

|

|

April 28, 2017

|

|

Name: Jeffrey D. Heeter

|

|

|

|

|

INDEX TO EXHIBITS

|

|

|

|

|

Exhibit

No.

|

|

Description of Exhibit

|

|

|

|

|

1.1

|

|

Underwriting Agreement, dated as of April 26, 2017, among Alcoa Corporation, Arconic Inc., Citigroup Global Markets Inc. and Credit Suisse Securities (USA) LLC*

|

|

|

|

|

2.1

|

|

Separation and Distribution Agreement, dated as of October 31, 2016, by and between Arconic Inc. and Alcoa Corporation (incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K dated November 4,

2016)

|

|

|

|

|

2.2

|

|

Transition Services Agreement, dated as of October 31, 2016, by and between Arconic Inc. and Alcoa Corporation (incorporated by reference to Exhibit 2.2 to the Company’s Current Report on Form 8-K dated November 4,

2016)

|

|

|

|

|

2.3

|

|

Tax Matters Agreement, dated as of October 31, 2016, by and between Arconic Inc. and Alcoa Corporation (incorporated by reference to Exhibit 2.3 to the Company’s Current Report on Form 8-K dated November 4, 2016)

|

|

|

|

|

2.4

|

|

Employee Matters Agreement, dated as of October 31, 2016, by and between Arconic Inc. and Alcoa Corporation (incorporated by reference to Exhibit 2.4 to the Company’s Current Report on Form 8-K dated November 4, 2016)

|

|

|

|

|

2.5

|

|

Amendment No. 1 to Employee Matters Agreement, dated as of December 13, 2016, by and between Arconic Inc. and Alcoa Corporation**

|

|

|

|

|

2.6

|

|

Alcoa Corporation to Arconic Inc. Patent, Know-How, and Trade Secret License Agreement, dated as of October 31, 2016, by and between Alcoa USA Corp. and Arconic Inc. (incorporated by reference to Exhibit 2.5 to the Company’s

Current Report on Form 8-K dated November 4, 2016)

|

|

|

|

|

2.7

|

|

Arconic Inc. to Alcoa Corporation Patent, Know-How, and Trade Secret License Agreement, dated as of October 31, 2016, by and between Arconic Inc. and Alcoa USA Corp. (incorporated by reference to Exhibit 2.6 to the Company’s

Current Report on Form 8-K dated November 4, 2016)

|

|

|

|

|

2.8

|

|

Alcoa Corporation to Arconic Inc. Trademark License Agreement, dated as of October 31, 2016, by and between Alcoa USA Corp. and Arconic Inc. (incorporated by reference to Exhibit 2.7 to the Company’s Current Report on Form 8-K

dated November 4, 2016)

|

|

|

|

|

2.9

|

|

Toll Processing and Services Agreement, dated as of October 31, 2016, by and between Arconic Inc. and Alcoa Warrick LLC (incorporated by reference to Exhibit 2.8 to the Company’s Current Report on Form 8-K dated

November 4, 2016)

|

|

|

|

|

2.10

|

|

Master Agreement for the Supply of Primary Aluminum, dated as of October 31, 2016, by and between Alcoa Corporation and its affiliates and Arconic Inc. (incorporated by reference to Exhibit 2.9 to the Company’s Current Report

on Form 8-K dated November 4, 2016)

|

|

|

|

|

2.11

|

|

Massena Land Lease Agreement, dated as of October 31, 2016, by and between Arconic Inc. and Alcoa USA Corp. (incorporated by reference to Exhibit 2.10 to the Company’s Current Report on Form 8-K dated November 4,

2016)

|

|

|

|

|

2.12

|

|

English Translation of Fusina Lease and Operations Agreement by and between Alcoa Servizi S.r.l. and Fusina Rolling S.r.l., dated as of August 4, 2016 (incorporated by reference to Exhibit 2.11 to Amendment No. 1 to the

Company’s Registration Statement on Form 10 (Commission file number 1-37816) filed on August 12, 2016)

|

|

|

|

|

3.1

|

|

Amended and Restated Certificate of Incorporation of Alcoa Corporation (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K dated November 3, 2016)

|

|

|

|

|

3.2

|

|

Amended and Restated Bylaws of Alcoa Corporation (incorporated by reference to Exhibit 3.2 to the Company’s Current Report on Form 8-K dated November 3, 2016)

|

|

|

|

|

4.1

|

|

Stockholder and Registration Rights Agreement, dated as of October 31, 2016, by and between Arconic Inc. and Alcoa Corporation (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K dated November

4, 2016)

|

|

|

|

|

4.2

|

|

Indenture, dated September 27, 2016, among Alcoa Nederland Holding B.V., Alcoa Upstream Corporation and The Bank of New York Mellon Trust Company, N.A. (incorporated by reference to Exhibit 10.19 to Amendment No. 4 to the

Company’s Registration Statement on Form 10 (Commission file number 1-37816) filed on September 29, 2016)

|

|

|

|

|

4.3

|

|

Supplemental Indenture, dated as of November 1, 2016, among the entities listed in Annex A thereto, subsidiaries of Alcoa Corporation, Alcoa Corporation, Alcoa Nederland Holding B.V. and The Bank Of New York Mellon Trust

Company, N.A. (incorporated by reference to Exhibit 4.3 to the Company’s Current Report on Form 8-K dated November 4, 2016)

|

|

|

|

|

5.1

|

|

Opinion of Cleary Gottlieb Steen & Hamilton LLP**

|

|

|

|

|

|

Exhibit

No.

|

|

Description of Exhibit

|

|

|

|

|

10.1

|

|

Revolving Credit Agreement dated as of September 16, 2016, among Alcoa Upstream Corporation, as Holdings, Alcoa Nederland Holding B.V., as the Borrower, a syndicate of lenders and issuers named therein and JPMorgan Chase Bank,

N.A., as administrative agent (incorporated by reference to Exhibit 99.1 to Alcoa Inc.’s Current Report on Form 8-K dated September 19, 2016)

|

|

|

|

|

10.2

|

|

Amendment No. 1, dated October 26, 2016, to the Revolving Credit Agreement, dated as of September 16, 2016, among Alcoa Upstream Corporation, Alcoa Nederland Holding B.V., the lenders and issuers from time to time party

thereto, and JPMorgan Chase Bank, N.A. as administrative agent for the lenders and issuers (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K dated October 31, 2016)

|

|

|

|

|

10.3

|

|

Amended and Restated Charter of the Strategic Council for the AWAC Joint Venture (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K dated November 4, 2016)

|

|

|

|

|

10.4

|

|

Third Amended and Restated Limited Liability Company Agreement of Alcoa World Alumina LLC, dated as of November 1, 2016, by and among Alcoa USA Corp., ASC Alumina, Alumina International Holdings Pty Ltd, Alumina (USA) Inc.,

Reynolds Metals Company, LLC and Reynolds Metals Exploration, Inc. (incorporated by reference to Exhibit 10.2 to the Company’s Current Report on Form 8-K dated November 4, 2016)

|

|

|

|

|

10.5

|

|

Side Letter of November 1, 2016, between Alcoa Corporation and Alumina Limited clarifying transfer restrictions (incorporated by reference to Exhibit 10.3 to the Company’s Current Report on Form 8-K dated November 4,

2016)

|

|

|

|

|

10.6

|

|

Enterprise Funding Agreement (Restated), dated November 1, 2016, between Alcoa Corporation, Alumina Limited, Alcoa Australian Holdings Pty Ltd, Alcoa of Australia Limited and Enterprise Funding Partnership (as defined therein)

(incorporated by reference to Exhibit 10.4 to the Company’s Current Report on Form 8-K dated November 4, 2016)

|

|

|

|

|

10.7

|

|

Alcoa Corporation 2016 Stock Incentive Plan (incorporated by reference to Exhibit 4.3 to Alcoa Corporation’s Registration Statement on Form S-8 (Commission file number 333-214420), filed on November 3, 2016)

|

|

|

|

|

10.8

|

|

Alcoa USA Corp. Deferred Compensation Plan (incorporated by reference to Exhibit 10.2 to Amendment No. 1 to the Company’s Registration Statement on Form 10 (Commission file number 1-37816) filed on August 12,

2016)

|

|

|

|

|

10.9

|

|

Alcoa USA Corp. Nonqualified Supplemental Retirement Plan C (incorporated by reference to Exhibit 10.3 to Amendment No. 1 to the Company’s Registration Statement on Form 10 (Commission file number 1-37816) filed on August 12,

2016)

|

|

|

|

|

10.10

|

|

Form of Indemnification Agreement by and between Alcoa Corporation and individual directors or officers (incorporated by reference to Exhibit 10.4 to Amendment No. 3 to the Company’s Registration Statement on Form 10

(Commission file number 1-37816) filed on September 13, 2016)

|

|

|

|

|

10.11

|

|

Aluminum Project Framework Shareholders’ Agreement, dated December 20, 2009, between Alcoa Inc. and Saudi Arabian Mining Company (Ma’aden) (incorporated by reference to Exhibit 10(i) to Alcoa Inc.’s Annual Report on

Form 10-K (Commission file number 1-3610) for the year ended December 31, 2009, filed on February 18, 2010)

|

|

|

|

|

10.12

|

|

First Supplemental Agreement, dated March 30, 2010, to the Aluminium Project Framework Shareholders Agreement, dated December 20, 2009, between Saudi Arabian Mining Company (Ma’aden) and Alcoa Inc. (incorporated by reference to

Exhibit 10(c) to Alcoa Inc.’s Quarterly Report on Form 10-Q (Commission file number 1-3610) for the quarter ended March 31, 2010, filed on April 22, 2010)

|

|

|

|

|

10.13

|

|

Kwinana State Agreement of 1961 (incorporated by reference to Exhibit 10.7 to Amendment No. 2 to the Company’s Registration Statement on Form 10 (Commission file number 1-37816) filed on September 1, 2016)

|

|

|

|

|

10.14

|

|

Pinjarra State Agreement of 1969 (incorporated by reference to Exhibit 10.8 to Amendment No. 2 to the Company’s Registration Statement on Form 10 (Commission file number 1-37816) filed on September 1, 2016)

|

|

|

|

|

10.15

|

|

Wagerup State Agreement of 1978 (incorporated by reference to Exhibit 10.9 to Amendment No. 2 to the Company’s Registration Statement on Form 10 (Commission file number 1-37816) filed on September 1, 2016)

|

|

|

|

|

10.16

|

|

Alumina Refinery Agreement of 1987 (incorporated by reference to Exhibit 10.10 to Amendment No. 2 to the Company’s Registration Statement on Form 10 (Commission file number 1-37816) filed on September 1, 2016)

|

|

|

|

|

10.17

|

|

Amended and Restated Limited Liability Company Agreement of Alcoa Alumina & Chemicals, L.L.C. dated as of December 31, 1994 (incorporated by reference to Exhibit 99.4 to Alcoa Inc.’s Current Report on Form 8-K

(Commission file number 1-3610), filed on November 28, 2001)

|

|

|

|

|

|

Exhibit

No.

|

|

Description of Exhibit

|

|

|

|

|

10.18

|

|

Shareholders’ Agreement between Alcoa of Australia Limited, Alcoa Australian Pty Ltd and Alumina Limited, originally dated as of May 10, 1996 (incorporated by reference to Exhibit 10.13 to Amendment No. 2 to the

Company’s Registration Statement on Form 10 (Commission file number 1-37816) filed on September 1, 2016)

|

|

|

|

|

10.19

|

|

Side Letter of November 1, 2016, between Alcoa Corporation and Alumina Limited clarifying transfer restrictions (incorporated by reference to Exhibit 10.3 to the Company’s Current Report on Form 8-K dated November 4,

2016)

|

|

|

|

|

10.20

|

|

Enterprise Funding Agreement (Restated), dated November 1, 2016, between Alcoa Corporation, Alumina Limited, Alcoa Australian Holdings Pty Ltd, Alcoa of Australia Limited and Enterprise Funding Partnership (as defined therein)

(incorporated by reference to Exhibit 10.4 to the Company’s Current Report on Form 8-K dated November 4, 2016)

|

|

|

|

|

10.21

|

|

Amendments to Enterprise Funding Agreement, effective January 25, 2008, between Alcoa Inc., certain of its affiliates and Alumina Limited (incorporated by reference to Exhibit 10(f)(1) to Alcoa Inc.’s Annual Report on Form 10-K

(Commission file number 1-3610) for the year ended December 31, 2007, filed on February 15, 2008)

|

|

|

|

|

10.22

|

|

Plea Agreement dated January 8, 2014, between the United States of America and Alcoa World Alumina LLC (incorporated by reference to Exhibit 10(l) to Alcoa Inc.’s Annual Report on Form 10-K for the year ended December

31, 2013, filed on February 13, 2014)

|

|

|

|

|

10.23

|

|

Alcoa Corporation Change in Control Severance Plan, dated as of December 1, 2016**

|

|

|

|

|

10.24

|

|

Incentive Compensation Plan of Alcoa Corporation (incorporated by reference to Exhibit 10.8 to the Company’s Current Report on Form 8-K dated November 4, 2016)

|

|

|

|

|

10.25

|

|

Alcoa Corporation Internal Revenue Code 162(m) Compliant Annual Cash Incentive Compensation Plan (incorporated by reference to Exhibit 10.7 to the Company’s Current Report on Form 8-K dated November 4, 2016)

|

|

|

|

|

10.26

|

|

Form of Alcoa Corporation 2016 Deferred Fee Plan for Directors (incorporated by reference to Exhibit 10.24 to Amendment No. 4 to the Company’s Registration Statement on Form 10 (Commission file number 1-37816) filed on

September 29, 2016)

|

|

|

|

|

10.27

|

|

Form of Alcoa Corporation Corporate Officer Severance Agreement, effective December 1, 2016**

|

|

|

|

|

10.28

|

|

Form of Alcoa Corporation Chief Executive Officer and Chief Financial Officer Severance Agreement, effective December 1, 2016**

|

|

|

|

|

10.29

|

|

Terms and Conditions for Employee Restricted Share Units**

|

|

|

|

|

10.30

|

|

Terms and Conditions for Employee Stock Option Awards**

|

|

|

|

|

10.31

|

|

Terms and Conditions for Employee Special Retention Awards**

|

|

|

|

|

10.32

|

|

Alcoa Corporation Non-Employee Director Compensation Policy, effective November 1, 2016**

|

|

|

|

|

10.33

|

|

Appendix C to the Alcoa Corporation Deferred Fee Plan for Directors, effective December 1, 2016**

|

|

|

|

|

10.34

|

|

Terms and Conditions for Deferred Fee Restricted Share Units Director Awards, effective December 1, 2016**

|

|

|

|

|

10.35

|

|

Terms and Conditions for Restricted Share Units Annual Director Awards, effective December 1, 2016**

|

|

|

|

|

21.1

|

|

List of Subsidiaries (incorporated by reference to Exhibit 21.1 to the Company’s Annual Report on Form 10-K filed on March 15, 2017)

|

|

|

|

|

23.1

|

|

Consent of PricewaterhouseCoopers LLP**

|

|

|

|

|

23.2

|

|

Consent of Cleary Gottlieb Steen & Hamilton LLP (included in Exhibit 5.1)**

|

|

|

|

|

24.1

|

|

Power of Attorney**

|

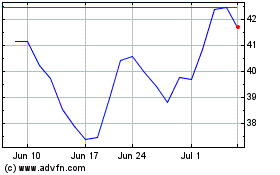

Alcoa (NYSE:AA)

Historical Stock Chart

From Mar 2024 to Apr 2024

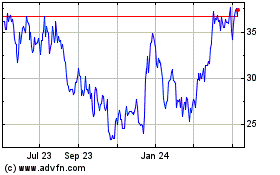

Alcoa (NYSE:AA)

Historical Stock Chart

From Apr 2023 to Apr 2024