Table of

Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange

Act of 1934 (Amendment No. )

| Filed by the Registrant

[X] |

| Filed by a Party other than

the Registrant [ ] |

| |

| Check the appropriate

box: |

| |

| [ ] |

|

Preliminary Proxy

Statement |

| [ ] |

|

Confidential, for Use of the

Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] |

|

Definitive Proxy

Statement |

| [ ] |

|

Definitive Additional

Materials |

| [ ] |

|

Soliciting Material Pursuant to §240.14a-12 |

| |

Express, Inc. |

|

| |

(Name of Registrant as

Specified In Its Charter) |

|

|

|

|

| |

|

|

| |

(Name

of Person(s) Filing Proxy Statement, if other than the

Registrant) |

|

| Payment of Filing Fee (Check

the appropriate box): |

| [X] |

|

No fee required. |

|

[

] |

|

Fee computed on

table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

|

| |

|

1) |

|

Title of each class of

securities to which transaction applies: |

| |

|

|

|

|

|

|

2) |

|

Aggregate number of securities to

which transaction applies: |

|

|

|

|

|

|

|

3) |

|

Per unit price or other underlying

value of transaction computed pursuant to Exchange Act Rule 0-11 (set

forth the amount on which the filing fee is calculated and state how it

was determined): |

|

|

|

|

|

|

|

4) |

|

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

|

5) |

|

Total fee paid: |

|

|

|

|

|

|

[

] |

|

Fee paid previously

with preliminary materials. |

|

|

|

|

[

] |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for

which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or

Schedule and the date of its filing. |

|

|

|

|

|

| |

|

1) |

|

Amount Previously

Paid: |

| |

|

|

|

|

|

|

2) |

|

Form, Schedule or Registration

Statement No.: |

| |

|

|

|

|

|

|

3) |

|

Filing Party: |

| |

|

|

|

|

|

|

4) |

|

Date Filed: |

|

|

|

|

|

Table of

Contents

Notice of

2017

Annual

Meeting

of

Stockholders

Table of

Contents

Columbus, Ohio

April 28,

2017

LETTER TO OUR STOCKHOLDERS

FROM THE

BOARD OF DIRECTORS

Dear Fellow Stockholders,

Express, Inc.’s Board of Directors remains

committed to the creation of long-term value for our stockholders through

effective corporate governance. We believe that effective Board oversight is

achieved through having the right combination of skills, attributes, and

experience reflected in the composition of the Board and effective Board

leadership and governance practices. I want to take this opportunity to

highlight a few governance items that are more fully discussed in the proxy

statement.

Board Composition: In 2016, we welcomed Karen Leever and Terry Davenport as new

directors to the Board. Ms. Leever, currently EVP and General Manager, Digital

Media, of Discovery Communications, has significant experience in technology

development and management, data analytics, and e-commerce. Mr. Davenport,

currently Global Brand Advisor at Starbucks, has significant experience in

consumer brand marketing and advertising. With the additions of Ms. Leever and

Mr. Davenport, we have strengthened the collective skills, experience, and

diversity of the Board necessary to effectively oversee the Company as the

retail sector continues to evolve.

Board Leadership &

Structure: Immediately following last year’s

annual meeting of stockholders, I assumed the role of independent Chairman of

the Board and Peter Swinburn assumed the role of Chair of the Compensation and

Governance Committee. We evaluate the effectiveness of our Board, including

leadership and structure, through an annual Board evaluation process that

provides us with valuable information so that we can continue to adapt our

governance practices to the needs of the Company and our

stockholders.

Stockholder Engagement: Each year, the Company contacts our largest stockholders

collectively representing at least a majority of our outstanding shares to

solicit feedback on our governance practices and executive compensation program.

We welcome your feedback and thank those stockholders who have taken time to

share their feedback with us.

Executive Compensation: In 2016, Mr. Kornberg’s target total direct compensation was

increased to approximate the median level of our peer group at the time while

incorporating challenging performance targets to ensure pay for performance. Mr.

Kornberg’s actual compensation in 2016 was significantly less than target and

significantly less than the prior year, reflecting the Company’s decreased

performance in 2016. We continue to believe that the CEO compensation package is

appropriately designed with the CEO receiving actual pay that is reflective of

Company performance. When Mr. Kornberg assumed the role of CEO in 2015, we

designed his compensation package in part based on feedback received from

stockholders on our executive compensation program in prior years. That

compensation package received strong support in last year’s say-on-pay vote, and

our stockholder engagement program this past year did not yield any concerns or

requests for changes to our executive compensation program. Accordingly, the

overall design and target pay opportunity for Mr. Kornberg’s compensation

package will remain the same for 2017.

Oversight: The Board recognizes that the retail environment is rapidly evolving

and that to generate long-term growth our strategy must allow us to quickly

adapt and meet the demands of our customers. The Board and the management team

regularly review the Company’s strategy to ensure that it is designed to

accomplish long-term growth. In addition to strategy, the Board continues to be

focused on and committed to oversight of management and business performance,

risk management, compliance, and corporate responsibility.

We also want to express our gratitude to

Theo Killion who plans to leave the Board following the Company’s 2017 annual

meeting of stockholders after more than five years of service.

We acknowledge the tremendous trust that

our stockholders place in us to exercise effective oversight of the Company and

assure you that we are engaged and committed to the best interests of our

stockholders. We thank you for your ongoing support of the

Company.

Mylle H. Mangum

Chairman of the Board

Table of

Contents

Notice

of

2017

Annual Meeting of Stockholders

| Time and

Date |

|

8:30 a.m., Eastern Daylight Time, on

Wednesday, June 7, 2017 |

| Place |

|

Express Corporate Headquarters, 1

Express Drive, Columbus, OH 43230 |

| Items

of Business |

|

1. |

|

Election of Class I directors; |

| |

|

2. |

|

Advisory vote to approve executive compensation

(say-on-pay); |

|

|

3. |

|

Ratification of PricewaterhouseCoopers LLP as the Company’s

independent registered public accounting firm for 2017; |

|

|

4. |

|

Approval of the Internal Revenue Code (“Code”) Section 162(m)

performance goals and various annual grant limitations under the Express,

Inc. 2010 Incentive Compensation Plan; and |

|

|

5. |

|

Such

other business as may properly come before the meeting. |

| Record

Date |

|

Holders of

record of the Company’s common stock at the close of business on April 10,

2017 are entitled to notice of and to vote at the 2017 Annual Meeting of

Stockholders or any adjournment or postponement

thereof. |

This proxy statement is issued in

connection with the solicitation of proxies by the Board of Directors of

Express, Inc. for use at the 2017 Annual Meeting of Stockholders and at any

adjournment or postponement thereof. On or about April 28, 2017, we will begin

distributing print or electronic materials regarding the annual meeting to each

stockholder entitled to vote at the meeting. Shares represented by a properly

executed proxy will be voted in accordance with instructions provided by the

stockholder.

|

How to Vote

YOUR VOTE IS VERY

IMPORTANT. Whether or not you plan to

attend the 2017 Annual Meeting of Stockholders, we urge you to vote your

shares now in order to ensure the presence of a quorum.

Stockholders of record may

vote: |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By

Internet: go to www.proxyvote.com; |

|

|

|

By

telephone: call toll free (800) 690-6903; or |

|

|

|

By

mail: if you received paper copies in the mail of the proxy

materials and proxy card, mark, sign, date, and promptly mail the enclosed

proxy card in the postage-paid envelope. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Beneficial Stockholders. If you hold your

shares through a broker, bank, or other nominee, follow the voting

instructions you receive from your broker, bank, or other nominee, as

applicable, to vote your shares. |

By Order of the Board of

Directors,

Lacey Bundy

Senior Vice President, General Counsel and Corporate

Secretary

Important Notice Regarding the

Availability of Proxy Materials for the Annual Meeting of Stockholders to be

held on June 7, 2017: this Notice of Annual Meeting and Proxy Statement and our

2016 Annual Report are available in the investor relations section of our

website at www.express.com/investor. Additionally, and in accordance with

the Securities and Exchange Commission (“SEC”) rules, you may access our proxy

materials at www.proxyvote.com, a site that does not have “cookies” that

identify visitors to the site.

Table of

Contents

Table of

Contents

Table of

Contents

Proxy Statement Summary

Information

The Board of Directors (the “Board”) of

Express, Inc. (the “Company”) is soliciting your proxy to vote at the Company’s

2017 Annual Meeting of Stockholders (the “Annual Meeting”), or at any

adjournment or postponement of the Annual Meeting. To assist you in your review

of this proxy statement, we have provided a summary of certain information

relating to the items to be voted on at the Annual Meeting in this section. For

additional information about these topics, please review this proxy statement in

full and the Company’s Annual Report on Form 10-K for 2016 which was filed with

the SEC on March 24, 2017 (the “Annual Report”).

We follow a 52/53 week fiscal year that

ends on the Saturday nearest to January 31 in each year. Fiscal years in this

proxy statement are identified according to the calendar year in which the

fiscal year commences. For example, references to “2016,” “fiscal 2016,” “2016

fiscal year,” or similar references refer to the fiscal year ended January 28,

2017 and references to “2015,” “fiscal 2015,” “2015 fiscal year,” or similar

references refer to the fiscal year ended January 30, 2016.

In this proxy statement, we refer to

adjusted diluted earnings per share (“Adjusted EPS”), a financial measure that

is not calculated in accordance with U.S. generally accepted accounting

principles (“GAAP”). Please refer to Appendix A to this proxy statement for more

information on Adjusted EPS, a non-GAAP measure, and a reconciliation of

Adjusted EPS information included in this proxy statement, to reported diluted

earnings per share (“EPS”), the most directly comparable GAAP

measure.

2016 Business

Performance

| |

|

|

| Progress Against Select Strategic

Initiatives |

| ☒ |

Increase Store

Productivity. Same store sales

declined by 12% year over year. |

|

| ☑ |

Optimize Retail Store

Fleet. Since the beginning of 2015

we closed 47 of the 50 retail stores identified in our store

rationalization plan. |

|

| ☑ |

E-commerce

Growth. E-Commerce sales grew 5%

year over year to over $400 million. |

|

| ☑ |

Open New Outlet

Stores. Added 23 outlet locations

in 2016. |

|

| ☑ |

Significant Cost Savings

Initiatives. Announced $44-$54

million in cost savings opportunities expected to be realized through 2019

and realized $9 million in 2016. |

|

| ☑ |

Transform and Leverage

Information Technology Systems. Successfully

implemented new retail management, order management, and enterprise

planning systems. |

|

| |

|

|

|

EXPRESS Notice of 2017 Annual Meeting of

Stockholders |

|

1 |

|

|

|

Table of

Contents

|

Proxy Statement Summary

Information |

2016 Compensation

Highlights

| |

|

|

| |

CEO Target Compensation

Established at Median and Tied to Challenging Performance

Targets. |

|

| |

●The overall design for Mr.

Kornberg’s compensation package remained the same in 2016, while his

target total direct compensation increased to $7.3 million to approximate

the median level of our peer group based on market data at the time. This

decision was made based on the Company’s strong financial performance in

2015 and in recognition of Mr. Kornberg’s strong individual performance

during his first year as CEO in 2015.

●Over 90% of the increase in

target compensation was in the form of short-term and long-term incentives

that included challenging performance targets to ensure that the target

payout would only occur if the Company achieved the challenging financial

goals established by the Compensation and Governance

Committee.

●When Mr. Kornberg assumed

the role of CEO in 2015, his compensation package was designed in part

based on feedback received from stockholders on our executive compensation

program in prior years. We received over 95% support in last year’s

say-on-pay vote and our stockholder engagement program in 2016 did not

yield any concerns or requests for changes to the CEO compensation

package.

●Mr. Kornberg’s compensation

package will remain the same for 2017 with respect to overall design and

target pay opportunity.

|

|

| |

CEO Actual Total Direct

Compensation Decreased Significantly in 2016 and was Significantly Below

Target, Reflecting Business Results. |

|

| |

●No amounts were paid to our

CEO or other senior executives under the Company’s seasonal short-term

cash incentive program.

●No performance-based

restricted stock units are expected to be earned by our CEO or other

senior executives under our 2016 long-term equity incentive awards that

are subject to challenging Adjusted EPS performance targets based on a

three-year performance period from 2016 through

2018. |

|

| |

|

|

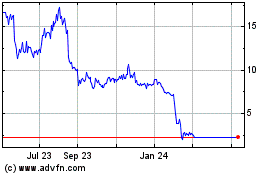

The chart on the right shows our CEO’s

total direct compensation as reported in the Summary Compensation Table on page

47 in 2015 and 2016. Amounts reported in the Summary Compensation Table reflect

the grant date fair value of long-term equity incentive awards, at target in the

case of performance-based restricted stock units. Our CEO is not expected to

earn any of the $2.5 million performance-based restricted stock award granted to

him in 2016 that is subject to challenging Adjusted EPS performance targets

based on a three-year performance period from 2016 through 2018.

Summary Compensation Table

Total

Direct Compensation (“TDC”)(1)

| (1) |

Total direct compensation is

comprised of base salary, short-term incentives, and long-term incentives,

and excludes non-qualified deferred compensation and all other

compensation reported in the Summary Compensation Table on page

47. |

| (2) |

Long-term equity incentive awards

consist of performance-based restricted stock units, time-based restricted

stock units, and stock options. |

Table of

Contents

|

Proxy Statement Summary Information |

CEO Realizable TDC(1): Target

vs. Actual

The chart on the left illustrates our

CEO’s actual realizable total direct compensation compared to target realizable

total direct compensation for the 2015 and 2016 fiscal years. Actual realizable

total direct compensation reflects the actual amount of pay our CEO can expect

to receive from equity awards, including a current estimate of value for awards

that have either not yet vested or have not yet been earned. For more

information on CEO realizable compensation refer to “Executive

Compensation—Compensation Discussion and Analysis—What We Pay and Why: Elements

of Compensation—CEO Realizable Pay” on page 40.

| (1) |

Total direct compensation is

comprised of base salary, short-term incentives, and long-term incentives,

and excludes non-qualified deferred compensation and all other

compensation reported in the Summary Compensation Table on page

47. |

| (2) |

Long-term equity incentive awards

consist of performance-based restricted stock units, time-based restricted

stock units, and stock options. |

For more information on 2016 CEO

compensation refer to “Executive Compensation—Compensation Discussion and

Analysis—What We Pay and Why: Elements of Compensation” beginning on page 34 and

the Summary Compensation Table on page 47. For more information on our

short-term cash incentive program refer to “Executive Compensation—Compensation

Discussion and Analysis—What We Pay And Why: Elements of

Compensation—Performance-Based Incentives—Short-Term Incentives” beginning on

page 36. For information on our long-term equity incentive program see

“Executive Compensation—Compensation Discussion and Analysis—What We Pay And

Why: Elements of Compensation—Performance-Based Incentives—Long-Term Incentives”

beginning on page 37.

| EXECUTIVE COMPENSATION

OBJECTIVES AND PRACTICES |

| |

| Program Objective |

|

What We

DO: |

| Pay for Performance |

|

☑ |

Performance-Based CEO Compensation

Package with 86% Variable Compensation |

|

|

☑ |

Short-Term and Long-Term Incentives

with Challenging Performance Targets that Incentivize Creation of

Stockholder Value |

|

|

☑ |

Performance-Based Equity Awards with 3-Year Performance

Periods |

| Pay

Competitively |

|

☑ |

Robust Compensation Setting Process that Utilizes Market

Data to Ensure Competitiveness |

| Pay Responsibly |

|

☑ |

3-Year Performance Periods for

Performance-Based Equity Awards and 4-year Vesting Requirements for

Time-Based Restricted Stock Units and Stock Options |

|

|

☑ |

Annual Stockholder Engagement Process

and the Incorporation of Stockholder Feedback into Executive Compensation

Decision Making |

|

|

☑ |

Stock Ownership

Guidelines |

|

|

☑ |

Mitigate Risk Through Incentive

Compensation Design |

|

|

☑ |

Utilize Independent Compensation

Consultant |

|

|

☑ |

Clawback Policy |

| |

|

|

What We DON’T

DO: |

| Pay Responsibly |

|

☒ |

No Special Tax Gross-Ups |

|

|

☒ |

No Pension Plans or Other

Post-Employment Defined Benefit Plans |

|

|

☒ |

No Repricing of Underwater Stock

Options or Reloads of Stock Options |

|

|

☒ |

No Hedging or Pledging

Transactions |

|

|

☒ |

No Single Trigger Change-in-Control

Payments |

|

|

☒ |

No Special Perquisites |

|

EXPRESS Notice of 2017 Annual Meeting of

Stockholders |

|

3 |

|

|

|

Table of

Contents

|

Proxy Statement Summary

Information |

Governance

Highlights

| Governance

Changes: |

|

|

|

| Board

Leadership |

|

● |

Mylle Mangum assumed the

role of independent Chairman of the Board and Peter Swinburn assumed the

role of Chair of the Compensation and Governance Committee in June

2016. |

| Board Composition |

|

● |

The Board strengthened its collective competencies and

experience with the appointments of Mr. Davenport and Ms. Leever to the

Board. |

| |

| Other Governance Highlights: |

|

|

|

| Board

Independence |

|

● |

All of our directors are

independent, except for Mr. Kornberg, our President and CEO. |

|

|

● |

We currently have an

independent Chairman of the Board. |

|

|

● |

All of our committee

members are independent. |

| |

|

● |

Our independent directors have an opportunity to meet in

executive session at each meeting and do so routinely. |

| Director Elections |

|

● |

We adhere to a majority vote standard, with a director

resignation policy, for uncontested director elections. |

Board and

Committee

Meetings |

|

● |

Each of our directors attended at least 75% of all Board

meetings and applicable Committee meetings. |

Board and

Committee

Evaluations |

|

● |

The Board and each Committee conduct a comprehensive

self-evaluation each year to identify potential areas of

improvement. |

| Corporate Strategy |

|

● |

At least once per year, the Board and management engage

in an in-depth discussion and align on the Company’s long-term corporate

strategy. The strategy is revisited regularly during Board and committee

meetings. |

| Stockholder Engagement |

|

● |

As part of our annual stockholder engagement cycle, we

reach out to our largest stockholders who collectively hold over a

majority of the shares of our outstanding common stock, which usually

includes approximately our top 20 largest stockholders. |

| Succession Planning |

|

● |

The Board reviews and discusses succession plans for

executives and key contributors at least

annually. |

Proposals to be Voted on and

Voting Recommendations

| Proposal |

|

Board Voting

Recommendation |

|

Page Reference

(for more

detail) |

| Election of Class I Directors (Proposal No. 1) |

|

☑ |

FOR |

|

9 |

| Advisory vote to approve executive compensation

(say-on-pay) (Proposal No. 2) |

|

☑ |

FOR |

|

63 |

| Ratification of PricewaterhouseCoopers LLP as the

Company’s independent registered public accounting firm for 2017 (Proposal

No. 3) |

|

☑ |

FOR |

|

64 |

| Approval of the Code Section 162(m) performance goals and

various annual grant limitations under the Express, Inc. 2010 Incentive

Compensation Plan (Proposal No. 4) |

|

☑ |

FOR |

|

65 |

Table of

Contents

|

Proxy Statement Summary Information |

Director Nominees

The following table provides summary

information about our Class I director nominees. The Class I directors will be

elected to serve a three-year term that will expire at the Company’s 2020 annual

meeting of stockholders.

| Nominee |

|

Age |

|

Director

Since |

|

Select

Professional

Experience |

|

Independent |

|

Board

Committees |

|

Select

Skills/Qualifications |

Michael

Archbold |

|

56 |

|

January

2012 |

|

Retired Retail Executive:

-Former CEO of GNC

Holdings, Inc.

-Former CEO of The Talbots

Inc.

-Former President & COO

of Vitamin Shoppe

-Former Chief

Financial Officer of multiple retailers |

|

Yes |

|

Audit Committee |

|

Accounting, finance and capital structure; risk

management; retail merchandising and operations; business development and

strategic planning; investor relations; executive leadership of complex

organizations |

| Peter Swinburn |

|

64 |

|

February

2012 |

|

Retired Consumer Products

Executive:

-Former CEO of Molson Coors

Brewing Company

-Former CEO of Coors

(US)

-Former CEO of Coors Brewing

Worldwide

-Former COO of Molson

Coors Brewing Company (UK) |

|

Yes |

|

Compensation and Governance Committee |

|

Business development and strategic planning; consumer

brand marketing and advertising; international operations; finance and

capital structure; corporate governance and board practices; executive

leadership of complex organizations; mergers and acquisitions; executive compensation

|

Forward-Looking

Statements

This proxy statement contains

“forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements include any statement

that does not directly relate to any historical or current fact and are based on

current expectations and assumptions, which may not prove to be accurate.

Forward-looking statements are not guarantees and are subject to risks,

uncertainties, changes in circumstances that are difficult to predict, and

significant contingencies, many of which are beyond the Company’s control. Many

factors could cause actual results to differ materially and adversely from these

forward-looking statements, including those set forth in Item 1A of the

Company’s Annual Report on Form 10-K. The Company undertakes no obligation to

publicly update or revise any forward-looking statements as a result of new

information, future events, or otherwise, except as required by

law.

|

EXPRESS Notice of 2017 Annual Meeting of

Stockholders |

|

5 |

|

|

|

Table of Contents

Frequently Asked

Questions

about

Voting and the Annual Meeting

Who is entitled to vote at

the meeting?

Only stockholders of record at the close

of business on April 10, 2017, the record date for the Annual Meeting (the

“Record Date”), are entitled to receive notice of and to participate in the

Annual Meeting. If you were a stockholder of record on that date, you will be

entitled to vote all of the shares that you held on that date at the Annual

Meeting or at any adjournments or postponements of the meeting.

A list of stockholders of record entitled

to vote at the Annual Meeting will be available at the Annual Meeting and will

also be available for ten business days prior to the Annual Meeting between the

hours of 9:00 a.m. and 4:00 p.m., Eastern Daylight Time, at the Office of the

Corporate Secretary located at 1 Express Drive, Columbus, OH 43230. A

stockholder may examine the list for any germane purpose related to the Annual

Meeting.

What are the voting rights

of the holders of Express, Inc. common stock?

Holders of Express, Inc. common stock are

entitled to one vote for each share held of record as of the Record Date on all

matters submitted to a vote of the stockholders, including the election of

directors. Stockholders do not have cumulative voting rights.

How do I

vote?

Beneficial Stockholders. If you hold your shares through a broker, bank, or other

nominee, you are a beneficial stockholder. In order to vote your shares, please

refer to the materials forwarded to you by your broker, bank, or other nominee,

as applicable, for instructions on how to vote the shares you hold as a

beneficial stockholder.

Registered Stockholders. If you hold your shares in your own name, you are a

registered stockholder and may vote by proxy before the Annual Meeting via the

Internet at www.proxyvote.com, by calling (800) 690-6903, or if you received

paper copies of the proxy materials and proxy card in the mail, by signing and

returning the enclosed proxy card. Proxies submitted via the Internet, by

telephone, or by mail must be received by 11:59 p.m., Eastern Daylight Time, on

June 6, 2017. You may also vote at the Annual Meeting by delivering your

completed proxy card in person. If you vote by telephone or via the Internet you

do not need to return your proxy card.

Why did I receive a Notice

in the mail regarding the Internet Availability of Proxy Materials instead of a

full set of proxy materials?

Under rules adopted by the SEC, we are

making this proxy statement available to our stockholders primarily via the

Internet (“Notice and Access”). On or about April 28, 2017, we will mail the

Notice regarding the Internet Availability of Proxy Materials (the “Notice of

Internet Availability”) to stockholders at the close of business on the Record

Date, other than those stockholders who previously requested electronic or paper

delivery of communications from us. The Notice of Internet Availability contains

instructions on how to access an electronic copy of our proxy materials,

including this proxy statement and our Annual Report, and also contains

instructions on how to request a paper copy of the proxy materials.

Can I vote my shares by

filling out and returning the Notice of Internet Availability?

No. The Notice of Internet Availability

only identifies the items to be voted on at the Annual Meeting. You cannot vote

by marking the Notice of Internet Availability and returning it. The Notice of

Internet Availability provides instructions on how to cast your vote. For

additional information, please see the section above titled “How do I

vote?”

Table of Contents

| Frequently Asked Questions about Voting and the Annual

Meeting |

What are “broker non-votes”

and why is it so important that I submit my voting instructions for shares I

hold as a beneficial stockholder?

If a broker or other financial institution

holds your shares in its name and you do not provide voting instructions to it,

New York Stock Exchange (“NYSE”) rules allow that firm to vote your shares only

on routine matters. Proposal No. 3, the ratification of PricewaterhouseCoopers

LLP as the Company’s independent registered public accounting firm for 2017, is

the only routine matter for consideration at the Annual Meeting. For all matters

other than Proposal No. 3, you must submit voting instructions to the firm that

holds your shares if you want your vote to count on such matters. When a firm

votes a client’s shares on some but not all of the proposals, the missing votes

are referred to as “broker non-votes.”

What constitutes a quorum

and how will votes be counted?

The presence at the Annual Meeting, in

person or by proxy, of the holders of a majority of the outstanding shares of

common stock entitled to vote will constitute a quorum for purposes of the

Annual Meeting. A quorum is required in order for the Company to conduct its

business at the Annual Meeting. As of the Record Date, 78,455,141 shares of

common stock were outstanding.

Proxies received but marked as abstentions and

broker non-votes will be included in the calculation of the number of shares

considered to be present at the Annual Meeting for purposes of establishing a

quorum.

What vote is required to

approve each proposal?

| Proposal |

|

Vote Required |

|

Board Voting

Recommendation |

|

Election of Class I directors

(Proposal No. 1) |

|

Majority of the votes cast FOR the

director nominee |

|

FOR the nominee |

|

Advisory vote to approve executive

compensation (say-on-pay) (Proposal No. 2) |

|

The affirmative vote of a majority

of the shares present in person or represented by proxy and entitled to

vote at the Annual Meeting |

|

FOR the executive compensation of our named executive

officers |

|

Ratification of

PricewaterhouseCoopers LLP as the Company’s independent registered public

accounting firm for 2017 (Proposal No. 3) |

|

The affirmative vote of a majority

of the shares present in person or represented by proxy and entitled to

vote at the Annual Meeting |

|

FOR the ratification of PricewaterhouseCoopers LLP as the Company’s independent registered

public accounting firm for 2017 |

|

Approval of the Code Section 162(m)

performance goals and various annual grant limitations under the Express,

Inc. 2010 Incentive Compensation Plan (Proposal No. 4) |

|

The affirmative vote of a majority

of the shares present in person or represented by proxy and entitled to

vote at the Annual Meeting |

|

FOR the approval of the Code Section 162(m) performance goals and

various annual grant limitations under the Express, Inc. 2010 Incentive

Compensation Plan |

What are my choices for

casting my vote on each matter to be voted on?

| Proposal |

|

Voting Options |

|

Effect of

Abstentions |

|

Broker

Discretionary

Voting Allowed? |

|

Effect of

Broker

Non-Votes |

|

Election of Class I director

(Proposal No. 1) |

|

FOR, AGAINST or ABSTAIN

|

|

No effect—not counted

as a “vote

cast” |

|

No |

|

No effect |

|

Advisory vote to approve executive

compensation (say-on-pay) (Proposal No. 2) |

|

FOR, AGAINST or ABSTAIN

|

|

Treated as a vote

AGAINST the

proposal |

|

No |

|

No effect |

|

Ratification of

PricewaterhouseCoopers LLP as the Company’s independent registered public

accounting firm for 2017 (Proposal No. 3) |

|

FOR, AGAINST or

ABSTAIN |

|

Treated as a vote

AGAINST the

proposal |

|

Yes |

|

Not applicable |

|

Approval of the Code Section 162(m)

performance goals and various annual grant limitations under the Express,

Inc. 2010 Incentive Compensation Plan (Proposal No. 4) |

|

FOR, AGAINST or

ABSTAIN |

|

Treated as a vote

AGAINST the

proposal |

|

No |

|

No

effect |

Unless you give other instructions when

you vote, the persons named as proxies, David Kornberg and Lacey Bundy, will

vote in accordance with the Board’s recommendations. We do not expect any other

business to properly come before the Annual Meeting; however, if any other

business should properly come before the Annual Meeting, the proxy holders will

vote as recommended by the Board or, if no recommendation is given, in their own

discretion.

|

EXPRESS Notice of 2017 Annual Meeting of

Stockholders |

|

7 |

|

|

|

Table of Contents

| Frequently Asked Questions about Voting and the

Annual Meeting |

What happens if a director

nominee does not receive a majority of the votes cast for his or her

re-election?

Pursuant to the Company’s Corporate

Governance Guidelines, the Board expects any director nominee who fails to

receive a greater number of votes cast “for” than votes cast “against” his or

her re-election to tender his or her resignation for consideration by the

Compensation and Governance Committee. The Compensation and Governance Committee

will act on an expedited basis to determine whether to accept the director’s

resignation and will submit such recommendation for prompt consideration by the

Board. The Board expects the director whose resignation is under consideration

to abstain from participating in any decision regarding the resignation. The

Compensation and Governance Committee and the Board may consider any factors

they deem relevant in deciding whether to accept the director’s

resignation.

May I change my vote or

revoke my proxy?

Beneficial Stockholders. Beneficial stockholders should contact their broker, bank,

or other nominee for instructions on how to change their vote or revoke their

proxy.

Registered Stockholders. Registered stockholders may change their vote or revoke a

properly executed proxy at any time before its exercise by:

| ● |

delivering written notice of

revocation to the Office of the Corporate Secretary, Express, Inc., 1

Express Drive, Columbus, OH 43230;

|

| ● |

submitting another proxy that is

dated later than the original proxy (including a proxy submitted via

telephone or Internet); or

|

| ● |

voting in person at the Annual

Meeting. |

Can I attend the Annual

Meeting?

Subject to space availability, all

stockholders as of the Record Date, or their duly appointed proxies, may attend

the Annual Meeting. Since seating is limited, admission to the Annual Meeting

will be on a first-come, first-served basis. Registration will begin at 8:00

a.m., Eastern Daylight Time. If you attend, please note that you may be asked to

present valid photo identification, such as a driver’s license or passport, and

will need to check in at the registration desk prior to entering the Annual

Meeting. Please also note that if you are a beneficial stockholder (that is, you

hold your shares through a broker, bank, or other nominee), you will need to

show proof of your stock ownership as of the Record Date, such as a copy of a

brokerage statement, to present at the registration desk in order to gain

admission to the Annual Meeting. Cameras, cell phones, recording devices, and

other electronic devices will not be permitted at the Annual Meeting other than

those operated by the Company or its designees. All bags, briefcases, and

packages will be subject to search.

Table of Contents

Election of Class I

Directors

(Proposal No.

1)

The Board and its Compensation and

Governance Committee are committed to ensuring that the Board possesses the

right diversity of backgrounds, skills, experience, and perspectives to

constitute an effective Board. The Board currently consists of eight members and

is divided into three classes of directors, with two Class I directors, three

Class II directors, and three Class III directors. The current term of our Class

I directors expires at the Annual Meeting, while the terms for Class II and

Class III directors will expire at our 2018 and 2019 annual meetings of

stockholders, respectively. Mr. Killion, a Class III director, will resign from

the Board following the Annual Meeting. Effective upon Mr. Killion’s

resignation, the size of the Board will be reduced to seven members, with two

Class I directors, three Class II directors, and two Class III

directors.

Mr. Archbold and Mr. Swinburn currently

serve as Class I directors and are independent. Upon the recommendation of the

Compensation and Governance Committee, the Board has nominated Mr. Archbold and

Mr. Swinburn for re-election as Class I directors, to each serve three-year

terms expiring at the 2020 annual meeting of stockholders. Mr. Archbold and Mr.

Swinburn have each served as a director since 2012 and were each elected to

serve a three-year term at our 2014 annual meeting of stockholders.

Mr. Archbold and Mr. Swinburn have

consented to serve if elected. If re-elected, each of Mr. Archbold and Mr.

Swinburn will hold office until his respective successor has been duly elected

and qualified or until his earlier resignation or removal. If Mr. Archbold or

Mr. Swinburn becomes unavailable to serve as a director, the Board may either

designate a substitute nominee or reduce the number of directors. If the Board

designates a substitute nominee, the persons named as proxies will vote for the

substitute nominee designated by the Board.

Information with respect to our Class I

director nominees and our continuing Class II and Class III directors, including

their recent employment or principal occupation, a summary of select

qualifications, skills, and experience that led to the conclusion that they are

qualified to serve as directors, the names of other public companies for which

they currently serve as a director or have served as a director within the past

five years, their period of service on the Board, and their ages as of the

Record Date, are provided in this section. The Board believes that our

continuing directors, together with our director nominees, possess a

complementary and diverse set of qualifications, skills, and experience to allow

the Board to function at a high-level and fulfill its responsibilities to our

stockholders. Please refer to “Corporate Governance — Board Composition” on page

15 for other information about our Board, including a description of the

qualifications, skills, and experience that the Board believes are important in

order to effectively oversee the Company’s strategy to achieve sustainable,

long-term value creation.

|

EXPRESS Notice of 2017 Annual Meeting of

Stockholders |

|

9 |

|

|

|

Table of Contents

| Election of Class I Directors (Proposal No.

1) |

Nominees For Class I Directors

for Election at the 2017 Annual Meeting

|

MICHAEL ARCHBOLD |

|

|

Director

Since: January 2012

Age: 56

Audit Committee

Member

|

| |

Select Qualifications, Skills,

and Experience:

●Accounting, finance, and capital structure

●Risk management

●Retail merchandising and operations

●Business development and strategic planning

●Investor relations

●Executive leadership of complex

organizations |

|

Business

Experience

Mr. Archbold served as Chief

Executive Officer of GNC Holdings Inc. from August 2014 until July 2016

and also served as a director on the Board of GNC Holdings Inc. Prior to

that he was the Chief Executive Officer of The Talbots Inc. from August

2012 until June 2013 and also served as a director on the Board of The

Talbots Inc. Prior to that, Mr. Archbold served as President and Chief

Operating Officer of Vitamin Shoppe, Inc. from April 2011 until June 2012

and prior to that as its Executive Vice President, Chief Operating

Officer, and Chief Financial Officer from April 2007. Mr. Archbold served

as Executive Vice President / Chief Financial and Administrative Officer

of Saks Fifth Avenue from 2005 to 2007. From 2002 to 2005 he served as

Chief Financial Officer for AutoZone, originally as Senior Vice President,

and later as Executive Vice President. Mr. Archbold is an inactive

Certified Public Accountant, and has 20 years of financial experience in

the retail industry. |

|

PETER SWINBURN |

|

|

Director

Since: February 2012

Age: 64

Chair of the Compensation

and Governance Committee

|

| |

Select Qualifications, Skills,

and Experience:

●Business development and strategic planning

●Consumer brand marketing and advertising

●International operations

●Finance and capital structure

●Corporate governance and public company board practices

●Executive leadership of complex

organizations

●Mergers and acquisitions

●Executive compensation |

|

Business

Experience

Mr. Swinburn served as Chief

Executive Officer and President of Molson Coors Brewing Company from July

2008 until he retired in December 2014. He also served as a director of

Molson Coors Brewing Company and MillerCoors Brewing Company from July

2008 until his retirement. Prior to that he was Chief Executive Officer of

Coors (US) and from 2005 to October 2007, Mr. Swinburn served as President

and Chief Executive Officer of Molson Coors Brewing Company (UK) Limited.

Prior to that, he served as President and Chief Executive Officer of Coors

Brewing Worldwide and Chief Operating Officer of Molson Coors Brewing

Company (UK) Limited following the Molson Coors Brewing Company’s

acquisition of Molson Coors Brewing Company (UK) Limited in 2002 until

2003. Mr. Swinburn currently serves as a director of Cabela’s

Inc. |

|

THE BOARD OF DIRECTORS

RECOMMENDS A VOTE FOR EACH OF THE CLASS I NOMINEES TO BE ELECTED AS

DIRECTORS. |

Table of Contents

| Election of Class I Directors (Proposal No.

1) |

Class II Directors With Terms

Continuing Until the 2018 Annual Meeting

|

MICHAEL F. DEVINE |

|

|

Director

Since: May 2010

Age: 58

Chair of the Audit

Committee

|

| |

Select Qualifications, Skills,

and Experience:

●Accounting, finance, and capital structure

●Risk management

●Retail merchandising

●Corporate governance and public company board

practices

●Investor relations

●Executive leadership of complex

organizations |

|

Business

Experience

Mr. Devine was appointed Senior Vice

President and Chief Financial Officer of Coach in December 2001 and

Executive Vice President in August 2007, a role he held until he retired

in August 2011. Prior to joining Coach, Mr. Devine served as Chief

Financial Officer and Vice President—Finance of Mothers Work, Inc. (now

known as Destination Maternity Corporation) from February 2000 until

November 2001. From 1997 to 2000, Mr. Devine was Chief Financial Officer

of Strategic Distribution, Inc. Mr. Devine was Chief Financial Officer at

Industrial System Associates, Inc. from 1995 to 1997, and for the six

years prior to that he was the Director of Finance and Distribution for

McMaster-Carr Supply Co. Mr. Devine previously served as a director of

Nutrisystems, Inc. He currently serves as a director of Deckers, Inc. and

Five Below, Inc. He also serves as a director of The Talbots Inc. and Sur

La Table, both of which are privately held

companies. |

|

DAVID KORNBERG |

|

|

Director

Since: January 2015

Age: 49

President and

CEO

|

| |

Select Qualifications, Skills,

and Experience:

●Retail merchandising and operations

●Apparel merchandising and design

●Business development and strategic planning

●E-commerce and omni-channel retailing

●Consumer brand marketing and advertising

●Experience with target customers

●Supply chain |

|

Business

Experience

Mr. Kornberg has served as our

President and CEO since January 30, 2015. He has also served as a member

of the Board since becoming CEO. Mr. Kornberg first joined Express in 1999

and has held various roles of increasing responsibility, including as

President since October 2012, Executive Vice President of Men’s

Merchandising and Design from December 2007 to October 2012, and General

Merchandise Manager of the Express Men’s business prior to that. From 2002

to 2003, Mr. Kornberg was Vice President of Business Development for

Disney Stores. Mr. Kornberg spent the first ten years of his career with

Marks & Spencer PLC in the United

Kingdom. |

|

EXPRESS Notice of 2017 Annual Meeting of

Stockholders |

|

11 |

|

|

|

Table of Contents

| Election of Class I Directors (Proposal No.

1) |

|

MYLLE MANGUM |

|

|

Director

Since: August 2010

Age:

68

Chairman of the Board;

Compensation and Governance Committee Member; Audit Committee

Member

|

| |

Select Qualifications, Skills,

and Experience:

●Business development and strategic planning

●Corporate governance and public company board

practices

●Executive leadership of complex

organizations

●Leadership development and succession

planning

●International and franchise operations

●Accounting, finance, and capital structure

●Executive compensation |

|

Business

Experience

Ms. Mangum is the Chief Executive

Officer of IBT Enterprises, LLC (formerly International Banking

Technologies), a position she has held since October 2003, and is also

Chairman and CEO of IBT Holdings, a position she has held since July 2007.

Prior to that, Ms. Mangum served as Chief Executive Officer of True

Marketing Services, LLC since July 2002. She served as Chief Executive

Officer of MMS Incentives, Inc. from 1999 to 2002. From 1997 to 1999 she

served as President-Global Payment Systems and Senior Vice

President-Expense Management and Strategic Planning for Carlson Wagonlit

Travel, Inc. From 1992 to 1997 she served as Executive Vice

President-Strategic Management for Holiday Inn Worldwide. Ms. Mangum was

previously employed with BellSouth Corporation as Director-Corporate

Planning and Development from 1986 to 1992 and President of BellSouth

International from 1985 to 1986. Prior to that, she was with the General

Electric Company. Ms. Mangum previously served as a director of Emageon,

Inc., Scientific-Atlanta, Inc., Respironics, Inc., and Collective Brands,

Inc. Ms. Mangum currently serves as a director of PRGX Global, Inc.,

Barnes Group Inc., and Haverty Furniture Companies,

Inc. |

Table of Contents

| Election of Class I Directors (Proposal No.

1) |

Class III Directors With Terms

Continuing Until the 2019 Annual Meeting

|

TERRY DAVENPORT |

|

|

Director

Since: November 2016

Age:

59

Compensation and Governance

Committee Member (Effective March 2017)

|

| |

Select Qualifications, Skills,

and Experience:

●Consumer brand marketing and advertising

●E-commerce and omni-channel retailing

●Retail merchandising and operations

●Business development and strategic planning

●International operations

●Corporate responsibility

●Experience with target customers |

|

Business

Experience

Mr. Davenport is currently Global

Brand Advisor for Starbucks Coffee Company. Throughout his career, Mr.

Davenport has held various senior leadership roles in the areas of brand

building, marketing, advertising and retail design for leading consumer

brands. Mr. Davenport has spent the last ten years of his career at

Starbucks Coffee Company, where he has served as Global Brand Advisor

since February 2014. His prior roles at Starbucks include: SVP of Global

Creative Studios, SVP of Marketing and Category for Europe, Middle East,

and Africa (EMEA), and SVP of Marketing for the U.S. He originally joined

Starbucks as VP of Brand Strategy and Consumer Insights in October 2006.

Prior to joining Starbucks, Mr. Davenport held senior brand leadership

roles with YUM! Brands, PepsiCo. and Omnicom

Agencies. |

|

THEO KILLION |

|

|

Director

Since: April 2012

Age:

65

Compensation and Governance

Committee Member

|

| |

Select Qualifications, Skills,

and Experience:

●Human resources and organizational design

●Leadership development and succession

planning

●Retail merchandising and operations

●Business development and strategic planning

●Executive leadership of complex

organizations

●Consumer brand marketing and advertising

●Executive compensation |

| Business Experience

Mr. Killion served as Vice Chairman

of Herbert Mines Associates from May 2015 until March 2016. Prior to that,

Mr. Killion served as Chief Executive Officer of Zale Corporation from

September 2010 to July 2014. He also served as a director of Zale

Corporation from September 2010 until July 2014. Prior to that, Mr.

Killion served in a variety of other positions with Zale Corporation,

including President from August 2008 to September 2010, Interim Chief

Executive Officer from January 2010 to September 2010 and Executive Vice

President of Human Resources, Legal and Corporate Strategy from January

2008 to August 2008. From May 2006 to January 2008, Mr. Killion was

employed with the executive recruiting firm Berglass+Associates, focusing

on companies in the retail, consumer goods, and fashion industries. From

April 2004 through April 2006, Mr. Killion served as Executive Vice

President of Human Resources at Tommy Hilfiger. From 1996 to 2004, Mr.

Killion served in various management positions with Limited Brands (now

known as L Brands). Mr. Killion currently serves as a director of Libbey

Inc. |

|

EXPRESS Notice of 2017 Annual Meeting of

Stockholders |

|

13 |

|

|

|

Table of Contents

| Election of Class I Directors (Proposal No.

1) |

|

KAREN LEEVER |

|

|

Director

Since: August 2016

Age:

53

Compensation and Governance

Committee Member (Effective March 2017)

|

| |

Select Qualifications, Skills,

and Experience:

●E-commerce and omni-channel retailing

●Technology development and management

experience

●Data analytics

●Business development and strategic planning

●Retail merchandising and operations

●Experience with target customers |

|

Business

Experience

Ms. Leever is Executive Vice

President and General Manager, Digital Media, of Discovery Communications,

a role she has held since October 2015. Throughout her career, Ms. Leever

has held a variety of leadership positions across digital media,

marketing, product development, direct sales, and operations in media and

retail. Prior to joining Discovery Communications, she spent ten years

with DIRECTV, and held several roles including, Senior Vice President,

Digital and Direct Sales from 2013 to 2015, Senior Vice President of

Digital Marketing and Media in 2012, and Senior Vice President of

directv.com and Customer Communications in 2011. Additionally, Ms. Leever

served as Vice President, Marketing at Kmart Corporation during 2005 and

as Divisional Vice President, eCommerce from 2004 until 2005. Earlier in

her career, she spent more than a decade in electronic television

retailing at HSN and QVC, overseeing website design, messaging, pricing,

and programming strategies. |

Table of

Contents

Corporate Governance

Board

Responsibilities

The Board is responsible for overseeing

the affairs of the Company in order to generate sustainable long-term value for

our stockholders and does so through oversight of the Company’s (1) strategy and

performance, (2) management, including succession planning, (3) risk management

program, (4) compliance and corporate responsibility programs, and (5) other

corporate governance practices, including stockholder engagement.

| Board Oversight |

| |

|

Strategy and

Performance |

|

Management, including Succession

Planning |

|

Risk Management |

|

Compliance and Corporate

Responsibility |

|

Other Corporate Governance

Practices, including Stockholder

Engagement |

The Board believes that effective

oversight is best achieved through (1) having the right combination of people on

the Board, (2) an effective Board leadership and committee structure, and (3)

effective Board practices. The Board continually reassesses the composition of

the Board, the Board’s leadership and structure, and its governance practices

and believes that the continuing directors, along with the director nominees,

together have a complementary and diverse set of skills, backgrounds, and

experiences to constitute an effective Board and that the Board’s leadership and

committee structure as well as its governance practices are effective. See

“Board Composition” below and “Election of Class I Directors (Proposal No. 1)”

on page 9 for more information about the composition of the Board; see “Board

Leadership and Structure” on page 18 for more information about the Board’s

leadership structure and its committees; and see “Board Practices” on page 22

for more information about the Board’s governance practices.

| Board

Composition |

|

+ |

|

Board Leadership &

Structure |

|

+ |

|

Board Practices |

|

= |

|

Effective

Oversight |

Board Composition

The Board and its Compensation and

Governance Committee are committed to ensuring that the Board possesses the

right diversity of backgrounds, skills, experience, and perspectives to

constitute an effective Board. The Compensation and Governance Committee is

responsible for developing the criteria for, and reviewing periodically with the

Board, the skills and characteristics of nominees, as well as the composition of

the Board as a whole. These criteria include independence, diversity, age,

skills, tenure, and experience in the context of the needs of the Board. The

Compensation and Governance Committee also considers a number of other factors,

including the ability to represent all stockholders without a conflict of

interest; the ability to work in and promote a productive environment;

sufficient time and willingness to fulfill the substantial duties and

responsibilities of a director; a high level of character and integrity; broad

professional and leadership experience and skills necessary to effectively

respond to complex issues encountered by a publicly-traded company; and the

ability to apply sound and independent business judgment.

|

EXPRESS Notice of 2017 Annual Meeting of

Stockholders |

|

15 |

|

|

|

Table of

Contents

|

BOARD COMPETENCIES AND

EXPERIENCE |

The Board believes that it has the right

mix of qualifications, skills, and experience that allow it to fulfill its

responsibilities, including overseeing management’s execution of the Company’s

corporate strategy which is designed to create long-term stockholder value. The

information below shows how the Board’s collective qualifications, skills, and

experience relate to the Company’s corporate strategy. For biographical

information regarding each of our directors and their individual qualifications,

skills, and experience see, “Election of Class I Directors (Proposal No. 1)”

beginning on page 9.

| Long-Term Strategy for Value Creation |

|

Improving Profitability Through a

Balanced Approach to Growth

●Increase

Productivity of our Existing Stores

●Optimize our Retail

Store Footprint and Open New Outlet Stores

●Grow our E-commerce

Business

●Significant Cost

Savings Initiatives Across our Business |

|

Increasing Brand Awareness and

Elevating our Customer Experience |

|

Transforming and Leveraging

Information Technology Systems |

|

Investing in the Growth and

Development of our People |

|

|

|

|

|

|

|

|

Strategic Competencies and

Experience |

|

●Retail merchandising

& operations

●Apparel

merchandising & design

●E-commerce and

omni-channel retailing

●Business development

& strategic planning

●Supply

chain

●International and

franchise operations |

|

●Consumer brand

marketing/advertising

●Experience with

target customers |

|

●Technology

development and management experience

●Data

analytics |

|

●Human resources

& organizational design

●Leadership

development |

|

|

Corporate Governance

Competencies and Experience |

●Accounting, finance,

and capital structure

●Investor

relations

●Executive

compensation

●Mergers and

acquisitions

●Executive leadership

of complex organizations |

|

●Corporate

responsibility

●Corporate governance

and public company board practices

●Risk

management

●Succession

planning |

In 2016, the Board strengthened its

collective competencies and experience with the appointments of Mr. Davenport

and Ms. Leever to the Board. Mr. Davenport has significant experience in

consumer brand marketing and advertising and Ms. Leever has significant

experience in technology development and management, data analytics, and

e-commerce. See “Election of Class I Directors (Proposal No. 1)” beginning on

page 9 for additional information about Mr. Davenport and Ms. Leever, including

the qualifications that led to their appointment to the Board.

Table of

Contents

|

BOARD DEMOGRAPHICS AND

REFRESHMENT |

As previously noted, in addition to

ensuring that the Board collectively has a diverse set of competencies and

experience, the Compensation and Governance Committee and Board also consider

independence as well as diversity, age, and tenure. The charts below show

certain demographic information about our Board as of April 10, 2017.

| Independence |

|

Diversity |

|

Tenure |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

All of our directors are independent

except for Mr. Kornberg, our President & CEO |

|

●One director, Mr.

Killion, is African-American

●Two directors, Mr.

Kornberg and Mr. Swinburn, are originally from the United Kingdom and have

significant international business experience |

|

Average Tenure: 4 years

Average Age: 59 years old |

| |

|

|

|

| |

|

|

|

| |

|

|

|

In order to assure the appropriate balance

between members with new and different perspectives and those with a deep

understanding of the Company built up over many years, the Compensation and

Governance Committee reviews a director’s continuation on the Board each time

such director’s term of office expires. This allows each director the

opportunity to conveniently confirm his or her desire to continue as a member of

the Board. In addition, the Company’s Corporate Governance Guidelines provide

that a director will not be nominated for re-election if he or she is 72 years

of age or older at the time of nomination. The Board believes that together

these practices are effective at ensuring an appropriate balance between

experience and a fresh perspective on the Board.

|

EXPRESS Notice of 2017 Annual Meeting of

Stockholders |

|

17 |

|

|

|

Table of

Contents

|

IDENTIFYING AND EVALUATING DIRECTOR

CANDIDATES |

The Compensation and Governance Committee

is responsible for identifying, recruiting, and recommending candidates for the

Board and is responsible for reviewing and evaluating any candidates recommended

by stockholders.

The following shows our new director

nomination process.

| Conduct a Needs

Assessment |

|

The Committee determines the

director skills, experience, and attributes needed for the Board to

exercise effective oversight of the Company. The Committee assesses the

skills, experience, and attributes of existing directors against desired

director skills, experience, and attributes to identify any skills,

experience, and attributes that would strengthen the collective skills and

experience of the Board. |

|

|

Develop a New Director

Profile |

|

The Committee develops a profile

that sets forth the skills, experience, and attributes desired for the new

director, which satisfies the needs identified in the needs

assessment. |

|

|

Identify New Director

Candidates |

|

The Committee may identify new

director candidates through professional search firms, professional

networks of sitting directors, and nominations suggested by

stockholders. |

|

|

Selection of New

Director |

|

The Committee makes a recommendation

to the Board based on an initial round of interviews, reference checks,

and a final round of interviews with all directors. |

|

|

Due Diligence and

Onboarding |

|

Once due diligence is performed and

the nominee is appointed to the Board, the Company provides a robust

onboarding program which includes a full day of in-person meetings with

senior leadership at the Company’s headquarters and participation in a

multi-day new director education program for first-time

directors. |

The Compensation and Governance Committee

followed the process described above in connection with the appointments of Mr.

Davenport and Ms. Leever to the Board in 2016 and such process included the

engagement of a third party search firm to identify and pre-qualify both Mr.

Davenport and Ms. Leever.

The Compensation and Governance Committee

considers all director candidates, including candidates proposed by stockholders

in accordance with our Bylaws, based on the same criteria. As noted above, the

Compensation and Governance Committee may engage third party search firms to

identify potential director nominees.

Board

Leadership & Structure

At our 2016 Annual Meeting of

Stockholders, Ms. Mangum assumed the role of independent Chairman. The

independent Chairman’s roles and responsibilities include: (1) establishing the

Board agendas and schedules to confirm that appropriate topics are reviewed and

sufficient time is allocated to each; (2) providing input to the CEO with

respect to the information provided to the Board; (3) serving as a liaison

between the independent directors and the CEO; (4) presiding at the executive

sessions of independent directors; (5) facilitating communications and

coordination of activities among the committees as appropriate; and (6)

approving and coordinating the retention of advisors and consultants to the

Board.

Table of

Contents

Our Corporate Governance Guidelines

provide that the roles of Chairman and CEO may be separated or combined. The

Board exercises its discretion in combining or separating these positions as it

deems appropriate. The Board believes that the combination or separation of

these positions should be considered as part of the succession planning process.

In the event that the Chairman is not independent, the Board believes that it is

beneficial for the independent directors to appoint an independent Lead

Director. Currently, the Board believes that having an independent Chairman best

serves the Board in its oversight role.

The Board has two standing committees: an

Audit Committee and a Compensation and Governance Committee. The composition and

leadership of these committees are shown in the table below. In the future, the

Board may establish other committees, as it deems appropriate, to assist it with

its responsibilities. The committees report to the Board as they deem

appropriate, and as the Board may request. Each standing committee operates

under a charter that has been approved by the Board and each is comprised solely

of independent directors.

| Board Member |

Audit

Committee |

|

Compensation

and

Governance Committee |

| Michael Archbold |

X |

|

— |

| Terry Davenport |

— |

|

X(1) |

| Michael F. Devine |

▲ |

|

— |

| Theo Killion |

— |

|

X |

| David Kornberg |

— |

|

— |

| Karen Leever |

— |

|

X(1) |

| Mylle Mangum |

X |

|

X |

| Peter Swinburn |

— |

|

▲ |

| ▲ |

|

Chair of the committee |

| (1) |

|

Effective March 2017, Mr. Davenport and Ms.

Leever were appointed to serve on the Compensation and Governance

Committee. |

AUDIT

COMMITTEE

Audit Committee

Responsibilities

The Audit Committee is responsible for,

among other matters:

●appointing,

compensating, retaining, evaluating, terminating, and overseeing our

independent registered public accounting firm;

●reviewing the

independent registered public accounting firm’s independence from

management;

●reviewing with our

independent registered public accounting firm the scope and results of

their audit;

●approving all audit

and permissible non-audit services to be performed by the Company’s

independent registered public accounting firm;

●overseeing the

financial reporting process and discussing with management and the

Company’s independent registered public accounting firm the interim and

annual financial statements, including related disclosures, that the

Company files with the SEC, as well as earnings releases and non-GAAP

measures;

●reviewing and

monitoring the Company’s accounting principles, accounting policies,

financial and accounting controls, and compliance with legal and

regulatory requirements;

●establishing

procedures for the confidential anonymous submission of concerns regarding

questionable accounting, internal controls, or auditing

matters;

●reviewing and

approving known related person transactions;

●reviewing internal

audit activities and reports; and

●assisting the Board

in its oversight of the Company’s risk management program, including

regularly reviewing the Company’s risk portfolio, management’s process for

identifying risks, and the steps management has taken to monitor and

control such risks. |

|

EXPRESS Notice of 2017 Annual Meeting of

Stockholders |

|

19 |

|

|

|

Table of

Contents

The Audit Committee also prepares the

Audit Committee Report that SEC rules require to be included in our annual proxy

statement. This report is on page 61 of this proxy statement.

Audit Committee

Meetings

The Audit Committee met eight times in

2016. The Audit Committee generally has eight regularly scheduled meetings per

year and has an opportunity at each meeting to speak with the lead audit partner

from the Company’s independent registered public accounting firm as well as the

Company’s director of internal audit without any other members of management

present. In addition, the Audit Committee Chair has regularly scheduled

teleconferences with each of the Company’s Chief Financial Officer and the lead

audit partner from the Company’s independent registered public accounting

firm.

Audit Committee

Practices

At the end of each quarter, the Audit

Committee reviews and discusses with management and the Company’s independent

registered public accounting firm the Company’s financial results, press

releases concerning the Company’s financial performance and earnings estimates,

any significant control deficiencies identified and steps management has taken

or plans to take to remediate the deficiencies, significant estimates and

proposed adjustments to the financial statements, reports to the Company’s

ethics hotline, internal audit activities and reports, and the results of the

independent registered public accounting firm’s review or audit of the Company’s

financial statements, among other things.

Each year the Audit Committee evaluates

the performance of the Company’s independent registered public accounting firm

and considers whether it is in the best interests of the Company and its

stockholders to engage the firm for another year. As part of its evaluation, the

Audit Committee considers the qualifications of the persons who will be staffed

on the Company’s engagement, including the lead audit partner, quality of work,

firm reputation, independence, fees, retail experience, and understanding of the

Company’s financial reporting processes, policies, and procedures. The Audit

Committee solicits feedback from management as part of its evaluation

process.

Audit Committee

Independence and Expertise

The Board has affirmatively determined

that (1) each of our Audit Committee members meets the definition of

“independent director” for purposes of serving on the Audit Committee under both

Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and the NYSE listing rules, and (2) each qualifies as an “audit committee

financial expert,” as such term is defined in Item 407(d)(5) of Regulation

S-K.

Audit Committee

Charter

The Audit Committee Charter may be viewed

in the investor relations section of our website at www.express.com/investor. We

will also provide a copy of the charter in print without charge upon written

request delivered to the Office of the Corporate Secretary at 1 Express Drive,

Columbus, OH 43230.