Texas Pacific Land Trust Announces First Quarter 2017 Financial Results

April 27 2017 - 4:20PM

Business Wire

Texas Pacific Land Trust (NYSE: TPL) today announced financial

results for the first quarter of fiscal 2017, which ended March 31,

2017.

Results for first quarter 2017:

- Net Income of $14.9 million, or $1.88

per sub-share, for first quarter 2017, compared with $7.3 million,

or $0.90 per sub-share, for first quarter 2016.

- Revenues of $24.2 million for first

quarter 2017, compared with $11.9 million for first quarter

2016.

- Increases of 112.7% in easements and

sundry income and 99.5% in oil and gas royalty revenue for first

quarter 2017, compared with first quarter 2016.

Further Details:

Easements and sundry income was $12,911,778 for the first

quarter of 2017, an increase of 112.7% compared with the first

quarter of 2016 when easements and sundry income was $6,070,973.

This increase resulted primarily from an increase in pipeline

easement income and water sales, and to a lesser extent, material

sales (caliche).

Oil and gas royalty revenue was $11,192,762 for the first

quarter of 2017, compared with $5,610,751 for the first quarter of

2016, an increase of 99.5%. Crude oil and gas production subject to

the Trust’s royalty interests increased 38.6% and 36.4%

respectively in the first quarter of 2017 compared with 2016. In

addition, the prices received for crude oil and gas production

increased 47.8% and 37.0% respectively in the first quarter of 2017

compared with 2016.

“As reflected in the first quarter 2017 results, the Trust

continues to see an increase in development of oil and gas assets

by operators on land owned by the Trust and where the Trust has a

royalty interest,” said Robert J. Packer, General Agent and Chief

Financial Officer.

Texas Pacific Land Trust is not a

REIT.

This news release may contain forward-looking statements as

defined in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include statements regarding the Trust's

future operations and prospects, the markets for real estate in the

areas in which the Trust owns real estate, applicable zoning

regulations, the markets for oil and gas, production limits on

prorated oil and gas wells authorized by the Railroad Commission of

Texas, expected competitions, management's intent, beliefs or

current expectations with respect to the Trust's future financial

performance and other matters. We assume no responsibility to

update any such forward-looking statements.

TEXAS PACIFIC LAND TRUST

REPORT OF OPERATIONS

- UNAUDITED

Three Months

Ended

March 31,

2017

March 31,

2016

Oil and gas royalties $ 11,192,762 $ 5,610,751 Land sales --

86,000 Easements and sundry income* 12,911,778 6,070,973

Other income 133,722 130,379 Total

income $ 24,238,262 $ 11,898,103 Provision for income tax $

7,228,137 $ 3,522,363 Net income $ 14,885,422 $ 7,280,051

Net income per sub-share $ 1 .88 $ .90 Average

sub-shares outstanding during period 7,919,085 8,098,106

* The Trust deferred $6,806,890 of easement income for the first

quarter of 2017 due to the transition to term easements.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170427006458/en/

Texas Pacific Land TrustRobert J. Packer, 214-969-5531General

Agent, Chief Financial Officer

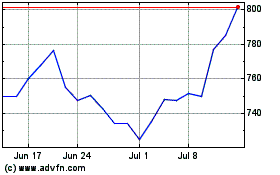

Texas Pacific Land (NYSE:TPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

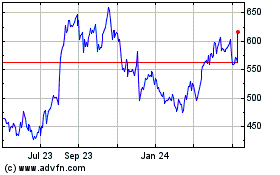

Texas Pacific Land (NYSE:TPL)

Historical Stock Chart

From Apr 2023 to Apr 2024