Western Digital Corp. (NASDAQ: WDC) today reported revenue of

$4.6 billion, operating income of $525 million and net income of

$248 million, or $0.83 per share, for its third fiscal quarter

ended March 31, 2017. The GAAP net income for the period includes

charges associated with the company’s recent acquisitions.

Excluding these charges and after other non-GAAP adjustments, third

quarter non-GAAP operating income was $1.0 billion and non-GAAP net

income was $716 million, or $2.39 per share.

In the year-ago quarter, the company reported revenue of $2.8

billion, operating income of $88 million and net income of $74

million, or $0.32 per share. Non-GAAP operating income in the

year-ago quarter was $347 million and non-GAAP net income was $317

million, or $1.35 per share.

The company generated $1.0 billion in cash from operations

during the third fiscal quarter of 2017, ending with $5.8 billion

of total cash, cash equivalents and available-for-sale securities.

On Feb. 1, 2017, the company declared a cash dividend of $0.50 per

share of its common stock, which was paid to shareholders on April

17, 2017.

“We reported strong financial performance in the March quarter,

enabled by excellent operational execution by our team in a healthy

market environment with good demand for all NAND based products, as

well as for capacity enterprise and client hard drives,” said Steve

Milligan, chief executive officer. “We also achieved targeted cost

and efficiency improvements and improved our liquidity position

with strong cash flow generation.

“With three consecutive quarters of strong financial results

since completing the SanDisk acquisition, we are seeing continued

validation of our growth strategy and our ongoing transformation

into a comprehensive provider of diversified storage products and

technologies. We have constructed a powerful platform with the

broadest set of products, enabling us to be a leader in the storage

industry. Our transformation provides us with the opportunity to

not only compete in today’s marketplace but also to be positioned

to grow and thrive into the future.”

The investment community conference call to discuss these

results and the company’s guidance for the fourth fiscal quarter

2017 will be broadcast live over the Internet today at 2:30 p.m.

Pacific/5:30 p.m. Eastern. The live and archived conference

call/webcast can be accessed online at investor.wdc.com.

Supplemental financial information, including the company’s

guidance for the fourth fiscal quarter 2017, will also be posted on

the same website. The telephone replay number in the U.S. is

1(855)859-2056 or +1(404)537-3406 for international callers. The

required passcode is 94428076.

About Western Digital

Western Digital is an industry-leading provider of storage

technologies and solutions that enable people to create, leverage,

experience and preserve data. The company addresses ever-changing

market needs by providing a full portfolio of compelling,

high-quality storage solutions with customer-focused innovation,

high efficiency, flexibility and speed. Our products are marketed

under the HGST, SanDisk and WD brands to OEMs, distributors,

resellers, cloud infrastructure providers and consumers. Financial

and investor information is available on the company's Investor

Relations website at investor.wdc.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements concerning the company’s preliminary

financial results for its third fiscal quarter ended March 31,

2017; market and demand trends; achievement of synergy goals

associated with our acquisitions; our product portfolio and market

position; and our growth strategy. These forward-looking statements

are based on management’s current expectations and are subject to

risks and uncertainties that could cause actual results to differ

materially from those expressed or implied in the forward-looking

statements. The preliminary financial results for the company’s

third fiscal quarter ended March 31, 2017 included in this press

release represent the most current information available to

management. The company’s actual results when disclosed in its

quarterly report on Form 10-Q may differ from these preliminary

results as a result of the completion of the company’s financial

closing procedures; final adjustments; completion of the review by

the company’s independent registered accounting firm and other

developments that may arise between now and the disclosure of the

final results. Other risks and uncertainties that could cause

actual results to differ materially from those expressed or implied

in the forward-looking statements include: uncertainties with

respect to the company’s business ventures with Toshiba; volatility

in global economic conditions; business conditions and growth in

the storage ecosystem; impact of competitive products and pricing;

market acceptance and cost of commodity materials and specialized

product components; actions by competitors; unexpected advances in

competing technologies; our development and introduction of

products based on new technologies and expansion into new data

storage markets; risks associated with acquisitions, mergers and

joint ventures; difficulties or delays in manufacturing; and other

risks and uncertainties listed in the company’s filings with the

Securities and Exchange Commission (the “SEC”), including the

company’s Form 10-Q filed with the SEC on Feb. 7, 2017, to which

your attention is directed. You should not place undue reliance on

these forward-looking statements, which speak only as of the date

hereof, and the company undertakes no obligation to update these

forward-looking statements to reflect new information or

events.

Western Digital, WD and SanDisk are registered trademarks or

trademarks of Western Digital Corporation or its affiliates in the

U.S. and/or other countries. Other trademarks, registered

trademarks, and/or service marks, indicated or otherwise, are the

property of their respective owners. © 2017 Western Digital

Corporation or its affiliates. All rights reserved.

WESTERN DIGITAL CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS (in

millions; unaudited) Mar. 31, July 1,

2017 2016 ASSETS Current assets:

Cash and cash equivalents $ 5,652 $ 8,151 Short-term investments 25

227 Accounts receivable, net 1,948 1,461 Inventories 2,254 2,129

Other current assets 434 616 Total current assets

10,313 12,584 Property, plant and equipment, net 3,099 3,503 Notes

receivable and investments in Flash Ventures 1,291 1,171 Goodwill

10,012 9,951 Other intangible assets, net 4,144 5,034 Other

non-current assets 589 619 Total assets $ 29,448 $

32,862

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities: Accounts payable $ 2,185 $ 1,888

Accounts payable to related parties 194 168 Accrued expenses 1,073

995 Accrued compensation 480 392 Accrued warranty 196 172 Bridge

loan - 2,995 Current portion of long-term debt 181

339 Total current liabilities 4,309 6,949 Long-term debt 12,907

13,660 Other liabilities 1,201 1,108 Total

liabilities 18,417 21,717 Total shareholders' equity 11,031

11,145 Total liabilities and shareholders' equity $ 29,448 $

32,862

WESTERN DIGITAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (in millions, except per share amounts;

unaudited) Three Months Ended

Nine Months Ended Mar. 31, Apr. 1, Mar.

31, Apr. 1, 2017 2016 2017

2016 Revenue, net $ 4,649 $ 2,822 $ 14,251 $ 9,499

Cost of revenue 3,126 2,069

9,860 6,885 Gross profit 1,523

753 4,391 2,614 Operating

expenses: Research and development 613 359 1,837 1,133 Selling,

general and administrative 346 166 1,100 565 Charges related to

arbitration award - - - 32 Employee termination, asset impairment

and other charges 39 140 152

223 Total operating expenses 998

665 3,089 1,953 Operating

income 525 88 1,302 661 Interest and other expense, net (221

) (8 ) (948 ) (23 ) Income before taxes 304 80

354 638 Income tax expense 56 6

237 30 Net income $ 248 $ 74 $

117 $ 608 Income per common share: Basic $

0.86 $ 0.32 $ 0.41 $ 2.62 Diluted $

0.83 $ 0.32 $ 0.40 $ 2.60

Weighted average shares outstanding: Basic 289

233 287 232 Diluted 299

234 295 234

WESTERN DIGITAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(in millions; unaudited)

Three Months Ended Nine

Months Ended Mar. 31, Apr. 1, Mar.

31, Apr. 1, 2017 2016 2017

2016 Operating Activities Net income $ 248 $

74 $ 117 $ 608 Adjustments to reconcile net income to net cash

provided by operations: Depreciation and amortization 560 246 1,582

734 Stock-based compensation 102 42 303 121 Deferred income taxes

(56 ) (32 ) 61 (17 ) Loss on disposal of assets 2 7 12 13 Write-off

of issuance costs and amortization of debt discounts 17 1 275 3

Loss on convertible debt 1 - 6 - Non-cash portion of employee

termination, asset impairment and other charges - 18 13 36 Other

non-cash operating activities, net 16 - 58 - Changes in operating

assets and liabilities, net 108 129

71 130 Net cash provided by operating

activities 998 485 2,498

1,628

Investing Activities Purchases of

property, plant and equipment, net (103 ) (133 ) (432 ) (433 )

Activity related to Flash Ventures, net (154 ) - (224 ) -

Investment activity, net 136 587 231 445 Strategic investments and

other, net (9 ) (11 ) (21 ) (23 ) Net

cash provided by (used in) investing activities (130 )

443 (446 ) (11 )

Financing

Activities Employee stock plans, net (4 ) 14 102 17 Proceeds

from acquired call option - - 61 - Repurchases of common stock - -

- (60 ) Dividends paid to shareholders (144 ) (116 ) (428 ) (347 )

Proceeds from debt, net of issuance costs 3,913 - 7,898 - Repayment

of debt (3,925 ) (302 ) (12,179 ) (364

) Net cash used in financing activities (160 ) (404 )

(4,546 ) (754 ) Effect of exchange rate changes on

cash 4 - (5 ) -

Net increase (decrease) in cash and cash equivalents 712 524 (2,499

) 863 Cash and cash equivalents, beginning of period 4,940

5,363 8,151 5,024

Cash and cash equivalents, end of period $ 5,652 $ 5,887

$ 5,652 $ 5,887

WESTERN DIGITAL

CORPORATION RECONCILIATION OF

GAAP TO NON-GAAP FINANCIAL MEASURES (in millions,

except per share amounts; unaudited)

Three Months Ended

Nine Months Ended Mar. 31, Apr. 1, Mar.

31, Apr. 1, 2017 2016 2017

2016

Summary

Reconciliation of Net Income:

GAAP net income $ 248 $ 74 $ 117 $ 608 Amortization

of acquired intangible assets 324 22 843 71 Stock-based

compensation expense 98 36 293 112 Employee termination, asset

impairment and other charges 39 140 152 223 Acquisition-related

charges 2 16 35 43 Charges related to cost saving initiatives 28 49

114 86 Charges related to arbitration award - - - 32 Convertible

debt activity, net 1 - 7 - Debt extinguishment costs 7 - 274 -

Other 6 (4 ) 20 (8 ) Income tax adjustments (37 ) (16

) (16 ) (35 )

Non-GAAP net income $ 716

$ 317 $ 1,839 $ 1,132

GAAP cost of

revenue $ 3,126 $ 2,069 $ 9,860 $ 6,885 Amortization of

acquired intangible assets (284 ) (16 ) (724 ) (49 ) Stock-based

compensation expense (13 ) (4 ) (37 ) (13 ) Acquisition-related

charges - - (18 ) - Charges related to cost saving initiatives (6 )

(25 ) (44 ) (47 ) Other - 2 (3 )

5

Non-GAAP cost of revenue $ 2,823 $

2,026 $ 9,034 $ 6,781

GAAP gross

profit $ 1,523 $ 753 $ 4,391 $ 2,614 Amortization of acquired

intangible assets 284 16 724 49 Stock-based compensation expense 13

4 37 13 Acquisition-related charges - - 18 - Charges related to

cost saving initiatives 6 25 44 47 Other - (2

) 3 (5 )

Non-GAAP gross profit $ 1,826

$ 796 $ 5,217 $ 2,718

GAAP

operating expense $ 998 $ 665 $ 3,089 $ 1,953 Amortization of

acquired intangible assets (40 ) (6 ) (119 ) (22 ) Stock-based

compensation expense (85 ) (32 ) (256 ) (99 ) Employee termination,

asset impairment and other charges (39 ) (140 ) (152 ) (223 )

Acquisition-related charges (2 ) (16 ) (17 ) (43 ) Charges related

to arbitration award - - - (32 ) Charges related to cost saving

initiatives (22 ) (24 ) (70 ) (39 ) Other 1 2

(4 ) 3

Non-GAAP operating

expense $ 811 $ 449 $ 2,471 $ 1,498

GAAP operating income $ 525 $ 88 $ 1,302 $ 661 Cost

of revenue adjustments 303 43 826 104 Operating expense adjustments

187 216 618 455

Non-GAAP operating income $ 1,015 $ 347

$ 2,746 $ 1,220

GAAP interest and other

expense, net $ (221 ) $ (8 ) $ (948 ) $ (23 ) Convertible debt

activity, net 1 - 7 - Debt extinguishment costs 7 - 274 - Other

7 - 13 -

Non-GAAP interest and other expense, net $ (206 ) $ (8 ) $

(654 ) $ (23 )

GAAP income tax expense $ 56 $ 6 $ 237

$ 30 Income tax adjustments 37 16

16 35

Non-GAAP income tax

expense $ 93 $ 22 $ 253 $ 65

GAAP net income $ 248 $ 74 $ 117 $ 608 Cost of revenue

adjustments 303 43 826 104 Operating expense adjustments 187 216

618 455 Interest and other expense, net adjustments 15 - 294 -

Income tax adjustments (37 ) (16 ) (16 )

(35 )

Non-GAAP net income $ 716 $ 317 $

1,839 $ 1,132

Diluted net income per common

share: GAAP $ 0.83 $ 0.32 $ 0.40 $ 2.60

Non-GAAP $ 2.39 $ 1.35 $ 6.23 $ 4.84

Diluted weighted average shares outstanding:

GAAP 299 234 295

234 Non-GAAP 299 234 295

234

To supplement the condensed consolidated financial statements

presented in accordance with U.S. generally accepted accounting

principles (“GAAP”), the table above sets forth non-GAAP cost of

revenue; non-GAAP gross profit; non-GAAP operating expenses;

non-GAAP operating income; non-GAAP interest and other expense,

net; non-GAAP income tax expense; non-GAAP net income and non-GAAP

diluted net income per common share (“Non-GAAP measures”). These

Non-GAAP measures are not in accordance with, or an alternative

for, measures prepared in accordance with GAAP and may be different

from Non-GAAP measures used by other companies. Western Digital

Corporation believes the presentation of these Non-GAAP measures,

when shown in conjunction with the corresponding GAAP measures,

provides useful information to investors for measuring the

Company’s earnings performance and comparing it against prior

periods. Specifically, we believe these Non-GAAP measures provide

useful information to both management and investors as they exclude

certain expenses, gains and losses that we believe are not

indicative of our core operating results or because they are

consistent with the financial models and estimates published by

many analysts who follow us and our peers. As discussed further

below, these Non-GAAP measures exclude the amortization of acquired

intangible assets, stock-based compensation expense, employee

termination, asset impairment and other charges,

acquisition-related charges, charges related to arbitration award,

charges related to cost saving initiatives, convertible debt

activity, debt extinguishment costs, other charges, and income tax

adjustments, and we believe these measures along with the related

reconciliations to the GAAP measures provide additional detail and

comparability for assessing our results. These Non-GAAP measures

are some of the primary indicators management uses for assessing

our performance and planning and forecasting future periods. These

measures should be considered in addition to results prepared in

accordance with GAAP, but should not be considered a substitute

for, or superior to, GAAP results.

As described above, we exclude the following items from our

Non-GAAP measures:

Amortization of acquired intangible

assets. We incur expenses from the amortization of acquired

intangible assets over their economic lives. Such charges are

significantly impacted by the timing and magnitude of our

acquisitions and any related impairment charges.

Stock-based compensation expense.

Because of the variety of equity awards used by companies, the

varying methodologies for determining stock-based compensation

expense, the subjective assumptions involved in those

determinations, and the volatility in valuations that can be driven

by market conditions outside our control, we believe excluding

stock-based compensation expense enhances the ability of management

and investors to understand and assess the underlying performance

of our business over time and compare it against our peers, a

majority of whom also exclude stock-based compensation expense from

their non-GAAP results.

Employee termination, asset impairment and

other charges. From time-to-time, in order to realign our

operations with anticipated market demand or to achieve cost

synergies from the integration of acquisitions, we may terminate

employees and/or restructure our operations. From time-to-time, we

may also incur charges from the impairment of intangible assets and

other long-lived assets. These charges (including any reversals of

charges recorded in prior periods) are inconsistent in amount and

frequency and are not indicative of the underlying performance of

our business.

Acquisition-related charges. In

connection with our business combinations, we incur expenses which

we would not have otherwise incurred as part of our business

operations. These expenses include third-party professional service

and legal fees, third-party integration services, severance costs,

non-cash adjustments to the fair value of acquired inventory,

contract termination costs, and retention bonuses. We may also

experience other accounting impacts in connection with these

transactions. These charges and impacts are related to

acquisitions, are inconsistent in amount and frequency, and are not

indicative of the underlying performance of our business.

Charges related to arbitration

award. In relation to an arbitration award for claims

brought against the Company by Seagate Technology LLC, which was

satisfied in October 2014, and the related dispute over the

calculation of post-award interest, we have recorded loss

contingencies. The resulting expense is inconsistent in amount and

frequency.

Charges related to cost saving

initiatives. In connection with the transformation of our

business, we have incurred charges related to cost saving

initiatives which do not qualify for special accounting treatment

as exit or disposal activities. These charges, which are not

indicative of the underlying performance of our business, primarily

relate to costs associated with rationalizing our channel partners

or vendors, transforming our information systems infrastructure,

integrating our product roadmap, and accelerated depreciation on

assets.

Convertible debt activity, net. We

exclude non-cash economic interest expense associated with the

convertible senior notes, the gains and losses on the conversion of

the convertible senior notes and call option, and unrealized gains

and losses related to the change in fair value of the exercise

option and call option. These charges and gains and losses do not

reflect our cash operating results and are not indicative of the

underlying performance of our business.

Debt extinguishment costs. From

time-to-time, we replace our existing debt with new financing at

more favorable interest rates or utilize available capital to

settle debt early, both of which generate interest savings in

future periods. We incur debt extinguishment charges consisting of

the costs to call the existing debt and/or the write-off of any

related unamortized debt issuance costs. These gains and losses

related to our debt activity occur infrequently and are not

indicative of the underlying performance of our business.

Other charges. From time-to-time,

we sell or impair investments or other assets which are not

considered necessary to our business operations; are a party to

legal or arbitration proceedings, which could result in an expense

or benefit due to settlements, final judgments, or accruals for

loss contingencies; or incur other charges or gains which are not a

part of the ongoing operation of our business. The resulting

expense or benefit is inconsistent in amount and frequency.

Income tax adjustments. Income tax

adjustments reflect the difference between income taxes based on a

forecasted annual non-GAAP tax rate and a forecasted annual GAAP

tax rate as a result of the timing of certain non-GAAP pre-tax

adjustments.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170427006718/en/

Western Digital Corp.Media Contact:Jim Pascoe,

408.717.6999jim.pascoe@wdc.comorInvestor Contact:Bob Blair,

949.672.7834robert.blair@wdc.com

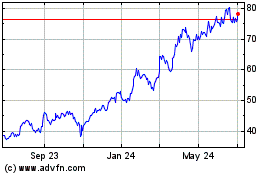

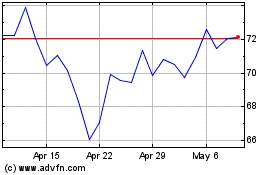

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Apr 2023 to Apr 2024