Mitek Reports Record Revenue and Profitability in Second Quarter of Fiscal 2017

April 27 2017 - 4:05PM

Mitek (NASDAQ:MITK) (www.miteksystems.com), a global leader in

mobile capture and identity verification software solutions, today

announced its financial results for the second quarter of fiscal

2017 ended March 31, 2017.

Fiscal Second Quarter Financial Highlights

- Record total revenue of $11.4 million, up 34% year over

year.

- SaaS revenue of $1.7 million, up 41% year over year.

- Record GAAP net income of $1.2 million, or $0.03 per diluted

share, up 109% year over year.

- Record Non-GAAP net income of $3.0 million, or $0.08 per

diluted share, up 23% year over year.

- Cash and investments totaled $39.9 million at March 31, 2017,

up $5.4 million, or 16% from the first fiscal quarter.

Commenting on the results, James DeBello, Chairman and

CEO of Mitek, said:

“We are pleased to report the best quarter in Mitek’s

history. Our record revenue and profits were driven by growth

from both our ID verification and industry leading mobile check

deposit products. Our ID solutions are playing a key role

globally in the digital transformation of financial services and

other companies who need to verify the identity of their customers

to meet regulatory requirements. We believe that our market

momentum, competitive advantages, global footprint and solid

balance sheet position us well for continued growth in this large

and growing market.”

Conference Call Information

Mitek management will host a conference call and live webcast

for analysts and investors today at 1:30 p.m. Pacific Time (4:30

p.m. Eastern Time) to discuss the Company's financial results.

To listen to the live conference call, parties in the United

States and Canada should dial 888-378-4353, access code 8540639.

International parties should call 719-457-2605 using access code

8540639. Please dial in approximately 15 minutes prior to the start

of the call.

A live and archived webcast of the conference call will be

accessible on the "Investor Relations" section of the Company's

website at www.miteksystems.com. To access the live webcast, please

log in 15 minutes prior to the start of the call to download and

install any necessary audio software.

About Mitek

Mitek (MITK) is a global leader in mobile capture and identity

verification software solutions. Mitek’s ID document verification

allows an enterprise to verify a user’s identity during a mobile

transaction, enabling financial institutions, payments companies

and other businesses operating in highly regulated markets to

transact business safely while increasing revenue from the mobile

channel. Mitek also reduces the friction in the mobile user

experience with advanced data prefill. These innovative mobile

solutions are embedded into the apps of approximately 5,600

organizations and used by tens of millions of consumers daily for

mobile check deposit, new account opening, insurance quoting and

more. Learn more at www.miteksystems.com. [(MITK-F)]

Notice Regarding Forward-Looking Statements

Statements contained in this news release relating to the

Company's or management's intentions, hopes, beliefs, expectations

or predictions of the future, including, but not limited to,

statements relating to the Company's long-term prospects and market

opportunities are forward-looking statements. Such forward-looking

statements are subject to a number of risks and uncertainties,

including, but not limited to, risks related to the Company's

ability to withstand negative conditions in the global economy, a

lack of demand for or market acceptance of the Company's products,

the Company's ability to continue to develop, produce and introduce

innovative new products in a timely manner or the outcome of any

pending or threatened litigation and the timing of the

implementation and launch of the Company’s products by the

Company's signed customers.

Additional risks and uncertainties faced by the Company are

contained from time to time in the Company's filings with the U.S.

Securities and Exchange Commission (SEC), including, but not

limited to, the Company's Annual Report on Form 10-K for the fiscal

year ended September 30, 2016 and its quarterly reports on Form

10-Q and current reports on Form 8-K, which you may obtain for free

on the SEC's website at www.sec.gov. Collectively, these risks and

uncertainties could cause the Company's actual results to differ

materially from those projected in its forward-looking statements

and you are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date hereof.

The Company disclaims any intention or obligation to update, amend

or clarify these forward-looking statements, whether as a result of

new information, future events or otherwise, except as may be

required under applicable securities laws.

Note Regarding Use of Non-GAAP Financial

Measures

This news release contains non-GAAP financial measures for

non-GAAP net income and non-GAAP net income per share that exclude

stock compensation expenses, intellectual property litigation costs

and acquisition-related costs and expenses. These financial

measures are not calculated in accordance with generally accepted

accounting principles (GAAP) and are not based on any comprehensive

set of accounting rules or principles. In evaluating the Company's

performance, management uses certain non-GAAP financial measures to

supplement financial statements prepared under GAAP. Management

believes these non-GAAP financial measures provide a useful measure

of the Company's operating results, a meaningful comparison with

historical results and with the results of other companies, and

insight into the Company's ongoing operating performance. Further,

management and the Board of Directors utilize these non-GAAP

financial measures to gain a better understanding of the Company's

comparative operating performance from period-to-period and as a

basis for planning and forecasting future periods. Management

believes these non-GAAP financial measures, when read in

conjunction with the Company's GAAP financials, are useful to

investors because they provide a basis for meaningful

period-to-period comparisons of the Company's ongoing operating

results, including results of operations against investor and

analyst financial models, which helps identify trends in the

Company's underlying business and provides a better understanding

of how management plans and measures the Company's underlying

business.

| MITEK SYSTEMS, INC. |

| CONSOLIDATED BALANCE SHEETS |

| (Unaudited) |

| (amounts in thousands except share data) |

| |

|

|

|

|

| |

|

March 31, 2017 (Unaudited) |

|

September 30, 2016 |

|

ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

12,959 |

|

|

$ |

9,010 |

|

|

Short-term investments |

|

23,051 |

|

|

24,863 |

|

| Accounts

receivable, net |

|

5,104 |

|

|

4,949 |

|

| Other

current assets |

|

1,130 |

|

|

1,485 |

|

| Total

current assets |

|

42,244 |

|

|

40,307 |

|

| Long-term

investments |

|

3,896 |

|

|

1,952 |

|

| Property and equipment,

net |

|

474 |

|

|

440 |

|

| Goodwill and intangible

assets |

|

5,088 |

|

|

5,646 |

|

| Other non-current

assets |

|

62 |

|

|

40 |

|

| Total assets |

|

$ |

51,764 |

|

|

$ |

48,385 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

| Current

liabilities: |

|

|

|

|

| Accounts

payable |

|

$ |

1,820 |

|

|

$ |

1,318 |

|

| Accrued

payroll and related taxes |

|

2,370 |

|

|

3,263 |

|

| Deferred

revenue, current portion |

|

3,677 |

|

|

3,391 |

|

| Other

current liabilities |

|

348 |

|

|

355 |

|

| Total

current liabilities |

|

8,215 |

|

|

8,327 |

|

| Deferred revenue,

non-current portion |

|

51 |

|

|

259 |

|

| Other non-current

liabilities |

|

686 |

|

|

314 |

|

| Total liabilities |

|

8,952 |

|

|

8,900 |

|

| Stockholders’

equity: |

|

|

|

|

| Preferred

stock, $0.001 par value, 1,000,000 shares authorized, none issued

and outstanding |

|

— |

|

|

— |

|

| Common

stock, $0.001 par value, 60,000,000 shares authorized, 33,324,328

and 32,781,704 issued and outstanding, as of March 31, 2017 and

September 30, 2016, respectively |

|

33 |

|

|

33 |

|

|

Additional paid-in capital |

|

74,067 |

|

|

71,036 |

|

|

Accumulated other comprehensive loss |

|

(356 |

) |

|

(42 |

) |

|

Accumulated deficit |

|

(30,932 |

) |

|

(31,542 |

) |

| Total

stockholders’ equity |

|

42,812 |

|

|

39,485 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

51,764 |

|

|

$ |

48,385 |

|

| |

|

|

|

|

|

|

|

|

| MITEK SYSTEMS, INC. |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

| (Unaudited) |

| (amounts in thousands except share data) |

| |

|

|

|

|

| |

|

Three Months Ended March 31, |

|

Six Months Ended March 31, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| Revenue |

|

|

|

|

|

|

|

|

|

Software |

|

$ |

7,797 |

|

|

$ |

5,556 |

|

|

$ |

13,780 |

|

|

$ |

10,286 |

|

| SaaS,

maintenance and consulting |

|

3,622 |

|

|

2,966 |

|

|

6,908 |

|

|

5,640 |

|

| Total

revenue |

|

11,419 |

|

|

8,522 |

|

|

20,688 |

|

|

15,926 |

|

| Operating costs and

expenses |

|

|

|

|

|

|

|

|

| Cost of

revenue-software |

|

154 |

|

|

132 |

|

|

368 |

|

|

522 |

|

| Cost of

revenue-SaaS, maintenance and consulting |

|

676 |

|

|

588 |

|

|

1,353 |

|

|

1,140 |

|

| Selling

and marketing |

|

3,704 |

|

|

2,553 |

|

|

7,542 |

|

|

5,016 |

|

| Research

and development |

|

2,401 |

|

|

1,813 |

|

|

4,852 |

|

|

3,520 |

|

| General

and administrative |

|

2,742 |

|

|

2,264 |

|

|

4,985 |

|

|

4,355 |

|

|

Acquisition-related costs and expenses |

|

518 |

|

|

541 |

|

|

1,036 |

|

|

1,084 |

|

| Total

operating costs and expenses |

|

10,195 |

|

|

7,891 |

|

|

20,136 |

|

|

15,637 |

|

| Operating income |

|

1,224 |

|

|

631 |

|

|

552 |

|

|

289 |

|

| Other income, net |

|

67 |

|

|

30 |

|

|

132 |

|

|

66 |

|

| Income before income

taxes |

|

1,291 |

|

|

661 |

|

|

684 |

|

|

355 |

|

| Income tax

provision |

|

(74 |

) |

|

(79 |

) |

|

(74 |

) |

|

(95 |

) |

| Net income |

|

$ |

1,217 |

|

|

$ |

582 |

|

|

$ |

610 |

|

|

$ |

260 |

|

| Net income per share –

basic |

|

$ |

0.04 |

|

|

$ |

0.02 |

|

|

$ |

0.02 |

|

|

$ |

0.01 |

|

| Net income per share –

diluted |

|

$ |

0.03 |

|

|

$ |

0.02 |

|

|

$ |

0.02 |

|

|

$ |

0.01 |

|

| Shares used in

calculating net income per share – basic |

|

32,786,079 |

|

|

31,325,577 |

|

|

32,581,988 |

|

|

31,214,325 |

|

| Shares used in

calculating net income per share – diluted |

|

34,815,304 |

|

|

33,133,920 |

|

|

34,818,392 |

|

|

32,625,526 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| MITEK SYSTEMS, INC. |

| NON-GAAP NET INCOME (LOSS)

RECONCILIATION |

| (Unaudited) |

| (amounts in thousands except share data) |

| |

|

|

|

|

| |

|

Three Months Ended March 31, |

|

Six Months Ended March 31, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| Income before income

taxes |

|

$ |

1,291 |

|

|

$ |

661 |

|

|

$ |

684 |

|

|

$ |

355 |

|

| Add back: |

|

|

|

|

|

|

|

|

|

Acquisition-related costs and expenses |

|

518 |

|

|

541 |

|

|

1,036 |

|

|

1,084 |

|

|

Litigation costs |

|

— |

|

|

114 |

|

|

— |

|

|

227 |

|

| Stock

compensation expense |

|

1,223 |

|

|

1,172 |

|

|

2,308 |

|

|

2,161 |

|

| Non-GAAP income before

income taxes |

|

3,032 |

|

|

2,488 |

|

|

4,028 |

|

|

3,827 |

|

| Non-GAAP provision for

income taxes |

|

(74 |

) |

|

(79 |

) |

|

(74 |

) |

|

(95 |

) |

| Non-GAAP net

income |

|

2,958 |

|

|

2,409 |

|

|

3,954 |

|

|

3,732 |

|

| Non-GAAP income per

share - basic |

|

$ |

0.09 |

|

|

$ |

0.08 |

|

|

$ |

0.12 |

|

|

$ |

0.12 |

|

| Non-GAAP income per

share - diluted |

|

$ |

0.08 |

|

|

$ |

0.07 |

|

|

$ |

0.11 |

|

|

$ |

0.11 |

|

| Shares used in

calculating non-GAAP net income per share - basic |

|

32,786,079 |

|

|

31,325,577 |

|

|

32,581,988 |

|

|

31,214,325 |

|

| Shares used in

calculating non-GAAP net income per share - diluted |

|

34,815,304 |

|

|

33,133,920 |

|

|

34,818,392 |

|

|

32,625,526 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

________________

Follow Mitek on

LinkedIn: http://www.linkedin.com/company/mitek-systems-inc- Follow

Mitek on Twitter: @miteksystemsConnect with Mitek on Facebook:

http://www.facebook.com/MitekSystems See Mitek on YouTube:

http://www.youtube.com/miteksystems Read Mitek’s latest blog

post: http://www.miteksystems.com/blog

Investor Contact:

Todd Kehrli or Jim Byers

MKR Group, Inc.

mitk@mkr-group.com

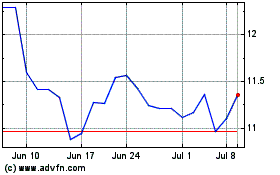

Mitek Systems (NASDAQ:MITK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mitek Systems (NASDAQ:MITK)

Historical Stock Chart

From Apr 2023 to Apr 2024