Additional Proxy Soliciting Materials (definitive) (defa14a)

April 27 2017 - 11:55AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒ Filed by a party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material under

§240.14a-12

|

Ardelyx, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than The Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules

14a-6(i)(1)

and

0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule

0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2)

and identify the filing for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

DOWNLOADS STOCKHOLDER LETTER 2016 IN REVIEW PROGRAMS OUR TEAM OUR 2021 GOALS

16

ANNUAL REPORT

THE GATEWAY TO BETTER HEALTH

We are committed to bringing effective medicines with distinct

safety and dosing advantages to underserved patients by using the gut as the gateway to better health.

2016 OVERVIEW PDF DOWNLOAD

Download the full Annual Report

A MESSAGE FROM OUR CEO

Mike Raab, CEO

When we look back at the performance of the company in 2016, it is clear that

our successes were the result of years of hard work and our long-standing commitment to our vision of dramatically enhancing the way patients with cardiorenal and gastrointestinal (Gl) diseases are treated. The achievements of 2016 have paved the

path toward our goal of becoming a leading, fully integrated, revenue-generating biotechnology company.

FULL STOCKHOLDER LETTER

2016

A YEAR IN REVIEW

42

EMPLOYEES joined in 2016, nearly doubling staff to 100+

Multiple

PHASE 3

TRIALS UNDERWAY

3

BUSINESS

PORTFOLIOS

(Cardiorenal,

GI and Discovery)

$201M

MILLION IN CASH*

WITH $0 DEBT

12/31/16

2K+

PATIENTS TREATED WITH TENAPANOR; 19 CLINICAL TRIALS

*Cash, cash equivalents and short-term investments

BI-COASTAL

TEAM WITH ACCESS TO TOP TALENT

San Francisco, CA

Boston, MA

EXPANDED SOCIAL PRESENCE

Twitter

LinkedIn

ONE COMPANY. THREE COMPONENTS.

As we prepare for

potential commercialization of our late-stage programs, we’ve established three unique business portfolios to streamline our efforts as an integrated company. Across each of these portfolios remains our underlying approach to developing

medicines - using the gut as the gateway to better health.

Gl PORTFOLIO

CARDIORENAL PORTFOLIO

DISCOVERY PLATFORM

Gl PORTFOLIO

Our Gl portfolio is led by tenapanor, which is currently in Phase 3 development

for the treatment of irritable bowel syndrome with constipation

(IBS-C).

Tenapanor for

IBS-C

is being evaluated in the Phase 3

T3MP0-1

and

T3MP0-2

trials, and a long-term safety study,

T3MPO-3.

All three trials are fully enrolled, with data expected from

T3MPO-1

in Q2 2017, from

T3MPO-2

in the second half of 2017 and from

T3MPO-3

in late 2017. The successful completion of these studies

would support the NDA for tenapanor in this indication, which we expect to file in 2018.

In addition to tenapanor, RDX8940 is a minimally systemic TGR5 agonist IND

candidate advancing towards Phase 1 clinical development for various Gl indications. We are also advancing our RDX011 program of minimally systemic NHE3 inhibitors, and RDX023, our program of gut-biased FXR agonists, both for various Gl indications,

towards clinical development.

LEARN MORE

CARDIORENAL PORTFOLIO

Our cardiorenal portfolio is

led by the Phase 3 development of tenapanor for the treatment of hyperphosphatemia in patients with

end-stage

renal disease (ESRD) who are on dialysis. In February 2017, we reported

top-line,

positive data from the first of two Phase 3 studies for tenapanor in hyperphosphatemia, that demonstrated statistical significance in lowering serum phosphorus and a favorable Gl tolerability profile. We

plan to initiate the second Phase 3 study in this indication in

mid-2017.

At the end of 2016, we initiated a Phase 3 study

and an

onset-of-action

study for our potassium binder, RDX7675, for the treatment of patients with hyperkalemia. We plan to report data from the

onset-of-action

study in Q3 2017. Also in our cardiorenal portfolio, we are advancing our RDX011 NHE3 inhibitor program, and our RDX013 potassium secretagogue program, with a

focus on cardiorenal indications and hyperkalemia, respectively.

LEARN MORE

DISCOVERY PLATFORM

Our platform serves as a discovery engine and has allowed

us to identify a number of therapeutic programs that support long-term pipeline development. RDX013, RDX009, RDX011 and RDX023 are the most recent programs to emerge from our discovery platform.

LEARN MORE

OUR PATIENTS DRIVE US FORWARD

We are a passionate

team with strong culture built on integrity.

We don’t come to work just to do a job, we come to make a difference.

OUR CULTURE

DELIVER

2021

2016 was an important stepping stone as we work to deliver on our 2021 vision. We plan to

work tirelessly in an effort to achieve our goals.

Independent, fully integrated, revenue-generating biotech company

Profitable cardiorenal business

Double-digit growth in GI business

Approval in 4+ cardiorenal and GI diseases

Robust pipeline of 4 Phase 2 assets with 1 IND

filing per year

ARDELYX

Ardelyx Annual Report | 2016

April 25, 2017

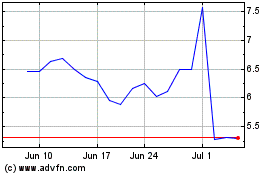

Ardelyx (NASDAQ:ARDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ardelyx (NASDAQ:ARDX)

Historical Stock Chart

From Apr 2023 to Apr 2024