Orrstown Financial Services, Inc. (the “Company”) (NASDAQ:ORRF),

the parent company of Orrstown Bank (the “Bank”) and Wheatland

Advisors, Inc. ("Wheatland"), announced earnings for the three

months ended March 31, 2017. Net income was $2.0 million

for the three months ended March 31, 2017, compared with $2.6

million for the same period in 2016. Diluted earnings per share

totaled $0.24 and $0.32 for the three months ended March 31,

2017 and 2016. Earnings in the first quarter of 2017 reflected

increased interest income from expanding loan and investment

portfolios as the Company pursued its growth strategy and continued

to take advantage of market disruption. Results for the first

quarter of 2016 were significantly influenced by investment

securities gains of $1.4 million compared with minimal gains in the

first quarter of 2017. Noninterest income, excluding securities

gains, was consistent between 2017 and 2016. Noninterest expenses

totaled $12.1 million, up from $11.1 million in the 2016 quarter,

with overall increases attributable to salaries and benefits

associated with the Company's growth.

Thomas R. Quinn, Jr., President and Chief

Executive Officer, commented, “The momentum which began in the

second half of 2016 has continued and is growing in the first

quarter of 2017. Our growth in loans, combined with effective

balance sheet management, has moved our net interest margin

substantially from 2016, ultimately resulting in over 18% net

interest income growth. Our growth in loans, deposits and net

interest margin are the result of great efforts by our staff in the

Company’s core markets, and our 2016 investments we made in new

markets."

OPERATING RESULTS

Net Interest Income

Net interest income totaled $10.2 million for

the three months ended March 31, 2017, an 18.3% increase over

$8.7 million for the same period in 2016. Net interest margin

on a fully taxable-equivalent basis was 3.35% for the three months

ended March 31, 2017, compared to 3.06% for the same period in

2016. For the first quarter of 2017, the net interest margin of

3.35% expanded 15 basis points over the fourth quarter of 2016, and

was 29 basis points higher than the first quarter of 2016.

Increased yields in loans and investments

reflected a higher interest rate environment as well as purchases

of additional tax-exempt securities in late 2016 and 2017 with

yields higher than the portfolio average. The cost of

interest-bearing liabilities increased at a slower pace than the

yields earned on interest-earning assets from 2016 to 2017, as the

market has been slow to respond to interest rate changes.

Provision for Loan Losses

The Company recorded no provision for loan

losses during the three months ended March 31, 2017 or

2016. In calculating the required provision for loan losses,

both quantitative and qualitative factors are considered in the

determination of the adequacy of the allowance for loan losses.

Favorable historical charge-off data combined with stable economic

and market conditions resulted in the determination that no

provision for loan losses was required to offset net charge-offs or

for loan growth experienced during the first quarter of 2017.

Despite improvement in many of the asset quality

metrics since March 2016, the growth the Company has experienced in

its loan portfolio is one factor that may result in the need for

additional provisions for loan losses in future quarters.

Noninterest Income

Noninterest income, excluding securities gains,

for the three months ended March 31, 2017 totaled $4.3

million, compared with $4.2 million in the prior year period.

Trust, investment management and brokerage income increased $128

thousand, which is largely attributable to activity from Wheatland

Advisors, Inc., which was acquired in December 2016. Mortgage

banking activities income decreased $139 thousand due to decreased

refinance activity as interest rates have increased.

Investment securities gains were not significant

in the three months ended March 31, 2017, compared with $1.4

million for the same period in 2016. As market conditions

present opportunities to act on asset/liability management

strategies or interest rate market conditions, the Company may sell

investment securities.

Noninterest Expenses

Noninterest expenses totaled $12.1 million and

$11.1 million for the three months ended March 31, 2017 and

2016. The principal drivers of the increase were salaries and

employee benefits, which increased $1.2 million, and occupancy,

furniture and equipment which increased $181 thousand. These

increases reflect previously disclosed market expansion actions by

the Company as it has added new, primarily customer-facing,

employees and facilities, principally in Berks, Cumberland, Dauphin

and Lancaster counties.

Other line items within noninterest expenses

showed modest fluctuations between 2017 and 2016.

Income Taxes

Income tax expense totaled $424 thousand for the

three months ended March 31, 2017, compared to $614 thousand

for the same period in 2016. The Company’s effective tax rate is

significantly less than the 34.0% federal statutory rate

principally due to tax-exempt income, including interest earned on

tax-exempt loans and securities and earnings on the cash value of

life insurance policies. The effective tax rate for the three

months ended March 31, 2017 was 17.5%, compared with 19.2% for

the three months ended March 31, 2016. The lower effective tax

rate for the first quarter of 2017 compared with 2016 is primarily

the result of a larger percentage of tax-exempt income to total

income and additional tax credits.

FINANCIAL CONDITION

Assets totaled $1.45 billion at March 31,

2017, an increase of $39.4 million from $1.41 billion at

December 31, 2016 and of $166.7 million from $1.29 billion at

March 31, 2016. The principal growth components were securities

available for sale, which increased $23.4 million from December 31,

2016 to March 31, 2017 and $96.0 million year-over-year, and loans

which are summarized below. Deposit growth of $31.4 million

in the first quarter of 2017 was the primary source of funding for

growth in securities and loans in the quarter. Deposit growth of

$135.5 million, coupled with an overall reduction in cash balances

of $38.4 million, was the primary source of funding for

year-over-year growth in securities and loans.

Gross loans, excluding those held for sale,

totaled $901.3 million at March 31, 2017, and increased $17.9

million, or 2.0% (8.2% annualized), from $883.4 million at

December 31, 2016, In comparison to March 31, 2016’s

loan balance of $804.7 million, loans increased $96.6 million, or

12.0%.

The following table presents loan balances, by

loan class within segments, at March 31, 2017,

December 31, 2016 and March 31, 2016.

| (Dollars in

thousands) |

March 31, 2017 |

|

December 31, 2016 |

|

March 31, 2016 |

| |

|

|

|

|

|

| Commercial real

estate: |

|

|

|

|

|

| Owner

occupied |

$ |

114,991 |

|

|

$ |

112,295 |

|

|

$ |

106,464 |

|

| Non-owner

occupied |

209,601 |

|

|

206,358 |

|

|

154,731 |

|

|

Multi-family |

47,893 |

|

|

47,681 |

|

|

37,664 |

|

| Non-owner

occupied residential |

64,809 |

|

|

62,533 |

|

|

54,834 |

|

| Acquisition and

development: |

|

|

|

|

|

| 1-4

family residential construction |

5,790 |

|

|

4,663 |

|

|

7,270 |

|

|

Commercial and land development |

27,648 |

|

|

26,085 |

|

|

42,245 |

|

| Commercial and

industrial |

90,638 |

|

|

88,465 |

|

|

77,277 |

|

| Municipal |

53,225 |

|

|

53,741 |

|

|

62,302 |

|

| Residential

mortgage: |

|

|

|

|

|

| First

lien |

143,282 |

|

|

139,851 |

|

|

125,706 |

|

| Home

equity – term |

13,605 |

|

|

14,248 |

|

|

16,578 |

|

| Home

equity – lines of credit |

122,473 |

|

|

120,353 |

|

|

111,770 |

|

| Installment and other

loans |

7,376 |

|

|

7,118 |

|

|

7,862 |

|

| |

$ |

901,331 |

|

|

$ |

883,391 |

|

|

$ |

804,703 |

|

Growth was experienced in nearly all loan

segments from December 31, 2016 to March 31, 2017, with

the largest increase in the commercial real estate segment, which

grew by $8.4 million, which was approximately half of the portfolio

growth for the period, or 8.0% annualized. The Company continues to

grow in both core markets and new markets through expansion in the

sales force and capitalizing on continued market disruption.

Total deposits grew 2.7% (11.1% annualized) from

$1.15 billion at December 31, 2016 to $1.18 billion at March 31,

2017, and increased 12.9% in comparison with $1.05 billion at March

31, 2016, due principally to growth in interest-bearing accounts.

The Company has continued to increase both noninterest-bearing and

interest-bearing deposit relationships from enhanced cash

management offerings delivered by its expanded sales force.

Shareholders’ Equity

Shareholders’ equity totaled $137.5 million at

March 31, 2017, an increase of $2.6 million, or 1.9%, from

$134.9 million at December 31, 2016. This increase was

principally the result of net income totaling $2.0 million for the

three months ended March 31, 2017 coupled with a $1.1 million

increase in accumulated other comprehensive income (loss), net of

tax, and offset by dividends declared on common stock during the

quarter.

Asset Quality

Asset quality metrics remained relatively stable

in comparing March 31, 2017 with December 31, 2016 and have

improved since March 31, 2016.

The allowance for loan losses balance totaled

$12.7 million at March 31, 2017, compared with the $12.8

million at December 31, 2016 and the $13.3 million balance at

March 31, 2016. Management believes the allowance for loan

losses to total loans ratio remains adequate at 1.41% as of

March 31, 2017. Favorable historical charge-off data and

management's emphasis on loan quality have been significant

contributors to the determination that a relatively stable

allowance for loan losses balance is adequate as the loan portfolio

has been increasing.

The allowance for loan losses to nonperforming

loans totaled 198.6% at March 31, 2017 compared with 181.4% at

December 31, 2016, and 83.9% at March 31, 2016, reflecting a

substantial decrease in nonaccrual loans from a year ago. The

allowance for loan losses to nonperforming and restructured loans

still accruing totaled 173.5% at March 31, 2017, compared to

160.2% at December 31, 2016 and 78.7% at March 31,

2016.

Nonperforming and other risk assets, defined as

nonaccrual loans, restructured loans still accruing, loans past due

90 days or more and still accruing, and other real estate owned

totaled decreased 52.3% from March 31, 2016 to March 31, 2017. The

balance at March 31, 2017 and December 31, 2017 was a similar $8.3

million compared with $17.4 million at March 31, 2016, as

nonaccrual loans decreased $9.5 million from March 31, 2016 to

March 31, 2017.

Classified loans, defined as loans rated

substandard, doubtful or loss, totaled $22.0 million at

March 31, 2017, or approximately 2.4% of total loans, compared

with $22.9 million (2.6%) at December 31, 2016 and $24.4

million (3.0%) at March 31, 2016.

| ORRSTOWN

FINANCIAL SERVICES, INC. |

|

|

|

|

| Operating

Highlights (Unaudited) |

|

|

|

|

| |

|

Three Months Ended |

| |

|

March 31, |

|

March 31, |

| (Dollars in thousands,

except per share data) |

|

2017 |

|

2016 |

| |

|

|

|

|

| Net income |

|

$ |

2,002 |

|

|

$ |

2,580 |

|

| Diluted earnings per

share |

|

$ |

0.24 |

|

|

$ |

0.32 |

|

| Dividends per

share |

|

$ |

0.10 |

|

|

$ |

0.08 |

|

| Return on average

assets |

|

0.57 |

% |

|

0.80 |

% |

| Return on average

equity |

|

6.01 |

% |

|

7.64 |

% |

| Net interest

income |

|

$ |

10,237 |

|

|

$ |

8,650 |

|

| Net interest

margin |

|

3.35 |

% |

|

3.06 |

% |

| ORRSTOWN

FINANCIAL SERVICES, INC. |

|

|

|

|

|

| Balance Sheet

Highlights (Unaudited) |

|

|

|

|

|

| |

March 31, |

|

December 31, |

|

March 31, |

| (Dollars in thousands,

except per share data) |

2017 |

|

2016 |

|

2016 |

| |

|

|

|

|

|

| Assets |

$ |

1,453,946 |

|

|

$ |

1,414,504 |

|

|

$ |

1,287,279 |

|

| Loans, gross |

901,331 |

|

|

883,391 |

|

|

804,703 |

|

| Allowance for loan

losses |

(12,668 |

) |

|

(12,775 |

) |

|

(13,347 |

) |

| Deposits |

1,183,876 |

|

|

1,152,452 |

|

|

1,048,376 |

|

| Shareholders'

equity |

137,469 |

|

|

134,859 |

|

|

138,247 |

|

| Book value per

share |

16.50 |

|

|

16.28 |

|

|

16.68 |

|

|

ORRSTOWN FINANCIAL SERVICES, INC. |

|

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited) |

|

|

|

| |

|

|

|

|

|

|

|

| |

March 31, |

|

December 31, |

|

March 31, |

| (Dollars in

thousands) |

2017 |

|

2016 |

|

2016 |

|

Assets |

|

|

|

|

|

| Cash and

cash equivalents |

$ |

28,551 |

|

|

$ |

30,273 |

|

|

$ |

66,915 |

|

| Securities

available for sale |

423,601 |

|

|

400,154 |

|

|

327,590 |

|

| |

|

|

|

|

|

|

|

| Loans held

for sale |

3,349 |

|

|

2,768 |

|

|

3,499 |

|

| |

|

|

|

|

|

| Loans |

901,331 |

|

|

883,391 |

|

|

804,703 |

|

| Less:

Allowance for loan losses |

(12,668 |

) |

|

(12,775 |

) |

|

(13,347 |

) |

| |

Net

loans |

888,663 |

|

|

870,616 |

|

|

791,356 |

|

| |

|

|

|

|

|

|

|

| Premises

and equipment, net |

34,767 |

|

|

34,871 |

|

|

29,689 |

|

| Other

assets |

75,015 |

|

|

75,822 |

|

|

68,230 |

|

| |

|

Total assets |

$ |

1,453,946 |

|

|

$ |

1,414,504 |

|

|

$ |

1,287,279 |

|

| |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

| |

Noninterest-bearing |

$ |

157,983 |

|

|

$ |

150,747 |

|

|

$ |

146,094 |

|

| |

Interest-bearing |

1,025,893 |

|

|

1,001,705 |

|

|

902,282 |

|

| |

|

Total deposits |

1,183,876 |

|

|

1,152,452 |

|

|

1,048,376 |

|

|

Borrowings |

117,491 |

|

|

112,027 |

|

|

87,106 |

|

| Accrued

interest and other liabilities |

15,110 |

|

|

15,166 |

|

|

13,550 |

|

| |

|

Total liabilities |

1,316,477 |

|

|

1,279,645 |

|

|

1,149,032 |

|

| |

|

|

|

|

|

|

|

|

Shareholders' Equity |

|

|

|

|

|

| Common

stock |

434 |

|

|

437 |

|

|

437 |

|

| Additional

paid - in capital |

124,365 |

|

|

124,935 |

|

|

124,548 |

|

| Retained

earnings |

12,848 |

|

|

11,669 |

|

|

9,855 |

|

| Accumulated

other comprehensive income (loss) |

(98 |

) |

|

(1,165 |

) |

|

4,434 |

|

| Treasury

stock |

(80 |

) |

|

(1,017 |

) |

|

(1,027 |

) |

| |

|

Total shareholders'

equity |

137,469 |

|

|

134,859 |

|

|

138,247 |

|

| |

|

Total liabilities and

shareholders' equity |

$ |

1,453,946 |

|

|

$ |

1,414,504 |

|

|

$ |

1,287,279 |

|

|

ORRSTOWN FINANCIAL SERVICES, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Unaudited) |

| |

|

|

|

|

|

| |

|

|

Three Months Ended |

| |

|

|

March 31, |

|

March 31, |

| (Dollars in

thousands, except share data) |

|

2017 |

|

2016 |

|

Interest and dividend income |

|

|

|

|

| Interest

and fees on loans |

|

$ |

9,204 |

|

|

$ |

7,991 |

|

| Interest

and dividends on investment securities |

|

2,626 |

|

|

1,970 |

|

| |

Total interest and

dividend income |

|

11,830 |

|

|

9,961 |

|

|

Interest expense |

|

|

|

|

| Interest on

deposits |

|

1,326 |

|

|

1,139 |

|

| Interest on

borrowings |

|

267 |

|

|

172 |

|

| |

Total interest

expense |

|

1,593 |

|

|

1,311 |

|

| Net

interest income |

|

10,237 |

|

|

8,650 |

|

| Provision

for loan losses |

|

0 |

|

|

0 |

|

| |

Net interest income

after provision for loan losses |

|

10,237 |

|

|

8,650 |

|

| |

|

|

|

|

|

|

Noninterest income |

|

|

|

|

| Service

charges on deposit accounts |

|

1,358 |

|

|

1,303 |

|

| Trust,

investment management and brokerage income |

|

1,913 |

|

|

1,785 |

|

| Mortgage

banking activities |

|

503 |

|

|

642 |

|

| Other

income |

|

558 |

|

|

515 |

|

| Investment

securities gains |

|

3 |

|

|

1,420 |

|

| |

Total noninterest

income |

|

4,335 |

|

|

5,665 |

|

| |

|

|

|

|

|

|

Noninterest expenses |

|

|

|

|

| Salaries

and employee benefits |

|

7,400 |

|

|

6,183 |

|

| Occupancy,

furniture and equipment |

|

1,493 |

|

|

1,312 |

|

| Data

processing |

|

511 |

|

|

635 |

|

| Advertising

and bank promotions |

|

387 |

|

|

456 |

|

| FDIC

insurance |

|

137 |

|

|

232 |

|

|

Professional services |

|

508 |

|

|

520 |

|

| Collection

and problem loan |

|

75 |

|

|

52 |

|

| Real estate

owned |

|

20 |

|

|

43 |

|

| Taxes other

than income |

|

228 |

|

|

155 |

|

| Other

operating expenses |

|

1,387 |

|

|

1,533 |

|

| |

Total noninterest

expenses |

|

12,146 |

|

|

11,121 |

|

| |

Income before income

tax |

|

2,426 |

|

|

3,194 |

|

| Income tax

expense |

|

424 |

|

|

614 |

|

| Net

income |

|

$ |

2,002 |

|

|

$ |

2,580 |

|

| |

|

|

|

|

|

| Per

share information: |

|

|

|

|

| |

Basic earnings per

share |

|

$ |

0.25 |

|

|

$ |

0.32 |

|

| |

Diluted earnings per

share |

|

0.24 |

|

|

0.32 |

|

| |

Dividends per

share |

|

0.10 |

|

|

0.08 |

|

| |

Diluted

weighted-average shares of common stock outstanding |

|

8,198,127 |

|

|

8,139,070 |

|

| ORRSTOWN

FINANCIAL SERVICES, INC. |

|

|

|

|

|

|

|

|

|

|

|

| ANALYSIS OF NET

INTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

Average Balances and Interest Rates, Taxable-Equivalent

Basis (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

| |

March 31, 2017 |

|

March 31, 2016 |

| |

|

|

Taxable- |

|

Taxable- |

|

|

|

Taxable- |

|

Taxable- |

| |

Average |

|

Equivalent |

|

Equivalent |

|

Average |

|

Equivalent |

|

Equivalent |

| (Dollars in

thousands) |

Balance |

|

Interest |

|

Rate |

|

Balance |

|

Interest |

|

Rate |

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

| Federal funds sold

& interest-bearing bank balances |

$ |

5,545 |

|

|

$ |

18 |

|

|

1.32 |

% |

|

$ |

43,242 |

|

|

$ |

65 |

|

|

0.60 |

% |

| Securities |

415,342 |

|

|

3,010 |

|

|

2.94 |

|

|

363,614 |

|

|

2,142 |

|

|

2.37 |

|

| Loans |

895,331 |

|

|

9,423 |

|

|

4.27 |

|

|

795,785 |

|

|

8,261 |

|

|

4.18 |

|

| Total interest-earning

assets |

1,316,218 |

|

|

12,451 |

|

|

3.84 |

|

|

1,202,641 |

|

|

10,468 |

|

|

3.50 |

|

| Other assets |

107,587 |

|

|

|

|

|

|

94,292 |

|

|

|

|

|

| Total |

$ |

1,423,805 |

|

|

|

|

|

|

$ |

1,296,933 |

|

|

|

|

|

| Liabilities and

Shareholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing demand

deposits |

$ |

609,052 |

|

|

$ |

365 |

|

|

0.24 |

|

|

$ |

521,442 |

|

|

$ |

252 |

|

|

0.19 |

|

| Savings deposits |

93,312 |

|

|

36 |

|

|

0.16 |

|

|

87,702 |

|

|

35 |

|

|

0.16 |

|

| Time deposits |

296,725 |

|

|

925 |

|

|

1.26 |

|

|

304,800 |

|

|

852 |

|

|

1.12 |

|

| Short-term

borrowings |

104,651 |

|

|

172 |

|

|

0.67 |

|

|

76,342 |

|

|

66 |

|

|

0.35 |

|

| Long-term debt |

21,460 |

|

|

95 |

|

|

1.80 |

|

|

24,459 |

|

|

106 |

|

|

1.74 |

|

| Total interest-bearing

liabilities |

1,125,200 |

|

|

1,593 |

|

|

0.57 |

|

|

1,014,745 |

|

|

1,311 |

|

|

0.52 |

|

| Noninterest-bearing

demand deposits |

148,502 |

|

|

|

|

|

|

133,214 |

|

|

|

|

|

| Other |

14,588 |

|

|

|

|

|

|

13,206 |

|

|

|

|

|

| Total Liabilities |

1,288,290 |

|

|

|

|

|

|

1,161,165 |

|

|

|

|

|

| Shareholders'

Equity |

135,515 |

|

|

|

|

|

|

135,768 |

|

|

|

|

|

| Total |

$ |

1,423,805 |

|

|

|

|

|

|

$ |

1,296,933 |

|

|

|

|

|

| Taxable-equivalent net

interest income / net interest spread |

|

|

10,858 |

|

|

3.27 |

% |

|

|

|

9,157 |

|

|

2.98 |

% |

| Taxable-equivalent net

interest margin |

|

|

|

|

3.35 |

% |

|

|

|

|

|

3.06 |

% |

| Taxable-equivalent

adjustment |

|

|

(621 |

) |

|

|

|

|

|

(507 |

) |

|

|

| Net interest

income |

|

|

$ |

10,237 |

|

|

|

|

|

|

$ |

8,650 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| NOTES: |

|

|

|

|

|

|

|

|

|

|

|

| (1) Yields

and interest income on tax-exempt assets have been computed on a

taxable-equivalent basis assuming a 34% tax rate. |

| (2) For

yield calculation purposes, nonaccruing loans are included in the

average loan balance. |

| ORRSTOWN

FINANCIAL SERVICES, INC. |

|

|

|

|

|

| Nonperforming

Assets / Risk Elements (Unaudited) |

|

|

|

|

|

| |

|

|

|

|

|

| |

March 31, |

|

December 31, |

|

March 31, |

| (Dollars in

thousands) |

2017 |

|

2016 |

|

2016 |

| |

|

|

|

|

|

| Nonaccrual loans (cash

basis) |

$ |

6,379 |

|

|

$ |

7,042 |

|

|

$ |

15,906 |

|

| Other real estate

(OREO) |

1,019 |

|

|

346 |

|

|

495 |

|

| Total nonperforming

assets |

7,398 |

|

|

7,388 |

|

|

16,401 |

|

| Restructured loans

still accruing |

921 |

|

|

930 |

|

|

1,044 |

|

| Loans past due 90 days

or more and still accruing |

0 |

|

|

0 |

|

|

1 |

|

| Total nonperforming and

other risk assets |

$ |

8,319 |

|

|

$ |

8,318 |

|

|

$ |

17,446 |

|

| |

|

|

|

|

|

| Loans 30-89 days past

due |

$ |

1,315 |

|

|

$ |

1,218 |

|

|

$ |

1,391 |

|

| |

|

|

|

|

|

| Asset quality

ratios: |

|

|

|

|

|

| Total nonperforming

loans to total loans |

0.71 |

% |

|

0.80 |

% |

|

1.98 |

% |

| Total nonperforming

assets to total assets |

0.51 |

% |

|

0.52 |

% |

|

1.27 |

% |

| Total nonperforming

assets to total loans and OREO |

0.82 |

% |

|

0.84 |

% |

|

2.04 |

% |

| Total risk assets to

total loans and OREO |

0.92 |

% |

|

0.94 |

% |

|

2.17 |

% |

| Total risk assets to

total assets |

0.57 |

% |

|

0.59 |

% |

|

1.36 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Allowance for loan

losses to total loans |

1.41 |

% |

|

1.45 |

% |

|

1.66 |

% |

| Allowance for loan

losses to nonperforming loans |

198.59 |

% |

|

181.41 |

% |

|

83.91 |

% |

| Allowance for loan

losses to nonperforming and restructured loans still accruing |

173.53 |

% |

|

160.25 |

% |

|

78.74 |

% |

| ORRSTOWN

FINANCIAL SERVICES, INC. |

|

|

|

| Roll Forward of

Allowance for Loan Losses (Unaudited) |

|

|

|

| |

|

|

|

| |

Three Months Ended |

| |

March 31, |

|

March 31, |

| (Dollars in

thousands) |

2017 |

|

2016 |

| |

|

|

|

| Balance at beginning of

period |

$ |

12,775 |

|

|

$ |

13,568 |

|

| Provision

for loan losses |

0 |

|

|

0 |

|

|

Recoveries |

22 |

|

|

108 |

|

|

Charge-offs |

(129 |

) |

|

(329 |

) |

| Balance at end of

period |

$ |

12,668 |

|

|

$ |

13,347 |

|

About the Company

With over $1.4 billion in assets, Orrstown

Financial Services, Inc. and its wholly-owned subsidiaries,

Orrstown Bank and Wheatland Advisors, Inc., provide a wide range of

consumer and business financial services through 26 banking and

financial advisory offices in Berks, Cumberland, Dauphin, Franklin,

Lancaster and Perry Counties, Pennsylvania and Washington County,

Maryland. Orrstown Bank is an Equal Housing Lender and its

deposits are insured up to the legal maximum by the FDIC.

Orrstown Financial Services, Inc.’s stock is traded on Nasdaq

(ORRF). For more information about Orrstown Financial

Services, Inc. and Orrstown Bank, visit www.orrstown.com. For more

information about Wheatland Advisors, Inc., visit

www.wheatlandadvisors.com.

Cautionary Note Regarding Forward-looking Statements:

This news release may contain forward-looking

statements as defined in the Private Securities Litigation Reform

Act of 1995. Forward-looking statements are statements that

include projections, predictions, expectations, or beliefs about

events or results or otherwise are not statements of historical

facts, including, without limitation, our ability to integrate

additional teams across all business lines as we continue our

expansion into Dauphin, Lancaster and Berks counties and fill a

void created in the community banking space from the disruption

caused by the acquisition of several competitors, and our belief

that we are positioned to create additional long-term shareholder

value from these expansion initiatives.

Actual results and trends could differ

materially from those set forth in such statements and there can be

no assurances that we will be able to continue to successfully

execute on our strategic expansion east into Dauphin, Lancaster and

Berks counties, take advantage of market disruption, and experience

sustained growth in loans and deposits. Factors that could

cause actual results to differ from those expressed or implied by

the forward looking statements include, but are not limited to, the

following: ineffectiveness of the Company's business strategy due

to changes in current or future market conditions; the effects of

competition, including industry consolidation and development of

competing financial products and services; changes in laws and

regulations, including the Dodd-Frank Wall Street Reform and

Consumer Protection Act; interest rate movements; changes in credit

quality; inability to raise capital, if necessary, under favorable

conditions; volatilities in the securities markets;

deteriorating economic conditions; the integration of the Company's

strategic acquisitions; and other risks and uncertainties,

including those detailed in Orrstown Financial Services, Inc.'s

Annual Report on Form 10-K for the year ended December 31, 2016,

under the headings “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” and “Risk Factors”

and in other filings made with the Securities and Exchange

Commission. The statements are valid only as of the date

hereof and Orrstown Financial Services, Inc. disclaims any

obligation to update this information.

The review period for subsequent events extends

up to and includes the filing date of a public company’s financial

statements, when filed with the Securities and Exchange

Commission. Accordingly, the consolidated financial

information presented in this announcement is subject to

change.

Contact:

David P. Boyle

Executive Vice President & CFO

Phone 717.530.2294

77 East King Street | Shippensburg PA

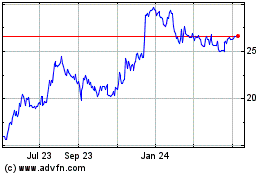

Orrstown Financial Servi... (NASDAQ:ORRF)

Historical Stock Chart

From Mar 2024 to Apr 2024

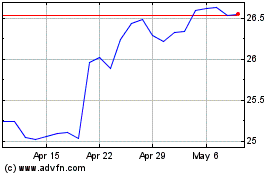

Orrstown Financial Servi... (NASDAQ:ORRF)

Historical Stock Chart

From Apr 2023 to Apr 2024