InterDigital, Inc. (NASDAQ:IDCC), a mobile technology research and

development company, today announced results for the first quarter

ended March 31, 2017.

First Quarter 2017 Financial Highlights

- First quarter 2017 total revenue was $94.5 million, compared to

$107.8 million in first quarter 2016. The decrease was

primarily attributable to the elimination of seasonality related to

Apple shipments as a result of the fixed-fee agreement signed in

fourth quarter 2016. That seasonality, driven by new product

launches, had previously resulted in higher per-unit revenue in

first quarter. The decrease in first quarter total revenue was

partially offset by revenue from our fixed-fee agreement with

Huawei, signed in third quarter 2016.

- First quarter 2017 operating expenses of $60.6 million were

relatively flat compared to $59.4 million in first quarter

2016.

- Net income1 was $33.8 million, or $0.93 per diluted share,

compared to $28.1 million, or $0.79 per diluted share, in first

quarter 2016. This increase was driven by a discrete first

quarter 2017 tax benefit associated with vesting of stock-based

compensation.

- In first quarter 2017, the company recorded $25.9 million of

cash used by operating activities, compared to cash generated of

$19.6 million in first quarter 2016. The company used $33.9

million and generated $10.0 million of free cash flow2 in first

quarter 2017 and first quarter 2016, respectively. These

decreases in cash generated were primarily due to the timing of

cash receipts under new fixed-fee agreements. Ending cash and

short-term investments totaled $886.1 million.

“Our licensing success in 2016 has resulted in very strong and

stable revenues that provide the company with a platform for

continued growth,” said William J. Merritt, President and CEO of

InterDigital. “With a significant proportion of the cellular market

left to license, our position in the Avanci IoT licensing platform,

and strong technologies to market in both IoT and sensor

technology, InterDigital is focused on growing our business while

maintaining strong expense discipline.”

Additional Financial Highlights for First Quarter

2017

- The slight increase in operating expenses was primarily

attributable to a $2.6 million increase in costs associated with

commercial initiatives and a $1.7 million increase in depreciation

and amortization, both primarily due to the acquisition of

Hillcrest Labs during fourth quarter 2016. These increases

were partially offset by a decrease in performance-based incentive

compensation and personnel-related costs, primarily due to the

recognition in first quarter 2016 of a $4.9 million non-recurring

charge related to an increase to accrual rates associated with our

long-term performance-based compensation plans and the recognition

of a severance charge.

- The company's first quarter 2017 effective tax rate was a

benefit of 5.2% compared to a provision of 34.1% during first

quarter 2016 based on the statutory federal tax rate net of

discrete federal and state taxes. The effective tax rate was

favorably impacted by our current year adoption of Accounting

Standard Update 2016-09, “Improvements to Employee Share-Based

Payment Accounting.” As a result, we recorded discrete benefits of

$11.8 million for excess tax benefits related to share-based

compensation. The effective rate would have been a provision of

32.6% not including these discrete benefits.

Conference Call Information

InterDigital will host a conference call on Thursday, April 27,

2017 at 10:00 a.m. Eastern Time to discuss its first quarter 2017

financial performance and other company matters. For a live

Internet webcast of the conference call,

visit www.interdigital.com and click on the link to the

live webcast on the Investors page. The company encourages

participants to take advantage of the Internet option.

For telephone access to the conference, call (800) 211-3767

within the United States or +1 719 325-2341 from outside the United

States. Please call by 9:50 a.m. ET on April 27 and give the

operator conference ID number 3262776.

An Internet replay of the conference call will be available on

InterDigital's website in the Investors section. In addition, a

telephone replay will be available from 1:00 p.m. ET April 27

through 1:00 p.m. ET May 2. To access the recorded replay, call

(888) 203-1112 or +1 719 457-0820 and use the replay code

3262776.

About InterDigital®

InterDigital develops mobile technologies that are at the core

of devices, networks, and services worldwide. We solve many of the

industry's most critical and complex technical challenges,

inventing solutions for more efficient broadband networks and a

richer multimedia experience years ahead of market deployment.

InterDigital has licenses and strategic relationships with many of

the world's leading wireless companies. Founded in 1972,

InterDigital is listed on NASDAQ and is included in the S&P

MidCap 400® index.

InterDigital is a registered trademark of InterDigital,

Inc.

For more information, visit the InterDigital website:

www.interdigital.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended. Such statements include information regarding our

current beliefs, plans and expectations, including, without

limitation, our belief that our strong and stable revenues provide

the company with a platform for continued growth and our plans to

focus on growing our business while maintaining strong expense

discipline. Words such as "believe," "anticipate,"

"estimate," "expect," "project," "intend," "plan," "forecast,"

"goal," and variations of any such words or similar expressions are

intended to identify such forward-looking statements.

Forward-looking statements are subject to risks and

uncertainties. Actual outcomes could differ materially from

those expressed in or anticipated by such forward-looking

statements due to a variety of factors, including, without

limitation, those identified in this press release, as well as the

following: (i) unanticipated delays, difficulties or acceleration

in the execution of patent license agreements; (ii) our ability to

leverage our strategic relationships and secure new patent license

agreements on acceptable terms; (iii) our ability to enter into

sales and/or licensing partnering arrangements for certain of our

patent assets; (iv) our ability to enter into partnerships with

leading inventors and research organizations and identify and

acquire technology and patent portfolios that align with

InterDigital's roadmap; (v) our ability to commercialize the

company's technologies and enter into customer agreements; (vi) the

failure of the markets for the company's current or new

technologies and products to materialize to the extent or at the

rate that we expect; (vii) unexpected delays or difficulties

related to the development of the company's technologies and

products; (viii) changes in the market share and sales performance

of our primary licensees, delays in product shipments of our

licensees, delays in the timely receipt and final reviews of

quarterly royalty reports from our licensees, delays in payments

from our licensees and related matters; (ix) the resolution of

current legal or regulatory proceedings, including any awards or

judgments relating to such proceedings, additional legal or

regulatory proceedings, changes in the schedules or costs

associated with legal or regulatory proceedings or adverse rulings

in such legal or regulatory proceedings; (x) changes or

inaccuracies in market projections; and (xi) changes in the

company's business strategy.

We undertake no duty to update publicly any forward-looking

statement, whether as a result of new information, future events or

otherwise, except as may be required by applicable law, regulation

or other competent legal authority.

Footnotes

1 Throughout this press release, net income (loss)

and diluted earnings per share ("EPS") are attributable to

InterDigital, Inc. (e.g., after adjustments for noncontrolling

interests), unless otherwise stated.

2 Free cash flow is a supplemental non-GAAP financial

measure that InterDigital believes is helpful in evaluating the

company's ability to invest in its business, make strategic

acquisitions and fund share repurchases, among other things.

A limitation of the utility of free cash flow as a measure of

financial performance is that it does not represent the total

increase or decrease in the company's cash balance for the period.

InterDigital defines “free cash flow” as net cash provided by

operating activities less purchases of property and equipment,

technology licenses and investments in patents.

InterDigital's computation of free cash flow might not be

comparable to free cash flow reported by other companies. The

presentation of this financial information, which is not prepared

under any comprehensive set of accounting rules or principles, is

not intended to be considered in isolation or as a substitute for

the financial information prepared and presented in accordance with

GAAP. A detailed reconciliation of free cash flow to net cash

provided by operating activities, the most directly comparable GAAP

financial measure, is provided at the end of this press

release.

| SUMMARY CONSOLIDATED STATEMENTS OF

INCOME |

| (dollars in thousands except per share data) |

| (unaudited) |

| |

| |

For the Three Months Ended March

31, |

| |

2017 |

|

2016 |

| REVENUES: |

|

|

|

| Per-unit

royalty revenue |

$ |

15,859 |

|

|

$ |

73,689 |

|

| Fixed fee

amortized royalty revenue |

73,367 |

|

|

29,098 |

|

| Current

patent royalties |

89,226 |

|

|

102,787 |

|

| Past

patent royalties |

— |

|

|

4,167 |

|

| Total

patent licensing royalties |

89,226 |

|

|

106,954 |

|

| Current

technology solutions revenue |

5,304 |

|

|

810 |

|

|

|

$ |

94,530 |

|

|

$ |

107,764 |

|

|

|

|

|

|

| OPERATING

EXPENSES: |

|

|

|

| Patent

administration and licensing |

29,407 |

|

|

27,167 |

|

|

Development |

18,521 |

|

|

20,269 |

|

| Selling,

general and administrative |

12,634 |

|

|

11,972 |

|

| |

60,562 |

|

|

59,408 |

|

|

|

|

|

|

| Income

from operations |

33,968 |

|

|

48,356 |

|

| |

|

|

|

| OTHER EXPENSE

(NET) |

(2,814 |

) |

|

(7,137 |

) |

| Income

before income taxes |

31,154 |

|

|

41,219 |

|

| INCOME TAX BENEFIT

(PROVISION) |

1,624 |

|

|

(14,068 |

) |

| NET

INCOME |

$ |

32,778 |

|

|

$ |

27,151 |

|

| Net loss

attributable to noncontrolling interest |

(978 |

) |

|

(920 |

) |

| NET INCOME ATTRIBUTABLE

TO INTERDIGITAL, INC. |

$ |

33,756 |

|

|

$ |

28,071 |

|

| NET INCOME PER COMMON

SHARE — BASIC |

$ |

0.98 |

|

|

$ |

0.80 |

|

| WEIGHTED AVERAGE NUMBER

OF COMMON SHARES OUTSTANDING — BASIC |

34,370 |

|

|

35,045 |

|

| NET INCOME PER COMMON

SHARE — DILUTED |

$ |

0.93 |

|

|

$ |

0.79 |

|

| WEIGHTED AVERAGE NUMBER

OF COMMON SHARES OUTSTANDING — DILUTED |

36,220 |

|

|

35,377 |

|

| CASH DIVIDENDS DECLARED

PER COMMON SHARE |

$ |

0.30 |

|

|

$ |

0.20 |

|

| SUMMARY CONSOLIDATED CASH FLOWS |

| (dollars in thousands) |

| (unaudited) |

| |

| |

For the Three Months Ended March

31, |

| |

2017 |

|

2016 |

| Income before income

taxes |

$ |

31,154 |

|

|

$ |

41,219 |

|

| Taxes paid |

(2,990 |

) |

|

(14,423 |

) |

| Non-cash expenses |

23,046 |

|

|

25,385 |

|

| Increase in deferred

revenue |

185,000 |

|

|

80,440 |

|

| Deferred revenue

recognized |

(78,921 |

) |

|

(34,594 |

) |

| (Decrease) increase in

operating working capital, deferred charges and other |

(183,144 |

) |

|

(78,389 |

) |

| Capital spending and

capitalized patent costs |

(8,055 |

) |

|

(9,656 |

) |

| FREE CASH FLOW |

(33,910 |

) |

|

9,982 |

|

| |

|

|

|

| Payments on long-term

debt |

— |

|

|

(230,000 |

) |

| Long-term

investments |

(501 |

) |

|

— |

|

| Acquisition of

patents |

— |

|

|

(4,500 |

) |

| Dividends paid |

(10,292 |

) |

|

(7,068 |

) |

| Taxes withheld upon

vesting of restricted stock units |

(21,955 |

) |

|

(3,405 |

) |

| Share repurchases |

— |

|

|

(40,399 |

) |

| Net proceeds from

exercise of stock options |

82 |

|

|

— |

|

| Unrealized (loss) gain

on short-term investments |

(45 |

) |

|

376 |

|

| NET DECREASE IN CASH

AND SHORT-TERM INVESTMENTS |

$ |

(66,621 |

) |

|

$ |

(275,014 |

) |

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

| (dollars in thousands) |

| (unaudited) |

| |

| |

MARCH 31, 2017 |

|

DECEMBER 31, 2016 |

|

ASSETS |

|

|

|

| Cash

& short-term investments |

$ |

886,140 |

|

|

$ |

952,761 |

|

| Accounts

receivable |

402,533 |

|

|

228,464 |

|

| Other

current assets |

53,562 |

|

|

39,894 |

|

| Property &

equipment and patents (net) |

318,108 |

|

|

323,394 |

|

| Other long-term assets

(net) |

205,045 |

|

|

183,340 |

|

| TOTAL ASSETS |

$ |

1,865,388 |

|

|

$ |

1,727,853 |

|

| |

|

|

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

| Accounts

payable, accrued liabilities, taxes payable & dividends

payable |

$ |

86,341 |

|

|

$ |

65,288 |

|

| Current

deferred revenue, including customer advances |

328,324 |

|

|

360,192 |

|

| Long-term

deferred revenue |

398,960 |

|

|

261,013 |

|

| Long-term

debt & other long-term liabilities |

291,622 |

|

|

286,992 |

|

| TOTAL LIABILITIES |

1,105,247 |

|

|

973,485 |

|

| TOTAL INTERDIGITAL,

INC. SHAREHOLDERS' EQUITY |

746,460 |

|

|

739,709 |

|

| Noncontrolling

interest |

13,681 |

|

|

14,659 |

|

| TOTAL EQUITY |

760,141 |

|

|

754,368 |

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY |

$ |

1,865,388 |

|

|

$ |

1,727,853 |

|

RECONCILIATION OF FREE CASH FLOW TO NET

CASHPROVIDED BY OPERATING ACTIVITIES

In the summary consolidated cash flows and throughout this

release, the company refers to free cash flow. The table

below presents a reconciliation of this non-GAAP financial measure

to net cash provided by operating activities, the most directly

comparable GAAP financial measure.

| |

|

For the Three Months Ended March

31, |

| |

|

2017 |

|

2016 |

| Net cash (used in)

provided by operating activities |

|

$ |

(25,855 |

) |

|

$ |

19,638 |

|

| Purchases of property,

equipment, & technology licenses |

|

(268 |

) |

|

(1,594 |

) |

| Capitalized patent

costs |

|

(7,787 |

) |

|

(8,062 |

) |

| Free cash flow |

|

$ |

(33,910 |

) |

|

$ |

9,982 |

|

CONTACT:

InterDigital, Inc.:

Patrick Van de Wille

patrick.vandewille@interdigital.com

+1 (858) 210-4814

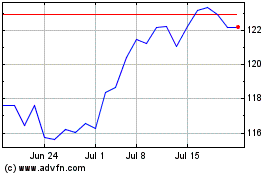

InterDigital (NASDAQ:IDCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

InterDigital (NASDAQ:IDCC)

Historical Stock Chart

From Apr 2023 to Apr 2024