-- Net income of $76 million or $0.34 per

diluted share –

-- Adjusted diluted net operating income per

share of $0.37 –

-- New MI business written grows 25%; MI in

force increases 6% year-over-year –

-- Book value per share increases 9%

year-over-year to $13.58 –

Radian Group Inc. (NYSE: RDN) today reported net income for the

quarter ended March 31, 2017, of $76.5 million, or $0.34 per

diluted share. This compares to net income for the quarter ended

March 31, 2016, of $66.2 million, or $0.29 per diluted share.

Consolidated pretax income for the quarter ended March 31, 2017,

was $114.7 million, which compares to consolidated pretax income of

$102.4 million for the quarter ended March 31, 2016.

Book value per share at March 31, 2017, was $13.58, compared to

$13.39 at December 31, 2016, and an increase of 9 percent from

$12.42 at March 31, 2016.

Key Financial Highlights (dollars in millions, except per

share data)

Quarter EndedMarch 31, 2017

Quarter EndedMarch 31, 2016

PercentChange

Net income $76.5 $66.2 16 % Diluted net income

per share $0.34 $0.29 17 % Pretax income

$114.7 $102.4 12 % Adjusted pretax operating

income $125.3 $130.2 (4 %) Adjusted diluted

net operating

income per share *

$0.37 $0.37 -- Net premiums earned –

insurance $221.8 $221.0 -- New Mortgage

Insurance Written (NIW) $10,055 $8,071 25 %

Mortgage insurance in force 185.9 175.4 6 %

Book value per share $13.58 $12.42 9 %

* Adjusted diluted net operating income per share is calculated

using the company’s statutory tax rate of 35 percent.

Adjusted pretax operating income for the quarter ended March 31,

2017, was $125.3 million, compared to $130.2 million for the

quarter ended March 31, 2016. Adjusted diluted net operating income

per share for the quarter ended March 31, 2017, was $0.37, flat to

$0.37 for the quarter ended March 31, 2016. See “Non-GAAP Financial

Measures” below as well as Exhibits F and G for additional details

regarding these adjusted measures.

“I am pleased to report strong first quarter results for Radian,

including year over year growth in net income, book value and new

MI business written,” said Radian’s Chief Executive Officer Rick

Thornberry. “As persistency rises, we expect our large,

high-quality MI in-force portfolio to grow and generate future

premium revenue. This is the primary driver of future earnings for

Radian.”

Thornberry added, “After nearly two months with Radian as CEO,

my excitement about the prospects ahead continues to grow. I

decided to join the company based on the excellent businesses,

great team, diversified set of products and services, high quality

portfolio, and the institutional commitment to serve customers.

Those qualities, along with a strong capital base, solid

profitability and excellent market opportunity, are a winning

combination.”

FIRST QUARTER HIGHLIGHTS

Mortgage Insurance

- New mortgage insurance written (NIW)

was $10.1 billion for the quarter, compared to $13.9 billion in the

fourth quarter of 2016 and $8.1 billion in the prior-year quarter.

- For the first quarter of 2017, NIW grew

25 percent compared to the first quarter of 2016.

- Of the $10.1 billion in new business

written in the first quarter of 2017, 25 percent was written with

single premiums. Net single premiums written, after consideration

of the 35 percent ceded under the Single Premium Quota Share

Reinsurance Transaction, was 16 percent in the first quarter of

2017.

- Refinances accounted for 16 percent of

total NIW in the first quarter of 2017, compared to 27 percent in

the fourth quarter of 2016, and 19 percent a year ago.

- NIW continued to consist of loans with

excellent risk characteristics.

- Total primary mortgage insurance in

force as of March 31, 2017, grew to $185.9 billion, compared to

$183.5 billion as of December 31, 2016, and $175.4 billion as of

March 31, 2016.

- The composition of Radian’s mortgage

insurance portfolio continues to improve, with 89 percent

consisting of new business written after 2008, including those

loans that successfully completed the Home Affordable Refinance

Program (HARP).

- Persistency, which is the percentage of

mortgage insurance that remains in force after a twelve-month

period, was 77.1 percent as of March 31, 2017, compared to 76.7

percent as of December 31, 2016, and 79.4 percent as of March 31,

2016.

- Annualized persistency for the

three-months ended March 31, 2017, was 84.4 percent, compared to

76.8 percent for the three-months ended December 31, 2016, and 82.3

percent for the three-months ended March 31, 2016.

- Total net premiums earned were $221.8

million for the quarter ended March 31, 2017, compared to $233.6

million for the quarter ended December 31, 2016, and $221.0 million

for the quarter ended March 31, 2016.

- Accelerated revenue recognition due to

Single Premium Policy cancellations, which are net of reinsurance,

were $5.9 million in the first quarter, compared to $15.7 million

in the fourth quarter of 2016, and $9.8 million in the first

quarter of 2016.

- Ceded premiums of $14.3 million, $18.2

million and $19.4 million for the quarters ended March 31, 2017,

December 31, 2016, and March 31, 2016, respectively, are net of

accrued profit commission on reinsurance transactions of $5.9

million in the first quarter of 2017, compared to $8.5 million in

the fourth quarter of 2016, and $6.1 million in the first quarter

of 2016.

- The decrease in the level of

refinancing activity in the first quarter contributed to the

decrease in acceleration of premiums related to Single Premium

Policy cancellations as well as the decrease in ceded premiums and

profit commission related to the company’s Single Premium Quota

Share Reinsurance transaction.

- The mortgage insurance provision for

losses was $47.2 million in the first quarter of 2017, compared to

$54.7 million in the fourth quarter of 2016, and $43.3 million in

the prior-year period.

- The provision for losses in the first

quarter included the positive impact of a modest reduction in the

company’s default to claim rate assumption for new notices of

default.

- The loss ratio in the first quarter was

21.3 percent, compared to 23.4 percent in the fourth quarter of

2016 and 19.6 percent in the first quarter of 2016.

- Mortgage insurance loss reserves were

$726.2 million as of March 31, 2017, compared to $760.3 million as

of December 31, 2016, and $891.3 million as of March 31, 2016.

- Primary reserve per primary default

(excluding IBNR and other reserves) was $24,230 as of March 31,

2017. This compares to primary reserve per primary default of

$22,503 as of December 31, 2016, and $24,959 as of March 31,

2016.

- The total number of primary delinquent

loans decreased by 11.4 percent in the first quarter from the

fourth quarter of 2016, and by 16.4 percent from the first quarter

of 2016. The primary mortgage insurance delinquency rate decreased

to 2.8 percent in the first quarter of 2017, compared to 3.2

percent in the fourth quarter of 2016, and 3.5 percent in the first

quarter of 2016.

- Total net mortgage insurance claims

paid were $82.1 million in the first quarter, compared to $116.5

million in the fourth quarter of 2016, and $127.7 million in the

first quarter of 2016. In addition, the company’s pending claim

inventory declined 37 percent from the first quarter of 2016.

Mortgage and Real Estate Services

- The Services segment provides analytics

and outsourced services, including residential loan due diligence

and underwriting, valuations, servicing surveillance, title and

escrow, and consulting services for buyers and sellers of, and

investors in, mortgage- and real estate-related loans and

securities. These services and solutions are provided primarily

through Clayton and its subsidiaries, including Green River

Capital, Red Bell Real Estate and ValuAmerica.

- Total revenues for the first quarter

were $40.1 million, compared to $52.6 million for the fourth

quarter of 2016, and $34.5 million for the first quarter of

2016.

- The adjusted pretax operating loss

before corporate allocations for the quarter ended March 31, 2017,

was $1.2 million, compared to income of $3.6 million for the

quarter ended December 31, 2016, and a loss of $3.8 million for the

quarter ended March 31, 2016.

- Services adjusted earnings before

interest, income taxes, depreciation and amortization (Services

adjusted EBITDA) for the quarter ended March 31, 2017, was a loss

of $0.3 million, compared to income of $4.4 million for the quarter

ended December 31, 2016, and a loss of $3.1 million for the quarter

ended March 31, 2016. Additional details regarding the non-GAAP

measure Services adjusted EBITDA may be found in Exhibits F and

G.

Consolidated Expenses

Other operating expenses were $68.4 million in the first

quarter, compared to $62.4 million in the fourth quarter of 2016,

and $57.2 million in the first quarter of last year.

- Notable increases to items impacting

other operating expenses in the first quarter of 2017 compared to

the first quarter of 2016 include:

- $3.6 million associated with retirement

and consulting agreements entered into in February 2017 with the

company’s former CEO. Additional expenses are expected to be

recognized throughout the year. A portion of both the current and

future expenses are subject to change, based on the company’s and

former CEO’s future performance. Details may be found in the

company’s recent proxy statement.

- $3.7 million related to variable and

incentive-based compensation expenses, including an increase in the

first quarter 2017 for year-end bonus accruals related to the

company’s 2016 performance, compared to a decrease in year-end

bonus accruals in the first quarter of 2016.

- $2.4 million associated with various

items including periodic non-capitalized costs associated with

recently deployed technology systems as well as consulting

services, including those related to the company’s CEO search.

- $1.2 million in expense, driven

primarily by depreciation, related to the company’s investment to

significantly upgrade its technology systems.

Details regarding notable variable items impacting other

operating expenses may be found in Exhibit D.

CAPITAL AND LIQUIDITY UPDATE

- Radian Group maintained approximately

$360 million of available liquidity as of March 31, 2017. The

company initiated a series of capital actions two years ago, in

order to strengthen its capital and liquidity position, improve its

debt maturity profile and reduce the impact of dilution from its

convertible bonds. The combination of these capital actions

decreased the company’s total number of diluted shares outstanding

by 27.1 million from March 31, 2015, to March 31, 2017. During the

same time period, the company’s debt to capital ratio decreased

from 34.6 percent to 25.7 percent. Radian Group has no material

debt maturities prior to June 2019.

- The company’s most recent capital

action was executed in January 2017, in which Radian settled its

obligations with respect to the remaining $68.0 million aggregate

principal amount of its Convertible Senior Notes due 2019. While

the transaction had a negative impact of $0.20 to book value per

share during the first quarter of 2017, it also reduced the

company’s diluted shares by 6.4 million at the time of the

settlement, or approximately 3 percent of diluted shares

outstanding as of December 31, 2016.

CONFERENCE CALL

Radian will discuss first quarter financial results in a

conference call today, Thursday, April 27, 2017, at 10:00 a.m.

Eastern time. The conference call will be broadcast live over the

Internet at http://www.radian.biz/page?name=Webcasts or at

www.radian.biz. The call may also be accessed by dialing

800.230.1096 inside the U.S., or 612.332.0228 for international

callers, using passcode 422045 or by referencing Radian.

A replay of the webcast will be available on the Radian website

approximately two hours after the live broadcast ends for a period

of one year. A replay of the conference call will be available

approximately two and a half hours after the call ends for a period

of two weeks, using the following dial-in numbers and passcode:

800.475.6701 inside the U.S., or 320.365.3844 for international

callers, passcode 422045.

In addition to the information provided in the company's

earnings news release, other statistical and financial information,

which is expected to be referred to during the conference call,

will be available on Radian's website under Investors >Quarterly

Results, or by clicking on

http://www.radian.biz/page?name=QuarterlyResults.

NON-GAAP FINANCIAL MEASURES

Radian believes that adjusted pretax operating income and

adjusted diluted net operating income per share (non-GAAP measures)

facilitate evaluation of the company’s fundamental financial

performance and provide relevant and meaningful information to

investors about the ongoing operating results of the company. On a

consolidated basis, these measures are not recognized in accordance

with accounting principles generally accepted in the United States

of America (GAAP) and should not be viewed as alternatives to GAAP

measures of performance. The measures described below have been

established in order to increase transparency for the purpose of

evaluating the company’s operating trends and enabling more

meaningful comparisons with Radian’s competitors.

Adjusted pretax operating income is defined as earnings

excluding the impact of certain items that are not viewed as part

of the operating performance of the company’s primary activities,

or not expected to result in an economic impact equal to the amount

reflected in pretax income (loss). Adjusted pretax operating income

adjusts GAAP pretax income to remove the effects of: (i) net gains

(losses) on investments and other financial instruments; (ii) loss

on induced conversion and debt extinguishment; (iii)

acquisition-related expenses; (iv) amortization and impairment of

intangible assets; and (v) net impairment losses recognized in

earnings. Adjusted diluted net operating income per share

represents a diluted net income per share calculation using as its

basis adjusted pretax operating income, net of taxes at the

company’s statutory tax rate for the period.

In addition to the above non-GAAP measures for the consolidated

company, the company also presents as supplemental information a

non-GAAP measure for the Services segment, representing earnings

before interest, income taxes, depreciation and amortization

(EBITDA). Services adjusted EBITDA is calculated by using the

Services segment’s adjusted pretax operating income as described

above, further adjusted to remove the impact of depreciation and

corporate allocations for interest and operating expenses. Services

adjusted EBITDA is presented to facilitate comparisons with other

services companies, since it is a widely accepted measure of

performance in the services industry.

See Exhibit F or Radian’s website for a description of these

items, as well as Exhibit G for reconciliations to the most

comparable consolidated GAAP measures.

ABOUT RADIAN

Radian Group Inc. (NYSE: RDN), headquartered in Philadelphia,

provides private mortgage insurance, risk management products and

real estate services to financial institutions. Radian offers

products and services through two business segments:

- Mortgage Insurance, through its

principal mortgage insurance subsidiary Radian Guaranty Inc. This

private mortgage insurance helps protect lenders from

default-related losses, facilitates the sale of low-downpayment

mortgages in the secondary market and enables homebuyers to

purchase homes more quickly with downpayments less than 20%.

- Mortgage and Real Estate

Services, through its principal services subsidiary Clayton, as

well as Green River Capital, Red Bell Real Estate and ValuAmerica.

These solutions include information and services that financial

institutions, investors and government entities use to evaluate,

acquire, securitize, service and monitor loans and asset-backed

securities.

Additional information may be found at www.radian.biz.

FINANCIAL RESULTS AND SUPPLEMENTAL INFORMATION CONTENTS

(Unaudited)

For historical trend information, refer to Radian’s quarterly

financial statistics at

http://www.radian.biz/page?name=FinancialReportsCorporate.

Exhibit A: Condensed Consolidated Statements of Operations

Trend Schedule Exhibit B: Net Income Per Share Trend Schedule

Exhibit C: Condensed Consolidated Balance Sheets Exhibit D: Net

Premiums Earned – Insurance and Other Operating Expenses Exhibit E:

Segment Information Exhibit F: Definition of Consolidated Non-GAAP

Financial Measures Exhibit G: Consolidated Non-GAAP Financial

Measure Reconciliations Exhibit H: Mortgage Insurance Supplemental

Information New Insurance Written Exhibit I: Mortgage Insurance

Supplemental Information Primary Insurance in Force and Risk in

Force Exhibit J: Mortgage Insurance Supplemental Information Claims

and Reserves Exhibit K: Mortgage Insurance Supplemental Information

Default Statistics Exhibit L: Mortgage Insurance Supplemental

Information Captives, QSR and Persistency

Radian

Group Inc. and Subsidiaries Condensed Consolidated

Statements of Operations Trend Schedule (1) Exhibit A

2017 2016

(In thousands,

except per-share amounts)

Qtr 1 Qtr 4 Qtr 3 Qtr 2 Qtr 1

Revenues: Net premiums earned - insurance $

221,800 $ 233,585 $ 238,149 $ 229,085 $ 220,950

Services

revenue 38,027 49,905 45,877 40,263 32,849

Net

investment income 31,032 28,996 28,430 28,839 27,201

Net gains (losses) on investments and other financial

instruments (2,851 ) (38,773 ) 7,711 30,527

31,286

Other income 746 736 716

1,454 666

Total revenues 288,754

274,449 320,883 330,168 312,952

Expenses: Provision for losses 46,913 54,287

55,785 49,725 42,991

Policy acquisition costs 6,729

5,579 6,119 5,393 6,389

Cost of services 28,375

33,812 29,447 27,365 23,550

Other operating expenses

68,377 62,416 62,119 63,173 57,188

Interest expense

15,938 17,269 19,783 22,546 21,534

Loss on induced

conversion and debt extinguishment 4,456 — 17,397 2,108

55,570

Amortization and impairment of intangible assets

3,296 3,290 3,292 3,311 3,328

Total expenses 174,084 176,653

193,942 173,621 210,550

Pretax

income 114,670 97,796 126,941 156,547 102,402

Income

tax provision 38,198 36,707 44,138

58,435 36,153

Net income $

76,472 $ 61,089 $ 82,803 $ 98,112

$ 66,249

Diluted net income per share

$ 0.34 $ 0.27 $ 0.37 $ 0.44 $ 0.29

Selected

Mortgage Insurance Key Ratios Loss ratio (1) 21.3

% 23.4 % 23.6 % 21.9 % 19.6 %

Expense ratio (1)

27.1 % 22.7 % 22.7 % 23.6 % 21.8 %

(1)

Calculated on a GAAP basis using net

premiums earned.

Radian Group Inc. and Subsidiaries Net

Income Per Share Trend Schedule Exhibit B The

calculation of basic and diluted net income per share was as

follows: 2017 2016

(In thousands,

except per-share amounts)

Qtr 1 Qtr 4 Qtr 3 Qtr 2 Qtr 1

Net

income: Net income—basic $ 76,472 $ 61,089

$ 82,803 $ 98,112 $ 66,249

Adjustment for dilutive Convertible

Senior Notes due 2019, net of tax (1) (215 ) 665

848 913 3,390

Net income—diluted

$ 76,257 $ 61,754 $ 83,651 $

99,025 $ 69,639

Average common shares

outstanding—basic 214,925 214,481 214,387 214,274

203,706

Dilutive effect of Convertible Senior Notes due 2017

(2) 701 421 178 12 —

Dilutive effect of Convertible

Senior Notes due 2019 1,854 6,417 8,274 8,928 33,583

Dilutive effect of stock-based compensation arrangements (2)

4,017 3,457 3,129 2,989 2,418

Adjusted average common shares outstanding—diluted

221,497 224,776 225,968 226,203

239,707

Basic net income per share $

0.36 $ 0.28 $ 0.39 $ 0.46 $ 0.33

Diluted net

income per share $ 0.34 $ 0.27 $ 0.37 $ 0.44 $

0.29

(1)

As applicable, includes coupon

interest, amortization of discount and fees, and other changes in

income or loss that would result from the assumed conversion. Due

to the January 2017 settlement of our obligations with respect to

the remaining Convertible Senior Notes due 2019, a benefit was

recorded to adjust estimated accrued expense to actual

amounts.

(2)

The following number of shares of our

common stock equivalents issued under our share-based compensation

arrangements and convertible debt were not included in the

calculation of diluted net income per share because they were

anti-dilutive:

2017 2016

(In

thousands)

Qtr 1 Qtr 4 Qtr 3 Qtr 2 Qtr 1

Shares

of Convertible Senior Notes due 2017 — — — — 1,902

Shares of common stock equivalents 445 1,042 1,045

1,042 709

Radian Group

Inc. and Subsidiaries Condensed Consolidated Balance

Sheets Exhibit C March 31, December 31,

September 30, June 30, March 31,

(In thousands,

except per-share data)

2017 2016 2016 2016 2016

Assets:

Investments $ 4,437,716 $ 4,462,430 $

4,565,748 $ 4,636,914 $ 4,470,172

Cash 77,954 52,149

46,356 55,062 64,844

Restricted cash 8,436 9,665

10,312 9,298 10,060

Accounts and notes receivable

73,794 77,631 94,692 77,170 66,340

Deferred income taxes,

net 369,209 411,798 401,442 444,513 518,059

Goodwill

and other intangible assets, net 273,068 276,228 279,400

282,703 286,069

Prepaid reinsurance premium 230,148

229,438 229,754 229,231 228,718

Other assets 357,435

343,835 422,123 332,372 325,129

Total assets $ 5,827,760 $ 5,863,174

$ 6,049,827 $ 6,067,263 $ 5,969,391

Liabilities and stockholders’ equity: Unearned

premiums $ 684,797 $ 681,222 $ 680,973 $ 677,599

$ 673,887

Reserve for losses and loss adjustment expense

726,169 760,269 821,934 848,379 891,348

Long-term

debt 1,008,777 1,069,537 1,067,666 1,278,051 1,286,466

Reinsurance funds withheld 167,427 158,001 177,147

163,360 151,104

Other liabilities 319,282

321,859 413,401 294,507 306,188

Total liabilities 2,906,452 2,990,888

3,161,121 3,261,896 3,308,993

Equity

component of currently redeemable convertible senior notes

883 — — — —

Common stock 233 232 232

232 232

Treasury stock (893,372 ) (893,332 )

(893,197 ) (893,176 ) (893,176 )

Additional paid-in capital

2,743,594 2,779,891 2,778,860 2,781,136 2,773,349

Retained earnings 1,073,333 997,890 937,338 855,070

757,202

Accumulated other comprehensive income (loss)

(3,363 ) (12,395 ) 65,473 62,105 22,791

Total stockholders’ equity 2,920,425

2,872,286 2,888,706 2,805,367 2,660,398

Total liabilities and stockholders’ equity $

5,827,760 $ 5,863,174 $ 6,049,827 $

6,067,263 $ 5,969,391

Shares

outstanding 215,091 214,521 214,405 214,284 214,265

Book value per share $ 13.58 $ 13.39 $

13.47 $ 13.09 $ 12.42

Statutory Capital Ratios

Risk to capital ratio-Radian Guaranty only 14.3

:1

(1)

13.5 :1 13.7 :1 14.0 :1 12.5 :1

Risk to capital ratio-Mortgage

Insurance combined 13.4 :1 (1) 13.6 :1

13.9 :1 14.2 :1 12.9 :1

(1)

Preliminary.

Radian Group Inc. and Subsidiaries Net

Premiums Earned - Insurance and Other Operating Expenses

Exhibit D 2017 2016

(In

thousands)

Qtr 1 Qtr 4 Qtr 3 Qtr 2 Qtr 1

Premiums earned - insurance: Direct $

236,062 $ 251,751 $ 258,074 $ 248,938 $ 240,330

Assumed 7 8 9 9 9

Ceded (14,269

) (18,174 ) (19,934 ) (19,862 ) (19,389 )

Net premiums

earned - insurance $ 221,800 $ 233,585

$ 238,149 $ 229,085 $ 220,950

Notable variable items: (1) Single Premium Policy

cancellations, net of reinsurance $ 5,879 $

15,702 $ 18,448 $ 14,841 $ 9,783

Profit commission - reinsurance

(2) 5,888 8,458 8,922 7,891

6,134

Total $ 11,767 $ 24,160

$ 27,370 $ 22,732 $ 15,917

Other operating expenses $ 68,377 $

62,416 $ 62,119 $ 63,173 $ 57,188

Notable variable items: (3) Technology upgrade

project (4) $ 3,512 $ 3,648 $ 2,440 $ 2,443 $

2,271

Severance costs 961 888 1,137 277 3,040

Retirement and consulting agreement (5) 3,622 — — — —

Incentive compensation (6) (7) 7,447 9,072 12,652

14,183 6,235

Ceding commissions (8) (3,864 )

(5,105 ) (5,460 ) (5,006 ) (4,413 )

Total $

11,678 $ 8,503 $ 10,769 $ 11,897

$ 7,133

(1)

Affecting net premiums earned -

insurance. These amounts are included in net premiums earned -

insurance.

(2)

The amounts represent the profit

commission on the Single Premium QSR Transaction.

(3)

Affecting other operating expenses.

These amounts are included in other operating expenses.

(4)

Represents the expense impact of

certain costs incurred in our initiative to significantly upgrade

our technology systems.

(5)

The amount represents expenses

associated with retirement and consulting agreements entered into

in February 2017 with our former CEO. Additional expenses are

expected to be recognized throughout the year. A portion of both

the current and future expenses are subject to change, based on the

Company's and former CEO's future performance.

(6)

The expense relates to short- and

long-term incentive programs.

(7)

Incentive compensation expense is shown

net of deferred policy acquisition costs.

(8)

Ceding commissions are shown net of

deferred policy acquisition costs.

Radian Group Inc. and

Subsidiaries

Segment Information

Exhibit E (page 1 of 2)

Summarized financial information concerning our operating

segments as of and for the periods indicated is as follows. For a

definition of adjusted pretax operating income and Services

adjusted EBITDA, along with reconciliations to consolidated GAAP

measures, see Exhibits F and G.

Mortgage

Insurance 2017 2016

(In

thousands)

Qtr 1 Qtr 4 Qtr 3 Qtr 2 Qtr 1

Net premiums written

- insurance $ 224,665 $ 234,172 $ 240,999 $

232,353 $ 26,310

(1)

(Increase) decrease in unearned premiums (2,865

) (587 ) (2,850 ) (3,268 ) 194,640

Net premiums earned - insurance 221,800 233,585

238,149 229,085 220,950

Net investment income 31,032

28,996 28,430 28,839 27,201

Other income 746

736 716 1,454 666

Total 253,578 263,317 267,295

259,378 248,817

Provision for

losses 47,232 54,675 56,151 50,074 43,275

Policy

acquisition costs 6,729 5,579 6,119 5,393 6,389

Other

operating expenses before corporate allocations 39,289

37,773 35,940 34,365

32,546

Total (2) 93,250 98,027

98,210 89,832 82,210

Adjusted

pretax operating income before corporate allocations

160,328 165,290 169,085 169,546 166,607

Allocation of

corporate operating expenses 14,186 9,652 11,911 14,286

9,329

Allocation of interest expense 11,509

12,843 15,360 18,124 17,112

Adjusted pretax operating income $

134,633 $ 142,795 $ 141,814 $ 137,136

$ 140,166

Services

2017 2016

(In

thousands)

Qtr 1 Qtr 4 Qtr 3 Qtr 2 Qtr 1

Services revenue

(2) $ 40,089 $ 52,558 $ 48,033

$42,210 $ 34,448

Cost of

services 28,690 34,130 29,655 27,730 23,854

Other

operating expenses before corporate allocations 12,604

14,842 13,575 13,030 14,368

Total 41,294 48,972 43,230

40,760 38,222

Adjusted pretax

operating income (loss) before corporate allocations (3)

(1,205 ) 3,586 4,803 1,450 (3,774 )

Allocation of

corporate operating expenses 3,718 1,738 2,265 2,779

1,751

Allocation of interest expense 4,429

4,426 4,423 4,422 4,422

Adjusted pretax operating income (loss) $

(9,352 ) $ (2,578 ) $ (1,885

)

$(5,751

)

$

(9,947

)

(1)

Net of ceded premiums written under the

Single Premium QSR transaction of $197.6 million.

(2)

Inter-segment information:

2017 2016

Qtr 1

Qtr 4 Qtr 3 Qtr 2 Qtr 1

Inter-segment

expense included in Mortgage Insurance segment $

2,062 $ 2,653 $ 2,156 $ 1,947 $ 1,599

Inter-segment revenue included in Services segment

2,062 2,653 2,156 1,947 1,599

Radian Group Inc. and

Subsidiaries

Segment Information

Exhibit E (page 2 of 2)

(3)

Supplemental information for Services

adjusted EBITDA (see definition in Exhibit F):

2017 2016

Qtr 1

Qtr 4 Qtr 3 Qtr 2 Qtr 1

Adjusted pretax

operating income (loss) before corporate allocations $

(1,205 ) $ 3,586 $ 4,803 $ 1,450 $ (3,774 )

Depreciation and amortization 858 829

884 749 663

Services adjusted EBITDA

$ (347 ) $ 4,415 $ 5,687 $ 2,199

$ (3,111 )

Selected balance sheet information for

our segments, as of the periods indicated, is as follows:

At March 31, 2017 (In thousands)

MortgageInsurance

Services Total Total assets

$ 5,475,502 $ 352,258 $

5,827,760 At December 31, 2016

(In

thousands)

MortgageInsurance

Services Total

Total assets $ 5,506,338 $ 356,836 $

5,863,174

Radian Group Inc. and

Subsidiaries

Definition of Consolidated Non-GAAP

Financial Measures

Exhibit F (page 1 of 2)

Use of Non-GAAP Financial Measures

In addition to the traditional GAAP financial measures, we have

presented “adjusted pretax operating income” and “adjusted diluted

net operating income per share,” non-GAAP financial measures for

the consolidated company, among our key performance indicators to

evaluate our fundamental financial performance. These non-GAAP

financial measures align with the way the Company’s business

performance is evaluated by both management and the board of

directors. These measures have been established in order to

increase transparency for the purposes of evaluating our operating

trends and enabling more meaningful comparisons with our peers.

Although on a consolidated basis “adjusted pretax operating income”

and “adjusted diluted net operating income per share” are non-GAAP

financial measures, we believe these measures aid in understanding

the underlying performance of our operations. Our senior

management, including our Chief Executive Officer (Radian's chief

operating decision maker), uses adjusted pretax operating income

(loss) as our primary measure to evaluate the fundamental financial

performance of the Company’s business segments and to allocate

resources to the segments.

Adjusted pretax operating income is defined as GAAP pretax

income excluding the effects of: (i) net gains (losses) on

investments and other financial instruments; (ii) loss on induced

conversion and debt extinguishment; (iii) acquisition-related

expenses; (iv) amortization and impairment of intangible assets;

and (v) net impairment losses recognized in earnings. Adjusted

diluted net operating income per share is calculated by dividing

(i) adjusted pretax operating income attributable to common

shareholders, net of taxes computed using the company’s statutory

tax rate, by (ii) the sum of the weighted average number of common

shares outstanding and all dilutive potential common shares

outstanding. Interest expense on convertible debt, share dilution

from convertible debt and the impact of share-based compensation

arrangements have been reflected in the per share calculations

consistent with the accounting standard regarding earnings per

share, whenever the impact is dilutive.

Although adjusted pretax operating income excludes certain items

that have occurred in the past and are expected to occur in the

future, the excluded items represent those that are: (i) not viewed

as part of the operating performance of our primary activities or

(ii) not expected to result in an economic impact equal to the

amount reflected in pretax income (loss). These adjustments, along

with the reasons for their treatment, are described below.

(1)

Net gains (losses) on investments and

other financial instruments. The recognition of realized investment

gains or losses can vary significantly across periods as the

activity is highly discretionary based on the timing of individual

securities sales due to such factors as market opportunities, our

tax and capital profile and overall market cycles. Unrealized

investment gains and losses arise primarily from changes in the

market value of our investments that are classified as trading

securities. These valuation adjustments may not necessarily result

in realized economic gains or losses.

Trends in the profitability of our fundamental operating

activities can be more clearly identified without the fluctuations

of these realized and unrealized gains or losses. We do not view

them to be indicative of our fundamental operating activities.

Therefore, these items are excluded from our calculation of

adjusted pretax operating income (loss). (2)

Loss on induced conversion and debt

extinguishment. Gains or losses on early extinguishment of debt and

losses incurred to purchase our convertible debt prior to maturity

are discretionary activities that are undertaken in order to take

advantage of market opportunities to strengthen our financial and

capital positions; therefore, we do not view these activities as

part of our operating performance. Such transactions do not reflect

expected future operations and do not provide meaningful insight

regarding our current or past operating trends. Therefore, these

items are excluded from our calculation of adjusted pretax

operating income (loss).

(3)

Acquisition-related expenses.

Acquisition-related expenses represent the costs incurred to effect

an acquisition of a business (i.e., a business combination).

Because we pursue acquisitions on a strategic and selective basis

and not in the ordinary course of our business, we do not view

acquisition-related expenses as a consequence of a primary business

activity. Therefore, we do not consider these expenses to be part

of our operating performance and they are excluded from our

calculation of adjusted pretax operating income (loss).

Radian Group Inc. and

Subsidiaries

Definition of Consolidated Non-GAAP

Financial Measures

Exhibit F (page 2 of 2)

(4)

Amortization and impairment of intangible

assets. Amortization of intangible assets represents the periodic

expense required to amortize the cost of intangible assets over

their estimated useful lives. Intangible assets with an indefinite

useful life are also periodically reviewed for potential

impairment, and impairment adjustments are made whenever

appropriate. These charges are not viewed as part of the operating

performance of our primary activities and therefore are excluded

from our calculation of adjusted pretax operating income

(loss).

(5)

Net impairment losses recognized in

earnings. The recognition of net impairment losses on investments

can vary significantly in both size and timing, depending on market

credit cycles. We do not view these impairment losses to be

indicative of our fundamental operating activities. Therefore,

whenever these losses occur, we exclude them from our calculation

of adjusted pretax operating income (loss).

In addition to the above non-GAAP measures for the consolidated

company, we also have presented as supplemental information a

non-GAAP measure for our Services segment, representing a measure

of earnings before interest, income taxes, depreciation and

amortization (“EBITDA”). We calculate Services adjusted EBITDA by

using adjusted pretax operating income as described above, further

adjusted to remove the impact of depreciation and corporate

allocations for interest and operating expenses. We have presented

Services adjusted EBITDA to facilitate comparisons with other

services companies, since it is a widely accepted measure of

performance in the services industry.

See Exhibit G for the reconciliation of the most comparable GAAP

measures, consolidated pretax income and diluted net income per

share, to our non-GAAP financial measures for the consolidated

company, adjusted pretax operating income and adjusted diluted net

operating income per share, respectively. Exhibit G also contains

the reconciliation of the most comparable GAAP measure, net income,

to Services adjusted EBITDA.

Total adjusted pretax operating income, adjusted diluted net

operating income per share and Services adjusted EBITDA are not

measures of total profitability, and therefore should not be viewed

as substitutes for GAAP pretax income, diluted net income per share

or net income. Our definitions of adjusted pretax operating income,

adjusted diluted net operating income per share or Services

adjusted EBITDA may not be comparable to similarly-named measures

reported by other companies.

Radian Group Inc. and Subsidiaries

Consolidated Non-GAAP Financial Measure Reconciliations

Exhibit G (page 1 of 2) Reconciliation of

Consolidated Pretax Income to Adjusted Pretax Operating Income

2017 2016

(In

thousands)

Qtr 1 Qtr 4 Qtr 3 Qtr 2 Qtr 1

Consolidated pretax income $ 114,670 $ 97,796

$ 126,941 $ 156,547 $ 102,402

Less income (expense) items:

Net gains (losses) on investments and other financial

instruments (2,851 ) (38,773 ) 7,711 30,527

31,286

Loss on induced conversion and debt extinguishment

(4,456 ) — (17,397 ) (2,108 ) (55,570 )

Acquisition-related expenses (1) (8 ) (358 )

(10 ) 54 (205 )

Amortization and impairment of intangible

assets (3,296 ) (3,290 ) (3,292 ) (3,311 ) (3,328

)

Total adjusted pretax operating income (2) $

125,281 $ 140,217 $ 139,929 $ 131,385

$ 130,219

(1)

Please see Exhibit F for the definition

of this line item.

(2)

Total adjusted pretax operating income

consists of adjusted pretax operating income (loss) for each

segment as follows:

2017 2016

(In

thousands)

Qtr 1 Qtr 4 Qtr 3 Qtr 2 Qtr 1

Adjusted pretax operating income (loss): Mortgage

Insurance $ 134,633 $ 142,795 $ 141,814 $ 137,136

$ 140,166

Services (9,352 ) (2,578 ) (1,885 )

(5,751 ) (9,947 )

Total adjusted pretax operating income

$ 125,281 $ 140,217 $ 139,929 $

131,385 $ 130,219

Reconciliation of Diluted Net Income

Per Share to Adjusted Diluted Net Operating Income Per

Share

2017 2016

Qtr 1 Qtr 4 Qtr 3 Qtr

2 Qtr 1

Diluted net income per share $

0.34 $ 0.27 $ 0.37 $ 0.44 $ 0.29

Less per-share impact of debt items: Loss

on induced conversion and debt extinguishment (0.02

) — (0.08 ) (0.01 ) (0.23 )

Income tax provision

(benefit) (1) (0.01 ) — (0.03 ) —

(0.03 )

Per-share impact of debt items (0.01 )

— (0.05 ) (0.01 ) (0.20 )

Less per-share impact of

other income (expense) items: Net gains (losses) on

investments and other financial instruments (0.01

) (0.17 ) 0.03 0.13 0.13

Amortization and impairment of

intangible assets (0.01 ) (0.02 ) (0.01 ) (0.01 )

(0.01 )

Income tax provision (benefit) on other income (expense)

items (2) (0.01 ) (0.07 ) 0.01 0.04 0.04

Difference between statutory and effective tax rate

(0.01 ) (0.02 ) — (0.01 ) 0.04

Per-share impact of other income (expense) items

(0.02 ) (0.14 ) 0.01 0.07 0.12

Adjusted diluted net operating income per share (2) $

0.37 $ 0.41 $ 0.41 $ 0.38 $ 0.37

(1)

A portion of the loss on induced

conversion and debt extinguishment is non-deductible for tax

purposes. The income tax benefit is based on the tax deductible

loss using the company's federal statutory tax rate of 35%.

(2)

Calculated using the company’s federal

statutory tax rate of 35%. Any permanent tax adjustments and state

income taxes on these items have been deemed immaterial and are not

included.

Radian Group Inc. and Subsidiaries

Consolidated Non-GAAP Financial Measure Reconciliations

Exhibit G (page 2 of 2) Reconciliation of Net

Income to Services Adjusted EBITDA 2017 2016

(In

thousands)

Qtr 1 Qtr 4 Qtr 3 Qtr 2 Qtr 1

Net income $ 76,472 $ 61,089 $ 82,803 $ 98,112

$ 66,249

Less income (expense) items: Net gains (losses)

on investments and other financial instruments (2,851

) (38,773 ) 7,711 30,527 31,286

Loss on induced

conversion and debt extinguishment (4,456 ) —

(17,397 ) (2,108 ) (55,570 )

Acquisition-related expenses

(8 ) (358 ) (10 ) 54 (205 )

Amortization and

impairment of intangible assets (3,296 ) (3,290 )

(3,292 ) (3,311 ) (3,328 )

Income tax provision

38,198 36,707 44,138 58,435 36,153

Mortgage Insurance

adjusted pretax operating income 134,633 142,795

141,814 137,136 140,166

Services

adjusted pretax operating income (loss) (9,352 )

(2,578 ) (1,885 ) (5,751 ) (9,947 )

Less income (expense)

items: Allocation of corporate operating expenses to

Services (3,718 ) (1,738 ) (2,265 ) (2,779 )

(1,751 )

Allocation of corporate interest expense to

Services (4,429 ) (4,426 ) (4,423 ) (4,422 )

(4,422 )

Services depreciation and amortization (858

) (829 ) (884 ) (749 ) (663 )

Services adjusted

EBITDA $ (347 ) $ 4,415

$ 5,687 $ 2,199

$ (3,111 )

On a consolidated basis, “adjusted pretax operating income” and

“adjusted diluted net operating income per share” are measures not

determined in accordance with GAAP. “Services adjusted EBITDA” is

also a non-GAAP measure. These measures are not representative of

total profitability, and therefore should not be viewed as

substitutes for GAAP pretax income, diluted net income per share or

net income. Our definitions of adjusted pretax operating income,

adjusted diluted net operating income per share or Services

adjusted EBITDA may not be comparable to similarly-named measures

reported by other companies. See Exhibit F for additional

information on our consolidated non-GAAP financial measures.

Radian Group Inc. and Subsidiaries Mortgage

Insurance Supplemental Information - New Insurance Written

Exhibit H 2017 2016

($ in

millions)

Qtr 1 Qtr 4 Qtr 3 Qtr 2 Qtr 1

Total primary new insurance written $ 10,055

$ 13,882 $ 15,656 $ 12,921 $ 8,071

Percentage of

primary new insurance written by FICO score

>=740 61.3 % 63.4 % 64.2 % 60.9 % 58.4 %

680-739

32.7 31.4 30.4 32.2 33.7

620-679

6.0 5.2 5.4 6.9 7.9

Total Primary 100.0 % 100.0 % 100.0 % 100.0 %

100.0 %

Percentage of

primary new insurance written

Direct monthly and other premiums 75 % 73 % 73

% 74 % 71 %

Direct single premiums 25 % 27 %

27 % 26 % 29 %

Net single premiums (1) 16

% 17 % 17 % 17 % 19 %

Refinances 16

% 27 % 22 % 18 % 19 %

LTV 95.01% and

above 9.2 % 7.4 % 6.0 % 4.8 % 3.7 %

90.01% to

95.00% 47.3 % 43.6 % 47.1 % 50.2 % 50.5 %

85.01% to 90.00% 30.3 % 32.3 % 31.4 % 31.8 %

33.1 %

85.00% and below 13.2 % 16.7 % 15.5 %

13.2 % 12.7 %

(1)

Represents the percentage of direct

single premiums written, after consideration of the 35% single

premium NIW ceded under the Single Premium QSR Transaction.

Radian Group Inc. and

Subsidiaries

Mortgage Insurance Supplemental

Information - Primary Insurance in Force and Risk in Force

Exhibit I

March 31, December 31, September 30, June 30, March

31,

($ in millions) 2017 2016 2016 2016 2016

Primary insurance in force (1)

Prime $ 177,702 $ 174,927 $ 172,178 $ 168,259

$ 165,526

Alt-A 4,842 5,064 5,363 5,627 5,907

A

minus and below 3,315 3,459 3,624

3,786 3,953

Total Primary $

185,859 $ 183,450 $ 181,165 $ 177,672

$ 175,386

Primary risk in

force (1) (2)

Prime $ 45,442 $ 44,708 $ 44,075

$ 43,076 $ 42,312

Alt-A 1,118 1,168 1,241 1,302 1,366

A minus and below 834 865 906

946 988

Total Primary $ 47,394

$ 46,741 $ 46,222 $ 45,324 $ 44,666

Percentage of

primary risk in force

Direct monthly and other premiums 69 % 69 % 69

% 69 % 69 %

Direct single premiums 31 % 31 %

31 % 31 % 31 %

Net single premiums (3) 25

% 25 % 25 % 25 % 25 %

Percentage of

primary risk in force by FICO score

>=740 57.9 % 57.6 % 57.4 % 57.1 % 57.0 %

680-739 31.1 31.0 30.9 30.8 30.6

620-679

9.6 9.9 10.2 10.5 10.7

<=619 1.4 1.5

1.5 1.6 1.7

Total Primary

100.0 % 100.0 % 100.0 % 100.0 % 100.0 %

Percentage of

primary risk in force by LTV

95.01% and above 7.6 % 7.4 % 7.2 % 7.1 % 7.2 %

90.01% to 95.00% 52.6 52.3 52.1 51.6 50.9

85.01%

to 90.00% 32.2 32.5 32.8 33.3 33.7

85.00% and

below 7.6 7.8 7.9 8.0 8.2

Total 100.0 % 100.0 % 100.0 % 100.0 %

100.0 %

Percentage of

primary risk in force by policy year

2008 and prior 18.5 % 19.5 % 20.8 % 22.4 %

24.0 %

2009

0.9 1.0 1.2 1.3 1.5

2010

0.8 0.9 1.0 1.2 1.3

2011

1.8 2.0 2.2 2.5 2.7

2012

7.4 8.0 8.8 9.7 10.6

2013

11.8 12.6 13.9 15.5 17.0

2014

11.2 12.0 13.4 14.9 16.3

2015

17.3 18.1 19.4 21.0 22.0

2016

25.0 25.9 19.3 11.5 4.6

2017

5.3 — — — —

Total

100.0 % 100.0 % 100.0 % 100.0 % 100.0 %

Primary risk in force on defaulted loans (4) $

1,224 $ 1,363 $ 1,381 $ 1,398 $ 1,446

(1)

Includes amounts ceded under our

reinsurance agreements, as well as amounts related to the Freddie

Mac Agreement.

(2)

Does not include pool risk in force or

other risk in force, which combined represent less than 3.0% of our

total risk in force for all periods presented.

(3)

Represents the percentage of Single

Premium RIF, after giving effect to all reinsurance ceded.

(4)

Excludes risk related to loans subject

to the Freddie Mac Agreement.

Radian Group Inc. and

Subsidiaries

Mortgage Insurance Supplemental

Information - Claims and Reserves

Exhibit J

2017 2016

($ in

thousands)

Qtr 1 Qtr 4 Qtr 3 Qtr 2 Qtr 1

Net claims paid: (1) Prime $ 52,044 $

70,151 $ 51,964 $ 56,036 $ 74,432

Alt-A 16,165 27,558

16,334 18,349 28,929

A minus and below 9,460

13,760 9,615 12,315 13,196

Total

primary claims paid 77,669 111,469 77,913 86,700 116,557

Pool 4,180 4,788 4,492 5,451 7,389

Second-lien and

other 78 (264 ) (234 ) (231 ) 345

Subtotal 81,927 115,993 82,171 91,920 124,291

Impact of captive terminations — 492

(171

) (2,619 ) (120 )

Impact of settlements 161 —

705 1,400 3,500

Total net claims

paid $ 82,088 $ 116,485 $ 82,705

$ 90,701 $ 127,671

Average net

claims paid: (2) Prime $ 50.5 $ 45.5 $

48.3 $ 48.6 $ 47.7

Alt-A 67.1 65.5 65.3 63.5 63.0

A minus and below 39.6 37.7 41.3 39.9 36.8

Total

average net primary claims paid 51.4 47.9 50.0 49.5 49.0

Pool 49.2 45.6 51.0 58.0 53.2

Total average net

claims paid $ 50.9 $ 47.6 $ 49.7 $ 49.6 $ 48.9

Average direct primary claims paid (2) (3) $

51.6 $ 48.2 $ 50.3 $ 49.9 $ 49.6

Average total direct

claims paid (2) (3) $ 51.1 $ 47.9 $ 50.0 $ 50.0 $

49.5

($ in thousands,

except primary reserve per primary default amounts)

March 31,2017

December 31,2016

September 30,2016

June 30,2016

March 31,2016

Reserve for losses by category Prime $

362,804 $ 379,845 $ 409,438 $ 420,281 $ 438,598

Alt-A

140,543 148,006 166,349 173,284 183,189

A minus and

below 96,373 101,653 106,678 112,001 116,835

IBNR and

other 70,651 71,107 73,057 74,639 79,051

LAE

17,550 18,630 21,255 22,389 23,600

Reinsurance

recoverable (4) 7,681 6,816 6,448

6,044 8,239

Total primary reserves

695,602 726,057 783,225 808,638

849,512

Pool insurance 28,453 31,853 36,065

36,982 38,843

IBNR and other 603 673 823 897 1,050

LAE 822 932 1,112 1,163 1,227

Reinsurance

recoverable (4) 28 35 36 33

—

Total pool reserves 29,906 33,493

38,036 39,075 41,120

Total 1st lien

reserves 725,508 759,550 821,261 847,713 890,632

Second-lien and other 661 719 673

666 716

Total reserves $

726,169 $ 760,269 $ 821,934 $ 848,379

$ 891,348

1st lien reserve per default

Primary reserve per primary default excluding IBNR and other

$ 24,230 $ 22,503 $ 24,049 $ 24,609 $ 24,959

(1)

Net of reinsurance recoveries.

(2)

Calculated without giving effect to the

impact of the termination of captive transactions and

settlements.

(3)

Before reinsurance recoveries.

(4)

Represents ceded losses on captive

transactions and quota share reinsurance transactions.

Radian Group Inc. and

Subsidiaries

Mortgage Insurance Supplemental

Information - Default Statistics

Exhibit K

March 31, December 31, September 30, June 30, March

31,

2017 2016 2016 2016 2016

Default

Statistics

Primary Insurance:

Prime

Number of insured loans 858,248 849,227 840,534

826,511 817,236

Number of loans in default 16,981

19,101 19,100 19,025 19,510

Percentage of loans in default

1.98 % 2.25 % 2.27 % 2.30 % 2.39 %

Alt-A

Number of insured loans 25,425 26,536 28,080 29,445

30,990

Number of loans in default 3,812 4,193 4,545

4,820 5,138

Percentage of loans in default 14.99

% 15.80 % 16.19 % 16.37 % 16.58 %

A minus and

below

Number of insured loans 26,043 27,115 28,313 29,450

30,681

Number of loans in default 5,000 5,811 5,885

5,982 6,221

Percentage of loans in default 19.20

% 21.43 % 20.79 % 20.31 % 20.28 %

Total

Primary Number of insured loans 909,716 902,878

896,927 885,406 878,907

Number of loans in default (1)

25,793 29,105 29,530 29,827 30,869

Percentage of loans in

default 2.84 % 3.22 % 3.29 % 3.37 % 3.51 %

(1)

Excludes the following number of loans

subject to the Freddie Mac Agreement that are in default as we no

longer have claims exposure on these loans:

March 31,

December 31, September 30, June 30, March 31,

2017 2016 2016

2016 2016

Number of loans in default

1,395 1,639 1,888 2,180 2,339

Radian Group Inc. and

Subsidiaries

Mortgage Insurance Supplemental

Information - QSR Transactions, Captives and Persistency

Exhibit L

2017 2016

($ in

thousands)

Qtr 1 Qtr 4 Qtr 3 Qtr 2 Qtr 1

Quota Share

Reinsurance (“QSR”) Transactions

QSR ceded premiums written (1) $ 5,457 $ 6,049

$ 6,730 $ 7,356 $ 7,962

% of premiums written 2.3

% 2.4 % 2.6 % 2.9 % 3.4 %

QSR ceded premiums earned

(1) $ 7,834 $ 9,421 $ 10,597 $ 11,172 $ 11,325

% of premiums earned 3.3 % 3.8 % 4.1 % 4.5 %

4.7 %

Ceding commissions written $ 1,559 $

1,728 $ 1,922 $ 2,099 $ 2,270

Ceding commissions earned (2)

$ 3,894 $ 4,374 $ 3,974 $ 3,779 $ 4,446

Profit

commission $ — $ — $ — $ — $ —

RIF included in

QSR Transactions (3) $ 1,488,972 $ 1,578,300 $

1,718,031 $ 1,872,017 $ 2,018,468

Single Premium

QSR Transaction

QSR ceded premiums written (1) $ 8,960 $

11,121 $ 13,004 $ 11,488 $ 197,593

(4 ) % of

premiums written 3.7 % 4.4 % 5.0 % 4.6 % 84.7 %

QSR ceded premiums earned (1) $ 5,859 $ 8,060

$ 8,608 $ 7,146 $ 5,994

% of premiums earned 2.5

% 3.2 % 3.3 % 2.9 % 2.5 %

Ceding commissions written

$ 3,712 $ 4,895 $ 5,482 $ 4,844 $ 50,932

Ceding

commissions earned (2) $ 2,937 $ 4,130 $ 4,382 $

3,759 $ 3,032

Profit commission $ 5,888 $

8,458 $ 8,922 $ 7,891 $ 6,134

RIF included in Single Premium QSR

Transaction (3) $ 3,904,402 $ 3,761,648 $

3,621,993 $ 3,461,464 $ 3,308,057

Total RIF included in

QSR Transactions and Single Premium QSR Transaction $

5,393,374 $ 5,339,948 $ 5,340,024 $ 5,333,481 $ 5,326,525

1st Lien

Captives

Premiums earned ceded to captives $ 389 $ 503

$ 537 $ 1,346 $ 1,869

% of total premiums earned 0.2

% 0.2 % 0.2 % 0.5 % 0.8 %

Persistency Rate (twelve

months ended) 77.1 % 76.7 % 78.4 % 79.9 % 79.4 %

Persistency Rate (quarterly, annualized) (5) 84.4

% 76.8 % 75.3 % 78.0 % 82.3 %

(1)

Net of profit commission.

(2)

Includes amounts reported in policy

acquisition costs and other operating expenses.

(3)

Included in primary RIF.

(4)

Includes ceded premiums for policies

written in prior periods.

(5)

The Persistency Rate on a quarterly,

annualized basis may be impacted by seasonality or other factors,

and may not be indicative of full-year trends.

FORWARD-LOOKING STATEMENTS

All statements in this press release that address events,

developments or results that we expect or anticipate may occur in

the future are “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, Section 21E of the

Exchange Act and the U.S. Private Securities Litigation Reform Act

of 1995. In most cases, forward-looking statements may be

identified by words such as “anticipate,” “may,” “will,” “could,”

“should,” “would,” “expect,” “intend,” “plan,” “goal,”

“contemplate,” “believe,” “estimate,” “predict,” “project,”

“potential,” “continue,” “seek,” “strategy,” “future,” “likely” or

the negative or other variations on these words and other similar

expressions. These statements, which may include, without

limitation, projections regarding our future performance and

financial condition, are made on the basis of management’s current

views and assumptions with respect to future events. Any

forward-looking statement is not a guarantee of future performance

and actual results could differ materially from those contained in

the forward-looking statement. These statements speak only as of

the date they were made, and we undertake no obligation to update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise. We operate in a

changing environment where new risks emerge from time to time and

it is not possible for us to predict all risks that may affect us.

The forward-looking statements, as well as our prospects as a

whole, are subject to risks and uncertainties that could cause

actual results to differ materially from those set forth in the

forward-looking statements. These risks and uncertainties include,

without limitation:

- changes in general economic and

political conditions, including unemployment rates, interest rates

and changes in housing and mortgage credit markets, that impact the

size of the insurable market and the credit performance of our

insured portfolio;

- changes in the way customers,

investors, regulators or legislators perceive the performance and

financial strength of private mortgage insurers;

- Radian Guaranty’s ability to remain

eligible under the Private Mortgage Insurance Eligibility

Requirements (“PMIERs”) and other applicable requirements imposed

by the Federal Housing Finance Agency and by the

Government-Sponsored Enterprises (“GSEs”) to insure loans purchased

by the GSEs;

- our ability to successfully execute and

implement our capital plans and to maintain sufficient holding

company liquidity to meet our short- and long-term liquidity

needs;

- our ability to successfully execute and

implement our business plans and strategies, including plans and

strategies that require GSE and/or regulatory approvals;

- our ability to maintain an adequate

level of capital in our insurance subsidiaries to satisfy existing

and future state regulatory requirements;

- changes in the charters or business

practices of, or rules or regulations imposed by or applicable to

the GSEs, including the GSEs’ interpretation and application of the

PMIERs to our mortgage insurance business;

- changes in the current housing finance

system in the U.S., including the role of the Federal Housing

Administration (“FHA”), the GSEs and private mortgage insurers in

this system;

- any disruption in the servicing of

mortgages covered by our insurance policies, as well as poor

servicer performance;

- a significant decrease in the

Persistency Rates of our mortgage insurance policies;

- competition in our mortgage insurance

business, including price competition and competition from the FHA,

U.S. Department of Veteran Affairs and other forms of credit

enhancement;

- the effect of the Dodd-Frank Wall

Street Reform and Consumer Protection Act (“Dodd-Frank Act”) on the

financial services industry in general, and on our businesses in

particular;

- the adoption of new laws and

regulations, or changes in existing laws and regulations (including

to the Dodd-Frank Act), or the way they are interpreted or

applied;

- the outcome of legal and regulatory

actions, reviews, audits, inquiries and investigations that could

result in adverse judgments, settlements, fines, injunctions,

restitutions or other relief that could require significant

expenditures or have other effects on our business;

- the amount and timing of potential

payments or adjustments associated with federal or other tax

examinations, including deficiencies assessed by the IRS resulting

from its examination of our 2000 through 2007 tax years, which we

are currently contesting;

- the possibility that we may fail to

estimate accurately the likelihood, magnitude and timing of losses

in connection with establishing loss reserves for our mortgage

insurance business;

- volatility in our results of operations

caused by changes in the fair value of our assets and liabilities,

including a significant portion of our investment portfolio;

- changes in accounting principles

generally accepted in the U.S. (“GAAP”) or statutory accounting

principles and practices (“SAPP”) rules and guidance, or their

interpretation;

- our ability to attract and retain key

employees;

- legal and other limitations on

dividends and other amounts we may receive from our subsidiaries;

and

- the possibility that we may need to

impair the carrying value of goodwill established in connection

with our acquisition of Clayton.

For more information regarding these risks and uncertainties as

well as certain additional risks that we face, you should refer to

the Risk Factors detailed in Item 1A of our Annual Report on Form

10-K for the year ended December 31, 2016, and subsequent reports

filed from time to time with the U.S. Securities and Exchange

Commission. We caution you not to place undue reliance on these

forward-looking statements, which are current only as of the date

on which we issued this press release. We do not intend to, and we

disclaim any duty or obligation to, update or revise any

forward-looking statements to reflect new information or future

events or for any other reason.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170427005367/en/

Radian Group Inc.Emily Riley,

215-231-1035emily.riley@radian.biz

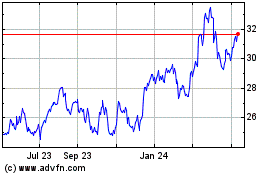

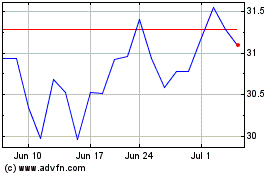

Radian (NYSE:RDN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Radian (NYSE:RDN)

Historical Stock Chart

From Apr 2023 to Apr 2024