Helmerich & Payne, Inc. (NYSE:HP) reported a net loss of $49

million or $(0.45) per diluted share from operating revenues of

$405 million for the second quarter of fiscal 2017. The net

loss per diluted share includes $0.02 of after-tax income comprised

of select items(1). Net cash provided by operating activities

was $76 million for the second quarter of fiscal 2017.

President and CEO John Lindsay commented, “We experienced

continued activity and spot pricing improvement in the U.S. Land

market during our second fiscal quarter and H&P once again led

the industry in AC drive rig reactivations and horizontal market

share capture. The driving forces behind this success are our

people, our continuing investment in technology and our integrated

business model. Our ability to grow is enabled by promoting

and hiring the best people, and delivering industry leading

performance. FlexRig® technology supported by H&P’s

integrated model has over 1900 rig years of experience and is the

preferred AC drive rig offering in the marketplace. H&P

is uniquely positioned with a fleet of FlexRigs that provide a

Family of Solutions™ for our customers, and the right rig for

their project. Our uniform fleet size and scale is unmatched

in the U.S. land AC drive segment which provides H&P an

opportunity for additional market share capture. H&P’s

experience and expertise within an integrated model of designing,

building, learning and upgrading the FlexRig fleet allow us to meet

market needs in highest demand and provide the best value for

customers. We can upgrade these higher specification FlexRigs

in a very capital-efficient way and meet today’s demand without the

need to invest in new rigs to meet customer requirements. We

have 122 super-spec capable rigs in the U.S. land market today and

another 50 rigs that are active that can also be upgraded. In

addition, we have approximately 100 idle FlexRigs that are capable

of being upgraded to drill the more challenging horizontal wells,

representing about two-thirds of the number of idle high-spec AC

drive rigs in the industry fleet.

“We see some signs indicating that the recovery in U.S. land

continues to modestly build momentum, which should support

continued improvements in both FlexRig activity and pricing.

However, we expect our international land and offshore market

outlook to remain weak for the foreseeable future. Our budget

for capital expenditures has allowed us to remain ahead of

demand. We have been able to maintain an industry leading

cadence for upgrades allowing us to increase our active fleet by 89

rigs since September, including close to 60 rigs upgraded to

super-spec capability. Our supply pipeline of capital spares

and upgrade equipment should be sufficient for the level of demand

we see going forward. We believe that the Company is

positioned to successfully manage the new market dynamics.

Our organizational effectiveness efforts implemented during the

downturn are having a significant effect on our ability to respond

to demand and add significant value for our customers. This

is clearly demonstrated by the success we have enjoyed growing our

U.S. land market share from 15% to 19% since the peak in 2014. We

remain confident about the future for H&P because our

competitive advantages remain in our people, performance,

technology, reliability and uniform FlexRig fleet.”

Operating Segment Results

U.S. Land Operations

Segment operating loss widened by $21 million

sequentially. The change was primarily attributable to

approximately $18 million in abandonment charges, as increasing

activity was offset by lower margins. The abandonment charges

are included with depreciation in the segment and are related to

the decommissioning of used drilling equipment as a result of our

ongoing rig upgrade program.

The number of quarterly revenue days increased sequentially by

approximately 35%. This H&P rate of increase was greater

than the overall market’s rate of increase (estimated at 27%)(2),

resulting in significant market share growth for the Company.

From the first to the second fiscal quarter of 2017, adjusted

average rig revenue per day decreased by $1,690 to $22,201(3), as

the proportion of rigs working in the spot market increased

significantly quarter to quarter. The adjusted average rig

expense per day increased sequentially by $548 to $15,612(3); the

increase in the average was mostly attributable to upfront rig

start-up expenses related to reactivating a large number of

rigs. The corresponding adjusted average rig margin per day

decreased sequentially by $2,238 to $6,589(3).

Offshore Operations

Segment operating income decreased 13% sequentially. The

number of quarterly revenue days decreased sequentially by

approximately 8%, and the average rig margin per day increased

sequentially by $339 to $10,817. Additionally, management

contracts on platform rigs contributed approximately $4 million to

the segment’s operating

income.

International Land Operations

The segment had an operating loss this quarter as compared to

operating income the previous quarter. The $12 million

sequential change was attributable to declines in average rig

margin per day and rig revenue days, as well as the absence of

early termination revenues in the most recent quarter.

Quarterly revenue days decreased sequentially by approximately

25%, and the adjusted average rig margin per day decreased

sequentially by $5,192 to $3,691 during this year’s second fiscal

quarter(3). Quarterly revenue days and adjusted average rig

margin per day declined primarily as a result of the previously

announced early termination notice from a customer for five rigs

under long-term contracts in the segment.

Operational Outlook for the Third Quarter of Fiscal 2017

U.S. Land Operations:

- Quarterly revenue days expected to increase by roughly 25%

sequentially

- Average rig revenue per day expected to be roughly

$21,000 (excluding any impact from early termination revenue)

- Average rig expense per day expected to be roughly $14,300

Offshore Operations:

- Quarterly revenue days expected to decrease by approximately

10% to 15% sequentially

- Average rig margin per day expected to be approximately

$12,500

- Management contracts expected to generate approximately $4

million in operating income

International Land Operations:

- Quarterly revenue days expected to decrease by approximately

10% sequentially

- Average rig margin per day expected to remain under $4,000

Other Estimates for Fiscal 2017

- FY17 depreciation is now expected to be approximately $580

million. Included in this depreciation estimate are

approximately $40 million of abandonment charges, about half of

which has already been recognized in the first half of the fiscal

year.

Other Highlights

- The Company’s total active rig market share in U.S. Land Lower

48 grew to approximately 19% as of March 31, 2017.

- Since January 26, 2017 (date of first quarter results

announcements), 22 AC drive FlexRigs with 1,500 hp drawworks and

750,000 lbs. hookload ratings were upgraded to include a 7,500 psi

mud circulating system and/or multiple-well pad capability,

resulting in 122 rigs in our fleet today with rig specifications in

highest demand(4).

- On January 26, 2017, EnergyPoint Research announced, “Helmerich

& Payne again rated first in total satisfaction among onshore

contract drillers. The company also captured the top spot in

performance and reliability, service and professionalism,

horizontal and directional wells, high-pressure/high-temperature

(HPHT) wells, safety and environmental (HSE), shale-oriented

applications, Interior Texas & Mid-continent, and three

additional categories.”

- On March 1, 2017, Directors of the Company declared a quarterly

cash dividend of $0.70 per share on the Company’s common stock

payable June 1, 2017 (as filed on Form 8-K at the time of the

declaration).

Select Items Included in Net Income (or Loss) per Diluted

Share

Second Quarter of Fiscal 2017 included $0.02 in after-tax income

comprised of the following:

- $0.04 of after-tax income from long-term contract early

termination compensation from customers

- $0.09 of after-tax gains related to the sale of used drilling

equipment

- $0.11 of after-tax losses from abandonment charges related to

the decommissioning of used drilling equipment

First Quarter of Fiscal 2017 included $0.08 in after-tax income

comprised of the following:

- $0.08 of after-tax income from long-term contract early

termination compensation from customers

- $0.01 of after-tax gains related to the sale of used drilling

equipment

- $0.01 of after-tax losses from accrued charges related to a

lawsuit settlement agreement

About Helmerich & Payne, Inc.

Helmerich & Payne, Inc. is primarily a contract drilling

company. As of April 27, 2017, the Company’s existing fleet

includes 350 land rigs in the U.S., 38 international land rigs, and

eight offshore platform rigs. The Company’s global fleet has

a total of 388 land rigs, including 373 AC drive FlexRigs.

Forward-Looking Statements

This release includes "forward-looking statements" within the

meaning of the Securities Act of 1933 and the Securities Exchange

Act of 1934, and such statements are based on current expectations

and assumptions that are subject to risks and uncertainties.

All statements other than statements of historical facts

included in this release, including, without limitation, statements

regarding the registrant’s future financial position, operations

outlook, business strategy, budgets, projected costs and plans and

objectives of management for future operations, are forward-looking

statements. For information regarding risks and uncertainties

associated with the Company's business, please refer to the "Risk

Factors" and "Management's Discussion and Analysis of Financial

Condition and Results of Operations" sections of the Company's SEC

filings, including but not limited to its annual report on Form

10-K and quarterly reports on Form 10-Q. As a result of these

factors, Helmerich & Payne, Inc.'s actual results may differ

materially from those indicated or implied by such forward-looking

statements. We undertake no duty to update or revise our

forward-looking statements based on changes in internal estimates,

expectations or otherwise, except as required by law.

Note Regarding Trademarks. Helmerich & Payne, Inc. owns or

has rights to the use of trademarks, service marks and trade names

that it uses in conjunction with the operation of its business.

Some of the trademarks that appear in this release include FlexRig

and Family of Solutions, which may be registered or trademarked in

the U.S. and other jurisdictions.

(1)See the corresponding section of this release for details

regarding the select items.(2)The overall market’s rate of increase

was calculated using the average U.S. Land rig counts from the

fourth calendar quarter of 2016 and first calendar quarter of 2017

as publicly published by Baker Hughes. (3)See the Selected

Statistical & Operational Highlights table(s) for details on

the revenues or charges excluded on a per revenue day

basis.(4)These combined rig specifications are in high demand and

fit the description of what some industry followers refer to as

“super-spec” rigs.

| |

|

| HELMERICH & PAYNE, INC. |

|

| Unaudited |

|

| (in thousands, except per share

data) |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended |

Six Months Ended |

|

|

CONSOLIDATED STATEMENTS OF |

March 31 |

December 31 |

March 31 |

March 31 |

|

| OPERATIONS |

|

|

2017 |

|

|

2016 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

|

| |

|

|

|

|

|

|

|

|

|

Operating Revenues: |

|

|

|

|

|

|

|

|

Drilling – U.S. Land |

$ |

330,967 |

|

$ |

263,636 |

|

$ |

349,283 |

|

$ |

594,603 |

|

$ |

719,088 |

|

|

|

Drilling – Offshore |

|

|

36,235 |

|

|

33,812 |

|

|

34,325 |

|

|

70,047 |

|

|

76,205 |

|

|

|

Drilling – International Land |

|

34,757 |

|

|

68,031 |

|

|

51,352 |

|

|

102,788 |

|

|

123,546 |

|

|

| Other |

|

|

|

3,324 |

|

|

3,111 |

|

|

3,231 |

|

|

6,435 |

|

|

7,199 |

|

|

| |

|

|

$ |

405,283 |

|

$ |

368,590 |

|

$ |

438,191 |

|

$ |

773,873 |

|

$ |

926,038 |

|

|

| |

|

|

|

|

|

|

|

|

|

Operating costs and expenses: |

|

|

|

|

|

|

|

Operating costs, excluding depreciation |

|

296,829 |

|

|

247,679 |

|

|

221,611 |

|

|

544,508 |

|

|

498,255 |

|

|

|

Depreciation |

|

|

152,777 |

|

|

133,847 |

|

|

141,517 |

|

|

286,624 |

|

|

283,646 |

|

|

|

General and administrative |

|

33,519 |

|

|

34,262 |

|

|

33,811 |

|

|

67,781 |

|

|

65,885 |

|

|

|

Research and development |

|

2,719 |

|

|

2,808 |

|

|

2,315 |

|

|

5,527 |

|

|

5,234 |

|

|

|

Income from asset sales |

|

(14,889 |

) |

|

(842 |

) |

|

(2,684 |

) |

|

(15,731 |

) |

|

(7,273 |

) |

|

| |

|

|

|

470,955 |

|

|

417,754 |

|

|

396,570 |

|

|

888,709 |

|

|

845,747 |

|

|

| |

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

(65,672 |

) |

|

(49,164 |

) |

|

41,621 |

|

|

(114,836 |

) |

|

80,291 |

|

|

| |

|

|

|

|

|

|

|

|

| Other

income (expense): |

|

|

|

|

|

|

|

Interest and dividend income |

|

1,338 |

|

|

990 |

|

|

799 |

|

|

2,328 |

|

|

1,532 |

|

|

|

Interest expense |

|

|

(6,084 |

) |

|

(5,055 |

) |

|

(5,721 |

) |

|

(11,139 |

) |

|

(10,245 |

) |

|

| Other |

|

|

|

174 |

|

|

387 |

|

|

653 |

|

|

561 |

|

|

392 |

|

|

| |

|

|

|

(4,572 |

) |

|

(3,678 |

) |

|

(4,269 |

) |

|

(8,250 |

) |

|

(8,321 |

) |

|

| |

|

|

|

|

|

|

|

|

| Income

(loss) from continuing operations |

|

|

|

|

|

|

|

before income taxes |

|

|

(70,244 |

) |

|

(52,842 |

) |

|

37,352 |

|

|

(123,086 |

) |

|

71,970 |

|

|

| Income tax

provision |

|

|

(21,771 |

) |

|

(18,288 |

) |

|

12,178 |

|

|

(40,059 |

) |

|

30,898 |

|

|

| Income

(loss) from continuing operations |

|

(48,473 |

) |

|

(34,554 |

) |

|

25,174 |

|

|

(83,027 |

) |

|

41,072 |

|

|

| |

|

|

|

|

|

|

|

|

| Income

(loss) from discontinued operations, |

|

|

|

|

|

|

|

before income taxes |

|

(94 |

) |

|

(424 |

) |

|

(56 |

) |

|

(518 |

) |

|

48 |

|

|

| Income tax

provision |

|

|

251 |

|

|

85 |

|

|

3,913 |

|

|

336 |

|

|

3,913 |

|

|

| Loss from

discontinued operations |

|

(345 |

) |

|

(509 |

) |

|

(3,969 |

) |

|

(854 |

) |

|

(3,865 |

) |

|

| |

|

|

|

|

|

|

|

|

| NET

INCOME (LOSS) |

|

$ |

(48,818 |

) |

$ |

(35,063 |

) |

$ |

21,205 |

|

$ |

(83,881 |

) |

$ |

37,207 |

|

|

| |

|

|

|

|

|

|

|

|

| Basic

earnings per common share: |

|

|

|

|

|

|

|

Income (loss) from continuing operations |

$ |

(0.45 |

) |

$ |

(0.33 |

) |

$ |

0.23 |

|

$ |

(0.77 |

) |

$ |

0.38 |

|

|

| Loss

from discontinued operations |

$ |

- |

|

$ |

- |

|

$ |

(0.04 |

) |

$ |

(0.01 |

) |

$ |

(0.04 |

) |

|

| |

|

|

|

|

|

|

|

|

| Net

income (loss) |

|

$ |

(0.45 |

) |

$ |

(0.33 |

) |

$ |

0.19 |

|

$ |

(0.78 |

) |

$ |

0.34 |

|

|

| |

|

|

|

|

|

|

|

|

| Diluted

earnings per common share: |

|

|

|

|

|

|

|

Income (loss) from continuing operations |

$ |

(0.45 |

) |

$ |

(0.33 |

) |

$ |

0.23 |

|

$ |

(0.77 |

) |

$ |

0.37 |

|

|

| Loss

from discontinued operations |

$ |

- |

|

$ |

- |

|

$ |

(0.04 |

) |

$ |

(0.01 |

) |

$ |

(0.04 |

) |

|

| |

|

|

|

|

|

|

|

|

| Net

income (loss) |

|

$ |

(0.45 |

) |

$ |

(0.33 |

) |

$ |

0.19 |

|

$ |

(0.78 |

) |

$ |

0.33 |

|

|

| |

|

|

|

|

|

|

|

|

| Weighted

average shares outstanding: |

|

|

|

|

|

|

| Basic |

|

|

|

108,565 |

|

|

108,276 |

|

|

108,014 |

|

|

108,419 |

|

|

107,933 |

|

|

| Diluted |

|

|

|

108,565 |

|

|

108,276 |

|

|

108,466 |

|

|

108,419 |

|

|

108,430 |

|

|

| |

|

|

|

|

|

|

|

|

| HELMERICH & PAYNE, INC. |

| Unaudited |

| (in thousands) |

| |

|

|

|

|

| |

|

March 31 |

|

September 30 |

|

CONSOLIDATED CONDENSED BALANCE SHEETS |

|

2017 |

|

2016 |

| |

|

|

|

|

|

ASSETS |

|

|

|

|

| Cash and cash

equivalents |

|

$ |

741,746 |

|

$ |

905,561 |

| Short-term

investments |

|

|

48,012 |

|

|

44,148 |

| Other current

assets |

|

|

574,093 |

|

|

622,913 |

|

Current assets of discontinued operations |

|

|

36 |

|

|

64 |

|

Total current assets |

|

|

1,363,887 |

|

|

1,572,686 |

| Investments |

|

|

88,299 |

|

|

84,955 |

| Net property,

plant, and equipment |

|

|

5,061,368 |

|

|

5,144,733 |

| Other

assets |

|

|

24,630 |

|

|

29,645 |

| |

|

|

|

|

| TOTAL

ASSETS |

|

$ |

6,538,184 |

|

$ |

6,832,019 |

| |

|

|

|

|

| LIABILITIES AND

SHAREHOLDERS' EQUITY |

|

|

|

|

| Current

liabilities |

|

$ |

301,377 |

|

$ |

330,061 |

|

Current liabilities of discontinued operations |

|

|

40 |

|

|

59 |

|

Total current liabilities |

|

|

301,417 |

|

|

330,120 |

|

Non-current liabilities |

|

|

1,392,346 |

|

|

1,445,237 |

| Non-current

liabilities of discontinued operations |

|

|

4,654 |

|

|

3,890 |

| Long-term debt

less unamortized discount and debt issuance costs |

|

|

492,373 |

|

|

491,847 |

| Total

shareholders’ equity |

|

|

4,347,394 |

|

|

4,560,925 |

| |

|

|

|

|

| TOTAL

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

$ |

6,538,184 |

|

$ |

6,832,019 |

| |

|

|

|

|

| HELMERICH & PAYNE, INC. |

| Unaudited |

| (in thousands) |

| |

|

|

|

| |

Six Months Ended |

| |

March 31 |

|

CONSOLIDATED CONDENSED STATEMENTS OF CASH

FLOWS |

|

2017 |

|

|

|

2016 |

|

| |

|

|

|

| OPERATING

ACTIVITIES: |

|

|

|

| Net income

(loss) |

$ |

(83,881 |

) |

|

$ |

37,207 |

|

| Adjustment for

loss from discontinued operations |

|

854 |

|

|

|

3,865 |

|

| Income (loss)

from continuing operations |

|

(83,027 |

) |

|

|

41,072 |

|

|

Depreciation |

|

286,624 |

|

|

|

283,646 |

|

|

Changes in assets and liabilities |

|

(58,283 |

) |

|

|

158,870 |

|

|

Income from asset sales |

|

(15,731 |

) |

|

|

(7,273 |

) |

|

Other |

|

16,856 |

|

|

|

16,104 |

|

|

Net cash provided by operating activities from continuing

operations |

|

146,439 |

|

|

|

492,419 |

|

|

Net cash provided by (used in) operating activities from

discontinued operations |

|

(80 |

) |

|

|

98 |

|

|

Net cash provided by operating

activities |

|

146,359 |

|

|

|

492,517 |

|

| |

|

|

|

| INVESTING

ACTIVITIES: |

|

|

|

| Capital

expenditures |

|

(175,303 |

) |

|

|

(180,481 |

) |

| Purchase of

short-term investments |

|

(37,899 |

) |

|

|

(21,869 |

) |

| Proceeds from

sale of short-term investments |

|

34,000 |

|

|

|

21,676 |

|

| Proceeds from

asset sales |

|

13,459 |

|

|

|

9,715 |

|

|

Net cash used in investing

activities |

|

(165,743 |

) |

|

|

(170,959 |

) |

| |

|

|

|

| FINANCING

ACTIVITIES: |

|

|

|

| Debt issuance

costs |

|

- |

|

|

|

(32 |

) |

| Dividends

paid |

|

(152,617 |

) |

|

|

(149,300 |

) |

| Exercise of

stock options, net of tax withholding |

|

9,946 |

|

|

|

(199 |

) |

| Tax withholdings

related to net share settlements of restricted stock |

|

(5,679 |

) |

|

|

(3,617 |

) |

|

Excess tax benefit from stock-based compensation |

|

3,919 |

|

|

|

219 |

|

|

Net cash used in financing

activities |

|

(144,431 |

) |

|

|

(152,929 |

) |

| |

|

|

|

| Net increase

(decrease) in cash and cash equivalents |

|

(163,815 |

) |

|

|

168,629 |

|

| Cash and cash

equivalents, beginning of period |

|

905,561 |

|

|

|

729,384 |

|

| Cash and cash

equivalents, end of period |

$ |

741,746 |

|

|

$ |

898,013 |

|

| |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| SEGMENT

REPORTING |

Three Months Ended |

|

Six Months Ended |

| |

March 31 |

|

December 31 |

|

March 31 |

|

March 31 |

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

| |

(in thousands, except days and per day

amounts) |

| U.S. LAND

OPERATIONS |

|

|

|

|

|

|

|

|

|

| Revenues |

$ |

330,967 |

|

|

$ |

263,636 |

|

|

$ |

349,283 |

|

|

$ |

594,603 |

|

|

$ |

719,088 |

|

| Direct operating

expenses |

|

238,249 |

|

|

|

170,606 |

|

|

|

155,884 |

|

|

|

408,855 |

|

|

|

337,425 |

|

| General and

administrative expense |

|

12,573 |

|

|

|

11,642 |

|

|

|

12,196 |

|

|

|

24,215 |

|

|

|

24,569 |

|

| Depreciation |

|

131,995 |

|

|

|

112,276 |

|

|

|

118,682 |

|

|

|

244,271 |

|

|

|

239,041 |

|

| Segment operating

income (loss) |

$ |

(51,850 |

) |

|

$ |

(30,888 |

) |

|

$ |

62,521 |

|

|

$ |

(82,738 |

) |

|

$ |

118,053 |

|

| |

|

|

|

|

|

|

|

|

|

| Revenue days |

|

13,166 |

|

|

|

9,784 |

|

|

|

9,601 |

|

|

|

22,950 |

|

|

|

21,546 |

|

| Average rig revenue per

day |

$ |

22,654 |

|

|

$ |

24,788 |

|

|

$ |

34,218 |

|

|

$ |

23,564 |

|

|

$ |

31,132 |

|

| Average rig expense per

day |

$ |

15,612 |

|

|

$ |

15,204 |

|

|

$ |

14,139 |

|

|

$ |

15,438 |

|

|

$ |

13,447 |

|

| Average rig margin per

day |

$ |

7,042 |

|

|

$ |

9,584 |

|

|

$ |

20,079 |

|

|

$ |

8,126 |

|

|

$ |

17,685 |

|

| Rig utilization |

|

42 |

% |

|

|

31 |

% |

|

|

31 |

% |

|

|

36 |

% |

|

|

35 |

% |

| |

|

|

|

|

|

|

|

|

|

| OFFSHORE

OPERATIONS |

|

|

|

|

|

|

|

|

|

| Revenues |

$ |

36,235 |

|

|

$ |

33,812 |

|

|

$ |

34,325 |

|

|

$ |

70,047 |

|

|

$ |

76,205 |

|

| Direct operating

expenses |

|

26,023 |

|

|

|

22,845 |

|

|

|

27,065 |

|

|

|

48,868 |

|

|

|

57,358 |

|

| General and

administrative expense |

|

902 |

|

|

|

916 |

|

|

|

837 |

|

|

|

1,818 |

|

|

|

1,699 |

|

| Depreciation |

|

3,398 |

|

|

|

3,267 |

|

|

|

3,124 |

|

|

|

6,665 |

|

|

|

6,127 |

|

| Segment operating

income |

$ |

5,912 |

|

|

$ |

6,784 |

|

|

$ |

3,299 |

|

|

$ |

12,696 |

|

|

$ |

11,021 |

|

| |

|

|

|

|

|

|

|

|

|

| Revenue days |

|

595 |

|

|

|

644 |

|

|

|

691 |

|

|

|

1,239 |

|

|

|

1,427 |

|

| Average rig revenue per

day |

$ |

36,006 |

|

|

$ |

31,317 |

|

|

$ |

28,004 |

|

|

$ |

33,569 |

|

|

$ |

27,764 |

|

| Average rig expense per

day |

$ |

25,189 |

|

|

$ |

20,839 |

|

|

$ |

20,658 |

|

|

$ |

22,929 |

|

|

$ |

20,123 |

|

| Average rig margin per

day |

$ |

10,817 |

|

|

$ |

10,478 |

|

|

$ |

7,346 |

|

|

$ |

10,640 |

|

|

$ |

7,641 |

|

| Rig

utilization |

|

77 |

% |

|

|

78 |

% |

|

|

84 |

% |

|

|

77 |

% |

|

|

87 |

% |

| |

|

|

|

|

|

|

|

|

|

| INTERNATIONAL

LAND OPERATIONS |

|

|

|

|

|

|

|

|

|

| Revenues |

$ |

34,757 |

|

|

$ |

68,031 |

|

|

$ |

51,352 |

|

|

$ |

102,788 |

|

|

$ |

123,546 |

|

| Direct operating

expenses |

|

32,181 |

|

|

|

53,350 |

|

|

|

38,113 |

|

|

|

85,531 |

|

|

|

102,121 |

|

| General and

administrative expense |

|

920 |

|

|

|

669 |

|

|

|

887 |

|

|

|

1,589 |

|

|

|

1,605 |

|

| Depreciation |

|

12,633 |

|

|

|

13,187 |

|

|

|

14,620 |

|

|

|

25,820 |

|

|

|

28,753 |

|

| Segment operating

income (loss) |

$ |

(10,977 |

) |

|

$ |

825 |

|

|

$ |

(2,268 |

) |

|

$ |

(10,152 |

) |

|

$ |

(8,933 |

) |

|

|

|

|

|

|

|

|

|

|

|

| Revenue days |

|

870 |

|

|

|

1,157 |

|

|

|

1,307 |

|

|

|

2,027 |

|

|

|

2,718 |

|

| Average rig revenue per

day |

$ |

37,340 |

|

|

$ |

55,880 |

|

|

$ |

36,774 |

|

|

$ |

47,923 |

|

|

$ |

41,580 |

|

| Average rig expense per

day |

$ |

33,649 |

|

|

$ |

42,911 |

|

|

$ |

26,287 |

|

|

$ |

38,936 |

|

|

$ |

30,406 |

|

| Average rig margin per

day |

$ |

3,691 |

|

|

$ |

12,969 |

|

|

$ |

10,487 |

|

|

$ |

8,987 |

|

|

$ |

11,174 |

|

| Rig

utilization |

|

25 |

% |

|

|

33 |

% |

|

|

38 |

% |

|

|

29 |

% |

|

|

39 |

% |

| |

|

|

|

|

|

|

|

|

|

| Operating statistics exclude the effects of offshore platform

management contracts, gains and losses from translation of foreign

currency transactions, and do not include reimbursements of

“out-of-pocket” expenses in revenue per day, expense per day and

margin calculations. |

| |

|

|

|

|

|

|

|

|

|

| Reimbursed amounts were

as follows: |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| U.S. Land

Operations |

$ |

32,704 |

|

|

$ |

21,098 |

|

|

$ |

20,751 |

|

|

$ |

53,802 |

|

|

$ |

48,322 |

|

| Offshore

Operations |

$ |

6,066 |

|

|

$ |

4,431 |

|

|

$ |

6,086 |

|

|

$ |

10,497 |

|

|

$ |

12,417 |

|

| International Land

Operations |

$ |

2,272 |

|

|

$ |

3,377 |

|

|

$ |

3,288 |

|

|

$ |

5,649 |

|

|

$ |

10,532 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment

operating income for all segments is a non-GAAP financial measure

of the Company’s performance, as it excludes general and

administrative expenses, corporate depreciation, income from asset

sales and other corporate income and expense. The Company

considers segment operating income to be an important supplemental

measure of operating performance for presenting trends in the

Company’s core businesses. This measure is used by the

Company to facilitate period-to-period comparisons in operating

performance of the Company’s reportable segments in the aggregate

by eliminating items that affect comparability between

periods. The Company believes that segment operating income

is useful to investors because it provides a means to evaluate the

operating performance of the segments and the Company on an ongoing

basis using criteria that are used by our internal decision

makers. Additionally, it highlights operating trends and aids

analytical comparisons. However, segment operating income has

limitations and should not be used as an alternative to operating

income or loss, a performance measure determined in accordance with

GAAP, as it excludes certain costs that may affect the Company’s

operating performance in future periods. |

|

|

| The

following table reconciles operating income per the information

above to income (loss) from continuing operations before income

taxes as reported on the Consolidated Statements of Operations (in

thousands). |

| |

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

|

| |

March 31 |

|

December 31 |

|

March 31 |

|

March 31 |

|

| |

|

2017 |

|

|

|

2016 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

|

| Operating

income |

|

|

|

|

|

|

|

|

|

|

| U.S. Land |

$ |

(51,850 |

) |

|

$ |

(30,888 |

) |

|

$ |

62,521 |

|

|

$ |

(82,738 |

) |

|

$ |

118,053 |

|

|

| Offshore |

|

5,912 |

|

|

|

6,784 |

|

|

|

3,299 |

|

|

|

12,696 |

|

|

|

11,021 |

|

|

| International Land |

|

(10,977 |

) |

|

|

825 |

|

|

|

(2,268 |

) |

|

|

(10,152 |

) |

|

|

(8,933 |

) |

|

| Other |

|

(1,134 |

) |

|

|

(2,049 |

) |

|

|

(1,349 |

) |

|

|

(3,183 |

) |

|

|

(2,653 |

) |

|

|

Segment operating income (loss) |

$ |

(58,049 |

) |

|

$ |

(25,328 |

) |

|

$ |

62,203 |

|

|

$ |

(83,377 |

) |

|

$ |

117,488 |

|

|

| Corporate general and

administrative |

|

(19,124 |

) |

|

|

(21,035 |

) |

|

|

(19,891 |

) |

|

|

(40,159 |

) |

|

|

(38,012 |

) |

|

| Other depreciation |

|

(3,822 |

) |

|

|

(4,077 |

) |

|

|

(3,971 |

) |

|

|

(7,899 |

) |

|

|

(7,581 |

) |

|

| Inter-segment

elimination |

|

434 |

|

|

|

434 |

|

|

|

596 |

|

|

|

868 |

|

|

|

1,123 |

|

|

| Income from asset

sales |

|

14,889 |

|

|

|

842 |

|

|

|

2,684 |

|

|

|

15,731 |

|

|

|

7,273 |

|

|

|

Operating income (loss) |

$ |

(65,672 |

) |

|

$ |

(49,164 |

) |

|

$ |

41,621 |

|

|

$ |

(114,836 |

) |

|

$ |

80,291 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

|

| Interest

and dividend income |

|

1,338 |

|

|

|

990 |

|

|

|

799 |

|

|

|

2,328 |

|

|

|

1,532 |

|

|

| Interest

expense |

|

(6,084 |

) |

|

|

(5,055 |

) |

|

|

(5,721 |

) |

|

|

(11,139 |

) |

|

|

(10,245 |

) |

|

|

Other |

|

174 |

|

|

|

387 |

|

|

|

653 |

|

|

|

561 |

|

|

|

392 |

|

|

| Total

other income (expense) |

|

(4,572 |

) |

|

|

(3,678 |

) |

|

|

(4,269 |

) |

|

|

(8,250 |

) |

|

|

(8,321 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Income (loss)

from continuing operations before income taxes |

$ |

(70,244 |

) |

|

$ |

(52,842 |

) |

|

$ |

37,352 |

|

|

$ |

(123,086 |

) |

|

$ |

71,970 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| SUPPLEMENTARY STATISTICAL

INFORMATION |

|

| |

|

|

|

|

| The tables and information that follow are additional

information that may also help provide further clarity and insight

into the operations of the Company. |

|

| |

|

|

|

|

| SELECTED STATISTICAL & OPERATIONAL

HIGHLIGHTS |

|

| (Used to determine adjusted per revenue day

statistics) |

|

| |

Three Months Ended |

|

| |

March 31 |

|

December 31 |

|

| |

2017 |

|

|

2016 |

|

|

|

|

(in dollars per revenue day) |

|

| U.S. Land

Operations |

|

|

|

|

| Early contract

termination revenues |

$ |

453 |

|

$ |

897 |

|

|

| Lawsuit settlement

charges |

$ |

- |

|

$ |

(140 |

) |

|

| Total impact

per revenue day: |

$ |

453 |

|

$ |

757 |

|

|

| |

|

|

|

|

| International

Land Operations |

|

|

|

|

| Early contract

termination revenues |

$ |

- |

|

$ |

4,086 |

|

|

| Total impact

per revenue day: |

$ |

- |

|

$ |

4,086 |

|

|

| |

|

|

|

|

| U.S. LAND RIG COUNTS & MARKETABLE FLEET

STATISTICS |

| |

| |

April 27 |

March 31 |

December 31 |

Q2FY17 |

| |

2017 |

2017 |

2016 |

Average |

| U.S. Land

Operations |

|

|

|

|

| Term Contract Rigs |

88 |

88 |

82 |

76.6 |

| Spot Contract Rigs |

88 |

79 |

42 |

69.7 |

| Total Rigs

Generating Revenue Days |

176 |

167 |

124 |

146.3 |

| Other Contracted

Rigs |

1 |

1 |

3 |

1.0 |

| Total

Contracted Rigs |

177 |

168 |

127 |

147.3 |

| Idle or Other Rigs |

173 |

182 |

223 |

202.7 |

| Total

Marketable Fleet |

350 |

350 |

350 |

350.0 |

| |

| |

|

|

|

|

|

|

|

| H&P GLOBAL FLEET UNDER TERM CONTRACT

STATISTICS |

| Number of Rigs Already Under Long-Term

Contracts(1) |

| (Estimated Quarterly Average, Including Announced New

Builds – as of 4/27/17) |

|

|

|

|

|

|

|

|

|

| |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

| |

FY17 |

FY17 |

FY18 |

FY18 |

FY18 |

FY18 |

FY19 |

|

Segment |

|

|

|

|

|

|

|

| U.S. Land

Operations |

86.4 |

74.9 |

65.0 |

48.8 |

38.7 |

32.3 |

26.8 |

| International Land

Operations |

11.0 |

10.0 |

10.0 |

10.0 |

10.0 |

10.0 |

10.0 |

| Offshore

Operations |

2.0 |

2.0 |

2.0 |

2.0 |

1.9 |

0.3 |

0.0 |

|

Total |

99.4 |

86.9 |

77.0 |

60.8 |

50.6 |

42.6 |

36.8 |

| |

|

(1)The above term contract coverage excludes long-term contracts

for which the Company received early contract termination

notifications as of 4/27/17. Given notifications as of

4/27/17, the Company expects to generate approximately $5 million

in the third fiscal quarter of 2017 and over $18 million thereafter

from early terminations corresponding to long-term contracts and

related to its U.S. Land segment. All of the above rig contracts

include provisions for early termination fees.

Contact: Investor Relations

investor.relations@hpinc.com

(918) 588-5190

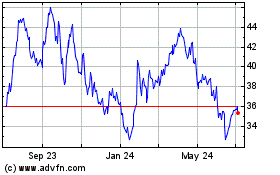

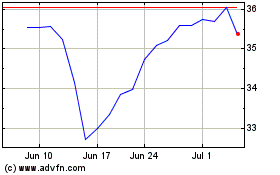

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Apr 2023 to Apr 2024