MUFG Union Bank, N.A. (Union Bank) today announced four

appointments within the Small Business Administration Lending

group. Craig Cornwell, Billy Szeto, Jeff Theiler, and Sam Vichattu

join as Vice Presidents reporting to Kirsten (Didi) Hakes, head of

the Small Business Administration Lending group. These individuals

will assist small business owners with a broad range of financial

services, including owner-occupied commercial real estate lending,

business acquisition, and expansion.

“Small business owners across the West Coast are optimistic

about the business opportunities ahead and we are expanding our

team to support their growing needs,” Hakes said. “This

high-caliber team, with an average of 18 years of experience

serving small business owners, is qualified to counsel clients on

the various Small Business Administration programs and other

financing options that will help them achieve their specific

business goals.”

Based in Los Angeles, Craig Cornwell brings to Union Bank more

than 20 years of Small Business Administration expertise. He also

brings deep understanding of owner-occupied lending. Together with

a team of Los Angeles-based bankers, he will cover the Los Angeles

market. Cornwell is a licensed California real estate broker and

holds a BA in Economics from The University of California, Los

Angeles.

Billy Szeto joins Union Bank from J.P. Morgan Chase, where most

recently he served as a Relationship Manager serving businesses in

the Los Angeles area. He brings Union Bank small business clients

more than 20 years of financial industry experience in the Greater

Los Angeles Area. He is a Small Business Administration specialist

with a commercial banking background that includes experience in

commercial real estate, equipment financing, and commercial and

industrial lending. Szeto has also held positions at SoCal

Certified Development Company, California Bank &Trust, First

Bank, and Comerica Bank. He is based in Los Angeles.

Covering the Pacific Northwest, Jeff Theiler joins Union Bank

from Bank of the West, where he was a Small Business Administration

Specialist. Previous to that, he was a Vice President with Lehman

Brothers, Key Bank, and GE Capital. Theiler’s professional

background includes banking experience in commercial real estate

and equipment financing. He also brings more than 20 years of

financial services experience as a Small Business Administration

Specialist and Commercial Banker. Theiler earned a Bachelor’s

degree in Justice Studies from Arizona State University. He is

based in Portland and serves the Pacific Northwest.

Sam Vichattu brings more than 12 years of financial services

experience, which includes expertise in commercial real estate

finance, SBA lending, market development, and financial analysis.

He is based in San Jose, Calif., and will cover the San Francisco

Bay Area market. Vichattu is a licensed real estate agent and holds

a degree in Business Administration from De Anza College.

About the Union Bank Small Business Administration

group

The Small Business Administration group serves businesses that

fall within the U.S. Small Business Administration guidelines. It

offers an array of products and services for businesses and their

owners, including deposit solutions, loans, lines of credit,

specialized credit programs, and online business products. The team

serves clients throughout the bank’s footprint across California,

Oregon, and Washington.

Union Bank Small Business Economic Survey

In February 2017, Union Bank published the results of its 18th

annual Small Business Economic survey. Union Bank conducted the

survey from Dec. 12, 2016 to Jan. 3, 2017, compiling results from

nearly 700 small business owners in California, Oregon, and

Washington.

Overall, 53 percent of respondents said the national economy is

headed in the right direction, a significant reversal from January

2016 when a majority (58%) believed the economy was headed in the

wrong direction. More than half of respondents (57%) also said they

believe the economic outlook at the state and local levels has

improved versus 49 percent in January 2016. However, 62 percent of

survey participants said the United States, as an entity, is headed

in the wrong direction. This reflects a 5 percentage point increase

from January 2016. For more information about the survey, please

visit

https://www.unionbank.com/global/about/newsroom/press-releases/union-bank-small-business-economic-survey.jsp.

The above survey is for informational purposes only. The

findings are based on surveys of small businesses, and the

information is not a guarantee of actual or future performance.

Union Bank third party vendors are separate legal entities that

are not affiliated with each other in any way by common ownership,

management, control, or otherwise. The content, availability, and

processing accuracy of their websites and products are the

responsibility of each respective company. Union Bank makes no

representations or warranties as to the suitability, accuracy,

completeness or timeliness of the information provided, including

any information provided by third parties. Clients should consult

their own legal and/or tax advisors.

About the Survey

Union Bank, working with its survey partner (MaritzCX), surveyed

693 respondents (591 in California and 102 in the Pacific

Northwest) online from Dec. 12, 2016 to Jan. 3, 2017. The small

business respondents were screened to ensure that they have been in

operation for a minimum of two years with owners over the age of

25. The small businesses were defined for the survey as having $15

million or less in annual sales. The margin of error for the full

sample is +/-4 percentage points. For the various regions, the

margins of error are as follows: Southern California +/-4%,

Northern California +/-7%, and Pacific Northwest +/-10%.

About MUFG Union Bank, N.A.

MUFG Union Bank, N.A., is a full-service bank with offices

across the United States. We provide a wide spectrum of corporate,

commercial and retail banking and wealth management solutions to

meet the needs of customers. We also offer an extensive portfolio

of value-added solutions for customers, including investment

banking, personal and corporate trust, global custody, transaction

banking, capital markets, and other services. With assets of $115.6

billion, as of December 31, 2016, MUFG Union Bank has strong

capital reserves, credit ratings and capital ratios relative to

peer banks. MUFG Union Bank is a proud member of the Mitsubishi UFJ

Financial Group (NYSE: MTU), one of the world’s largest financial

organizations with total assets of approximately ¥302.1 trillion

(JPY) or $2.6 trillion (USD)¹, as of December 31, 2016. The

corporate headquarters (principal executive office) for MUFG

Americas Holdings Corporation, which is the financial holding

company and MUFG Union Bank, is in New York City. The main banking

office of MUFG Union Bank is in San Francisco, California.

1 Exchange rate of 1 USD=¥116.49 (JPY) as of December 31,

2016

©2017 MUFG Union Bank, N.A. All rights reserved. Member

FDIC.Union Bank is a registered trademark and brand name of MUFG

Union Bank, N.A.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170426006156/en/

Union BankJuanita Gutierrez,

+1-213-236-5017juanita.gutierrez@unionbank.com

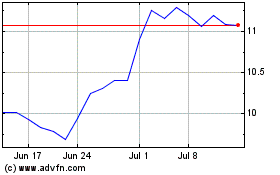

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

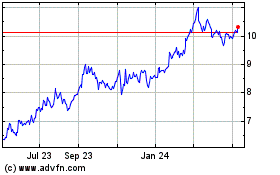

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024