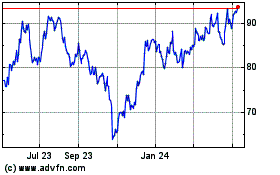

BOK Financial Corporation (Nasdaq:BOKF) reported net income of

$88.4 million or $1.35 per diluted share for the first quarter of

2017. Net income was $50.0 million or $0.76 per diluted share for

the fourth quarter of 2016 and $42.6 million or $0.64 per diluted

share for the first quarter of 2016.

Steven G. Bradshaw, president and chief executive officer of BOK

Financial, stated, “The year is off to a very strong start, and

financial results in the first quarter of 2017 represent the

second-highest net income total in our company’s history. Net

interest margin and net interest revenue are up substantially due

to the improved interest rate environment. Fee and commissions

revenue growth remains steady, driven by the strength of our

diverse wealth management business. And cost containment

initiatives executed last year are driving much better results in

terms of expense management, with total expenses down by over $20

million sequentially despite including the first full quarter of

Mobank-related operating expenses.”

Bradshaw continued, “We completed the operational conversion of

Mobank in February, and this acquisition is well ahead of our

financial forecasts. With Mobank, total deposits at quarter–end are

up 11 percent compared to March 31, 2016; and organic deposit

growth during the same period was 6.5 percent. Our deposit

franchise provides a significant funding advantage, and while we

continue to believe that some demand deposits will migrate into

interest–bearing accounts in the current rising rate environment,

to date we have seen very limited pressure on deposit costs.”

First Quarter 2017 Highlights

- Net interest revenue totaled $201.2 million for the first

quarter of 2017, up $7.0 million over the fourth quarter of 2016.

Net interest margin was 2.81 percent for the first quarter of 2017,

compared to 2.69 percent for the fourth quarter of 2016. Average

earning assets increased $416 million during the first quarter of

2017, primarily due to a $412 million increase in average loan

balances.

- Fees and commissions revenue totaled $164.4 million for the

first quarter of 2017, a $2.3 million increase over the prior

quarter. Fiduciary and asset management revenue grew by $4.1

million due to an increase in the value of assets managed and a

decrease in waived fees. Mortgage banking revenue decreased $3.2

million and transaction card revenue decreased $2.4 million.

Brokerage and trading revenue was unchanged, excluding a $5.0

million loss on trading asset positions from the previous

quarter.

- The change in the fair value of mortgage servicing rights, net

of economic hedges increased pre-tax net income in the first

quarter of 2017 by $188 thousand. The change in the fair value of

mortgage servicing rights, net of economic hedges decreased pre-tax

net income in the fourth quarter of 2016 by $17.0 million.

- Operating expense was $244.7 million for the first quarter of

2017, a decrease of $20.8 million compared to the prior quarter.

Expenses related to the Mobank acquisition, severance and a

contribution to the BOKF Foundation added $11.7 million to the

fourth quarter of 2016. Excluding these items, operating expense

decreased $9.1 million, primarily due to lower mortgage banking and

deposit insurance costs.

- Income tax expense was $38.1 million or 30.1 percent of net

income before taxes for the first quarter of 2017, compared to

$22.5 million or 31.1 percent in the fourth quarter of 2016. The

first quarter included a $3.9 million benefit related to the

implementation of a new accounting standard that includes the tax

effect of vested equity compensation awards in income tax expense.

Previously the tax effect of these awards was included in

stockholders' equity.

- No provision for credit losses was recorded in the first

quarter of 2017 or the fourth quarter of 2016 due to continued

improvement in credit metric trends. The company had a net recovery

of $747 thousand in the first quarter of 2017, compared to a net

recovery of $1.2 million in the previous quarter.

- The combined allowance for credit losses totaled $258 million

or 1.52 percent of outstanding loans at March 31, 2017

compared to $257 million or 1.52 percent of outstanding loans at

December 31, 2016.

- Nonperforming assets that are not guaranteed by U.S. government

agencies totaled $240 million or 1.43 percent of outstanding loans

and repossessed assets (excluding those guaranteed by U.S.

government agencies) at March 31, 2017 and $263 million or

1.56 percent of outstanding loans and repossessed assets (excluding

those guaranteed by U.S. government agencies) at December 31,

2016. The decrease in nonperforming assets was primarily due to a

$22 million decrease in nonaccruing energy loans.

- Average loans increased by $412 million over the previous

quarter, primarily due to a full quarter's impact of the Mobank

acquisition. Excluding this impact, average loan balances were

largely unchanged compared to the fourth quarter of 2016.

Period-end outstanding loan balances totaled $17.0 billion at

March 31, 2017, largely unchanged compared to

December 31, 2016.

- Average deposits increased $666 million over the previous

quarter, including $390 million related to the impact of a full

quarter of deposits from the Mobank acquisition. Excluding this

impact, average interest-bearing transaction deposits grew by $402

million and time deposit balances were up $63 million, partially

offset by a $201 million decrease in demand deposits. Period-end

deposits were $22.6 billion at March 31, 2017, a $173 million

decrease compared to December 31, 2016.

- The common equity Tier 1 capital ratio at March 31, 2017

was 11.60 percent. Other regulatory capital ratios were Tier 1

capital ratio, 11.60 percent, total capital ratio, 13.26 percent

and leverage ratio, 8.89 percent. At December 31, 2016, the

common equity Tier 1 capital ratio was 11.21 percent, the Tier 1

capital ratio was 11.21 percent, total capital ratio was 12.81

percent, and leverage ratio was 8.72 percent.

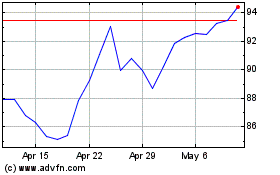

- The company paid a regular quarterly cash dividend of $29

million or $0.44 per common share during the first quarter of 2017.

On April 25, 2017, the board of directors approved a quarterly

cash dividend of $0.44 per common share payable on or about

May 26, 2017 to shareholders of record as of May 12,

2017.

Net Interest Revenue

Net interest revenue was $201.2 million for the first quarter of

2017, up $7.0 million over the fourth quarter of 2016.

Net interest margin was 2.81 percent for the first quarter of

2017, an increase of 12 basis points over the fourth quarter of

2016, due largely to a full quarter effect of the Fed's 25 basis

point December increase in short-term rates. The yield on average

earning assets was 3.15 percent, an increase of 17 basis points.

The loan portfolio yield increased 21 basis points to 3.88 percent

primarily due to increases in the 30 day and 90 day LIBOR and

improved energy loan yields. The yield on the available for sale

securities portfolio increased 5 basis points to 2.05 percent. The

yield on interest-bearing cash and cash equivalents increased 27

basis points. Funding costs were 0.52 percent, up 8 basis

points. Growth in the cost of interest-bearing deposits was limited

to 3 basis points by a lack of market pricing pressure.

Average earning assets increased $416 million during the first

quarter of 2017. Average loan balances increased $412 million,

primarily due to a full quarter's impact of the Mobank acquisition.

The average balance of fair value option securities held as an

economic hedge of our mortgage servicing rights increased $206

million. Average trading securities portfolio balances increased

$103 million and interest-bearing cash and cash equivalents

balances were up $55 million. These increases were offset by a $200

million decrease in available for sale securities portfolio

balances and a $125 million decrease in the average balance of

residential mortgage loans held for sale.

Average interest-bearing deposit balances increased $689 million

over the fourth quarter of 2016, including $212 million related to

a full quarter's impact of the Mobank acquisition. The average

balance of borrowed funds decreased $378 million.

Fees and Commissions Revenue

Fees and commissions revenue totaled $164.4 million for the

first quarter of 2017, an increase of $2.3 million over the fourth

quarter of 2016. Brokerage and trading revenue for the fourth

quarter of 2016 included a $5.0 million decrease in the value of

trading assets caused by an unexpected 85 basis point increase in

the 10-year U.S. Treasury interest rate and related rates.

Fiduciary and asset management revenue grew by $4.1 million over

the fourth quarter of 2016 to $38.6 million. Revenue growth was

largely due to a $2.6 billion increase in the value of fiduciary

assets under management to a record high of $44.4 billion at

March 31, 2017. Additionally, waived fees earned as

administrator and investment advisor of the Cavanal Hill Funds

decreased $964 thousand compared to the previous quarter of $445

thousand.

Mortgage banking revenue totaled $25.2 million for the first

quarter of 2017, a $3.2 million decrease over the fourth quarter of

2016. Revenue from mortgage loan production decreased $3.4 million

due to a $103 million decrease in mortgage production volume and a

26 basis point decrease in gain on sale margin compared to the

prior quarter. Production volume decreased in response to higher

primary mortgage interest rates and margin narrowed due to

increased competition, largely in the Home Direct online delivery

channel.

Transaction card revenue was down $2.4 million, primarily due to

a seasonal decrease in transaction volumes.

Operating Expense

Total operating expense was $244.7 million for the first quarter

of 2017, a decrease of $20.8 million compared to the fourth quarter

of 2016. Expenses related to the completion of the Mobank

acquisition were $2.0 million in the first quarter of 2017 and $4.7

million in the fourth quarter of 2016. In addition, operating

expense in the fourth quarter of 2016 included $5.0 million of

severance and other expenses related to staff reductions and a $2.0

million contribution to the BOKF Foundation. The discussion

following excludes the impact of these items.

Personnel expense increased $1.9 million over the fourth quarter

of 2016. Employee benefits costs were up $4.7 million primarily due

to a seasonal increase in payroll tax expense and increased

employee retirement plans costs, partially offset by lower employee

medical costs. Regular compensation increased $2.5 million and

included a full quarter impact of the Mobank acquisition. Incentive

compensation expense decreased $5.3 million.

Non-personnel expense decreased $13.1 million compared to the

fourth quarter of 2016. Mortgage banking expense decreased $4.3

million primarily due to the effect of slowing actual residential

mortgage loan prepayments on the fair value of mortgage servicing

rights. Deposit insurance expense was $2.3 million lower due to

improvements in credit quality and other risk factors. Professional

fees were down $2.3 million and other expenses decreased $2.3

million.

Loans, Deposits and Capital

Loans

Outstanding loans were $17.0 billion at March 31, 2017,

largely unchanged compared to the previous quarter. Growth in

commercial real estate was offset by a decrease in commercial loan

balances.

Outstanding commercial loan balances decreased $64 million.

Healthcare sector loans grew by $64 million. Energy loan balances

increased $39 million. Unfunded energy loan commitments were

largely unchanged at $2.7 billion. Manufacturing loans increased

$28 million. This growth was offset by a $96 million decrease in

service sector loan balances, a $71 million decrease in

wholesale/retail sector loan balances and a $29 million decrease in

other commercial and industrial loans.

Commercial real estate loans grew by $62 million. Loans secured

by office buildings increased by $62 million and were broadly

distributed across the Texas, New Mexico and Oklahoma markets.

Multifamily residential loans increased $20 million. Growth in the

Arizona and Kansas/Missouri markets was partially offset by a

decrease in loans attributed to the Texas and Oklahoma markets.

Retail sector loans decreased $17 million, primarily in the Texas

and Arizona markets, partially offset by growth in the Oklahoma

market.

Deposits

Period-end deposits totaled $22.6 billion at March 31,

2017, a $173 million decrease compared to December 31, 2016.

Interest-bearing transaction account balances decreased $506

million, partially offset by a $271 million increase in demand

deposit balances. In addition, both savings and time deposit

balances grew over the prior quarter. Excluding the impact of

allocating Mobank deposits among the lines of business, Wealth

Management deposits decreased $154 million and Commercial Banking

deposits decreased $101 million. Consumer Banking deposits grew by

$122 million.

Capital

The company's common equity Tier 1 capital ratio was 11.60

percent at March 31, 2017. In addition, the company's Tier 1

capital ratio was 11.60 percent, total capital ratio was 13.26

percent and leverage ratio was 8.89 percent at March 31, 2017.

At December 31, 2016, the company's common equity Tier 1

capital ratio was 11.21 percent, Tier 1 capital ratio was 11.21

percent, total capital ratio was 12.81 percent, and leverage ratio

was 8.72 percent.

The company's tangible common equity ratio, a non-GAAP measure,

was 8.88 percent at March 31, 2017 and 8.61 percent at

December 31, 2016. The tangible common equity ratio is

primarily based on total shareholders' equity which includes

unrealized gains and losses on available for sale securities. The

company has elected to exclude unrealized gains and losses from

available for sale securities from its calculation of Tier 1

capital for regulatory capital purposes, consistent with the

treatment under the previous capital rules.

Credit Quality

Nonperforming assets totaled $334 million or 1.96 percent of

outstanding loans and repossessed assets at March 31, 2017

compared to $357 million or 2.09 percent at December 31, 2016.

Nonperforming assets that are not guaranteed by U.S. government

agencies totaled $240 million or 1.43 percent of outstanding loans

and repossessed assets (excluding those guaranteed by U.S.

government agencies) at March 31, 2017 compared to $263

million or 1.56 percent at December 31, 2016.

Nonaccruing loans totaled $208 million or 1.22 percent of

outstanding loans at March 31, 2017, down from $231 million or

1.36 percent of outstanding loans at December 31, 2016. The

decrease in nonaccruing loans was primarily due to a $22 million

decrease in nonaccruing energy loans. New nonaccruing loans

identified in the first quarter totaled $23 million, offset by $35

million in payments received, $2.2 million in charge-offs and $3.3

million in foreclosures and repossessions. Additionally, $5.9

million was returned to accruing status based on improved credit

risk and performance. At March 31, 2017, nonaccruing

commercial loans totaled $157 million or 1.52 percent of

outstanding commercial loans, nonaccruing commercial real estate

loans totaled $4.5 million or 0.12 percent of outstanding

commercial real estate loans and nonaccruing residential mortgage

loans totaled $46 million or 2.37 percent of outstanding

residential mortgage loans.

Potential problem loans, which are defined as performing loans

based on known information cause management concern as to the

borrowers' ability to continue to perform, totaled $413 million at

March 31 compared to $399 million at December 31. The

increase largely resulted from healthcare and manufacturing

potential problem loans, partially offset by a decrease in

potential problem energy loans.

Marc Maun, chief credit officer, stated, “We continued to see a

stable credit environment in the first quarter, with no segments of

our loan portfolio showing any material signs of stress. We

recognized net recoveries during the quarter, saw nonaccrual loans

decrease by over ten percent, and have a combined allowance for

credit losses to period–end loans at or near the top of our peer

group of mid-sized regional banks. After evaluating all

credit factors, no provision for loan losses was booked for the

first quarter. Looking forward, we are forecasting $15 million to

$20 million provision for the full year.”

Maun continued, “Retail commercial real estate (CRE) has been in

the spotlight recently due to several high–profile retailer store

closings. I’m pleased to report that as of March 31, 2017 we

had minimal criticized or classified retail CRE loans in our

portfolio. Our portfolio is carefully constructed to limit

CRE exposure to any one retailer, is geographically diverse, and

represents best–in–class retail developers with multiple sources of

repayment.”

The company had a net recovery of $747 thousand for the first

quarter of 2017, compared to a net recovery of $1.2 million in the

fourth quarter of 2016. Gross charge-offs totaled $2.2 million for

the first quarter, compared to $1.7 million for the previous

quarter. Recoveries totaled $2.9 million for the first quarter of

2017 and $2.8 million for the fourth quarter of 2016.

As noted above, the company determined that no provision for

credit losses was necessary during the first quarter of 2017 based

on the continued improvement in credit metrics. No provision for

credit losses was recorded in the previous quarter. The combined

allowance for credit losses totaled $258 million or 1.52 percent of

outstanding loans and 131 percent of nonaccruing loans at

March 31, 2017. The allowance for loan losses was $249 million

and the accrual for off-balance sheet credit losses was $9.4

million.

Securities and Derivatives

The fair value of the available for sale securities portfolio

totaled $8.4 billion at March 31, 2017, a $240 million

decrease compared to December 31, 2016. At March 31,

2017, the available for sale portfolio consisted primarily of $5.4

billion of residential mortgage-backed securities fully backed by

U.S. government agencies and $2.9 billion of commercial

mortgage-backed securities fully backed by U.S. government

agencies.

At March 31, 2017, the available for sale securities

portfolio had a net unrealized loss of $5.5 million compared to a

net unrealized loss of $15 million at December 31, 2016. The

decrease in net unrealized loss was primarily due to changes in

interest rates during the quarter. Net unrealized losses on

residential mortgage-backed securities issued by U.S. government

agencies at March 31, 2017 decreased $7.7 million during the

first quarter to $7.3 million. Commercial mortgage-backed

securities had a net unrealized loss of $18 million at

March 31, 2017, unchanged compared to December 31,

2016.

The company also maintains a portfolio of financial instruments

primarily consisting of residential mortgage-backed securities

issued by U.S. government agencies and interest rate derivative

contracts as an economic hedge of the changes in the fair value of

our mortgage servicing rights.

The net economic benefit of the changes in fair value of

mortgage servicing rights and related economic hedges was $1.5

million, including a $1.9 million increase in the fair value of the

mortgage servicing rights, a $1.7 million decrease in the fair

value of securities and derivative contracts held as an economic

hedge and $1.3 million of related net interest revenue. The

improvement over the prior quarter was due primarily to materially

higher long-term interest rates and a relatively stable rate

environment during the first quarter.

The fair value of mortgage servicing rights increased by $39.8

million during the fourth quarter of 2016 primarily due to an

increase in residential mortgage rates during the quarter. The fair

value of securities and interest rate derivative contracts held as

an economic hedge of mortgage servicing rights decreased by $56.8

million. The significant increase in long-term interest rates in

the fourth quarter resulted in a loss on this hedge, partially

offset by an increase in the fair value of the mortgage servicing

rights.

Conference Call and Webcast

The company will hold a conference call at 9 a.m. Central time

on Wednesday, April 26, 2017 to discuss the financial results

with investors. The live audio webcast and presentation slides

will be available on the company’s website at www.bokf.com. The

conference call can also be accessed by dialing 1-201-689-8471. A

conference call and webcast replay will also be available shortly

after conclusion of the live call at www.bokf.com or by

dialing 1-844-512-2921 and referencing conference ID #

13659658.

About BOK Financial Corporation

BOK Financial Corporation is a $33 billion regional financial

services company based in Tulsa, Oklahoma. The company's stock is

publicly traded on NASDAQ under the Global Select market listings

(symbol: BOKF). BOK Financial's holdings include BOKF, NA, BOK

Financial Securities, Inc. and The Milestone Group, Inc. BOKF, NA

operates TransFund, Cavanal Hill Investment Management, BOK

Financial Asset Management, Inc. and seven banking divisions: Bank

of Albuquerque, Bank of Arizona, Bank of Arkansas, Mobank, Bank of

Oklahoma, Bank of Texas and Colorado State Bank and Trust. Through

its subsidiaries, the company provides commercial and consumer

banking, investment and trust services, mortgage origination and

servicing, and an electronic funds transfer network. For more

information, visit www.bokf.com.

The company will continue to evaluate critical assumptions and

estimates, such as the appropriateness of the allowance for credit

losses and asset impairment as of March 31, 2017 through the

date its financial statements are filed with the Securities and

Exchange Commission and will adjust amounts reported if

necessary.

This news release contains forward-looking statements that are

based on management's beliefs, assumptions, current expectations,

estimates and projections about BOK Financial, the financial

services industry and the economy generally. Words such as

“anticipates,” “believes,” “estimates,” “expects,” “forecasts,”

“plans,” “projects,” “will,” “intends,” variations of

such words and similar expressions are intended to identify such

forward-looking statements. Management judgments relating to and

discussion of the provision and allowance for credit losses,

allowance for uncertain tax positions, accruals for loss

contingencies and valuation of mortgage servicing rights involve

judgments as to expected events and are inherently forward-looking

statements. Assessments that BOK Financial's acquisitions and other

growth endeavors will be profitable are necessary statements of

belief as to the outcome of future events based in part on

information provided by others which BOK Financial has not

independently verified. These statements are not guarantees of

future performance and involve certain risks, uncertainties, and

assumptions which are difficult to predict with regard to timing,

extent, likelihood and degree of occurrence. Therefore, actual

results and outcomes may materially differ from what is expected,

implied or forecasted in such forward-looking statements. Internal

and external factors that might cause such a difference include,

but are not limited to changes in commodity prices, interest rates

and interest rate relationships, demand for products and services,

the degree of competition by traditional and nontraditional

competitors, changes in banking regulations, tax laws, prices,

levies and assessments, the impact of technological advances, and

trends in customer behavior as well as their ability to repay

loans. BOK Financial and its affiliates undertake no obligation to

update, amend or clarify forward-looking statements, whether as a

result of new information, future events, or otherwise.

|

BALANCE SHEETS -- UNAUDITEDBOK FINANCIAL

CORPORATION(In thousands) |

| |

March 31, 2017 |

|

Dec. 31, 2016 |

|

March 31, 2016 |

|

ASSETS |

|

|

|

|

|

| Cash and due from

banks |

$ |

546,575 |

|

|

$ |

620,846 |

|

|

$ |

481,510 |

|

| Interest-bearing cash

and cash equivalents |

2,220,640 |

|

|

1,916,651 |

|

|

1,831,162 |

|

| Trading securities |

677,156 |

|

|

337,628 |

|

|

279,539 |

|

| Investment

securities |

519,402 |

|

|

546,145 |

|

|

576,047 |

|

| Available for sale

securities |

8,437,291 |

|

|

8,676,829 |

|

|

8,886,036 |

|

| Fair value option

securities |

441,714 |

|

|

77,046 |

|

|

418,887 |

|

| Restricted equity

securities |

283,936 |

|

|

307,240 |

|

|

314,590 |

|

| Residential mortgage

loans held for sale |

248,707 |

|

|

301,897 |

|

|

332,040 |

|

| Loans: |

|

|

|

|

|

|

Commercial |

10,327,110 |

|

|

10,390,824 |

|

|

10,288,425 |

|

|

Commercial real estate |

3,871,063 |

|

|

3,809,046 |

|

|

3,370,507 |

|

|

Residential mortgage |

1,946,274 |

|

|

1,949,832 |

|

|

1,869,309 |

|

|

Personal |

847,459 |

|

|

839,958 |

|

|

494,325 |

|

| Total loans |

16,991,906 |

|

|

16,989,660 |

|

|

16,022,566 |

|

| Allowance

for loan losses |

(248,710 |

) |

|

(246,159 |

) |

|

(233,156 |

) |

| Loans, net of

allowance |

16,743,196 |

|

|

16,743,501 |

|

|

15,789,410 |

|

| Premises and equipment,

net |

325,546 |

|

|

325,849 |

|

|

311,161 |

|

| Receivables |

394,394 |

|

|

772,952 |

|

|

167,209 |

|

| Goodwill |

445,738 |

|

|

448,899 |

|

|

383,789 |

|

| Intangible assets,

net |

42,556 |

|

|

46,931 |

|

|

44,944 |

|

| Mortgage servicing

rights |

249,403 |

|

|

247,073 |

|

|

196,055 |

|

| Real estate and other

repossessed assets, net |

42,726 |

|

|

44,287 |

|

|

29,896 |

|

| Derivative contracts,

net |

304,727 |

|

|

689,872 |

|

|

790,146 |

|

| Cash surrender value of

bank-owned life insurance |

310,537 |

|

|

308,430 |

|

|

305,510 |

|

| Receivable on unsettled

securities sales |

9,921 |

|

|

7,188 |

|

|

5,640 |

|

| Other

assets |

384,767 |

|

|

353,017 |

|

|

270,374 |

|

|

TOTAL ASSETS |

$ |

32,628,932 |

|

|

$ |

32,772,281 |

|

|

$ |

31,413,945 |

|

| |

|

|

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

Demand |

$ |

9,506,573 |

|

|

$ |

9,235,720 |

|

|

$ |

7,950,675 |

|

|

Interest-bearing transaction |

10,359,214 |

|

|

10,865,105 |

|

|

9,709,766 |

|

|

Savings |

465,724 |

|

|

425,470 |

|

|

416,505 |

|

|

Time |

2,243,848 |

|

|

2,221,800 |

|

|

2,341,374 |

|

| Total deposits |

22,575,359 |

|

|

22,748,095 |

|

|

20,418,320 |

|

| Funds purchased |

47,629 |

|

|

57,929 |

|

|

62,755 |

|

| Repurchase

agreements |

508,352 |

|

|

668,661 |

|

|

630,101 |

|

| Other borrowings |

5,238,947 |

|

|

4,846,072 |

|

|

5,633,862 |

|

| Subordinated

debentures |

144,649 |

|

|

144,640 |

|

|

226,385 |

|

| Accrued interest, taxes

and expense |

140,235 |

|

|

146,704 |

|

|

148,711 |

|

| Due on unsettled

securities purchases |

137,069 |

|

|

6,508 |

|

|

19,508 |

|

| Derivative contracts,

net |

276,422 |

|

|

664,531 |

|

|

705,578 |

|

| Other

liabilities |

189,376 |

|

|

182,784 |

|

|

212,460 |

|

| TOTAL LIABILITIES |

29,258,038 |

|

|

29,465,924 |

|

|

28,057,680 |

|

| Shareholders'

equity: |

|

|

|

|

|

| Capital,

surplus and retained earnings |

3,346,965 |

|

|

3,285,821 |

|

|

3,228,446 |

|

|

Accumulated other comprehensive income (loss) |

(5,221 |

) |

|

(10,967 |

) |

|

93,109 |

|

| TOTAL SHAREHOLDERS'

EQUITY |

3,341,744 |

|

|

3,274,854 |

|

|

3,321,555 |

|

|

Non-controlling interests |

29,150 |

|

|

31,503 |

|

|

34,710 |

|

| TOTAL

EQUITY |

3,370,894 |

|

|

3,306,357 |

|

|

3,356,265 |

|

|

TOTAL LIABILITIES AND EQUITY |

$ |

32,628,932 |

|

|

$ |

32,772,281 |

|

|

$ |

31,413,945 |

|

|

AVERAGE BALANCE SHEETS -- UNAUDITEDBOK

FINANCIAL CORPORATION(in thousands) |

| |

Three Months Ended |

| |

March 31, 2017 |

|

Dec. 31, 2016 |

|

Sept. 30, 2016 |

|

June 30, 2016 |

|

March 31, 2016 |

|

ASSETS |

|

|

|

|

|

|

|

|

|

| Interest-bearing cash

and cash equivalents |

$ |

2,087,964 |

|

|

$ |

2,032,785 |

|

|

$ |

2,047,991 |

|

|

$ |

2,022,028 |

|

|

$ |

2,052,840 |

|

| Trading securities |

579,549 |

|

|

476,498 |

|

|

366,545 |

|

|

237,808 |

|

|

188,100 |

|

| Investment

securities |

530,936 |

|

|

542,869 |

|

|

552,592 |

|

|

562,391 |

|

|

587,465 |

|

| Available for sale

securities |

8,567,049 |

|

|

8,766,555 |

|

|

8,862,590 |

|

|

8,890,112 |

|

|

8,951,435 |

|

| Fair value option

securities |

416,524 |

|

|

210,733 |

|

|

266,998 |

|

|

368,434 |

|

|

450,478 |

|

| Restricted equity

securities |

312,498 |

|

|

334,114 |

|

|

335,812 |

|

|

319,136 |

|

|

294,529 |

|

| Residential mortgage

loans held for sale |

220,325 |

|

|

345,066 |

|

|

445,930 |

|

|

401,114 |

|

|

289,743 |

|

| Loans: |

|

|

|

|

|

|

|

|

|

|

Commercial |

10,414,579 |

|

|

10,228,095 |

|

|

10,109,692 |

|

|

10,265,782 |

|

|

10,268,793 |

|

|

Commercial real estate |

3,903,850 |

|

|

3,749,393 |

|

|

3,789,673 |

|

|

3,550,611 |

|

|

3,364,076 |

|

|

Residential mortgage |

1,962,759 |

|

|

1,919,296 |

|

|

1,870,855 |

|

|

1,864,458 |

|

|

1,865,742 |

|

|

Personal |

854,637 |

|

|

826,804 |

|

|

677,530 |

|

|

582,281 |

|

|

493,382 |

|

| Total loans |

17,135,825 |

|

|

16,723,588 |

|

|

16,447,750 |

|

|

16,263,132 |

|

|

15,991,993 |

|

| Allowance

for loan losses |

(249,379 |

) |

|

(246,977 |

) |

|

(247,901 |

) |

|

(245,448 |

) |

|

(234,116 |

) |

| Total

loans, net |

16,886,446 |

|

|

16,476,611 |

|

|

16,199,849 |

|

|

16,017,684 |

|

|

15,757,877 |

|

| Total earning

assets |

29,601,291 |

|

|

29,185,231 |

|

|

29,078,307 |

|

|

28,818,707 |

|

|

28,572,467 |

|

| Cash and due from

banks |

547,104 |

|

|

578,694 |

|

|

511,534 |

|

|

507,085 |

|

|

505,522 |

|

| Derivative contracts,

net |

401,886 |

|

|

681,455 |

|

|

766,671 |

|

|

823,584 |

|

|

632,102 |

|

| Cash surrender value of

bank-owned life insurance |

309,223 |

|

|

309,532 |

|

|

308,670 |

|

|

306,318 |

|

|

304,141 |

|

| Receivable on unsettled

securities sales |

62,641 |

|

|

33,813 |

|

|

259,906 |

|

|

49,568 |

|

|

115,101 |

|

| Other

assets |

2,032,844 |

|

|

2,172,351 |

|

|

1,721,385 |

|

|

1,480,780 |

|

|

1,379,138 |

|

|

TOTAL ASSETS |

$ |

32,954,989 |

|

|

$ |

32,961,076 |

|

|

$ |

32,646,473 |

|

|

$ |

31,986,042 |

|

|

$ |

31,508,471 |

|

| |

|

|

|

|

|

|

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

|

|

|

Demand |

$ |

9,101,763 |

|

|

$ |

9,124,595 |

|

|

$ |

8,497,037 |

|

|

$ |

8,162,134 |

|

|

$ |

8,105,756 |

|

|

Interest-bearing transaction |

10,567,475 |

|

|

9,980,132 |

|

|

9,650,618 |

|

|

9,590,855 |

|

|

9,756,843 |

|

|

Savings |

441,254 |

|

|

421,654 |

|

|

420,009 |

|

|

417,122 |

|

|

397,479 |

|

|

Time |

2,258,930 |

|

|

2,177,035 |

|

|

2,197,350 |

|

|

2,297,621 |

|

|

2,366,543 |

|

| Total deposits |

22,369,422 |

|

|

21,703,416 |

|

|

20,765,014 |

|

|

20,467,732 |

|

|

20,626,621 |

|

| Funds purchased |

55,508 |

|

|

62,004 |

|

|

68,280 |

|

|

70,682 |

|

|

112,211 |

|

| Repurchase

agreements |

523,561 |

|

|

560,891 |

|

|

522,822 |

|

|

611,264 |

|

|

662,640 |

|

| Other borrowings |

5,737,955 |

|

|

6,072,150 |

|

|

6,342,369 |

|

|

6,076,028 |

|

|

5,583,917 |

|

| Subordinated

debentures |

144,644 |

|

|

144,635 |

|

|

255,890 |

|

|

232,795 |

|

|

226,368 |

|

| Derivative contracts,

net |

405,444 |

|

|

682,808 |

|

|

747,187 |

|

|

791,313 |

|

|

544,722 |

|

| Due on unsettled

securities purchases |

91,529 |

|

|

77,575 |

|

|

200,574 |

|

|

93,812 |

|

|

158,050 |

|

| Other

liabilities |

299,534 |

|

|

321,404 |

|

|

352,671 |

|

|

298,170 |

|

|

268,705 |

|

| TOTAL LIABILITIES |

29,627,597 |

|

|

29,624,883 |

|

|

29,254,807 |

|

|

28,641,796 |

|

|

28,183,234 |

|

| Total

equity |

3,327,392 |

|

|

3,336,193 |

|

|

3,391,666 |

|

|

3,344,246 |

|

|

3,325,237 |

|

|

TOTAL LIABILITIES AND EQUITY |

$ |

32,954,989 |

|

|

$ |

32,961,076 |

|

|

$ |

32,646,473 |

|

|

$ |

31,986,042 |

|

|

$ |

31,508,471 |

|

|

STATEMENTS OF EARNINGS -- UNAUDITEDBOK

FINANCIAL CORPORATION(in thousands, except per share

data) |

| |

Three Months Ended |

| |

March 31, |

| |

2017 |

|

2016 |

| |

|

|

|

| Interest revenue |

$ |

226,390 |

|

|

$ |

201,796 |

|

| Interest

expense |

25,208 |

|

|

19,224 |

|

| Net interest

revenue |

201,182 |

|

|

182,572 |

|

| Provision for credit

losses |

— |

|

|

35,000 |

|

|

Net interest revenue after provision for credit

losses |

201,182 |

|

|

147,572 |

|

| Other operating

revenue: |

|

|

|

| Brokerage

and trading revenue |

33,623 |

|

|

32,341 |

|

|

Transaction card revenue |

32,127 |

|

|

32,354 |

|

| Fiduciary

and asset management revenue |

38,631 |

|

|

32,056 |

|

| Deposit

service charges and fees |

23,030 |

|

|

22,542 |

|

| Mortgage

banking revenue |

25,191 |

|

|

32,100 |

|

|

Other revenue |

11,752 |

|

|

11,904 |

|

|

Total fees and commissions |

164,354 |

|

|

163,297 |

|

| Other

gains, net |

3,627 |

|

|

1,560 |

|

| Gain

(loss) on derivatives, net |

(450 |

) |

|

7,138 |

|

| Gain

(loss) on fair value option securities, net |

(1,140 |

) |

|

9,443 |

|

| Change in

fair value of mortgage servicing rights |

1,856 |

|

|

(27,988 |

) |

|

Gain on available for sale securities, net |

2,049 |

|

|

3,964 |

|

| Total other

operating revenue |

170,296 |

|

|

157,414 |

|

| Other operating

expense: |

|

|

|

|

Personnel |

136,425 |

|

|

133,562 |

|

| Business

promotion |

6,717 |

|

|

5,696 |

|

|

Professional fees and services |

12,379 |

|

|

11,759 |

|

| Net

occupancy and equipment |

21,624 |

|

|

18,766 |

|

|

Insurance |

6,404 |

|

|

7,265 |

|

| Data

processing and communications |

33,940 |

|

|

32,017 |

|

| Printing,

postage and supplies |

3,851 |

|

|

3,907 |

|

| Net

losses and operating expenses of repossessed assets |

1,009 |

|

|

1,070 |

|

|

Amortization of intangible assets |

1,802 |

|

|

1,159 |

|

| Mortgage

banking costs |

13,003 |

|

|

12,330 |

|

|

Other expense |

7,557 |

|

|

15,039 |

|

| Total other

operating expense |

244,711 |

|

|

242,570 |

|

| |

|

|

|

| Net income

before taxes |

126,767 |

|

|

62,416 |

|

| Federal

and state income taxes |

38,103 |

|

|

21,428 |

|

| |

|

|

|

| Net

income |

88,664 |

|

|

40,988 |

|

| Net

income (loss) attributable to non-controlling interests |

308 |

|

|

(1,576 |

) |

|

Net income attributable to BOK Financial Corporation

shareholders |

$ |

88,356 |

|

|

$ |

42,564 |

|

| |

|

|

|

| Average shares

outstanding: |

|

|

|

|

Basic |

64,639,437 |

|

|

65,296,541 |

|

|

Diluted |

64,707,210 |

|

|

65,331,428 |

|

| |

|

|

|

| Net income per

share: |

|

|

|

|

Basic |

$ |

1.35 |

|

|

$ |

0.64 |

|

|

Diluted |

$ |

1.35 |

|

|

$ |

0.64 |

|

|

FINANCIAL HIGHLIGHTS -- UNAUDITEDBOK

FINANCIAL CORPORATION(in thousands, except ratio and share

data) |

| |

Three Months Ended |

| |

March 31, 2017 |

|

Dec. 31, 2016 |

|

Sept. 30, 2016 |

|

June 30, 2016 |

|

March 31, 2016 |

|

Capital: |

|

|

|

|

|

|

|

|

|

|

Period-end shareholders' equity |

$ |

3,341,744 |

|

|

$ |

3,274,854 |

|

|

$ |

3,398,311 |

|

|

$ |

3,368,833 |

|

|

$ |

3,321,555 |

|

| Risk

weighted assets |

$ |

24,882,046 |

|

|

$ |

25,274,848 |

|

|

$ |

24,358,385 |

|

|

$ |

24,191,016 |

|

|

$ |

23,707,824 |

|

|

Risk-based capital ratios: |

|

|

|

|

|

|

|

|

|

| Common

equity tier 1 |

11.60 |

% |

|

11.21 |

% |

|

11.99 |

% |

|

11.86 |

% |

|

12.00 |

% |

| Tier

1 |

11.60 |

% |

|

11.21 |

% |

|

11.99 |

% |

|

11.86 |

% |

|

12.00 |

% |

| Total

capital |

13.26 |

% |

|

12.81 |

% |

|

13.65 |

% |

|

13.51 |

% |

|

13.21 |

% |

| Leverage

ratio |

8.89 |

% |

|

8.72 |

% |

|

9.06 |

% |

|

9.06 |

% |

|

9.12 |

% |

| Tangible

common equity ratio1 |

8.88 |

% |

|

8.61 |

% |

|

9.19 |

% |

|

9.33 |

% |

|

9.34 |

% |

| |

|

|

|

|

|

|

|

|

|

| Common

stock: |

|

|

|

|

|

|

|

|

|

| Book

value per share |

$ |

51.09 |

|

|

$ |

50.12 |

|

|

$ |

51.56 |

|

|

$ |

51.15 |

|

|

$ |

50.21 |

|

| Tangible

book value per share |

43.63 |

|

|

42.53 |

|

|

45.12 |

|

|

44.68 |

|

|

43.73 |

|

| Market

value per share: |

|

|

|

|

|

|

|

|

|

| High |

$ |

85.25 |

|

|

$ |

85.00 |

|

|

$ |

70.05 |

|

|

$ |

65.14 |

|

|

$ |

60.16 |

|

| Low |

$ |

73.44 |

|

|

$ |

67.11 |

|

|

$ |

56.36 |

|

|

$ |

51.00 |

|

|

$ |

43.74 |

|

| Cash

dividends paid |

$ |

28,646 |

|

|

$ |

28,860 |

|

|

$ |

28,181 |

|

|

$ |

28,241 |

|

|

$ |

28,294 |

|

| Dividend

payout ratio |

32.42 |

% |

|

57.69 |

% |

|

37.94 |

% |

|

42.92 |

% |

|

66.47 |

% |

| Shares

outstanding, net |

65,408,019 |

|

|

65,337,432 |

|

|

65,910,454 |

|

|

65,866,317 |

|

|

66,155,103 |

|

| Stock

buy-back program: |

|

|

|

|

|

|

|

|

|

| Shares

repurchased |

— |

|

|

700,000 |

|

|

— |

|

|

305,169 |

|

|

— |

|

|

Amount |

$ |

— |

|

|

$ |

49,021 |

|

|

$ |

— |

|

|

$ |

17,771 |

|

|

$ |

— |

|

|

Average price per share |

$ |

— |

|

|

$ |

70.03 |

|

|

$ |

— |

|

|

$ |

58.23 |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

|

|

Performance ratios (quarter annualized): |

| Return on

average assets |

1.09 |

% |

|

0.60 |

% |

|

0.91 |

% |

|

0.83 |

% |

|

0.54 |

% |

| Return on

average equity |

10.86 |

% |

|

6.03 |

% |

|

8.80 |

% |

|

8.00 |

% |

|

5.21 |

% |

| Net

interest margin |

2.81 |

% |

|

2.69 |

% |

|

2.64 |

% |

|

2.63 |

% |

|

2.65 |

% |

|

Efficiency ratio |

65.77 |

% |

|

72.93 |

% |

|

68.88 |

% |

|

68.16 |

% |

|

68.84 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Reconciliation of non-GAAP measures: |

| 1 Tangible common

equity ratio: |

|

|

|

|

|

|

|

|

|

| Total

shareholders' equity |

$ |

3,341,744 |

|

|

$ |

3,274,854 |

|

|

$ |

3,398,311 |

|

|

$ |

3,368,833 |

|

|

$ |

3,321,555 |

|

|

Less: Goodwill and intangible assets, net |

488,294 |

|

|

495,830 |

|

|

424,716 |

|

|

426,111 |

|

|

428,733 |

|

|

Tangible common equity |

$ |

2,853,450 |

|

|

$ |

2,779,024 |

|

|

$ |

2,973,595 |

|

|

$ |

2,942,722 |

|

|

$ |

2,892,822 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total

assets |

$ |

32,628,932 |

|

|

$ |

32,772,281 |

|

|

$ |

32,779,231 |

|

|

$ |

31,970,450 |

|

|

$ |

31,413,945 |

|

|

Less: Goodwill and intangible assets, net |

488,294 |

|

|

495,830 |

|

|

424,716 |

|

|

426,111 |

|

|

428,733 |

|

|

Tangible assets |

$ |

32,140,638 |

|

|

$ |

32,276,451 |

|

|

$ |

32,354,515 |

|

|

$ |

31,544,339 |

|

|

$ |

30,985,212 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible common equity ratio |

8.88 |

% |

|

8.61 |

% |

|

9.19 |

% |

|

9.33 |

% |

|

9.34 |

% |

|

|

|

|

|

|

|

|

|

|

|

| Other

data: |

|

|

|

|

|

|

|

|

|

| Fiduciary

assets |

$ |

44,371,510 |

|

|

$ |

41,781,564 |

|

|

$ |

41,222,162 |

|

|

$ |

39,924,734 |

|

|

$ |

39,113,305 |

|

| Tax

equivalent interest |

$ |

4,428 |

|

|

$ |

4,389 |

|

|

$ |

4,455 |

|

|

$ |

4,372 |

|

|

$ |

4,385 |

|

| Net

unrealized gain (loss) on available for sale securities |

$ |

(5,537 |

) |

|

$ |

(14,899 |

) |

|

$ |

159,533 |

|

|

$ |

195,385 |

|

|

$ |

155,236 |

|

|

|

|

|

|

|

|

|

|

|

|

| Mortgage

banking: |

|

|

|

|

|

|

|

|

|

| Mortgage

production revenue |

$ |

8,543 |

|

|

$ |

11,937 |

|

|

$ |

21,958 |

|

|

$ |

19,086 |

|

|

$ |

16,647 |

|

|

|

|

|

|

|

|

|

|

|

|

| Mortgage

loans funded for sale |

$ |

711,019 |

|

|

$ |

1,189,975 |

|

|

$ |

1,864,583 |

|

|

$ |

1,818,844 |

|

|

$ |

1,244,015 |

|

| Add:

current period-end outstanding commitments |

381,732 |

|

|

318,359 |

|

|

630,804 |

|

|

965,631 |

|

|

902,986 |

|

|

Less: prior period end outstanding commitments |

318,359 |

|

|

630,804 |

|

|

965,631 |

|

|

902,986 |

|

|

601,147 |

|

|

Total mortgage production volume |

$ |

774,392 |

|

|

$ |

877,530 |

|

|

$ |

1,529,756 |

|

|

$ |

1,881,489 |

|

|

$ |

1,545,854 |

|

|

|

|

|

|

|

|

|

|

|

|

| Mortgage

loan refinances to mortgage loans funded for sale |

44 |

% |

|

63 |

% |

|

51 |

% |

|

44 |

% |

|

49 |

% |

| Gain on

sale margin |

1.10 |

% |

|

1.36 |

% |

|

1.44 |

% |

|

1.01 |

% |

|

1.08 |

% |

|

|

|

|

|

|

|

|

|

|

|

| Mortgage

servicing revenue |

$ |

16,648 |

|

|

$ |

16,477 |

|

|

$ |

16,558 |

|

|

$ |

15,798 |

|

|

$ |

15,453 |

|

| Average

outstanding principal balance of mortgage loans service for

others |

22,006,295 |

|

|

21,924,552 |

|

|

21,514,962 |

|

|

20,736,525 |

|

|

19,986,444 |

|

| Average

mortgage servicing revenue rates |

0.31 |

% |

|

0.30 |

% |

|

0.31 |

% |

|

0.31 |

% |

|

0.31 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Gain (loss) on mortgage servicing rights, net of economic

hedge: |

| Gain

(loss) on mortgage hedge derivative contracts, net |

$ |

(528 |

) |

|

$ |

(35,868 |

) |

|

$ |

2,268 |

|

|

$ |

10,766 |

|

|

$ |

7,138 |

|

|

Gain (loss) on fair value option securities, net |

(1,140 |

) |

|

(20,922 |

) |

|

(3,355 |

) |

|

4,279 |

|

|

9,443 |

|

| Gain

(loss) on economic hedge of mortgage servicing rights |

(1,668 |

) |

|

(56,790 |

) |

|

(1,087 |

) |

|

15,045 |

|

|

16,581 |

|

|

Gain (loss) on changes in fair value of mortgage servicing

rights |

1,856 |

|

|

39,751 |

|

|

2,327 |

|

|

(16,283 |

) |

|

(27,988 |

) |

| Gain

(loss) on changes in fair value of mortgage servicing rights, net

of economic hedges, included in other operating revenue |

188 |

|

|

(17,039 |

) |

|

1,240 |

|

|

(1,238 |

) |

|

(11,407 |

) |

|

Net interest revenue on fair value option securities2 |

1,271 |

|

|

114 |

|

|

861 |

|

|

1,348 |

|

|

2,033 |

|

|

Total economic benefit (cost) of changes in the fair value of

mortgage servicing rights, net of economic hedges |

$ |

1,459 |

|

|

$ |

(16,925 |

) |

|

$ |

2,101 |

|

|

$ |

110 |

|

|

$ |

(9,374 |

) |

2 Actual interest earned on fair value option

securities less internal transfer-priced cost of funds.

|

QUARTERLY EARNINGS TREND -- UNAUDITEDBOK

FINANCIAL CORPORATION(in thousands, except ratio and per

share data) |

| |

Three Months Ended |

| |

March 31, 2017 |

|

Dec. 31, 2016 |

|

Sept. 30, 2016 |

|

June 30, 2016 |

|

March 31, 2016 |

| |

|

|

|

|

|

|

|

|

|

| Interest revenue |

$ |

226,390 |

|

|

$ |

215,737 |

|

|

$ |

209,317 |

|

|

$ |

202,267 |

|

|

$ |

201,796 |

|

| Interest

expense |

25,208 |

|

|

21,539 |

|

|

21,471 |

|

|

19,655 |

|

|

19,224 |

|

| Net interest

revenue |

201,182 |

|

|

194,198 |

|

|

187,846 |

|

|

182,612 |

|

|

182,572 |

|

| Provision

for credit losses |

— |

|

|

— |

|

|

10,000 |

|

|

20,000 |

|

|

35,000 |

|

| Net interest

revenue after provision for credit losses |

201,182 |

|

|

194,198 |

|

|

177,846 |

|

|

162,612 |

|

|

147,572 |

|

| Other operating

revenue: |

|

|

|

|

|

|

|

|

|

| Brokerage

and trading revenue |

33,623 |

|

|

28,500 |

|

|

38,006 |

|

|

39,530 |

|

|

32,341 |

|

|

Transaction card revenue |

32,127 |

|

|

34,521 |

|

|

33,933 |

|

|

34,950 |

|

|

32,354 |

|

| Fiduciary

and asset management revenue |

38,631 |

|

|

34,535 |

|

|

34,073 |

|

|

34,813 |

|

|

32,056 |

|

| Deposit

service charges and fees |

23,030 |

|

|

23,365 |

|

|

23,668 |

|

|

22,618 |

|

|

22,542 |

|

| Mortgage

banking revenue |

25,191 |

|

|

28,414 |

|

|

38,516 |

|

|

34,884 |

|

|

32,100 |

|

|

Other revenue |

11,752 |

|

|

12,693 |

|

|

13,080 |

|

|

13,352 |

|

|

11,904 |

|

|

Total fees and commissions |

164,354 |

|

|

162,028 |

|

|

181,276 |

|

|

180,147 |

|

|

163,297 |

|

| Other

gains (losses), net |

3,627 |

|

|

(1,279 |

) |

|

2,442 |

|

|

1,307 |

|

|

1,560 |

|

| Gain

(loss) on derivatives, net |

(450 |

) |

|

(35,815 |

) |

|

2,226 |

|

|

10,766 |

|

|

7,138 |

|

| Gain

(loss) on fair value option securities, net |

(1,140 |

) |

|

(20,922 |

) |

|

(3,355 |

) |

|

4,279 |

|

|

9,443 |

|

| Change in

fair value of mortgage servicing rights |

1,856 |

|

|

39,751 |

|

|

2,327 |

|

|

(16,283 |

) |

|

(27,988 |

) |

|

Gain (loss) on available for sale securities, net |

2,049 |

|

|

(9 |

) |

|

2,394 |

|

|

5,326 |

|

|

3,964 |

|

| Total other

operating revenue |

170,296 |

|

|

143,754 |

|

|

187,310 |

|

|

185,542 |

|

|

157,414 |

|

| Other operating

expense: |

|

|

|

|

|

|

|

|

|

|

Personnel |

136,425 |

|

|

141,132 |

|

|

139,212 |

|

|

139,213 |

|

|

133,562 |

|

| Business

promotion |

6,717 |

|

|

7,344 |

|

|

6,839 |

|

|

6,703 |

|

|

5,696 |

|

|

Charitable contributions to BOKF Foundation |

— |

|

|

2,000 |

|

|

— |

|

|

— |

|

|

— |

|

|

Professional fees and services |

12,379 |

|

|

16,828 |

|

|

14,038 |

|

|

14,158 |

|

|

11,759 |

|

| Net

occupancy and equipment |

21,624 |

|

|

21,470 |

|

|

20,111 |

|

|

19,677 |

|

|

18,766 |

|

|

Insurance |

6,404 |

|

|

8,705 |

|

|

9,390 |

|

|

7,129 |

|

|

7,265 |

|

| Data

processing and communications |

33,940 |

|

|

33,691 |

|

|

33,331 |

|

|

32,802 |

|

|

32,017 |

|

| Printing,

postage and supplies |

3,851 |

|

|

3,998 |

|

|

3,790 |

|

|

3,889 |

|

|

3,907 |

|

| Net

losses (gains) and operating expenses of repossessed assets |

1,009 |

|

|

1,627 |

|

|

(926 |

) |

|

1,588 |

|

|

1,070 |

|

|

Amortization of intangible assets |

1,802 |

|

|

1,558 |

|

|

1,521 |

|

|

2,624 |

|

|

1,159 |

|

| Mortgage

banking costs |

13,003 |

|

|

17,348 |

|

|

15,963 |

|

|

15,746 |

|

|

12,330 |

|

|

Other expense |

7,557 |

|

|

9,846 |

|

|

14,819 |

|

|

7,856 |

|

|

15,039 |

|

| Total other

operating expense |

244,711 |

|

|

265,547 |

|

|

258,088 |

|

|

251,385 |

|

|

242,570 |

|

| Net income

before taxes |

126,767 |

|

|

72,405 |

|

|

107,068 |

|

|

96,769 |

|

|

62,416 |

|

| Federal

and state income taxes |

38,103 |

|

|

22,496 |

|

|

31,956 |

|

|

30,497 |

|

|

21,428 |

|

| Net

income |

88,664 |

|

|

49,909 |

|

|

75,112 |

|

|

66,272 |

|

|

40,988 |

|

| Net

income (loss) attributable to non-controlling interests |

308 |

|

|

(117 |

) |

|

835 |

|

|

471 |

|

|

(1,576 |

) |

|

Net income attributable to BOK Financial Corporation

shareholders |

$ |

88,356 |

|

|

$ |

50,026 |

|

|

$ |

74,277 |

|

|

$ |

65,801 |

|

|

$ |

42,564 |

|

| |

|

|

|

|

|

|

|

|

|

| Average shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

64,639,437 |

|

|

64,719,018 |

|

|

65,085,392 |

|

|

65,245,887 |

|

|

65,296,541 |

|

|

Diluted |

64,707,210 |

|

|

64,787,728 |

|

|

65,157,841 |

|

|

65,302,926 |

|

|

65,331,428 |

|

| Net income per

share: |

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

1.35 |

|

|

$ |

0.76 |

|

|

$ |

1.13 |

|

|

$ |

1.00 |

|

|

$ |

0.64 |

|

|

Diluted |

$ |

1.35 |

|

|

$ |

0.76 |

|

|

$ |

1.13 |

|

|

$ |

1.00 |

|

|

$ |

0.64 |

|

|

LOANS TREND -- UNAUDITEDBOK FINANCIAL

CORPORATION(In thousands) |

| |

|

March 31, 2017 |

|

Dec. 31, 2016 |

|

Sept. 30, 2016 |

|

June 30, 2016 |

|

March 31, 2016 |

| Commercial: |

|

|

|

|

|

|

|

|

|

|

|

Energy |

|

$ |

2,537,112 |

|

|

$ |

2,497,868 |

|

|

$ |

2,520,804 |

|

|

$ |

2,818,656 |

|

|

$ |

3,029,420 |

|

|

Services |

|

3,013,375 |

|

|

3,108,990 |

|

|

2,936,599 |

|

|

2,830,864 |

|

|

2,728,891 |

|

|

Healthcare |

|

2,265,604 |

|

|

2,201,916 |

|

|

2,085,046 |

|

|

2,051,146 |

|

|

1,995,425 |

|

|

Wholesale/retail |

|

1,506,243 |

|

|

1,576,818 |

|

|

1,602,030 |

|

|

1,532,957 |

|

|

1,451,846 |

|

|

Manufacturing |

|

543,430 |

|

|

514,975 |

|

|

499,486 |

|

|

595,403 |

|

|

600,645 |

|

| Other

commercial and industrial |

|

461,346 |

|

|

490,257 |

|

|

476,198 |

|

|

527,411 |

|

|

482,198 |

|

|

Total commercial |

|

10,327,110 |

|

|

10,390,824 |

|

|

10,120,163 |

|

|

10,356,437 |

|

|

10,288,425 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Commercial real

estate: |

|

|

|

|

|

|

|

|

|

|

|

Retail |

|

745,046 |

|

|

761,888 |

|

|

801,377 |

|

|

795,419 |

|

|

810,522 |

|

|

Multifamily |

|

922,991 |

|

|

903,272 |

|

|

873,773 |

|

|

787,200 |

|

|

733,689 |

|

|

Office |

|

860,889 |

|

|

798,888 |

|

|

752,705 |

|

|

769,112 |

|

|

695,552 |

|

|

Industrial |

|

871,463 |

|

|

871,749 |

|

|

838,021 |

|

|

645,586 |

|

|

564,467 |

|

|

Residential construction and land development |

|

135,994 |

|

|

135,533 |

|

|

159,946 |

|

|

157,576 |

|

|

171,949 |

|

| Other

commercial real estate |

|

334,680 |

|

|

337,716 |

|

|

367,776 |

|

|

427,073 |

|

|

394,328 |

|

|

Total commercial real estate |

|

3,871,063 |

|

|

3,809,046 |

|

|

3,793,598 |

|

|

3,581,966 |

|

|

3,370,507 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Residential

mortgage: |

|

|

|

|

|

|

|

|

|

|

| Permanent

mortgage |

|

977,743 |

|

|

1,006,820 |

|

|

969,558 |

|

|

969,007 |

|

|

948,405 |

|

| Permanent

mortgages guaranteed by U.S. government agencies |

|

204,181 |

|

|

199,387 |

|

|

190,309 |

|

|

192,732 |

|

|

197,350 |

|

| Home

equity |

|

764,350 |

|

|

743,625 |

|

|

712,926 |

|

|

719,184 |

|

|

723,554 |

|

|

Total residential mortgage |

|

1,946,274 |

|

|

1,949,832 |

|

|

1,872,793 |

|

|

1,880,923 |

|

|

1,869,309 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Personal |

|

847,459 |

|

|

839,958 |

|

|

678,232 |

|

|

587,423 |

|

|

494,325 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

$ |

16,991,906 |

|

|

$ |

16,989,660 |

|

|

$ |

16,464,786 |

|

|

$ |

16,406,749 |

|

|

$ |

16,022,566 |

|

|

LOANS BY PRINCIPAL MARKET AREA --

UNAUDITEDBOK FINANCIAL CORPORATION(in

thousands) |

| |

March 31, 2017 |

|

Dec. 31, 2016 |

|

Sept. 30, 2016 |

|

June 30, 2016 |

|

March 31, 2016 |

| |

|

|

|

|

|

|

|

|

|

| Bank of Oklahoma: |

|

|

|

|

|

|

|

|

|

|

Commercial |

$ |

3,189,183 |

|

|

$ |

3,370,259 |

|

|

$ |

3,545,924 |

|

|

$ |

3,698,215 |

|

|

$ |

3,656,034 |

|

|

Commercial real estate |

691,332 |

|

|

684,381 |

|

|

795,806 |

|

|

781,458 |

|

|

747,689 |

|

|

Residential mortgage |

1,404,054 |

|

|

1,407,197 |

|

|

1,401,166 |

|

|

1,415,766 |

|

|

1,411,409 |

|

|

Personal |

310,708 |

|

|

303,823 |

|

|

271,420 |

|

|

246,229 |

|

|

204,158 |

|

|

Total Bank of Oklahoma |

5,595,277 |

|

|

5,765,660 |

|

|

6,014,316 |

|

|

6,141,668 |

|

|

6,019,290 |

|

| |

|

|

|

|

|

|

|

|

|

| Bank of Texas: |

|

|

|

|

|

|

|

|

|

|

Commercial |

4,148,316 |

|

|

4,022,455 |

|

|

3,903,218 |

|

|

3,901,632 |

|

|

3,936,809 |

|

|

Commercial real estate |

1,452,988 |

|

|

1,415,011 |

|

|

1,400,709 |

|

|

1,311,408 |

|

|

1,211,978 |

|

|

Residential mortgage |

231,647 |

|

|

233,981 |

|

|

229,345 |

|

|

222,548 |

|

|

217,539 |

|

|

Personal |

312,092 |

|

|

306,748 |

|

|

278,167 |

|

|

233,304 |

|

|

210,456 |

|

|

Total Bank of Texas |

6,145,043 |

|

|

5,978,195 |

|

|

5,811,439 |

|

|

5,668,892 |

|

|

5,576,782 |

|

| |

|

|

|

|

|

|

|

|

|

| Bank of

Albuquerque: |

|

|

|

|

|

|

|

|

|

|

Commercial |

407,403 |

|

|

399,256 |

|

|

398,147 |

|

|

398,427 |

|

|

402,082 |

|

|

Commercial real estate |

307,927 |

|

|

284,603 |

|

|

299,785 |

|

|

322,956 |

|

|

323,059 |

|

|

Residential mortgage |

106,432 |

|

|

108,058 |

|

|

110,478 |

|

|

114,226 |

|

|

117,655 |

|

|

Personal |

11,305 |

|

|

11,483 |

|

|

11,333 |

|

|

10,569 |

|

|

10,823 |

|

|

Total Bank of Albuquerque |

833,067 |

|

|

803,400 |

|

|

819,743 |

|

|

846,178 |

|

|

853,619 |

|

| |

|

|

|

|

|

|

|

|

|

| Bank of Arkansas: |

|

|

|

|

|

|

|

|

|

|

Commercial |

88,010 |

|