Enhanced Cigna Health First Elite Medical Plan offers comprehensive

and personalized solutions to meet customer needs throughout their

life journeys

|

|

Mr. Austin Marsh (middle), CEO and Country Manager; Mr.

Ramsy Yeung (right), Chief Marketing Officer; and Ms. Cherie Chan

(left), Head of Marketing and Communications introduced the key

features of the new Cigna HealthFirst Elite Medical Plan at the

press event. |

HONG KONG, Apr 26, 2017 - (ACN Newswire) - Hong

Kong's overall health score has continued in a declining trend over

the past three years, dropping from 59.9 in 2015 to 58.6 in 2017,

the latest Cigna 360 Well-being Score Survey reveals. The survey

results show that Hong Kong people, regardless of their age, often

don't see themselves as "old" and are not financially prepared.

Only 12% of respondents think they are financially secure should

they be unable to work and only 17% perform well on current

financial situation.

In terms of medical expenses, Hong Kong people tend to rely on

their group medical insurance, however there is a big gap between

actual medical needs and the coverage provided by employers. As a

consequence, they often find themselves in a difficult situation

financially and also jeopardize their family well-being. The lack

of awareness of the implications of aging, deficiencies in coverage

from work and lack of adequate financial preparation are all

inter-related factors that could impact one's overall health and

well-being.

Conducted for the third year, the Cigna 360 Well-being Score Survey

examines the health and well-being of people annually across five

indices - physical, social, family, financial, and workplace health

and well-being - in 13 Asian and international markets.

"As people don't see themselves as old, they keep delaying their

preparation for the future, and many of them have fallen into the

'age trap'," said Mr. Austin Marsh, CEO and Country Manager, Cigna

Hong Kong, "The lack of financial preparation resulted in a drop in

financial well-being according to this year's survey. While medical

costs keep inflating, healthcare and medical expenses also climb

with age. It is crucial for people to get prepared for their old

age before falling into the age trap."

The survey also found a big gap between people's actual needs and

work health coverage they get. Less than half of respondents

receive the benefits they need from their current group medical

insurance coverage. More than half (54%) of the respondents have

had to pay medical expenses themselves or their families in the

past 12 months with middle-aged people in the 40s and 50s spent

most.

Among the five well-being indices, family, financial and workplace

well-being scores all declined this year with financial well-being

performing the lowest, scoring 50.2. Only physical and social

well-being improved over the last year. The majority of respondents

rated themselves as having performed poorly across all financial

well-being indicators. More than half of the respondents said they

were unable to meet their family's medical needs (53%) and those of

their parents' (57%).

The lack of money to take care of family needs in turn spurred

respondents to give up family time for work, and that is reflected

in the biggest year-on-year drop of the family well-being score.

Only 38% thought they spend enough time with their families, and

only 34% said they are able to take care of their children's

well-being and 28% of that of their parents'.

"The survey results indicate that if one is unprepared financially,

the well-being of other aspects of their lives will be adversely

affected and suffer. It is essential that people start planning

their finances as early as possible. A comprehensive medical

insurance plan can help safeguard people's overall well-being by

providing protection, support and care throughout their life

journeys," said Mr. Marsh.

"As an active health and well-being partner, Cigna is there for our

customers throughout their life journeys. This spirit of

partnership goes deeper than paying claims, and is often

life-changing - helping customers stay well, preventing sickness,

obtaining access to health care, recovering from illness or injury,

and returning to work," commented Mr. Marsh.

To better serve people's healthcare needs, Cigna has recently

revamped its flagship healthcare solution - Cigna HealthFirst Elite

Medical Plan1, which offers comprehensive worldwide coverage

without a lifetime coverage limit. The maximum annual limit is

HK$23,800,000 which includes a range of hospital and surgical

benefits. It covers outpatient expenses for up to 120 pre-admission

and post-hospitalization visits, the highest among similar

insurance plans available in Hong Kong2.

To give customers additional financial flexibility during difficult

times, the Cigna HealthFirst Elite Medical Plan provides a premium

waiver for up to six months upon diagnosis of cancer, which is a

new feature in the market2. It provides annual rehabilitation

benefit of HK$300,000 and full coverage of professional nursing

care, including private nurse fees during hospital confinement and

home nursing expenses after discharge from hospital.

"Cigna has designed the Cigna HealthFirst Elite Medical Plan to

take care of customers' entire 'health journey' should they fall

ill, ensuring customers get all-round care from maintaining good

health, diagnosis to recovery - from pre-admission clinic visits,

full coverage of various medical expenses and six months premium

waiver, to post-hospitalization, home nursing and healthcare

concierge service," said Mr. Marsh.

"The new features of the Cigna HealthFirst Elite Medical Plan

demonstrates Cigna's mission to help people improve their health,

well-being and sense of security. These features are also

highlighted in our latest brand campaign in Hong Kong, which

designed to showcase that Cigna can provide more value than just

helping pay medical bills through people's perception of what

health insurance can bring. We are dedicated to developing products

and services that provide customers with useful advice they need at

each stage of their lives," concluded Mr. Marsh.

Note:

1. The above mentioned benefits are subject to terms and

conditions. Please refer to the product brochure for more

details.

2. The comparison is made for the same category of medical products

among major insurance companies in Hong Kong in January 2017.

About Cigna 360 Well-being Score Survey

It was established in 2014 as an annual index that continues to

identify and monitor the factors, motivations, perceptions and

attitudes that impact an individual person's, as well as the

region's, health and well-being. The survey covers five key

well-being indices - physical, social, family, financial and

workplace health and well-being. It is an independent study

commissioned by Cigna and conducted by a research company in 13

countries and regions that covers the APAC and international

markets of Hong Kong, China, India, Indonesia, New Zealand,

Singapore, South Korea, Spain, Taiwan, Thailand, Turkey, UAE and

the UK.

About Cigna Corporation

Cigna Corporation (NYSE:CI) is a global health service company

dedicated to helping people improve their health, well-being and

sense of security. All products and services are provided

exclusively by or through operating subsidiaries of Cigna

Corporation, including Connecticut General Life Insurance Company,

Cigna Health and Life Insurance Company, Life Insurance Company of

North America and Cigna Life Insurance Company of New York. Such

products and services include an integrated suite of health

services, such as medical, dental, behavioural health, pharmacy,

vision, supplemental benefits, and other related products including

group life, accident and disability insurance. Cigna maintains

sales capability in over 30 countries and jurisdictions, and has

more than 94 million customer relationships throughout the

world.

About Cigna

Since its presence in Hong Kong in 1933, Cigna has been offering

insurance solutions at the right place and the right time,

providing advice to customers throughout the different stages of

their life journeys. Cigna delivers comprehensive health and

wellness solutions to employers, employees and individual

customers. Leveraging an extensive global healthcare network, Cigna

provides group medical benefits that are suitable for international

companies with a worldwide workforce, but also tailors

cost-effective plans for local small and medium-sized enterprises

that fit specific needs of the company and its employees. For

individual customers, Cigna offers a full suite of health insurance

products that caters for consumers' diverse needs.

For more details, please visit www.cigna.com.hk .

MEDIA CONTACTS:

Cigna Worldwide Life Insurance Co. Ltd. & Cigna Worldwide

General Insurance Co. Ltd.

Brenda Ngo

Email: brenda.ngo@cigna.com

Tel: (+852) 2539 9138

Strategic Financial Relations Limited

Courtney Ngai / Rita Fong / James Fung

Email: courtney.ngai@sprg.com.hk

rita.fong@sprg.com.hk

james.fung@sprg.com.hk

Tel: (+852) 2114 4952 / (+852) 2114 4939 / (+852) 2114 4956

Source: Cigna Hong Kong

Copyright 2017 ACN Newswire . All rights reserved.

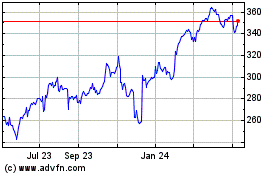

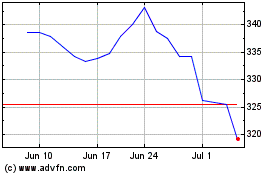

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024