By Andrew Tangel

Caterpillar Inc. is gaining steam after years of sluggish demand

for its giant yellow trucks and heavy machinery, as some markets

hobbled by a yearslong commodity slump begin to turn around.

The equipment giant reported its first quarterly sales increase

since 2015 for the period ended March 31, and boosted its outlook

for this year on signs of recovery in some long-struggling

construction and mining markets.

"It's a start of a recovery," Chief Financial Officer Brad

Halverson said in an interview. "We're feeling positive about

things -- much better than we felt a year ago for sure."

The results mark an unexpected victory for Chief Executive Jim

Umpleby, who since taking over on Jan. 1 has pushed ahead with cuts

to Caterpillar's workforce and manufacturing footprint and dealt

with a raid by federal agents at the company's headquarters in

Peoria, Ill.

Caterpillar said it expects to take in up to $41 billion in

revenue this year; its previous projection topped out at $39

billion. Caterpillar reported $38.5 billion in revenue in 2016, its

fourth straight year of declining sales.

On Monday, Caterpillar reported a measure of retail sales of its

machines world-wide had increased for the first time since November

2012. Caterpillar shares rose 7.9% Tuesday to close at $104.42, the

highest level since November 2014.

Rising commodity prices and mining activity in much of the world

outside the Americas helped drive a 15% revenue increase for

Caterpillar's resource-industries segment in the first quarter,

thanks largely to aftermarket parts sales. Revenue in Caterpillar's

construction segment also increased 1% the first quarter, boosted

by sales in Asia-Pacific and Latin America. The company said strong

demand in China for public works and housing projects was in large

part responsible for that bump.

Caterpillar was sent reeling in recent years as commodity prices

slumped and global mining activity slowed. The downturn consumed

the final years of Doug Oberhelman's tenure as chairman and CEO

before he retired at the end of March.

Caterpillar executives said Tuesday that many of their main

markets remain depressed. Its construction-equipment sales remain

weak in many markets outside of the Asia-Pacific region. Economic

turmoil in Brazil has weighed on business there, and Middle Eastern

economies remain hobbled by low oil prices.

"There continues to be uncertainty across the globe, potential

for volatility in commodity prices, and weakness in key markets,"

Mr. Umpleby said. He called his first quarter as chief executive

"eventful."Despite positive signals abroad, Caterpillar reported a

7% decline in construction sales in North America.

Amy Campbell, director of investor relations, said it was "very

doable" for Caterpillar to double the number large mining trucks it

sells this year to about 140; but that would still be the

second-lowest number of those vehicles Caterpillar has sold in a

year.

Caterpillar cited a glut of used equipment on the market and

"weak infrastructure development." Executives have said that even

if President Donald Trump succeeds in his plan to inject $1

trillion into public-works projects, the boost in infrastructure

spending might not translate into new business for Caterpillar

until next year.

Caterpillar's business in the U.S. in many ways reflects

activity in the broader domestic construction market.

But many used machines remain on the market in the U.S., and a

building spurt may not immediately translate into orders for new

machines. Japanese rival Komatsu Ltd. reports earnings this week.

Analysts will be looking for signs that its recent performance also

reflects evidence of pockets of improved activity globally and in

the U.S.

Caterpillar's restructuring costs are expected to jump to $1.25

billion this year, up from a previously projected $750 million, as

Caterpillar closes factories in Aurora, Ill., and Gosselies,

Belgium. Its workforce continues to shrink along with its global

manufacturing footprint. Caterpillar had 95,300 full-time employees

at the end of the first quarter, down from 101,400 a year earlier.

In a call with analysts, Mr. Umpleby offered no new insights into

the federal government's criminal investigation of the company's

tax strategy, one of its Swiss subsidiaries and export filings.

Mr. Halverson said the multiple rounds of cuts have "been really

hard on us and our employees," but he didn't rule out further

closures and said the company would pay close attention to

costs.

On March 2, agents from the U.S. Department of Commerce,

Internal Revenue Service and the Federal Deposit Insurance Corp.'s

inspector general raided Caterpillar's headquarters and two nearby

facilities. Executives have said the company was surprised by the

search warrant, noting Caterpillar's cooperation with the

investigation.

"If we find something that violates our values and our code of

conduct we will take appropriate action," Mr. Umpleby said. Mr.

Halverson, in the interview, declined to elaborate.

Overall, Caterpillar reported a profit of $192 million or 32

cents a share for the first quarter, compared with $271 million or

46 cents a share a year ago. Excluding restructuring costs, the

company said it earned $1.28 a share, compared with 64 cents a year

ago. Total sales and revenues rose to $9.82 billion from $9.46

billion a year ago.

Caterpillar expects earnings per-share this year to be $2.10

based on sales at the midpoint of projections, or $3.75 excluding

restructuring costs. Previously the company said it expected

per-share earnings of $2.30, or $2.90 excluding restructuring

costs.

--Joshua Jamerson contributed to this article.

Write to Andrew Tangel at Andrew.Tangel@wsj.com

(END) Dow Jones Newswires

April 26, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

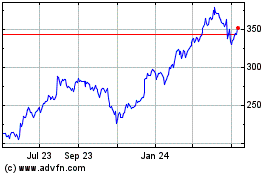

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

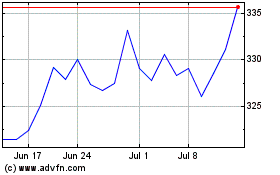

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024