First US Bancshares, Inc. Reports First Quarter Results

April 25 2017 - 6:23PM

First US Bancshares, Inc. (Nasdaq:FUSB) (the “Company”) today

reported net income of $0.4 million, or $0.06 per diluted share,

for the quarter ended March 31, 2017. The results represent

an increase of $0.01 per diluted share compared to the first

quarter of 2016.

Financial Highlights – First Quarter

2017 Compared to First Quarter 2016

- Revenue Growth – Increased first quarter earnings were driven

by growth in revenue, including both interest and non-interest

income, which increased on a combined basis by $0.5 million, or

6.0%, compared to the first quarter of 2016. The increase in

interest income resulted from loan growth that occurred in 2016

primarily at the Company’s banking subsidiary, First US Bank (the

“Bank”). Net loans totaled $317.7 million as of March 31,

2017, compared to $264.0 million as of March 31, 2016. The

increase in non-interest income resulted from increases in credit

insurance income at the Company’s finance company subsidiary,

Acceptance Loan Company (ALC), as well as increases in service and

other charges on deposit accounts at the Bank.

- Provision for Loan Loss – The revenue growth experienced by the

Company during the first quarter of 2017 was partially offset by an

increase in the Company’s provision for loan losses of $0.3

million, comparing the first quarter of 2017 to the first quarter

of 2016. The increase resulted primarily from a negative

provision of $0.3 million at the Bank during the first quarter of

2016 that was not repeated during the first quarter of 2017. Total

provision expense, including both the Bank and ALC, was $0.5

million in the first quarter of 2017, compared to $0.2 million

during the first quarter of 2016.

- Asset Quality Improvement – Non-performing assets, including

loans in non-accrual status and other real estate owned, decreased

to $6.8 million, or 1.10% of total assets, as of March 31, 2017,

compared to $8.6 million, or 1.50% of total assets, as of March 31,

2016.

- Deposit Growth – Deposits, which represent the Company’s

largest funding source, remained strong during the first quarter of

2017. Deposits totaled $509.1 million as of March 31, 2017,

compared to $485.5 million as of March 31, 2016, an increase of

4.8% over the 12-month period.

“We are pleased to report year-over-year

earnings improvement driven by growth in revenues, as well as

continued improvement in asset quality,” stated James F. House,

President and Chief Executive Officer of the Company. “During

2016, we reported growth in net loans of 26.4%. That growth

has enabled us to start 2017 in a stronger earnings position than

we started 2016. Although we do not expect to achieve the

same level of loan growth each quarter, and indeed we saw a small

decrease in our loan balances from the prior quarter, we remain

optimistic about our prospects for growth over the remainder of

2017. Our management team is committed to improving revenue

through loan growth at the Bank and sustained performance at ALC,”

continued Mr. House.

Results of Operations

- Pre-provision net interest income totaled $6.9 million in the

first quarter of 2017, compared to $7.1 million in the prior

quarter and $6.7 million in the first quarter of 2016. Net

yield on interest-earning assets was 5.05% for the first quarter,

compared to 5.17% for the prior quarter, and 5.10% during the first

quarter of 2016. The reduction in net yield in the first quarter of

2017 resulted primarily from a mix-shift in loan composition at ALC

away from traditional consumer loans to point-of-sale retail

lending, which provides higher credit quality, but at reduced

yield. This change in mix is generally more pronounced during

the first quarter when ALC’s traditional consumer lending is

typically lower than other quarters of the year. Yield on

ALC’s loans was 19.11% during the first quarter of 2017, compared

to 19.94% and 19.60% for the fourth and first quarters of 2016,

respectively. At the Bank, yield on loans totaled 4.06%

during the first quarter of 2017, compared to 4.02% and 4.47%

during the fourth and first quarters of 2016, respectively.

The decrease in the Bank’s yield compared to the first quarter of

2016 resulted primarily from continued efforts by management to

adhere to lending practices designed to improve the credit quality

of the Bank’s portfolio. The Company’s average cost of funds

on deposits and borrowings was 0.54% during the first quarter of

2017, compared to 0.54% and 0.52% during the fourth and first

quarters of 2016, respectively.

- The provision for loan losses was $0.5 million for the first

quarter of 2017, compared to $1.8 million and $0.2 million for the

fourth and first quarters of 2016, respectively. The

allowance for loan losses as a percentage of loans was 1.51% as of

March 31, 2017, compared to 1.48% as of December 31, 2016, and

1.26% as of March 31, 2016. Loan growth at the Bank was the

primary driver in increasing the allowance for loan losses during

2016.

- Non-interest income totaled $1.2 million in both the first

quarter of 2017 and the fourth quarter of 2016, compared to $1.0

million during the first quarter of 2016. The increase in the

more recent quarters was the result of increases in credit

insurance income on loans at ALC, as well as increased service

charge income on deposit accounts at the Bank.

- Non-interest expense totaled $7.0 million in the first quarter

of 2017, compared to $6.8 million and $7.1 million in the fourth

and first quarters of 2016, respectively.

Balance Sheet Management

- Net loans totaled $317.7 million as of March 31, 2017, compared

to $322.8 million as of December 31, 2016. The decrease

included reductions of $4.3 million and $0.8 million at the Bank

and ALC, respectively. The majority of the Bank’s reduction

occurred in the non-farm, non-residential real estate portfolio and

was due primarily to scheduled maturity of loans. The reduction in

this category was partially offset by growth in the Bank’s real

estate construction loan category. ALC’s reduction occurred in its

consumer and real estate portfolios. A decrease in consumer loans

at ALC is generally expected during the first quarter due to the

seasonal nature of traditional consumer finance lending. Real

estate lending was previously discontinued at ALC as part of

management’s efforts to improve credit quality. Accordingly, ALC’s

real estate portfolio is expected to decrease each quarter. The

reductions in these portfolio categories were partially offset by

increases in ALC’s indirect sales portfolio during the

quarter.

- As a result of the decrease in loan volume, excess funds were

redeployed into the investment securities portfolio. Investment

securities totaled $213.5 million as of March 31, 2017, compared to

$207.8 million as of December 31, 2016. Investment securities serve

to both enhance interest income and provide an additional source of

liquidity available to fund loan growth and capital expenditures.

Management has structured the investment portfolio to provide cash

flows through interest earned and the maturity or payoff of

securities in the portfolio on a monthly basis. In the current

environment, it is expected that cash flows from the investment

portfolio will continue to serve as a significant source of

liquidity available for the funding of future loan growth.

- Liabilities increased to $542.5 million as of March 31, 2017,

compared to $530.7 million as of December 31, 2016. The increase

resulted from an increase in deposits of $11.5 million and an

increase in short-term borrowings of $0.6 million. These

increases were partially offset by a decrease in other liabilities

of approximately $0.3 million. Deposits generated through the

Bank’s branch system are considered the Company’s primary funding

source to meet short- and long-term liquidity needs. Deposit

levels fluctuate throughout the year based on seasonality, as well

as specific circumstances impacting deposit customers. In addition

to deposits, significant external sources of liquidity are

available to the Bank, including access to funding through federal

funds lines, Federal Home Loan Bank advances and brokered

deposits.

- Shareholders’ equity increased to $77.3 million, or $12.77 per

outstanding common share, as of March 31, 2017, compared to $76.2

million, or $12.62 per outstanding common share, as of December 31,

2016. The increase in shareholders’ equity resulted primarily

from continued growth in retained earnings and increases in other

comprehensive income resulting from changes in the fair value of

investment securities available-for-sale.

- The Company declared a cash dividend of $0.02 per share on its

common stock in the first quarter of 2017. This amount is

consistent with the Company’s quarterly dividend declarations for

each quarter of 2016.

- During the first quarter, the Bank continued to maintain

capital ratios at higher levels than the ratios required to be

considered a “well-capitalized” institution under applicable

banking regulations. As of March 31, 2017, the Bank’s common

equity Tier 1 capital and Tier 1 risk-based capital ratios were

each 18.98%. Its total capital ratio was 20.23%, and its Tier 1

leverage ratio was 12.15%.

About First US Bancshares, Inc.

First US Bancshares, Inc. is a bank holding

company that operates banking offices in Alabama through First US

Bank. In addition, the Company’s operations include

Acceptance Loan Company, Inc., a consumer loan company, and FUSB

Reinsurance, Inc., an underwriter of credit life and credit

accident and health insurance policies sold to the Bank’s and ALC’s

consumer loan customers. The Company’s stock is traded on the

Nasdaq Capital Market under the symbol “FUSB.”

Forward-Looking Statements

This press release contains forward-looking

statements, as defined by federal securities laws. Statements

contained in this press release that are not historical facts are

forward-looking statements. These statements may address

issues that involve significant risks, uncertainties, estimates and

assumptions made by management. The Company undertakes no

obligation to update these statements following the date of this

press release, except as required by law. In addition, the

Company, through its senior management, may make from time to time

forward-looking public statements concerning the matters described

herein. Such forward-looking statements are necessarily

estimates reflecting the best judgment of the Company’s senior

management based upon current information and involve a number of

risks and uncertainties. Certain factors that could affect

the accuracy of such forward-looking statements are identified in

the public filings made by the Company with the Securities and

Exchange Commission, and forward-looking statements contained in

this press release or in other public statements of the Company or

its senior management should be considered in light of those

factors. Specifically, with respect to statements relating to

loan demand, growth and earnings potential, geographic expansion

and the adequacy of the allowance for loan losses for the Company,

these factors include, but are not limited to, the rate of growth

(or lack thereof) in the economy generally and in the Bank’s and

ALC’s service areas, the availability of quality loans in the

Bank’s and ALC’s service areas, the relative strength and weakness

in the consumer and commercial credit sectors and in the real

estate markets and collateral values. There can be no

assurance that such factors or other factors will not affect the

accuracy of such forward-looking statements.

| FIRST US BANCSHARES, INC. AND

SUBSIDIARIES |

| SELECTED FINANCIAL DATA – LINKED

QUARTERS |

| (Dollars in Thousands, Except Per Share

Data) |

|

|

|

|

Quarter

Ended(Unaudited) |

| |

|

2017 |

|

|

|

2016 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

March31, |

|

|

|

December31, |

|

|

|

September30, |

|

|

|

June30, |

|

|

|

March31, |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Results of

Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

$ |

7,510 |

|

|

$ |

7,721 |

|

|

$ |

7,760 |

|

|

$ |

7,478 |

|

|

$ |

7,196 |

|

| Interest expense |

|

591 |

|

|

|

588 |

|

|

|

587 |

|

|

|

561 |

|

|

|

535 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

interest income |

|

6,919 |

|

|

|

7,133 |

|

|

|

7,173 |

|

|

|

6,917 |

|

|

|

6,661 |

|

| Provision for loan

losses |

|

515 |

|

|

|

1,814 |

|

|

|

680 |

|

|

|

536 |

|

|

|

167 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income

after provision for loan losses |

|

6,404 |

|

|

|

5,319 |

|

|

|

6,493 |

|

|

|

6,381 |

|

|

|

6,494 |

|

| Non-interest

income |

|

1,167 |

|

|

|

1,165 |

|

|

|

1,567 |

|

|

|

1,480 |

|

|

|

989 |

|

| Non-interest

expense |

|

7,037 |

|

|

|

6,826 |

|

|

|

7,348 |

|

|

|

7,255 |

|

|

|

7,066 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before

income taxes |

|

534 |

|

|

|

(342) |

|

|

|

712 |

|

|

|

606 |

|

|

|

417 |

|

| Provision for (benefit

from) income taxes |

|

130 |

|

|

|

(237) |

|

|

|

162 |

|

|

|

144 |

|

|

|

100 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income (loss) |

$ |

404 |

|

|

$ |

(105) |

|

|

$ |

550 |

|

|

$ |

462 |

|

|

$ |

317 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per Share Data: |

|

|

|

|

|

|

|

|

| Basic net income (loss)

per share |

$ |

0.07 |

|

|

$ |

(0.02) |

|

|

$ |

0.09 |

|

|

$ |

0.08 |

|

|

$ |

0.05 |

|

| Diluted net income

(loss) per share |

$ |

0.06 |

|

|

$ |

(0.02) |

|

|

$ |

0.09 |

|

|

$ |

0.07 |

|

|

$ |

0.05 |

|

| Dividends declared |

$ |

0.02 |

|

|

$ |

0.02 |

|

|

$ |

0.02 |

|

|

$ |

0.02 |

|

|

$ |

0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Period-End Balance

Sheet: |

|

|

|

|

|

|

|

|

| Total assets |

$ |

619,827 |

|

|

$ |

606,892 |

|

|

$ |

600,307 |

|

|

$ |

601,754 |

|

|

$ |

575,582 |

|

| Loans, net of allowance

for loan losses |

|

317,677 |

|

|

|

322,772 |

|

|

|

317,121 |

|

|

|

298,901 |

|

|

|

263,975 |

|

| Allowance for loan

losses |

|

4,879 |

|

|

|

4,856 |

|

|

|

3,668 |

|

|

|

3,591 |

|

|

|

3,375 |

|

| Investment securities,

net |

|

213,497 |

|

|

|

207,814 |

|

|

|

209,566 |

|

|

|

213,165 |

|

|

|

231,466 |

|

| Total deposits |

|

509,078 |

|

|

|

497,556 |

|

|

|

493,828 |

|

|

|

495,618 |

|

|

|

485,537 |

|

| Long-term debt |

|

15,000 |

|

|

|

15,000 |

|

|

|

15,000 |

|

|

|

15,000 |

|

|

|

5,000 |

|

| Total shareholders’

equity |

|

77,297 |

|

|

|

76,241 |

|

|

|

78,848 |

|

|

|

78,525 |

|

|

|

77,727 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Key Ratios: |

|

|

|

|

|

|

|

|

| Return on average

assets (annualized) |

|

0.27 |

% |

|

|

(0.07 |

)% |

|

|

0.36 |

% |

|

|

0.31 |

% |

|

|

0.22 |

% |

| Return on average

equity (annualized) |

|

2.12 |

% |

|

|

(0.53 |

)% |

|

|

2.78 |

% |

|

|

2.30 |

% |

|

|

1.65 |

% |

| Loans to deposits |

|

62.4 |

% |

|

|

64.9 |

% |

|

|

64.2 |

% |

|

|

60.3 |

% |

|

|

54.4 |

% |

| Allowance for loan

losses as % of loans |

|

1.51 |

% |

|

|

1.48 |

% |

|

|

1.14 |

% |

|

|

1.19 |

% |

|

|

1.26 |

% |

| Nonperforming assets as

% of total assets |

|

1.10 |

% |

|

|

1.20 |

% |

|

|

1.28 |

% |

|

|

1.33 |

% |

|

|

1.50 |

% |

| |

|

|

|

|

|

|

|

|

| FIRST US BANCSHARES, INC. AND

SUBSIDIARIES |

| INTERIM CONDENSED CONSOLIDATED BALANCE

SHEETS |

| (Dollars in Thousands, Except Share and Per

Share Data) |

| |

| |

March31, |

|

December31, |

| |

|

2017 |

|

|

|

2016 |

|

| |

(Unaudited) |

|

|

| ASSETS |

| Cash and due from

banks |

$ |

5,701 |

|

|

$ |

7,018 |

|

| Interest-bearing

deposits in banks |

|

27,204 |

|

|

|

16,512 |

|

| Total

cash and cash equivalents |

|

32,905 |

|

|

|

23,530 |

|

| Investment securities

available-for-sale, at fair value |

|

183,858 |

|

|

|

181,910 |

|

| Investment securities

held-to-maturity, at amortized cost |

|

29,639 |

|

|

|

25,904 |

|

| Federal Home Loan Bank

stock, at cost |

|

1,609 |

|

|

|

1,581 |

|

| Loans, net of allowance

for loan losses of $4,879 and $4,856, respectively |

|

317,677 |

|

|

|

322,772 |

|

| Premises and equipment,

net |

|

22,192 |

|

|

|

18,340 |

|

| Cash surrender value of

bank-owned life insurance |

|

14,683 |

|

|

|

14,603 |

|

| Accrued interest

receivable |

|

1,924 |

|

|

|

1,987 |

|

| Other real estate

owned |

|

4,587 |

|

|

|

4,858 |

|

| Other assets |

|

10,753 |

|

|

|

11,407 |

|

| Total

assets |

$ |

619,827 |

|

|

$ |

606,892 |

|

| |

|

|

|

| LIABILITIES AND SHAREHOLDERS’

EQUITY |

| Deposits |

$ |

509,078 |

|

|

$ |

497,556 |

|

| Accrued interest

expense |

|

229 |

|

|

|

241 |

|

| Other liabilities |

|

7,473 |

|

|

|

7,735 |

|

| Short-term

borrowings |

|

10,750 |

|

|

|

10,119 |

|

| Long-term debt |

|

15,000 |

|

|

|

15,000 |

|

| Total

liabilities |

|

542,530 |

|

|

|

530,651 |

|

| |

|

|

|

| Shareholders’

equity: |

|

|

|

| Common stock, par value

$0.01 per share, 10,000,000 shares authorized; |

|

|

|

| 7,341,061

and 7,329,060 shares issued, respectively; 6,055,103 and 6,043,102

shares outstanding, respectively |

|

73 |

|

|

|

73 |

|

| Surplus |

|

10,826 |

|

|

|

10,786 |

|

| Accumulated other

comprehensive income, net of tax |

|

(543 |

) |

|

|

(1,277 |

) |

| Retained earnings |

|

87,717 |

|

|

|

87,434 |

|

| Less treasury stock:

1,285,958 shares at cost |

|

(20,764 |

) |

|

|

(20,764 |

) |

| Noncontrolling

interest |

|

(12 |

) |

|

|

(11 |

) |

| |

|

|

|

| Total

shareholders’ equity |

|

77,297 |

|

|

|

76,241 |

|

|

|

|

|

|

| Total

liabilities and shareholders’ equity |

$ |

619,827 |

|

|

$ |

606,892 |

|

| |

|

|

|

| FIRST US BANCSHARES, INC. AND

SUBSIDIARIES |

| INTERIM CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (Dollars in Thousands, Except Per Share

Data) |

| |

| |

Three Months Ended |

| |

March 31, |

| |

|

2017 |

|

2016 |

| |

|

|

|

|

|

| |

(Unaudited) |

| Interest income: |

|

|

|

| Interest

and fees on loans |

$ |

6,496 |

|

$ |

6,053 |

| Interest

on investment securities |

|

1,014 |

|

|

1,143 |

| Total

interest income |

|

7,510 |

|

|

7,196 |

| |

|

|

|

| Interest expense: |

|

|

|

| Interest

on deposits |

|

528 |

|

|

523 |

| Interest

on borrowings |

|

63 |

|

|

12 |

| Total

interest expense |

|

591 |

|

|

535 |

| |

|

|

|

| Net interest

income |

|

6,919 |

|

|

6,661 |

| |

|

|

|

| Provision for loan

losses |

|

515 |

|

|

167 |

| |

|

|

|

| Net interest income

after provision for loan losses |

|

6,404 |

|

|

6,494 |

| |

|

|

|

| Non-interest

income: |

|

|

|

| Service

and other charges on deposit accounts |

|

464 |

|

|

417 |

| Credit

insurance income |

|

256 |

|

|

152 |

| Net gain

on sales and prepayments of investment securities |

|

49 |

|

|

2 |

| Other

income, net |

|

398 |

|

|

418 |

| Total

non-interest income |

|

1,167 |

|

|

989 |

| |

|

|

|

| Non-interest

expense: |

|

|

|

| Salaries

and employee benefits |

|

4,398 |

|

|

4,164 |

| Net

occupancy and equipment |

|

777 |

|

|

769 |

| Other

real estate/foreclosure expense, net |

|

84 |

|

|

117 |

| Other

expense |

|

1,778 |

|

|

2,016 |

| Total

non-interest expense |

|

7,037 |

|

|

7,066 |

| |

|

|

|

| Income before income

taxes |

|

534 |

|

|

417 |

| Provision for income

taxes |

|

130 |

|

|

100 |

| Net income |

$ |

404 |

|

$ |

317 |

| Basic net income per

share |

$ |

0.07 |

|

$ |

0.05 |

| Diluted net income per

share |

$ |

0.06 |

|

$ |

0.05 |

| Dividends per

share |

$ |

0.02 |

|

$ |

0.02 |

| |

|

|

|

Contact:

Thomas S. Elley

334-636-5424

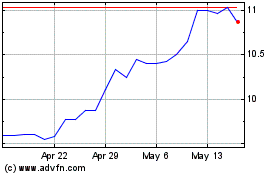

First US Bancshares (NASDAQ:FUSB)

Historical Stock Chart

From Mar 2024 to Apr 2024

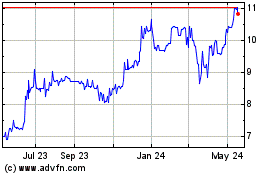

First US Bancshares (NASDAQ:FUSB)

Historical Stock Chart

From Apr 2023 to Apr 2024