Century Aluminum Company (NASDAQ:CENX) today announced first

quarter 2017 results.

First Quarter 2017 Financial Results

- Net loss of $15.1 million, or $0.17 per share

- Adjusted net loss1 of $5.0 million, or $0.05 per share

- Adjusted EBITDA1 of $22.2 million, up $10.3 million

sequentially on higher LME prices, partially offset by higher raw

material costs

- Revenue of $365.8 million, an 8% increase over prior

quarter

- Cash position at quarter end of $125.9 million and revolver

availability of $99.5 million

| $MM (except shipments and per share

data) |

|

|

|

Q1 2017 |

|

Q4 2016 |

|

|

Shipments (tonnes) |

186,395 |

|

|

183,210 |

|

|

|

Revenue |

$ |

365.8 |

|

|

$ |

339.8 |

|

|

|

Net Loss |

(15.1 |

) |

|

(168.5 |

) |

|

|

EPS |

(0.17 |

) |

|

(1.93 |

) |

|

|

Adjusted Net Loss1 |

(5.0 |

) |

|

(11.5 |

) |

|

|

Adjusted EPS1 |

(0.05 |

) |

|

(0.12 |

) |

|

|

Adjusted EBITDA1 |

22.2 |

|

|

11.9 |

|

|

| |

|

|

|

|

|

|

Note:1 – Non-GAAP measure; see reconciliation of non-GAAP

financial measures

First Quarter 2017 Business Developments

- WTO trade case brought against China for providing illegal

subsides to its aluminum producers

- Filed antitrust lawsuit alleging utility serving Mt. Holly

smelter is violating state and federal antitrust laws

- Ravenswood facility sale finalized, resulting in proceeds of

$14 million

Century Aluminum Company reported a net loss of $15.1 million

($0.17 per share) for the first quarter of 2017. Results were

impacted by a $14.0 million ($0.16 per share) unrealized loss

relating to LME forward sales. This result compares to a net

loss of $168.5 million ($1.93 per share) for the fourth quarter of

2016, which included a $152.2 million ($1.75 per share) impairment

charge related to Helguvik.

The first quarter of 2017 adjusted net loss was $5.0 million

($0.05 per share) compared to an adjusted net loss of $11.5 million

($0.12 per share) for the fourth quarter of 2016.

For the first quarter of 2017, Century reported adjusted EBITDA

of $22.2 million, up $10.3 million from the fourth quarter of

2016. The increase was primarily attributable to higher

aluminum prices, partially offset by higher raw material costs.

Sales for the first quarter of 2017 were $365.8 million compared

with $339.8 million for the fourth quarter of 2016. Shipments

of primary aluminum for the first quarter of 2017 were 186,395

tonnes compared with 183,210 tonnes shipped in the fourth quarter

of 2016.

Net cash used in operating activities in the first quarter of

2017 was $11.3 million. We received $13.6 million in proceeds

from the sale of our Ravenswood, W.V. facility. Our cash

position at quarter end was $125.9 million and we had $99.5 million

of revolver availability.

"All operations are stable and are performing well," commented

Michael Bless, President and Chief Executive Officer.

"Conversion costs during the quarter were in line with expectations

and remain so. Alumina pricing has, consistent with our

expectations, shown a downward trend. Financial results

should continue to strengthen in this market environment, given

that the vast majority of our sales are based upon metal prices one

to three months prior to the current month. Cash flow was

impacted by a working capital adjustment related to changes in the

commercial terms of a portion of our U.S. sales contracts, but was

otherwise strong."

"Industry conditions remain mixed," continued Bless. "Our

markets in the U.S. and Europe continue to be distorted by

significant trade flows caused by the illegally subsidized excess

capacity and production in China. This uneconomic capacity

must be permanently removed in order to restore fair global trade

conditions throughout the value chain in our sector. We are

confident the U.S. and other governments will continue to insist

that China take immediate steps to address the unsustainable

structure of its aluminum industry. Demand, on the other

hand, remains vibrant in our markets. Fair trading

conditions, coupled with our company’s market position in the U.S.

and Europe, should produce an attractive environment for Century’s

shareholders.”

About Century Aluminum

Century Aluminum Company owns primary aluminum capacity in the

United States and Iceland. Century's corporate offices are

located in Chicago, IL. Visit www.centuryaluminum.com for more

information.

Non-GAAP Financial Measures

Adjusted net income (loss), adjusted earnings (loss) per share

and adjusted EBITDA are non-GAAP financial measures that management

uses to evaluate Century's financial performance. These

non-GAAP financial measures facilitate comparisons of this period’s

results with prior periods on a consistent basis by excluding items

that management does not believe are indicative of Century’s

ongoing operating performance and ability to generate cash.

Management believes these non-GAAP financial measures enhance an

overall understanding of Century’s performance and our investors’

ability to review Century’s business from the same perspective as

management. The table below, under the heading

"Reconciliation of Non-GAAP Financial Measures," provides a

reconciliation of each non-GAAP financial measure to the most

directly comparable GAAP financial measure. Non-GAAP

financial measures should be viewed in addition to, and not as an

alternative for, Century's reported results prepared in accordance

with GAAP. In addition, because not all companies use

identical calculations, adjusted net income (loss), adjusted

earnings (loss) per share and adjusted EBITDA included in this

press release may not be comparable to similarly titled measures of

other companies. Investors are encouraged to review the

reconciliation in conjunction with the presentation of these

non-GAAP financial measures.

Cautionary Statement

This press release contains "forward-looking statements" within

the meaning of the Private Securities Litigation Reform Act of

1995, Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934. Forward-looking

statements are statements about future events and are based on our

current expectations. These forward-looking statements may be

identified by the words "believe," "expect," "hope," "target,"

"anticipate," "intend," "plan," "seek," "estimate," "potential,"

"project," "scheduled," "forecast" or words of similar meaning, or

future or conditional verbs such as "will," "would," "should,"

"could," "might," or "may." Our forward-looking statements

include, without limitation, statements with respect to: future

global and local financial and economic conditions; our assessment

of the aluminum market and aluminum prices (including premiums);

the potential outcome of any trade claims to address excess

capacity or unfair trade practices, our assessment of power pricing

and our ability to successfully obtain and/or implement long-term

competitive power arrangements for our operations and projects; our

ability to procure alumina, carbon products and other raw materials

and our assessment of pricing and costs and other terms relating

thereto; the future operation or potential curtailment of our U.S.

assets; the future financial and operating performance of Century,

its subsidiaries and its projects; future earnings, operating

results and liquidity; our future business objectives, strategies

and initiatives.

Where we express an expectation or belief as to future events or

results, such expectation or belief is expressed in good faith and

believed to have a reasonable basis. However, our

forward-looking statements are based on current expectations and

assumptions that are subject to risks and uncertainties which may

cause actual results to differ materially from future results

expressed, projected or implied by those forward-looking

statements. Important factors that could cause actual results

and events to differ from those described in such forward-looking

statements can be found in the risk factors and forward-looking

statements cautionary language contained in our Annual Report on

Form 10-K, quarterly reports on Form 10-Q and in other filings made

with the Securities and Exchange Commission. Although we have

attempted to identify those material factors that could cause

actual results or events to differ from those described in such

forward-looking statements, there may be other factors that could

cause results or events to differ from those anticipated, estimated

or intended. Many of these factors are beyond our ability to

control or predict. Given these uncertainties, the reader is

cautioned not to place undue reliance on our forward-looking

statements. We undertake no obligation to update or revise

publicly any forward-looking statements, whether as a result of new

information, future events, or otherwise.

| CENTURY ALUMINUM COMPANY |

| CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (in thousands, except per share amounts) |

| (Unaudited) |

| |

Three months ended |

| |

March 31, |

|

December 31, |

|

March 31, |

| |

2017 |

|

2016 |

|

2016 |

| NET SALES: |

|

|

|

|

|

| Related

parties |

$ |

280,573 |

|

|

$ |

306,860 |

|

|

$ |

280,377 |

|

| Other

customers |

85,213 |

|

|

32,976 |

|

|

38,477 |

|

| Total net sales |

365,786 |

|

|

339,836 |

|

|

318,854 |

|

| Cost of

goods sold |

348,935 |

|

|

334,779 |

|

|

321,906 |

|

| Gross profit

(loss) |

16,851 |

|

|

5,057 |

|

|

(3,052 |

) |

| Selling,

general and administrative expenses |

10,702 |

|

|

10,961 |

|

|

9,625 |

|

| Helguvik

impairment |

— |

|

|

152,220 |

|

|

— |

|

| Other

operating expense - net |

973 |

|

|

1,520 |

|

|

881 |

|

| Operating income

(loss) |

5,176 |

|

|

(159,644 |

) |

|

(13,558 |

) |

| Interest

expense |

(5,571 |

) |

|

(5,695 |

) |

|

(5,493 |

) |

| Interest

income |

230 |

|

|

283 |

|

|

114 |

|

| Net gain

(loss) on forward and derivative contracts |

(16,137 |

) |

|

489 |

|

|

353 |

|

| Other

income (expense) - net |

384 |

|

|

1,781 |

|

|

(6 |

) |

| Loss before income

taxes and equity in earnings of joint ventures |

(15,918 |

) |

|

(162,786 |

) |

|

(18,590 |

) |

| Income

tax benefit (expense) |

308 |

|

|

(6,061 |

) |

|

2,070 |

|

| Loss before equity in

earnings of joint ventures |

(15,610 |

) |

|

(168,847 |

) |

|

(16,520 |

) |

| Equity in

earnings of joint ventures |

471 |

|

|

383 |

|

|

357 |

|

| Net loss |

$ |

(15,139 |

) |

|

$ |

(168,464 |

) |

|

$ |

(16,163 |

) |

| |

|

|

|

|

|

| Net loss allocated to

common stockholders |

$ |

(15,139 |

) |

|

$ |

(168,464 |

) |

|

$ |

(16,163 |

) |

| LOSS PER COMMON

SHARE: |

|

|

|

|

|

| Basic and

diluted |

$ |

(0.17 |

) |

|

$ |

(1.93 |

) |

|

$ |

(0.19 |

) |

| WEIGHTED AVERAGE COMMON

SHARES OUTSTANDING: |

|

|

|

|

|

| Basic and

diluted |

87,254 |

|

|

87,079 |

|

|

87,040 |

|

| CENTURY ALUMINUM COMPANY |

| CONSOLIDATED BALANCE SHEETS |

| (in thousands, except share amounts) |

| (Unaudited) |

| |

| |

|

March 31, 2017 |

|

December 31, 2016 |

|

ASSETS |

|

|

|

|

| Cash and cash

equivalents |

|

$ |

125,895 |

|

|

$ |

132,403 |

|

| Restricted cash |

|

797 |

|

|

1,050 |

|

| Accounts receivable -

net |

|

36,225 |

|

|

12,432 |

|

| Due from

affiliates |

|

11,789 |

|

|

16,651 |

|

| Inventories |

|

244,720 |

|

|

233,563 |

|

| Prepaid and other

current assets |

|

18,968 |

|

|

22,210 |

|

| Assets held for

sale |

|

— |

|

|

22,313 |

|

| Total

current assets |

|

438,394 |

|

|

440,622 |

|

| Property, plant and

equipment - net |

|

1,012,564 |

|

|

1,026,285 |

|

| Other assets |

|

74,849 |

|

|

73,420 |

|

|

TOTAL |

|

$ |

1,525,807 |

|

|

$ |

1,540,327 |

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

LIABILITIES: |

|

|

|

|

| Accounts payable,

trade |

|

$ |

88,701 |

|

|

$ |

94,960 |

|

| Due to affiliates |

|

20,020 |

|

|

15,368 |

|

| Accrued and other

current liabilities |

|

58,094 |

|

|

50,100 |

|

| Accrued employee

benefits costs |

|

10,914 |

|

|

10,917 |

|

| Industrial revenue

bonds |

|

7,815 |

|

|

7,815 |

|

| Total

current liabilities |

|

185,544 |

|

|

179,160 |

|

| Senior notes

payable |

|

247,809 |

|

|

247,699 |

|

| Accrued pension

benefits costs - less current portion |

|

48,863 |

|

|

49,493 |

|

| Accrued postretirement

benefits costs - less current portion |

|

126,729 |

|

|

126,355 |

|

| Other liabilities |

|

64,608 |

|

|

72,026 |

|

| Deferred taxes |

|

109,510 |

|

|

108,939 |

|

| Total

noncurrent liabilities |

|

597,519 |

|

|

604,512 |

|

| |

|

|

|

|

| SHAREHOLDERS’

EQUITY: |

|

|

|

|

| Series A Preferred

stock (one cent par value, 5,000,000 shares authorized; 160,000

issued and 75,577 outstanding at March 31, 2017; 160,000

issued and 75,625 outstanding at December 31, 2016) |

|

1 |

|

|

1 |

|

| Common stock (one cent

par value, 195,000,000 authorized; 94,448,636 issued and

87,262,115 outstanding at September 30, 2016; 94,437,418 issued and

87,250,897 outstanding at December 31, 2016) |

|

944 |

|

|

944 |

|

| Additional paid-in

capital |

|

2,515,647 |

|

|

2,515,131 |

|

| Treasury stock, at

cost |

|

(86,276 |

) |

|

(86,276 |

) |

| Accumulated other

comprehensive loss |

|

(113,181 |

) |

|

(113,893 |

) |

| Accumulated

deficit |

|

(1,574,391 |

) |

|

(1,559,252 |

) |

| Total

shareholders’ equity |

|

742,744 |

|

|

756,655 |

|

|

TOTAL |

|

$ |

1,525,807 |

|

|

$ |

1,540,327 |

|

| |

|

|

|

|

|

|

|

|

| CENTURY ALUMINUM COMPANY |

| CONSOLIDATED STATEMENTS OF CASH

FLOWS |

| (in thousands) |

| (Unaudited) |

| |

Three months ended |

| |

March 31, |

|

March 31, |

| |

2017 |

|

2016 |

| CASH FLOWS FROM

OPERATING ACTIVITIES: |

|

|

|

| Net

loss |

$ |

(15,139 |

) |

|

$ |

(16,163 |

) |

|

|

|

|

|

|

Adjustments to reconcile net loss to net cash provided by operating

activities: |

|

|

|

|

Unrealized loss on forward and derivative contracts |

13,978 |

|

|

— |

|

|

Unrealized gain on E.ON contingent obligation |

(353 |

) |

|

(353 |

) |

| Lower of

cost or market inventory adjustment |

(3,880 |

) |

|

(5,784 |

) |

|

Depreciation and amortization |

20,938 |

|

|

21,260 |

|

| Pension

and other postretirement benefits |

1,576 |

|

|

632 |

|

| Deferred

income taxes |

(95 |

) |

|

(3,587 |

) |

|

Stock-based compensation |

477 |

|

|

321 |

|

| Equity in

earnings of joint ventures, net of dividends |

(393 |

) |

|

(357 |

) |

| Change in

operating assets and liabilities: |

|

|

|

| Accounts

receivable - net |

(23,793 |

) |

|

(3,193 |

) |

| Due from

affiliates |

4,862 |

|

|

1,939 |

|

|

Inventories |

(4,677 |

) |

|

17,648 |

|

| Prepaid

and other current assets |

4,726 |

|

|

14,290 |

|

| Accounts

payable, trade |

(4,377 |

) |

|

(5,983 |

) |

| Due to

affiliates |

3,296 |

|

|

(5,372 |

) |

| Accrued

and other current liabilities |

(4,905 |

) |

|

1,253 |

|

| Other -

net |

(3,585 |

) |

|

(1,648 |

) |

| Net cash provided by

(used in) operating activities |

(11,344 |

) |

|

14,903 |

|

| CASH FLOWS FROM

INVESTING ACTIVITIES: |

|

|

|

| Purchase

of property, plant and equipment |

(9,045 |

) |

|

(3,835 |

) |

| Proceeds

from sale of property, plant and equipment |

13,585 |

|

|

— |

|

|

Restricted and other cash deposits |

253 |

|

|

— |

|

| Net cash provided by

(used in) investing activities |

4,793 |

|

|

(3,835 |

) |

| CASH FLOWS FROM

FINANCING ACTIVITIES: |

|

|

|

|

Borrowings under revolving credit facilities |

233 |

|

|

371 |

|

|

Repayments under revolving credit facilities |

(233 |

) |

|

(371 |

) |

| Issuance

of common stock |

43 |

|

|

— |

|

| Net cash provided by

financing activities |

43 |

|

|

— |

|

| CHANGE IN CASH AND CASH

EQUIVALENTS |

(6,508 |

) |

|

11,068 |

|

| Cash and cash

equivalents, beginning of period |

132,403 |

|

|

115,393 |

|

| Cash and cash

equivalents, end of period |

$ |

125,895 |

|

|

$ |

126,461 |

|

| |

|

|

|

|

|

|

|

| CENTURY ALUMINUM COMPANY |

| SELECTED OPERATING DATA |

| (Unaudited) |

|

|

|

SHIPMENTS - PRIMARY ALUMINUM |

|

|

|

|

| |

|

|

|

|

|

| |

Direct¹ |

|

Toll |

| |

United States |

|

Iceland |

|

Iceland |

| |

Tonnes |

|

Sales $ (000) |

|

Tonnes |

|

Sales $ (000) |

|

Tonnes |

|

Sales $ (000) |

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

| 1st Quarter |

106,961 |

|

|

$ |

214,705 |

|

|

79,434 |

|

|

$ |

149,535 |

|

|

— |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

2016 |

|

|

|

|

|

|

|

|

|

|

|

| 4th Quarter |

103,186 |

|

|

$ |

198,202 |

|

|

80,024 |

|

|

$ |

141,090 |

|

|

— |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| 1st Quarter |

105,089 |

|

|

194,826 |

|

|

55,030 |

|

|

92,151 |

|

|

22,500 |

|

|

26,115 |

|

Notes:

1 - Excludes scrap aluminum sales

| |

| CENTURY ALUMINUM COMPANY |

| RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES |

| (in millions, except per share amounts) |

| (Unaudited) |

| |

|

|

|

Three months ended |

|

Three months ended |

|

|

|

March 31, 2017 |

|

December 31, 2016 |

|

|

|

$MM |

|

EPS |

|

$MM |

|

EPS |

| Net loss as

reported |

|

$ |

(15.1 |

) |

|

$ |

(0.17 |

) |

|

$ |

(168.5 |

) |

|

$ |

(1.93 |

) |

| Helguvik

impairment |

|

— |

|

|

— |

|

|

152.2 |

|

|

1.75 |

|

|

Unrealized loss on forward and derivative contracts |

|

14.0 |

|

|

0.16 |

|

|

— |

|

|

— |

|

| Discrete

tax item |

|

— |

|

|

— |

|

|

6.9 |

|

|

0.08 |

|

| Lower of

cost or market inventory adjustment |

|

(3.9 |

) |

|

(0.04 |

) |

|

(2.1 |

) |

|

(0.02 |

) |

| Adjusted net loss |

|

$ |

(5.0 |

) |

|

$ |

(0.05 |

) |

|

$ |

(11.5 |

) |

|

$ |

(0.12 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Three Months Ended |

| |

March 31, 2017 |

|

December 31, 2016 |

| Net loss |

$ |

(15.1 |

) |

|

$ |

(168.5 |

) |

| Interest

expense |

5.6 |

|

|

5.7 |

|

| Interest

income |

(0.2 |

) |

|

(0.3 |

) |

| Net loss

(gain) on forward and derivative contracts |

16.1 |

|

|

(0.5 |

) |

| Other

expense - net |

(0.4 |

) |

|

(1.8 |

) |

| Income

tax (benefit) expense |

(0.3 |

) |

|

6.1 |

|

| Equity in

earnings of joint ventures |

(0.5 |

) |

|

(0.4 |

) |

| Operating income

(loss) |

$ |

5.2 |

|

|

$ |

(159.6 |

) |

| Helguvik

impairment |

— |

|

|

152.2 |

|

| Lower of

cost or market inventory adjustments |

(3.9 |

) |

|

(2.1 |

) |

|

Depreciation and amortization |

20.9 |

|

|

21.5 |

|

| Adjusted EBITDA |

$ |

22.2 |

|

|

$ |

11.9 |

|

| |

|

|

|

Source: Century Aluminum Company

Contact

Peter Trpkovski

(Investors and media)

312-696-3112

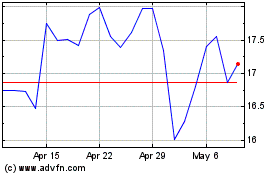

Century Aluminum (NASDAQ:CENX)

Historical Stock Chart

From Mar 2024 to Apr 2024

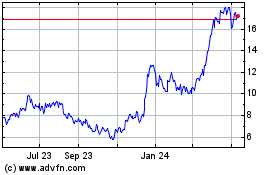

Century Aluminum (NASDAQ:CENX)

Historical Stock Chart

From Apr 2023 to Apr 2024