Affirms Financial Guidance for 2017

Acadia Healthcare Company, Inc. (NASDAQ: ACHC) today announced

financial results for the first quarter ended March 31, 2017.

Revenue for the quarter was $679.2 million, an increase of 10.1%

from $616.8 million for the first quarter of 2016. Net income

attributable to Acadia stockholders increased 36.1% to $35.0

million for the first quarter of 2017 from $25.7 million for the

first quarter of 2016. Net income attributable to Acadia

stockholders per diluted share increased 29.0% to $0.40 for the

first quarter of 2017 from $0.31 for the first quarter of 2016, on

a 4.2% increase in weighted average diluted shares outstanding.

Adjusted income from continuing operations attributable to Acadia

stockholders per diluted share was $0.46 for the first quarter of

2017 compared with $0.55 for the first quarter of 2016. The results

for the first quarter of 2017 were impacted by the decline in the

exchange rate of the British Pound Sterling to the U.S. dollar, the

divestiture of 22 facilities in the U.K. during the fourth quarter

of 2016 and the loss of one day due to leap year in 2016. A

reconciliation of all non-GAAP financial results in this release

appears beginning on page 8.

Joey Jacobs, Chairman and Chief Executive Officer of Acadia,

commented, “Acadia produced financial results for the first quarter

of 2017 that were largely consistent with our expectations for the

quarter and financial guidance for the year. Our revenue growth

primarily resulted from the acquisition of Priory Group on February

16, 2016, which added approximately 6,200 beds, net of the

divestiture, to our operations in the United Kingdom. In the

trailing 12 months ended March 31, 2017, we also acquired nearly

240 beds through three transactions and added 719 beds to existing

facilities and de novo facilities, 82 of which were added to

existing facilities in the first quarter of 2017.

“The favorable impact of the growth in our beds in operation

during the first quarter was partially offset by a reduction of

approximately six percentage points in our revenue growth rate due

to the post-Brexit decline in the exchange rate of the British

Pound Sterling to the U.S. dollar, in addition to the impact of the

first quarter of 2017 having one less day due to leap year in

2016.”

Acadia’s same facility revenues increased 4.8% for the first

quarter of 2017 compared with the same prior-year quarter, as

patient days rose 3.7% and revenue per patient day increased 1.0%.

Same facility revenue increased 5.5% for the U.S. facilities, with

an increase of 5.8% in patient days and a decline of 0.3% in

revenue per patient day. Same facility revenues increased 2.6% for

the U.K. facilities, with a 0.1% increase in patient days and a

2.4% increase in revenue per patient day. Total same facility

EBITDA margin declined to 25.2% for the first quarter of 2017 from

25.6% for the first quarter of 2016. Acadia’s consolidated adjusted

EBITDA was $136.4 million for the first quarter of 2017, up 4.1%

from $131.0 million for the first quarter of 2016.

As of January 1, 2017, the Company adopted a new accounting

standard, ASU 2016-09, under which adjustments to the income tax

effects of share-based awards are now recognized in the income

statement when the awards vest, instead of through equity on the

balance sheet. This change resulted in an increase in Acadia’s

income tax provision for the first quarter of 2017 of $1.7 million

or an increase in the unadjusted tax rate of 3.6 percentage points.

Adjusted income from continuing operations for the first quarter of

2017 excludes the impact of adopting ASU 2016-09, and as a result

the adjusted tax rate is 24.5%.

Acadia today affirmed its previously established financial

guidance for 2017, as follows:

- Revenue for 2017 in a range of $2.85

billion to $2.9 billion;

- Adjusted EBITDA for 2017 in a range of

$625 million to $640 million; and

- Adjusted earnings per diluted share for

2017 in a range $2.40 to $2.50.

The Company’s 2017 financial guidance assumes an exchange rate

of $1.25 per British Pound Sterling and a tax rate of approximately

25%. The Company’s guidance does not include the impact of any

future acquisitions or transaction-related expenses. EBITDA is

defined as net income adjusted for net loss attributable to

noncontrolling interests, income tax provision, net interest

expense and depreciation and amortization. Adjusted EBITDA is

defined as EBITDA adjusted for equity-based compensation expense,

gain on foreign currency derivatives and transaction-related

expenses. Adjusted income is defined as net income adjusted for

provision for income taxes, gain on foreign currency derivatives,

transaction-related expenses and income tax provision reflecting

tax effect of adjustments attributable to Acadia.

Acadia will hold a conference call to discuss its first quarter

financial results at 8:00 a.m. Eastern Time on Wednesday,

April 26, 2017. A live webcast of the conference call will be

available at www.acadiahealthcare.com in the “Investors” section of

the website. The webcast of the conference call will be available

through May 10, 2017.

Risk Factors

This news release contains forward-looking statements. Generally

words such as “may,” “will,” “should,” “could,” “anticipate,”

“expect,” “intend,” “estimate,” “plan,” “continue,” and “believe”

or the negative of or other variation on these and other similar

expressions identify forward-looking statements. These

forward-looking statements are made only as of the date of this

news release. We do not undertake to update or revise the

forward-looking statements, whether as a result of new information,

future events or otherwise. Forward-looking statements are based on

current expectations and involve risks and uncertainties and our

future results could differ significantly from those expressed or

implied by our forward-looking statements. Factors that may cause

actual results to differ materially include, without limitation,

(i) potential difficulties operating our business in light of

political and economic instability in the U.K. and globally

following the referendum in the U.K. on June 23, 2016, in which

voters approved an exit from the European Union, or Brexit; (ii)

the impact of fluctuations in foreign exchange rates, including the

devaluation of the British Pound Sterling (GBP) relative to the

U.S. Dollar (USD) following the Brexit vote; (iii) Acadia’s ability

to complete acquisitions and successfully integrate the operations

of acquired facilities, including Priory facilities; (iv) Acadia’s

ability to add beds, expand services, enhance marketing programs

and improve efficiencies at its facilities; (v) potential

reductions in payments received by Acadia from government and

third-party payors; (vi) the occurrence of patient incidents and

governmental investigations, which could adversely affect the price

of our common stock and result in incremental regulatory burdens;

(vii) the risk that Acadia may not generate sufficient cash from

operations to service its debt and meet its working capital and

capital expenditure requirements; and (viii) potential operating

difficulties, client preferences, changes in competition and

general economic or industry conditions that may prevent Acadia

from realizing the expected benefits of its business strategy.

These factors and others are more fully described in Acadia’s

periodic reports and other filings with the SEC.

About Acadia

Acadia is a provider of behavioral healthcare services. At March

31, 2017, Acadia operated a network of 575 behavioral healthcare

facilities with approximately 17,200 beds in 39 states, the United

Kingdom and Puerto Rico. Acadia provides behavioral health and

addiction services to its patients in a variety of settings,

including inpatient psychiatric hospitals, residential treatment

centers, outpatient clinics and therapeutic school-based

programs.

Acadia Healthcare Company, Inc. Condensed

Consolidated Statements of Operations (Unaudited)

Three Months Ended March 31,

2017 2016 (In thousands, except per share

amounts) Revenue before provision for doubtful accounts

$ 689,341 $ 627,183 Provision for doubtful accounts (10,147

) (10,370 ) Revenue 679,194 616,813

Salaries, wages and benefits (including

equity-based compensation expense of $7,396 and $6,956,

respectively)

376,421 341,028 Professional fees 43,409 39,991 Supplies 27,709

26,685 Rents and leases 18,971 14,806 Other operating expenses

83,711 70,247 Depreciation and amortization 33,613 27,975 Interest

expense, net 42,757 37,714 Gain on foreign currency derivatives -

(410 ) Transaction-related expenses 4,119

26,298 Total expenses 630,710 584,334

Income before income taxes 48,484 32,479 Provision for

income taxes 13,711 7,110 Net income

34,773 25,369 Net loss attributable to noncontrolling interests

185 319 Net income attributable to

Acadia Healthcare Company, Inc. $ 34,958 $ 25,688

Earnings per share attributable to Acadia Healthcare

Company, Inc. stockholders: Basic $ 0.40 $ 0.31

Diluted $ 0.40 $ 0.31 Weighted-average shares

outstanding: Basic 86,762 82,943 Diluted 86,908 83,420

Acadia Healthcare Company, Inc. Condensed

Consolidated Balance Sheets (Unaudited)

March 31,2017

December 31,2016

(In thousands) ASSETS Current assets: Cash and

cash equivalents $ 43,087 $ 57,063

Accounts receivable, net of allowance for

doubtful accounts of $41,121 and $38,916, respectively

276,089 263,327 Other current assets 104,837

107,537 Total current assets 424,013 427,927 Property and

equipment, net 2,749,538 2,703,695 Goodwill 2,683,787 2,681,188

Intangible assets, net 83,718 83,310 Deferred tax assets -

noncurrent 3,750 3,780 Derivative instruments 59,257 73,509 Other

assets 61,727 51,317 Total assets $

6,065,790 $ 6,024,726

LIABILITIES

AND EQUITY Current liabilities: Current portion of long-term

debt $ 34,805 $ 34,805 Accounts payable 92,673 80,034 Accrued

salaries and benefits 102,333 105,068 Other accrued liabilities

106,046 122,958 Total current

liabilities 335,857 342,865 Long-term debt 3,246,577 3,253,004

Deferred tax liabilities - noncurrent 63,858 78,520 Other

liabilities 165,995 164,859 Total

liabilities 3,812,287 3,839,248 Redeemable noncontrolling interests

17,570 17,754 Equity: Common stock 869 867 Additional paid-in

capital 2,499,760 2,496,288 Accumulated other comprehensive loss

(528,392 ) (549,570 ) Retained earnings 263,696

220,139 Total equity 2,235,933

2,167,724 Total liabilities and equity $ 6,065,790 $

6,024,726

Acadia Healthcare Company,

Inc. Condensed Consolidated Statements of Cash Flows

(Unaudited) Three Months

Ended March 31, 2017 2016 (In thousands)

Operating activities: Net income $ 34,773 $ 25,369

Adjustments to reconcile net income to net cash provided by

continuing operating activities: Depreciation and amortization

33,613 27,975 Amortization of debt issuance costs 2,396 2,147

Equity-based compensation expense 7,396 6,956 Deferred income tax

expense 2,007 9,085 Gain on foreign currency derivatives - (410 )

Other 3,825 882 Change in operating assets and liabilities, net of

effect of acquisitions: Accounts receivable, net (12,459 ) (3,749 )

Other current assets 5,886 (8,075 ) Other assets (1,710 ) (2,402 )

Accounts payable and other accrued liabilities (16,993 ) 7,498

Accrued salaries and benefits (3,437 ) (6,347 ) Other liabilities

2,142 354 Net cash provided by

continuing operating activities 57,439 59,283 Net cash used in

discontinued operating activities (425 ) (619 ) Net

cash provided by operating activities 57,014 58,664

Investing activities: Cash paid for acquisitions, net of

cash acquired - (580,096 ) Cash paid for capital expenditures

(50,549 ) (90,089 ) Cash paid for real estate acquisitions (2,495 )

(14,799 ) Settlement of foreign currency derivatives - 745 Other

(5,051 ) (1,208 ) Net cash used in investing

activities (58,095 ) (685,447 )

Financing activities:

Borrowings on long-term debt - 1,480,000 Borrowings on revolving

credit facility - 58,000 Principal payments on revolving credit

facility - (166,000 ) Principal payments on long-term debt (8,638 )

(13,669 ) Repayment of assumed debt - (1,348,389 ) Payment of debt

issuance costs - (34,167 ) Issuance of common stock, net - 685,097

Common stock withheld for minimum statutory taxes, net (4,234 )

(6,679 ) Other (865 ) (224 ) Net cash (used in)

provided by financing activities (13,737 ) 653,969

Effect of exchange rate changes on cash 842

(1,819 ) Net (decrease) increase in cash and

cash equivalents (13,976 ) 25,367 Cash and cash equivalents at

beginning of the period 57,063 11,215

Cash and cash equivalents at end of the period $ 43,087 $

36,582

Effect of acquisitions: Assets acquired, excluding cash $ -

$ 2,372,358 Liabilities assumed - (1,575,380 ) Issuance of common

stock in connection with acquisition -

(216,882 ) Cash paid for acquisitions, net of cash acquired $ -

$ 580,096

Acadia Healthcare Company,

Inc. Operating Statistics (Unaudited, Revenue in

thousands)

Three Months Ended March 31, 2017 2016 %

Change Same Facility Results (a,c) Revenue $ 547,965 $ 523,031

4.8% Patient Days 905,650 873,476 3.7% Admissions 37,489 34,514

8.6% Average Length of Stay (b) 24.2 25.3 -4.5% Revenue per Patient

Day $ 605 $ 599 1.0% EBITDA margin 25.2 % 25.6 % -40 bps

U.S. Same Facility Results (a) Revenue $ 418,852 $ 397,139 5.5%

Patient Days 583,805 552,016 5.8% Admissions 36,317 33,476 8.5%

Average Length of Stay (b) 16.1 16.5 -2.5% Revenue per Patient Day

$ 717 $ 719 -0.3% EBITDA margin 26.3 % 27.2 % -90 bps U.K.

Same Facility Results (a,c) Revenue $ 129,113 $ 125,892 2.6%

Patient Days 321,845 321,460 0.1% Admissions 1,172 1,038 12.9%

Average Length of Stay (b) 274.6 309.7 -11.3% Revenue per Patient

Day $ 401 $ 392 2.4% EBITDA margin 21.4 % 20.7 % 70 bps

U.S. Facility Results Revenue $ 440,223 $ 408,264

7.8% Patient Days 606,527 561,323 8.1% Admissions 38,356 34,465

11.3% Average Length of Stay (b) 15.8 16.3 -2.9% Revenue per

Patient Day $ 726 $ 727 -0.2% EBITDA margin 25.5 % 26.2 % -70 bps

U.K. Facility Results (c) Revenue $ 238,971 $ 152,291 56.9%

Patient Days 671,720 406,646 65.2% Admissions 2,589 1,391 86.1%

Average Length of Stay (b) 259.5 292.3 -11.3% Revenue per Patient

Day $ 356 $ 375 -5.0% EBITDA margin 18.5 % 20.1 % -160 bps

Total Facility Results (c) Revenue $ 679,194 $ 560,555 21.2%

Patient Days 1,278,247 967,969 32.1% Admissions 40,945 35,856 14.2%

Average Length of Stay (b) 31.2 27.0 15.6% Revenue per Patient Day

$ 531 $ 579 -8.2% EBITDA margin 23.0 % 24.5 % -150 bps

(a)

Same-facility results for the periods

presented exclude the U.K. divestiture and other closed

services.

(b)

Average length of stay is defined as

patient days divided by admissions.

(c)

U.K. Facility and Total Facility results

for the periods presented exclude the U.K. divestiture. Revenue and

revenue per patient day for the three months ended March 31, 2016

is adjusted to reflect the foreign currency exchange rate for the

comparable period of 2017 in order to eliminate the effect of

changes in the exchange rate. The exchange rate used in the

adjusted revenue and revenue per patient day amounts for the three

months ended March 31, 2016 is 1.24.

Acadia Healthcare Company, Inc.

Reconciliation of Net Income Attributable to Acadia Healthcare

Company, Inc. to Adjusted EBITDA (Unaudited)

Three Months Ended March 31,

2017 2016 (in thousands) Net income

attributable to Acadia Healthcare Company, Inc. $ 34,958 $ 25,688

Net loss attributable to noncontrolling interests (185 ) (319 )

Provision for income taxes 13,711 7,110 Interest expense, net

42,757 37,714 Depreciation and amortization 33,613

27,975 EBITDA 124,854 98,168 Adjustments:

Equity-based compensation expense (a) 7,396 6,956 Gain on foreign

currency derivatives (b) - (410 ) Transaction-related expenses (c)

4,119 26,298 Adjusted EBITDA $ 136,369

$ 131,012 See footnotes on page 11.

Acadia Healthcare Company, Inc. Reconciliation of

Adjusted Income Attributable to Acadia Healthcare Company, Inc.

to Net Income Attributable to Acadia Healthcare Company,

Inc. (Unaudited) Three

Months Ended March 31, 2017 2016 (in

thousands, except per share amounts) Net income

attributable to Acadia Healthcare Company, Inc. $ 34,958 $ 25,688

Provision for income taxes 13,711 7,110

Income attributable to Acadia Healthcare Company, Inc. before

income taxes 48,669 32,798 Adjustments to income: Gain on

foreign currency derivatives (b) - (410 ) Transaction-related

expenses (c) 4,119 26,298 Income tax provision reflecting tax

effect of adjustments to income (d) (12,912 ) (12,852

) Adjusted income attributable to Acadia Healthcare Company, Inc. $

39,876 $ 45,834 Weighted-average shares outstanding -

diluted 86,908 83,420 Adjusted income attributable to Acadia

Healthcare Company, Inc. per diluted share $ 0.46 $ 0.55

See footnotes on page 11.

Acadia

Healthcare Company, Inc. Constant Currency Condensed

Consolidated Statements of Operations (e) (Unaudited)

Three Months Ended March 31,

2017 2016 (In thousands, except per share

amounts) Revenue before provision for doubtful accounts

$ 726,811 $ 627,183 Provision for doubtful accounts (10,147

) (10,370 ) Revenue 716,664 616,813

Salaries, wages and benefits (including

equity-based compensation expense of $7,396 and $6,956,

respectively)

397,221 341,028 Professional fees 46,317 39,991 Supplies 28,969

26,685 Rents and leases 20,560 14,806 Other operating expenses

87,677 70,247 Depreciation and amortization 36,270 27,975 Interest

expense, net 42,789 37,714 Gain on foreign currency derivatives -

(410 ) Transaction-related expenses 4,532

26,298 Total expenses 664,335 584,334

Income before income taxes 52,329 32,479 Provision for

income taxes 13,951 7,110 Net income

38,378 25,369 Net loss attributable to noncontrolling interests

185 319 Net income attributable to

Acadia Healthcare Company, Inc. $ 38,563 $ 25,688

Constant Currency Reconciliation of Adjusted

Income Attributable to Acadia Healthcare Company, Inc. to

Net Income Attributable to Acadia Healthcare Company, Inc.

(g) (Unaudited) Net income attributable to Acadia

Healthcare Company, Inc. $ 38,563 $ 25,688 Provision for income

taxes 13,951 7,110 Income attributable

to Acadia Healthcare Company, Inc. before income taxes $ 52,514 $

32,798 Adjustments to income: Gain on foreign currency

derivatives (b) - (410 ) Transaction-related expenses (c) 4,532

26,298 Income tax provision reflecting tax effect of adjustments to

income (d) (13,240 ) (12,852 ) Adjusted income

attributable to Acadia Healthcare Company, Inc. $ 43,806 $ 45,834

Weighted-average shares outstanding - diluted 86,908 83,420

Adjusted income attributable to Acadia Healthcare Company,

Inc. per diluted share $ 0.50 $ 0.55 See

footnotes on page 11.

Acadia Healthcare Company, Inc. Footnotes

We have included certain financial measures in this press

release, including EBITDA, Adjusted EBITDA, Adjusted income, and

constant currency adjusted income, which are “non-GAAP financial

measures” as defined under the rules and regulations promulgated by

the SEC. We define EBITDA as net income adjusted for net loss

attributable to noncontrolling interests, income tax provision, net

interest expense and depreciation and amortization. We define

Adjusted EBITDA as EBITDA adjusted for equity-based compensation

expense, gain on foreign currency derivatives and

transaction-related expenses. We define Adjusted income as net

income adjusted for provision for income taxes, gain on foreign

currency derivatives, transaction-related expenses and income tax

provision reflecting tax effect of adjustments attributable to

Acadia. EBITDA, Adjusted EBITDA, Adjusted income and

constant currency adjusted income are supplemental measures of our

performance and are not required by, or presented in accordance

with, generally accepted accounting principles in the United States

(“GAAP”). EBITDA, Adjusted EBITDA, Adjusted income and constant

currency adjusted income are not measures of our financial

performance under GAAP and should not be considered as alternatives

to net income or any other performance measures derived in

accordance with GAAP or as an alternative to cash flow from

operating activities as measures of our liquidity. Our measurements

of EBITDA, Adjusted EBITDA, Adjusted income and constant currency

adjusted income may not be comparable to similarly titled measures

of other companies. We have included information concerning EBITDA,

Adjusted EBITDA, Adjusted income and constant currency adjusted

income in this press release because we believe that such

information is used by certain investors as measures of a company’s

historical performance. We believe these measures are frequently

used by securities analysts, investors and other interested parties

in the evaluation of issuers of equity securities, many of which

present EBITDA, Adjusted EBITDA, Adjusted income and constant

currency adjusted income when reporting their results. Our

presentation of EBITDA, Adjusted EBITDA, Adjusted income and

constant currency adjusted income should not be construed as an

inference that our future results will be unaffected by unusual or

nonrecurring items. Foreign currency exchange rate

fluctuations affect the amounts reported from translating U.K.

revenues and expenses into USD. These rate fluctuations can have a

significant effect on our reported operating results. As a

supplement to our reported operating results, we present constant

currency financial information. We use constant currency financial

information to provide a framework to assess how our business

performed excluding the effects of changes in foreign currency

translation rates. Management believes this information is useful

to investors to facilitate comparison of operating results and

better identify trends in our businesses. To calculate financial

information on a constant currency basis, financial information in

the current period for amounts recorded in GBP is translated into

USD at the average exchange rates that were in effect during the

comparable period of the prior year (rather than the actual

exchange rates in effect during the current year period).

The Company is not able to provide a reconciliation of projected

Adjusted EBITDA and adjusted earnings per diluted share, where

provided, to expected results due to the unknown effect, timing and

potential significance of transaction-related expenses and the tax

effect of such expenses. (a) Represents the equity-based

compensation expense of Acadia. (b) Represents the change in

fair value of foreign currency derivatives purchased by Acadia

related to (i) acquisitions in the U.K. and (ii) transfers of cash

between the U.S. and U.K. under the Company’s cash management and

foreign currency risk management programs. (c) Represents

transaction-related expenses incurred by Acadia related to

acquisitions. (d) Represents the income tax provision

adjusted to reflect the tax effect of the adjustments to income

based on tax rates of 24.5% and 21.9% for the three months ended

March 31, 2017 and 2016, respectively. The adjusted income tax

provision for the three months ended March 31, 2017 excludes the

impact of adopting ASU 2016-09 "Improvements to Employee

Share-Based Payment Accounting” of approximately $1.7 million.

(e) Calculated on a constant currency basis whereby

financial information in the current period for amounts recorded

GBP is translated into USD at the average exchange rates in effect

during the comparable period of the prior year (rather than the

actual exchange rates in effect during the current year period).

The exchange rate used for the three months ended March 31, 2016 is

1.43.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170425006602/en/

Acadia Healthcare Company, Inc.Gretchen Hommrich,

615-861-6000Director, Investor Relations

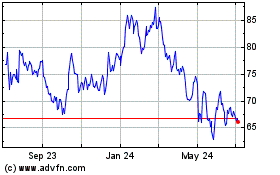

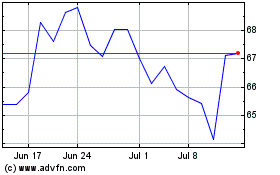

Acadia Healthcare (NASDAQ:ACHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Acadia Healthcare (NASDAQ:ACHC)

Historical Stock Chart

From Apr 2023 to Apr 2024