UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

☑

Filed by the

Registrant

☐

Filed by a Party other

than the Registrant

|

|

|

|

|

Check the appropriate

box:

|

|

☐

|

|

Preliminary Proxy

Statement

|

|

☐

|

|

CONFIDENTIAL, FOR USE OF THE

COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2))

|

|

☐

|

|

Definitive Proxy

Statement

|

|

☑

|

|

Definitive Additional

Materials

|

|

☐

|

|

Soliciting Material Pursuant to

ss.240.14a-12

|

GENERAL MOTORS COMPANY

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

☑

|

|

No fee required.

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

|

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to

which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

|

|

☐

|

|

Fee paid previously with

preliminary materials.

|

|

☐

|

|

Check box if any part of the fee

is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing.

|

|

|

|

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

|

GENERAL MOTORS COMPANY

2016 CHAIRMAN’S LETTER

We are here to win.

To Our Shareholders,

|

|

|

|

|

2016 was a very strong year for General Motors, one that included the launch of dozens of award-winning products around the world, record sales and

earnings, substantial return of capital to shareholders and remarkable progress in our drive to define and lead the future of personal mobility. As always, we continued to put the customer at the center of everything we do as we recast the company

to win in a rapidly changing world.

As the graphics on this page show, our company’s

financial performance in 2016 set new records on a number of key metrics and extended our track record of consistently improving results.

A telling indicator of this improvement is our

earnings-per-share

performance. Since

2013,

EPS-diluted-adjusted

has grown 92 percent from $3.18 to a record $6.12 in 2016. We fully expect to grow EPS further in 2017.

Other records for 2016 include net revenue, EBIT-adjusted, EBIT-adjusted margin and adjusted automotive free cash flow. As we have for several years, we achieved our

financial commitments in 2016 and remain on track to achieve our longer-term goals.

|

|

|

2016 FINANCIAL RESULTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

92.5%

EPS-diluted-adjusted

growth vs. 2013*

|

|

|

|

46.1%

EBIT-adjusted

growth vs. 2013*

|

|

|

|

36.5%

Basis-point growth

in EBIT-adjusted

margins vs. 2013

|

|

*

|

Non-GAAP

financial measure. See Page 16 for more information.

|

|

**

|

Represents core operating performance, excludes recalls.

|

1

|

|

|

|

|

$18 billion returned

to shareholders since 2012

|

|

Creating Value for Shareholders

We continue to execute a very transparent and disciplined capital allocation framework that deploys capital where it is expected to deliver higher returns for our owners

over the long term. After appropriately reinvesting in the business and maintaining our investment-grade balance sheet, we have committed to return all available free cash flow to shareholders.

In 2016, we returned $4.8 billion to shareholders through dividends and share repurchases.

From 2012 through 2016, we returned $18 billion to shareholders, which represents more than 90 percent of free cash flow.

In January of this year, the GM board approved an additional $5 billion in common stock repurchases under our share-repurchase program, bringing the total

authorization under the program to $14 billion. In 2015 and 2016, the company repurchased a total of $6 billion in common stock.

Our total shareholder return in 2016 was 7.5 percent, highest among major global automakers.

GM is also an industry leader in return on invested capital. At the end of 2016, our ROIC-adjusted

was 28.9 percent. Importantly, we have shown the willingness and discipline to take actions when we believe we can prioritize our resources to achieve higher returns.

We demonstrated this discipline most significantly in March 2017, when we announced the sale of our Opel/Vauxhall and GM Financial European operations to the PSA Group,

a transaction that will unlock significant value for our shareholders and allow us to focus more intently on higher-return opportunities. We expect the transaction to

|

2 2016 CHAIRMAN’S LETTER

close in 2017 and immediately improve GM’s EBIT-adjusted, EBIT-adjusted margin and adjusted automotive free cash flow

and

de-risk

our balance sheet. It will also allow GM to participate in the future success of PSA through warrants to purchase PSA shares. GM and PSA will collaborate on future technology development and

deployment, and existing supply agreements for our Holden and Buick brands.

Winning Vehicles

GM’s financial results are driven by great cars, trucks and crossovers. Every vehicle we produce starts with a foundational commitment to safety, quality and

performance, and an unrelenting drive to lead in each segment in which we compete. Nothing makes this point better than the 2017 Chevrolet Bolt EV.

Bolt EV is the

world’s first electric vehicle to combine long range with affordable pricing. Bolt EV gets an

EPA-estimated

238 miles per charge at a price below $30,000 after government incentives.

Deliveries began in the U.S. late last year, as did a number of third-party awards. Among its many honors, Bolt EV has been named the 2017 North American Car of the

Year, the 2017

Motor Trend

Car of the Year,

Green Car Journal’s

2017 Green Car of the Year and one of

Car and Driver’s

10 Best Cars for 2017.

Bolt EV is a tremendous opportunity for us – an outstanding

zero-emissions

car that is fun to drive, breaks new ground and

puts our commitment to new technology in customers’ hands. And it’s just one of many great new models we launched around the world last year, including the Cadillac XT5 luxury crossover, Chevrolet Cruze sedan and hatchback, GMC Acadia

crossover, Buick LaCrosse premium sedan, Opel Mokka X crossover and Baojun 310 and Chevrolet Onix hatchbacks, to name a few.

Our global product offensive continues

in 2017 with the right products in the right markets at the right time, including a number of launches aimed at the heart of the

red-hot

North American crossover segment. Among our major launches for 2017 are

four

all-new

crossovers – Chevrolet Traverse and Equinox, GMC Terrain and Buick Enclave – as well as exciting new sedans such as the Cadillac CT6

Plug-In

Hybrid and the Opel Insignia sedan.

Between 2017 and 2020, we expect approximately 38 percent of our volume to come from recently launched vehicles, which is

up from 26 percent the past six years. Importantly, we expect more than 50 percent of these launches to be our more-profitable trucks, crossovers and SUVs.

Strong Brands

Our focus on great cars, trucks and crossovers also allowed us

to strengthen our brands in 2016.

In the U.S., GM brands had more segment winners than any other automaker in the J.D. Power Vehicle Dependability, Initial Quality

and Automotive Performance Execution and Layout (APEAL) studies;

Consumer Reports

recommended 12 GM models in its Annual Reliability Survey; and IHS Markit recognized GM as the automaker with the

GM BRANDS EARNED MORE

SEGMENT AWARDS

THAN ANY

OTHER AUTOMAKER IN KEY

J.D. POWER STUDIES

|

|

|

|

|

|

|

U.S. VEHICLE

DEPENDABILITY

8

Award-recognized

models

(a)

|

|

|

|

|

|

U.S. VEHICLE

INITIAL QUALITY

7

Award-recognized

models

(b)

|

|

|

|

|

|

U.S. AUTOMOTIVE

PERFORMANCE,

EXECUTION AND

LAYOUT

6

Award-recognized

models

(c)

|

|

|

|

(a)

|

Buick Encore, Buick LaCrosse, Buick Verano, Chevrolet Camaro, Chevrolet Equinox, Chevrolet Malibu, Chevrolet Silverado HD and GMC Yukon

|

|

(b)

|

Buick Cascada, Chevrolet Equinox, Chevrolet Silverado HD, Chevrolet Silverado LD, Chevrolet Spark, Chevrolet Tahoe and GMC Terrain

|

|

(c)

|

Chevrolet Sonic, Chevrolet Camaro, Chevrolet Colorado, Chevrolet Tahoe, Buick Cascada and GMC Sierra HD

|

3

|

|

|

|

|

Industry sales leader in North America,

including the U.S., and

South America

|

|

highest overall U.S. customer loyalty for the second consecutive year. In China, four GM brands – Baojun, Buick, Chevrolet and Wuling –

accounted for nine segment winners in the China Automobile Customer Satisfaction Index and seven segment winners in the J.D. Power Vehicle Dependability, Initial Quality and APEAL studies. And in Europe, Opel ADAM placed first among small cars in

the J.D. Power Vehicle Dependability Study.

Among individual brands, Cadillac had its best

global sales performance since 1986 and is now enjoying its highest average transaction prices ever. In China, Cadillac was named Luxury Car Brand of the Year by Auto.Sina.com.

In 2016, Chevrolet had its best U.S. retail sales performance in 10 years. In fact, Chevrolet has

grown its U.S. retail market share faster than any other full-line brand for the last two consecutive years.

Buick marked its fourth straight year of record global sales – more than 1.4 million vehicles, the most in its

113-year

history. Buick was also one of only two brands in the industry last year to earn a National Highway Traffic Safety Administration five-star Overall Vehicle Safety Score for every model in its lineup.

GMC last year had its best U.S. retail sales performance in 12 years and now has the highest

average transaction prices of all

non-luxury

brands.

Regional Highlights

In 2016, GM remained the industry sales leader in North America, including the U.S., and South America. Around the world, we recorded our fourth consecutive year of

record global sales.

|

4 2016 CHAIRMAN’S LETTER

|

|

|

|

|

In North America, we achieved record earnings last year and exceeded our

10-percent-margin

goal for the second

consecutive year. GM overall enjoyed its highest U.S. retail sales volume since 2007 and grew its year-over-year retail market share faster than any other full-line automaker.

In the U.S., we support a strong and competitive economy and automotive industry. The U.S. is our home market, and we are committed to a manufacturing base that is

competitive globally and grows jobs, while safeguarding the environment and promoting vehicle safety. We believe that long-term investment in sustainable manufacturing is good for our investors, dealers, suppliers, employees and customers.

In January of this year, we announced plans to invest $1 billion in our U.S. manufacturing

operations, which along with other actions, will create or retain up to 7,000 U.S. jobs in the next few years. In March, we announced plans to add an additional 900 jobs in Michigan over the next 12 months. These latest moves support our ongoing

strategy to streamline and simplify our operations, gain efficiencies and grow our business. They are part of our continued strong commitment to our U.S. operations, where we have invested more than $21 billion since 2009.

In China, GM and its joint-venture partners launched 13 new or refreshed models in 2016 and sold a

record 3.87 million vehicles. In 2017, we plan to launch 18 more models, with a particular emphasis on higher-margin SUVs, crossovers and luxury vehicles. Between 2016 and 2020, GM will introduce more than 10 New Energy Vehicles (NEVs) to the

China market.

In South America in 2016, Chevrolet continued as the market-share leader in

Brazil and throughout the region. In Brazil, we continued to position the company for strong growth when macroeconomic conditions improve.

In Europe, Opel/Vauxhall, notwithstanding the negative impact of Brexit, increased sales by 4 percent in 2016 and reduced losses by about $600 million.

Adjacent Business Growth

In addition to our core business, we see excellent growth and profit opportunities in a number of

adjacent areas.

GM Financial continues to grow as our full-captive finance company, providing

coverage for more than 85 percent of our global sales footprint at the close of 2016. The business is growing both in terms of profitability and long-term benefits, especially customer satisfaction and retention.

Another excellent opportunity is our aftermarket business for service parts and accessories. Robust

growth in recent years in the number of GM vehicles on the road – especially in North America and China – has created outstanding opportunities to grow revenue and profitability in this high-margin business.

A third area with great potential is our OnStar vehicle connectivity service. We have now surpassed

12 million OnStar-connected vehicles around the world, including nearly 40 models with 4G LTE, Apple CarPlay and Android Auto – the largest fleet

|

|

|

5

|

|

|

|

|

|

|

in the industry by far. In 2016, use of OnStar’s 4G data connection grew by about 200 percent to more than 4.2 million gigabytes –

the equivalent of more than 17 million hours of streaming video. Globally, our customers now interact with myChevrolet, myCadillac, myBuick, myGMC and our other branded mobile apps on average more than 18 million times a month. We expect

OnStar growth to continue at a rapid pace for years to come and are working both to monetize the data and use it to improve the customer experience.

All told, we expect adjacent businesses to contribute an incremental $2 billion to GM’s EBIT in 2019 versus 2015.

Driving Efficiencies

We continue to maintain an intense focus on reducing costs and improving efficiency, both to improve

our current results and position the company to perform well throughout the business cycle.

Earlier this year, we increased our cost efficiency target by $1 billion to $6.5 billion through 2018. We expect these savings will more than offset our

incremental investments in technology, engineering and brand building. At the end of 2016, we had already achieved $4 billion toward our goal.

Throughout the company, we operate on the belief that everything can be made better. In 2016, our Operational Excellence team chartered 1,400 efficiency projects that we

expect to deliver $1.5 billion in business impact. I’m confident we will do much more.

Enhancing Life’s Journey

At GM, we are committed to our core values of customers, relationships and excellence. We act with integrity, take accountability for results, do what we say we are

going to do and do the right thing, even when it is hard.

We are working to create a company

that stakeholders value, people aspire to work for and communities are proud to embrace. We start with a clear understanding of who we are and why we are here. We work every day to earn customers for life, create brands that inspire passion and

loyalty, translate breakthrough technologies into vehicles and experiences that people love, serve and improve the communities in which we live and work around the world and strive to build the most valued automotive company.

In 2016, we revamped our global philanthropy and corporate-giving strategy to better reflect and

align our priorities as a responsible corporate citizen, specifically focusing on areas where we believe we can have a direct impact. Around the world, we now focus on expanding and improving science, technology, engineering and math (STEM)

education, advancing vehicle and road safety and promoting economic empowerment in the communities where we live and work. For businesses to thrive, we know that communities must flourish.

GM Student Corps is an innovative summer internship program in which GM retirees and college

students mentor high school students working on community-service

|

6 2016 CHAIRMAN’S LETTER

|

|

|

|

|

projects in their own schools and neighborhoods. In 2016, GM Student Corps involved 130 students from Detroit-area high schools. Separately, through

our employee volunteer program, more than 12,000 GM employees volunteered nearly 110,000 hours in 2016 with 148 different nonprofit organizations.

GM is an industry leader in using technology to solve big problems, improve the planet and enhance peoples’ lives. In 2016, we achieved our 2020 commitment to

generate 125 megawatts of clean energy four years ahead of schedule. Building on that success, we announced a plan to source all electrical power for our 350 facilities in 59 countries with renewable energy by 2050 – the only automaker to make

such a commitment.

2016 also marked a record year for our landfill-free commitment. We added 23

new sites last year and now have a total of 152 landfill-free sites worldwide – more than any other automaker – including 100 manufacturing sites. This exceeds our 2020 landfill-free target – again, four years ahead of schedule. We

continue to pursue more landfill-free operations with the goal of becoming a

zero-waste

company.

We are also expanding our focus to embrace the circular economy and the opportunities it offers to drive broader social and economic benefits. One example is our

water-bottle recycling effort in Michigan. Working with the city of Flint and six regional GM facilities, we collected more than four million used water bottles in 2016 and worked with local companies and organizations to recycle the bottles into

insulating fleece used in coats for the homeless,

air-filtration

components for use at GM facilities and a noise-reducing fabric that covers the engine of our Chevrolet Equinox crossover.

Building a Workplace of Choice

When it comes to the sustainability of our workforce, we are investing in both our current and

future employees. We want people to know that if they truly want to make the world a better place, they can make a real difference here.

From boardroom to dealer showroom, we are committed to building a dynamic and diverse team that shares a passion for solving the world’s mobility challenges. And

we’re creating a culture, an energy and an attitude that says anything is possible.

Our

team has changed rapidly in recent years. Today, 35 percent of our salaried employees have worked at the company less than four years. Many of our new hires come from the same sources that feed the global tech economy. In fact, our applications

from Silicon Valley were up more than 100 percent in 2016. Around the world, GM job applications were up more than 24 percent last year.

At GM, we recognize growing concerns around the world about the impact of globalization and technology on labor markets, and we are committed to helping our employees

acquire and update the skills they need for success in today’s economy.

In 2014, we

launched our “Shifting Gears” program in partnership with the U.S. Army and Raytheon Company to help soldiers transition from military service into successful careers as GM service technicians at more than 4,200 GM dealerships across the

U.S. The initiative is part of GM’s longstanding commitment to help veterans succeed by connecting them with education and career opportunities beyond their military service.

|

|

|

7

|

|

|

|

|

|

|

|

|

|

|

Our goal:

to be nothing less than

a global best employer

|

In 2016, we introduced a new program at GM called Take 2, a series of

12-week

internships for experienced technical professionals – primarily women – eager to relaunch their careers after being out of the workforce for two or more years. Participants receive technical training, professional development and

personalized mentoring with GM leaders that prepares them to pursue opportunities in engineering, IT, finance, customer care and other critical functions in GM’s global workforce.

Take 2 has been an effective and popular program for helping parents, caregivers and trailing spouses return to the workforce. In the first year, we offered

85 percent of participants a full-time position, and had a 96 percent acceptance rate. We recently accepted our third cohort, which is larger than the first two cohorts combined, and we expect the program to continue growing as we expand

to other functions and regions this fall.

Around the world, we are dedicated to empowering a diverse and inclusive workplace that values the contributions of all

employees. We know that a diverse workforce promotes fresh, innovative thinking that translates into a competitive advantage for GM and winning products for our customers.

Throughout the company, we offer collaborative workplaces and an enterprise-wide commitment to peoples’ life choices. Nearly 3,000 employees took advantage of our

tuition assistance programs in 2016, and nearly 800 more participated in our well-established technical and professional education programs. We also believe that fair and equitable pay is an essential element of any successful business model, and we

were proud in 2016 to have signed the White House Equal Pay Pledge.

One way we measure engagement at GM is through a global biennial “Workplace of

Choice” survey. Participation rates in our 2016 survey were at an

all-time

high, including 86 percent for salaried employees. Engagement levels for salaried employees improved 50 percent from

2012 to 2016, and overall employee engagement levels at GM (including hourly workers, who participated in the survey starting in 2016) are now significantly above the global average. Our goal is to be nothing less than a global best employer.

To win in tomorrow’s increasingly sophisticated auto industry, we also have a responsibility to help develop a pool of capable and highly educated potential

employees. In 2016, GM filled a position in a STEM role every 26 minutes, and we expect our need for STEM graduates will only continue to grow in the years to come.

As part of preparing tomorrow’s workforce, we support a number of local, national and international efforts to advance STEM education, including FIRST Robotics, A

World in Motion, Partners for the Advancement of Collaborative Engineering Education (PACE) and a new organization we are very excited to support, Girls Who Code (GWC).

GWC is a U.S. nonprofit committed to closing the technology gender gap. Research suggests that programs designed specifically to spark and maintain girls’ interest

in STEM from middle school into the workforce could triple the number of women in computing in the next 10 years. Earlier this year, we provided an initial grant of $250,000 to help expand GWC’s Clubs programs in underserved communities. These

programs further GWC’s mission to promote computer science education for girls by providing free after-school activities in schools, universities and community centers.

8 2016 CHAIRMAN’S LETTER

Defining the Future of Personal Mobility

Perhaps nothing GM is doing today is more important for society’s long-term future than leading the transformation of personal mobility.

The convergence of connectivity, alternative propulsion, autonomous vehicles and the sharing economy is truly allowing us to stretch the boundaries of what is possible

and develop vehicles that are safer, smarter, cleaner and more energy-efficient than ever before.

In 2016, we made remarkable progress in each of these areas, and

our work continues in earnest in 2017.

GM is the industry leader in vehicle connectivity with more

4G-equipped

models than

the rest of the industry combined. In 2016, OnStar celebrated its 20

th

anniversary by surpassing 1.5 billion customer interactions, and the growth rate is astounding. It took 19 years to

reach 1 billion customer interactions. Eighteen months later, we hit 1.5 billion, and the pace continues to accelerate.

Another area where we are

changing the industry is alternative propulsion, especially electric vehicles. New battery technologies have helped us launch cars like the groundbreaking Chevrolet Bolt EV, which will also serve as our platform for future autonomous vehicle

development. When it comes to affordable

all-electric

propulsion with extraordinary capability, no other car on the road comes close.

In 2016, we also launched the new Chevrolet Malibu Hybrid, which gets an

EPA-estimated

city-highway fuel economy of 47 miles per

gallon, and ramped up production of the second-generation Chevrolet Volt, which offers a pure EV range of 53 miles and a gasoline equivalent of 106 MPG. Launching this year is the Cadillac CT6

Plug-In

Hybrid,

which achieves an

EPA-estimated

city-highway fuel economy equivalent of 62 MPG.

We are also working to develop new

clean-energy technologies, such as hydrogen fuel cells that hold great potential for land, sea and air applications. A modified Chevrolet Colorado is being evaluated by the U.S. Army to determine whether fuel cells are a viable propulsion system for

military use. And in an industry first, GM and Honda have announced a joint venture to mass produce an advanced hydrogen fuel cell system beginning around 2020.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

More

4G-equipped

models than the rest of

the industry combined

|

|

|

9

|

|

|

|

|

|

|

|

|

|

|

First high-volume

automaker to build

autonomous test vehicles

in a mass-production facility

|

In other areas of the business, technology is

becoming available that will make driving dramatically safer and more convenient. From active-safety features such as Adaptive Cruise Control and forward collision alerts to Super Cruise and fully self-driving vehicles, our engineers and technology

experts are developing vehicles that meet or exceed the same strict standards for safety and quality that we’ve been building into traditional vehicles for generations.

Earlier this year, we became the first automaker to introduce advanced

Vehicle-to-Vehicle

(V2V) communications on the Cadillac CTS. V2V uses dedicated wireless communications to share information such as vehicle speed and direction. V2V is

an important safety feature on its own, but it also lays the groundwork for a connected, safer future down the road.

Another advancement that will make driving

safer and easier is Super Cruise, a highly automated driving technology from Cadillac that enables hands-free driving on the highway, even in

stop-and-go

traffic.

Cadillac will introduce Super Cruise on the CT6 this fall.

Beyond Super Cruise, GM has a very active effort to develop a vehicle that can operate without a driver.

We believe this technology will fundamentally change the way vehicles are used, and because more than 90 percent of traffic accidents are due to human error, this technology will be a primary enabler for reducing traffic fatalities. We also

think we can use this technology to make transportation available to many people without good transportation options today.

Last year, GM acquired San

Francisco-based Cruise Automation, a leading Silicon Valley startup in autonomous technology. The Cruise team specializes in developing the software that drives our autonomous vehicles and is responsible for the commercialization of our

autonomous-vehicle business. We now have more than 50 autonomous test vehicles operating in San Francisco, Scottsdale and Metro Detroit, with plans to increase the fleet to hundreds of test vehicles by the end of 2017.

Right now, all of our autonomous test vehicles are accompanied by trainers who can assume control of the vehicle, if necessary. Not until we have assured both ourselves

and the appropriate regulatory agencies that the system is safe will we remove the trainers.

Our first application of autonomous technology will be in ridesharing

fleets in major U.S. cities, and we have been working with the appropriate state and local governments to this end. When we deploy vehicles into ridesharing fleets, GM will retain control of the vehicles to support safe operation. These fleets will

give many people the opportunity to experience this truly extraordinary technology.

A fourth area where we are breaking new ground is shared mobility. Last year,

we launched our own

car-sharing

service called Maven, which we are scaling up quickly. Maven now operates a fleet of about 10,000 GM vehicles in 17 U.S. cities, including our Express Drive short-term rental

program for Lyft drivers. Customers use a mobile app to locate and reserve a vehicle and have already logged more than 100 million miles in Maven-branded GM vehicles.

10 2016 CHAIRMAN’S LETTER

In Los Angeles, Maven is collaborating with the city’s Sustainable City pLAn to help create smart transportation

options that enhance mobility, create jobs and ease parking and congestion. Maven is adding more than 100 Bolt EVs to its Los Angeles fleet, which will be capable of covering 250,000

all-electric

miles per

month.

This is a new business area for us – one that is allowing us to expand the transportation options we offer our customers, as well as improve our

ability to innovate and iterate at the speed of today’s leading technology companies.

A Different Company

Again, 2016 was a very strong year for GM, made possible by the fact that we are a fundamentally different company than we were just a few years ago.

GM is a more profitable, more disciplined and more focused company. We are also more diverse, more responsive to the needs of our customers and more determined than

ever to take our commitment to clean energy and climate resilience mainstream.

After three years of record-setting operating performance and a series of bold and

decisive actions, we have built strong momentum at GM. In 2017, we continue to accelerate. As always, we are putting the customer at the center of everything we do, as we continue to meet our commitments and deploy our resources to deliver the

highest possible returns over the long term.

I see endless opportunities at GM to build not just a better company, but a better world – by delivering

transportation solutions that are safer, simpler and better, and enhancing life’s journey for people around the world.

By living our values and doing what we

say we will do, I am confident we will achieve our goals for our customers and shareholders for years to come.

Respectfully,

|

|

|

|

Mary Barra

Chairman & CEO

April 25, 2017

|

11

BOARD OF DIRECTORS

As of

April 1, 2017

|

|

|

|

|

|

|

MARY BARRA

Chairman & Chief Executive

Officer,

General Motors Company,

Joined Board 01/15/14

TIM SOLSO

Independent Lead Director,

General Motors Company and

Retired Chairman & Chief

Executive Officer, Cummins Inc.,

Joined Board 06/12/12

JOE ASHTON

Retired Vice President,

United Auto Workers,

Joined Board 08/11/14

|

|

LINDA GOODEN

Retired Executive Vice

President,

Information Systems & Global

Solutions, Lockheed Martin

Corporation,

Joined Board 02/05/15

JOE JIMENEZ

Chief Executive Officer, Novartis AG,

Joined Board 06/09/15

JANE MENDILLO

Retired President & Chief Executive Officer,

Harvard Management Company,

Joined Board 06/07/16

MIKE MULLEN

Former Chairman, Joint Chiefs of Staff,

Joined Board 02/01/13

|

|

JIM MULVA

Retired Chairman & Chief

Executive Officer, ConocoPhillips,

Joined Board 06/12/12

PAT RUSSO

Chairman, Hewlett Packard

Enterprise Company,

Joined Board 07/24/09

TOM SCHOEWE

Retired Executive Vice President

& Chief Financial Officer,

Wal-Mart

Stores, Inc.,

Joined Board 11/14/11

CAROL STEPHENSON

Retired Dean, Ivey Business School,

The University of Western Ontario,

Joined Board 07/24/09

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LEADERSHIP TEAM

As of April 1, 2017

|

|

|

|

|

|

|

MARY BARRA

Chairman & Chief Executive

Officer

DAN AMMANN

President

ALAN BATEY

Executive Vice President

& President, North America

DAN BERCE

Senior Vice President

President & CEO, GM Financial

ALICIA BOLER-DAVIS

Executive Vice President,

Global Manufacturing

TONY CERVONE

Senior Vice President,

Global Communications

MARGARET CURRY

Vice President, Tax

JOHAN DE NYSSCHEN

Executive Vice President

& President, Cadillac

|

|

BARRY ENGLE

Executive Vice President

& President, South America

CRAIG GLIDDEN

Executive Vice President

& General Counsel,

Legal and Public Policy

STEFAN JACOBY

Executive Vice President

& President, GM International

VICTORIA MCINNIS

Vice President, Audit

RANDY MOTT

Senior Vice President,

Global Information Technology

& Chief Information Officer

KARL-THOMAS NEUMANN

Executive Vice President

& President, Europe

JOHN QUATTRONE

Senior Vice President,

Global Human Resources

|

|

MARK REUSS

Executive Vice President,

Global Product Development,

Purchasing and Supply Chain

CHUCK STEVENS

Executive Vice President

& Chief Financial Officer

DHIVYA SURYADEVARA

Vice President, Finance and Treasurer

JILL SUTTON

Deputy General Counsel

& Corporate Secretary

TOM TIMKO

Vice President, Controller

& Chief Accounting Officer

MATT TSIEN

Executive Vice President

& President, GM China

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 2016 CHAIRMAN’S LETTER

2016 FINANCIAL

HIGHLIGHTS

|

|

|

|

|

|

|

|

|

|

|

$166B

|

|

|

|

$9.4B

|

|

|

|

$6.00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WORLDWIDE NET

SALES & REVENUE

|

|

|

|

NET INCOME ATTRIBUTABLE

TO COMMON

STOCKHOLDERS

|

|

|

|

DILUTED EARNINGS

PER COMMON SHARE

|

Source: Bloomberg

13

VEHICLE SALES

AND NET

REVENUE

|

|

|

|

|

|

|

|

|

|

|

(in millions, except units per share & employment)

|

|

2015

|

|

|

2016

|

|

|

VEHICLE SALES, INCLUDING JOINT VENTURES

(000’s units)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GMNA

|

|

|

3,613

|

|

|

|

3,630

|

|

|

GME

|

|

|

1,176

|

|

|

|

1,207

|

|

|

GMIO

|

|

|

4,525

|

|

|

|

4,587

|

|

|

GMSA

|

|

|

645

|

|

|

|

584

|

|

|

|

|

|

|

|

|

|

|

|

|

Worldwide Vehicle Sales

|

|

|

9,959

|

|

|

|

10,008

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCIAL RESULTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Worldwide Net Sales & Revenue

|

|

$

|

152,356

|

|

|

$

|

166,380

|

|

|

Net Income Attributable to Common Stockholders

|

|

$

|

9,687

|

|

|

$

|

9,427

|

|

|

Earnings Before Interest and Income Taxes - Adjusted*

|

|

$

|

10,814

|

|

|

$

|

12,530

|

|

|

Diluted Earnings Per Common Share

|

|

$

|

5.91

|

|

|

$

|

6.00

|

|

|

|

|

|

|

|

|

|

|

|

|

AUTOMOTIVE LIQUIDITY & KEY OBLIGATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AVAILABLE AUTOMOTIVE LIQUIDITY

|

|

|

|

|

|

|

|

|

|

Cash and Marketable Securities

|

|

$

|

20,340

|

|

|

$

|

21,600

|

|

|

Credit Facilities

|

|

|

12,152

|

|

|

|

14,035

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Available Automotive Liquidity

|

|

$

|

32,492

|

|

|

$

|

35,635

|

|

|

|

|

|

|

KEY AUTOMOTIVE OBLIGATIONS

|

|

|

|

|

|

|

|

|

|

Debt

|

|

$

|

8,765

|

|

|

$

|

10,752

|

|

|

Underfunded U.S. Pension

|

|

|

10,414

|

|

|

|

7,205

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Automotive Obligations

|

|

$

|

19,179

|

|

|

$

|

17,957

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYMENT - YEAR END

(000’s)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GMNA

|

|

|

115

|

|

|

|

124

|

|

|

GME

|

|

|

36

|

|

|

|

38

|

|

|

GMIO

|

|

|

32

|

|

|

|

32

|

|

|

GMSA

|

|

|

24

|

|

|

|

22

|

|

|

GM Financial

|

|

|

8

|

|

|

|

9

|

|

|

|

|

|

|

|

|

|

|

|

|

Worldwide Employment

|

|

|

215

|

|

|

|

225

|

|

|

*

|

Includes GM Financial on an Earnings Before Tax (EBT)-adjusted basis

|

14 2016 CHAIRMAN’S LETTER

FORWARD-LOOKING

STATEMENTS

In this document and in reports we subsequently file and have previously filed with the U.S. Securities and Exchange Commission (the “SEC”) on Forms

10-K

and

10-Q

and file or furnish on Form

8-K,

and in related comments by our management, we use words like “anticipate,”

“appears,” “approximately,” “believe,” “continue,” “could,” “designed,” “effect,” “estimate,” “evaluate,” “expect,” “forecast,”

“goal,” “initiative,” “intend,” “may,” “objective,” “outlook,” “plan,” “potential,” “priorities,” “project,” “pursue,” “seek,”

“should,” “target,” “when,” “will,” “would,” or the negative of any of those words or similar expressions to identify forward-looking statements that represent our current judgment about possible

future events. In making these statements we rely on assumptions and analyses based on our experience and perception of historical trends, current conditions and expected future developments as well as other factors we consider appropriate under the

circumstances. We believe these judgments are reasonable, but these statements are not guarantees of any events or financial results, and our actual results may differ materially due to a variety of important factors, both positive and negative.

These factors, which may be revised or supplemented in subsequent reports on SEC Forms

10-Q

and

8-K,

include among others the following: (1) our ability to deliver

new products, services and customer experiences in response to new participants in the automotive industry; (2) our ability to fund and introduce new and improved vehicle models that are able to attract a sufficient number of consumers;

(3) the success of our

full-size

pick-up

trucks and SUVs, which may be affected by increases in the price of oil; (4) global automobile market sales volume,

which can be volatile; (5) aggressive competition in China; (6) the international scale and footprint of our operations which exposes us to a variety of domestic and foreign political, economic and regulatory risks, including the risk of

changes in existing, the adoption of new, or the introduction of novel interpretations of, laws regulations, policies or other activities of governments, agencies and similar organizations particularly laws, regulations and policies relating to free

trade agreements, vehicle safety including recalls, and, including such actions that may affect the production, licensing, distribution or sale of our products, the cost thereof or applicable tax rates; (7) our joint ventures, which we cannot

operate solely for our benefit and over which we may have limited control; (8) our ability to comply with extensive laws and regulations applicable to our industry, including those regarding fuel economy and emissions; (9) costs and risks

associated with litigation and government investigations including the potential imposition of damages, substantial fines, civil lawsuits and criminal penalties, interruptions of business, modification of business practices, equitable remedies and

other sanctions against us in connection with various legal proceedings and investigations relating to our various recalls; (10) our ability to comply with the terms of the DPA; (11) our ability to maintain quality control over our

vehicles and avoid material vehicle recalls and the cost and effect on our reputation and products; (12) the ability of our suppliers to deliver parts, systems and components without disruption and at such times to allow us to meet production

schedules; (13) our dependence on our manufacturing facilities around the world; (14) our highly competitive industry, which is characterized by excess manufacturing capacity and the use of incentives and the introduction of new and

improved vehicle models by our competitors; (15) our ability to realize production efficiencies and to achieve reductions in costs as we implement operating effectiveness initiatives throughout our automotive operations; (16) our ability

to successfully restructure our operations in various countries; (17) our ability to manage risks related to security breaches and other disruptions to our vehicles, information technology networks and systems; (18) our continued ability

to develop captive financing capability through GM Financial; (19) significant increases in our pension expense or projected pension contributions resulting from changes in the value of plan assets, the discount rate applied to value the

pension liabilities or mortality or other assumption changes; (20) significant changes in economic, political, regulatory environment, market conditions, foreign currency exchange rates or political stability in the countries in which we

operate, particularly China, with the effect of competition from new market entrants and in the United Kingdom with passage of a referendum to discontinue membership in the European Union; and (21) risks and uncertainties associated with the

consummation of the sale of Opel/Vauxhall to the PSA Group, including satisfaction of the closing conditions.

We caution readers not to place undue reliance on

forward-looking statements. We undertake no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information, future events or other factors that affect the subject of these statements, except

where we are expressly required to do so by law.

IMPORTANT ADDITIONAL INFORMATION

REGARDING PROXY SOLICITATION

General Motors Company (“GM”) has

filed a definitive proxy statement and form of WHITE proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies for GM’s 2017 Annual Meeting. GM, its directors and certain of

its executive officers may be deemed participants in the solicitation of proxies from shareholders in respect of the 2017 Annual Meeting. Information regarding the names of GM’s directors and executive officers and their respective interests in

GM by security holdings or otherwise is set forth in the definitive proxy statement. Details concerning the nominees of GM’s Board of Directors for election at the 2017 Annual Meeting are included in the definitive proxy statement. BEFORE

MAKING ANY VOTING DECISION, INVESTORS AND SHAREHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE COMPANY’S DEFINITIVE PROXY STATEMENT AND ANY SUPPLEMENTS THERETO AND ACCOMPANYING

WHITE PROXY CARD, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Investors and shareholders can obtain a copy of the definitive proxy statement and other relevant documents filed by GM free of charge from the SEC’s website, www.sec.gov. GM’s

shareholders can also obtain, without charge, a copy of the definitive proxy statement and other relevant documents filed by GM by directing a request by mail to GM Shareholder Relations at General Motors Company, Mail Code

482-C23-D24,

300 Renaissance Center, Detroit, Michigan 48265 or by email to shareholder.relations@gm.com, by calling GM’s proxy solicitor, Innisfree M&A Incorporated,

toll-free at

1-877-825-8964,

or from the investor relations section of GM’s website, http://www.gm.com/investors.

15

GENERAL MOTORS COMPANY AND SUBSIDIARIES

RECONCILIATION OF

NON-GAAP

MEASURES

Our

non-GAAP

measures include earnings before interest and taxes (EBIT)-adjusted presented net of noncontrolling interests,

EPS-diluted-adjusted,

return on invested capital-adjusted (ROIC-adjusted) and adjusted automotive free cash flow. Our calculation of these

non-GAAP

measures may not be

comparable to similarly titled measures of other companies due to potential differences between companies in the method of calculation. As a result, the use of these

non-GAAP

measures has limitations and

should not be considered superior to, in isolation from, or as a substitute for, related U.S. GAAP measures.

These

non-GAAP

measures allow management and investors to view operating trends, perform analytical comparisons and benchmark performance between periods and among geographic regions to understand operating performance without regard to items we do not consider a

component of our core operating performance. Furthermore, these

non-GAAP

measures allow investors the opportunity to measure and monitor our performance against our externally communicated targets and evaluate

the investment decisions being made by management to improve ROIC-adjusted. Management uses these measures in its financial, investment and operational decision-making processes, for internal reporting and as part of its forecasting and budgeting

processes. Further, our Board of Directors uses these and other measures as key metrics to determine management performance under our performance-based compensation plans. For these reasons we believe these

non-GAAP

measures are useful for our investors.

EBIT-adjusted is used by management and can be used by investors to review

our consolidated operating results because it excludes automotive interest income, automotive interest expense and income taxes as well as certain additional adjustments that are not considered part of our core operations. Examples of adjustments to

EBIT include but are not limited to impairment charges related to goodwill; impairment charges on long-lived assets and other exit costs resulting from strategic shifts in our operations or discrete market and business conditions; costs arising from

the ignition switch recall and related legal matters; and certain currency devaluations associated with hyperinflationary economies. For EBIT-adjusted and our other

non-GAAP

measures, once we have made an

adjustment in the current period for an item, we will also adjust the related

non-GAAP

measure in any future periods in which there is an impact from the item.

EPS-diluted-adjusted

is used by management and can be used by investors to review our consolidated diluted earnings per share

results on a consistent basis.

EPS-diluted-adjusted

is calculated as net income attributable to common stockholders-diluted less certain adjustments noted above for EBIT-adjusted and gains or losses on the

extinguishment of debt obligations on an

after-tax

basis as well as redemptions of preferred stock and certain income tax adjustments divided by weighted-average common shares outstanding-diluted. Examples of

income tax adjustments include the establishment or reversal of significant deferred tax asset valuation allowances.

Adjusted automotive free cash flow is used by

management and can be used by investors to review the liquidity of our automotive operations and to measure and monitor our performance against our capital allocation program and evaluate our automotive liquidity against the substantial cash

requirements of our automotive operations. We measure adjusted automotive free cash flow as automotive cash flow from operations less capital expenditures adjusted for management actions, primarily related to strengthening our balance sheet, such as

prepayments of debt and discretionary contributions to employee benefit plans.

16 2016 CHAIRMAN’S LETTER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013

|

|

|

2014

|

|

|

2015

|

|

|

2016

|

|

|

OPERATING SEGMENTS

(dollars in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GMNA

(a)

|

|

$

|

7,461

|

|

|

$

|

6,603

|

|

|

$

|

11,026

|

|

|

$

|

12,047

|

|

|

GME

(a)

|

|

|

(869

|

)

|

|

|

(1,369

|

)

|

|

|

(813

|

)

|

|

|

(257

|

)

|

|

GMIO

(a)

|

|

|

1,255

|

|

|

|

1,222

|

|

|

|

1,397

|

|

|

|

1,135

|

|

|

GMSA

(a)

|

|

|

327

|

|

|

|

(180

|

)

|

|

|

(622

|

)

|

|

|

(374

|

)

|

|

GM Financial

(b)

|

|

|

898

|

|

|

|

803

|

|

|

|

837

|

|

|

|

913

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Operating Segments

|

|

$

|

9,072

|

|

|

$

|

7,079

|

|

|

$

|

11,825

|

|

|

$

|

13,464

|

|

|

Corporate and Eliminations

|

|

|

(494

|

)

|

|

|

(585

|

)

|

|

|

(1,011

|

)

|

|

|

(934

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBIT-ADJUSTED

(dollars in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income Attributable to Stockholders

|

|

$

|

5,346

|

|

|

$

|

3,949

|

|

|

$

|

9,687

|

|

|

$

|

9,427

|

|

|

Income Tax Expense (benefit)

|

|

|

2,127

|

|

|

|

228

|

|

|

|

(1,897

|

)

|

|

|

2,416

|

|

|

(Gain) Loss on Extinguishment of Debt

|

|

|

212

|

|

|

|

(202

|

)

|

|

|

(449

|

)

|

|

|

—

|

|

|

Automotive Interest Expense

|

|

|

334

|

|

|

|

403

|

|

|

|

443

|

|

|

|

572

|

|

|

Automotive Interest Income

|

|

|

(246

|

)

|

|

|

(211

|

)

|

|

|

(169

|

)

|

|

|

(185

|

)

|

|

Adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ignition Switch Recall and Related Legal Matters

|

|

|

—

|

|

|

|

400

|

|

|

|

1,785

|

|

|

|

300

|

|

|

Recall Campaign

Catch-up

Adjustment

|

|

|

—

|

|

|

|

874

|

|

|

|

—

|

|

|

|

—

|

|

|

Thailand Asset Impairments

|

|

|

—

|

|

|

|

158

|

|

|

|

297

|

|

|

|

—

|

|

|

Venezuela Currency Devaluation and Asset Impairment

|

|

|

162

|

|

|

|

419

|

|

|

|

720

|

|

|

|

—

|

|

|

Russia Exit Costs and Asset Impairment

|

|

|

—

|

|

|

|

245

|

|

|

|

438

|

|

|

|

—

|

|

|

Goodwill Impairment

|

|

|

442

|

|

|

|

120

|

|

|

|

—

|

|

|

|

—

|

|

|

Impairment Charges of Property and Other Assets

|

|

|

774

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Chevy Europe Exit Costs

|

|

|

636

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Gain on Sale of Equity Investment in Ally Financial

|

|

|

(483

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Korea Wage Litigation

|

|

|

(577

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Other

|

|

|

(149

|

)

|

|

|

111

|

|

|

|

(41

|

)

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBIT-adjusted

|

|

$

|

8,578

|

|

|

$

|

6,494

|

|

|

$

|

10,814

|

|

|

$

|

12,530

|

|

|

Costs Related to Recall

(c)

|

|

|

—

|

|

|

|

2,762

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBIT-adjusted (excluding costs related to recall)

|

|

$

|

8,578

|

|

|

$

|

9,256

|

|

|

$

|

10,814

|

|

|

$

|

12,530

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013

|

|

|

2014

|

|

|

2015

|

|

|

2016

|

|

|

|

|

Amount

|

|

|

Per Share

|

|

|

Amount

|

|

|

Per Share

|

|

|

Amount

|

|

|

Per Share

|

|

|

Amount

|

|

|

Per Share

|

|

|

EPS-DILUTED-ADJUSTED

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings per Common Share

|

|

$

|

3,988

|

|

|

$

|

2.38

|

|

|

$

|

2,786

|

|

|

$

|

1.65

|

|

|

$

|

9,686

|

|

|

$

|

5.91

|

|

|

$

|

9,427

|

|

|

$

|

6.00

|

|

|

Adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss on Extinguishment of Debt

|

|

|

240

|

|

|

|

0.14

|

|

|

|

(202

|

)

|

|

|

(0.12

|

)

|

|

|

(449

|

)

|

|

|

(0.27

|

)

|

|

|

—

|

|

|

|

—

|

|

|

VEBA Preferred Share Buyback

|

|

|

816

|

|

|

|

0.49

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Redemption and Purchase of Series A Preferred Stock

|

|

|

—

|

|

|

|

—

|

|

|

|

794

|

|

|

|

0.47

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

All Other Adjustments

(d)

|

|

|

805

|

|

|

|

0.48

|

|

|

|

2,327

|

|

|

|

1.38

|

|

|

|

3,199

|

|

|

|

1.95

|

|

|

|

300

|

|

|

|

0.19

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Adjustments

|

|

$

|

1,861

|

|

|

$

|

1.11

|

|

|

$

|

2,919

|

|

|

$

|

1.73

|

|

|

$

|

2,750

|

|

|

$

|

1.68

|

|

|

$

|

300

|

|

|

$

|

0.19

|

|

|

Tax Effect on Adjustments

(e)

|

|

|

(42

|

)

|

|

|

(0.03

|

)

|

|

|

(561

|

)

|

|

|

(0.33

|

)

|

|

|

(201

|

)

|

|

|

(0.13

|

)

|

|

|

(114

|

)

|

|

|

(0.07

|

)

|

|

Tax Adjustments

(f)

|

|

|

(473

|

)

|

|

|

(0.28

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

(4,001

|

)

|

|

|

(2.44

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EPS-diluted-adjusted

|

|

$

|

5,334

|

|

|

$

|

3.18

|

|

|

$

|

5,144

|

|

|

$

|

3.05

|

|

|

$

|

8,234

|

|

|

$

|

5.02

|

|

|

$

|

9,613

|

|

|

$

|

6.12

|

|

|

Impact of Costs Related to Recall

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1.07

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EPS-diluted-adjusted

(excluding costs related to

recall)

|

|

$

|

5,334

|

|

|

$

|

3.18

|

|

|

$

|

5,144

|

|

|

$

|

4.12

|

|

|

$

|

8,234

|

|

|

$

|

5.02

|

|

|

$

|

9,613

|

|

|

$

|

6.12

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

|

|

2016

|

|

|

ADJUSTED AUTOMOTIVE FREE CASH FLOW

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Cash Flow

(g)

|

|

$

|

9,979

|

|

|

$

|

14,321

|

|

|

Less: Capital Expenditures

|

|

|

(7,784

|

)

|

|

|

(9,435

|

)

|

|

Adjustments - Discretionary Pension Plan Contributions

|

|

|

—

|

|

|

|

1,982

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Automotive Free Cash Flow

|

|

$

|

2,195

|

|

|

$

|

6,868

|

|

|

(a)

|

GM’s automotive operations’ interest income and interest expense are recorded centrally in Corporate.

|

|

(b)

|

GM Financial amounts represent earnings before income taxes adjusted.

|

|

(c)

|

GMNA major recall campaign expense was $2.4B.

|

|

(d)

|

Refer to the reconciliation of Net Income Attributable to Stockholders to EBIT-Adjusted.

|

|

(e)

|

The tax effect of each adjustment is determined based on the tax laws and valuation allowance status of the jurisdiction in which the adjustment relates.

|

|

(f)

|

These adjustments primarily consist of the tax benefit related to the valuation allowance reversal in Europe. The adjustment was excluded because valuation allowance reversals are not considered part of our core

operations.

|

|

(g)

|

The Company adopted Accounting Standards Board Update

2016-18

“Statement of Cash Flows (Topic 230): Restricted Cash” on a retrospective basis during 2016.

|

17

GENERAL

INFORMATION

COMMON STOCK

GM common stock,

$0.01 par value, is listed on the New York Stock Exchange and the Toronto Stock Exchange.

Ticker symbol:

GM - New York Stock Exchange

GMM - Toronto Stock Exchange

SHAREHOLDER ASSISTANCE

Shareholders of record requiring information about

their accounts should contact:

Computershare Trust Company, N.A.

General Motors Company

P.O. Box 43078

Providence, Rl 02940-3078

888-887-8945

or

781-575-3334

(from outside the United States, Canada or Puerto Rico)

Computershare representatives are available Monday through Friday from 9 a.m. to 6 p.m. ET. Automated phone service and the Computershare website at

www.computershare.com/gm are always available.

For other information, shareholders may contact:

GM Shareholder Relations

General Motors Company

Mail Code

482-C23-D24

300 Renaissance Center

Detroit, Ml 48265

313-667-1500

ELECTRONIC DELIVERY OF ANNUAL MEETING MATERIALS

Shareholders may consent to receive their GM annual report and proxy materials via the internet. Shareholders of record may enroll at www.computershare.com/gm. If your

GM stock is held through a broker, bank or other nominee, contact them directly.

SECURITIES AND INSTITUTIONAL ANALYST QUERIES

GM Investor Relations

General Motors Company

Mail Code

482-C29-D36

300 Renaissance Center

Detroit, Ml 48265

313-667-1669

AVAILABLE PUBLICATIONS

GM’s Proxy Statement, Forms

10-K

and

10-Q

and GM’s Code of Conduct,

Winning

With Integrity

, are available online at www.gm.com/investors.

Printed copies may be requested on our website or from GM Shareholder Relations at the

address listed above (allow four to six weeks for delivery of materials).

PRINCIPAL OFFICE

General Motors Company

300 Renaissance Center

Detroit, Ml 48265

313-556-5000

VISIT GM ON THE INTERNET

Learn

more about General Motors vehicles and services on our website at www.gm.com.

GM CUSTOMER ASSISTANCE CENTERS

Satisfaction with your entire ownership experience is important to us. To request product information or to receive assistance with your vehicle, please contact the

appropriate brand via phone or Twitter:

Buick:

800-521-7300

or @BuickCustCare

Cadillac:

800-458-8006

or @CadillacCustSvc

Chevrolet:

800-222-1020

or @ChevyCustCare

GMC:

800-462-8782

or @GMCCustCare

GM of Canada:

800-263-3777

GM Mobility:

800-323-9935

OTHER PRODUCTS AND SERVICES

GM Card:

888-316-2390

OnStar:

888-667-8277

18 2016 CHAIRMAN’S LETTER

GENERAL MOTORS COMPANY

300 RENAISSANCE CENTER | DETROIT, MI 48265 | WWW.GM.COM

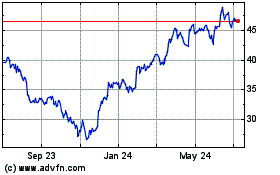

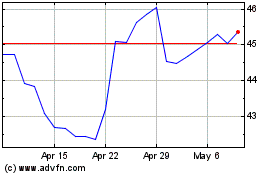

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Apr 2024

General Motors (NYSE:GM)

Historical Stock Chart

From Apr 2023 to Apr 2024