NGL Energy Partners LP (NYSE: NGL) (the “Partnership” or “NGL”)

announced today that the Board of Directors of its general partner

declared a quarterly distribution of $0.39 per unit, or $1.56 per

unit on an annualized basis, for the quarter ended March 31, 2017.

This cash distribution is payable on May 15, 2017 to common

unitholders of record at the close of business on May 8, 2017.

Additionally, the Board of Directors declared a distribution for

the quarter ended March 31, 2017 to be paid to the holders of the

Class A Preferred Units according to the terms outlined in NGL's

Partnership Agreement. The Class A Preferred distribution will also

be paid on May 15, 2017.

In April 2016, the Board of Directors of NGL’s general partner

made the decision to reduce the distribution by 39% in order to

focus on strengthening the balance sheet, which included foregoing

approximately $64 million of annual general partner distributions.

Since that time, NGL has successfully increased liquidity and

executed several growth initiatives while targeting distribution

coverage in excess of 1.3x. While NGL had anticipated an increase

in distributions commencing this quarter, in light of current

market conditions, particularly fluctuating commodity prices and

their anticipated impact on NGL's results for its quarter ended

March 31, 2017, the Board of Directors has chosen to defer this

increase in distributions for up to an additional three quarters.

Following this deferral, NGL's management anticipates then

recommending to its Board of Directors an increase in the

distribution policy consistent with NGL's previously announced

distribution guidance.

Fiscal Years 2017 and 2018 Guidance

Based upon preliminary financial information, NGL expects fiscal

year 2017 Adjusted EBITDA of approximately $380 million, which

includes an approximately $42 million contribution by the Grand

Mesa Pipeline. These preliminary results were adversely influenced

by the significantly warmer than normal winter resulting in lower

propane volumes and pricing, continued pressure in crude marketing

and transportation, decreased demand for diesel fuel, lower than

expected margins for biodiesel sales and an extended decline in

gasoline line space values on the Colonial Pipeline, all of which

negatively impacted fourth quarter results.

For fiscal year 2018, NGL expects to generate Adjusted EBITDA of

approximately $500 million to $525 million, which includes Adjusted

EBITDA for Grand Mesa Pipeline for 12 months of operations at

approximately $130 million; continued improvement in the water

segment; an anticipated increase in crude production and refined

products demand; and the benefit of a full 12 months of operations

for several of our recent projects and acquisitions, including the

Houma and Port of Point Comfort projects and the Port Hudson and

Kingfisher terminal assets which were acquired from Murphy Energy

in January 2017. NGL's guidance also takes into consideration

management’s lowered expectations for propane volumes, continued

challenges in crude marketing and transportation together with the

impact of lower line space values carrying into fiscal year 2018.

Distributable Cash Flow is expected to be $300-325 million and

could generate over $100 million of excess cash flow, which would

provide at least 1.3x coverage for the year based on the deferral

of the distribution increase. Additional information regarding our

fiscal year 2018 guidance is expected to be provided on NGL’s

earnings call for its fiscal year ended March 31, 2017, which is

expected to be held on Thursday, May 25, 2017.

Non-GAAP Financial Measures

NGL defines EBITDA as net income (loss) attributable to NGL

Energy Partners LP, plus interest expense, income tax expense

(benefit), and depreciation and amortization expense. NGL defines

Adjusted EBITDA as EBITDA excluding net unrealized gains and losses

on derivatives, lower of cost or market adjustments, gains and

losses on disposal or impairment of assets, gain on early

extinguishment of liabilities, revaluation of investments,

equity-based compensation expense, acquisition expense and other.

We also include in Adjusted EBITDA certain inventory valuation

adjustments related to our Refined Products and Renewables segment,

as described below. EBITDA and Adjusted EBITDA should not be

considered alternatives to net income, income before income taxes,

cash flows from operating activities, or any other measure of

financial performance calculated in accordance with GAAP as those

items are used to measure operating performance, liquidity or the

ability to service debt obligations. NGL believes that EBITDA

provides additional information to investors for evaluating NGL’s

ability to make quarterly distributions to NGL’s unitholders and is

presented solely as a supplemental measure. NGL believes that

Adjusted EBITDA provides additional information to investors for

evaluating NGL’s financial performance without regard to NGL’s

financing methods, capital structure and historical cost basis.

Further, EBITDA and Adjusted EBITDA, as NGL defines them, may not

be comparable to EBITDA, Adjusted EBITDA, or similarly titled

measures used by other entities.

Other than for NGL’s Refined Products and Renewables segment,

for purposes of the Adjusted EBITDA calculation, NGL makes a

distinction between realized and unrealized gains and losses on

derivatives. During the period when a derivative contract is open,

NGL records changes in the fair value of the derivative as an

unrealized gain or loss. When a derivative contract matures or is

settled, NGL reverses the previously recorded unrealized gain or

loss and records a realized gain or loss. NGL does not draw such a

distinction between realized and unrealized gains and losses on

derivatives of NGL’s Refined Products and Renewables segment. The

primary hedging strategy of NGL’s Refined Products and Renewables

segment is to hedge against the risk of declines in the value of

inventory over the course of the contract cycle, and many of the

hedges are six months to one year in duration at inception. The

“inventory valuation adjustment” row in the reconciliation table

reflects the difference between the market value of the inventory

of NGL’s Refined Products and Renewables segment at the balance

sheet date and its cost. NGL includes this in Adjusted EBITDA

because the gains and losses associated with derivative contracts

of this segment, which are intended primarily to hedge inventory

holding risk, also affect Adjusted EBITDA.

Distributable Cash Flow is defined as Adjusted EBITDA minus

maintenance capital expenditures and cash interest expense.

Maintenance capital expenditures represent capital expenditures

necessary to maintain the Partnership’s operating capacity.

Distributable Cash Flow is a performance metric used by senior

management to compare cash flows generated by the Partnership

(excluding growth capital expenditures and prior to the

establishment of any retained cash reserves by the Board of

Directors) to the cash distributions expected to be paid to

unitholders. Using this metric, management can quickly compute the

coverage ratio of estimated cash flows to planned cash

distributions. This financial measure also is important to

investors as an indicator of whether the Partnership is generating

cash flow at a level that can sustain, or support an increase in,

quarterly distribution rates. Actual distributions are set by the

Board of Directors of NGL’s general partner.

Forward-Looking Statements

This press release includes “forward-looking statements.” All

statements other than statements of historical facts included or

incorporated herein may constitute forward-looking statements.

Actual results could vary significantly from those expressed or

implied in such statements and are subject to a number of risks and

uncertainties. While NGL believes such forward-looking statements

are reasonable, NGL cannot assure they will prove to be correct.

The forward-looking statements involve risks and uncertainties that

affect operations, financial performance, and other factors as

discussed in filings with the Securities and Exchange Commission.

Other factors that could impact any forward-looking statements are

those risks described in NGL’s annual report on Form 10-K,

quarterly reports on Form 10-Q, and other public filings. You are

urged to carefully review and consider the cautionary statements

and other disclosures made in those filings, specifically those

under the heading “Risk Factors.” NGL undertakes no obligation to

publicly update or revise any forward-looking statements except as

required by law.

About NGL Energy Partners LP

NGL Energy Partners LP is a Delaware limited partnership. NGL

owns and operates a vertically integrated energy business with five

primary businesses: water solutions, crude oil logistics, NGL

logistics, refined products/renewables and retail propane. For

further information, visit the Partnership’s website at

www.nglenergypartners.com.

This release is a qualified notice under Treasury Regulation

Section 1.1446-4(b). Brokers and nominees should treat 100% of NGL

Energy Partners LP’s distributions to foreign investors as being

attributable to income that is effectively connected with a United

States trade or business. Therefore, distributions to foreign

investors are subject to federal income tax withholding at the

highest applicable effective tax rate.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170424006689/en/

NGL Energy Partners LPTrey Karlovich, 918-481-1119Executive Vice

President and Chief Financial

OfficerTrey.Karlovich@nglep.comorLinda Bridges, 918-481-1119Vice

President – Finance and TreasurerLinda.Bridges@nglep.com

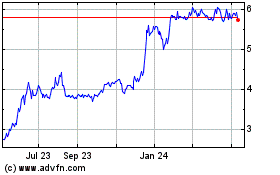

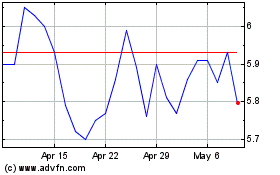

NGL Energy Partners (NYSE:NGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

NGL Energy Partners (NYSE:NGL)

Historical Stock Chart

From Apr 2023 to Apr 2024