As

filed with the Securities and Exchange Commission on April 24, 2017.

Registration

No. 333-205519

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

POST-EFFECTIVE

AMENDMENT NO. 2

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

COHBAR,

INC.

(Exact

name of Registrant as specified in its charter)

|

Delaware

|

|

2834

|

|

26-1299952

|

(State

or other jurisdiction of

incorporation or organization)

|

|

(Primary

Standard Industrial

Classification Code Number)

|

|

(IRS

Employer

Identification Number)

|

1455

Adams Dr., Suite 2050

Menlo

Park, CA 94025

(650)

446-7888

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Simon

Allen

Chief

Executive Officer

1455

Adams Dr., Suite 2050

Menlo

Park, CA 94025

(650)

446-7888

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copy

to:

Peter

B. Cancelmo

Garvey

Schubert Barer

1191

2nd Avenue, Suite 1800

Seattle,

Washington 98101

(206)

464-3939

Approximate

date of proposed sale to the public:

As soon as practicable and from time to time after the effective date of this Registration

Statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting

company, or an emerging growth company.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

(Do not check if a smaller reporting company)

|

Smaller reporting company

|

☒

|

|

|

|

Emerging

growth company

|

☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act.

☐

EXPLANATORY

NOTE

This Post-Effective Amendment No.

2 to Form S-1 (this “Post-Effective Amendment) is being filed pursuant to Section 10(a)(3) of the Securities Act of 1933,

as amended (the “Securities Act”), to update the Registration Statement on Form S-1 (No. 333-205519), which was previously

declared effective by the Securities and Exchange Commission (the “Commission”) on July 20, 2015, as amended by Post-Effective

Amendment No. 1 to Form S-1 (No. 333-205519), which was declared effective by the Commission on May 3, 2016. The Post-Effective

Amendment includes (i) the Registrant’s audited financial statements and the notes thereto included in the Registrant’s

Annual Report on Form 10-K for the year ended December 31, 2016, as filed with the Commission on March 31, 2017 and (ii) an updated

prospectus relating to the offering and sale of the securities described therein.

Pursuant

to Rule 429(b) under the Securities Act, this Post-Effective Amendment to Registration Statement No. 333-205519 shall also

act, upon effectiveness, as a post-effective amendment to the Registrant’s Registration Statement on Form S-1 (No.

333-200033). The prospectus included in Registration Statement No. 333-205519 was a single combined prospectus relating to

(i) the issuance of certain securities of the Registrant upon exercise of Unit Purchase Options and common stock purchase

warrants originally registered pursuant to Registration Statement No. 333-200033, which was initially declared effective by

the Commission on December 18, 2014, and (ii) a secondary offering of the Registrant’s common stock initially

registered on Registration Statement No. 333-205519.

In

addition to the updates described above, this Post-Effective Amendment is being filed to deregister unsold securities underlying

Unit Purchase Options and common stock purchase warrants as follows:

|

|

●

|

48

shares of common stock and 24 common stock purchase warrants underlying Unit Purchase

Options which expired on July 6, 2016.

|

|

|

|

|

|

|

●

|

4,421,846

shares of common stock underlying common stock purchase warrants issued in our initial

public offering and upon exercise of Unit Purchase Options. The common stock purchase

warrants expired on January 6, 2017.

|

|

|

|

|

|

|

●

|

274,000

shares of common stock registered for resale by the holders thereof upon the exercise of common stock purchase warrants issued

in a private placement completed concurrently with our initial public offering. The common stock purchase warrants expired on

January 6, 2017.

|

All

applicable registration fees were paid at the time of the original filing of the Registration Statements No. 333-200033 and No.

333-205519 on November 10, 2014, and July 6, 2015, respectively.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the Post-Effective Amendment

No. 2 to Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer

to sell these securities or the solicitation of an offer to buy these securities in any state in which such offer, solicitation

or sale is not permitted.

|

PRELIMINARY

PROSPECTUS

|

Subject

to Completion, Dated April 24, 2017

|

COHBAR,

INC.

This

prospectus relates to 21,665,896 shares of our common stock, which may be offered for sale from time to time by the selling stockholders

identified in this prospectus.

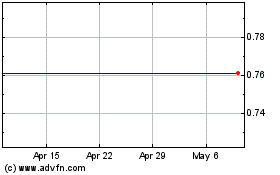

Shares of our common stock are quoted

on the TSX Venture Exchange (TSX-V) under the symbol “COB.U” and on the OTCQX marketplace operated by OTC Markets Group,

Inc. under the symbol “CWBR.” On April 20, 2017 the closing prices for our common stock on the TSX-V and OTCQX were

$1.70 and $1.65 per share, respectively.

All

costs associated with this registration statement will be borne by us. The selling stockholders will offer their shares at prevailing

market prices on the OTCQX or the TSX-V, or at privately negotiated prices in one or more transactions that may take place by

ordinary broker’s transactions, privately-negotiated transactions or through sales to one or more dealers for resale. We

will not receive any of the proceeds from the sale of shares of common stock by the selling stockholders. All amounts are in United

States dollars unless otherwise stated.

We

are an “emerging growth company” under the U.S. federal securities laws and will be subject to reduced public company

reporting requirements. Investing in our securities involves substantial risks. See “Risk Factors” beginning on page

4.

Neither

the Securities and Exchange Commission (SEC) nor any other securities commission or regulatory authority has approved or disapproved

of these securities or has passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal

offense.

The

date of this prospectus is ,

2017.

Table

of Contents

This

prospectus is part of a post-effective amendment to an effective registration statement that we have filed with the Securities

and Exchange Commission, which we refer to as the “SEC” or the “Commission”. It is important for you to

read and consider all of the information contained in this prospectus and any applicable prospectus supplement before making a

decision whether to invest in the common stock. You should also read and consider the information contained in the exhibits filed

with our registration statement, of which this prospectus is a part, as described in “Where You Can Find More Information”

in this prospectus.

You

should rely only on the information contained in this prospectus and any applicable prospectus supplement, including the information

incorporated by reference. We have not authorized anyone to provide you with different information. We are not offering to sell

or soliciting offers to buy, and will not sell, any securities in any jurisdiction where it is unlawful. You should assume that

the information contained in this prospectus or any prospectus supplement, as well as information contained in a document that

we have previously filed or in the future will file with the SEC, is accurate only as of the date of this prospectus, the applicable

prospectus supplement or the document containing that information, as the case may be. Persons outside the United States who come

into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering and the

distribution of this prospectus outside of the United States.

COHBAR

TM

and other trademarks or service marks of CohBar, Inc. appearing in this prospectus are the property of CohBar, Inc. Trade

names, trademarks and service marks of other companies appearing in this prospectus are the property of their respective holders.

PROSPECTUS

SUMMARY

This

summary provides an overview of selected information contained elsewhere in this prospectus and does not contain all of the information

you should consider before investing in our securities. You should carefully read the prospectus and the registration statement

of which this prospectus is a part in their entirety before investing in our securities. We refer to CohBar, Inc. as “CohBar,”

the “Company,” “we,” “our,” and “us.”

COHBAR,

INC.

Overview

CohBar,

Inc. (“CohBar,” “we,” “us,” “our,” “its” or the “Company”)

is an innovative biotechnology company and a leader in the research and development of mitochondria based therapeutics (MBTs),

an emerging class of drugs with the potential to treat a wide range of diseases associated with aging and metabolic dysfunction,

including obesity, fatty liver disease (NAFLD) and non-alcoholic steatohepatitis (NASH), type 2 diabetes mellitus (T2D), cancer,

atherosclerosis, cardiovascular disease and neurodegenerative diseases such as Alzheimer’s.

MBTs

originate from almost two decades of research by our founders, resulting in their discovery of a novel group of peptides called

mitochondrial-derived peptides (MDPs) encoded within the genome of mitochondria, the powerhouses of the cell. These naturally

occurring MDPs and certain related analogs have demonstrated a range of biological activity and therapeutic potential in pre-clinical

models across multiple diseases associated with aging.

We

believe CohBar is a first mover in exploring the mitochondrial genome for therapeutically relevant peptides, and have developed

a proprietary MBT technology platform which uses cell based assays and animal models of disease to rapidly identify

mitochondrial peptides with promising biological activity. Once identified, we deploy optimization techniques to improve

the drug-like properties of our MBT candidates, enabling us to match the most biologically promising peptides to disease indications

that have substantial unmet medical needs.

In September 2016, we advanced

two novel, optimized analogs of our MOTS-c MDP, CB4209 and CB4211, into IND-enabling studies as our lead MBT drug candidates with

potential for treatment of fatty liver disease (NAFLD), Nonalcoholic steatohepatitis (NASH), obesity, and type 2 diabetes (T2D).

In addition, our founders and scientific team have discovered a large number of MDPs that have demonstrated a range of biological

activities and therapeutic potential. Our ongoing research and development of our pipeline MDPs is focused on identifying and

advancing novel improved analogs of those MDPs that have the greatest therapeutic and commercial potential for development into

drugs.

Our

scientific team includes the expertise of our founders, Dr. Pinchas Cohen, Dean of the Davis School of Gerontology at the

University of Southern California, and Dr. Nir Barzilai, Professor of Genetics and Director of the Institute for Aging Research

at the Albert Einstein College of Medicine, and is augmented by our co-founders, Dr. David Sinclair, Professor of Genetics

at Harvard Medical School, and Dr. John Amatruda, former Senior Vice President and Franchise Head for Diabetes and Obesity

at Merck Research Laboratories. Our research and development efforts are conducted under the leadership of our Chief Scientific

Officer, Dr. Kenneth Cundy, former Chief Scientific Officer at Xenoport, Inc. and Senior Director of Biopharmaceutics at Gilead

Sciences, Inc. Dr. Cundy is the co-inventor of several approved drugs including tenofovir, an antiretroviral drug that is marketed

globally in various combinations with other drugs for the treatment of HIV infection (Atripla®, Viread®, Complera®,

Stribild®, Truvada®), gabapentin enacarbil (Horizant®) for the treatment of RLS and post-herpetic neuralgia, and Nanocrystal®

technology, employed in several other approved drugs.

We

are the exclusive licensee from the Regents of the University of California and the Albert Einstein College of Medicine of four

issued U.S. patents, four U.S. patent applications and several related international patent applications in various international

jurisdictions. Our licensed patents and patent applications include claims that are directed to compositions comprising MDPs and

their analogs and/or methods of their use in the treatment of indicated diseases. We have also filed more than 65 provisional

patent applications with claims directed to both compositions comprising and methods of using novel proprietary MDPs and their

analogs. See “Business – Patents and Intellectual Property”.

We

believe that the proprietary capabilities of our technology platform combined with our scientific expertise and intellectual property

portfolio provides a competitive advantage in our mission to treat age-related diseases and extend healthy life spans through

the advancement of MBTs as a new class of transformative drugs.

We

were formed as a limited liability company in the state of Delaware in 2007, and we incorporated in Delaware in 2009. We completed

our initial public offering of common stock in January 2015 and our common stock is listed for trading on the TSXV (COB.U) and

the OTCQX (CWBR).

Our

laboratory and corporate headquarters are located in Menlo Park, California.

Business

Strategy

Our

strategic objective is to secure, maintain and exploit a leading scientific, commercial and intellectual property position in

the arena of mitochondria based therapeutics, with best-in-class treatments for diseases associated with aging and metabolic dysfunction.

The key elements of our strategy include:

|

|

●

|

advancing

our lead program to IND submission and through clinical trials;

|

|

|

●

|

utilizing

our proprietary technology platform to continue identifying, assessing and optimizing new analogs of biologically active MDPs

and advancing those MBT candidates with the greatest therapeutic and commercial potential;

|

|

|

●

|

developing

strategic partnerships with leading pharmaceutical companies and other organizations

to support our research programs and future development and commercialization efforts;

|

|

|

●

|

raising

adequate capital to support our operations, research and clinical development programs;

|

|

|

●

|

minimizing

operating costs and related funding requirements for our research and development activities

through careful program management and cost-efficient relationships with academic partners,

consultants and contract research organizations (CROs);

|

|

|

●

|

optimizing

the development of our intellectual property portfolio to capture all novel therapeutically

relevant peptides encoded within the mitochondrial genome; and

|

|

|

●

|

increasing

awareness and recognition of our team, assets, capabilities and opportunities within

the investment and scientific communities.

|

OUR

PIPELINE

Our

pipeline includes a number of MDPs and MBT candidates in different stages of pre-clinical study. Our research efforts are focused

on identifying, assessing and optimizing new analogs of biologically active MDPs and advancing those MDPs considered to have greatest

therapeutic and commercial potential as MBT candidates.

Lead

MBT Drug Candidates (CB4209/CB4211)

Our

lead development candidates, CB4209/CB4211, are being evaluated as MBTs for the potential treatment of NASH, obesity and T2D.

In September 2016, we announced the advancement of these candidates into IND-enabling activities.

CB4209

and CB4211 are novel, optimized analogs of MOTS-c, a naturally occurring mitochondrial peptide discovered by our founders and

their academic collaborators in 2012. Their research in cells and animal models indicated that MOTS-c plays a significant role

in the regulation of metabolism. Certain of the original MOTS-c studies were published in an article entitled “The Mitochondrial-Derived

Peptide, MOTS-c, Promotes Metabolic Homeostasis and Reduces Obesity and Insulin Resistance,” which appeared in the March

3, 2015 edition of the journal

Cell Metabolism

.

In

pre-clinical models, CB4209 and CB4211 have demonstrated significant therapeutic potential for the treatment of obesity, including

significantly greater weight loss together with more selective reduction of fat mass versus lean mass in head-to-head comparison

to a market-leading obesity drug. In these models, treatment with CB4209 and CB4211 also showed improvements in triglyceride levels,

as well as favorable effects on liver enzyme markers associated with fatty liver disease (NAFLD) and NASH. The therapeutic effects

of CB4209 and CB4211 have been further evaluated in the well-established preclinical STAM™ mouse model of NASH. In this

model, treatment with CB4209 or CB4211 resulted in a significant reduction of the non-alcoholic fatty liver disease activity score,

or NAS, a composite measure of steatosis (fat accumulation), inflammation and hepatocyte ballooning (cellular injury). Additional

efficacy studies are ongoing or planned. CB4209 and CB4211 represent first-in-class drugs for the treatment of NASH and obesity,

targeting energy regulation and lipid metabolism.

Investigational

Programs

Our

R&D pipeline also includes the MDPs described below. Our pre-clinical activities with respect to these peptides are focused

on identifying and optimizing those MDPs and their analogs that demonstrate the greatest commercial and therapeutic potential

as MBTs.

Humanin Analogs

:

Humanin, the first MDP to be discovered, has demonstrated protective effects in various animal models of age-related diseases,

including Alzheimer’s disease, atherosclerosis, myocardial and cerebral ischemia and T2D. Humanin levels in humans have

been shown to decline with age, and elevated levels of humanin together with lower incidence of age-related diseases have been

observed in centenarians as well as their offspring.

In vitro

studies with humanin and humanin analogs have demonstrated

protective effects against neuronal toxicity suggesting that a humanin analog may have potential for development as an MBT treatment

for neurodegenerative diseases such as Alzheimer’s

disease.

SHLP

Analogs

: Our founders and their academic collaborators discovered several other peptides encoded within the mitochondrial

genome with a similar origin to humanin; we refer to these as small humanin-like peptides, or SHLPs. In cancer treatment models

conducted by our founders and their collaborators, both in cell culture and in mice, SHLP-6 demonstrated suppression of cancer

progression via mechanisms involving both suppression of tumor angiogenesis (blood vessel development) and induction of apoptosis

(cancer cell death). There is preclinical evidence to suggest that SHLP-2 has protective effects against neuronal toxicity. Certain

of the SHLP studies were published in a research paper entitled “Naturally occurring mitochondrial-derived peptides are

age-dependent regulators of apoptosis, insulin sensitivity, and inflammatory markers,” which appeared in the April 2016

edition of the journal

Aging

.

Additional

MDPs

: We have discovered over 65 new, previously untested peptides encoded within the mitochondrial genome. These MDPs and

their analogs have demonstrated various degrees of biological activity in a wide range of cell based and/or animal models relevant

to diseases, such as NASH, obesity, T2D, cancer, cardiovascular and Alzheimer’s.

All

of our pipeline MDPs and MBT candidates are in the pre-clinical stage of development, and there is no guarantee that the activity

demonstrated in pre-clinical models will be shown in human testing.

OUR TECHNOLOGY PLATFORM

Our proprietary technology platform is designed

to rapidly identify therapeutically relevant peptides encoded within the mitochondrial genome and to optimize these peptides into

novel MBTs that have the potential to treat diseases with major unmet medical needs. We believe our technology platform presents

multiple opportunities for value creation. Our multiplexed peptide optimization process is designed to discover numerous

potential drug candidate opportunities with near term value. These drug candidates could be internally developed by CohBar or advanced

through strategic partnerships with larger pharmaceutical companies. At the same time, our strategy of capturing the most valuable

MBT space by aggressively filing for broad intellectual property coverage is designed to secure CohBar’s leadership role

in the field and protect our ability to create additional value in the future.

We use a broad range of proprietary activity screens to assess the therapeutic potential of our novel peptides

and to prioritize our development opportunities. Some of our novel peptides have demonstrated promising biological effects in a

variety of in vitro and/or in vivo models of age related diseases. We are prioritizing our novel peptides by assessing their activity

in areas such as metabolic regulation, oxidative stress, cellular energy levels, cell proliferation, cell death, cellular protection,

carbohydrate metabolism, lipid metabolism, body weight, regulation of body fat, insulin sensitivity, regulation of glucose, glucose

tolerance, and liver function.

Company

Information

Our

Company was formed as a Delaware limited liability company on October 19, 2007. We converted to a Delaware corporation under

the provisions of the Delaware Limited Liability Company Act and the Delaware General Corporation Law on September 16, 2009.

Our principal executive offices are located at 1455 Adams Dr., Suite 2050, Menlo Park, CA 94025. Our telephone number is (650)

446-7888. We maintain an Internet website at www.cohbar.com. The information contained on, connected to or that can be accessed

via our website is not a part of, and is not incorporated into, this prospectus and the inclusion of our website address in this

prospectus is an inactive textual reference only. We have no subsidiaries.

About

This Prospectus

All

references to common stock, preferred stock, stock options, share data, per share data and related information have been retroactively

adjusted where applicable in this prospectus to reflect the 3.6437695-for-1 forward stock split completed in April 2014 as if

it had occurred at the beginning of the earliest period presented.

Unless

otherwise specified, all references to “dollars,” “US$” or “$” in this prospectus are to United

States dollars.

The

Offering

This

prospectus relates to the following securities of the Company:

|

Securities offered by selling stockholders

|

|

21,665,896 shares of our common stock, which may be offered for sale from

time to time by the selling stockholders identified in this prospectus.

As of the date of this prospectus 4,459,600 of the shares being registered

hereunder for resale by certain of our affiliates are held in escrow subject to resale restrictions imposed under applicable policies

of the TSX-V in connection with our IPO. The shares are scheduled for release from the escrow and resale restrictions in two equal

installments on July 6, 2017 and January 6, 2018.

|

|

|

|

|

|

Use of Proceeds

|

|

We will not receive proceeds for any shares sold by selling stockholders.

|

|

|

|

|

|

Trading Markets

|

|

Our common stock is currently listed on the TSX-V under the symbol “COB.U,” and traded on the OTCQX marketplace operated by OTC Markets Group, Inc., under the symbol “CWBR.” On April 20, 2017, the closing sales price for our common stock was $1.70 per share on the TSX-V and $1.65 per share on the OTCQX.

|

RISK

FACTORS

An

investment in our securities involves a high degree of risk. You should carefully consider the risks described below, together

with all of the other information included in this prospectus, before making an investment decision. If any of the following risks

actually occurs, our business, financial condition or results of operations could suffer. In that case, the market value of our

securities could decline, and you may lose all or part of your investment. The risks and uncertainties described in this prospectus

are not the only risks and uncertainties that we face. Additional risks and uncertainties that presently are not considered material

or are not known to us, and therefore not mentioned herein, may impair our business operations.

Risk

Factors Related to Our Company and Industry

We

have had a history of losses and no revenue.

Since

our conversion to a Delaware corporation in September 2009 through December 31, 2016, we have accumulated losses of $14,409,536.

As of December 31, 2016, we had working capital of $8,430,652 and stockholders’ equity of $8,697,974. We can offer no assurance

that we will ever operate profitably or that we will generate positive cash flow in the future. To date, we have not generated

any revenues from our operations and do not expect to generate any revenue from the sale of products in the near future. As a

result, our management expects the business to continue to experience negative cash flow for the foreseeable future and cannot

predict when, if ever, our business might become profitable. With the cash and investments on hand as of December 31, 2016

combined with the exercises of warrants subsequent to December 31, 2016, the Company believes that it has sufficient

capital to meet its operating expenses and obligations for the next twelve months from the date of this filing.

Until we can generate significant revenues, if ever, we expect to satisfy our future cash needs through equity or debt financing.

We will need to raise additional funds, and such funds may not be available on commercially acceptable terms, if at all. If we

are unable to raise funds on acceptable terms, we may not be able to execute our business plan, take advantage of future opportunities,

or respond to competitive pressures or unanticipated requirements. This may seriously harm our business, financial condition and

results of operations. In the event we are not able to continue operations our stockholders will likely suffer a complete loss

of their investments in our securities.

We

are an early research stage biotechnology company and may never be able to successfully develop marketable products or generate

any revenue. We have a very limited relevant operating history upon which an evaluation of our performance and prospects can be

made. There is no assurance that our future operations will result in profits. If we cannot generate sufficient revenues, we may

suspend or cease operations.

We

are an early-stage company. Our operations to date have been limited to organizing and staffing our company, business planning,

raising capital, in-licensing intellectual property, identifying MDPs for further research and performing research on identified

MDPs. We have not generated any revenues to date. All of our MBTs are in the concept or research stage. Moreover, we cannot be

certain that our research and development efforts will be successful or, if successful, that our MBTs will ever be approved by

the FDA. Typically, it takes 10-12 years to develop one new medicine from the time it is discovered to when it is available for

treating patients and longer timeframes are not uncommon. Even if approved, our products may not generate commercial revenues.

We have no relevant operating history upon which an evaluation of our performance and prospects can be made. We are subject to

all of the business risks associated with a new enterprise, including, but not limited to, risks of unforeseen capital requirements,

failure of potential drug candidates either in research, pre-clinical testing or in clinical trials, failure to establish business

relationships and competitive disadvantages against other companies. If we fail to become profitable, we may suspend or cease

operations.

We

will need additional funding and may be unable to raise additional capital when needed, which would force us to delay, reduce

or eliminate our research and development activities.

Our

operations to date have consumed substantial amounts of cash, and we expect our capital and operating expenditures to increase

in the next few years. We may not be able to generate significant revenues for several years, if at all. Until we can generate

significant revenues, if ever, we expect to satisfy our future cash needs through equity or debt financing. We cannot be certain

that additional funding will be available on acceptable terms, or at all. If adequate funds are not available, we may be required

to delay, reduce the scope of, or eliminate one or more of our research and development activities.

We

may not be successful in our efforts to identify or discover potential drug development candidates.

A

key element of our strategy is to identify and test MDPs that play a role in cellular processes underlying our targeted disease

indications. A significant portion of the research that we are conducting involves emerging scientific knowledge and drug discovery

methods. Our drug discovery efforts may not be successful in identifying MBTs that are useful in treating disease. Our research

programs may initially show promise in identifying potential drug development candidates, yet fail to yield candidates for pre-clinical

and clinical development for a number of reasons, including:

|

|

●

|

the

research methodology used may not be successful in identifying appropriate potential

drug development candidates; or

|

|

|

|

|

|

|

●

|

potential

drug development candidates may, on further study, be shown not to be effective in humans,

or to have unacceptable toxicities, harmful side effects, or other characteristics that

indicate that they are unlikely to be medicines that will receive marketing approval

and achieve market acceptance.

|

Research

programs to identify new product candidates require substantial technical, financial and human resources. We may choose to focus

our efforts and resources on a potential product candidate that ultimately proves to be unsuccessful. If we are unable to identify

suitable MBTs for pre-clinical and clinical development, we will not be able to obtain product revenues in future periods, which

likely would result in significant harm to our financial position and adversely impact our stock price.

Our

research and development plans will require substantial additional future funding which could impact our operational and financial

condition. Without the required additional funds, we will likely cease operations.

It

will take several years before we are able to develop potentially marketable products, if at all. Our research and development

plans will require substantial additional capital to:

|

|

●

|

conduct

research, pre-clinical testing and human studies;

|

|

|

|

|

|

|

●

|

manufacture

any future drug development candidate or product at pilot and commercial scale; and

|

|

|

|

|

|

|

●

|

establish

and develop quality control, regulatory, and administrative capabilities to support these

programs.

|

|

|

|

|

Our

future operating and capital needs will depend on many factors, including:

|

|

●

|

the

pace of scientific progress in our research programs and the magnitude of these programs;

|

|

|

|

|

|

|

●

|

the

scope and results of pre-clinical testing and human studies;

|

|

|

|

|

|

|

●

|

the

time and costs involved in obtaining regulatory approvals;

|

|

|

|

|

|

|

●

|

the

time and costs involved in preparing, filing, prosecuting, securing, maintaining and

enforcing intellectual property rights;

|

|

|

|

|

|

|

●

|

competing

technological and market developments;

|

|

|

|

|

|

|

●

|

our

ability to establish additional collaborations;

|

|

|

|

|

|

|

●

|

changes

in any future collaborations;

|

|

|

|

|

|

|

●

|

the

cost of manufacturing our drug products; and

|

|

|

|

|

|

|

●

|

the

effectiveness of efforts to commercialize and market our products.

|

We

base our outlook regarding the need for funds on many uncertain variables. Such uncertainties include the success of our research

and development initiatives, regulatory approvals, the timing of events outside our direct control such as negotiations with potential

strategic partners and other factors. Any of these uncertain events can significantly change our cash requirements as they determine

such one-time events as the receipt or payment of major milestones and other payments.

Additional

funds will be required to support our operations and if we are unable to obtain them on favorable terms, we may be required to

cease or reduce further research and development of our drug product programs, sell or abandon some or all of our intellectual

property, merge with another entity or cease operations.

We have

a material weakness in our internal control over financial reporting. In addition, because of our status as an emerging growth

company, our independent registered public accountants are not required to provide an attestation report as to our internal control

over financial reporting for several years.

We

are required to annually assess the effectiveness of our internal control over financial reporting pursuant to Section 404

of Sarbanes-Oxley Act of 2002, as amended (“Sarbanes-Oxley Act”) and to report any material weaknesses in such internal

control. A “material weakness” is a deficiency, or a combination of deficiencies, in internal control over financial

reporting such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements

will not be prevented or detected on a timely basis. As of December 31, 2016, we conducted an evaluation of the effectiveness

of the design and operation of our internal control over financial reporting and based on this evaluation we concluded, as of December 31,

2016, that our internal controls over financial reporting were not effective due to a material weakness. The material

weakness relates to our having one employee assigned to positions that involve processing financial information, resulting in

a lack of segregation of duties so that all journal entries and account reconciliations are reviewed by someone other than the

preparer, heightening the risk of error or fraud. Because of our limited resources we may be unable remediate the identified material

weakness in a timely manner, or additional control deficiencies may be identified. If we are unable to remediate the material

weakness, or otherwise maintain effective internal control over financial reporting, we may not be able to report our financial

results accurately, prevent fraud or file our periodic reports in a timely manner.

Our

independent registered public accounting firm will not be required to attest formally to the effectiveness of our internal control

over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act until we are no longer an “emerging growth

company” as defined in the Jumpstart our Business Startups Act of 2012 (“JOBS Act”). We will be an emerging

growth company until December 31, 2020, although circumstances could cause us to lose that status earlier, including if the market

value of our common stock held by non-affiliates exceeds $700 million as of any June 30 before that time, in which case we would

no longer be an emerging growth company as of the following December 31. Accordingly, you will not likely be able to depend on

any attestation concerning our internal control over financial reporting from our independent registered public accountants for

several years.

If

we fail to demonstrate efficacy in our research and clinical trials, our future business prospects, financial condition and operating

results will be materially adversely affected.

The

success of our research and development efforts will be greatly dependent upon our ability to demonstrate efficacy of MBTs in

non-clinical studies, as well as in clinical trials. Non-clinical studies involve testing potential MBTs in appropriate non-human

disease models to demonstrate efficacy and safety. Regulatory agencies evaluate these data carefully before they will approve

clinical testing in humans. If certain non-clinical data reveals potential safety issues or the results are inconsistent with

an expectation of the potential drug’s efficacy in humans, the program may be discontinued or the regulatory agencies may

require additional testing before allowing human clinical trials. This additional testing will increase program expenses and extend

timelines. We may decide to suspend further testing on our potential drugs if, in the judgment of our management and advisors,

the non-clinical test results do not support further development.

Moreover,

success in research, pre-clinical testing and early clinical trials does not ensure that later clinical trials will be successful,

and we cannot be sure that the results of later clinical trials will replicate the results of prior clinical trials and non-clinical

testing. The clinical trial process may fail to demonstrate that our potential drug candidates are safe for humans and effective

for indicated uses. This failure would cause us to abandon a drug candidate and may delay development of other potential drug

candidates. Any delay in, or termination of, our non-clinical testing or clinical trials will delay the filing of an investigational

new drug application and new drug application with the Food and Drug Administration or the equivalent applications with pharmaceutical

regulatory authorities outside the United States and, ultimately, our ability to commercialize our potential drugs and generate

product revenues. In addition, we expect that our early clinical trials will involve small patient populations. Because of the

small sample size, the results of these early clinical trials may not be indicative of future results.

Following

successful non-clinical testing, potential drugs will need to be tested in a clinical development program to provide data on safety

and efficacy prior to becoming eligible for product approval and licensure by regulatory agencies.

If

any of our future potential drugs in clinical development become the subject of problems, our ability to sustain our development

programs will become critically compromised. For example, efficacy or safety concerns may arise, whether or not justified, that

could lead to the suspension or termination of our clinical programs. Examples of problems that could arise include, among others:

|

|

●

|

efficacy

or safety concerns with the potential drug candidates, even if not justified;

|

|

|

|

|

|

|

●

|

failure

of agencies to approve a drug candidate and/or requiring additional clinical or non-clinical

studies before prior to determining approvability;

|

|

|

|

|

|

|

●

|

manufacturing

difficulties or concerns;

|

|

|

|

|

|

|

●

|

regulatory

proceedings subjecting the potential drug candidates to potential recall;

|

|

|

|

|

|

|

●

|

publicity

affecting doctor prescription or patient use of the potential drugs;

|

|

|

|

|

|

|

●

|

pressure

from competitive products; or

|

|

|

|

|

|

|

●

|

introduction

of more effective treatments.

|

Each

clinical phase is designed to test attributes of the drug and problems that might result in the termination of the entire clinical

plan. These problems can be revealed at any time throughout the overall clinical program. The failure to demonstrate efficacy

in our clinical trials would have a material adverse effect on our future business prospects, financial condition and operating

results.

Even

if we are able to develop our potential drugs, we may not be able to obtain regulatory approval, or if approved, we may not be

able to generate significant revenues or successfully commercialize our products, which will adversely affect our financial results

and financial condition and we will have to delay or terminate some or all of our research and development plans which may force

us to cease operations.

All

of our potential drug candidates will require extensive additional research and development, including pre-clinical testing and

clinical trials, as well as regulatory approvals, before we can market them. We cannot predict if or when any potential drug candidate

we intend to develop will be approved for marketing. There are many reasons that we may fail in our efforts to develop our potential

drug candidates. These include:

|

|

●

|

the

possibility that pre-clinical testing or clinical trials may show that our potential

drugs are ineffective and/or cause harmful side effects or toxicities;

|

|

|

|

|

|

|

●

|

our

potential drugs may prove to be too expensive to manufacture or administer to patients;

|

|

|

|

|

|

|

●

|

our

potential drugs may fail to receive necessary regulatory approvals from the United States

Food and Drug Administration or foreign regulatory authorities in a timely manner, or

at all;

|

|

|

|

|

|

|

●

|

even

if our potential drugs are approved, we may not be able to produce them in commercial

quantities or at reasonable costs;

|

|

|

|

|

|

|

●

|

even

if our potential drugs are approved, they may not achieve commercial acceptance;

|

|

|

|

|

|

|

●

|

regulatory

or governmental authorities may apply restrictions to any of our potential drugs, which

could adversely affect their commercial success; and

|

|

|

|

|

|

|

●

|

the

proprietary rights of other parties may prevent us or our potential collaborative partners

from marketing our potential drugs.

|

If

we fail to develop our potential drug candidates, our financial results and financial condition will be adversely affected, we

will have to delay or terminate some or all of our research and development plans and may be forced to cease operations.

If

we do not maintain the support of qualified scientific collaborators, our revenue, growth and profitability will likely be limited,

which would have a material adverse effect on our business.

We

will need to maintain our existing relationships with leading scientists and/or establish new relationships with scientific collaborators.

We believe that such relationships are pivotal to establishing products using our technologies as a standard of care for various

indications. There is no assurance that our founders, scientific advisors or research partners will continue to work with us or

that we will be able to attract additional research partners. If we are not able to establish scientific relationships to assist

in our research and development, we may not be able to successfully develop our potential drug candidates. If this happens, our

business will be adversely affected.

We

will seek to establish development and commercialization collaborations, and, if we are not able to establish them on commercially

reasonable terms, we may have to alter our development and commercialization plans.

Our

potential drug development programs and the potential commercialization of our drug candidates will require substantial additional

cash to fund expenses. We may decide to collaborate with pharmaceutical or biotechnology companies in connection with the development

or commercialization of our potential drug candidates.

We

face significant competition in seeking appropriate collaborators. Whether we reach a definitive collaboration agreement will

depend, among other things, upon our assessment of the collaborator’s resources and expertise, the terms and conditions

of the proposed collaboration and the proposed collaborator’s evaluation of a number of factors. Those factors may include

the design or results of clinical trials, the likelihood of approval by the FDA or similar regulatory authorities outside the

United States, the potential market for the subject product candidate, the costs and complexities of manufacturing and delivering

such product candidate to patients, the potential of competing products, the existence of uncertainty with respect to our ownership

of technology, which can exist if there is a challenge to such ownership without regard to the merits of the challenge and industry

and market conditions generally. The collaborator may also consider alternative product candidates or technologies for similar

indications that may be available to collaborate on, and whether such alternative collaboration project could be more attractive

than the one with us for our product candidate.

Collaborations

are complex and time-consuming to negotiate and document. In addition, there have been a significant number of recent business

combinations among large pharmaceutical companies that have resulted in a reduced number of potential future collaborators.

We

may not be able to negotiate collaborations on a timely basis, on acceptable terms, or at all. If we are unable to do so, we may

have to curtail the development of the product candidate for which we are seeking to collaborate, reduce or delay its development

program or one or more of our other development programs, delay its potential commercialization or reduce the scope of any sales

or marketing activities, or increase our expenditures and undertake development or commercialization activities at our own expense.

If we elect to increase our expenditures to fund development or commercialization activities on our own, we may need to obtain

additional capital, which may not be available to us on acceptable terms or at all. If we do not have sufficient funds, we may

not be able to further develop our product candidates or bring them to market and generate product revenue.

We

expect to rely on third parties to conduct our clinical trials and some aspects of our research and pre-clinical testing. These

third parties may not perform satisfactorily, including failing to meet deadlines for the completion of such trials, research

or pre-clinical testing.

We

currently rely on third parties to conduct some aspects of our research and expect to continue to rely on third parties to conduct

additional aspects of our research and pre-clinical testing, as well as any future clinical trials. Any of these third parties

may terminate their engagements with us at any time. If we need to enter into alternative arrangements, it would delay our product

research and development activities.

Our

reliance on these third parties for research and development activities will reduce our control over these activities but will

not relieve us of our responsibilities. For example, we will remain responsible for ensuring that each of our clinical trials

is conducted in accordance with the general investigational plan and protocols for the trial. Moreover, the FDA requires us to

comply with standards, commonly referred to as Good Clinical Practices, for conducting, recording and reporting the results of

clinical trials to assure that data and reported results are credible and accurate and that the rights, integrity and confidentiality

of trial participants are protected. We also are required to register ongoing clinical trials and post the results of completed

clinical trials on a government-sponsored database, ClinicalTrials.gov, within certain timeframes. Failure to do so can result

in fines, adverse publicity and civil and criminal sanctions.

Furthermore,

these third parties may also have relationships with other entities, some of which may be our competitors. If these third parties

do not successfully carry out their contractual duties, meet expected deadlines or conduct our clinical trials in accordance with

regulatory requirements or our stated protocols, we will not be able to obtain, or may be delayed in obtaining, marketing approvals

for our drug candidates and will not be able to, or may be delayed in our efforts to, successfully commercialize our medicines.

We

also expect to rely on other third parties to store and distribute drug supplies for our clinical trials. Any performance failure

on the part of our distributors could delay clinical development or marketing approval of our drug candidates or commercialization

of our products, producing additional losses and depriving us of potential product revenue.

We

contract with third parties for the manufacture of our peptide materials for research and expect to continue to do so for any

future product candidate advanced to pre-clinical testing, clinical trials and commercialization. This reliance on third parties

increases the risk that we will not have sufficient quantities of our research peptide materials, product candidates or medicines,

or that such supply will not be available to us at an acceptable cost, which could delay, prevent or impair our research, development

or commercialization efforts.

We

do not have manufacturing facilities adequate to produce our research peptide materials or supplies of any future product candidate.

We currently rely, and expect to continue to rely, on third-party manufacturers for the manufacture of our peptide materials,

any future product candidates for pre-clinical and clinical testing, and for commercial supply of any of these product candidates

for which we or future collaborators obtain marketing approval. We do not have long term supply agreements with any third-party

manufacturers, and we purchase our research peptides on a purchase order basis.

We

may be unable to establish any agreements with third-party manufacturers or to do so on acceptable terms. Even if we are able

to establish agreements with third-party manufacturers, reliance on third-party manufacturers entails additional risks, including:

|

|

●

|

reliance

on the third party for regulatory compliance and quality assurance;

|

|

|

|

|

|

|

●

|

the

possible breach of the manufacturing agreement by the third party;

|

|

|

|

|

|

|

●

|

the

possible termination or nonrenewal of the agreement by the third party at a time that

is costly or inconvenient for us; and

|

|

|

|

|

|

|

●

|

reliance

on the third party for regulatory compliance, quality assurance, and safety and pharmacovigilance

reporting.

|

Third-party

manufacturers may not be able to comply with current good manufacturing practices, or cGMP, regulations or similar regulatory

requirements outside the United States. Our failure, or the failure of our third-party manufacturers, to comply with applicable

regulations could result in sanctions being imposed on us, including fines, injunctions, civil penalties, delays, suspension or

withdrawal of approvals, license revocation, seizures or recalls of product candidates or medicines, operating restrictions and

criminal prosecutions, any of which could significantly and adversely affect supplies of our medicines and harm our business and

results of operations.

Any

drug candidate that we may develop may compete with other drug candidates and products for access to manufacturing facilities.

There are a limited number of manufacturers that operate under cGMP regulations and that might be capable of manufacturing for

us.

Our

current and anticipated future dependence upon others for the manufacture of our investigational materials or future product candidates

or medicines may adversely affect our future profit margins and our ability to commercialize any medicines that receive marketing

approval on a timely and competitive basis.

We

may not be able to develop drug candidates, market or generate sales of our products to the extent anticipated. Our business may

fail and investors could lose all of their investment in our Company.

Assuming

that we are successful in developing our potential drug candidates and receiving regulatory clearances to market our potential

products, our ability to successfully penetrate the market and generate sales of those products may be limited by a number of

factors, including the following:

|

|

●

|

if

our competitors receive regulatory approvals for and begin marketing similar products

in the United States, the European Union, Japan and other territories before we do, greater

awareness of their products as compared to ours will cause our competitive position to

suffer;

|

|

|

|

|

|

|

●

|

information

from our competitors or the academic community indicating that current products or new

products are more effective or offer compelling other benefits than our future products

could impede our market penetration or decrease our future market share; and

|

|

|

|

|

|

|

●

|

the

pricing and reimbursement environment for our future products, as well as pricing and

reimbursement decisions by our competitors and by payers, may have an effect on our revenues.

|

If

any of these happened, our business could be adversely affected.

Any

product candidate we are able to develop and commercialize would compete in the marketplace with existing therapies and new therapies

that may become available in the future. These competitive therapies may be more effective, less costly, more easily administered,

or offer other advantages over any product we seek to market.

There

are numerous therapies currently marketed to treat diabetes, cancer, Alzheimer’s disease and other diseases for which our

potential product candidates may be indicated. For example, if we develop an approved treatment for type 2 diabetes, it would

compete with several classes of drugs for type 2 diabetes that are approved to improve glucose control. These include the insulin

sensitizers pioglitazone (Actos) and rosiglitazone (Avandia), which are administered as oral once daily pills, and metformin,

which is sometimes called an insulin sensitizer and is available as a generic once daily formulation. If we develop an approved

treatment for Alzheimer’s disease it would compete with approved therapies such as donepezil (Aricept), galantamine (Razadyne),

memantine (Namenda), rivastigmine (Exelon) and tacrine (Cognex). These therapies are varied in their design, therapeutic application

and mechanism of action and may provide significant competition for any of our product candidates for which we obtain market approval.

New products may also become available that provide efficacy, safety, convenience and other benefits that are not provided by

currently marketed therapies. As a result, they may provide significant competition for any of our product candidates for which

we obtain market approval. Our commercial opportunity could be reduced or eliminated if our competitors develop and commercialize

products that are safer, more effective, have fewer or less severe side effects, are more convenient or are less expensive than

any products that we may develop. Our competitors also may obtain FDA or other regulatory approval for their products more rapidly

than we may obtain approval for ours, which could result in our competitors establishing a strong market position before we are

able to enter the market. In addition, our ability to compete may be affected in many cases by insurers or other third-party payers

seeking to encourage the use of existing products which are generic or are otherwise less expensive to provide.

Our

future success depends on key members of our scientific team and our ability to attract, retain and motivate qualified personnel.

We

are highly dependent on our founders, Dr. Pinchas Cohen and Dr. Nir Barzilai, and the other principal members of our

management and scientific teams. Drs. Cohen and Barzilai are members of our board of directors and provide certain scientific

and research advisory services to us pursuant to consulting arrangements with each of them. Other members of our key management

and scientific teams are employed “at will,” meaning we or they may terminate the employment relationship at any time.

Our consultants and advisors, including our founders, may be employed by employers other than us and may have commitments under

consulting or advisory contracts with other entities that may limit their availability to us. In addition, we rely on other consultants

and advisors from time to time, including drug discovery and development advisors, to assist us in formulating our research and

development strategy. Agreements with these advisors typically may be terminated by either party, for any reason, on relatively

short notice. We do not maintain “key person” insurance for any of the key members of our team. The loss of the services

of any of these persons could impede the achievement of our research, development and commercialization objectives.

Recruiting

and retaining qualified scientific, clinical, and managerial personnel will also be critical to our success. We may not be able

to attract and retain these personnel on acceptable terms given the competition among numerous pharmaceutical and biotechnology

companies for similar personnel. We also experience competition for the hiring of scientific and clinical personnel from universities

and research institutions.

We

expect to expand our research, development and regulatory capabilities, and as a result, we may encounter difficulties in managing

our growth, which could disrupt our operations.

We

expect to experience significant growth in the scope of our operations, particularly in the areas of research, drug development

and regulatory affairs. To manage our anticipated future growth, we must continue to implement and improve our managerial, operational

and financial systems, expand our facilities and continue to recruit and train additional qualified personnel. Due to our limited

financial resources and our limited operating history, we may not be able to effectively manage the expected expansion of our

operations. Any inability to manage growth could delay the execution of our business plans or disrupt our operations.

The

use of any of our products in clinical trials may expose us to liability claims, which may cost us significant amounts of money

to defend against or pay out, causing our business to suffer.

The

nature of our business exposes us to potential liability risks inherent in the testing, manufacturing and marketing of our products.

We do not currently have any drug candidates in clinical trials, however, if any of our drug candidates enter into clinical trials

or become marketed products, they could potentially harm people or allegedly harm people, possibly subjecting us to costly and

damaging product liability claims. Some of the patients who participate in clinical trials are already ill when they enter a trial

or may intentionally or unintentionally fail to meet the exclusion criteria. The waivers we obtain may not be enforceable and

may not protect us from liability or the costs of product liability litigation. Although we intend to obtain product liability

insurance which we believe is adequate, we are subject to the risk that our insurance will not be sufficient to cover claims.

The insurance costs along with the defense or payment of liabilities above the amount of coverage could cost us significant amounts

of money and management distraction from other elements of the business, causing our business to suffer.

The

patent positions of biopharmaceutical products are complex and uncertain and we may not be able to protect our patented or other

intellectual property. If we cannot protect this property, we may be prevented from using it or our competitors may use it and

our business could suffer significant harm. Also, the time and money we spend on acquiring and enforcing patents and other intellectual

property will reduce the time and money we have available for our research and development, possibly resulting in a slow down

or cessation of our research and development.

We

are the exclusive licensee of patents and patent applications related to our MDPs and expect to own or license patents related

to our potential drug candidates. However, neither patents nor patent applications ensure the protection of our intellectual property

for a number of reasons, including the following:

|

|

●

|

The

United States Supreme Court rendered a decision in Molecular Pathology vs. Myriad Genetics,

Inc., 133 S.Ct. 2107 (2013) (“Myriad”), in which the court held that

naturally occurring DNA segments are products of nature and not patentable as compositions

of matter. On March 4, 2014, the U.S. Patent and Trademark Office (“USPTO”)

issued guidelines for examination of such claims that, among other things, extended the

Myriad decision to any natural product. Since MDPs are natural products isolated from

cells, the USPTO guidelines may affect allowability of some of our patent claims (pertaining

to natural MDP sequences) that are filed in the USPTO but are not yet issued. Further,

while the USPTO guidelines are not binding on the courts, it is likely that as the law

of subject matter eligibility continues to develop Myriad will be extended to natural

products other than DNA. Thus, our issued U.S. patent claims directed to MDPs as compositions

of matter may be vulnerable to challenge by competitors who seek to have our claims rendered

invalid. While Myriad and the USPTO guidelines described above will affect our patents

only in the United States, there is no certainty that similar laws or regulations will

not be adopted in other jurisdictions.

|

|

|

|

|

|

|

●

|

Competitors

may interfere with our patenting process in a variety of ways. Competitors may claim

that they invented the claimed invention prior to us. Competitors may also claim that

we are infringing their patents and restrict our freedom to operate. Competitors may

also contest our patents and patent applications, if issued, by showing in various patent

offices that, among other reasons, the patented subject matter was not original, was

not novel or was obvious. In litigation, a competitor could claim that our patents and

patent applications are not valid or enforceable for a number of reasons. If a court

agrees, we would lose some or all of our patent protection.

|

|

|

●

|

As

a company, we have no meaningful experience with competitors interfering with our patents

or patent applications. In order to enforce our intellectual property, we may need to

file a lawsuit against a competitor. Enforcing our intellectual property in a lawsuit

can take significant time and money. We may not have the resources to enforce our intellectual

property if a third party infringes an issued patent claim. Infringement lawsuits may

require significant time and money resources. If we do not have such resources, the licensor

is not obligated to help us enforce our patent rights. If the licensor does take action

by filing a lawsuit claiming infringement, we will not be able to participate in the

suit and therefore will not have control over the proceedings or the outcome of the suit.

|

|

|

|

|

|

|

●

|

Because

of the time, money and effort involved in obtaining and enforcing patents, our management

may spend less time and resources on developing potential drug candidates than they otherwise

would, which could increase our operating expenses and delay product programs.

|

|

|

|

|

|

|

●

|

Our

licensed patent applications directed to the composition and methods of using MOTS-c,

and SHLP-6, which we consider as a research peptide for the potential treatment of cancer,

have not yet been issued. There can be no assurance that these or our other licensed

patent applications will result in the issuance of patents, and we cannot predict the

breadth of claims that may be allowed in our currently pending patent applications or

in patent applications we may file or license from others in the future.

|

|

|

|

|

|

|

●

|

Issuance

of a patent may not provide much practical protection. If we receive a patent of narrow

scope, then it may be easy for competitors to design products that do not infringe our

patent(s).

|

|

|

|

|

|

|

●

|

We

have limited ability to expand coverage of our licensed patent related to SHLP-2 and

our licensed patent application related to SHLP-6 outside of the United States. The lack

of patent protection in international jurisdictions may inhibit our ability to advance

MBT drug candidates in these markets.

|

|

|

|

|

|

|

●

|

If

a court decides that the method of manufacture or use of any of our drug candidates infringes

on a third-party patent, we may have to pay substantial damages for infringement.

|

|

|

|

|

|

|

●

|

A

court may prohibit us from making, selling or licensing a potential drug candidate unless

the patent holder grants a license. A patent holder is not required to grant a license.

If a license is available, we may have to pay substantial royalties or grant cross licenses

to our patents, and the license terms may be unacceptable.

|

|

|

|

|

|

|

●

|

Redesigning

our potential drug candidates so that they do not infringe on other patents may not be

possible or could require substantial funds and time.

|

It

is also unclear whether our trade secrets are adequately protected. While we use reasonable efforts to protect our trade secrets,

our employees or consultants may unintentionally or willfully disclose our information to competitors. Enforcing a claim that

someone illegally obtained and is using our trade secrets is expensive and time consuming, and the outcome is unpredictable. In

addition, courts outside the United States are sometimes less willing to protect trade secrets. Our competitors may independently

develop equivalent knowledge, methods and know-how. We may also support and collaborate in research conducted by government organizations,

hospitals, universities or other educational institutions. These research partners may be unable or unwilling to grant us exclusive

rights to technology or products derived from these collaborations prior to entering into the relationship.

If

we do not obtain required intellectual property rights, we could encounter delays in our drug development efforts while we attempt

to design around other patents or even be prohibited from developing, manufacturing or selling potential drug candidates requiring

these rights or licenses. There is also a risk that disputes may arise as to the rights to technology or potential drug candidates

developed in collaboration with other parties.

Risks

Related to Our Common Stock

If securities or

industry analysts do not publish or cease publishing research or reports about us, our business or our market, or if they change

their recommendations regarding our stock adversely, our stock price and trading volume could decline.

The

trading market for our common stock will be influenced by the research and reports that industry or securities analysts may publish

about us, our business, our market, or our competitors. If any of the analysts who may cover us change their recommendation regarding

our stock adversely, or provide more favorable relative recommendations about our competitors, our stock price would likely decline.

If any analysts who may cover us were to cease coverage or our company or fail to regularly publish reports on us, we could lose

visibility in the financial markets, which in turn could cause our stock price or trading volume to decline.

Shares

of our common stock eligible for future sale in the public marketplace may adversely affect the market price of our common stock.

The

price of our common stock could decline if there are substantial sales of our common stock in the public stock market. There were

34,807,881 shares of our common stock outstanding as of December 31, 2016. Of these, 12,915,343 shares were subject to lock-up

agreements which expired on January 6, 2017 and which will be eligible for resale under the registration statement of which this

prospectus forms a part. Sales of a substantial number of these shares, or the perception in the market that the holders of a

large number of shares are able to or intend to sell shares, could reduce the market price of our common stock.

The

market price of our common stock may be highly volatile.

The

market for our common stock will likely be characterized by significant price volatility when compared to more established issuers

and we expect that it will continue to be so for the foreseeable future. The market price of our common stock is likely to be

volatile for a number of reasons. First, our common stock is likely to be sporadically and/or thinly traded. As a consequence

of this lack of liquidity, the trading of relatively small quantities of common stock by our stockholders may disproportionately

influence the price of the common stock in either direction. The price of the common stock could, for example, decline precipitously

if even a relatively small number of shares are sold on the market without commensurate demand, as compared to a market for shares

of an established issuer which could better absorb those sales without adverse impact on its share price. Secondly, we are a speculative

investment due to our lack of profits to date and substantial uncertainty regarding our ability to develop and commercialize a

drug product from our new or existing technologies. As a consequence of this enhanced risk, more risk-adverse investors may, under

the fear of losing all or most of their investment in the event of negative news or lack of progress, be more inclined to sell

their shares on the market more quickly and at greater discounts than would be the case with the shares of an established issuer.

We cannot make any predictions or projections as to what the prevailing market price for our common stock will be at any time

or as to what effect the sale of common stock or the availability of common stock for sale at any time will have on the prevailing

market price.

Our

ability to utilize our net operating loss carryforwards and certain other tax attributes may be limited.

Under

Section 382 and related provisions of the Internal Revenue Code of 1986, as amended (the “Code”), if a corporation

undergoes an “ownership change” (generally defined as a greater than 50% change (by value) in its equity ownership

over a three year period), the corporation’s ability to use its pre-change net operating loss carryforwards and other pre-change