Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

April 21 2017 - 3:11PM

Edgar (US Regulatory)

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by

the registrant ☐ Filed by a party other than the

registrant ☒

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary proxy statement

|

|

|

|

|

☐

|

|

Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive proxy statement

|

|

|

|

|

☐

|

|

Definitive additional materials

|

|

|

|

|

☒

|

|

Soliciting material pursuant to §240.14a-12

|

Provectus

Biopharmaceuticals, Inc.

(Name of Registrant as Specified In Its Charter)

Peter R. Culpepper

(Name

of Person Filing Proxy Statement)

Payment of filing fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transactions applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the form or schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount previously paid:

|

|

|

|

(2)

|

|

Form, schedule or registration statement no.:

|

|

|

|

(3)

|

|

Filing party:

|

|

|

|

(4)

|

|

Date filed:

|

Peter R. Culpepper

P.O. Box 32429

Knoxville,

Tennessee 37930

April 21, 2017

Dr. Timothy

Scott

President

Provectus Biopharmaceuticals, Inc.

7327 Oak Ridge Highway

Knoxville, TN 37931

Dear Dr. Scott:

I am writing this letter to object to the

incorrect and incomplete, and in many instances defamatory, statements made about me in the preliminary proxy statement filed by Provectus Biopharmaceuticals, Inc. with the Securities and Exchange Commission on April 18, 2017, and to demand

that those statements be removed or corrected in the definitive proxy materials that are distributed to stockholders.

Among the incorrect and incomplete

statements made about me in the preliminary proxy statement on the following:

|

|

•

|

|

In the letter to stockholders, in the section of the preliminary proxy statement captioned “Background of the Solicitation,” and in several other places in the preliminary proxy statement, there are statements

that there were improper travel expense advances and reimbursements to me totaling approximately $294,255 or that a Special Committee of the Board of Directors had concluded that I owed Provectus $294,255 for improper travel advances and expense

reimbursement. One of those statements was preceded by a statement that I provided “18 new or revised schedules/spreadsheets analyzing [my] business expense reporting and reimbursements,” together with a statement that the explanations had

been rejected by a consultant to the Special Committee “as unsupported or nonsensical.” However, there is no disclosure of the fact that the spreadsheets reconcile all but approximately $39,000 of the discrepancies that had been identified

by the consultant in its review of the hundreds of thousands of dollars of expenses I incurred in connection with extensive travel over several years, and that I had subsequently reimbursed Provectus for the approximately $39,000. There also is no

disclosure of the fact that spreadsheets were transmitted with a suggestion that somebody from the consultant’s office should come to Provectus’ offices (where I worked at that time) and go over with me the backup for my reconciliations.

Nor is it disclosed that after the board purported to terminate my employment for cause, my attorney told counsel for the Special Committee that if the board would like to discuss the spread sheets and other information I had provided regarding my

travel expenses, I would do that. Neither is there any disclosure that, in spite of these offers to review the reconciliations and backup, neither the consultant nor anybody from his office, nor anybody else on behalf of the Special Committee or the

Provectus board of directors, ever spoke to me about my reconciliations or asked to review the backup for them.

|

|

|

•

|

|

Although the preliminary proxy statement says in several places that I have disputed that I was terminated

“for cause” under my employment agreement and the amount I owe Provectus and have demanded this issue be resolved by mediation, in only one of those places does it disclose that I have also asserted that, because the termination of my

employment was not “for cause,”

|

2

|

|

Provectus owes me $1 million in severance payments and that my severance claim is one of the subjects of the pending mediation/arbitration process under my employment contract.

|

|

|

•

|

|

The letter to stockholders and Note 12 to the Stock Ownership table on page 15 each states that I am required to make immediate payment of $2,051,083 with regard to the Kleba litigation settlement. It does not point out

that payment of that amount will only be required if it is determined that the termination of my employment was “for cause.” If, as I am confident will be the case, it is determined that there was no “cause” for the termination

of my employment, I am current in my payments regarding the Kleba settlement and my total settlement commitment is limited to $1,025,542, of which, as the preliminary proxy statement fails to state, I have already paid $433,333 (which also reduces

the amount I would owe if there had been “cause”).

|

|

|

•

|

|

In the section captioned “Background of the Solicitation,” there is a statement that Provectus believes my filing of a Schedule 13D violated the proxy solicitation rules under Rule 14a-1(1) of the Securities

Exchange Act and Rule 10b-5 under the Exchange Act. That is followed by the statement, as though it were an established fact, that I “willfully violated federal securities laws as a means to publicize [my] own false version of events regarding

[my] termination from Provectus.” The preliminary proxy statement fails to disclose that when an attorney for Provectus made similar claims in a letter to my attorney, together with an assertion that I violated the Williams Act by filing a

Schedule 13D when I was not required to do so, my attorney sent a response that explained why the statements in my filing did not, and could not have, violated the SEC proxy rules, Rule 10b-5 or the Williams Act. The incorrect statement that I had

willfully violated federal securities laws constitutes an actionable accusation that I committed a crime. This is particularly defamatory and even if nothing else were removed from the proxy statement, this should be removed.

|

|

|

•

|

|

The preliminary proxy statement says Provectus reported my “filing a Schedule 13D in violation of federal securities laws to the SEC in order for the SEC to take appropriate action against [me].” Perhaps it

should also disclose that a member of the Staff of the SEC subsequently called my attorney, told him the SEC does not encourage holders of less than 5% of a company’s securities to file Schedule 13Ds, reminded him that because I had filed a

Schedule 13D even though I was not required to do so, I was subject to all the requirements applicable to Schedule 13D filers, including the need to amend the Schedule 13D under some circumstances, and said the SEC Staff was not going to open an

investigation with regard to the matter.

|

|

|

•

|

|

The preliminary proxy statement says on page 11 that in order to alleviate concerns of a hostile takeover by a

group of which I was a part, Provectus determined to initially structure the investment by the PRH Group as secured convertible debt. It then says “Once the threat of a hostile takeover by the Culpepper Group ceased, the debt would convert into

preferred securities, the original proposal by the PRH Group.” That is not what the Secured Convertible Promissory Note that was issued to Cal Enterprises LLC says. Unless the holder of that Note voluntarily converts it, the Note will not be

converted into preferred stock until 18 months after outstanding borrowings arranged by the PRH Group are $20 million, or Cal Enterprises LLC notifies Provectus that it will not disburse any additional funds under the Note Provectus issued to it,

provided it has disbursed at least $10 million under that Note (even though the Note says it shall have a maximum principal amount of up to $2.5 million). There is no obligation in the Note, or insofar as we can tell from Provectus’

descriptions, in the Definitive Financing Term Sheet entered into by PRH, for PRH even to make efforts to raise $20 million of financing. This is critically important information for the Provectus stockholders, because the Notes are secured by all

of Provectus’ potentially hugely valuable intellectual property, and if anybody wants to buy Provectus or do anything else that would involve control of the board, even if I am in no way

|

3

|

|

involved, the holders of the Notes will be entitled to a “penalty” equal to ten times the principal amount of the Notes (assuming that provision is enforceable).

|

|

|

•

|

|

The preliminary proxy statement contains on pages 11 and 12 an unqualified statement that the Schedule 13D filed by the Miller Group “contained numerous misleading statements and failed to state material facts that

made the disclosure therein misleading.” As was conveyed to an attorney for Provectus, it is the belief of the members of the Miller Group who were responsible for the drafting of the Schedule 13D that all the statements made in it are complete

and accurate in all material respects. The statements in the preliminary proxy statement will constitute actionable defamation if they appear in the definitive proxy statement without at least a qualification to the effect that Provectus believes

the statements were misleading or omitted material facts.

|

|

|

•

|

|

There is a statement in Note 12 to the Stock Ownership table on page 15 that options I hold relating to 1,500,000 shares of common stock have expired as a result of my termination. That would only be the case if my

termination was for cause, which I have repeatedly asserted was not the case and which is the subject of the pending mediation/arbitration process.

|

|

|

•

|

|

On page 25 of the preliminary proxy statement, there is a statement that I was owed no severance payments because I was terminated for Cause. There is no accompanying disclosure of the fact that I have denied that there

was “cause” to terminate my employment, and that I am seeking through the pending mediation/arbitration process severance payments of $1 million.

|

The statements described above are not the only incorrect or incomplete statements in the preliminary proxy statement; however, they are the most egregious of

the incorrect or incomplete statements relating to me. Unless the statements described above are removed from, or corrected in, the definitive proxy statement that is distributed to stockholders, that proxy statement will be seriously misleading and

I will have to conclude the inaccurate and incomplete statements regarding me are an intentional effort to defame me, in which case I will consider the legal remedies available to me as a result of those statements.

Very truly yours,

/s/ Peter R. Culpepper

Peter R. Culpepper

4

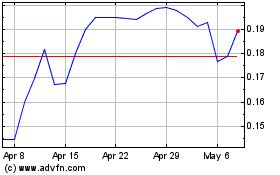

Provectus Biopharmaceuti... (QB) (USOTC:PVCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Provectus Biopharmaceuti... (QB) (USOTC:PVCT)

Historical Stock Chart

From Apr 2023 to Apr 2024