SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

April 21, 2017

Commission File Number: 001-32827

MACRO BANK INC.

(Translation of registrant’s name

into English)

Sarmiento 447

Buenos Aires C1 1041

Tel: 54 11 5222 6500

(Address of registrant’s principal

executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information

contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b): 82-

N/A

INDEX

|

|

1.

|

Translation of a submission from Banco Macro to the CNV dated

on April 21, 2017.

|

Buenos Aires, 21

st

April 2017

To

Comisión Nacional de Valores (Argentine

Securities Exchange Commission)

Please find attached hereto the notice

sent on the date hereof to the

Fondo de Garantía de Sustentabilidad - Administración Nacional de la Seguridad

Social (ANSES)

answering its request of information regarding the general and special shareholders’ meeting of Banco

Macro S.A. to be held on April 28

th

2017.

Sincerely,

Gustavo Alejandro Manríquez

Attorney

Buenos Aires, April 21st 2017

To

Fondo de Garantía de Sustentabilidad

Administración Nacional de la

Seguridad Social (ANSES)

Mr. Juan Martín Monge Varela

Tucumán 500, piso 2º

S __________/____________D

Re.: NOTES N° 902/17 and 1010/17

Dear Mr. Monge Varela,

We write to you in reply to your request

of information regarding the General and Special Shareholders’ Meeting of Banco Macro S.A. called for April 28

th

2017. In that respect, please be advised as follows:

1. Executed copy of the Minutes of the

Board of Directors’ Meeting calling the General and Special Shareholders’ Meeting.

Please be advised that the wording of the

minutes of the Board of Directors’ Meeting calling a General and Special Shareholders’ Meeting for April 28

th

2017 is available in the Financial Information Highway (or AIF for its acronym in Spanish) of the CNV or Securities and Exchange

Commission of the Republic of Argentina.

2. Current composition of the Board

of Directors (regular and alternate members) including the designation dates and effective term of office.

The current composition of the Board of

Directors is as follows:

|

NAME/S AND LAST NAME

|

POSITION

|

DESIGNATION DATE

|

Designation Expiry Date

– Shareholders’

Meeting evaluating the

Financial Statements of

the fiscal year

|

|

Jorge Horacio Brito

|

CHAIRMAN

|

04/26/2016

|

12/31/2017

|

|

Delfín Jorge Ezequiel Carballo

|

VICE CHAIRMAN

|

04/26/2016

|

12/31/2017

|

|

Jorge Pablo Brito

|

REGULAR DIRECTOR

|

04/26/2016

|

12/31/2018

|

|

Carlos Alberto Giovanelli

|

REGULAR DIRECTOR

|

04/26/2016

|

12/31/2018

|

|

Nelson Damián Pozzoli

|

REGULAR DIRECTOR

|

04/26/2016

|

12/31/2018

|

|

José Alfredo Sanchez

|

REGULAR DIRECTOR

|

04/26/2016

|

12/31/2018

|

|

Martín Estanislao Gorosito

|

REGULAR DIRECTOR

|

04/26/2016

|

12/31/2018

|

|

Roberto Julio Eilbaum

|

REGULAR DIRECTOR

|

04/26/2016

|

12/31/2017

|

|

Mario Luis Vicens

|

REGULAR DIRECTOR

|

04/26/2016

|

12/31/2017

|

|

Luis María Blaquier (*)

|

REGULAR DIRECTOR

|

04/26/2016

|

12/31/2017

|

|

Marcos Brito

|

REGULAR DIRECTOR

|

04/26/2016

|

12/31/2016

|

|

Alejandro Eduardo Fargosi

|

REGULAR DIRECTOR

|

04/26/2016

|

12/31/2016

|

|

Delfín Federico Ezequiel Carballo

|

REGULAR DIRECTOR

|

01/25/2017

|

12/31/2016

|

|

Constanza Brito

|

ALTERNATE DIRECTOR

|

04/26/2016

|

12/31/2018

|

|

Eliseo Felix Santi

|

ALTERNATE DIRECTOR

|

04/26/2016

|

12/31/2018

|

(*) On March 13th 2017 Mr. Blaquier communicated

his resignation as regular director as of the next shareholders’ meeting. Such resignation was accepted by the Board at the

Board of Directors’ Meeting held last March 16

th

.

3. Detailed description of the shareholders

structure to date.

Please be advised that last February 17

th

we posted in the AIF the note provided for in section 62 of the Rules and Regulations of the Buenos Aires Stock Exchange, informing

the Bank’s current ownership structure for the financial statements ended December 31

st

2016, to wit:

|

Shareholders

|

Class A Shares

|

Class B Shares

|

Capital Stock

|

Participating

Interest

%

|

|

Controlling Group

|

10,261,879

|

214,236,827

|

224,498,706

|

38.40

|

|

Others

|

973,791

|

359,090,531

|

360,064,322

|

61.60

|

|

Total

|

11,235,670

|

573,327,358

|

584,563,028

|

100.00

|

4. As to the following items of the

Agenda, please be advised as follows:

a. (Item 2) “Evaluate the documentation

provided for in section 234, subsection 1 of Law No. 19550, for the fiscal year ended December 31st 2016”. Regarding this

item, we consider all the documents are available in the Financial Information Highway (or AIF for its acronym in Spanish) of the

CNV. In case any of them is not available, please send the missing documentation.

The documentation provided for in section

234, subsection 1 of Law 19550 to be submitted to and evaluated by the next General and Special Shareholders’ Meeting was

made available to the public in due time and manner and are currently available in the AIF.

b. (Item 3) “Evaluate the management

of the Board and the Supervisory Committee”. Information regarding the administration and actions performed by the Board

and by the Supervisory Committee expressly identifying its members.

The Board’s administration and the

actions of the Supervisory Committee were in accordance with the provisions of the Argentine Business Company Law No. 19550, the

Capital Market La No. 26831, the Rules and Regulations of the

Comisión Nacional de Valores

(Argentine Securities

and Exchange Commission) and the rules and regulations of the Central Bank of the Republic of Argentina (BCRA).

c. (Item 4) “Application of the

retained earnings for the fiscal year ended 31 December 2016. Total Retained Earnings: AR$ 6,732,504,739.99 which the Board proposes

may be applied as follows: a) AR$ 1,308,459,923.00 to Legal Reserve Fund; b) AR$ 52,463,132.30 to tax on corporate personal assets

and participating interests: c) AR$ 5,371,581,684.69 to the optional reserve fund for future profit distributions, pursuant to

Communication “A” 5273 issued by the Central Bank of the Republic of Argentina. Please provide supporting information

regarding this item.

Retained earnings for the year 2016 arise from the

financial statements prepared for such fiscal year, which were unanimously approved by the directors at the Board’s meeting

held last February 15

th

and published in the AIF in due time and manner according to law.

The Board’s proposal as to the application

of retained earnings for the fiscal year ended 31 December 2016 was submitted in compliance with the rules of the Central Bank

of the Republic of Argentina applicable to this matter.

d. (Item 5) Separate a portion of the

optional reserve fund for future profit distributions in order to allow the application of AR$ AR$ 701,475,633.60 to the payment

of a cash dividend, subject to prior authorization of the Central Bank of the Republic of Argentina.” Please provide proposal

and information regarding this item. In particular, please identify the source of the separated portion of the optional reserve

fund, providing detailed information of all the activity from the creation thereof to date.

As evidenced by the minutes of the General

and Special Shareholders’ Meeting dated April 16th 2012 and duly published in the AIF, we created an “Optional Reserve

for Future Distributions” on the amount of AR$ 2,443,140,742.68. In addition, please be advised that the “Optional

Reserve Fund for Future Distributions” account was increased as a result of the resolutions adopted at the General Shareholders’

Meeting held on April 11

th

2013, the General and Special Shareholders’ Meeting held on April 29

th

2014,

the General and Special Shareholders’ Meeting held on April 23

rd

2015 and the General and Special Shareholders’

Meeting held on April 26

th

2016 in AR$ 1,170,680,720, 1,911,651,322.50, 2,736,054,342.94 and 3,903,591,780.29, respectively.

Moreover, the Shareholders’ Meetings dated April 29

th

2014, April 23

rd

2015 and April 26

th

2016 resolved to separate a portion of such reserve fund equal to AR$ 596,254,288.56, 596,254,288.56 and 643,019,330.80, respectively,

for the payment of a cash dividend. All the above mentioned resolutions were as well published in the AIF in due time and manner.

e. (Item 6) “Evaluate the remunerations

of the members of the Board of Directors for the fiscal year ended December 31st 2016 within the limits as to profits, pursuant

to section 261 of Law 19550 and the Rules of the

Comisión Nacional de Valores

(Argentine Securities and Exchange

Commission)”. Please provide proposal regarding this item, breaking down such amounts by description (directors’ remunerations,

remunerations to the members of the audit committee, fees paid for executive functions, etc.) and by director. Also please inform

whether there are Directors employed by the Bank and, in case there are, please inform the salary amount paid in each case. Additionally,

provide the amounts paid as Board fees for the fiscal years 2015, 2014 and 2013, following the same breakdown described above.

Finally, please provide a breakdown of the amounts advanced to each director during the year 2016 and the proposal of advance payments

for the year 2017, if applicable.

The proposed remuneration for the directors

for the above mentioned fiscal year was made available to the public in due time and manner according to law through the publication

of the proposed remuneration in the AIF, pursuant to the Rules of the Argentine Securities and Exchange Commission.

In the financial statements for the year

ended 31 December 2016 the amount of AR$ 273,402,491.85 is recorded in the Statement of Income as fees payable to the Board of

Directors. The remuneration proposed, as in previous years, does not exceed the limits established under section 261 of Law 19550.

The remuneration of the directors for the

fiscal years 2015, 2014 and 2013 are evidenced in the minutes of the shareholders’ meetings that evaluated all aspects of

such fiscal years, which were duly published in the AIF.

No member of the Board is employed by the

Bank.

As to the breakdown of the amount to be

paid separately to each director, we shall comply in due time with all the provisions set forth in section 75 of Decree No. 1023/2013,

as provided under the Interpretation Criterion No. 45 of the CNV.

There is no proposal as the advance payments

for the year ending 31 December 2017, which will be considered by the shareholders’ meeting evaluating the remunerations

of the directors for that same fiscal year.

f. (Item 7) “Evaluate the remunerations

of the members of the Supervisory Committee for the fiscal year ended 31 December 2016”. Please provide proposal regarding

this item and advance payments made for the year 2016, breaking down such amounts by member of the Supervisory Committee. In addition,

please inform the amounts paid as remuneration to the Supervisory Committee during the fiscal years 2015, 2014 and 2013, as well

as any other information supporting this item.

The financial statements for the year ended

31 December 2016 contemplate a provision of AR$ 1,224,556.20 for the payment of remunerations to the members of the Supervisory

Committee for the services rendered during the above mentioned fiscal year.

As to the breakdown of the amount to be

paid to each member of the Supervisory Committee, we shall comply in due time with all the provisions set forth in section 75 of

Decree No. 1023/2013, as provided under the Interpretation Criterion No. 45 of the CNV.

The remuneration of the members of the

supervisory committee for the fiscal years 2015, 2014 and 2013 are evidenced in the minutes of the shareholders’ meetings

that evaluated all aspects of such fiscal years, which were duly published in the AIF.

g. (Item 8) “Evaluate the remuneration

of the independent auditor for the fiscal year ended 31 December 2016”. Please provide the proposal of the remuneration to

be paid to the independent auditor to be appointed for the fiscal year ended 31 December 2016 as well as the amounts actually paid

as remuneration during the fiscal years ended 12/31/2015, 12/31/2014 and 12/31/2013.

The remuneration to be paid to the independent

auditor for the year ended 31 December 2016 amounts to AR$ 12,283,440. The amounts actually paid as remunerations to the independent

auditor for the fiscal years ended 31 December 2015, 2014 and 2013 arise from the minutes of the shareholders’ meeting dealing

with such issues, which are available in the AIF.

h. (Item 9) “Appoint three regular

directors who shall hold office for three fiscal years and one regular director who shall replace and complete the term of office

of Mr. Luis María Blaquier up to the end of the present fiscal year”. Please provide information about the 3 nominees

proposed as regular directors for three years and any other information regarding this item.

As evidenced by the relevant event published

in the AIF last March 30th, on that date the shareholders Jorge Horacio Brito and Delfín Jorge Ezequiel Carballo informed

the Board that, in connection with the next General and Special Shareholders’ Meeting of the Bank, they intend to propose

as regular directors, to hold office for three fiscal years, the re-election of Mr. Marcos Brito and the election of Delfìn

Federico Ezequiel Carballo, who was designated as alternate director by the last shareholders’ meeting and last January 25

th

took over as regular director to replace Mr. Ariel Sigal. Additionally, on the same date we received a letter of the shareholder

FGS-ANSES with the following proposal to be evaluated by the next shareholders’ meeting: (i) renewal of Mr. Alejandro Fargosi

as regular director; and (ii) appointment of Mr. Juan Martín Monge Varela as regular director to replace Mr. Luis María

Blaquier.

i. (Item 10) “Establish the number

and designate the members of the Supervisory Committee who shall hold office for one fiscal year”. Please provide the relevant

proposal and information regarding this item.

The proposal shall be made by the shareholders

at the General and Special Shareholders’ Meeting called for April 28

th

2017.

j. (Item 11) “Appoint the independent

auditor for the fiscal year to end on December 31st 2017”. Please provide the relevant proposal and information regarding

this item.

Pursuant to the sworn statements published

in the AIF, the Accountants Norberto N. Nacuzzi and Victor A. Bresler, members of the audit company Pistrelli, Henry Martin y Asociados

S.R.L., shall be proposed as candidates to be designated as Regular Independent Auditor and Alternate Independent Auditor, respectively.

k. (Item 12) “Define the audit

committee’s budget.” Please inform the amount of the Budget in connection herewith, as well as the amounts budgeted

for and actually paid under this description during the fiscal years ended 12/31/2016, 12/31/2015 and 12/31/2014 and any other

supporting information regarding this item.

The proposal shall be made by the shareholders

at the General and Special Shareholders’ Meeting called for next April 28

th

.

The audit committee’s budget for

each of the years ended December 31

st

2014, 2015 and 2016 was fixed in the amounts of AR$ 720,000.00, AR$ 750,000.00

and AR$ 700,000, respectively.

n. (Item 16) “Extend of the maximum

amount of the Bank’s Global Program of Negotiable Obligations of USD 1,000,000,000, approved by Resolution No. 18247 dated

October 6th 2016 and issued by the

Comisión Nacional de Valores

(Argentine Securities and Exchange Commission), to

USD 1,500,000,000 or any lesser amount, at any time, as the Board of Directors shall determine. Delegate to the Board of Directors

the necessary powers to perform all necessary acts and proceedings to obtain the authorization for the Program’s extension”

Please provide a report on the reasons for the extension of the Bank’s Global Program of Negotiable Obligations and the application

thereof, as well as additional information on the general terms and conditions thereof. Also provide any other relevant information

regarding this item.

The extension of the Bank’s Global

Program of Negotiable Obligations is driven by the favorable expectations for the banking business growth in our country and of

the Bank in particular, in order to keep on getting financing through the access to the capital market and having the necessary

flexibility therefor (taking into account that the Bank has already issued negotiable obligations under such program). The general

terms and conditions of the Bank’s Global Program of Negotiable Obligations and the application thereof are available by

visiting the CNV’s website, in the “Financial Information” link.

II. (Item 14) “Authorize any acts,

proceedings and presentations to obtain the administrative approval and registration of the any resolutions adopted at the Shareholders’

Meeting”. Inform the names of the persons that shall be authorized and the acts and proceedings that such persons shall be

authorize to perform.

The proposal shall be made by the shareholders

at the General and Special Shareholders’ Meeting called for next April 28

th

.

m. (Item 15) “Increase the corporate

capital of Banco Macro S.A. on the amount of up to the nominal value of $74,000,000 (nominal value seventy-four million), through

the issuance of up to 74,000,000 (seventy-four million) new Class B book-entry common shares, entitled to 1 (one) vote per share

and of par value AR $1 (one Argentine Peso) each and entitled to receive dividends ranking pari passu the then outstanding Class

B book-entry common shares, to be offered under a public offering within the country or abroad. Determine the values within which

the Board shall establish the premium on the new issued shares.” Please provide information and relevant documentation regarding

this item. In addition please provide use of proceeds of such capital increase. Lastly please provide proposed share premium terms

and legal documentation (Preliminary Offering Memorandum or any other relevant information).

Pursuant to the Board of Directors meeting

dated March 30th, 2017, the capital increase proposal is based on the positive outlook and the potential growth for the banking

sector in Argentina and particularly for Banco Macro. The Board of Directors deemed right to submit this proposal in the next General

& Special Shareholders’ Meeting in order to avoid calling a Special Shareholders’ meeting in the future just to

address this proposal that might lead to higher costs and inefficient use of resources.

The use of proceeds shall be determined

accordingly at a later date. Notwithstanding, most likely use of proceeds will be to finance the expansion of the Bank’s

businesses.

Share premium parameters shall be determined

by the General and Special Shareholders’ meeting. Once the capital increase proposal is approved by the General and Special

Shareholders’ meeting all legal documentation will be prepared for the Board of Directors consideration.

n. (Item 16) “Reduce the term

allowed for the exercise of the preemptive right and the right of the remaining shareholders to increase their ownership by picking

up the new Class B book-entry common shares up to the statutory minimum term of ten (10) days as provided for under section 194

of the Argentine Business Company Law No. 19550, as amended.” Please provide justification for this proposal, on the reduction

of the legal term to exercise preemptive rights.

The term reduction for exercising preemptive

rights and increase ownership rights for the subscription of new ordinary shares is in accordance with common market practice in

capital increases done by public offering, with the intent of avoiding share Price volatility during the period established for

exercising those rights.

ñ. (Item 17) “Request the

relevant authorization to make the public offering in the country and/or in the foreign markets as the Board may determine, and

listing at the Mercado de Valores de Buenos Aires S.A., the New York Stock Exchange and/or the foreign stock exchanges and/or markets

as the Board may as well designate.” Please provide information on this proposal.

In accordance with rules and regulations

for issuers, it is necessary to request the public offering and listing of the shares to be issued following an increase of capital.

o. (Item 18) “Delegate to the

Board all necessary powers to (i) implement the capital increase and the any issuance terms and conditions not established by the

Shareholders’ Meeting, and authorize the Board so that it may, if necessary, decide an additional increase of up to 15% in

the number of authorized shares in case of oversubscribed issue, under Sect. 62 of the Argentine Capital Market Law No. 26,831;

(ii) request the public offering and listing of the shares (or share certificates) to be issued pursuant to the capital increase

previously resolved to the Argentine Securities Exchange Commission, the US Securities and Exchange Commission, the Buenos Aires

Stock Exchange, the New York Stock Exchange and/or any other similar entity abroad; (iii) execute and deliver any and all kinds

of agreements with local and/or foreign financial entities and perform all necessary and/or convenient acts aimed at implementing

the resolutions approved by this Shareholders’ Meeting; (iv) if necessary, extend and/or adjust the American Depositary Receipts

program currently in force between the Bank and The Bank of New York Mellon as depositary, representing American Depositary Shares

and delegate to the Board the determination of all the terms and conditions and the scope thereof; and (v) implement all other

resolutions as this Shareholders’ Meeting may adopt regarding Items 15, 16 and 17 of the Agenda. Authorize the Board to subdelegate

the above described powers to one or more directors and/or managers of Banco Macro S.A., pursuant to the Rules of the Argentine

Securities Exchange Commission.” Please provide details on authorizations under this proposal, justification and any additional

relevant information.

In accordance to rules and regulations,

authorizations to be granted have the final purpose of giving flexibility to determine terms and conditions of the share issuance.

p. (Item 19) “In case under item

9 of the Agenda, an alternate director elected by the General and Special Shareholders’ Meeting of April 26th 2016 is appointed

regular director, designate an alternate director to hold office for two fiscal years to fill the vacancy in such office.”

Please provide proposal and information regarding this item.

In the case that when addressing item 9

of the agenda of the General and Special Shareholders’ meeting, Mr. Delfín Federico Ezequiel Carballo is appointed

Regular Director, the General and Special Shareholders’ meeting shall appoint an alternate Director to hold office for a

2 fiscal year term, to fill the vaccancy in such office.

Sincerely,

Gustavo Alejandro Manríquez

Attorney

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: April 21, 2017

|

|

MACRO BANK INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Jorge F. Scarinci

|

|

|

|

Name: Jorge F. Scarinci

|

|

|

|

Title: Finance Manager

|

|

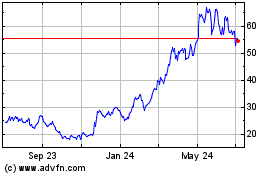

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

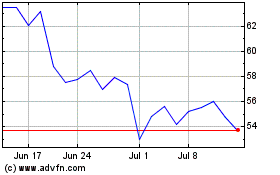

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Apr 2023 to Apr 2024