Steve Madden (Nasdaq:SHOO), a leading designer and marketer of

fashion footwear and accessories for women, men and children, today

announced financial results for the first quarter ended March 31,

2017.

Amounts referred to as Adjusted exclude the items that are

described under the heading “Non-GAAP Adjustments.”

For the First Quarter 2017:

- Net sales increased 11.2% to $366.4

million compared to $329.4 million in the same period of 2016.

- Gross margin was 36.2%. Adjusted gross

margin was 36.6% as compared to 35.3% in the same period last year,

an increase of 130 basis points.

- Operating expenses as a percentage of

sales were 28.9%. Adjusted operating expenses as a percentage of

sales were 26.8% as compared to 26.9% of sales in the same period

of 2016.

- Operating income totaled $30.8 million,

or 8.4% of net sales. Adjusted operating income was $39.5 million,

or 10.8% of net sales, compared with operating income of $29.9

million, or 9.1% of net sales, in the same period of 2016.

- Net income was $20.2 million, or $0.35

per diluted share. Adjusted net income was $27.5 million, or $0.47

per diluted share, compared to $23.7 million, or $0.39 per diluted

share, in the prior year's first quarter.

Edward Rosenfeld, Chairman and Chief Executive Officer,

commented, “We are pleased to have started off 2017 with a strong

first quarter. The highlight was our Steve Madden Women’s wholesale

footwear division, where we had another quarter of outstanding

growth in a challenging retail environment. Steve and his design

team have created an exceptional product assortment that is

enabling us to outperform the competition and take market share

with our flagship brand. As we look ahead to the balance of the

year, we are taking a prudent approach to planning our business in

light of retail industry headwinds. That said, the strength in our

core business gives us confidence that we are well-positioned to

navigate the uncertain environment.”

First Quarter 2017 Segment Results

Net sales for the wholesale business increased 13.6% to $313.3

million in the first quarter of 2017. Excluding the results of the

recently acquired Schwartz & Benjamin, wholesale net sales

increased 8.5% to $299.2 million from $275.8 million in the first

quarter of 2016, with strong gains in both wholesale footwear and

wholesale accessories. Gross margin in the wholesale business was

32.4%. Excluding the non-cash expense associated with the purchase

accounting fair value adjustment of inventory acquired in the

Schwartz & Benjamin acquisition, Adjusted gross margin in the

wholesale business was 32.8% compared to 31.2% in last year’s first

quarter, driven by an increase in the wholesale footwear

segment.

Retail net sales in the first quarter were $53.1 million

compared to $53.6 million in the first quarter of the prior year.

Same store sales decreased 6.0% in the quarter compared to a 10.7%

same store sales increase in the first quarter of 2016. Retail

gross margin increased to 58.7% in the first quarter of 2017

compared to 56.2% in the first quarter of the prior year, due to a

lower level of promotional activity.

During the first quarter, the Company opened one full price

store and one outlet location, and closed one full price store. The

Company ended the quarter with 190 company-operated retail

locations, including four Internet stores.

The Company’s effective tax rate for the first quarter of 2017

was 34.8%. Excluding the tax impact of the non-cash expense

associated with the purchase accounting fair value adjustment of

inventory acquired in the Schwartz & Benjamin acquisition and

the estimated bad debt expense associated with the Payless

ShoeSource bankruptcy, the Adjusted effective tax rate was 30.7%

compared to 19.6% in the first quarter of the prior year.

Balance Sheet and Cash Flow

During the first quarter of 2017, the Company repurchased

912,050 shares of the Company’s common stock for approximately

$33.2 million, which includes shares acquired through the net

settlement of employee stock awards.

As of March 31, 2017, cash, cash equivalents, and current and

non-current marketable securities totaled $193.2 million.

Company Outlook

The Company continues to expect that net sales in fiscal year

2017 will increase 8% to 10% over net sales in 2016. The Company

expects that diluted EPS on a GAAP basis for fiscal year 2017 will

be in the range of $1.97 to $2.03. The Company continues to expect

that Adjusted diluted EPS for fiscal year 2017 will be in the range

of $2.12 to $2.18.

Non-GAAP Adjustments

Amounts referred to as Adjusted exclude the items below.

For the first quarter 2017:

- $1.2 million pre-tax ($0.8 million

after-tax) in non-cash expense associated with the purchase

accounting fair value adjustment of inventory acquired in the

Schwartz & Benjamin acquisition, included in cost of

sales.

- $7.5 million pre-tax ($6.5 million

after-tax) in estimated bad debt expense associated with the

Payless ShoeSource bankruptcy, included in operating expenses.

For the fiscal year 2017:

- $1.7 million pre-tax ($1.0 million

after-tax) in non-cash expense associated with the purchase

accounting fair value adjustment of inventory acquired in the

Schwartz & Benjamin acquisition, included in cost of

sales.

- $1.5 million pre-tax ($1.0 million

after-tax) in expense expected to be incurred in connection with

the integration of the Schwartz & Benjamin acquisition and the

related restructuring, included in operating expenses.

- $7.5 million pre-tax ($6.5 million

after-tax) in estimated bad debt expense associated with the

Payless ShoeSource bankruptcy, included in operating expenses.

Reconciliations of amounts on a GAAP basis to Adjusted amounts

are presented in the Non-GAAP Reconciliation tables at the end of

this release and identify and quantify all excluded items.

Conference Call Information

Interested stockholders are invited to listen to the first

quarter earnings conference call scheduled for today, April 21,

2017, at 8:30 a.m. Eastern Time. The call will be broadcast live

over the Internet and can be accessed by logging onto

http://www.stevemadden.com. An online archive of the broadcast will

be available within one hour of the conclusion of the call and will

be accessible for a period of 30 days following the call.

Additionally, a replay of the call can be accessed by dialing

1-844-512-2921 (U.S.) and 1-412-317-6671 (international), passcode

4443584, and will be available until May 21, 2017.

About Steve Madden

Steve Madden designs, sources and markets fashion-forward

footwear and accessories for women, men and children. In addition

to marketing products under its own brands including Steve Madden®,

Dolce Vita®, Betsey Johnson®, Report®, Big Buddha®, Brian Atwood®,

Cejon®, Blondo® and Mad Love®, Steve Madden is a licensee of

various brands, including Kate Spade®, Superga® and Avec Les

Filles®. Steve Madden also designs and sources products under

private label brand names for various retailers. Steve Madden's

wholesale distribution includes department stores, specialty

stores, luxury retailers, national chains and mass merchants. Steve

Madden also operates 190 retail stores (including Steve Madden's

four Internet stores). Steve Madden licenses certain of its brands

to third parties for the marketing and sale of certain products,

including for ready-to-wear, outerwear, intimate apparel, eyewear,

hosiery, jewelry, fragrance, luggage and bedding and bath products.

For local store information and the latest Steve Madden booties,

pumps, men’s and women’s boots, dress shoes, sandals and more,

visit http://www.stevemadden.com/

Safe Harbor

This press release and oral statements made from time to time by

representatives of the Company contain certain “forward looking

statements” as that term is defined in the federal securities laws.

The events described in forward looking statements may not occur.

Generally, these statements relate to business plans or strategies,

projected or anticipated benefits or other consequences of the

Company's plans or strategies, projected or anticipated benefits

from acquisitions to be made by the Company, or projections

involving anticipated revenues, earnings or other aspects of the

Company's operating results. The words "may," "will," "expect,"

"believe," "anticipate," "project," "plan," "intend," "estimate,"

and "continue," and their opposites and similar expressions are

intended to identify forward looking statements. The Company

cautions you that these statements concern current expectations

about the Company’s future results and condition and are not

guarantees of future performance or events and are subject to a

number of uncertainties, risks and other influences, many of which

are beyond the Company's control, that may influence the accuracy

of the statements and the projections upon which the statements are

based. Factors which may affect the Company's results include, but

are not limited to, the risks and uncertainties discussed in the

Company's Annual Report on Form 10-K, Quarterly Reports on Form

10-Q and Current Reports on Form 8-K filed with the Securities and

Exchange Commission. Any one or more of these uncertainties, risks

and other influences could materially affect the Company's results

of operations and financial condition and whether forward looking

statements made by the Company ultimately prove to be accurate and,

as such, the Company's actual results, performance and achievements

could differ materially from those expressed or implied in these

forward looking statements. The Company undertakes no obligation to

publicly update or revise any forward looking statements, whether

as a result of new information, future events or otherwise.

STEVEN MADDEN, LTD. AND

SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS DATA

(In thousands, except per share amounts) (Unaudited)

Three Months Ended

March 31,

2017

March 31,

2016

Net sales $ 366,387 $ 329,357 Cost of sales 233,669

213,155 Gross profit 132,718 116,202 Commission and

licensing fee income, net 3,927 2,171 Operating expenses

105,865 88,493 Income from operations 30,780 29,880

Interest and other income (expense), net 684 (176 )

Income before provision for income taxes 31,464 29,704 Provision

for income taxes 10,942 5,808 Net income

20,522 23,896 Net income attributable to noncontrolling interest

364 237 Net income attributable to Steven

Madden, Ltd. $ 20,158 $ 23,659 Basic income

per share $ 0.36 $ 0.41 Diluted income per share $ 0.35 $ 0.39

Basic weighted average common shares

outstanding

55,828 57,709

Diluted weighted average common shares

outstanding

58,203 60,253

STEVEN MADDEN, LTD. AND

SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEET DATA

(In thousands)

As of

March 31,

2017

December 31,

2016

March 31,

2016

(Unaudited) (Unaudited) Cash and cash equivalents $ 94,261 $

126,115 $ 70,905 Marketable securities (current & non current)

98,980 110,054 121,994 Accounts receivables, net 232,466 200,958

217,136 Inventories 96,973 119,824 80,356 Other current assets

47,038 56,264 56,089 Property and equipment, net 74,747 72,381

72,727 Goodwill and intangibles, net 304,327 280,097 288,642 Other

assets 7,308 7,354 7,651 Total assets $

956,100 $ 973,047 $ 915,500 Accounts payable $ 70,896 $

80,584 $ 86,831 Contingent payment liability (current & non

current) 31,830 7,948 21,292 Other current liabilities 65,720

94,595 49,183 Other long term liabilities 48,832 48,848 54,528

Total Steven Madden, Ltd. stockholders' equity 737,187 740,867

703,319 Noncontrolling interest 1,635 205 347

Total liabilities and stockholders' equity $ 956,100 $ 973,047 $

915,500

STEVEN MADDEN, LTD. AND

SUBSIDIARIES

CONDENSED

CONSOLIDATED CASH FLOW DATA

(In thousands) (Unaudited) Three Months Ended

March 31,

2017

March 31,

2016

Net cash provided by operating activities $ 8,513 $

15,245

Investing

Activities

Purchases of property and equipment (3,293 ) (4,384 ) Sales of

marketable securities, net 11,292 1,037 Acquisition, net of cash

acquired (17,396 ) - Net cash used in

investing activities (9,397 ) (3,347 )

Financing

Activities

Common stock share repurchases for treasury (33,161 ) (14,034 )

Payment of contingent liability - (3,483 ) Proceeds from exercise

of stock options 1,812 3,678 Net cash

used in financing activities (31,349 ) (13,839 ) Effect of

exchange rate changes on cash and cash equivalents 379 432

Net decrease in cash and cash equivalents (31,854 ) (1,509 )

Cash and cash equivalents - beginning of period 126,115 72,414

Cash and cash equivalents - end of period $ 94,261

$ 70,905

STEVEN MADDEN, LTD. AND

SUBSIDIARIES

NON-GAAP

RECONCILIATION

(In thousands, except per share amounts) Unaudited

The Company uses non-GAAP financial information to evaluate its

operating performance and in order to represent the manner in which

the Company conducts and views its business. Additionally, the

Company believes the information assists investors in comparing the

Company's performance across reporting periods on a consistent

basis by excluding items that are not indicative of its core

business. The non-GAAP financial information is provided in

addition to, and not as an alternative to, the Company’s reported

results prepared in accordance with GAAP.

Table 1 -

Reconciliation of GAAP gross profit to Adjusted gross

profit

Three Months Ended

March 31,

2017

Consolidated

GAAP gross profit $ 132,718 Non-cash expense associated with

the purchase accounting fair value adjustment of inventory acquired

in the Schwartz & Benjamin acquisition 1,240

Adjusted gross profit $ 133,958

Wholesale

GAAP gross profit $ 101,560 Non-cash expense associated with

the purchase accounting fair value adjustment of inventory acquired

in the Schwartz & Benjamin acquisition 1,240

Adjusted gross profit $ 102,800

Table 2 -

Reconciliation of GAAP operating expenses to Adjusted operating

expenses

Three Months Ended

March 31,

2017

GAAP operating expenses $ 105,865 Bad debt expense

associated with the Payless ShoeSource bankruptcy (7,500 )

Adjusted operating expenses $ 98,365

Table 3 -

Reconciliation of GAAP operating income to Adjusted operating

income

Three Months Ended

March 31,

2017

GAAP operating income $ 30,780 Non-cash expense

associated with the purchase accounting fair value adjustment of

inventory acquired in the Schwartz & Benjamin acquisition 1,240

Bad debt expense associated with the Payless ShoeSource

bankruptcy 7,500 Adjusted operating income

$ 39,520

Table 4 -

Reconciliation of GAAP provision for income taxes to Adjusted

provision for income taxes

Three Months Ended

March 31,

2017

GAAP provision for income taxes $ 10,942 Tax effect

of non-cash expense associated with the purchase accounting fair

value adjustment of inventory acquired in the Schwartz &

Benjamin acquisition 425 Tax effect of bad debt expense

associated with the Payless ShoeSource bankruptcy 964

Adjusted provision for income taxes $ 12,331

Table 5 -

Reconciliation of GAAP net income to Adjusted net income

Three Months Ended

March 31,

2017

GAAP net income attributable to Steven Madden, Ltd. $ 20,158

After-tax impact of non-cash expense associated with the

purchase accounting fair value adjustment of inventory acquired in

the Schwartz & Benjamin acquisition 815 After-tax impact

of bad debt expense associated with the Payless ShoeSource

bankruptcy 6,536 Adjusted net income

attributable to Steven Madden, Ltd. $ 27,509 GAAP diluted

income per share $ 0.35 Adjusted diluted income per share

$ 0.47

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170421005111/en/

ICR, Inc.Investor RelationsJean Fontana/Megan

Crudele203-682-8200www.icrinc.com

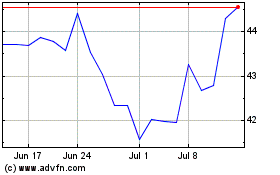

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Mar 2024 to Apr 2024

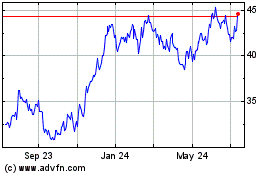

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Apr 2023 to Apr 2024