KKR Closes $250 Million Investment in Masan Group and Masan Nutri-Science

April 20 2017 - 11:39PM

Business Wire

Transaction marks KKR’s second investment in

Masan to accelerate its growth as Vietnam’s future consumer

champion

Masan Group Corporation (HOSE:MSN, “Masan Group” or the

“Company”), today announced that leading global investment firm KKR

has completed and funded its US$250 million investment in Masan

Group and in its branded meat platform, Masan Nutri-Science (the

“Transaction”). KKR’s investment is comprised of a US$100 million

purchase of secondary shares of Masan Group from PENM Partners, an

independent Danish private equity company, and a US$150 million

primary investment in Masan Nutri-Science for a 7.5% stake. This is

KKR’s second investment in Masan, having KKR previously invested

US$359 million in Masan Consumer.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20170420006729/en/

The Transaction's close makes KKR the second largest foreign

shareholder of Masan Group, after the funds owned by the Government

of Singapore ("GIC"), and the largest shareholder of Masan

Nutri-Science after Masan Group. In addition, the Transaction

allows PENM Partners to fully exit their original investment in

Masan Group.

Masan Group will be hosting its Annual General Meeting of

Shareholders on April 24 in Ho Chi Minh City, where Mr. Ming Lu,

Member of KKR and Head of Asia Private Equity, will attend as an

honorary guest to share his views on Vietnam’s consumer potential

and its partnership with Masan.

KKR invests from its Asian Fund II.

ABOUT MASAN GROUP CORPORATION

Masan Group Corporation (“Masan” and the “Company”) believes in

doing well by doing good. The Company’s mission is to provide

better products and services to the 90 million people of Vietnam,

so that they can pay less for their daily basic needs. Masan aims

to achieve this by driving productivity with technological

innovations, trusted brands, and focusing on fewer but bigger

opportunities that impact the most lives.

Masan Group’s member companies and associates are industry

leaders in meat, packaged food and beverage, resources, and

financial services, altogether representing segments of Vietnam’s

economy that are experiencing the most transformational growth.

ABOUT MASAN NUTRI-SCIENCE

Masan Nutri-Science, a subsidiary of Masan Group, is Vietnam’s

largest fully-integrated (“feed-farm-food” business model) branded

meat platform, focused on driving productivity in Vietnam’s animal

protein industry and ultimately directly serving consumers with

traceable, quality and affordable meat products, a US$18 billion

opportunity.

In 2016, Masan Nutri-Science sold over 2.5 million tons of

animal feed through its national network of over 4,500 dealers and

13 feed facilities, generating approximately US$1.1 billion in

sales. Growth was driven by animal feed brand “Bio-zeem” and

integration and turnaround of Proconco and ANCO by implementing an

FMCG approach to an agricultural business. In the same year, Masan

Nutri-Science completed its feed-farm-food (3F) model with the

groundbreaking of a scale and high-technology pig farm in Nghe An

and becoming a strategic partner of VISSAN, Vietnam’s largest meat

company.

ABOUT KKR

KKR is a leading global investment firm that manages investments

across multiple asset classes including private equity, energy,

infrastructure, real estate, credit and hedge funds. KKR aims to

generate attractive investment returns by following a patient and

disciplined investment approach, employing world-class people, and

driving growth and value creation at the asset level. KKR invests

its own capital alongside its partners' capital and brings

opportunities to others through its capital markets business.

References to KKR's investments may include the activities of its

sponsored funds. For additional information about KKR &

Co. L.P. (NYSE:KKR), please visit KKR's website

at www.kkr.com and on Twitter @KKR_Co.

ABOUT PENM PARTNERS

PENM Partners is an independent Danish private equity company.

PENM Partners offers equity capital and strategic partnership to

unlisted Vietnamese companies under the name Private Equity New

Markets (PENM). PENM Partners, through its four funds, manages

USD550 million, and is focused on unlisted companies with a proven

track record and a strong future development potential. The capital

from PENM will typically be applied towards expansion, growing the

business through investments or acquisitions.

This press release contains forward-looking statements regarding

Masan’s expectations, intentions or strategies that may involve

risks and uncertainties. These forward-looking statements,

including Masan’s expectations, involve known and unknown risks,

uncertainties and other factors, some of which are beyond Masan’s

control, which may cause Masan’s actual results of operations,

financial condition, performance or achievements to be materially

different from those expressed or implied by the forward-looking

statements. You should not rely upon forward-looking statements as

predictions, future events or promises of future performance.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170420006729/en/

Masan GroupInvestors/AnalystsTanveer Gill, +848 6256

3862tanveer@msn.masangroup.comorMediaVan Nguyen, +848 6256

3862van.nguyen@msn.masangroup.comorKKR & Co. L.P.Anita

Davis, +852 3602 7335anita.davis@kkr.comorSteven

Okunmedia@kkr.com

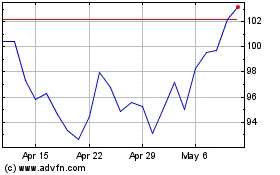

KKR (NYSE:KKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

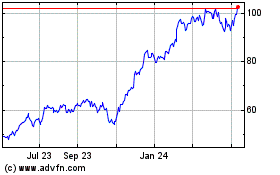

KKR (NYSE:KKR)

Historical Stock Chart

From Apr 2023 to Apr 2024