QUESTIONS AND ANSWERS ABOUT THE MERGER

The following are some questions that you, as a stockholder of Jaguar and/or Napo, may have regarding the merger,

together with brief answers to those questions. Jaguar and Napo urge you carefully read this joint proxy statement/prospectus in its entirety, including the annexes and other documents attached and/or

referred to in this joint proxy statement/prospectus, because the information in this section does not provide all of the information that will be important to you with respect to the

merger.

-

Q:

-

What will happen in the merger?

-

A:

-

In

the merger, Merger Sub will merge with and into Napo. Napo will be the surviving entity in the merger as a wholly-owned subsidiary of Jaguar. Thus, Jaguar will

acquire Napo through the merger.

-

Q:

-

What will Napo stockholders receive in the merger for their shares?

-

A:

-

At

the effective time of the merger, (i) each issued and outstanding share of Napo common stock (other than dissenting shares and shares held by Jaguar or

Napo) will be converted into a contingent right to receive (x) up to a whole number of shares of Jaguar common stock comprising in the aggregate up to approximately 21.5% of the fully diluted

shares of Jaguar common stock (sometimes referred to herein as the Merger Shares) immediately following the consummation of the merger, which contingent right will vest only if the resale of certain

shares of Jaguar common stock issued by Jaguar to Nantucket in the Napo debt settlement (sometimes referred to herein as the Tranche A Shares) provides Nantucket with specified cash returns

over a specified period of time (sometimes referred to herein as the Hurdle Amounts), and (y) if the applicable Hurdle Amount is achieved before all of the Tranche A Shares are sold,

additional shares of the Jaguar common stock (equal to 50% of the unsold Tranche A shares), which will be distributed pro rata among holders of contingent rights and holders of Napo restricted

stock units, (ii) existing creditors of Napo will be issued in the aggregate approximately 43,156,649 shares of Jaguar non-voting common stock and 2,005,245 shares of Jaguar voting common stock

in full satisfaction of all existing indebtedness then owed by Napo to such creditors and (iii) an existing Napo stockholder will be issued an aggregate of approximately 3,243,243 shares of

Jaguar common stock in return for $3 million of new funds invested into Jaguar by such investor, which will be immediately loaned to Napo to partially facilitate the extinguishment of the debt

that Napo owes to Nantucket. For a discussion of the specific groups of shares of Jaguar common stock from which the Merger Shares are drawn and the methodology for calculating the number of Merger

Shares issuable to the holders of contingent rights, see "The Merger Agreement and Related Agreements—Merger Consideration—Calculation of Shares of Jaguar Common Stock Issuable

to Holders of Contingent Rights" and

Annex E

to this joint proxy statement/prospectus. A summary of the Hurdle Amounts at different time periods

is set forth in

Annex F

to this joint proxy statement/prospectus.

Shares

of Jaguar non-voting common stock have the same rights to dividends and other distributions and are convertible into shares of Jaguar common stock on a one-for-one basis (x) upon

transfers to non-affiliates of Nantucket, (y) upon the release from escrow of certain non-voting shares held by Nantucket to the legacy stockholders of Napo under specified conditions and

(z) at any time on or after April 1, 2018 at the option of the respective holders thereof.

Jaguar

will also assume (i) each outstanding and unexercised option to purchase Napo common stock, which will be converted into options to purchase Jaguar common stock, (ii) each

outstanding warrant to purchase Napo common stock, which will be converted into warrants to purchase Jaguar common stock, and (iii) each outstanding restricted stock unit to acquire Napo common

stock, which will be converted into restricted stock units to acquire Jaguar common stock.

9

Table of Contents

The

stockholders of Jaguar will continue to own their existing shares and the rights and privileges of their existing shares will not be affected by the merger. However, because Jaguar will be issuing

new shares of Jaguar common stock and non-voting common stock to Napo creditors, and options, warrants and restricted stock units exercisable for Jaguar common stock to holders of Napo options,

warrants and restricted stock units in the merger, the stockholders of Jaguar will experience dilution as a result of the issuance of shares in the merger and each outstanding share of Jaguar common

stock immediately prior to the merger will represent a smaller percentage of the total number of shares of Jaguar common stock and non-voting common stock issued and outstanding after the merger. It

is expected that Jaguar stockholders before the merger will hold approximately 25% of the total Jaguar common stock and non-voting common stock issued and outstanding on a fully diluted basis

immediately following completion of the merger. Thus, Jaguar stockholders before the merger will experience dilution in the amount of approximately 75% as a result of the merger.

-

Q:

-

Will any fractional shares be issued in connection with the merger?

-

A:

-

No

fractional shares of Jaguar common stock or non-voting common stock will be issued. Instead, any fractional shares will be rounded down to the next whole number of

shares. See "Risk Factors" beginning on page 24 of this joint proxy statement/prospectus.

-

Q:

-

When will Napo stockholders know whether their contingent rights to receive Jaguar common stock are exchangeable for shares of Jaguar common

stock?

-

A:

-

A

final determination as to the final number of Merger Shares, if any, that will be issued to holders of all contingent rights pursuant to the merger agreement, will

be made no later than the later to occur of (x) the date on which both (a) the first anniversary of the consummation of the merger, which constitutes the expiration date of the

representations, covenants and agreements in the merger agreement or in any writing delivered by Napo to Jaguar in connection with the merger agreement (such 12-month period following the consummation

of the merger sometimes referred to herein as the Survival Period), has occurred, and (b) there are no outstanding claims for indemnification under Article VI of the merger agreement,

and (y) the third anniversary of the date on which the merger is consummated (such later date referenced in clauses (x) and (y) above, sometimes referred to herein as the Final

Determination Date).

Within

60 days of the Final Determination Date, solely to the extent holders of contingent rights are entitled to receive any Merger Shares under the terms of the Merger Agreement, Jaguar will

mail to each contingent right holder (such date of mailing sometimes referred to as the Contingent Right Holders Notice Date) a letter of transmittal and instructions for use in effecting the

surrender of such holder's Napo stock certificates representing the right to such Merger Shares in exchange for the Merger Shares. If you are a contingent right holder, you should carefully review and

follow the instructions accompanying the letter of transmittal. The letter of transmittal will be mailed to each Napo stockholder on the record date. You will need to sign, date and complete the

letter of transmittal and return it, along with your Napo stock certificates (or customary affidavits and indemnification regarding the loss or destruction of such certificates or the guaranteed

delivery of such certificates), to the exchange agent, at the address and pursuant to the instructions given in the materials. The submission deadline is 5:00 p.m. Pacific Time on the one-year

anniversary of the Contingent Right Holders Notice Date. If you do not submit a properly completed and signed letter of transmittal and surrender your Napo stock certificates to the exchange agent by

the submission deadline, you will look only to Jaguar (subject to abandoned property, escheat and other similar laws) as a general creditor for payment of your claim for Merger Shares (if any) and any

dividends or distributions with respect to Merger Shares. Jaguar will not be liable to any holder of Napo stock certificates (or dividends or distributions with respect thereto) or cash

10

Table of Contents

delivered

to a public official pursuant to any applicable abandoned property, escheat or similar law.

-

Q:

-

Should I send in my Napo stock certificates now?

-

A:

-

No.

The exchange agent will provide each Napo stockholder with a transmittal letter and instructions for surrendering each share of Napo common stock to the exchange

agent in exchange for the merger consideration. See "The Merger Agreement and Related Agreements—Conversion of Shares; Exchange of Certificates" beginning on page 259 of this joint proxy

statement/prospectus for more information regarding the procedure for exchanging your Napo stock certificates for the merger consideration. Jaguar stockholders will keep their existing stock

certificates.

-

Q:

-

What do I need to do now?

-

A:

-

After

you carefully read this joint proxy statement/prospectus, please respond by completing, signing, dating and returning your signed proxy card(s) in the enclosed

prepaid return envelope(s), or, for Jaguar stockholders only, by submitting your proxy by telephone or by the Internet, as soon as possible, so that your shares may be represented at your stockholders

meeting. If you hold your shares in "street name" through a broker, nominee, fiduciary or other custodian, follow the directions given by the broker, nominee, fiduciary or other custodian regarding

how to instruct them to vote your shares. In order to ensure that your vote is recorded, please submit your proxy as instructed on your proxy card(s) even if you currently plan to attend your

stockholders meeting in person.

-

Q:

-

Why is my vote important?

-

A:

-

If

you do not submit your proxy by returning your signed proxy card(s) by mail, voting in person at your stockholders meeting, or, for Jaguar stockholders only, by

submitting your proxy by telephone or by the Internet, it will be more difficult for Jaguar and Napo to obtain the necessary quorum to hold their respective annual and special meeting and to obtain

the stockholder approvals necessary for the completion of the merger. If a quorum is not present at the Jaguar special meeting or the Napo special meeting, the stockholders of that company will not be

able to take action on any of the proposals at that meeting.

While

a failure to submit a proxy or vote in person at the stockholders meeting, or a failure to provide your broker, nominee, fiduciary or other custodian, as applicable, with instructions on how to

vote your shares will not affect the outcome of the vote on the proposal to approve the issuance of shares of Jaguar common stock and non-voting common stock (Proposals 1-3), a failure to submit a

proxy or vote in person at the special meeting will make it more difficult to meet the requirement under Jaguar's bylaws that the holders of a majority of the shares of Jaguar common stock and

entitled to

vote at the special meeting be present in person or by proxy to constitute a quorum at the special meeting.

For

the Jaguar stockholders to approve the amendment of the 2014 Plan (Proposal 4), a majority of the outstanding shares of common stock entitled to vote on such matter must approve such proposal;

thus an abstention from voting, a failure to submit a proxy or vote in person at the special meeting, or a failure to provide your broker, nominee, fiduciary or other custodian, as applicable, with

instructions on how to vote your shares could have the same effect as a vote

"AGAINST"

the proposal.

For

the proposal to adopt Jaguar's Third Amended and Restated Certificate of Incorporation (Proposal 5), a majority of the outstanding shares of common stock entitled to vote on such matter must

approve such proposal; thus an abstention from voting, a failure to submit a proxy or vote in person at the special meeting, or a failure to provide your broker, nominee, fiduciary or other

11

Table of Contents

custodian,

as applicable, with instructions on how to vote your shares will have the same effect as a vote

"AGAINST"

the proposal.

For

the Napo stockholders to adopt the merger agreement and approve the merger, a majority of the outstanding shares of common stock entitled to vote on such matter must approve such proposal; thus an

abstention from voting, a failure to submit a proxy or vote in person at the special meeting, or a failure to provide your broker, nominee, fiduciary or other custodian, as applicable, with

instructions on how to vote your shares could have the same effect as a vote

"AGAINST"

the proposal.

Your vote is very important. Jaguar and Napo cannot complete the merger unless (i) holders of Jaguar common stock approve the share issuances in connection with the

transactions contemplated by the merger agreement, (ii) holders of Jaguar common stock approve the amendment of the 2014 Plan, (iii) holders of Jaguar common stock adopt the Third

Amended and Restated Certificate of Incorporation, and (iv) Napo stockholders adopt the merger agreement and approve the merger.

-

Q:

-

Why have Jaguar and Napo agreed to the merger?

-

A:

-

The

board of directors and management team of each of Jaguar and Napo believe the merger to provide substantial strategic and financial benefits to their

stockholders, customers and other stakeholders, including, among others:

-

•

-

expected synergies and economies of scale in manufacturing and commercialization of crofelemer for various human and animal indications;

-

•

-

the centrality of Napo's technology for proprietary gastrointestinal disease products to both Jaguar and Napo;

-

•

-

expected support to the development of crofelemer to address the problem of chemotherapy-induced diarrhea in both humans and companion animals;

-

•

-

expected efficiencies of combining the skillsets of the highly complementary Napo and Jaguar teams;

-

•

-

the strong foundation for collaborations resulting from the combined company's possession of global unencumbered rights to Mytesi and a host of

crofelemer-based human products, combined with horizontal product leverage to multiple animal species; and

-

•

-

learning, modeling and efficiencies provided by the weaving of clinical indications between humans and animals.

Additional

information on the reasons for the merger can be found below, beginning on page 230 of this joint proxy statement/prospectus for Jaguar and beginning on page 232 of this joint

proxy statement/prospectus for Napo.

-

Q:

-

Why is Jaguar asking to amend the 2014 Plan to increase the number of shares of Jaguar common stock authorized for issuance under the 2014

Plan?

-

A:

-

Under

the merger agreement, Jaguar will assume (i) each outstanding and unexercised option to purchase Napo common stock, which will be converted into options

to purchase Jaguar common stock, (ii) each outstanding warrant to purchase Napo common stock, which will be converted into warrants to purchase Jaguar common stock, and (iii) each

outstanding restricted stock unit to acquire Napo common stock, which will be converted into restricted stock units to acquire Jaguar common stock. Currently, Jaguar does not have a sufficient number

of shares authorized for issuance under the 2014 Plan to cover the conversion of these Napo securities into Jaguar

12

Table of Contents

securities.

Therefore, Jaguar must amend the 2014 Plan to authorize the issuance of additional shares so that Jaguar can meet its obligations to holders of the Napo options, warrants and restricted

stock units under the merger agreement.

-

Q:

-

Why is Jaguar asking to adopt its Third Amended and Restated Certificate of Incorporation to increase the number of authorized shares of

common stock from 50 million shares to 225 million shares, authorize a class of non-voting common stock, require Nantucket's prior written consent before the issuance of dividends to

holders of Jaguar common stock and/or non-voting common stock for so long as Nantucket or its affiliates own any shares of Jaguar non-voting common stock, and change the Jaguar corporate name to

"Jaguar Health, Inc."?

-

A:

-

Approval

of Jaguar's Third Amended and Restated Certificate of Incorporation to increase the number of authorized shares of common stock from 50 million shares

to 225 million shares, authorize a class of non-voting common stock, require Nantucket's prior written consent before the issuance of dividends to holders of Jaguar common stock and/or

non-voting common stock for so long as Nantucket or its affiliates own any shares of Jaguar non-voting common stock, and change the Jaguar corporate name to "Jaguar Health, Inc." (which is the

subject of Jaguar Proposal No. 5) is one of the conditions to the consummation of the merger. The merger consideration consists of a contingent right to receive Jaguar common stock for holders

of Napo common stock and Jaguar common stock and non-voting common stock for Napo's creditors; thus, Jaguar must amend its Certificate of Incorporation to increase the number of authorized shares of

common stock and to create this class of non-voting common stock. Shares of Jaguar non-voting common stock are the same in all respects to shares of Jaguar's common stock except that holders of shares

of non-voting common stock are not entitled to vote on matters submitted to Jaguar stockholders other than a change of control of Jaguar, and shares of non-voting common stock are convertible into

shares of common stock on a one-for-one basis (i) at the option of the respective holders thereof, at any time and from time to time on or after April 1, 2018 or

(ii) automatically, without any payment of additional consideration by the holder thereof, (x) upon a transfer of such shares to any person or entity that is neither an affiliate of

Nantucket nor an investment fund, investment vehicle or other account, that is, directly or indirectly, managed or advised by Nantucket or any of its affiliates pursuant to a sale of such stock to a

third-party for cash in accordance with the terms and condition set forth in the Investor Rights Agreement, or (y) upon the release or transfer of such shares to the registered holders of

Napo's outstanding shares of common stock immediately prior to the consummation of the merger (such shareholders sometimes referred to herein as the Napo Legacy Stockholders).

-

Q:

-

When do you expect the merger to be completed?

-

A:

-

Jaguar

and Napo hope to complete the merger as soon as reasonably practicable, subject to receipt of stockholder approvals, which are proposals presented at the

Jaguar special meeting and the Napo special meeting, and necessary regulatory approvals. Jaguar and Napo currently expect that the transaction will be completed in the second quarter of 2017. However,

Jaguar and Napo cannot predict when regulatory review will be completed, whether or when regulatory or stockholder approval will be received or the potential terms and conditions of any regulatory

approval that is received. In addition, certain other conditions to the merger, some of which are outside of the control of Jaguar and Napo, may not be satisfied until later in 2017 or at all. For a

discussion of the conditions to the completion of the merger and of the risks associated with obtaining regulatory approvals in connection with the merger, see "The Merger Agreement and Related

Agreements—Conditions to Completion of the Merger" beginning on page 265 of this joint proxy statement/prospectus and "The Proposed Merger—Regulatory Matters Relating to the

Merger" beginning on page 249 of this joint proxy statement/prospectus.

13

Table of Contents

-

Q:

-

Will the merger be taxable to stockholders of Jaguar?

-

A:

-

No,

the merger will not be taxable to stockholders of Jaguar, as they will continue to own their existing shares and the rights and privileges of their existing

shares will not be affected by the merger.

-

Q:

-

Will the merger be taxable to stockholders of Napo?

-

A:

-

The

merger will not qualify as a tax-free reorganization within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended (sometimes referred

to as the Code). Although it is not free from doubt, a Napo Stockholder should not recognize any taxable gain or loss until such Napo Stockholder's Certificate Delivery Date. The term "Certificate

Delivery Date" means, with respect to each Napo Stockholder, the date on which such Napo Stockholder delivers to the Exchange Agent his, her or its Napo stock certificate(s) for cancellation, together

with a letter of transmittal duly executed and completed in accordance with its terms and such other documents and/or payments of withholding taxes as may be reasonably required by the Exchange Agent

or Jaguar. At that time, such Napo Stockholder will recognize gain or loss from the sale of his, her or its shares of Napo common stock in an amount equal to the difference between (i) the fair

market value of a Merger Share on such Napo Stockholder's Certificate Delivery Date multiplied by the number of Merger Shares received by such Napo Stockholder (sometimes referred to as the Purchase

Price) and (ii) such Napo Stockholder's tax basis in his, her or its shares of Napo common stock surrendered in the merger. Any such capital gain or capital loss will constitute long-term

capital gain or loss if the Napo Stockholder's holding period for his, her or its shares of Napo common stock is more than one year as of the effective date of the merger. In addition, a portion of

the Purchase Price received by each Napo Stockholder will constitute imputed interest that will be taxed at ordinary rates pursuant to Section 483 of the Code. The imputed interest rules of

Section 483 apply regardless of whether a Napo Stockholder recognizes taxable gain or loss on the merger. However, if a Napo Stockholder recognizes capital gain on the merger, the amount of

such capital gain is reduced dollar-for-dollar by the amount of the Napo Stockholder's imputed interest, and if a Napo Stockholder recognizes a capital loss on the merger, the amount of such capital

loss will be increased dollar-for-dollar by the amount of the Napo Stockholder's imputed interest.

-

Q:

-

Will there be any changes to the Jaguar Board if the merger becomes effective?

-

A:

-

No.

The merger agreement provides that the merger will not result in any change to the composition of the Jaguar Board. For more information, please see the section

entitled "Management of the Combined Company After the Merger" beginning on page 173 of this joint proxy statement/prospectus.

-

Q:

-

Are there any Jaguar or Napo stockholders already committed to vote in favor of the merger-related

proposals?

-

A:

-

Jaguar

and Napo expect their respective executive officers and board members who own shares in the respective companies to vote in favor of the merger-related

proposals. In addition, Napo, which owns in the aggregate approximately 19% of Jaguar common stock, is expected to vote in favor of the merger-related proposals.

14

Table of Contents

-

Q:

-

What happens if Jaguar stockholders fail to approve the issuances of shares of Napo common stock and non-voting common stock, amend the 2014

Plan, or adopt Jaguar's Third Amended and Restated Certificate of Incorporation as contemplated by the merger agreement?

-

A:

-

In

this circumstance, either party is permitted to terminate the merger agreement, and no termination fee is payable by either Jaguar or Napo if the merger agreement

is terminated upon the occurrence of this event. However, if the merger fails to close for any reason on or prior to July 31, 2017, other than as a result directly or indirectly of

(x) lack of stockholder approval by either party or (y) Napo's failure to comply with, or breach of the provisions of the terms of the Binding Agreement of Terms for Jaguar Animal

Health, Inc. Acquisition of Napo Pharmaceuticals, Inc., dated February 8 , 2017, between Jaguar and Napo (sometimes referred to herein as the Binding Agreement of Terms) or the

merger documents, then on or before the close of business on August 7, 2017, Jaguar will issue 2,000,000 shares of its restricted common stock to Napo. See "The Merger Agreement and Related

Agreements—Termination" and "—Termination Fee and Expenses" each beginning on page 266 of this joint proxy statement/prospectus.

Except

as set forth above, whether or not the merger is completed, all costs and expenses incurred in connection with the merger agreement and the transactions contemplated by the merger agreement

will be paid by the party incurring those costs or expenses.

-

Q:

-

What happens if Napo stockholders fail to adopt the merger agreement and the transactions contemplated

thereby?

-

A:

-

In

this circumstance, either party is permitted to terminate the merger agreement, and no termination fee is payable by either Napo or Jaguar if the merger agreement

is terminated upon the occurrence of this event. See "The Merger Agreement and Related Agreements—Termination" and "—Termination Fee and Expenses" both beginning on page 266,

of this joint proxy statement/prospectus.

-

Q:

-

Am I entitled to exercise appraisal rights instead of receiving the per share merger consideration for my shares of Napo common

stock?

-

A:

-

Napo

stockholders are entitled to appraisal rights under Section 262, provided they fully comply with and follow the procedures and satisfy the conditions set

forth in Section 262. For more information regarding appraisal rights, see the section entitled "Appraisal Rights" beginning on page 23 of this joint proxy statement/prospectus. In

addition, a copy of Section 262 is attached as

Annex D

to this joint proxy statement/prospectus. Failure to comply with Section 262

will result in your waiver of, or inability to exercise, appraisal rights.

-

Q:

-

Are there risks that I, as a Jaguar stockholder, should consider in deciding to vote on the issuances of shares of Jaguar common stock and

non-voting common stock, the amendment of the 2014 Plan, and the adoption of Jaguar's Third Amended and Restated Certificate of Incorporation, as contemplated by the merger agreement or, as a Napo

stockholder, should consider in deciding to vote on the adoption of the merger agreement?

-

A:

-

Yes.

In evaluating the approval of the issuance of shares of Jaguar common stock and non-voting common stock, the amendment of the 2014 Plan, and/or the adoption of

Jaguar's Third Amended and Restated Certificate of Incorporation as contemplated by the merger agreement, you should carefully read this joint proxy statement/prospectus, including the risk factors

discussed in the section entitled "Risk Factors" beginning on page 24 of this joint proxy statement/prospectus.

-

Q:

-

Who can answer any questions I may have about the merger?

-

A:

-

Jaguar

stockholders may call [

·

], Jaguar's proxy

solicitors for the special meeting, toll-free at [

·

]. Napo stockholders may call

[

·

] at

[

·

] or email

[

·

].

15

Table of Contents

SUMMARY—THE MERGER

This summary highlights selected information contained in this joint proxy statement/prospectus and does not contain all

the information that may be important to you. Jaguar and Napo urge you to read carefully this joint proxy statement/prospectus in its entirety, including the Annexes. Unless stated otherwise, all

references in this joint proxy statement/prospectus to Jaguar refer to Jaguar Animal Health, Inc., a Delaware corporation, all references to Napo refer to Napo Pharmaceuticals, Inc., a

Delaware corporation, all references to Merger Sub refer to Napo Acquisition Corporation, a Delaware corporation, and all references to the merger agreement refer to the Agreement and Plan of Merger,

dated as of March 31, 2017, by and among Jaguar, Merger Sub, Napo and a Napo representative, a copy of which is attached as Annex A to this joint proxy statement/prospectus and is

incorporated by reference into this joint proxy statement/prospectus. See "Where you Can Find More Information" beginning on page 293.

The Companies Involved in the Merger

Jaguar

Jaguar Animal Health, Inc.

201 Mission Street, Suite 2375

San Francisco, CA 94105

(415) 371-8300

Jaguar

is an animal health company focused on developing and commercializing first-in-class gastrointestinal products for companion and production animals, foals, and high value horses.

Jaguar was founded in San Francisco, California as a Delaware corporation on June 6, 2013. Napo formed Jaguar to develop and commercialize animal health products. Effective as of

December 31, 2013, Jaguar

was a wholly-owned subsidiary of Napo, and until May 13, 2015, Jaguar was a majority-owned subsidiary of Napo.

For

additional information about Jaguar, see "Jaguar Business" beginning on page 86.

Napo

Napo Pharmaceuticals, Inc.

201 Mission Street, Suite 2375

San Francisco, CA 94105

(415) 963-9938

Napo

Pharmaceuticals, Inc. ("Napo") focuses on the development and commercialization of proprietary pharmaceuticals for the global marketplace from plants traditionally used in

rainforest areas. In October 2016 Napo launched Mytesi (formerly known as Fulyzaq), a human drug approved by the U.S. FDA for the symptomatic relief of noninfectious diarrhea in adults with HIV/AIDS

on antiretroviral therapy (ART). The active pharmaceutical ingredient (API) in Mytesi is crofelemer, Napo's proprietary, patented gastrointestinal anti-secretory agent sustainably harvested from the

rainforest. Napo was founded in San Francisco, California as a Delaware corporation on November 15, 2001.

For

additional information about Napo, see "Napo Business" beginning on page 118.

Merger Sub

Merger Sub, a wholly-owned subsidiary of Jaguar, is a Delaware corporation formed on March 30, 2017 for the sole purpose of effecting the

merger. Upon completion of the merger, Merger Sub will merge with and into Napo, with Napo surviving as a wholly-owned subsidiary of Jaguar after the merger.

16

Table of Contents

The Proposed Merger

Each of the Jaguar Board and Napo Board has approved the merger of Jaguar and Napo. Jaguar and Napo have entered into the merger agreement

pursuant to which Napo will merge with Merger Sub, a newly formed, wholly-owned subsidiary of Jaguar, with Napo surviving the merger as a wholly-owned subsidiary of Jaguar. At the effective time of

the merger, (i) each issued and outstanding share of Napo common stock (other than dissenting shares and shares held by Jaguar or Napo) will be converted into a contingent right to receive

(x) up to a whole number of shares of Jaguar common stock comprising in the aggregate up to approximately 21.5% of the fully diluted shares of Jaguar common stock immediately following the

consummation of the merger, which contingent right will vest only if the resale of the Tranche A Shares to third parties provides Nantucket with specified cash returns over a specified period

of time (sometimes referred to herein as the Hurdle Amounts), and (y) if the applicable Hurdle Amount is achieved before all of the Tranche A Shares are sold, additional shares of the

Jaguar common stock (equal to 50% of the unsold Tranche A shares), which will be distributed pro rata among holders of contingent rights and holders of Napo restricted stock units,

(ii) existing creditors of Napo (inclusive of Nantucket) will be issued in the aggregate approximately 43,156,649 shares of Jaguar non-voting common stock and 2,005,245 shares of Jaguar voting

common stock in full satisfaction of all existing indebtedness then owed by Napo to such creditors, and (iii) an existing Napo stockholder (sometimes referred to herein as Invesco) will be

issued an aggregate of approximately 3,243,243 shares of Jaguar common stock in return for $3 million of new funds invested into Jaguar by such investor, which will be immediately loaned to

Napo to partially facilitate the extinguishment of the debt that Napo owes to Nantucket. At closing, it is contemplated that unless consented to or waived by Jaguar, Napo will have no more than

(a) $11.3 million in secured and unsecured debt for monies borrowed (a portion of such debt proceeds which will be used to pay off Napo's secured debt owed to Nantucket),

(b) $6.2 million of trade payables and certain other debt, excluding transaction expenses and (c) Napo's cash at closing will be no less than $500,000.

Shares

of Jaguar non-voting common stock have the same rights to dividends and other distributions and are convertible into shares of common stock on a one-for-one basis (x) upon

transfers to

non-affiliates of Nantucket, (y) upon the release from escrow of certain non-voting shares held by Nantucket to the legacy stockholders of Napo under specified conditions and (z) at any

time on or after April 1, 2018 at the option of the respective holders thereof.

Jaguar

will assume (i) each outstanding and unexercised option to purchase Napo common stock, which will be converted into options to purchase Jaguar common stock,

(ii) each outstanding warrant to purchase Napo common stock, which will be converted into warrants to purchase Jaguar common stock, and (iii) each outstanding restricted stock unit to

acquire Napo common stock, which will be converted into restricted stock units to acquire Jaguar common stock.

The

stockholders of Jaguar will continue to own their existing shares and the rights and privileges of their existing shares will not be affected by the merger. However, because Jaguar

will be issuing new shares of Jaguar common stock and non-voting common stock to Napo creditors, contingent rights to receive Jaguar common stock to Napo stockholders, and options, warrants and

restricted stock units exercisable for Jaguar common stock to holders of Napo options, warrants and restricted stock units in the merger, the stockholders of Jaguar will experience dilution as a

result of the issuance of shares in the transactions contemplated by the merger and each outstanding share of Jaguar common stock immediately prior to the merger will represent a smaller percentage of

the total number of shares of Jaguar common stock and non-voting common stock issued and outstanding after the merger. It is expected that Jaguar stockholders before the merger will hold approximately

25% of the total Jaguar common stock and non-voting common stock issued and outstanding immediately following completion of the merger. Thus, Jaguar stockholders before the merger will experience

dilution in the amount of 75% as a result of the merger.

17

Table of Contents

A

copy of the merger agreement is attached as

Annex A

to this joint proxy statement/prospectus. Jaguar and Napo encourage you to

read the entire merger agreement carefully because they are the principal documents governing the merger. For more information on the merger agreement, see "The Merger Agreement and Related

Agreements" beginning on page 256.

The

merger is expected to be completed during the second quarter of 2017, subject to the satisfaction or waiver of the closing conditions.

Merger Consideration

At the effective time of the merger:

-

(i)

-

each

issued and outstanding share of Napo common stock (other than dissenting shares and shares held by Jaguar or Napo) will be converted into a contingent right to

receive (x) up to a whole number of shares of Jaguar common stock comprising in the aggregate up to approximately 21.5% of the fully diluted shares of Jaguar common stock immediately following

the consummation of the merger, which contingent right will vest only if the resale of the Tranche A Shares to third parties provides Nantucket with sufficient proceeds to satisfy the

applicable Hurdle Amount and (y) if the applicable Hurdle Amount is achieved before all of the Tranche A Shares are sold, additional shares of the Jaguar common stock (equal to 50% of

the unsold Tranche A shares), which will be distributed pro rata among holders of contingent rights and holders of Napo restricted stock units;

-

(ii)

-

existing

creditors of Napo will receive an aggregate of not more than 2,005,245 shares of Jaguar common stock and not more than 43,156,649 shares of Jaguar

non-voting common stock in full satisfaction of all existing indebtedness then owed by Napo to such creditors;

-

(iii)

-

an

existing Napo stockholder will be issued an aggregate of 3,243,243 shares of Jaguar common stock in return for $3 million of new funds invested into

Jaguar by such investor, which will be immediately loaned to Napo to partially facilitate the extinguishment of the debt that Napo owes to Nantucket;

-

(iv)

-

each

option to purchase shares of Napo common stock outstanding and unexercised immediately prior to the effective time of the merger will be assumed by Jaguar and

will become an option to purchase shares of Jaguar common stock, with the number of shares subject to each such option equal to the product of the number of shares of Napo common stock previously

subject to the Napo option and 0.183823529 (subject to adjustment for various contingencies, such as any financing transaction by either Jaguar or Napo that is consummated during the period between

the execution of the merger agreement and the consummation of the merger), rounded down to the next whole share;

-

(v)

-

each

warrant to purchase shares of Napo common stock outstanding and unexercised immediately prior to the effective time of the merger will be assumed by Jaguar and

will become a warrant to purchase shares of Jaguar common stock, with the number of shares subject to each such warrant equal to the product of the number of shares of Napo common stock previously

subject to the Napo warrant and 0.183823529 (subject to adjustment for various contingencies, such as any financing transaction by either Jaguar or Napo that is consummated during the period between

the execution of the merger agreement and the consummation of the merger), rounded down to the next whole share; and

-

(vi)

-

each

restricted stock unit to acquire shares of Napo common stock outstanding and unexercised immediately prior to the effective time of the merger will be assumed

by Jaguar and will become a restricted stock unit to acquire shares of Jaguar common stock, which will be governed by the terms of the Jaguar 2014 Stock Plan.

18

Table of Contents

Based

upon the current number of issued and outstanding shares of Napo common stock, an aggregate of approximately 69,299,346 shares of Jaguar common stock and non-voting common stock will be issued

upon the closing of the merger on a fully diluted basis, assuming the exercise or conversion of all outstanding options and warrants other than those options and warrants exercisable or convertible

for approximately 300,000 shares of Jaguar common stock with an exercise/conversion price of $5.00 or more. Jaguar will not issue any fractional shares in the merger. Instead, any fractional shares

will be rounded down to the next whole number of shares.

For

a more complete description of the merger consideration, see "The Merger Agreement and Related Agreements—Merger Consideration" beginning on page 256.

Treatment of Stock Options and Warrants

Jaguar will assume outstanding options and warrants to purchase shares of Napo common stock in the merger. Each outstanding option and warrant

to acquire Napo common stock will be converted automatically at the effective time of the merger into an option or warrant to acquire Jaguar common stock. Each option will thereafter be governed by

the terms of the 2014 Jaguar Stock Incentive Plan. The number of shares of Jaguar common stock for which each option or warrant is exercisable will be equal to the product of the number of shares of

Napo common stock previously subject to the Napo option or warrant and 0.183823529 (subject to adjustment for various contingencies, such as any financing transaction by either Jaguar or Napo that is

consummated during the period between the execution of the merger agreement and the consummation of the merger), rounded down to the next whole share, and the exercise price of each option or warrant

will be equal to the exercise price for each share of Napo common stock previously subject to the option or warrant immediately prior to completion of the merger, divided by 0.183823529 (subject to

adjustment for various contingencies, such as any financing transaction by either Jaguar or Napo that is consummated during the period between the execution of the merger agreement and the

consummation of the merger), rounded up to the nearest whole cent. In addition, the vesting and forfeiture provisions applicable to the converted options shall remain the same as the Napo options. As

of March 31, 2017, there were outstanding options and warrants to purchase up to 9,711,443 shares of Napo common stock, at exercise prices of $0.10 to $0.55328. For a more complete discussion

of the treatment of Napo options and other stock-based awards, see "The Merger Agreement and Related Agreements—Treatment of Napo Options and Warrants" beginning on page 259.

Directors and Executive Management of Jaguar Following the Merger

The current board of directors and executive management of Jaguar will remain unchanged following the merger.

For

a more complete discussion of the directors and management of Jaguar after the merger, see "Management of the Combined Company After the Merger" beginning on page 173.

Recommendation of the Jaguar Board

After careful consideration, the Jaguar Board unanimously recommends that holders of Jaguar common stock vote

"FOR"

the issuance of Jaguar

common stock and non-voting common stock in connection with the merger, vote

"FOR"

the issuance of shares of Jaguar common stock upon conversion of the Convertible Promissory Notes, due December 30,

2019, vote

"FOR"

the issuance of $3,000,000 of Jaguar common stock at a price equal to $0.925 per share to Invesco pursuant to the Invesco Commitment Letter,

"FOR"

the amendment of the 2014 Plan, vote

"FOR"

the adoption of Jaguar's Third Amended and Restated

Certificate of Incorporation to authorize a class of non-voting common stock and change the Jaguar corporate name to "Jaguar Health, Inc.", and vote

"FOR"

the adjournment of the special meeting if

necessary or advisable to permit further solicitation of proxies in

19

Table of Contents

the

event there are not sufficient votes at the time of the special meeting to approve all matters brought before the meeting.

For

a more complete description of Jaguar's reasons for the merger and the recommendations of the Jaguar Board, see "The Proposed Merger—Recommendation of the Jaguar Board

and its Reasons for the Merger" beginning on page 230.

Recommendation of the Napo Board

After careful consideration, the Napo Board unanimously recommends that holders of Napo common stock vote

"FOR"

the adoption of the merger

agreement and approval of the merger and vote

"FOR"

the adjournment of

the special meeting if necessary or advisable to permit further solicitation of proxies in the event there are not sufficient votes at the time of the special meeting to adopt the merger agreement and

approve the merger. It should be noted that in connection with the merger, the Napo Board will receive indemnification for acts or omissions occurring prior to the effective time of the merger. The

merger agreement also provides that, from and after the effective time of the merger, Napo will provide exculpation, indemnification and advancement expenses for each former director, officer,

employee or agent of Napo to cover actions at or prior to the effective time of the merger, including all transactions contemplated by the merger agreement, which is at least as favorable in scope and

amount as the exculpation, indemnification and advancement of expenses provided to such former director, officer, employee or agent of Napo prior to the effective time of the merger.

For

a more complete description of Napo's reasons for the merger and the recommendation of the Napo Board, see "The Proposed Merger—Recommendation of the Napo Board and its

Reasons for the Merger" beginning on page 232.

Opinion of Jaguar Financial Advisor

In connection with the merger and certain related transactions described in the merger agreement (sometimes referred to herein collectively as

the Transaction), the Jaguar Board received a written opinion from Stifel, Nicolaus & Company, Incorporated (sometimes referred to as Stifel), as to the fairness, from a financial point of view

and as of the date of its opinion, to Jaguar of the transaction consideration (as described in the opinion) to be issued by Jaguar in the Transaction (as described in the opinion). The full text of

Stifel's written opinion, dated March 28, 2017, is attached to this joint proxy statement/prospectus as

Annex C

. Holders of Jaguar common

stock are encouraged to read this opinion carefully in its entirety for a description of the assumptions made, procedures followed, matters considered and limitations on the review undertaken.

Stifel's Opinion was for the

information of, and directed to, the Jaguar Board for its information and assistance in connection with its consideration of the financial terms of

the Transaction. Stifel's Opinion did not constitute a recommendation to the Jaguar Board as to how the Jaguar Board should vote or otherwise act with respect to the Transaction or any other matter,

or to any stockholder of Jaguar or Napo as to how any such stockholder should vote or act with respect to the Transaction or any other matter, or whether or not any stockholder of Jaguar or Napo

should enter into a voting, stockholders', affiliates' or similar

agreement with respect to the Transaction or exercise any dissenters', appraisal or similar rights that may be available to such stockholder. In addition, Stifel's Opinion did not compare the relative

merits of the Transaction with any other alternative transactions or business strategies which may have been available to Jaguar, did not address the underlying business decision of the Jaguar Board

or Jaguar to proceed with or effect the Transaction and did not address the form or structure of the merger or any other part of the Transaction or any individual transaction or group of transactions

that is or are part of the Transaction.

20

Table of Contents

For

a more complete description of Stifel's opinion, see "The Proposed Merger—Opinion of Jaguar Financial Advisor" beginning on page 234. See also

Annex C

to this joint proxy statement/prospectus.

Interests of Certain Jaguar and Napo Directors and Executive Officers in the Merger

You should be aware that some of Jaguar and Napo's directors and executive officers may have interests in the transaction that may be different

from, or in addition to, the interests of stockholders of Jaguar and Napo, respectively.

For

a further discussion of interests of certain Napo directors and executive officers in the merger, see "Additional Interests of Certain of Jaguar and Napo's Directors and Executive

Officers in the Merger" beginning on page 252.

Material United States Federal Income Tax Consequences of the Merger

The merger will not be taxable to stockholders of Jaguar, as they will continue to own their existing shares and the rights and privileges of

their existing shares will not be affected by the merger.

The

merger will not qualify as a tax-free reorganization within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended (sometimes referred to as the Code).

Although it is not free from doubt, a Napo Stockholder should not recognize any taxable gain or loss until such Napo Stockholder's Certificate Delivery Date. The term "Certificate Delivery Date"

means, with respect to each Napo Stockholder, the date on which such Napo Stockholder delivers to the Exchange Agent his, her or its Napo stock certificate(s) for cancellation, together with a letter

of transmittal duly executed and completed in accordance with its terms and such other documents and/or payments of withholding taxes as may be reasonably required by the Exchange Agent or Jaguar. At

that time, such Napo Stockholder will recognize gain or loss from the sale of his, her or its shares of Napo common stock in an amount equal to the difference between (i) the fair market value

of a Merger Share on such Napo Stockholder's Certificate Delivery Date multiplied by the number of Merger Shares received by such Napo Stockholder (sometimes referred to as the Purchase Price) and

(ii) such Napo Stockholder's tax basis in his, her or its shares of Napo common stock surrendered in the merger. Any such capital gain or capital loss will constitute long-term capital gain or

loss if the Napo Stockholder's holding period for his, her or its shares of Napo common stock is more than one year as of the effective date of the merger. In addition, a portion of the Purchase Price

received by each Napo Stockholder will constitute imputed interest that will be taxed at ordinary rates pursuant to Section 483 of the Code. The imputed interest rules of Section 483

apply regardless of whether a Napo Stockholder recognizes taxable gain or loss on the merger. However, if a Napo Stockholder recognizes capital gain on the merger, the amount of such capital gain is

reduced dollar-for-dollar by the amount of the Napo Stockholder's imputed interest, and if a Napo Stockholder recognizes a capital loss on the merger, the amount of such capital loss will be increased

dollar-for-dollar by the amount of the Napo Stockholder's imputed interest.

Tax

matters are very complicated and the tax consequences of the merger to you, if you are a Napo stockholder, will depend upon the facts of your situation. In addition, you may be

subject to state, local or foreign tax laws that are not addressed in this joint proxy statement/prospectus. You are urged to consult with your own tax advisors for a full understanding of the tax

consequences of the merger to you.

For

a more complete description of the material United States federal income tax consequences of the merger, see "The Proposed Merger—Material United States Federal Income

Tax Consequences of the Merger" beginning on page 246.

21

Table of Contents

Accounting Treatment of the Merger

It is anticipated that the merger will be accounted for as an acquisition by Jaguar of Napo under the acquisition method of accounting according

to United States generally accepted accounting principles.

Regulatory Matters

Neither Jaguar nor Napo is required to make any filings or to obtain approvals or clearances from any antitrust regulatory authorities in the

United States or other countries to complete the merger. In the United States, Jaguar must comply with applicable federal and state securities laws and the rules and regulations of The NASDAQ Stock

Market LLC in connection with the issuance of shares of Jaguar's common stock in the merger, including the filing with the SEC of this proxy statement/prospectus/information statement. The

merger agreement provides that Napo and Jaguar shall obtain all necessary actions or nonactions, waivers, consents and approvals from governmental entities or other persons necessary in connection

with the consummation of the merger and the other transactions contemplated by the merger agreement and take all reasonable steps as may be necessary to obtain an approval or waiver from, or to avoid

any action or proceeding by, any governmental entity or other persons necessary in connection with the consummation of the merger and the other transactions contemplated by the merger agreement. For a

more complete discussion of the regulatory matters relating to the merger, see "The Proposed Merger—Regulatory Matters Relating to the Merger" beginning on page 249.

Conditions to Completion of the Merger

Jaguar and Napo expect to complete the merger after all the conditions to the merger in the merger agreement are satisfied or waived, including

after the receipt of stockholder approvals at their respective stockholder meetings. In addition to obtaining such stockholder approvals, each of the other closing conditions set forth in the merger

agreement must be satisfied. Jaguar and Napo currently expect to complete the merger during the second quarter of 2017. However, it is possible that factors outside of either company's control could

cause the merger to be completed at a later time or not at all. The merger agreement provides that the conditions to the closing of the merger may be waived, in whole or in part, by Jaguar or Napo, to

the extent legally allowed. Neither Jaguar nor Napo currently expects to waive any immaterial or material condition to the completion of the merger. If either Jaguar or Napo determines to waive any

material condition to the merger and such waiver renders the disclosure in this joint proxy statement/prospectus materially misleading, proxies will be resolicited from the Jaguar and/or Napo

stockholders, as applicable.

For

a more complete discussion of the conditions to the merger, see "The Merger Agreement and Related Agreements—Conditions to Completion of the Merger" beginning on page

265.

No Solicitation of Other Offers

The merger agreement contains certain restrictions on the ability of Napo to solicit or engage in discussions or negotiations with a third party

with respect to a proposal to acquire Napo's equity or assets.

For

a discussion of the prohibition on solicitation of acquisition proposals from third parties, see "The Merger Agreement and Related Agreements—Non-Solicitation"

beginning on page 265.

Termination

Jaguar and Napo may mutually agree at any time prior to the completion of the merger (including after stockholder approval) to terminate the

merger agreement and abandon the merger. In addition,

22

Table of Contents

the

merger agreement may be terminated by either Jaguar or Napo under certain circumstances or upon the occurrence of certain events.

For

a discussion of termination provisions of the merger agreement, see "The Merger Agreement and Related Agreements—Termination" beginning on page 266.

Termination Fees and Expenses

If the merger fails to close for any reason on, or prior to, July 31, 2017, other than as a result directly or indirectly of

(x) lack of stockholder approval by either party or (y) Napo (i) fails to perform in accordance with the terms and conditions of the Binding Agreement of Terms for Jaguar Animal

Health, Inc. Acquisition of Napo Pharmaceuticals, Inc., dated February 8, 2017, between Jaguar and Napo (sometimes referred to herein as the Binding Agreement of Terms) or the

merger documents or (ii) fails to abide by or breaches the provisions or representations, warranties and covenants of the Binding Agreement of Terms or the merger documents, then on, or before,

the close of business on

August 7, 2017, Jaguar will issue 2,000,000 shares of its restricted common stock to Napo (sometimes referred to herein as the Break-Up Fee). See "The Merger Agreement and Related

Agreements—Termination Fee and Expenses" and "—Effect of Termination," beginning on pages 266 and 267, respectively.

Shares Beneficially Owned by Directors and Executive Officers of Jaguar and Napo

Jaguar's directors and executive officers beneficially owned

[

·

] shares of Jaguar common stock on

[

·

], 2017, the record date for the special meeting. These shares represent in

total [

·

]% of the total voting power of Jaguar's voting securities outstanding and

entitled to vote as of the record date. To approve the issuance of shares of Jaguar common stock and non-voting common stock in the transactions contemplated by the merger agreement (Proposal 1), the

affirmative vote of, if a quorum is present at the special meeting, the holders of a majority of shares of Jaguar common stock, present in person or represented by proxy at the special meeting, voting

as a single class and entitled to vote, is required. Jaguar currently expects that Jaguar's directors and executive officers will vote their shares

"FOR"

all the proposals to be voted on at the special

meeting, although none of them has entered into any agreements obligating them to do so.

Napo's

directors and executive officers beneficially owned [

·

]

shares of Napo common stock on [

·

], 2017, the record date for the special meeting.

These shares represent in total [

·

]% of the total voting power of Napo's voting

securities outstanding and entitled to vote as of the record date. Napo currently expects that its directors and executive officers will vote their shares

"FOR"

all the proposals to be voted on at the

special meeting, although none of them has entered into any agreements obligating them to do so.

Appraisal Rights

Under Delaware law, Jaguar stockholders are not entitled to appraisal rights in connection with the issuance of shares of Jaguar common stock

and non-voting common stock as contemplated by the merger agreement. Napo stockholders of record have appraisal rights under the Delaware General Corporation Law (sometimes referred to as the DGCL) in

connection with the merger. For further discussion of appraisal rights, see "The Proposed Merger—Appraisal Rights" beginning on page 249.

Comparison of the Rights of Jaguar and Napo Stockholders

The rights of Napo stockholders as Jaguar stockholders after the merger will be governed by Jaguar's Third Amended and Restated Certificate of

Incorporation and amended and restated bylaws and the laws of the State of Delaware. Those rights differ from the rights of Napo stockholders under Napo's Fourth Amended and Restated Certificate of

Incorporation, as amended, and amended and restated bylaws. See "Comparison of Rights of Jaguar and Napo Stockholders" beginning on page 282.

23

Table of Contents

RISK FACTORS

In addition to the other information included in this joint proxy statement/prospectus, including the matters addressed

in the section entitled "Cautionary Statement Regarding Forward-Looking Statements" beginning on page 85, you should carefully consider the following risks before deciding how to vote, which include

risks associated with the businesses of Jaguar and Napo. In addition, you should read and consider the risk factors associated with the businesses of Jaguar and Napo because those risks will also

affect the combined company. Risks associated with the business of Jaguar and Napo can be found below. You should also read and consider the other information in this joint proxy

statement/prospectus.

Risks Related to the Merger

The contingent rights that Napo stockholders are receiving in the merger may be exchanged for fewer shares of

Jaguar stock than anticipated or none at all, depending on whether the resale of the Tranche A Shares to third parties provides Nantucket with sufficient proceeds to satisfy the applicable

Hurdle Amount.

Of the 69,299,346 shares of Jaguar common stock and non-voting common stock to be issued by Jaguar in the transactions contemplated by the

merger agreement and related Napo debt settlement, (x) up to approximately 19,900,202 shares of Jaguar common stock and (y) if the applicable Hurdle Amount is achieved before all of the

Tranche A Shares are sold, additional shares of the Jaguar common stock (equal to 50% of the unsold Tranche A Shares), which will be distributed pro rata among holders of contingent

rights and holders of Napo restricted stock units (sometimes referred to herein collectively as the Merger Shares), are issuable upon the vesting of the contingent rights that the Napo stockholders

are receiving in the merger (subject to adjustment for various contingencies, such as any financing transaction by either Jaguar or Napo that is consummated during the period between the execution of

the merger agreement and the consummation of the merger). A portion of the Merger Shares will initially be held in escrow (sometimes referred to herein as the Tranche B Shares) and will only be

released to the Napo stockholders if the resale of the Tranche A Shares provides Nantucket with sufficient cash proceeds to satisfy the applicable Hurdle Amount. If Nantucket does not receive

an amount equal to the Hurdle Amount from the sale of the Tranche A Shares before the third anniversary of the date on which the merger is consummated, then all of the Tranche B Shares

then held in escrow will be released to Nantucket. As a result, Napo stockholders may receive fewer Merger Shares than anticipated or none at all, depending on whether the resale of the

Tranche A Shares to third parties provides Nantucket with sufficient proceeds to satisfy the applicable Hurdle Amount. See "The Merger Agreement and Related Agreements—Merger

Consideration—Calculation of Shares of Jaguar Common Stock Issuable to Holders of Contingent Rights."

Because the market price of Jaguar common stock will fluctuate, Napo stockholders cannot be sure of the

market value of the Jaguar common stock that they will receive in the merger.

When Jaguar completes the merger, (i) each issued and outstanding share of Napo common stock (other than dissenting shares and shares

held by Jaguar or Napo) will be converted into a contingent right to receive (x) up to a whole number of shares of Jaguar common stock comprising in

the aggregate up to approximately 21.5% of the fully diluted shares of Jaguar common stock immediately following the consummation of the merger, which contingent right will vest only if the resale of

the Tranche A Shares to third parties provides Nantucket with sufficient cash proceeds to satisfy the applicable Hurdle Amount and (y) if the applicable Hurdle Amount is achieved before

all of the Tranche A Shares are sold, additional shares of the Jaguar common stock (equal to 50% of the unsold Tranche A Shares), which will be distributed pro rata among holders of

contingent rights and holders of Napo restricted stock units, (ii) existing creditors of Napo will receive an aggregate of not more than 43,156,649 shares of Jaguar non-voting common stock and

not more than 2,005,245 shares of Jaguar voting common stock in full satisfaction of all existing indebtedness then owed by Napo to such creditors, and (iii) an existing Napo stockholder will

be issued an aggregate of approximately 3,243,243

24

Table of Contents

shares

of Jaguar common stock in return for $3 million of new funds invested into Jaguar by such investor. The market value of Jaguar common stock will continue to fluctuate until the

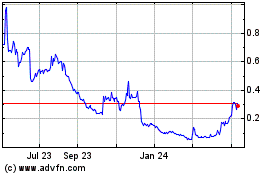

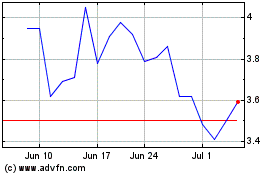

completion of the merger. For example, during the fourth quarter of 2016 and the first quarter of 2017, the closing sales price of Jaguar common stock ranged from a low of $0.51 to a high of $1.30, as

reported on The NASDAQ Capital Market. On April 14, 2017 the closing sales price of Jaguar common stock was $0.87. The merger agreement does not provide for any price-based termination right

for either party. Accordingly, the market value of the shares of Jaguar common stock that Jaguar issues and Napo creditors and stockholders will be entitled to receive when the parties complete the

merger will depend on the market value of shares of Jaguar common stock at the time that the parties complete the merger and could vary significantly from the market value on the date of this joint

proxy statement/prospectus or the date of the Jaguar special meeting and the Napo special meeting.

The issuance of shares of Jaguar common stock and non-voting common stock to Napo stockholders in the

transactions contemplated by the merger agreement will substantially dilute the interest in Jaguar held by Jaguar stockholders prior to the merger.

If the merger is completed, it is estimated that Jaguar will issue up to an aggregate of approximately 69,299,346 shares of Jaguar common stock

and non-voting common stock upon the closing of the merger. Based on the number of shares of Jaguar common stock and Napo common stock issued and outstanding on the Jaguar and Napo record dates, the

Napo Stakeholders will own, in the aggregate, approximately 75% of the aggregate number of shares of Jaguar common stock and non-voting common stock issued and outstanding immediately after the

merger, on a fully diluted basis assuming the exercise or conversion of all outstanding options and warrants other than those options and warrants exercisable or convertible for approximately 300,000

shares of Jaguar common stock with an exercise/conversion price of $5.00 or more. The issuance of shares of Jaguar common stock and non-voting common stock to the Napo Stakeholders will cause

approximately a 75% reduction in the relative percentage interest of current Jaguar stockholders in the earnings, voting rights, liquidation value and book and market value of Jaguar. It is expected

that Jaguar stockholders before the merger will hold approximately 25% of the total Jaguar common stock and non-voting

common stock issued and outstanding immediately following completion of the merger on a fully diluted basis of Jaguar as of March 31, 2017, assuming the exercise or conversion of all

outstanding options and warrants other than those options and warrants exercisable or convertible for approximately 300,000 shares of Jaguar common stock with an exercise/conversion price of $5.00 or

more. Thus, Jaguar stockholders before the merger will experience dilution in the amount of approximately 75% as a result of the merger.

Failure to complete the merger could adversely affect Jaguar's and Napo's stock prices and their future

business and financial results.

Completion of the merger is subject to a number of conditions, including among other things, the receipt of approval of the Jaguar and Napo

stockholders. There is no assurance that the parties will receive the necessary approvals or satisfy the other conditions to the completion of the merger. Failure to complete the proposed merger will

prevent Jaguar and Napo from realizing the anticipated benefits of the merger. Each company will also remain liable for significant transaction costs, including legal, accounting and financial

advisory fees, unless provided otherwise by the merger agreement. In addition, the market price of each company's common stock may reflect various market assumptions as to whether the merger will

occur. Consequently, the failure to complete the merger could result in a significant change in the market price of the common stock of Jaguar and Napo.

25

Table of Contents

The market price of Jaguar common stock after the merger may be affected by factors different from those

affecting the shares of Napo or Jaguar currently.

Upon completion of the merger and assuming the resale of the Tranche A shares to third parties provides Nantucket with sufficient

proceeds to satisfy the applicable Hurdle Amount, holders of Napo common stock will become holders of Jaguar common stock. Jaguar's business differs in important respects from that of Napo, and,

accordingly, the results of operations of the combined company and the market price of Jaguar common stock after the completion of the merger may be affected by factors different from those currently

affecting the independent results of operations of each of Jaguar and Napo. For a discussion of the businesses of Jaguar and Napo and of certain factors to consider in connection with those

businesses, see the risk factors included in this joint proxy statement/prospectus under the section entitled "Risk Factors—Risks Related to Jaguar's Business" beginning on

page 29,"Risk Factors—Risks Related to Napo's Business" beginning on page 64, the description of Jaguar's business under the section entitled "Jaguar Business"

beginning on page 86, and the description of Napo's business under the section entitled "Napo Business" beginning on page 118.

The unaudited pro forma combined condensed financial statements included in this document are preliminary and

the actual financial condition and results of operations after the merger may differ materially.

The unaudited pro forma combined condensed financial statements in this joint proxy statement/prospectus are presented for illustrative purposes

only and are not necessarily indicative of what Jaguar's actual financial condition or results of operations would have been had the merger been completed on the dates indicated. The unaudited pro

forma combined condensed financial statements reflect adjustments to illustrate the effect of the merger had it been completed on the dates indicated, which are based upon preliminary estimates, to

record the Napo identifiable assets acquired and liabilities assumed at fair value and the resulting goodwill recognized. The purchase price allocation for the merger reflected in this joint proxy

statement/prospectus is preliminary, and final allocation of the purchase price will be based upon the actual purchase price and the fair value of the assets and liabilities of Napo as of the date of

the completion of the merger. Accordingly, the final acquisition accounting adjustments may differ materially from the pro forma adjustments reflected in this document. For more information, see

"Unaudited Pro Forma Combined Condensed Financial Statements" beginning on page 269.

Because certain directors and executive officers of Napo, as the case may be, are parties to agreements or

are participants in other arrangements that give them interests that may be different from, or in addition to, your interests as a stockholder of Napo, these persons may have conflicts of interest in

recommending that Napo stockholders vote to adopt the merger agreement and approve the merger.

The directors and executive officers of Napo, as the case may be, are parties to certain agreements or are participants in other arrangements

that give them interests that may be different from, or in addition to, your interests as a stockholder of Napo. This difference of interests stems from the merger agreement providing that Napo will

provide exculpation, indemnification and advancement expenses for each former director, officer, employee or agent of Napo to cover actions at or prior to the consummation of the merger, including all

transactions contemplated by the merger agreement, which is at least as favorable in scope and amount as the exculpation, indemnification and advancement of expenses provided to such former director,

officer, employee or agent of Napo prior to the consummation of the merger. The interests of the directors and executive officers of Napo in the merger that are different than those of the Napo

stockholders are described under "Additional Interests of Certain of Jaguar and Napo's Directors and Executive Officers in the Merger" beginning on page 252.

26

Table of Contents

The merger agreement contains provisions that could discourage a potential alternative acquirer that might be

willing to pay more to acquire Napo.

The merger agreement contains a "no shop" provision that restricts Napo's ability to solicit or facilitate proposals regarding a merger or

similar transaction with another party. This provision could discourage a potential third party acquirer from considering or proposing an alternative acquisition, even if it were prepared to pay

consideration with a higher value than that proposed to be paid in the merger.

Obtaining required approvals necessary to satisfy the conditions to the completion of the merger may delay or

prevent completion of the merger.

To complete the merger, Jaguar stockholders must approve the issuance of shares of Jaguar common stock and non-voting common stock, amend the

2014 Plan, and adopt Jaguar's Third Amended and Restated Certificate of Incorporation, each as contemplated by the merger agreement, and Napo stockholders must adopt the merger agreement and approve

the merger. In addition, the completion of the merger is conditioned upon the receipt of certain governmental authorizations, consents, orders or other approvals.

Jaguar

and Napo intend to pursue all required approvals in accordance with the merger agreement. No assurance can be given that the required approvals will be obtained and, even if all

such approvals are obtained, no assurance can be given as to the terms, conditions and timing of the approvals or that they will satisfy the terms of the merger agreement. See the sections entitled

"The Merger Agreement and Related Agreements—Conditions to the Completion of the Merger" and "The Proposed Merger—Regulatory Matter Relating to the Merger" beginning on

pages 265 and 249, respectively, for a discussion of the conditions to the completion of the merger.

The shares of Jaguar common stock and/or non-voting common stock to be received by Napo stockholders as a

result of the merger, assuming the proceeds from the resale of the Tranche A Shares to third parties provides Nantucket with sufficient proceeds to satisfy the applicable Hurdle Amount, will

have different rights from shares of Napo common stock.

Following completion of the merger, Napo stockholders will no longer be stockholders of Napo and will instead be stockholders of Jaguar only if

the resale of the Tranche A Shares to third parties provides Nantucket with sufficient proceeds to satisfy the applicable Hurdle Amount. Although Napo and Jaguar are each incorporated under

Delaware law, there will be important differences between the current rights of Napo stockholders and the rights of Jaguar stockholders, including the rights of holders of Jaguar common stock and

non-voting common stock that may be important to Napo stockholders. See "Comparison of Rights of Jaguar and Napo Stockholders" beginning on page 282 for a discussion of the material differences

between the rights associated with Napo common stock and Jaguar common stock and non-voting common stock.

The fairness opinion received by the Jaguar Board from Stifel does not reflect changes in circumstances

subsequent to the date of the fairness opinion.

Stifel delivered to the Jaguar Board its opinion dated March 28, 2017. The opinion does not speak as of the time the merger will be

completed or any date other than the date of such opinion. The opinion does not reflect changes that may occur or may have occurred after the date of the opinion, including changes to the operations

and prospects of Napo or Jaguar, changes in general market and economic conditions or regulatory or other factors. Any such changes may materially alter or affect the relative values of Napo and

Jaguar.

27

Table of Contents

If the NASDAQ Stock Market determines that the merger with Napo and the issuance of the merger consideration

results in a change of control of the company, Jaguar may be required to submit a new application under NASDAQ's original listing standards and if such application is not approved, Jaguar's common

stock may be delisted from The NASDAQ Capital Market.