Navios Maritime Partners L.P. Agrees to Acquire 14-Vessel Container Fleet from Rickmers Maritime

April 20 2017 - 4:01PM

Navios Maritime Partners L.P. (“Navios Partners”) (NYSE:NMM)

an international owner and operator of drybulk and container

vessels, announced today that it has agreed to acquire the entire

container fleet (the “Fleet”) of Rickmers Maritime (the “Trust”)

for about $113.0 million.

Angeliki Frangou, Chairman and Chief Executive

Officer of Navios Partners stated, “We are pleased to announce the

agreement for the acquisition of 14 container vessels from Rickmers

Maritime. We anticipate acquiring five 4,250 TEU vessels on

May 15, 2017. These vessels are employed on charters that

have staggered expirations in 2018 and early 2019 at a net daily

charter rate of $26,850.”

Ms. Frangou continued, “Our operating platform

was attractive to the Trust and its lending banks because of our

disciplined technical and commercial management and favorable

operating costs. This acquisition demonstrates our ability to

source proprietary deals, and we are continuing to seek exposure to

the container sector.”

The acquisition is being financed through a $20

million equity investment by Navios Partners and a secured loan

facility under discussion. The vessels are expected to be delivered

starting May 15, 2017. The acquisition is subject to a number

of conditions, and no assurance can be provided that the

acquisition will close in all or part.

Navios Partners will acquire these vessels

though a wholly owned subsidiary, Navios Partners Containers Inc.,

which will be an “unrestricted subsidiary” as defined in the Credit

Agreement, dated March 14, 2017, for our Term Loan B

facility. In addition, a third party has an option to acquire

up to 25% of the equity in Navios Partners Containers Inc., based

on allocated cost.

The Fleet consists of 14 container vessels, 11

of which are 4,250 TEU vessels and three of which are 3,450 TEU

vessels. The average age of the Fleet is 9.5 years. Five of the

4,250 TEU vessels are employed on charters that have staggered

expirations in 2018 and early 2019 at a net daily charter rate of

$26,850.

Fleet Exhibit

|

Name |

TEU |

|

Yard |

|

Built |

|

| Initial Fleet

Acquisition |

|

|

|

|

|

|

| MOL Dominance |

4,250 |

|

Dalian, China |

|

2008 |

|

| MOL Dedication |

4,250 |

|

Dalian, China |

|

2008 |

|

| MOL Delight |

4,250 |

|

Dalian, China |

|

2008 |

|

| MOL Destiny |

4,250 |

|

Dalian, China |

|

2009 |

|

| MOL Devotion |

4,250 |

|

Dalian, China |

|

2009 |

|

| Subsequent

Fleet |

|

|

|

|

|

|

| Vicki Rickmers |

4,250 |

|

Dalian, China |

|

2007 |

|

| Maja Rickmers |

4,250 |

|

Dalian, China |

|

2007 |

|

| CMA CGM Azure |

4,250 |

|

Dalian, China |

|

2007 |

|

| Laranna Rickmers |

4,250 |

|

Dalian, China |

|

2007 |

|

| Sabine Rickmers |

4,250 |

|

Dalian, China |

|

2007 |

|

| Erwin Rickmers |

4,250 |

|

Dalian, China |

|

2007 |

|

| Henry Rickmers |

3,450 |

|

Hyundai, SK |

|

2006 |

|

| Richard Rickmers |

3,450 |

|

Hyundai, SK |

|

2006 |

|

| Moni Rickmers |

3,450 |

|

Hyundai, SK |

|

2007 |

|

|

Total |

57,100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

About Navios Maritime Partners

L.P.

Navios Partners (NYSE:NMM) is a publicly traded

master limited partnership which owns and operates container and

dry bulk vessels. For more information, please visit our website at

www.navios-mlp.com.

Forward-Looking Statements

This press release contains forward-looking

statements (as defined in Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended) concerning future events including the closing of

the acquisition of the Fleet, Navios Partners’ 2017 cash flow

generation, future contracted revenues, future distributions and

its ability to have a dividend going forward, opportunities to

reinvest cash accretively in a fleet renewal program or otherwise,

the benefits of the acquisition of the Fleet, potential capital

gains, our ability to take advantage of dislocation in the market

and Navios Partners’ growth strategy and measures to implement such

strategy; including expected vessel acquisitions and entering into

further time charters. Words such as “may”, “expects”, “intends”,

“plans”, “believes”, “anticipates”, “hopes”, “estimates”, and

variations of such words and similar expressions are intended to

identify forward-looking statements. Such statements include

comments regarding expected revenue and time charters. These

forward-looking statements are based on the information available

to, and the expectations and assumptions deemed reasonable by

Navios Partners at the time these statements were made. Although

Navios Partners believes that the expectations reflected in such

forward-looking statements are reasonable, no assurance can be

given that such expectations will prove to have been correct. These

statements involve known and unknown risks and are based upon a

number of assumptions and estimates which are inherently subject to

significant uncertainties and contingencies, many of which are

beyond the control of Navios Partners. Actual results may differ

materially from those expressed or implied by such forward-looking

statements. Factors that could cause actual results to differ

materially include the quality of the Fleet and the market for the

Fleet vessels, the ability to integrate the Fleet, but are not

limited to, uncertainty relating to global trade, including prices

of seaborne commodities and continuing issues related to seaborne

volume and ton miles, our continued ability to enter into long-term

time charters, our ability to maximize the use of our vessels,

expected demand in the dry cargo shipping sector in general and the

demand for our Panamax, Capesize, Ultra- Handymax and Container

vessels in particular, fluctuations in charter rates for dry cargo

carriers and container vessels, the aging of our fleet and

resultant increases in operations costs, the loss of any customer

or charter or vessel, the financial condition of our customers,

changes in the availability and costs of funding due to conditions

in the bank market, capital markets and other factors, increases in

costs and expenses, including but not limited to: crew wages,

insurance, provisions, port expenses, lube oil, bunkers, repairs,

maintenance and general and administrative expenses, the expected

cost of, and our ability to comply with, governmental regulations

and maritime self-regulatory organization standards, as well as

standard regulations imposed by our charterers applicable to our

business, general domestic and international political conditions,

competitive factors in the market in which Navios Partners

operates; risks associated with operations outside the United

States; and other factors listed from time to time in Navios

Partners’ filings with the Securities and Exchange Commission,

including its Form 20-Fs and Form 6-Ks. Navios Partners expressly

disclaims any obligations or undertaking to release publicly any

updates or revisions to any forward-looking statements contained

herein to reflect any change in Navios Partners’ expectations with

respect thereto or any change in events, conditions or

circumstances on which any statement is based. Navios Partners

makes no prediction or statement about the performance of its

common units.

Contact

Public & Investor Relations Contact:

Navios Maritime Partners L.P.

+1.212.906.8645

Investors@navios-mlp.com

Nicolas Bornozis

Capital Link, Inc.

+1.212.661.7566

naviospartners@capitallink.com

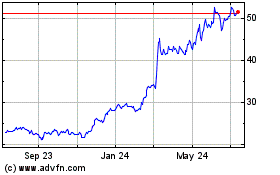

Navios Maritime Partners (NYSE:NMM)

Historical Stock Chart

From Mar 2024 to Apr 2024

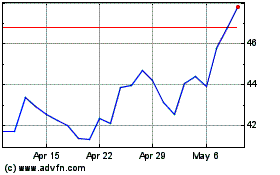

Navios Maritime Partners (NYSE:NMM)

Historical Stock Chart

From Apr 2023 to Apr 2024