Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 11-K

[X]

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

October 30, 2016

OR

[ ]

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission file number

1-2402

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

Hormel Foods Corporation Joint Earnings Profit Sharing Trust

B.

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

|

|

Hormel Foods Corporation

1 Hormel Place

Austin, MN 55912

507-437-5611

|

Table of Contents

Hormel Foods Corporation

Joint Earnings Profit Sharing Trust

Audited Financial Statements and Supplemental Schedule

Years Ended October 30, 2016 and October 25, 2015

Con

tents

Table of Contents

Report of Independent Registered Public Accounting Firm

The Hormel Foods Corporation Employee Benefits Committee

Hormel Foods Corporation Joint Earnings Profit Sharing Trust

We have audited the accompanying statements of net assets available for benefits of the Hormel Foods Corporation Joint Earnings Profit Sharing Trust (the Plan) as of October 30, 2016 and October 25, 2015, and the related statement of changes in net assets available for benefit for the year ended October 30, 2016. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Plan’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan at October 30, 2016 and October 25, 2015, and the changes in its net assets available for benefits for the year ended October 30, 2016, in conformity with U.S. generally accepted accounting principles.

The accompanying supplemental schedule of assets (held at end of year) as of October 30, 2016, have been subjected to audit procedures performed in conjunction with the audit of the Hormel Foods Corporation Joint Earnings Profit Sharing Trust’s financial statements. The information in the supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the information, we evaluated whether such information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Ernst & Young LLP

Minneapolis, Minnesota

April 20, 2017

1

Table of Contents

Hormel Foods Corporation

Joint Earnings Profit Sharing Trust

Statements of Net Assets Available for Benefits

|

|

|

October 30,

2016

|

|

October 25,

2015

|

|

|

Assets

|

|

|

|

|

|

|

Investments:

|

|

|

|

|

|

|

|

|

Investments at fair value

|

|

$

|

367,056,116

|

|

$

|

359,731,836

|

|

|

Investments at contract value

|

|

104,337,670

|

|

96,977,182

|

|

|

Total investments

|

|

471,393,786

|

|

456,709,018

|

|

|

Receivables:

|

|

|

|

|

|

|

Contributions from Hormel Foods Corporation

|

|

11,960,372

|

|

12,448,591

|

|

|

Interest and dividend income

|

|

870,571

|

|

-

|

|

|

Total receivables

|

|

12,830,943

|

|

12,448,591

|

|

|

Net assets available for benefits

|

|

$

|

484,224,729

|

|

$

|

469,157,609

|

|

See accompanying notes to the financial statements.

2

Table of Contents

Hormel Foods Corporation

Joint Earnings Profit Sharing Trust

Statements of Changes in Net Assets Available for Benefits

|

|

|

Year Ended

|

|

Year Ended

|

|

|

|

|

October 30,

|

|

October 25,

|

|

|

|

|

2016

|

|

2015

|

|

|

Additions:

|

|

|

|

|

|

|

Contributions from Hormel Foods Corporation

|

|

$

|

11,802,719

|

|

$

|

12,224,213

|

|

|

Interest and dividend income

|

|

12,422,905

|

|

8,009,763

|

|

|

Total additions

|

|

24,225,624

|

|

20,233,976

|

|

|

|

|

|

|

|

|

|

Deductions:

|

|

|

|

|

|

|

Distributions

|

|

30,246,749

|

|

26,778,501

|

|

|

Administrative expenses

|

|

136,212

|

|

95,986

|

|

|

Total deductions

|

|

30,382,961

|

|

26,874,487

|

|

|

|

|

|

|

|

|

|

Net realized and unrealized appreciation in fair value of investments

|

|

21,224,457

|

|

50,075,506

|

|

|

Net additions

|

|

15,067,120

|

|

43,434,995

|

|

|

Net assets available for benefits at beginning of year

|

|

469,157,609

|

|

425,722,614

|

|

|

Net assets available for benefits at end of year

|

|

$

|

484,224,729

|

|

$

|

469,157,609

|

|

See accompanying notes to the financial statements.

3

Table of Contents

Hormel Foods Corporation

Joint Earnings Profit Sharing Trust

Notes to the Financial Statements

October 30, 2016

1. Description of the Plan

The following description of the Hormel Foods Corporation Joint Earnings Profit Sharing Trust (the Plan) provides only general information. Participants should refer to the plan document or summary plan description for a more complete description of the Plan’s provisions.

General

– The Plan is a defined contribution plan covering certain employees of Hormel Foods Corporation (the Company or the Sponsor) and certain eligible subsidiaries. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA).

Eligibility

– Employees become participants in the Plan on the enrollment date following twelve months and 1,000 hours of eligibility service.

Contributions

– Participant contributions are not permitted. The amount contributed by the Company each year is discretionary, as authorized by the Board of Directors. The amount available to all participants is allocated in proportion of individual recognized compensation for the plan year to the recognized compensation for the plan year for all such eligible participants.

Participant Accounts

– Individual accounts are maintained for each plan participant. Each participant’s account is credited with the employer’s contributions and an allocation of the earnings and losses for the participant’s selected investment funds. The participant’s account is charged with an allocation of administrative expenses if the employer does not pay those expenses from its own assets. Allocations are based on account balances. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s account.

Investments

– Contributions to the Plan are invested in one or more investment funds at the option of the participant. The Plan contains a diversified selection of funds intended to satisfy Section 404(c) of ERISA. Participants may also invest in self-directed brokerage accounts. Certain restrictions exist, as defined in the plan document, for the investing of funds in other contribution accounts.

Vesting

– Employer contributions become fully vested after six years (20% per year beginning with the second year) of service.

Payment of Benefits

– Benefits are payable upon termination of service due to death, disability, termination, or retirement. Participants may elect to receive the vested interest of their accounts in the form of a lump sum, annuity, partial payments, or installments. Complete details of payment provisions are described in a Summary Plan Description, available from the Sponsor.

4

Table of Contents

Forfeitures and Unallocated Assets

– Forfeited balances of terminated participants’ non-vested accounts are used to reduce future employer contributions or plan administrative expenses. Forfeitures used to reduce employer contributions and plan administrative expenses for the years ended October 30, 2016 and October 25, 2015, totaled $303,928 and $287,519, respectively. Forfeited accounts and unallocated assets (e.g. rollovers) as of October 30, 2016 and October 25, 2015 were $353,456 and $286,277, respectively.

Plan Amendments –

During the years ended October 30, 2016 and October 25, 2015, the Plan adopted the following amendments:

·

Effective May 9, 2016, the closing date of the divestiture, Diamond Crystal Brands, Inc and Diamond Crystal Sales, LLC ceased being participating employers in the Plan. Participants employed by Diamond Crystal Brands, Inc. or one of its subsidiaries as of the closing date of the sale were fully vested in the participant’s account under the Plan.

·

On June 15, 2015, the Committee amended the Plan, effective July 13, 2015, the date Hormel Foods Corporation acquired Applegate Farms, LLC, to provide eligibility for the Applegate Farms, LLC salaried and office hourly employees in the Plan as follows: (i) hours of service with Applegate Farms, LLC and its predecessors prior to the acquisition date were credited for purposes of determining eligibility and vesting service in the Plan; and (ii) recognized employees on the acquisition date who were eligible to participate in the Applegate Farms, LLC Retirement Plan immediately prior to July 13, 2015, became an eligible participant in the Plan.

Plan Termination –

The employer may, at its sole discretion, discontinue contributions or terminate the Plan at any time, subject to the provisions of ERISA. Upon the Plan’s termination,

all amounts credited to participants would become fully vested, and

the assets of the Plan would be distributed to the participants based on amounts previously credited to their respective accounts.

2. Significant Accounting Policies

Basis of Accounting

– The accounting records of the Plan are maintained on the accrual basis.

Investment Valuation and Income Recognition –

Investments held by the Plan are stated at fair value with the exception of fully benefit-responsive investment contracts. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Contract value reflects the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan and is the relevant measure for the portion of assets attributable to fully benefit-responsive investment contracts. See Note 3 – Fair Value Measurements for further discussion of investment valuation.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. Net appreciation includes the Plan’s gains and losses on investments bought and sold as well as held during the year.

5

Table of Contents

Payment of Benefits

– Benefits payments to participants are recorded upon distribution. There were no distributions payable to participants as of October 30, 2016 or October 25, 2015.

Administrative Expenses

– All costs and expenses of administering the Plan are paid by the Plan.

Use of Estimates –

The preparation of financial statements in conformity with accounting principles generally accepted in the United States (US GAAP) requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

Risks and Uncertainties

–

The Plan invests in various investment securities. Investment securities are exposed to various risks, such as interest rate, market volatility, and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities could occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statements of net assets available for benefits.

Recent Accounting Pronouncements

– In May 2015,

the Financial Accounting Standards Board (FASB) issued Accounting Standards Update ASU 2015-07,

Fair Value Measurement (Topic 820): Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent),

which removes the requirement to present investments for which the practical expedient is used to measure fair value at net asset value (NAV) within the fair value hierarchy table. Instead, an entity would be required to include those investments as a reconciling item so that the total fair value amount of investments in the disclosure is consistent with the fair value investment balance on the statement of net assets available for benefits. The Plan elected to early adopt ASU 2015-07 as of October 25, 2015. The adoption has been reflected in Note 3 – Fair Value Measurements of the financial statements.

In July 2015, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update ASU 2015-12,

Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): (Part I) Fully Benefit-Responsive Investment Contract, (Part II) Plan Investment Disclosures, (Part III) Measurement Date Practical Expedient,

which simplifies the required disclosures related to employee benefit plans. Part I eliminates the requirement to measure and disclose the fair value of fully benefit-responsive contracts, including common collective trust assets. Contract value is the only required measure for fully benefit-responsive investment contracts. Part II eliminates the requirement to disclose individual investments which comprise 5% or more of total net assets available for benefits, as well as the net appreciation or depreciation of fair values by type. Part II also requires plans to continue to disaggregate investments that are measured using fair value by general type; however, plans are no longer required to also disaggregate investments by nature, characteristics, and risks. Furthermore, the disclosure of information about fair value measurements shall be provided by general type of plan asset. Part III allows plans to measure investments using values from the end of the calendar month closest to the plan’s fiscal year end. The Plan elected to early adopt ASU 2015-12 Parts I and II as of October 25, 2015. The Plan is not adopting the provisions of ASU 2015-12 Part III.

6

Table of Contents

3. Fair Value Measurements

Accounting guidance establishes a framework for measuring fair value. That framework classifies assets and liabilities measured at fair value into one of three levels based on the lowest level of input significant to the valuation. The three levels are defined as follows:

·

Level 1: Observable inputs based on quoted prices (unadjusted) in active markets for identical assets or liabilities.

·

Level 2:

Observable inputs, other than those included in Level 1, based on quoted prices for similar assets and liabilities in active markets, or quoted prices for identical assets and liabilities in inactive markets.

·

Level 3: Unobservable inputs that reflect an entity’s own assumptions about what inputs a market participant would use in pricing the asset or liability based on the best information available in the circumstances.

The following is a description of the valuation methodologies used for instruments held by the Plan measured at fair value, including the general classification of such instruments pursuant to the valuation hierarchy.

Non-Pooled Separate Account

The non-pooled separate account consists of common stock of the Company, which is valued at the last reported sales price on the last business day of the year, and a portion of uninvested cash, which is reported at carrying value as maturities are less than three months. This non-pooled separate account is deemed to be a Level 1 investment.

The Company has implemented a dividend pass through election for its participants.

Participants are authorized to invest up to 100% of the fair value of their net assets available for benefits in this fund. Each participant in this fund is entitled to exercise voting rights attributable to the shares allocated to their account and is notified by the Company prior to the time that such rights may be exercised. The trustee is not permitted to vote any allocated shares for which instructions have not been given by a participant. The trustee votes any unallocated shares in the same proportion as those shares that were allocated, unless the Committee directs the trustee otherwise. Participants have the same voting rights in the event of a tender or exchange offer.

Effective January 1, 2017, State Street Global Advisors was appointed as the independent fiduciary to oversee the Hormel Foods Corporation Stock Fund.

This fund is approximately 47% and 44% of the total investments in the Plan at October 30, 2016 and October 25, 2015, respectively.

7

Table of Contents

Self-Directed Brokerage Assets

The self-directed brokerage assets consist of common stock and mutual funds, which are valued at the last reported sales price on the last business day of the year, and uninvested cash, which is recorded at carrying value as maturities are less than three months. These assets are deemed to be a Level 1 investment.

Separate Trust Accounts – Mutual Funds

The mutual funds are held in separate investment accounts, which are valued using the NAV provided by the administrator of the fund. The NAV is based on the value of the underlying assets owned by the fund, which include a mix of U.S. and international equities, fixed income investments, and cash. There are no restrictions on redemptions and no unfunded commitments.

·

The U.S. equities investments include a mix of predominately U.S. common stocks, bonds, and cash.

·

The international equities investment includes a mix of predominately foreign common stocks and cash.

·

The fixed income investment includes a mix of domestic and foreign securities, including corporate obligations, government securities, mortgage-backed and other asset-backed securities, preferred stocks, and cash.

Separate Trust Accounts – Collective Trust Funds

The collective trust funds are held in separate investment accounts, which are valued using the NAV provided by the administrator of the fund. The NAV is based on the value of the underlying assets owned by the fund, which include a mix of U.S. and international equities, fixed income investments, and cash. There are no restrictions on redemptions and no unfunded commitments.

·

The LifePath funds are target retirement date funds and include investments in highly diversified funds designed to remain appropriate for investors in terms of risk through a variety of life circumstances. These funds contain a mix of domestic and foreign equities, fixed income investments, and cash.

·

The U.S. equities funds include a mix of predominately U.S. common stocks, bonds, and cash.

·

The international equities fund includes a mix of predominately foreign common stocks and cash.

·

The fixed income fund includes a mix of domestic and foreign securities, including corporate obligations, government securities, mortgage-backed and other asset-backed securities, domestic and foreign common stocks, and cash.

8

Table of Contents

The investments of the Plan that are measured at fair value on a recurring basis as of October 30, 2016 and October 25, 2015, and their level within the fair value hierarchy, are as follows:

|

|

|

Fair Value Measurements at October 30, 2016

|

|

|

|

|

Total

Fair Value

|

|

Quoted Prices

in Active

Markets for

Identical Assets

(Level 1)

|

|

Significant

Other

Observable

Inputs

(Level 2)

|

|

Significant

Unobservable

Inputs

(Level 3)

|

|

|

Investments at fair value:

|

|

|

|

|

|

|

|

|

|

|

|

Non-pooled separate account:

|

|

|

|

|

|

|

|

|

|

|

|

Hormel Foods Corporation Stock Fund

|

|

$

|

219,805,197

|

|

|

$

|

219,805,197

|

|

$

|

–

|

|

$

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Self-directed brokerage accounts

|

|

6,635,181

|

|

|

6,635,181

|

|

–

|

|

–

|

|

|

Total investments in the fair value hierarchy

|

|

226,440,378

|

|

|

$

|

226,440,378

|

|

$

|

–

|

|

$

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments measured at net asset value:

|

|

|

|

|

|

|

|

|

|

|

|

Separate trust accounts:

|

|

|

|

|

|

|

|

|

|

|

|

Mutual funds

|

|

45,448,932

|

|

|

|

|

|

|

|

|

|

Collective trusts

|

|

95,166,806

|

|

|

|

|

|

|

|

|

|

Total separate trust accounts

|

|

140,615,738

|

|

|

|

|

|

|

|

|

|

Total investments at fair value

|

|

$

|

367,056,116

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements at October 25, 2015

|

|

|

|

|

Total

Fair Value

|

|

|

Quoted Prices

in Active

Markets for

Identical Assets

(Level 1)

|

|

Significant

Other

Observable

Inputs

(Level 2)

|

|

Significant

Unobservable

Inputs

(Level 3)

|

|

|

Investments at fair value:

|

|

|

|

|

|

|

|

|

|

|

|

Non-pooled separate account:

|

|

|

|

|

|

|

|

|

|

|

|

Hormel Foods Corporation Stock Fund

|

|

$

|

202,529,028

|

|

|

$

|

202,529,028

|

|

$

|

–

|

|

$

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Self-directed brokerage accounts

|

|

7,286,327

|

|

|

7,286,327

|

|

–

|

|

–

|

|

|

Total investments in the fair value hierarchy

|

|

209,815,355

|

|

|

$

|

209,815,355

|

|

$

|

–

|

|

$

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments measured at net asset value:

|

|

|

|

|

|

|

|

|

|

|

|

Separate trust accounts:

|

|

|

|

|

|

|

|

|

|

|

|

Mutual funds

|

|

51,897,924

|

|

|

|

|

|

|

|

|

|

Collective trusts

|

|

98,018,557

|

|

|

|

|

|

|

|

|

|

Total separate trust accounts

|

|

149,916,481

|

|

|

|

|

|

|

|

|

|

Total investments at fair value

|

|

$

|

359,731,836

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9

Table of Contents

4. Fully Benefit-Responsive Investment Contract

The General Investment Account is a fully benefit-responsive investment and is reported at contract value in the statements of net assets available for benefits. The statements of changes in net assets available for benefits are also prepared on a contract value basis. Benefit responsiveness is defined as the extent to which a contract’s terms and the Plan permit or require participant-initiated withdrawals at contract value. Contract value is the relevant measure for fully benefit-responsive investment contracts because this is the amount received by participants if they were to initiate permitted transactions under the terms of the Plan. Contract value represents contributions made under each contract, plus earnings, less participant withdrawals, and administrative expenses.

The fully benefit-responsive investment contract with Massachusetts Mutual Life Insurance Company (MassMutual) is a general account evergreen group annuity contract. MassMutual maintains the contributions in a general account. Specific securities within the general account are not attributed to the investment contract with the Plan. The Plan owns a series of guarantees that are embedded in the insurance contract. The contractual guarantees are backed up by the full faith and credit of MassMutual, the contract issuer. The account is credited with earnings on the underlying investments and charged for participant withdrawals and administrative expenses. MassMutual is contractually obligated to repay the principal and a specified interest rate that is guaranteed to the Plan. There are no reserves against contract value for credit risk of the contract issuer or otherwise. The crediting interest rate is based on a formula agreed upon with the issuer and includes such factors as the investment-year method experience of the underlying contract or pool, projected levels of cash flows within the current interest rate environment, and the projected maturity of the underlying investments. Such interest rates are reviewed on a semiannual basis for resetting.

The investment option for the General Investment Account is a Guaranteed Interest Account, provided through a group annuity contract. This contract does not allow the insurance company to terminate the agreement prior to a breach of the contract terms by the investor. The Plan may terminate the contract on the contract anniversary date with 90 days prior notice.

Certain events limit the ability of the Plan to transact at contract value with the issuer. Such events include the following: (i) amendments to the plan documents (including complete or partial plan termination or merger with another plan); (ii) changes to the Plan’s prohibition on competing investment options or deletion of equity wash provisions; (iii) bankruptcy of the Sponsor or other Sponsor event (e.g., divestures or spin-offs of a subsidiary) that causes a significant withdrawal from the Plan; or (iv) the failure of the trust to qualify for exemption from federal income taxes or any required prohibited transaction exemption under ERISA. The plan administrator does not believe that the occurrence of any such event, which would limit the Plan’s ability to transact at contract value with participants, is probable.

10

Table of Contents

5. Income Tax Status

The Plan has received a determination letter from the IRS dated September 16, 2013, stating that the Plan is qualified under Section 401(a) of the Internal Revenue Code (the Code) and therefore, the related trust is exempt from taxation. Subsequent to this determination by the IRS, the Plan was amended and restated. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualified status. The plan administrator believes the Plan is being operated in compliance with the applicable requirements of the Code and therefore, believes the Plan, as amended and restated, is qualified and the related trust is tax exempt.

US GAAP requires plan management to evaluate uncertain tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The plan administrator has analyzed the tax positions taken by the Plan and has concluded that as of October 30, 2016, there are no uncertain positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax positions. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The plan administrator believes the Plan is no longer subject to income tax examinations for years prior to the plan year ended October 27, 2013.

6. Related Parties

The Plan maintains the following investments that qualify as party-in-interest transactions:

·

collective trust funds managed by State Street Global Markets, LLC;

·

common stock of Hormel Foods Corporation; and

·

General Investment Account of the record keeper, the Massachusetts Mutual Life Insurance Company.

These transactions qualify as party-in-interest transactions; however, they are exempt from the prohibited transactions rules under ERISA.

7. Subsequent Events

Management evaluated subsequent events for the Plan through April 20, 2017, the date the financial statements were available to be issued.

11

Table of Contents

Hormel Foods Corporation

Joint Earnings Profit Sharing Trust

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

EIN: 41-0319970 Plan Number: 030

October 30, 2016

|

Identity of Issuer, Borrower,

Lessor, or Similar Party

|

|

Number of

Shares/Units Held

|

|

Current

Value

|

|

|

|

|

|

|

|

|

|

Insurance company general account:

|

|

|

|

|

|

|

Massachusetts Mutual Life Insurance Company*:

|

|

|

|

|

|

|

General Investment Account, contract value

|

|

4,766,291 units

|

|

$

|

104,337,670

|

|

|

|

|

|

|

|

|

|

Non-pooled separate account:

|

|

|

|

|

|

|

State Street Corporation*:

|

|

|

|

|

|

|

Hormel Foods Corporation Stock Fund*

|

|

2,338,984 units

|

|

219,805,197

|

|

|

|

|

|

|

|

|

|

Separate trust accounts:

|

|

|

|

|

|

|

State Street Corporation*:

|

|

|

|

|

|

|

BlackRock Equity Index S&P 500

|

|

648,564 units

|

|

9,110,982

|

|

|

BlackRock LifePath Index 2020

|

|

1,149,158 units

|

|

13,072,203

|

|

|

BlackRock LifePath Index 2025

|

|

1,250,921 units

|

|

14,361,174

|

|

|

BlackRock LifePath Index 2030

|

|

934,134 units

|

|

10,818,907

|

|

|

BlackRock LifePath Index 2035

|

|

848,892 units

|

|

9,899,792

|

|

|

BlackRock LifePath Index 2040

|

|

701,831 units

|

|

8,227,561

|

|

|

BlackRock LifePath Index 2045

|

|

491,686 units

|

|

5,796,423

|

|

|

BlackRock LifePath Index 2050

|

|

361,328 units

|

|

4,287,425

|

|

|

BlackRock LifePath Index 2055

|

|

175,777 units

|

|

2,095,550

|

|

|

BlackRock LifePath Index 2060

|

|

1,463 units

|

|

14,569

|

|

|

BlackRock LifePath Index Retirement

|

|

665,990 units

|

|

7,447,755

|

|

|

BlackRock MSCI ACWI ex-US Index

|

|

82,264 units

|

|

831,423

|

|

|

BlackRock Russell 2500 Index

|

|

111,725 units

|

|

1,449,347

|

|

|

BlackRock US Debt Index

|

|

143,035 units

|

|

1,563,085

|

|

|

DFA US Large Cap Value Fund

|

|

1,437,460 units

|

|

14,621,092

|

|

|

Dodge & Cox International Stock Fund

|

|

649,775 units

|

|

8,830,333

|

|

|

Harbor Capital Appreciation

|

|

813,657 units

|

|

12,206,855

|

|

|

Prudential Core Plus Bond CIT

|

|

575,111 units

|

|

6,190,609

|

|

|

Wasatch Small Cap Growth Fund

|

|

320,182 units

|

|

4,870,070

|

|

|

Wells Fargo Advantage Intrinsic Small Cap Value

|

|

381,817 units

|

|

4,920,583

|

|

|

Total separate trust accounts

|

|

|

|

140,615,738

|

|

|

|

|

|

|

|

|

|

Self-directed brokerage assets

|

|

|

|

|

|

|

Charles Schwab & Co.

|

|

|

|

6,635,181

|

|

|

|

|

|

|

|

|

|

Total assets (held at end of year)

|

|

|

|

|

|

|

|

|

|

|

$

|

471,393,786

|

|

|

|

|

|

|

|

|

|

|

*Indicates a party-in-interest to the Plan.

12

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on their behalf by the undersigned hereunto duly authorized.

|

|

|

HORMEL FOODS CORPORATION

JOINT EARNINGS PROFIT SHARING TRUST

|

|

|

|

|

|

|

|

|

|

|

|

Date: April 20, 2017

|

|

By:

|

/s/ JAMES N. SHEEHAN

|

|

|

|

|

JAMES N. SHEEHAN

Senior Vice President and Chief Financial Officer,

Hormel Foods Corporation

|

13

Table of Contents

EXHIBIT INDEX

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

23

|

|

Consent of Independent Registered Public Accounting Firm

|

14

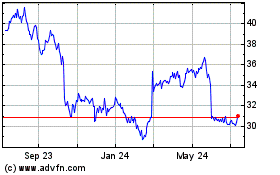

Hormel Foods (NYSE:HRL)

Historical Stock Chart

From Mar 2024 to Apr 2024

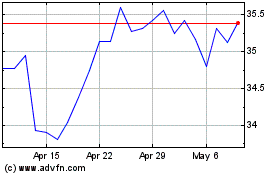

Hormel Foods (NYSE:HRL)

Historical Stock Chart

From Apr 2023 to Apr 2024