As filed with the Securities and Exchange Commission on April 20, 2017

Registration

No. 333-216922

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO.1

to

FORM

S-3

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

CENTRAL FEDERAL CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

|

34-1877137

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

7000 North High Street

Worthington, Ohio 43085

(614)

334-7979

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Timothy T. O’Dell

7000 North High Street

Worthington, Ohio 43085

(614)

334-7979

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Anthony D. Weis, Esq.

Vorys, Sater, Seymour and Pease LLP

52 East Gay Street

Columbus, OH 43215

(614)

464-6400

Approximate

date

of

commencement

of

proposed

sale

to

the

public:

From time to time after this Registration Statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and

list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

If this Form is a

post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall

become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form

is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated

filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule

12b-2

of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☐

|

|

Accelerated filer

|

|

☐

|

|

Non-accelerated filer

|

|

☐ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☒

|

|

|

|

|

|

Emerging growth company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF

REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class of

securities to be registered (1)

|

|

Amount

to be

registered (1)

|

|

Proposed

maximum

offering

price

per share (2)

|

|

Proposed

maximum

aggregate

offering price

|

|

Amount of

registration fee (3)

|

|

Common Stock, $0.01 par value per share

|

|

1,152,125 shares

|

|

$2.11

|

|

$2,430,984

|

|

$282

|

|

|

|

|

|

(1)

|

Consists of shares issuable upon the exercise of warrants to purchase shares of common stock. Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration

statement also covers such indeterminate number of additional shares of the registrant’s common stock as may from time to time be issued with respect to such securities as a result of stock splits, stock dividends, recapitalizations or certain

other capital adjustments.

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) of the Securities Act, based on the average of the high and low price per share of the common stock as reported on The

NASDAQ Capital Market on March 22, 2017.

|

The registrant hereby amends

this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in

accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling

stockholders named in this prospectus may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an

offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated April 20, 2017

PROSPECTUS

CENTRAL FEDERAL CORPORATION

1,152,125 Shares of Common Stock

This prospectus

relates to the offer and sale from time to time of up to 1,152,125 shares of our common stock which are issuable upon the exercise of warrants held by the selling stockholders identified in the “Selling Stockholders” section of this

prospectus, including their respective pledgees, donees, transferees or other

successors-in-interest.

The selling stockholders acquired the warrants to purchase common

stock (the “Warrants”) from us in May and July 2014 as part of a private placement of securities. We are not selling any common stock or any other securities under this prospectus and will not receive any of the proceeds from the sale of

common stock by the selling stockholders. However, we will receive the net proceeds of any Warrants exercised for cash.

The selling

stockholders identified in this prospectus, or their respective pledgees, donees, transferees or other

successors-in-interest,

may offer and sell the shares of common

stock described in this prospectus through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. See “Plan of Distribution” on page 8. We have agreed to

pay all expenses, including legal and accounting fees, in registering these shares. The selling stockholders will bear all applicable commissions and discounts, if any, attributable to the sale or other disposition of the shares.

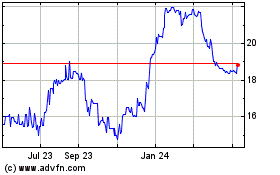

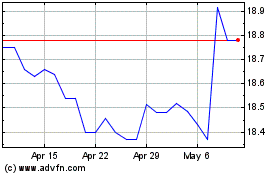

Our common stock is traded on The NASDAQ Capital Market under the symbol “CFBK.” On April 17, 2017, the closing price of our

common stock was $2.21.

Investing in our securities involves a high degree of risk. See “

Risk Factors

” on

page 4 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or

disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date

of this prospectus is , 2017.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus relates to the resale by the selling stockholders identified in the prospectus under the heading “Selling

Stockholders,” from time to time, of up to 1,152,125 shares of our common stock, par value $0.01 per share. We are not selling any shares of common stock under this prospectus and will not receive any proceeds from the sale of shares of common

stock by the selling stockholders. This prospectus is a part of a registration statement on Form

S-3

under the Securities Act of 1933, as amended (the “Securities Act”), that we filed with the

Securities and Exchange Commission (the “SEC”) using a “shelf” registration, or continuous offering, process. Under this shelf registration process, the selling stockholders may sell or otherwise dispose of up to all of the

shares of our common stock set forth above at any time or from time to time.

You should read this prospectus, together with the

information described under the heading “Where You Can Find More Information,” before deciding whether to invest in any of our securities. You should rely only on the information contained or incorporated by reference in this

prospectus. We have not authorized anyone to provide you with different or additional information. If anyone provides you with different, additional or inconsistent information, you should not rely on it. This prospectus is not an

offer to sell these securities, and it is not soliciting an offer to buy these securities, in any jurisdiction where it is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other

than the date on the cover of the applicable document, or that any information we have incorporated by reference herein or therein is accurate as of any date other than the date of the document incorporated by reference.

Unless the context otherwise requires, all references in this prospectus to the “Company,” “we,” “us,” and

“our” refer collectively to Central Federal Corporation (“CFC”) and its wholly-owned subsidiary, CFBank, National Association (“CFBank”).

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated herein by reference may contain “forward-looking statements” within the meaning of

Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including, but not limited to, (1) projections of revenues, income or loss, earnings or loss per

share of common stock, capital structure and other financial items; (2) plans and objectives of the management or Boards of Directors of Central Federal Corporation or CFBank; (3) statements regarding future events, actions or economic

performance; and (4) statements of assumptions underlying such statements. Words such as “estimate,” “strategy,” “may,” “believe,” “anticipate,” “expect,” “predict,”

“will,” “intend,” “plan,” “targeted,” and the negative of these terms, or similar expressions, are intended to identify forward-looking statements, but are not the exclusive means of identifying such

statements. Various risks and uncertainties may cause actual results to differ materially from those indicated by our forward-looking statements. Such risks and uncertainties are described in the “Risk Factors” section in our Annual Report

on Form

10-K

for the fiscal year ended December 31, 2016, and in our subsequent periodic reports filed with the SEC, which are incorporated by reference in this prospectus, and include, among other

factors:

|

|

•

|

|

changes in economic and political conditions that could adversely affect our earnings through declines in deposits, loan demand, the ability of our customers to repay loans and the value of the collateral securing our

loans;

|

|

|

•

|

|

changes in interest rates that may reduce net interest margin and impact funding sources;

|

|

|

•

|

|

the possibility that we will need to make increased provisions for loan and lease losses;

|

|

|

•

|

|

our ability to maintain sufficient liquidity to continue to fund our operations;

|

|

|

•

|

|

our ability to reduce our high level of nonperforming assets and the associated operating expenses;

|

|

|

•

|

|

changes in market rates and prices, including real estate values, which may adversely impact the value of financial products including securities, loans and deposits;

|

1

|

|

•

|

|

the possibility of other-than-temporary impairment of securities held in our securities portfolio;

|

|

|

•

|

|

results of examinations of the Company by the regulators, including the possibility that the regulators may, among other things, require CF Bank to increase its allowance for loan and lease losses or write-down assets;

|

|

|

•

|

|

our ability to continue to meet regulatory requirements and guidelines to which we are subject;

|

|

|

•

|

|

our ability to generate profits in the future;

|

|

|

•

|

|

our ability to raise additional capital if and when necessary in the future;

|

|

|

•

|

|

changes in tax laws, rules and regulations;

|

|

|

•

|

|

increases in deposit insurance rates or premiums;

|

|

|

•

|

|

further legislative and regulatory changes which may increase compliance costs and burdens;

|

|

|

•

|

|

unexpected losses of key management;

|

|

|

•

|

|

various monetary and fiscal policies and regulations, including those determined by the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation and the Office of the Comptroller of

the Currency;

|

|

|

•

|

|

further increases in competition from other local and regional commercial banks, savings banks, credit unions and other

non-bank

financial institutions;

|

|

|

•

|

|

our ability to grow our core businesses;

|

|

|

•

|

|

our ability to effectively manage our growth;

|

|

|

•

|

|

any failure, interruption or breach in security of our communications and information systems;

|

|

|

•

|

|

technological factors which may affect our operations, pricing, products and services;

|

|

|

•

|

|

unanticipated litigation, claims or assessments; and

|

|

|

•

|

|

our management’s ability to manage these and other risks.

|

The factors identified in this

section are not intended to represent a complete list of all the factors that could adversely affect our business, operating results, financial condition or cash flows. Other factors not presently known to us or that we currently deem immaterial to

us may also have an adverse effect on our business, operating results, financial condition or cash flows, and the factors we have identified could affect us to a greater extent than we currently anticipate. Many of the important factors that will

determine our future financial performance and financial condition are beyond our ability to control or predict. You are cautioned not to put undue reliance on any forward-looking statements, which speak only as of the date they are made. Except as

required by applicable law or the rules and regulations of the SEC, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. However, any further disclosures

made on related subjects in our subsequent filings and reports with the SEC should be consulted. This discussion is provided as permitted by the Private Securities Litigation Reform Act of 1995, and all of our forward-looking statements are

expressly qualified in their entirety by the cautionary statements contained or referenced in this section.

ABOUT THE COMPANY

CFC was organized as a Delaware corporation in September 1998 as the holding company for CFBank, in connection with CFBank’s conversion

from a mutual to stock form of organization. CFBank was originally organized in 1892 and was formerly known as Central Federal Savings and Loan Association of Wellsville and more recently as Central Federal Bank. On December 1, 2016, CFBank

converted from a federal savings

2

association to a national bank. Effective as of December 1, 2016 and in conjunction with the conversion of CFBank to a national bank, CFC became a registered bank holding company and elected

financial holding company status. As a financial holding company, CFC is subject to regulation by the Board of Governors of the Federal Reserve System (the “FRB”). At December 31, 2016, our consolidated assets totaled

$436.1 million and our stockholders’ equity totaled $39.3 million.

CFBank is a community-oriented national bank offering a

variety of financial services to meet the needs of the communities we serve. Our business model emphasizes personalized service, customer access to decision makers, quick execution, and the convenience of online internet banking, mobile banking,

remote deposit and corporate treasury management. In addition, CFBank provides residential lending and full service retail banking services and products. We attract retail and business deposits from the general public and use the deposits, together

with borrowings and other funds, primarily to originate commercial and commercial real estate loans, single-family and multi-family residential mortgage loans and home equity lines of credit. The majority of our customers are small businesses, small

business owners and consumers.

Revenues are derived principally from the generation of interest and fees on loans originated and, to a

lesser extent, interest and dividends on securities. Our primary sources of funds are retail and business deposit accounts and certificates of deposit, brokered certificates of deposit and, to a lesser extent, principal and interest payments on

loans and securities, Federal Home Loan Bank advances, other borrowings and proceeds from the sale of loans.

Our principal market area

for loans and deposits includes the following Ohio counties: Franklin County through our office in Worthington, Ohio; Summit County through our office in Fairlawn, Ohio; Columbiana County through our offices in Calcutta and Wellsville, Ohio; and

Cuyahoga County, through our agency office in Woodmere, Ohio. We originate commercial and residential real estate loans and business loans primarily throughout Ohio.

Our principal executive offices are located at 7000 North High Street, Worthington, Ohio 43085. The telephone number of our corporate

headquarters is

(614) 334-7979

and our website address is

cfbankonline.com

. Information on our website is not incorporated by reference in or otherwise a part of this prospectus or any applicable

prospectus supplement.

3

RISK FACTORS

Investing in our securities involves a high degree of risk. Before you decide to invest in our securities, you should carefully consider and

evaluate all of the information included and incorporated by reference in this prospectus, including the risk factors incorporated herein by reference from our most recent Annual Report on Form

10-K,

as

updated by our subsequent Quarterly Reports on Form

10-Q,

Current Reports on Form

8-K

and other filings with the SEC. It is possible that our business, financial

condition, liquidity or results of operations could be materially adversely affected by any of these risks. In addition, see “Forward-Looking Statements” above for a description of certain risks and uncertainties associated with our

business. The market or trading price of our securities could decline due to any of these risks and uncertainties, and you may lose all or a part of your investment.

USE OF PROCEEDS

The selling stockholders will receive all of the proceeds from the sale or other disposition of the shares of common stock covered by this

prospectus. For information about the selling stockholders, see “Selling Stockholders” below. We will not receive any of the proceeds from the sale or other disposition of the shares of common stock covered by this prospectus. However, we

will receive net proceeds upon the cash exercise of Warrants for which underlying shares of common stock are being registered hereunder. Assuming exercise of all of the Warrants for cash in full, we would receive an aggregate of $2,131,431. We will

use any cash we receive upon the exercise of the Warrants for general corporate purposes.

Pursuant to the terms of the Registration

Rights Agreements described under the heading “Selling Stockholders” below, we have agreed to pay all expenses, including all registration, filing and listing fees and all legal and accounting fees and disbursements, in effecting the

registration of the shares of common stock covered by this prospectus. The selling stockholders will bear all applicable commissions and discounts, if any, attributable to the sale or other disposition of the shares.

SELLING STOCKHOLDERS

The securities covered by this prospectus consist of up to 1,152,125 shares of common stock of the Company issuable to the selling

stockholders upon the exercise of Warrants. We are registering the shares of common stock issuable upon exercise of the Warrants in order to permit the selling stockholders, or their respective pledgees, donees, transferees or other

successors-in-interest,

to offer the shares for resale from time to time. Such persons may resell from time to time all, a portion, or none of such shares. We do not know when

or in what amounts the selling stockholders may offer shares for sale. See “Plan of Distribution” on page 8.

Throughout this

prospectus, when we refer to the “selling stockholders,” we are referring to the persons listed in the table below, together with their respective pledgees, donees, assignees, transferees or other

successors-in-interest.

When we refer to “registered shares,” we are referring to the shares of common stock, $0.01 par value per share, of the Company issuable upon the exercise of Warrants which

are being registered by the registration statement of which this prospectus is part.

Summary of Warrants

The selling stockholders acquired the Warrants from us in May and July 2014 as part of a private placement by the Company of its 6.25%

Non-Cumulative

Perpetual Preferred Stock, $0.01 par value per share (“Series B Preferred Stock”), for an offering price of $25.00 per share (the “Private Placement”). Pursuant to the Private

Placement, the Company sold an aggregate of 480,000 shares of Series B Preferred Stock on May 12, 2014 and July 15, 2014. For each share of Series B Preferred Stock sold in the Private Placement, the Company also

4

issued, at no additional charge, a Warrant to purchase shares of common stock of the Company. Warrants to purchase an aggregate of 1,152,125 shares of common stock were issued by the Company

in the Private Placement.

The offer and sale of the Series B Preferred Stock and Warrants were not registered under the Securities Act,

or under the securities laws of any state in reliance upon exemptions from registration thereunder, including the exemptions provided under Section 4(a)(2) of the Securities Act and Rule 506(b) promulgated thereunder. As a result, the shares of

commons stock issuable upon the exercise of the Warrants would constitute “restricted securities” under the Securities Act and applicable state securities laws absent the registration of such shares. Accordingly, we are registering the

shares of common stock issuable upon exercise of the Warrants in order to permit the selling stockholders, or their respective pledgees, donees, assignees, transferees or other

successors-in-interest,

to offer the shares for resale from time to time. Such registration is being effected in accordance with the terms of the Registration Rights

Agreements entered into by the Company with the purchasers of Series B Preferred Stock and Warrants in the Private Placement.

Selling Stockholders

Ownership Table

Beneficial ownership is determined in accordance with the rules of the SEC and includes shares of our common

stock over which the selling stockholder has voting and/or investment power. Unless otherwise indicated in the footnotes to the table below, to our knowledge, the selling stockholders named in the table below have sole voting and investment power

with respect to the shares of common stock beneficially owned by them. The number listed in the table below as the number of shares of common stock beneficially owned prior to the offering by each selling stockholder includes (1) the number of

registered shares issuable upon the exercise of Warrants held by the named person, (2) the number shares of common stock, if any, as to which the named person has the right to acquire beneficial ownership upon the conversion of shares of the

Company’s Series B Preferred Stock and (3) the number of shares of common stock, if any, as to which the named person has the right to acquire beneficial ownership upon the exercise of options which are currently exercisable or will first

become exercisable within 60 days after April 17, 2017.

The table below sets forth the following information as to each selling

stockholder as of March 22, 2017, except as otherwise specified:

|

|

(a)

|

The number of shares of our common stock that the selling stockholder beneficially owned prior to offering for resale any of the registered shares;

|

|

|

(b)

|

The number of registered shares; and

|

|

|

(c)

|

The number and percent of shares of our common stock to be held by each selling stockholder after the offering of the registered shares, assuming all of such registered shares are sold by the selling stockholder and

that such person does not acquire any other shares of our common stock prior to the assumed sale of all of the registered shares.

|

The following table and the information contained in the footnotes to the table are based upon information supplied by the selling

stockholders. Although we have assumed for purposes of the table below that the selling stockholders will sell all of the registered shares, each selling stockholder may sell all, a portion, or none of such shares. Therefore, no assurance can be

given as to the actual number of the registered shares that will be resold by any of the selling stockholders. To our knowledge, there are no current agreements, arrangements or understandings with respect to the resale of any of the registered

shares.

The selling stockholders include certain directors and/or officers of the Company, as indicated in the footnotes to the table

below. The Company’s wholly-owned subsidiary, CFBank, has had in the past three years, and expects to have in the future, banking transactions in the ordinary course of business with certain selling stockholders and associates of such persons.

All such banking transactions were on substantially the same terms, including interest rates and collateral, as those prevailing at the same time for comparable transactions with other

5

persons and did not involve more than normal risk of collectability or present other unfavorable features. All such loans presently outstanding to directors and executive officers of the Company,

including their immediate families and entities in which they are executive officers, are performing loans.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Selling Stockholder

|

|

(a)

Shares of Common

Stock Beneficially

Owned Prior to

Offering

|

|

|

(b)

Number of

Registered

Shares Being

Offered

|

|

|

(c)

Shares of Common Stock to be

Beneficially Owned After

Offering

|

|

|

|

|

|

Number

|

|

|

Percentage(1)

|

|

|

Thomas P. Ash (2)

|

|

|

87,410

|

|

|

|

800

|

|

|

|

86,610

|

|

|

|

|

*

|

|

Equity Trust Company Custodian FBO Denise Brooks IRA

|

|

|

42,343

|

|

|

|

5,200

|

|

|

|

37,143

|

|

|

|

|

*

|

|

Buhr Foundation

|

|

|

48,857

|

|

|

|

6,000

|

|

|

|

42,857

|

|

|

|

|

*

|

|

Edward W Cochran (3)

|

|

|

1,644,667

|

|

|

|

91,000

|

|

|

|

1,553,667

|

|

|

|

9.2

|

%

|

|

Stephen D. Davis

|

|

|

48,857

|

|

|

|

6,000

|

|

|

|

42,857

|

|

|

|

|

*

|

|

J. Dempsey Inc.

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

|

*

|

|

Michael Dempsey Living Trust

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

|

*

|

|

Judith A. Dobson Decl Trust

|

|

|

65,143

|

|

|

|

8,000

|

|

|

|

57,143

|

|

|

|

|

*

|

|

Equity Trust Company Custodian FBO James Epolito IRA

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

|

*

|

|

Patricia S. Fink Trust

|

|

|

114,000

|

|

|

|

14,000

|

|

|

|

100,000

|

|

|

|

|

*

|

|

James H. Frauenberg (Addison Holdings Inc.) (4)

|

|

|

919,833

|

|

|

|

91,000

|

|

|

|

828,833

|

|

|

|

4.9

|

%

|

|

Leslie Genova Living Trust

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

|

*

|

|

Todd M. Gensheimer Living Trust

|

|

|

65,143

|

|

|

|

8,000

|

|

|

|

57,143

|

|

|

|

|

*

|

|

Gilbert Investment Trust

|

|

|

26,057

|

|

|

|

3,200

|

|

|

|

22,857

|

|

|

|

|

*

|

|

Equity Trust C/F Daniel Hackett

|

|

|

65,143

|

|

|

|

8,000

|

|

|

|

57,143

|

|

|

|

|

*

|

|

Preston B. Happel & Mary K. Happel Trust dtd 03/28/2014

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

|

*

|

|

Equity Trust C/F William Hegarty IRA

|

|

|

65,143

|

|

|

|

8,000

|

|

|

|

57,143

|

|

|

|

|

*

|

|

John W. Helmsdoerfer (5)

|

|

|

137,729

|

|

|

|

1,600

|

|

|

|

136,129

|

|

|

|

|

*

|

|

Linda R. Himpelmann

|

|

|

48,857

|

|

|

|

6,000

|

|

|

|

42,857

|

|

|

|

|

*

|

|

Lynn L. Hobbs

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

*

|

|

|

Robert E. Hoeweler (6)

|

|

|

237,246

|

|

|

|

2,000

|

|

|

|

235,246

|

|

|

|

1.4

|

%

|

|

Howard S. Holmes Living Trust

|

|

|

98,476

|

|

|

|

8,000

|

|

|

|

90,476

|

|

|

|

|

*

|

|

Robert E. Hoptry, Tr, Robert E. & Norma E. Hoptry Revocable Trust dtd 11/25/2014

|

|

|

65,143

|

|

|

|

8,000

|

|

|

|

57,143

|

|

|

|

|

*

|

|

Sandra Hultquist Rev Living Trust

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

|

*

|

|

Jack & Ginny Sinn Family Foundation

|

|

|

48,857

|

|

|

|

6,000

|

|

|

|

42,857

|

|

|

|

|

*

|

|

Brandon Kanitz

|

|

|

2,800

|

|

|

|

2,800

|

|

|

|

—

|

|

|

|

|

*

|

|

Douglas and Mary Kapnick Family Foundation

|

|

|

35,071

|

|

|

|

6,500

|

|

|

|

28,571

|

|

|

|

|

*

|

|

Douglas Kapnick Trust

|

|

|

146,953

|

|

|

|

16,000

|

|

|

|

130,953

|

|

|

|

|

*

|

|

Douglas Kapnick and Heidi L. Elshoff, Joint

|

|

|

17,536

|

|

|

|

3,250

|

|

|

|

14,286

|

|

|

|

|

*

|

|

Norma Keeney Rev Trust

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

|

*

|

|

Kevin Kennelly

|

|

|

65,143

|

|

|

|

8,000

|

|

|

|

57,143

|

|

|

|

|

*

|

|

Wendy Koerner & Mark Koerner JTWROS

|

|

|

26,057

|

|

|

|

3,200

|

|

|

|

22,857

|

|

|

|

|

*

|

|

NYPT Edward B Neff Trust FBO Stephen Kusik

|

|

|

225,361

|

|

|

|

20,000

|

|

|

|

205,361

|

|

|

|

1.2

|

%

|

|

Edmund Lacross & Susan Lacross JT TEN

|

|

|

65,143

|

|

|

|

8,000

|

|

|

|

57,143

|

|

|

|

|

*

|

|

Wendy Lawson

|

|

|

42,343

|

|

|

|

5,200

|

|

|

|

37,143

|

|

|

|

|

*

|

|

Alliene L. Liden Trust

|

|

|

16,286

|

|

|

|

2,000

|

|

|

|

14,286

|

|

|

|

|

*

|

|

Phil Lifschitz

|

|

|

65,143

|

|

|

|

8,000

|

|

|

|

57,143

|

|

|

|

|

*

|

|

Chris Loiselle

|

|

|

14,029

|

|

|

|

2,600

|

|

|

|

11,429

|

|

|

|

|

*

|

|

Lynn Irrevocable Insurance Trust

|

|

|

48,857

|

|

|

|

6,000

|

|

|

|

42,857

|

|

|

|

|

*

|

|

William R. Lynn Irrev Trust

|

|

|

65,143

|

|

|

|

8,000

|

|

|

|

57,143

|

|

|

|

|

*

|

|

Mansour Properties

|

|

|

16,286

|

|

|

|

2,000

|

|

|

|

14,286

|

|

|

|

|

*

|

|

Nasr Mansour & Waseela Mansour JT TEN

|

|

|

48,857

|

|

|

|

6,000

|

|

|

|

42,857

|

|

|

|

|

*

|

|

Sandra Marvin (7)

|

|

|

17,029

|

|

|

|

2,600

|

|

|

|

14,429

|

|

|

|

|

*

|

6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Selling Stockholder

|

|

(a)

Shares of Common

Stock Beneficially

Owned Prior to

Offering

|

|

|

(b)

Number of

Registered

Shares Being

Offered

|

|

|

(c)

Shares of Common Stock to be

Beneficially Owned After

Offering

|

|

|

|

|

|

Number

|

|

|

Percentage(1)

|

|

|

Robert Mason & Susan Mason JT TEN

|

|

|

130,286

|

|

|

|

16,000

|

|

|

|

114,286

|

|

|

|

|

*

|

|

Matthews Investment Trust

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

|

*

|

|

James Mcgauley Trust

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

|

*

|

|

Richard M. Mershad

|

|

|

388,129

|

|

|

|

24,000

|

|

|

|

364,129

|

|

|

|

2.2

|

%

|

|

Robert H. Milbourne (8)

|

|

|

122,429

|

|

|

|

4,000

|

|

|

|

118,429

|

|

|

|

|

*

|

|

Sharon F. Nicola Revocable Living Trust

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

|

*

|

|

Northwest Bancshares Inc.

|

|

|

358,785

|

|

|

|

71,500

|

|

|

|

314,286

|

|

|

|

1.9

|

%

|

|

Timothy P. Norton Rev Liv Trust

|

|

|

75,524

|

|

|

|

6,000

|

|

|

|

69,524

|

|

|

|

|

*

|

|

ETC Custodian FBO Mark Nykaza

|

|

|

67,474

|

|

|

|

4,200

|

|

|

|

63,274

|

|

|

|

|

*

|

|

Timothy T. O’Dell (9)

|

|

|

998,476

|

|

|

|

46,000

|

|

|

|

952,476

|

|

|

|

5.7

|

%

|

|

Janice Onder Trust

|

|

|

48,857

|

|

|

|

6,000

|

|

|

|

42,857

|

|

|

|

|

*

|

|

Ozark Financial Service Intl LLC

|

|

|

111,525

|

|

|

|

111,525

|

|

|

|

—

|

|

|

|

|

*

|

|

David J. Peitz Trust

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

|

*

|

|

Rosemary A. Peitz Irrev Trust

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

|

*

|

|

Richard M. Peshkin Trust

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

|

*

|

|

Peter & Patricia Fink Co LLC

|

|

|

65,143

|

|

|

|

8,000

|

|

|

|

57,143

|

|

|

|

|

*

|

|

Gerald D. Pitcher Trust

|

|

|

13,029

|

|

|

|

1,600

|

|

|

|

11,429

|

|

|

|

|

*

|

|

Ranger Foundation

|

|

|

65,143

|

|

|

|

8,000

|

|

|

|

57,143

|

|

|

|

|

*

|

|

Edith A. Rasegan Rev Liv Trust

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

|

*

|

|

Jonathan Ratner Trust

|

|

|

16,286

|

|

|

|

2,000

|

|

|

|

14,286

|

|

|

|

|

*

|

|

Edward F. Redies Foundation

|

|

|

48,857

|

|

|

|

6,000

|

|

|

|

42,857

|

|

|

|

|

*

|

|

Stephanie Lee Rosenbaum Trust

|

|

|

130,286

|

|

|

|

16,000

|

|

|

|

114,286

|

|

|

|

|

*

|

|

S-3

Engineering Inc

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

|

*

|

|

Samuel Investment Mgmt LLC

|

|

|

162,857

|

|

|

|

20,000

|

|

|

|

142,857

|

|

|

|

|

*

|

|

Equity Trust C/F James Schaefer

|

|

|

9,867

|

|

|

|

3,200

|

|

|

|

6,667

|

|

|

|

|

*

|

|

Timothy Scholten & Lori Scholten JTROS

|

|

|

6,514

|

|

|

|

800

|

|

|

|

5,714

|

|

|

|

|

*

|

|

Sheri H. Schultz Rev Living Trust

|

|

|

48,857

|

|

|

|

6,000

|

|

|

|

42,857

|

|

|

|

|

*

|

|

Janet B. See Trust

|

|

|

26,057

|

|

|

|

3,200

|

|

|

|

22,857

|

|

|

|

|

*

|

|

Scott P. Shear & Constance C Shear TEN ENT

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

|

*

|

|

Equity Trust C/F Steve Shoemaker

|

|

|

19,543

|

|

|

|

2,400

|

|

|

|

17,143

|

|

|

|

|

*

|

|

Susan F. Skerker Trust

|

|

|

49,238

|

|

|

|

4,000

|

|

|

|

45,238

|

|

|

|

|

*

|

|

Andrea B. Stager Rev Trust

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

|

*

|

|

Anne Stover

|

|

|

242,514

|

|

|

|

26,000

|

|

|

|

216,514

|

|

|

|

1.3

|

%

|

|

James C. Stover

|

|

|

265,776

|

|

|

|

26,000

|

|

|

|

239,776

|

|

|

|

1.5

|

%

|

|

Patrick J. Stover

|

|

|

211,488

|

|

|

|

24,000

|

|

|

|

187,488

|

|

|

|

1.1

|

%

|

|

Team

All-Star

LLC

|

|

|

65,143

|

|

|

|

8,000

|

|

|

|

57,143

|

|

|

|

|

*

|

|

Thornapple River Capital - Financial Services Industry Fund LLC

|

|

|

1,190,612

|

|

|

|

91,000

|

|

|

|

1,099,612

|

|

|

|

6.5

|

%

|

|

Timothy Wadhams Trust

|

|

|

162,857

|

|

|

|

20,000

|

|

|

|

142,857

|

|

|

|

|

*

|

|

Frank Wiedemuth

|

|

|

21,043

|

|

|

|

3,900

|

|

|

|

17,143

|

|

|

|

|

*

|

|

David Wethey

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

|

*

|

|

Howard J. Weyers Trust

|

|

|

48,857

|

|

|

|

6,000

|

|

|

|

42,857

|

|

|

|

|

*

|

|

Stuart E. White Trust

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

|

*

|

|

Susan Whitmore Trust

|

|

|

32,571

|

|

|

|

4,000

|

|

|

|

28,571

|

|

|

|

|

*

|

|

Ann E. Wood Rev Trust

|

|

|

65,143

|

|

|

|

8,000

|

|

|

|

57,143

|

|

|

|

|

*

|

|

Joseph Zawistowski

|

|

|

65,143

|

|

|

|

8,000

|

|

|

|

57,143

|

|

|

|

|

*

|

|

Jill Zophia

|

|

|

3,507

|

|

|

|

650

|

|

|

|

2,875

|

|

|

|

|

*

|

|

*

|

Represents beneficial ownership of less than one percent of the outstanding shares of our common stock.

|

7

|

(1)

|

Percentage of common stock ownership is computed based on the sum of (a) 16,288,577 shares of common stock outstanding on April 17, 2017, (b) the number of shares of common stock, if any, as to which the named

person has the right to acquire beneficial ownership upon the exercise of options which are currently exercisable or will first become exercisable within 60 days after April 17, 2017, and (c) the number of shares of common stock, if any,

as to which the named person has the right to acquire beneficial ownership upon the conversion of shares of the Company’s Series B Preferred Stock and the exercise of Warrants.

|

|

(2)

|

Director of the Company and CFBank since 1985. Reflects shares of common stock beneficially owned as of April 17, 2017 and includes (a) options to acquire 25,600 shares of common stock which are currently

exercisable or will first become exercisable within 60 days after April 17, 2017, (b) Warrants to acquire 800 shares of common stock, and (c) shares of Series B Preferred Stock convertible into an aggregate of 5,714 shares of common stock.

|

|

(3)

|

Director of the Company and CFBank since December 2012. Reflects shares of common stock beneficially owned as of April 17, 2017 and includes (a) options to acquire 25,000 shares of common stock which are currently

exercisable or will first become exercisable within 60 days after April 17, 2017, (b) Warrants to acquire 91,000 shares of common stock, and (c) shares of Series B Preferred Stock convertible into an aggregate of 400,000 shares of common

stock.

|

|

(4)

|

Director of the Company and CFBank since August 2012. Reflects shares of common stock beneficially owned as of April 17, 2017 and includes (a) options to acquire 25,000 shares of common stock which are currently

exercisable or will first become exercisable within 60 days after April 17, 2017, (b) Warrants to acquire 91,000 shares of common stock of which 78,000 are beneficially owned by Addison Holdings Ltd. (of which Mr. Frauenberg is the

Principal), and (c) shares of Series B Preferred Stock convertible into an aggregate of 400,000 shares of common stock of which 342,857 are beneficially owned by Addison Holdings Ltd. (of which Mr. Frauenberg is the Principal).

|

|

(5)

|

Chief Financial Officer of the Company and CFBank and Treasurer of the Company since March 2013. Reflects shares of common stock beneficially owned as of April 17, 2017 and includes (a) options to acquire

60,000 shares of common stock which are currently exercisable or will first become exercisable within 60 days after April 17, 2017, (b) Warrants to acquire 1,600 shares of common stock, and (c) shares of Series B Preferred Stock

convertible into an aggregate of 11,429 shares of common stock.

|

|

(6)

|

Director and Chairman of the Board of the Company and CFBank since August 2012. Reflects shares of common stock beneficially owned as of April 17, 2017 and includes (a) options to acquire 80,000 shares of common

stock which are currently exercisable or will first become exercisable within 60 days after April 17, 2017, (b) Warrants to acquire 2,000 shares of common stock, and (c) shares of Series B Preferred Stock convertible into an aggregate of

14,286 shares of common stock.

|

|

(7)

|

Shares of common stock beneficially owned includes an aggregate of 1,600 shares of common stock held by Ms. Marvin as custodian for her two minor children.

|

|

(8)

|

Director of the Company and CFBank since May 2013. Reflects shares of common stock beneficially owned as of April 17, 2017 and includes (a) options to acquire 25,000 shares of common stock which are currently

exercisable or will first become exercisable within 60 days after April 17, 2017, (b) Warrants to acquire 4,000 shares of common stock, and (c) shares of Series B Preferred Stock convertible into an aggregate of 51,429 shares of common stock.

|

|

(9)

|

Director and Chief Executive Officer of the Company and CFBank since August 2012 and President of the Company and CFBank since October 2015. Reflects shares of common stock beneficially owned as of April 17, 2017

and includes (a) options to acquire 100,000 shares of common stock which are currently exercisable or will first become exercisable within 60 days after April 17, 2017, (b) Warrants to acquire 46,000 shares of common stock, and (c) shares

of Series B Preferred Stock convertible into an aggregate of 377,143 shares of common stock. Also includes 30,000 shares of common stock owned by Colleen O’Dell, Mr. O’Dell’s spouse, and 5,000 shares of common stock owned by

Colleen O’Dell as custodian for Mr. O’Dell’s daughter, Sara F. O’Dell.

|

8

PLAN OF DISTRIBUTION

The selling stockholders may, from time to time, sell any or all of their shares of common stock on The NASDAQ Capital Market and any other

stock exchange, market or trading facility on which the shares are traded, or in private transactions. These sales may be at prevailing market prices or privately negotiated prices. The selling stockholders may use any one or more of the following

methods when selling shares:

|

|

•

|

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

•

|

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transactions;

|

|

|

•

|

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

•

|

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

•

|

|

privately negotiated transactions;

|

|

|

•

|

|

broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per share;

|

|

|

•

|

|

a combination of any such methods of sale; and

|

|

|

•

|

|

any other method permitted pursuant to applicable law.

|

The selling stockholders may also sell

shares under Rule 144 under the Securities Act, or any other exemption from registration, if available, rather than under this prospectus.

Broker-dealers engaged by the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive

commissions or discounts from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated. The selling stockholders do not expect these commissions and discounts to

exceed what is customary in the types of transactions involved. Any profits on the resale of shares of common stock by a broker-dealer acting as principal might be deemed to be underwriting discounts or commissions under the Securities Act.

Discounts, concessions, commissions and similar selling expenses, if any, attributable to the sale of shares will be borne by a selling stockholder. The selling stockholders may agree to indemnify any agent, dealer or broker-dealer that participates

in transactions involving sales of the shares if liabilities are imposed on that person under the Securities Act.

The selling

stockholders may from time to time pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and

sell the shares of common stock from time to time under this prospectus after we have filed a supplement to this prospectus under Rule 424(b) or other applicable provision of the Securities Act supplementing or amending the list of selling

stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus.

The

selling stockholders also may transfer the shares of common stock in other circumstances, in which case the donees, transferees or other successors in interest will be the selling beneficial owners for purposes of this prospectus and may sell the

shares of common stock from time to time under this prospectus after we have filed a supplement to this prospectus under Rule 424(b) or other applicable provision of the Securities Act supplementing or amending the list of selling stockholders

to include the donee, transferee or other successors in interest as selling stockholders under this prospectus.

The selling stockholders

and any broker-dealers or agents that are involved in selling the shares of common stock may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such

9

sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares of common stock purchased by them may be deemed to be underwriting

commissions or discounts under the Securities Act.

Pursuant to the terms of the Registration Rights Agreements, we have agreed to

(i) pay all expenses, including all registration, filing and listing fees and all legal and accounting fees and disbursements, in registering the shares of common stock and (ii) indemnify the selling stockholders party to the Registration

Rights Agreements against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

No selling

stockholder has advised us that they have entered into any agreements, understandings or arrangements with any underwriters or broker-dealers regarding the sale of their shares of common stock, or that there is any underwriter or coordinating broker

acting in connection with a proposed sale of shares of common stock by any selling stockholders. If we are notified by any selling stockholders that any material arrangement has been entered into with a broker-dealer for the sale of shares of common

stock, if required, we will file a supplement to this prospectus. If the selling stockholders use this prospectus for any sale of the shares of common stock, they will be subject to the prospectus delivery requirements of the Securities Act.

We have advised the selling stockholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of

shares in the market and to the activities of the selling stockholders and their affiliates. In addition, to the extent applicable, we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the

selling stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act.

LEGAL MATTERS

The validity of the securities offered under this prospectus will be passed upon for us by Vorys, Sater, Seymour and Pease LLP, Columbus,

Ohio.

EXPERTS

The consolidated financial statements as of December 31, 2016 and 2015, and for each of the two years in the period ended

December 31, 2016, incorporated by reference in this prospectus, have been audited by BKD, LLP, an independent registered public accounting firm, as stated in their reports, which are incorporated herein by reference. Such consolidated

financial statements have been so incorporated in reliance upon the reports of such firm given upon their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of a registration statement on Form

S-3

that we filed with the SEC registering

the securities that may be offered hereunder. As permitted by SEC rules, this prospectus does not contain all of the information we have included in the registration statement. A copy of the registration statement can be obtained at the

address set forth in the next paragraph. You should read the registration statement for more information about our securities and us.

We

are subject to the reporting requirements of the Exchange Act and file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any materials we file with the SEC at the SEC’s Public

Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You can request copies of these documents, upon payment of a duplicating fee, by writing to the SEC. Please call the SEC at

10

1-800-SEC-0330

for further information on the operation of the Public

Reference Room. The SEC also maintains a website that contains reports, proxy and information statements and other information regarding issuers, like us, who file electronically with the SEC. The address of the SEC’s website is

www.sec.gov.

Our website address is www.cfbankonline.com. We make available, free of charge, on or through our website, our annual

reports on Form

10-K,

quarterly reports on Form

10-Q

and current reports on Form

8-K

that are filed with or furnished to the SEC,

and amendments to those reports, as soon as reasonably practicable after we electronically file such reports with, or furnish them to, the SEC. The contents of our website are not part of this prospectus, and the reference to our website does

not constitute incorporation by reference in this prospectus of the information contained at that site.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference” information in this prospectus. This means that we can disclose important

information to you by referring you to another document filed separately with the SEC. The following documents that we have filed with the SEC are incorporated by reference in, and considered a part of, this prospectus:

|

|

•

|

|

our Annual Report on Form

10-K

for the fiscal year ended December 31, 2016; and

|

|

|

•

|

|

the description of our common stock, $0.01 par value per share, contained in the

Pre-Effective

Amendment No. 2 to our Registration Statement on Form

S-1

(File

No. 333-177434)

filed with the SEC on February 3, 2012, or contained in any subsequent amendment or report filed for the purpose of updating such

description.

|

We are also incorporating by reference in this prospectus all documents (other than current reports furnished

under Item 2.02 or Item 7.01 of Form

8-K

and exhibits filed on such form that are related to such items) that we file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act

after the date of this prospectus and until all of the common stock to which this prospectus relates has been sold or the offering is otherwise terminated, including those made between the date of filing of the initial registration statement and

prior to effectiveness of the registration statement. A statement contained in a document incorporated by reference into this prospectus shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement

contained in this prospectus, any prospectus supplement or any other subsequently filed document which is also incorporated by reference into this prospectus modifies or replaces such statement. Any statements so modified or superseded shall not be

deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will provide to each person to whom this

prospectus is delivered, upon written or oral request and without charge, any of the above documents that are incorporated by reference in this prospectus (including any exhibits that are specifically incorporated by reference in such documents).

Requests should be directed to:

Central Federal Corporation

7000 North High Street

Worthington, Ohio 43085

Attn: Timothy T. O’Dell

(614)

334-7979

11

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

|

Item 14.

|

Other Expenses of Issuance and Distribution

|

The following table sets forth the costs

and expenses payable by the registrant in connection with the sale of the securities covered by this prospectus other than any sales commissions or discounts, which expenses will be paid by the selling stockholders. All amounts shown are estimates

except for the SEC registration fee:

|

|

|

|

|

|

|

SEC registration fee

|

|

$

|

282.00

|

|

|

Legal fees and expenses

|

|

|

10,000.00

|

|

|

Accounting fees and expenses

|

|

|

6,000.00

|

|

|

Miscellaneous fees and expenses

|

|

|

1,000.00

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

17,282.00

|

|

|

|

|

|

|

|

|

Item 15.

|

Indemnification of Directors and Officers

|

Central Federal Corporation is incorporated

under the laws of the State of Delaware. Section 145 of the General Corporation Law of the State of Delaware (“Section 145”) provides that a Delaware corporation may indemnify any persons who are, or are threatened to be made,

parties to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of such corporation), by reason of the fact that such person is or was an

officer, director, employee or agent of such corporation, or is or was serving at the request of such corporation as a director, officer, employee or agent of another corporation or enterprise. The indemnity may include expenses (including

attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding, provided such person acted in good faith and in a manner he reasonably

believed to be in or not opposed to the corporation’s best interests and, with respect to any criminal action or proceeding, had no reasonable cause to believe that his conduct was illegal. Similar provisions apply to actions brought by or in

the right of the corporation, except that no indemnification shall be made without judicial approval if the officer or director is adjudged to be liable to the corporation. Where an officer or director is successful on the merits or otherwise in the

defense of any action referred to above, the corporation must indemnify him against the expenses which such officer or director has actually and reasonably incurred.

Article Tenth of the Restated Certificate of Incorporation of Central Federal Corporation provides that, to the extent permitted by

Delaware General Corporation Law, Central Federal Corporation shall indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal,

administrative or investigative, by reason of the fact that such person is or was a director, officer, employee or agent of Central Federal Corporation or is or was serving at the request of the corporation as director, officer, employee or agent of

another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with such action,

suit or proceeding if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of Central Federal Corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to

believe his conduct was unlawful.

Article Eleventh of the Restated Certificate of Incorporation of Central Federal Corporation

provides that, to the fullest extent permitted by the Delaware General Corporation Law, no director of Central Federal Corporation shall be liable to Central Federal Corporation or its stockholders for monetary damages arising from a breach of a

fiduciary duty owed to Central Federal Corporation or its stockholders.

II-1

See the Exhibit Index attached to this registration statement.

|

|

(a)

|

The undersigned registrant hereby undertakes:

|

|

|

(1)

|

To file, during any period in which offers or sales are being made of the securities registered hereby, a post-effective amendment to this registration statement;

|

|

|

(i)

|

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

|

|

|

(ii)

|

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a

fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which

was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price

represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

|

|

|

(iii)

|

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

|

provided,

however

, that the undertakings set forth in paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) above do not apply if

the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities

Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is a part of the registration statement.

|

|

(2)

|

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and

the offering of such securities at that time shall be deemed to be the initial

bona

fide

offering thereof.

|

|

|

(3)

|

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

|

|

(4)

|

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

|

|

|

(i)

|

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration

statement; and

|

|

|

(ii)

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration

statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be

part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As

provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration

statement to which that

|

II-2

|

|

prospectus relates, and the offering of such securities at that time shall be deemed to be the initial

bona

fide

offering thereof.

Provided,

however

, that no statement

made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement

will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such

document immediately prior to such effective date.

|

|

|

(b)

|

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or