Additional Proxy Soliciting Materials (definitive) (defa14a)

April 20 2017 - 8:28AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

(Amendment No. )

Filed

by the Registrant

x

Filed

by a party other than the Registrant

¨

Check the appropriate box:

|

|

o

|

Preliminary

Proxy Statement

|

|

|

o

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

o

|

Definitive

Proxy Statement

|

|

|

o

|

Definitive

Additional Materials

|

|

|

x

|

Soliciting

Material under Rule 14a-12

|

Transgenomic, Inc.

(Name of Registrant as Specified in Its

Charter)

Payment of Filing Fee (Check the appropriate

box):

|

|

¨

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

|

|

|

¨

|

Fee

paid previously with preliminary materials:

|

|

|

¨

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Amount previously paid:

|

|

|

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

|

|

|

|

(4)

|

|

Date Filed:

|

|

|

|

|

|

EXPLANATORY NOTE

The purpose of this Schedule 14A is to file a press release

issued by Precipio Diagnostics, LLC on April 20, 2017.

Additional Information for Transgenomic Common Stockholders

In connection with the proposed merger,

Transgenomic has filed with the SEC a preliminary proxy statement relating to the approval of the merger agreement. The information

in the preliminary proxy statement is not complete and may be changed. The preliminary proxy statement and this press release are

not offers to sell Transgenomic securities and are not soliciting an offer to buy Transgenomic securities in any state where the

offer and sale is not permitted.

The definitive proxy statement will be

mailed to stockholders of Transgenomic. TRANSGENOMIC URGES INVESTORS AND SECURITY HOLDERS TO READ THE DEFINITIVE PROXY STATEMENT

AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the definitive

proxy statement (when available) and other documents filed with the SEC by Transgenomic through the web site maintained by the

SEC at www.sec.gov. Free copies of the definitive proxy statement (when available) and other documents filed with the SEC can also

be obtained on Transgenomic’s website at www.transgenomic.com/ir/investor-information.

Transgenomic and its directors and executive

officers may be deemed to be participants in the solicitation of proxies from the stockholders of Transgenomic in connection with

the merger. Information about the directors and executive officers of Transgenomic is set forth in Transgenomic’s proxy statement

filed with the SEC on April 29, 2016. Additional information regarding the interests of these participants and other persons who

may be deemed participants in the merger may be obtained by reading the definitive proxy statement regarding the proposed transaction

when it becomes available.

Forward-Looking Statements

Certain statements in this press release

constitute “forward-looking statements” of Transgenomic within the meaning of the Private Securities Litigation Reform

Act of 1995, which involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially

different from any future results, performance or achievements expressed or implied by such statements. Forward-looking statements

include, but are not limited to, those with respect to management's current views and estimates of future economic circumstances,

industry conditions, company performance and financial results, including the ability of the Company to grow its involvement in

the diagnostic products and services markets, expectations regarding new clients, projects and prospects, and MX-ICP’s ability

to accelerate the Company’s growth and generate revenue. The known risks, uncertainties and other factors affecting these

forward-looking statements are described from time to time in Transgenomic's filings with the Securities and Exchange Commission.

Any change in such factors, risks and uncertainties may cause the actual results, events and performance to differ materially from

those referred to in such statements. Accordingly, the Company claims the protection of the safe harbor for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995 with respect to all statements contained in this press release.

All information in this press release is as of the date of the release and Transgenomic does not undertake any duty to update this

information, including any forward-looking statements, unless required by law.

Precipio Renews its Exclusive Agreement

with Yale School of Medicine for an Additional Five Years

New Haven, CT

:

April 20

th

, 2017 – Precipio Diagnostics, a company harnessing the experience, knowledge and

expertise of academic-level pathology to deliver diagnostic accuracy to physicians and patients worldwide, announced that it

has signed an exclusive agreement with Yale School of Medicine for an additional five years, after concluding its initial

five year term.

Under the renewed agreement, Yale

will continue to provide Precipio with exclusive access to its world-class pathologists for their professional diagnostic

interpretation of clinical cases serving Precipio’s customers.

“Patients are often unaware of

the fact that oncologists rely on outside laboratories which determine the diagnosis. This diagnosis drives patients’

treatment plans, and industry sources estimate as many as 10-20% of these cases are misdiagnosed,” said Ilan Danieli,

CEO of Precipio Diagnostics. “We find this unacceptable. Precipio’s vision is to eliminate the problem of

misdiagnosis by harnessing academic expertise and making it available to physicians and their patients. Together with Yale,

we have served over 3,000 individuals, building a significant amount of data that clearly demonstrates the advantages of

academic pathologists in arriving at the right diagnosis. Improved accuracy rates translate into improved treatment outcomes,

and this renewal shows Yale’s strong dedication to the cause of delivering a high level of diagnostic

expertise to the medical community.”

Founded in 2011 and commencing clinical

services in 2012, Precipio established its own laboratory in New Haven, CT alongside its partner, Yale University. The Company

began its focus in cancer where the problem of misdiagnosis carries grave consequences.

“For many years I have believed that

the resources and expertise developed within world-class academic institutions have not been properly utilized to benefit patients

outside the walls of the university,” said Professor Jon Morrow, MD, PhD, Chair of the Department of Pathology at Yale School

of Medicine. “When the team at Precipio approached us with this novel idea, I saw an opportunity to expand our reach into

the community setting, while helping patients and their physicians gain access to some of the brightest minds in the field. I am

excited to continue building the partnership with Precipio and expand our service into other fields as well.”

About Precipio

Precipio is a diagnostic company

leveraging the medical expertise of highly respected academic institutions by providing exceedingly accurate diagnostic

capabilities to physicians and their patients, therefore reducing the frequency of misdiagnosis. By doing so, physicians can

help ensure that optimal treatment programs are recommended, improving patient outcomes and quality of life. Recognizing that

the incorporation of cutting edge technologies could be utilized to further aid the diagnostic process with our academic

partners, Precipio entered into a definitive merger agreement with Transgenomic, Inc. (OTCQB:TBIO) in late 2016.

Transgenomic’s Ice-Cold PCR (ICP), developed at the Dana Farber Cancer Center in Harvard University and licensed to

Transgenomic, represents the first of several technologies that Precipio will add to its platform with the objective

of further improving diagnostic accuracy for physicians and their patients. As Precipio continues to expand its

platform of academic institutions, it will build its cadre of world-class experts, and grow an arsenal

of intellectual property-based technologies to further solutions that eradicate the problem of misdiagnosis. For

more information on the Company, please visit

www.precipiodx.com

.

Company Contact:

Ilan Danieli, CEO

pr@precipiodx.com

Investor Relations Contact:

Mike Cole

MZ North America

949-259-4988

mike.cole@mzgroup.us

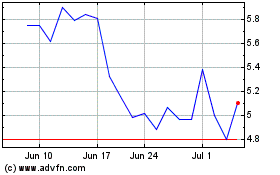

Precipio (NASDAQ:PRPO)

Historical Stock Chart

From Mar 2024 to Apr 2024

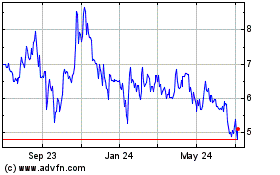

Precipio (NASDAQ:PRPO)

Historical Stock Chart

From Apr 2023 to Apr 2024