Current Report Filing (8-k)

April 20 2017 - 8:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 6, 2017

INTEGRA LIFESCIENCES HOLDINGS CORPORATION

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

0-26224

|

51-0317849

|

|

(State or other jurisdiction of incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

311 Enterprise Drive

Plainsboro, NJ 08536

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (609) 275-0500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 8.01 Other Events

On January 10, 2017, Integra LifeSciences Holdings Corporation (“Integra”) entered into an Agreement and Plan of Merger, dated January 10, 2017 (the “Merger Agreement”), by and among Integra, Integra Derma, Inc., a Delaware corporation and wholly owned subsidiary of Integra formed solely to facilitate the merger (“Merger Sub”), and Derma Sciences, Inc. (“Derma”). Pursuant to the terms of the Merger Agreement, Merger Sub commenced a tender offer (the “Tender Offer”) to purchase all of the outstanding shares of Derma’s common stock and series A and B convertible preferred stock (the “Merger”). On January 25, 2017, in connection with the Merger, Derma filed a Schedule 14D-9 with the United States Securities and Exchange Commission (the “SEC”).

Subsequent to the commencement of the Tender Offer and the filing of the Schedule 14D-9, Derma, Derma’s directors, Integra, and Merger Sub were named as defendants in three purported class action lawsuits related to the proposed Merger that were filed in the Delaware Court of Chancery (Parshall v. Derma Sciences Inc., et al., C.A. No. 2017-0074-TMR) and the United States District Court for the District of New Jersey (the “New Jersey District Court”) (Rabadi v. Derma Sciences Inc., et al., C.A. No. 3:17-cv-00628 and Klingel v. Derma Sciences Inc., et al., C.A. No. 3:17-cv-00738). The stockholder actions alleged that the 14D-9 omitted or misstated certain material information in connection with the Merger and sought class action certification and equitable relief, including judgments enjoining the defendants from consummating the Merger on the agreed-upon terms.

Plaintiffs and defendants subsequently agreed on certain additional disclosures that defendants included in an amendment to the Schedule 14D-9 Solicitation/Recommendation Statement filed with the SEC on February 10, 2017 (the “Supplemental Disclosures”). While defendants maintain that the Supplemental Disclosures were neither necessary nor material, defendants believed that filing the Supplemental Disclosures would moot the claims asserted by the plaintiffs, eliminating the possibility that plaintiffs’ class action claims would delay the closing of the Merger and allowing the Merger to be put to a vote of the stockholders. Plaintiffs thereafter withdrew their pending motions to expedite proceedings and to preliminarily enjoin the close of Tender Offer.

The Merger closed on February 24, 2017, and Derma became an indirect wholly-owned subsidiary of Integra.

In March 2017, the Delaware Court of Chancery and the New Jersey District Court approved separate stipulations dismissing the stockholder actions with prejudice as to the plaintiffs and without prejudice to the putative class members. The Courts retained jurisdiction solely for the purpose of adjudicating plaintiffs’ counsel’s respective anticipated applications for an award of attorneys’ fees and reimbursement of expenses in connection with the Supplemental Disclosures. In order to avoid the uncertainties and costs associated with a contested application for attorneys’ fees, the parties to the actions agreed to a payment made directly by Integra to plaintiffs’ counsel in the amount of $225,000 in full satisfaction of all claims for attorneys’ fees and expenses by all counsel in the three actions. Neither the Delaware Court of Chancery nor the New Jersey District Court have been asked to review, and will pass no judgment on, the payment of a fee or its reasonableness. Contact information for counsel is Brian D. Long for plaintiffs, who can be reached at (302) 295-5310, and Raymond J. DiCamillo for defendants, who can be reached at (302) 651-7700.

This Form 8-K is being furnished to the SEC in accordance with the Delaware Court of Chancery’s public notice requirement relating to the payment of the negotiated attorney fee. Aside from the disclosure itself, nothing under this Form 8-K shall be deemed to be an admission of the legal necessity or materiality under any federal, state or other applicable laws with respect to the negotiated attorney fee set forth herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

INTEGRA LIFESCIENCES HOLDINGS CORPORATION

|

|

|

|

|

|

Date: April 20, 2017

|

By:

|

/s/ Glenn G. Coleman

|

|

|

|

Glenn G. Coleman

|

|

|

Title:

|

Corporate Vice President and Chief Financial Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

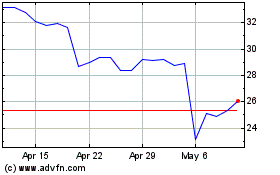

Integra LifeSciences (NASDAQ:IART)

Historical Stock Chart

From Mar 2024 to Apr 2024

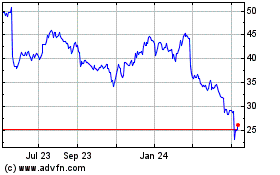

Integra LifeSciences (NASDAQ:IART)

Historical Stock Chart

From Apr 2023 to Apr 2024