AmEx Feels Loss of Relationship With Costco -- WSJ

April 20 2017 - 3:02AM

Dow Jones News

By AnnaMaria Andriotis and Anne Steele

American Express Co. posted lower first-quarter earnings and

revenue versus a year earlier, hurt by the loss of its relationship

with warehouse-club retailer Costco Wholesale Corp. Card-member

spending climbed, though, and the results beat Wall Street

expectations.

AmEx reported a profit of $1.2 billion, or $1.34 a share, down

from $1.4 billion, or $1.45 a share, a year earlier. Analysts, on

average, were expecting $1.28 a share. The stock rose more than 2%

after hours.

AmEx has suffered of late from issues ranging from the end of

its 16-year exclusive deal with Costco, heavy competition and

declines in corporate travel budgets. The latest earnings showed

signs of stabilization, however.

The card issuer reported flat world-wide billed business growth,

adjusted for currency fluctuations, from a year ago. That broke two

consecutive quarters of declines during the last half of 2016. The

company said that excluding the Costco card portfolio, this measure

would have shown an 8% increase year over year.

AmEx also reiterated its 2017 outlook for earnings per share of

$5.60 to $5.80.

"The last couple of years have been an important transition

period, and we've entered 2017 stronger, more focused and more

resilient," Chief Executive Kenneth Chenault said in a

statement.

Card-member spending grew by 8% during the quarter, excluding

the impact of Costco in the year-earlier period and the effect of

the stronger dollar.

The results gave some shareholders reason for optimism. "You

kind of knew there was going to be two to three years of pain and

if this is the kind of pain I have to put up with, we think we'll

be very excited to own AmEx," said Bill Smead, chief executive of

Smead Capital Management.

AmEx is in the midst of several key changes in its

consumer-facing strategy. Best known for its charge cards that

require customers to pay their bills in full every month, AmEx is

expanding its credit-card portfolio to encourage more customers to

carry a balance. The company is continuing to increase credit-card

balances faster than the industry as it seeks to get more of its

existing cardholders to sign up for loans or take on more card

balances. Total loans increased 11% to $63.6 billion from a year

earlier.

The company increased loan-loss reserves 23%, but credit didn't

deteriorate markedly. Net write-offs including principal, interest

and fees for its card-member loans increased to 2% in the first

quarter from 1.8% a year ago.

Still, the company has many hurdles to clear. Results again were

dragged down by the end of the company's relationship with Costco.

AmEx's revenue slipped 2.5% to $7.89 billion. Excluding the Costco

business and the impact of a stronger dollar, revenue rose 6.6%.

Analysts were looking for $7.75 billion, according to Thomson

Reuters.

New risks have emerged. AmEx is facing more competition in the

premium card sector -- especially from the popular Sapphire Reserve

card from J.P. Morgan Chase & Co. -- and has recently ramped up

rewards on its Platinum charge card. Analysts have expressed

concern about what these increases could mean for the company's

expenses

In the short term, though, AmEx has tried to keep those in

check. Marketing and promotion expenses, which hit a record level

in the fourth quarter, fell to $700 million in the first quarter,

down 4% from a year prior.

Total expenses ticked up slightly to $5.5 billion, the result of

higher rewards expenses from recent upgrades the card issuer made

to its card programs. Jeffrey Campbell, AmEx's finance chief, said

on the earnings call that the company believes it is on track to

remove $1 billion in total expenses by the end of 2017.

Corrections & Amplifications

American Express's expenses ticked up slightly to $5.5 billion.

An earlier version of this story misstated the figure. (April 19,

2017)

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com and

Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

April 20, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

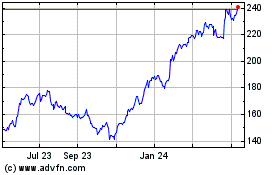

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

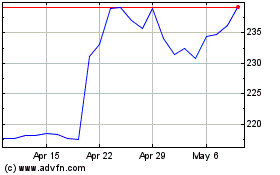

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024