American Express Results Slide on Higher Spending, End of Costco Deal

April 19 2017 - 5:05PM

Dow Jones News

By Anne Steele

American Express Co. posted lower earnings and revenue in the

first quarter of the year as the credit card company continues to

ramp up spending in a bid to turn around its business.

But results beat Wall Street expectations, sending shares 2.6%

higher after hours to $77.50.

American Express has suffered from issues ranging from the loss

of its 16-year exclusive relationship with warehouse-club retailer

Costco Wholesale Corp., heavy competition and declines in corporate

travel budgets.

"The last couple of years have been an important transition

period, and we've entered 2017 stronger, more focused and more

resilient," said Chief Executive Kenneth Chenault.

Results again were dragged by the end of the company's

relationship with Costco. AmEx's revenue slipped 2.5% to $7.89

billion. Excluding the Costco business and the impact of a stronger

U.S. dollar, revenue rose 6.6%. Analysts were looking for $7.75

billion, according to Thomson Reuters.

Card member spending grew 8% during the quarter, excluding the

impact of Costco in the year-earlier period and the effect of the

stronger dollar.

Best known for its charge cards that require customers to pay

their bills in full every month, AmEx is expanding its credit-card

portfolio allowing customers to carry a balance. The company also

last year ramped up marketing and promotions on its platinum charge

card.

"We acquired 2.6 million new cards across our global issuing

businesses during the quarter and continued to broaden our reach

among millennials with an expanded merchant network and enhanced

benefits and services to earn a greater share of their wallet,"

said Mr. Chenault.

The company backed its 2017 outlook, for earnings of $5.60 to

$5.80 a share.

In all for the first quarter, American Express reported a profit

of $1.2 billion, or $1.34 a share, down from $1.4 billion, or $1.45

a share, a year earlier. Analysts, on average, were expecting $1.28

a share.

Total expenses climbed 10%, to $1.6 billion, mostly owing to

higher rewards expenses, largely driven by recent product

enhancements and higher card member spending.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

April 19, 2017 16:50 ET (20:50 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

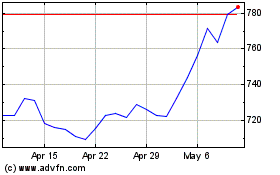

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Mar 2024 to Apr 2024

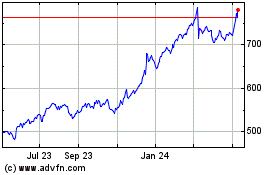

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Apr 2023 to Apr 2024