Report of Foreign Issuer (6-k)

April 19 2017 - 4:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of April 2017

Commission File Number: 001-34848

SEANERGY MARITIME HOLDINGS CORP.

(Translation of registrant's name into English)

16 Grigoriou Lambraki Street

166 74 Glyfada

Athens, Greece

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F [X] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ___

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)7: ___

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Attached to this report on Form 6-K as Exhibit 1 is a press release of Seanergy Maritime Holdings Corp. (the "Company") dated April 18, 2017 titled: "Seanergy Maritime Holdings Corp. Announces Time Charter Contract for One of its Capesize Vessels".

This report and the exhibits hereto, other than the statements attributed to Stamatis Tsantanis, are hereby incorporated by reference into the Company's registration statement on Form F-3 (File No. 333-166697) filed with the U.S. Securities and Exchange Commission (the "SEC") with an effective date of May 19, 2010, the Company's registration statement on Form F-3 (File No. 333-169813) filed with the SEC with an effective date of November 12, 2010 and the Company's registration statement on Form F-3 (File No. 333-205301) filed with the SEC with an effective date of August 14, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

SEANERGY MARITIME HOLDINGS CORP.

(Registrant)

|

|

Dated: April 19, 2017

|

|

|

|

/s/ Stamatios Tsantanis

By: Stamatios Tsantanis

Chief Executive Officer

|

EXHIBIT 1

Seanergy Maritime Holdings Corp. Announces Time Charter Contract for One of its Capesize Vessels

April 18, 2017 - Athens, Greece

- Seanergy Maritime Holdings Corp. (the "Company" or "Seanergy") (NASDAQ: SHIP), announced today that it has entered into a time charter contract ("T/C") with a major European charterer, for one of its Capesize dry bulk vessels, for a period of about eighteen (18) months to about twenty-two (22) months. The T/C is for the 180,000 dwt Capesize vessel M/V Lordship and is expected to commence in June 2017, upon expiration of the vessel's current T/C with the same charterer. The net daily charter hire is index-linked rate based on the 5 T/C route rate of Baltic Capesize Index ("BCI"). In addition, the charter contract provides the option to Seanergy to convert at any time and for a period of minimum three (3) months to maximum twelve (12) months the index-linked rate into a fixed rate corresponding to the prevailing value of the respective Capesize FFA.

Stamatis Tsantanis, the Company's Chairman & Chief Executive Officer, commented:

"We are pleased to announce the time charter contract of

M/V Lordship's

for a period of up to

twenty-two months with a major European charterer

. Our high quality of service has made us a preferred business partner to first-class charterers and we expect this to continue being a central pillar of our commercial strategy. Indicatively, based on the prevailing spot rate for Capesize vessels, this

time charter contract could contribute

more than $10 million of

net

revenues to the Company, assuming the full 22-month employment. Furthermore, the 5 T/C route rate associated with the agreement will allow us to benefit from the potential market upside, while our option to convert to a fixed rate provides us with the flexibility to lock into a profitable fixed rate for up to 12 months at any point.

"As the freight market strengthens, we expect to

secure additional long term employment agreements for our fleet.

"

About Seanergy Maritime Holdings Corp.

Seanergy Maritime Holdings Corp. is an international shipping company that provides marine dry bulk transportation services through the ownership and operation of dry bulk vessels. The Company currently owns a modern fleet of ten dry bulk carriers, consisting of eight Capesizes and two Supramaxes, with a combined cargo-carrying capacity of approximately 1,503,369 dwt and an average fleet age of about 8.2 years.

Following the delivery of the newly acquired Capesize vessel, the Company will have a modern fleet of a total of eleven dry bulk carriers, consisting of nine Capesizes and two Supramaxes, with a combined cargo-carrying capacity of approximately 1,682,582 dwt and an average fleet age of about 8.0 years.

The Company is incorporated in the Marshall Islands with executive offices in Athens, Greece and an office in Hong Kong. The Company's common shares and class A warrants trade on the Nasdaq Capital Market under the symbols "SHIP" and "SHIPW", respectively.

Forward-Looking Statements

This press release contains forward-looking statements (as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended) concerning future events. Words such as "may," "should," "expects," "intends," "plans," "believes," "anticipates," "hopes," "estimates," and variations of such words and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks and are based upon a number of assumptions and estimates, which are inherently subject to significant uncertainties and contingencies, many of which are beyond the control of the Company. Actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, the Company's operating or financial results; the Company's liquidity, including its ability to pay amounts that it owes and obtain additional financing in the future to fund capital expenditures, acquisitions, refinancings and other general corporate activities; competitive factors in the market in which the Company operates; shipping industry trends, including charter rates, vessel values and factors affecting vessel supply and demand; future, pending or recent acquisitions and dispositions, business strategy, areas of possible expansion or contraction, and expected capital spending or operating expenses; risks associated with operations outside the United States; and other factors listed from time to time in the Company's filings with the SEC, including its most recent annual report on Form 20-F. The Company's filings can be obtained free of charge on the SEC's website at www.sec.gov. Except to the extent required by law, the Company expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company's expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based.

For further information please contact:

Capital Link, Inc.

Paul Lampoutis

230 Park Avenue Suite 1536

New York, NY 10169

Tel: (212) 661-7566

E-mail: seanergy@capitallink.com

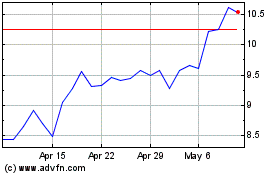

Seanergy Maritime (NASDAQ:SHIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

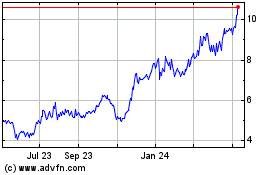

Seanergy Maritime (NASDAQ:SHIP)

Historical Stock Chart

From Apr 2023 to Apr 2024