Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Election of Director

On April 18, 2017, the Board of Directors of AAR CORP. (the “Company”), at its regularly scheduled meeting, increased the size of the Board to 13 members and, upon the recommendation of the Nominating and Governance Committee, elected General Duncan J. McNabb, U.S. Air Force (retired), as a director to fill the vacancy created by the increase. Until 2011, General McNabb served as Commander, U.S. Transportation Command, Scott Air Force Base. General McNabb is the co-founder and a managing partner of Ares Mobility Solutions, a privately held logistics business and a director of Atlas Air Worldwide Holdings, Inc., a publicly traded global airfreight company.

General McNabb will serve as a Class III director for a term expiring at the Company’s October 11, 2017 annual meeting of stockholders.

General McNabb will participate in the Company’s standard director compensation programs as described in the Company’s most recent proxy statement. As part of his director compensation, General McNabb received a grant of 625 restricted shares, which represents a pro-rata portion of the 5,000 share grant awarded to directors on June 1, 2016 for the fiscal year ending May 31, 2017. The restricted shares will vest on June 1, 2017.

There was no arrangement or understanding between General McNabb and any other persons pursuant to which he was selected as a director. There are no related person transactions within the meaning of Item 404(a) of Regulation S-K promulgated by the Securities and Exchange Commission between the Company and General McNabb.

A press release announcing the election of General McNabb to the Company’s Board of Directors is attached to this Current Report on Form 8-K as Exhibit 99.1.

Employment-Related Agreements

On April 18, 2017, the Company, upon approval of the Compensation Committee and the Board of Directors, entered into employment-related agreements with David P. Storch, John M. Holmes and Timothy J. Romenesko. The material terms of these agreements are described below. The full text of these agreements are attached to this Current Report on Form 8-K as Exhibits 10.1, 10.2 and 10.3, respectively.

Employment Agreement with David P. Storch

The Company entered into a new employment agreement with Mr. Storch, its Chairman of the Board and Chief Executive Officer. The agreement will become effective June 1, 2017

upon the expiration of the current employment agreement between the parties.

The initial term of the agreement is for three years until May 31, 2020, and the agreement will automatically renew thereafter for one-year periods on June 1, 2020 and June 1, 2021, respectively, unless either party gives 90 days advance notice.

The agreement reflects the following changes to Mr. Storch’s current employment agreement:

·

The agreement provides that, effective June 1, 2017, Mr. Storch will receive a base salary of $941,000 and his target and maximum bonus opportunities under the Company’s annual cash incentive plan will be 100% and 250% of base salary, respectively;

·

The agreement provides that the target value of Mr. Storch’s long-term incentive equity awards will be at the 75th percentile of similar awards to CEOs at companies in the Company’s peer group, unless otherwise provided by the Compensation Committee; and

·

Mr. Storch will not receive any severance benefits if the term of the agreement is not extended on June 1, 2020 or June 1, 2021.

2

The agreement retains all of the other principal terms of Mr. Storch’s current employment agreement. In particular, the agreement retains the following severance provisions:

·

If prior to a Change in Control (or later than 24 months following a Change in Control), either the Company terminates Mr. Storch’s employment without Cause or Mr. Storch terminates his employment for Good Reason, Mr. Storch is entitled to continued payment of his base salary for 36 months and a lump sum payment equal to three times the average of the cash incentive bonus paid to him for the preceding three fiscal years of the Company. Payments cease upon a breach of the confidentiality and non-compete provisions set forth in the agreement (the non-compete provisions remain in effect for the two-year period following any such termination of employment); and

·

If Mr. Storch’s employment is terminated within 24 months following a Change in Control, either by the Company other than for Cause or Disability or by Mr. Storch for Good Reason, he is entitled to:

(i)

an immediate lump-sum payment equal to the sum of (A) a pro-rata portion of the bonus that would have been paid to him had he remained employed until the end of the fiscal year and all performance goals were met at target and (B) three times his base salary and cash bonus for either the most recently completed fiscal year prior to the termination or the preceding fiscal year, whichever produces the higher amount;

(ii)

continued coverage for Mr. Storch and his spouse under the Company’s welfare and fringe benefit plans for three years following termination of employment (he and his spouse can elect continued medical and dental coverage pursuant to COBRA at the end of such three-year period);

(iii)

a lump-sum payment of an amount equal to the lesser of (A) three times the amount of Company contributions made under the Retirement Savings Plan and the defined contribution portion of the SKERP for the calendar year preceding the year in which the termination occurs or (B) $1,526,405;

(iv)

full vesting of all outstanding stock-based awards granted under the Company’s 2013 Stock Plan, with performance-based restricted stock shares awarded based on the higher of the target or actual Company performance through the employment termination date (outstanding awards granted under the Company’s Stock Benefit Plan — the Company’s prior stock plan — fully vest on a Change in Control, regardless of whether a termination of employment occurs); and

(v)

reasonable legal fees incurred by Mr. Storch in enforcing the agreement.

Mr. Storch can elect, with respect to any 280G excise tax, either to receive the full amount of severance benefits and be responsible for paying any excise tax or receive severance benefits that are reduced to the maximum amount that can be paid without triggering the excise tax.

Mr. Storch’s agreement also contains the following termination provisions, regardless of whether a Change in Control is involved (

these termination provisions are identical to the termination provisions in Mr. Storch’s current employment agreement):

·

If Mr. Storch’s termination is due to Retirement (

i.e.

, his voluntary termination that does not result in the payment of any severance benefits pursuant to the agreement), Mr. Storch may enter into a consulting agreement with the Company for a term of not less than one year pursuant to which he

3

will provide consulting services in return for a consulting fee equal to 50% of his base salary in effect at his Retirement. He and his spouse are also entitled to continued coverage under the Company’s medical, dental, welfare and executive health programs for his and his spouse’s lifetime (or until he obtains health coverage from a new employer); and

·

If Mr. Storch’s employment terminates due to Disability, he will receive payment pursuant to the Company’s disability plans then in effect (at a level no less favorable than that in effect on May 31, 2014), and he will continue to receive coverage under the Company’s medical, dental and life insurance plans for three years following such termination.

Any payment under the agreement in connection with Mr. Storch’s termination of employment that would be considered deferred compensation under Section 409A of the Internal Revenue Code will be delayed six months following such termination to the extent necessary to comply with Section 409A.

The terms Change in Control, Cause, Good Reason and Disability are defined in the agreement.

The foregoing description of the agreement is qualified in its entirety by reference to the full text of the agreement, a copy of which is filed with this Current Report on Form 8-K as Exhibit 10.1 and incorporated herein by reference.

Amended and Restated Employment Agreement with John M. Holmes

The Company entered into an amended and restated employment agreement, effective June 1, 2017, with Mr. Holmes, currently Vice President of the Company and Chief Operating Officer of the Company’s Aviation Services business group.

Under the agreement, Mr. Holmes will become President and Chief Operating Officer of the Company on June 1, 2017. The agreement provides for an increase in Mr. Holmes’s base salary to $564,600 and an increase to his maximum bonus opportunity under the Company’s annual cash incentive plan to 250% of base salary. The agreement also provides that the target value of Mr. Holmes’ long-term equity awards will be in the 50th-75th percentile of similar awards to comparable executives in the Company’s peer group, unless otherwise determined by the Compensation Committee.

The initial term of the agreement is for three years until May 31, 2020, and the agreement will automatically renew thereafter for one-year periods unless either party gives 90 days advance notice.

The remaining terms and conditions of Mr. Holmes’s employment remain unchanged from his current employment agreement. In particular, the agreement retains the following severance provisions:

·

If prior to a Change in Control (or later than 18 months following a Change in Control), either the Company terminates Mr. Holmes’ employment without Cause or Mr. Holmes terminates his employment for Good Reason, Mr. Holmes is entitled to continued payment of his base salary for 24 months and a lump sum payment equal to two times the average of the cash incentive bonus paid to him in the preceding two fiscal years of the Company. Payments cease upon a breach of the confidentiality and non-compete provisions set forth in the agreement (the non-compete provisions remain in effect for the two-year period following any such termination of employment); and

·

If Mr. Holmes’ employment is terminated within 18 months following a Change in Control, either by the Company other than for Cause or Disability or by Mr. Holmes for Good Reason, he is entitled to:

4

(i)

an immediate lump-sum payment equal to the sum of (A) a pro-rata portion of the bonus that would have been paid to him had he remained employed until the end of the fiscal year and all performance goals were met at target and (B) two times his base salary and cash bonus for either the most recently completed fiscal year prior to the termination or the preceding fiscal year, whichever produces the higher amount;

(ii)

continued coverage for Mr. Holmes and his spouse under the Company’s welfare and fringe benefit plans for two years following termination of employment (he and his spouse can elect continued medical and dental coverage pursuant to COBRA at the end of such two-year period);

(iii)

full vesting of all outstanding stock-based awards granted under the Company’s 2013 Stock Plan, with performance-based restricted stock shares awarded based on the higher of the target or actual Company performance through the employment termination date (outstanding stock-based awards granted under the Company’s Stock Benefit Plan — the Company’s prior stock plan — fully vest on a Change in Control, regardless of whether a termination of employment occurs); and

(iv)

reasonable legal fees incurred by Mr. Holmes in enforcing the agreement.

If Mr. Holmes’ employment terminates due to Disability, he will continue to receive coverage under the Company’s medical, dental and life insurance plans for two years following such termination.

Any payment under the agreement in connection with Mr. Holmes’ termination of employment that would be considered deferred compensation under Section 409A of the Internal Revenue Code will be delayed six months following such termination to the extent necessary to comply with Section 409A.

The terms Change in Control, Cause, Good Reason and Disability are defined in the agreement.

The foregoing description of the agreement is qualified in its entirety by reference to the full text of the agreement, a copy of which is filed with this Current Report on Form 8-K as Exhibit 10.2 and incorporated herein by reference.

Retirement and Consulting Agreement with Timothy J. Romenesko

The Company entered into a Retirement and Consulting Agreement with Mr. Romenesko, its Vice Chairman and Chief Financial Officer. Under the agreement, Mr. Romenesko will continue as Vice Chairman and Chief Financial Officer until his retirement on December 31, 2017, and thereafter he will provide consulting services to the Company for the one-year period beginning January 1, 2018. Mr. Romenesko’s service on the Company’s Board of Directors will terminate when his current director term expires on October 11, 2017.

The agreement provides that Mr. Romenesko’s severance and change in control agreement with the Company will terminate on December 31, 2017 (or upon his earlier termination of employment).

Until his retirement on December 31, 2017, Mr. Romenesko will be entitled to continued payment of his current salary, benefits and perquisites, including the annual contribution under the Company’s non-qualified retirement plan and a pro-rata bonus under the Company’s annual cash incentive plan based on his employment from June 1, 2017 through December 31, 2017, his current target bonus opportunity of 100% of salary, and actual Company performance.

Upon retirement from the Company on December 31, 2017, Mr. Romenesko will be entitled to continued coverage under the Company’s medical, dental, welfare and executive health plans for his and his spouse’s lifetime (or until he obtains health coverage from a new employer). During the one-year consulting period after retirement from the Company, Mr. Romenesko will report to the Company’s Chief Executive Officer and provide consulting services that include transition support for the Company’s successor Chief Financial Officer, assistance on M&A transactions and special accounting, financial or other projects as may be assigned by the Chief Executive Officer. During the one-year consulting period, Mr. Romenesko will receive an annual retainer of $230,000, payable monthly; general administrative/secretarial support; continued payment of country club dues and fees; financial and tax planning services and reimbursement of business

5

expenses; and continued coverage at active employee rates under the Company’s health and dental plans for his children. Mr. Romenesko is subject to a non-compete provision during the consulting period.

The foregoing description of the agreement is qualified in its entirety by reference to the full text of the agreement, a copy of which is filed with this Current Report on Form 8-K as Exhibit 10.3 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits

.

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Employment Agreement dated as of April 18, 2017 between AAR CORP. and David P. Storch.

|

|

|

|

|

|

10.2

|

|

Amended and Restated Employment Agreement dated as of April 18, 2017 between AAR CORP. and John M. Holmes.

|

|

|

|

|

|

10.3

|

|

Retirement and Consulting Agreement dated as of April 18, 2017 between AAR CORP. and Timothy J. Romenesko.

|

|

|

|

|

|

99.1

|

|

Press release issued by AAR CORP. on April 18, 2017.

|

6

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: April 19, 2017

|

|

|

|

AAR CORP.

|

|

|

|

|

|

By:

|

/s/ ROBERT J. REGAN

|

|

|

|

Name: Robert J. Regan

|

|

|

|

Vice President, General Counsel and Secretary

|

7

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Employment Agreement dated as of April 18, 2017 between AAR CORP. and David P. Storch.

|

|

|

|

|

|

10.2

|

|

Amended and Restated Employment Agreement dated as of April 18, 2017 between AAR CORP. and John M. Holmes.

|

|

|

|

|

|

10.3

|

|

Retirement and Consulting Agreement dated as of April 18, 2017 between AAR CORP. and Timothy J. Romenesko.

|

|

|

|

|

|

99.1

|

|

Press release issued by AAR CORP. on April 18, 2017.

|

8

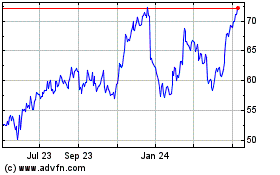

AAR (NYSE:AIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

AAR (NYSE:AIR)

Historical Stock Chart

From Apr 2023 to Apr 2024