Cardinal Swoops In, Strikes Deal -- WSJ

April 19 2017 - 3:02AM

Dow Jones News

Company buys some Medtronic businesses in bid to stem strains on

drug-wholesale unit

By Anne Steele and Joseph Walker

Cardinal Health Inc. struck a deal to buy part of Medtronic

PLC's patient monitoring and recovery unit for $6.1 billion,

bringing businesses under Cardinal's roof that it has sought for

years but also boosting its debt load.

Cardinal said it would fund the acquisition with $4.5 billion in

new debt plus existing cash.

Cardinal hopes the acquisition will help offset competitive

pressures in its drug-wholesaling business, where the company is

lowering generic-drug prices to maintain market share among

independent pharmacy retailers. Cardinal said it expects the prices

it charges customers for generic drugs to fall in the

low-double-digit-percentage range in its fiscal year ending in June

2017.

Due to the pricing pressure and other factors, Dublin,

Ohio-based Cardinal now forecasts its adjusted profit for this year

will be at the bottom of its previous guidance range of $5.35 to

$5.50 a share, and it guided for adjusted earnings in 2018 to be

flat to down midsingle digits. Analysts had expected 9.2% growth

for next year, according to Thomson Reuters.

Pharmaceutical companies have tempered their price increases

somewhat recently in response to growing political pressure in

Washington, including criticisms from President Donald Trump. But

Cardinal Chief Executive George S. Barrett said the generic pricing

pressure it is experiencing is related mainly to the prices it

charges its pharmacy customers, rather than unexpected price cuts

by drug manufacturers.

Cardinal is still able to "work with our [drug] manufacturing

partners to make sure that we're having...an excellent cost

position," Mr. Barrett said on a conference call with analysts

Tuesday. The pricing pressures are on the "sell-side downstream to

the customers. It's still a little bit more than what we

modeled."

Shares of Cardinal fell 11.6% to $72.29 midmorning. Shares in

competing wholesalers also declined, with AmerisourceBergen Corp.

down 4.9% to $82.46, and McKesson Corp. shares off 4.4% to

$137.85.

Cardinal's move to take on new debt to finance its deal with

Medtronic prompted Fitch Ratings to voice concerns over Cardinal's

debt and lower its outlook on the health-care services company.

Fitch, which rates Cardinal's debt at three notches above junk,

said it expects the company's leverage will remain elevated for an

extended period.

The three businesses included in the deal -- patient care, deep

vein thrombosis, and nutritional insufficiency -- generated roughly

$2.4 billion in combined revenue over the past four quarters. The

transaction also includes 17 manufacturing facilities.

Medtronic, which originally bought the trio of businesses as

part of its tie-up with Covidien PLC in 2015, will keep its

respiratory and monitoring operations as well as its renal care

businesses.

Dublin, Ireland-based Medtronic said it would set aside $1

billion of the after-tax proceeds -- estimated at about $5.5

billion -- for stock buybacks in fiscal 2018, and will use the

remainder to pay down debt.

Medtronic said the deal helps its debt leverage ratio, and gives

it cash for investment in higher-growth and higher-margin

opportunities.

Medtronic's shares were down 0.22% to $80.18.

The transaction is expected to close in Medtronic's fiscal 2018

second quarter, which ends in October, and add between 12 cents and

18 cents to the company's full-year adjusted per-share

earnings.

Write to Anne Steele at Anne.Steele@wsj.com and Joseph Walker at

joseph.walker@wsj.com

(END) Dow Jones Newswires

April 19, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

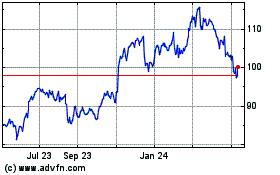

Cardinal Health (NYSE:CAH)

Historical Stock Chart

From Mar 2024 to Apr 2024

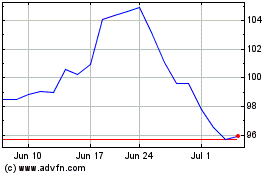

Cardinal Health (NYSE:CAH)

Historical Stock Chart

From Apr 2023 to Apr 2024