ADTRAN, Inc. (NASDAQ:ADTN) reported results for the first

quarter 2017. For the quarter, sales were $170.3 million compared

to $142.2 million for the first quarter of 2016. Net income was

$6.7 million compared to $5 million for the first quarter of 2016.

Earnings per share, assuming dilution, were $0.14 compared to $0.10

for the first quarter of 2016. Non-GAAP earnings per share were

$0.18 compared to $0.14 for the first quarter of 2016. The

reconciliation between GAAP earnings per share, diluted, and

non-GAAP earnings per share, diluted, is in the table provided.

ADTRAN Chairman and Chief Executive Officer Tom Stanton stated,

“We started 2017 setting a company record for first quarter

revenue, driven by increasing momentum in our ultra-broadband

product sales and continuing strength in our services area. Most

notably, we had very strong performances in our fiber to the

premises and vectoring products in both our domestic and

international markets. ADTRAN continues to be at the forefront of

enabling internet service providers of all types to meet increasing

customer demand and decrease their time to market for next

generation services.”

The Company also announced that its Board of Directors declared

a cash dividend for the first quarter of 2017. The quarterly cash

dividend is $0.09 per common share to be paid to holders of record

at the close of business on May 4, 2017. The ex-dividend date is

May 2, 2017, and the payment date is May 18, 2017.

The Company confirmed that its first quarter conference call

will be held Wednesday, April 19, 2017, at 9:30 a.m. Central Time.

This conference call will be web cast live through

StreetEvents.com. To listen, simply visit the Investor Relations

site

at www.adtran.com or www.streetevents.com approximately

10 minutes prior to the start of the call and click on the

conference call link provided.

An online replay of the conference call will be available for

seven days at www.streetevents.com. In addition, an online replay

of the conference call, as well as the text of the Company's

earnings release, will be available on the Investor Relations site

at www.adtran.com for at least 12 months following the call.

ADTRAN, Inc. is a leading global provider of networking and

communications equipment. ADTRAN’s products enable voice, data,

video and Internet communications across a variety of network

infrastructures. ADTRAN solutions are currently in use by

service providers, private enterprises, government organizations,

and millions of individual users worldwide. For more information,

please visit www.adtran.com.

For more information, contact the company at 800 9ADTRAN (800

923-8726) or via email at info@adtran.com. On the Web,

visit www.adtran.com.

This press release contains forward-looking statements which

reflect management’s best judgment based on factors currently

known. However, these statements involve risks and uncertainties,

including the successful development and market acceptance of new

products, the degree of competition in the market for such

products, the product and channel mix, component costs,

manufacturing efficiencies, and other risks detailed in our annual

report on Form 10-K for the year ended December 31, 2016.

These risks and uncertainties could cause actual results to differ

materially from those in the forward-looking statements included in

this press release.

Condensed Consolidated Balance

Sheet

(Unaudited)

(In thousands)

March 31,2017

December 31,2016

Assets Cash and cash equivalents $ 72,558 $ 79,895

Short-term investments 52,458 43,188 Accounts receivable, net

85,396 92,346 Other receivables 13,398 15,137 Income tax

receivable, net — 760 Inventory 112,774 105,117 Prepaid expenses

and other current assets 17,816 16,459

Total

Current Assets 354,400 352,902 Property,

plant and equipment, net 83,514 84,469 Deferred tax assets, net

39,085 38,036 Goodwill 3,492 3,492 Other assets 12,274 12,234

Long-term investments 174,413 176,102

Total

Assets $ 667,178 $ 667,235

Liabilities and Stockholders' Equity Accounts payable $

74,300 $ 77,342 Unearned revenue 16,969 16,326 Accrued expenses

15,035 12,434 Accrued wages and benefits 12,199 20,433 Income tax

payable, net 3,126 —

Total Current Liabilities

121,629 126,535 Non-current unearned revenue

5,675 6,333 Other non-current liabilities 30,861 28,050 Bonds

payable 26,800 26,800

Total Liabilities

184,965 187,718 Stockholders' Equity

482,213 479,517 Total

Liabilities and Stockholders' Equity $ 667,178

$ 667,235

Consolidated Statements of

Income

(Unaudited)

(In thousands, except per share

data)

Three Months Ended March 31,

2017 2016 Sales

Products $ 143,597 $ 123,883 Services 26,682

18,321

Total Sales 170,279

142,204 Cost of Sales Products 76,659 64,073

Services 19,905 12,337

Total

Cost of Sales 96,564 76,410 Gross

Profit 73,715 65,794 Selling, general and

administrative expenses 34,767 30,785 Research and development

expenses 31,916 29,488

Operating Income 7,032 5,521 Interest

and dividend income 933 855 Interest expense (141 ) (145 ) Net

realized investment gain 470 1,728 Other income, net 51

119

Income before provision for

income taxes 8,345 8,078 Provision for

income taxes (1,694 ) (3,064 )

Net

Income $ 6,651 $ 5,014

Weighted average shares outstanding - basic 48,430

49,220 Weighted average shares outstanding - diluted (1) 48,939

49,389 Earnings per common share - basic $ 0.14 $ 0.10

Earnings per common share - diluted (1) $ 0.14 $ 0.10 (1)

Assumes exercise of dilutive stock options calculated under the

treasury stock method.

Consolidated Statements of

Comprehensive Income

(Unaudited)

(In thousands)

Three Months Ended March 31,

2017 2016 Net Income $

6,651 $ 5,014

Other Comprehensive Income, net of

tax: Unrealized gains (losses) on available-for-sale

securities 1,335 (255 ) Unrealized gains on cash flow hedges 79 —

Defined benefit plan adjustments 55 45 Foreign currency translation

1,242 1,228

Other Comprehensive

Income, net of tax 2,711 1,018

Comprehensive Income, net of tax $

9,362 $ 6,032

Consolidated Statements of Cash

Flows

(Unaudited)

(In thousands)

Three Months Ended March 31,

2017 2016 Cash flows from operating

activities: Net income $ 6,651 $ 5,014 Adjustments to reconcile

net income to net cash provided by operating activities:

Depreciation and amortization 4,323 3,347 Amortization of net

premium on available-for-sale investments 124 220 Net realized gain

on long-term investments (470 ) (1,728 ) Net (gain) loss on

disposal of property, plant and equipment (16 ) 3 Stock-based

compensation expense 1,883 1,558 Deferred income taxes (1,947 ) 435

Change in operating assets and liabilities: Accounts receivable,

net 7,247 4,752 Other receivables 1,884 10,200 Inventory (7,399 )

163 Prepaid expenses and other assets (2,413 ) (3,083 ) Accounts

payable (1,713 ) (6,520 ) Accrued expenses and other liabilities

(3,166 ) 902 Income tax payable/receivable, net 4,049

413

Net cash provided by operating activities

9,037 15,676

Cash flows from investing activities: Purchases of property,

plant and equipment (3,872 ) (3,166 ) Proceeds from disposals of

property, plant and equipment 16 — Proceeds from sales and

maturities of available-for-sale investments 24,471 60,586

Purchases of available-for-sale investments (29,517 )

(52,053 )

Net cash provided by (used in) investing

activities (8,902 ) 5,367

Cash flows from financing activities: Proceeds

from stock option exercises 1,377 247 Purchases of treasury stock

(5,559 ) (11,003 ) Dividend payments (4,369 ) (4,453

)

Net cash used in financing activities (8,551

) (15,209 ) Net increase

(decrease) in cash and cash equivalents (8,416 ) 5,834 Effect of

exchange rate changes 1,079 1,225

Cash and cash equivalents,

beginning of period 79,895

84,550 Cash and cash equivalents, end of

period $ 72,558 $ 91,609

Supplemental disclosure of non-cash investing

activities Purchases of property, plant and equipment included in

accounts payable $ 509 $ 485

Supplemental Information

Acquisition Related Expenses,

Amortizations and Adjustments

(Unaudited)

(In thousands)

On August 4, 2011, we closed on the

acquisition of Bluesocket, Inc., on May 4, 2012, we closed on the

acquisition of the Nokia Siemens Networks Broadband Access business

(NSN BBA), and on September 13, 2016, we closed on the acquisition

of CommScope’s active fiber business (CommScope). Acquisition

related expenses, amortizations and adjustments for the three

months ended March 31, 2017 and 2016 for all three transactions are

as follows:

Three Months Ended March 31, 2017

2016 Bluesocket, Inc. acquisition Amortization

of acquired intangible assets $ 158 $ 173 NSN

BBA acquisition Amortization of acquired intangible assets 208 227

Amortization of other purchase accounting adjustments 28

36

Subtotal NSN BBA acquisition

236 263 CommScope

acquisition Amortization of acquired intangible assets 686 —

Amortization of other purchase accounting adjustments

50 — Acquisition related professional fees, travel and other

expenses 8 —

Subtotal CommScope

acquisition 744 —

Total acquisition related expenses,

amortizations and adjustments

1,138 436 Provision for income taxes (425 )

(149 )

Total acquisition related expenses,

amortizations and adjustments, net of tax $ 713

$ 287

The acquisition related expenses,

amortizations and adjustments above were recorded in the following

Consolidated Statements of Income categories for the three months

ended March 31, 2017 and 2016:

Three Months Ended March 31, 2017

2016 Cost of goods sold $ 50 $ 7

Selling, general and administrative expenses 62 3 Research and

development expenses 1,026 426

Total acquisition related expenses,

amortizations and adjustments included in operating

expenses

1,088 429 Total

acquisition related expenses, amortizations and adjustments

1,138 436 Provision for income taxes (425 )

(149 )

Total acquisition related expenses,

amortizations and adjustments, net of tax $ 713

$ 287

Supplemental Information

Stock-based Compensation

Expense

(Unaudited)

(In thousands)

Three Months Ended March 31,

2017 2016 Stock-based

compensation expense included in cost of sales $

91 $ 99 Selling, general

and administrative expense 1,016 769 Research and development

expense 776 690

Stock-based

compensation expense included in operating expenses

1,792 1,459 Total

stock-based compensation expense 1,883 1,558

Tax benefit for expense associated with

non-qualified options,restricted stock units and restricted

stock

(380 ) (212 )

Total stock-based

compensation expense, net of tax $ 1,503

$ 1,346

Reconciliation of GAAP net income per

share, diluted, to

Non-GAAP net income per share,

diluted

(Unaudited)

Three Months Ended March 31,

2017 2016 GAAP earnings per

common share – diluted $ 0.14 $

0.10 Acquisition related expenses, amortizations and

adjustments 0.01 0.01 Stock-based compensation expense 0.03

0.03

Non-GAAP earnings per common share –

diluted $ 0.18 $ 0.14

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170418006659/en/

ADTRAN, Inc.Investor Services/Assistance:Gloria Brown,

256-963-8220investor@adtran.com

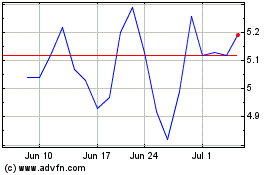

ADTRAN (NASDAQ:ADTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

ADTRAN (NASDAQ:ADTN)

Historical Stock Chart

From Apr 2023 to Apr 2024