Current Report Filing (8-k)

April 18 2017 - 4:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15 (d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): April 13, 2017

THE WILLIAMS COMPANIES, INC.

(Exact name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

1-4174

|

|

73-0569878

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

One Williams Center, Tulsa, Oklahoma

|

|

74172

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (918)

573-2000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

WILLIAMS PARTNERS L.P.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-34831

|

|

20-2485124

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

One Williams Center,

Tulsa, Oklahoma

|

|

74172

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (918)

573-2000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form

8-K

is intended to simultaneously satisfy the filing obligation of the

registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to

Rule 14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to

Rule 13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act (17 CFR 230.405) or Rule

12b-2

of the Securities Exchange Act of 1934 (17 CFR

240.12b-2).

Emerging growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On April 13, 2017, Williams Partners

L.P. (the “Partnership”), Williams Field Services Group, LLC, an indirect wholly owned subsidiary of the Partnership (“Williams FSG”), Williams Olefins, L.L.C., a wholly owned subsidiary of Williams FSG (the “Company”),

NOVA Chemicals Inc. (“Nova”), and NOVA Chemicals Corporation (“Nova Parent”) entered into a Membership Interest Purchase Agreement (the “Purchase Agreement”) pursuant to which Williams FSG agreed to sell, and Nova

agreed to buy, 100% of the issued and outstanding membership interests of the Company (the “Interests”). The Partnership has guaranteed the obligations of Williams FSG under the Purchase Agreement, and Nova Parent has guaranteed the

obligations of Nova under the Purchase Agreement and other related agreements entered into in connection with the Purchase Agreement. The purchase price for the Interests is $2.1 billion, subject to a working capital adjustment.

The Purchase Agreement includes customary (1) representations and warranties of the parties, (2) covenants, including without

limitation covenants with respect to actions taken prior to the closing, cooperation with respect to regulatory issues, and access to information, and (3) indemnities. The Purchase Agreement is also subject to customary closing conditions,

including the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 and approval by the Committee on Foreign Investment in the United States. The Purchase Agreement contains certain

termination rights for the parties, including if the closing of the transactions contemplated thereby does not occur by December 22, 2017 or, under certain conditions, if there has been a breach of certain representations and warranties or a

failure to perform any covenant by the other party. Closing is anticipated to occur in the summer of 2017.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On April 17, 2017, The Williams Companies, Inc. and the

Partnership issued a press release announcing the entry into the Purchase Agreement. A copy of this press release is furnished and attached as Exhibit 99.1 hereto and is incorporated herein by reference.

The information furnished is not deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended,

is not subject to the liabilities of that section and is not deemed incorporated by reference in any filing under the Securities Act.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d)

Exhibits.

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press release dated April 17, 2017

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

THE WILLIAMS COMPANIES, INC.

|

|

|

|

By: /s/ Joshua H. De Rienzis

|

|

|

|

Joshua H. De Rienzis

|

|

|

|

Vice President and Corporate Secretary

|

|

|

|

WILLIAMS PARTNERS L.P.

|

|

|

|

|

By:

|

|

WPZ GP LLC,

|

|

|

|

its General Partner

|

|

|

|

|

By:

|

|

/s/ Joshua H. De Rienzis

|

|

|

|

Joshua H. De Rienzis

|

|

|

|

Vice President and Secretary

|

DATED: April 18, 2017

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press release dated April 17, 2017

|

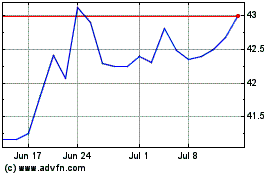

Williams Companies (NYSE:WMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

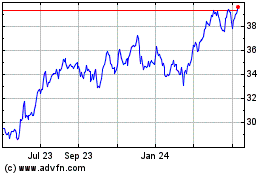

Williams Companies (NYSE:WMB)

Historical Stock Chart

From Apr 2023 to Apr 2024