Independent Auditor’s Report

To the Shareholders, Board of Directors and Management of

Companhia de Saneamento Básico do Estado de São Paulo – SABESP

São Paulo – SP

Opinion

We have audited the financial statements of Companhia de Saneamento Básico do Estado de São Paulo – SABESP (“the Company”), which comprise the statement of financial position as at December 31, 2016 the statements of profit or loss and other comprehensive income, changes in equity and cash flows for the year then ended, and notes, comprising significant accounting policies and other explanatory information.

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Companhia de Saneamento Básico do Estado de São Paulo – SABESP as at December 31, 2016, and of its financial performance and its cash flows for the year then ended in accordance with Accounting Practices Adopted in Brazil and with International Financial Reporting Standards (IFRS), issued by the International Accounting Standards Board (IASB).

Basis for Opinion

We conducted our audit in accordance with Brazilian and International Standards on Auditing. Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Company in accordance with the relevant ethical requirements included in the Accountant Professional Code of Ethics (“Código de Ética Profissional do Contador”) and in the professional standards issued by the Brazilian Federal Accounting Council (“Conselho Federal de Contabilidade”) and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Key Audit Matters

Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the financial statements of the current period. These matters were addressed in the context of our audit of the financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters.

Valuation of provisions for contingencies

As described in note 19, the Company is exposed to legal proceedings arising from civil and tax environmental matters. The measurement, recognition as provision and the disclosure of provisions and contingent liabilities related to these lawsuits require professional´s judgment of SABESP and its legal advisors regarding the completeness of the existing lawsuits, adequacy of provisions made and corresponding disclosure. Due to the relevance, complexity and judgment in the assessment, measurement and disclosure of contingent liabilities and the impact that the amounts involved may have on the Company's results if the potential exposures in these cases are realized, we consider this matter relevant to our audit.

How our audit addressed this matter

We evaluate the design, implementation and effectiveness of existing key internal controls related to the determination of estimates to provide or disclose the amounts in accordance with expected loss of litigation and how to ensure the completeness and accuracy of the likelihood determined by the Company. We evaluated the adequacy of the recognized amounts and the amounts of contingencies disclosed by analyzing the criteria and assumptions used to measure the amounts recogninez and/or disclosed and that took into account the assessments prepared by the Company's internal and external legal counsel. We assessed the assumptions used by the Company, obtaining a sample of processes, and, with confirmation of balances with internal and external advisors, analyzed the likelihood of gain or loss evaluating the risk classification considered by the Company based on the merit of the lawsuits and recently decision updates on the progress of cases. In addition, we assess the adequacy of the disclosures made in the financial statements in relation to the accrued litigation and contingent liabilities.

Capitalization of Intangible Assets

As mentioned in note 14, during 2016, significant amounts resulting from commitments related to the concession contracts with the respective granting authorities relating to the maintenance and expansion of infrastructures were capitalized in intangible assets. The commitments linked to the concession agreements have a combination of expansion and maintenance of the infrastructures, and therefore, the Company has to use a judgment to allocate expenditures between capitalized costs in the intangible asset, when the capacity increases and improvement of the network and maintenance expenses incurred to be recognized in profit & loss for the year. For this reason, we consider this matter relevant to our audit.

How our audit addressed this matter

Our audit procedures have included testing the design, implementation and effectiveness of key internal controls in the process of adding intangible assets , as well as assessing whether the cost capitalization policy in the intangible asset is in compliance with the accounting standards. We also tested a sample of the additions to the intangible asset to assess the existence, nature of the expense and proper classification between capitalizable cost or maintenance expenses. Finally, we assess the adequacy of the Company's disclosures about its capitalization policies and other related disclosures.

Other matters

Statements of value added

The statements of value added (DVA) for the year ended December 31, 2016, prepared under the responsibility of the Company’s management, and presented herein as supplementary information for IFRS purposes, have been subject to audit procedures jointly performed with the audit of the Company's financial statements. In order to form our opinion, we assessed whether those statements are reconciled with the financial statements and accounting records, as applicable, and whether their format and contents are in accordance with criteria determined in the Technical Pronouncement 09 (CPC 09) - Statement of Value Added issued by the Committee for Accounting Pronouncements (CPC). In our opinion, the statements of value added have been fairly prepared, in all material respects, in accordance with the criteria determined by the aforementioned Technical Pronouncement, and are consistent with the overall financial statements.

Corresponding values

The amounts corresponding to the year ended December 31, 2015, presented for comparison purposes, were previously audited by other independent auditors who issued a report dated March 24, 2016, which did not contain any modification.

Other information accompanying the financial statements

Management is responsible for the other information comprising the management report.

Our opinion on the financial statements does not cover the other information and we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit, or otherwise appears to be materially misstated. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact.

Responsibilities of management and those charged with governance for the financial statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with Brazilian accounting practices and with International Financial Reporting Standards (IFRS), issued by the International Accounting Standards Board (IASB) and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is responsible for assessing the Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Company’s financial reporting process.

Auditors’ responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Brazilian and international standards on auditing will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with Brazilian and international standards on auditing, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

-

Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

-

Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control.

-

Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

-

Conclude on the appropriateness of management's use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Company's ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditors' report to the related disclosures in the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditors' report. However, future events or conditions may cause the Company to cease to continue as a going concern.

-

Evaluate the overall presentation, structure and content of the financial statements, including the disclosures, and whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

-

Obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Group to express an opinion on the consolidated financial statements. We are responsible for the direction, supervision and performance of the group audit. We remain solely responsible for our audit opinion.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

We also provide those charged with governance with a statement that we have complied with relevant ethical requirements regarding independence, and communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

From the matters communicated with those charged with governance, we determine those matters that were of most significance in the audit of the financial statements of the current period and are therefore the key audit matters. We describe these matters in our auditors’ report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

São Paulo,

March 27, 2017

KPMG Auditores Independentes

CRC 2SP014428/O-6

(Original report in Portuguese signed by)

Marcelo Gavioli

CRC 1SP201409/O-1

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

2016 Management Report

MESSAGE FROM THE CEO

Overcoming the water crisis, legacies and management improvement

The highlight of 2016 was the end of the most serious water crisis ever recorded in the metropolitan region of São Paulo (RMSP). Today, we are back to normality, with a strong recovery of the reservoirs that supply the metropolis. The total volume of water reserves in early 2017 already surpasses that of 2013, before the severe drought took hold.

The return to normal conditions was possible thanks to a positive combination of three factors: emergency construction and structural works implemented right at the outset of the first signs of the crisis, which avoided a collapse in the water supply; resumption of normal rainfall levels, and the change in habits of the population, which understood the critical nature of the moment and began saving water. Notwithstanding the increase in water availability during 2016, the average consumption in the RMSP was 15% lower than that registered in 2013, before the crisis.

The severe crisis we faced has left us two important legacies. Today we have a more robust and resilient supply system, with capacity to face weather droughts as severe as the one we have experienced in 2014-2015, when three major projects come on stream: The São Lourenço Production System, the Interconnection between the Paraíba do Sul Water Basin and the Cantareira System and the reversal of the Itapanhaú Water Basin to the Alto Tietê System.

An example of operational legacy is the successful experience involving the intake of technical reserves of the Cantareira System through floating pumps, currently on loan to the National Integration Ministry to accelerate the arrival of waters from São Francisco river to the states of Paraíba and Pernambuco, which were on the verge of a collapse in water supply.

The all-out deployment of our professionals has added a significant technological and qualitative enhancement to our operations. From the institutional point of view, we are experiencing a movement towards closer relations between industry players (operators, regulators, specialists and water resource managers) with a view to improving the institutional framework.

The crisis has also spurred an extensive social debate about the need to review concepts of consumption and appreciation the value of water and sanitation, which in 2017 is now leading us toward a more qualified interaction with the regulatory agency (Sanitation and Energy Regulatory Agency of the State of São Paulo – ARSESP) regarding tariff review and restructuring process.

The regulatory body and the regulated party are required to explain the calculation of tariffs to society. Many opinion makers and individuals still mistakenly assume that they pay for the provision of a universalized service where all sewage is properly collected and treated. But actually the services delivered are not yet universal, particularly in areas of chaotic urbanization, due to Company deficiencies.

However, the reality is different: tariffs are calculated taking into account the investments and operational costs effectively incurred, rather than those that should have been made to provide services with, for example, European standards. SABESP has full technical capacity to advance towards universalization in the areas covered by its services. A proof of that is that the company is already providing full services in all cities of the interior of the State of São Paulo, which have lower urban complexity. This means that all urban properties are connected to the water and sewage network, and the waste collected is correctly treated prior to discharge in some water stream.

Year after year, the municipality of Franca, for example, has ranked first in the classification of the “

Trata Brasil

” Institute regarding the quality of services. Many cities have shown clear improvements in the quality of river waters, as a result of sewage treatment. This is the case, for example, of the Jundiaí river and of São Paulo’s stretch of the Paraíba do Sul river. In other words, there are no technical limits to advance towards more elevated and civilized sanitation standards.

We face two key challenges. First, we must combine the pace of investments to society’s capacity and willingness to pay. Since SABESP does not receive subsidies, the investments required for universalization come exclusively from earnings retained or loans, which, obviously, have to be repaid. To make it simple, the earnings received in a given year will make up the funds to be invested in subsequent years.

For this reason, the policy of distribution of dividends to SABESP’s shareholders is very important: in recent years, earnings have been allocated to investments in accordance with the legal limits. This benefits the population in the form of better services, and the shareholders, in the form of increased equity. In other words, contrary to the erroneous assumption that state-owned companies should not record profit, the excellent results achieved in 2016, of R$2.9 billion, mean good news for all, and not only for the company’s shareholders.

The second challenge is to align the actions of the Company to the municipal governments and the Public Prosecutor’s Office in order to reach solutions that may be compatible with the difficult task to provide sanitation services to irregular, yet consolidated, settlements.

Also, we should not limit the pace of investments to the payment capacity of the less well-off. If, on the one hand, we have to provide economic protection for this section of the population using social tariffs, on the other hand, we have to make all efforts to increase the willingness to pay of social levels that afford to do so. We must convince the middle and high social classes that society can do more and better. And the best way to reach this objective is to continuously increase the Company’s productivity in order to improve the quality of services in a manner that can be noticed by consumers.

With the situation normalized and having strengthened the structures and operations, in 2016 we were able to channel our efforts to improving the efficiency of our internal management. Once again we began addressing the phases for setting up the SABESP Integrated Information System– SiiS, in view of the SAP platform having come on stream in April 2017. Regarding the strategic planning, we completed the review of the Company’s targets for the next five years (2017-2021).

We gave the first steps towards expanding the Management Excellence Model (MEG) across all areas of the Company in order to promote best practices through exchange of experiences and partnerships, including internationally, for example, establishing technical cooperation arrangements and the Waste to Energy project of the ETE Barueri effluent treatment station. Another highlight was the evolution of risk management and compliance practices.

We have addressed the adjustments required in order to comply with the requirements of the State-owned Companies Law of June 2016, and we have made progress in building technical parameters for establishing an investment hierarchy in which ‘e match our limited resources with the urgencies of sanitation. The priorities obey the following order: 1) water quality, 2) water security, including countering losses and 3) sewage collection and treatment.

Countering water losses while providing health to those living in irregular areas, where SABESP is legally prevented from operating, is another task we have managed to address thanks to partnerships with the courts.

Planning is on-going, with partial execution to eliminate a total of 160,000 illegal connections. Being precarious and insalubrious, this “spaghetti junction” of pipes littering the side streets result in huge losses of water due to leakage and unlimited consumption, in addition to directly affecting the public health of the community.

Seeing the crisis in the rearview mirror, as we do now, does not mean removing the risk of water shortages from the list of priorities. Summarizing, we are now in the phase of enhancing what we have learned from the experience, but with our eyes always on the future of the water supply, but without losing sight of the expansion in sanitation and the efficient and sustainable management of our water resources

.

Jerson Kelman

,

Chief Executive Officer

THE WORLD’S FOURTH LARGEST SANITATION COMPANY REGARDING POPULATION SERVED

In 2016, Companhia de Saneamento Básico do Estado de São Paulo – SABESP completed 43 years of providing water and sewage services in the State of São Paulo, Brazil, always seeking to adapt to the needs of the different regions in which it operates, while preserving the collective interest that justified its creation.

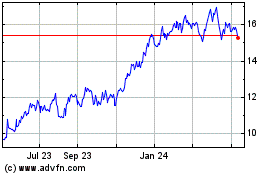

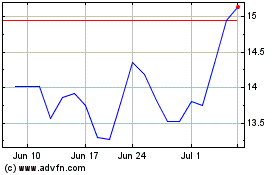

With its main offices in the capital of the State of São Paulo, it is a publicly-held and government-controlled company. The Government of the State of São Paulo holds 50.3% of the capital stock, with the remainder traded on stock exchanges in Brazil and overseas. On December 31, 2016, 30.3% of the shares were traded on the BM&FBovespa, in São Paulo, with the ticker SBSP3, while the remaining 19.4% were traded in the United States, on the New York Stock Exchange (NYSE) with the ticker SBS. On the BM&FBovespa, the Company’s shares continue to be part of the main indices.

Responsibility for controlling,

monitoring

and regulating SABESP’s operations, including tariffs, rests for the most part with the

São Paulo State Sanitation and Energy Regulatory Agency

- Arsesp.

Since early 2017, with the commencement of operations in the municipality of Santa Branca, SABESP is serving 367 municipalities of the State of São Paulo, providing water supply and sewage collection and treatment services to residential, commercial, government and industrial customers. Furthermore, it provides water on a wholesale basis to five municipalities in the metropolitan region of São Paulo (RMSP), four of whom also benefit from sewage treatment services.

In 2016, the Company provided water to around 27.7 million people (24.7 million directly and 3.0 million residents in the five municipalities served on the wholesale market), representing about 66% of the urban population in the State. The sewage collection service serves approximately 21.2 million people.

According to the Arup in Depth Water Yearbook 2014-2015, SABESP is the largest sanitation company in the Americas and the world’s fourth largest in population served.

In 2016, the Company maintained the trend towards the universalization of water supply already noticeable in previous years, reaching the mark of 8.7 million water connections. With regard to sewage services, the 7.1 million connections represent a sewage coverage ratio of 87%, and a collected sewage treatment ratio of 79% of the sewage collected.

Net revenues in 2016 were approximately R$14.1 billion, while income of R$2.9 billion exceeded the figure for the year preceding the water crisis, in current values. Assets amounted to R$36.7 billion, while market value stood at R$19.7 billion on December 31, 2016.

Still with regard to its area of operations and market, the Company remains a shareholder in the companies, Águas de Castilho S.A., Águas de Andradina S.A. and Saneaqua Mairinque S.A., companies that provide water and sewage services, while in SESAMM – Serviços de Saneamento de Mogi Mirim S.A., it is in charge of the modernization, implementation and management of the sewage treatment system. In the non-domestic sewage segment, the Company is a shareholder in the company Attend Ambiental.

In synergy with the importance of planning for developing water resources, SABESP continues to promote the use of reused water for non-prime purposes based on the production, supply and commercialization of reused water obtained from some of its sewage treatment plants, and it is also a shareholder in Aquapolo Ambiental.

In the electricity segment, SABESP is a shareholder in the company Paulista Geradora de Energia S.A, whose operations have been rescheduled to begin in the second half of 2018.

In 2016, SABESP injected R$818.0 thousand in its investees, an amount corresponding to its percentage equity stake in the companies: Saneaqua Mairinque S/A (R$150.0 thousand), Águas de Andradina S/A (R$607.0 thousand), and Águas de Castilho S/A (R$61.0 thousand).

In its mission to “provide sanitation services, thereby contributing to improving the quality of life and of the environment”, SABESP’s operations are aligned with the Ten Principles of the United Nations Global Compact and with the environmental and socioeconomic policies of the government of the State of São Paulo.

This is how the Company adopts an approach to providing services and establishing relations with society and its suppliers, through planning and economic, social and environmental responsibility.

PANEL OF INDICATORS

|

Indicators

|

Unit

|

2016

|

2015

|

2014

|

2013

|

2012

|

|

Service

|

|

Water coverage ratio

|

|

Tends towards universalization

(1)

|

|

Sewage collection coverage ratio

|

%

|

87

|

86

|

85

|

84

|

83

|

|

Collected sewage treatment coverage ratio

(2)

|

%

|

79

|

78

|

77

|

78

|

77

|

|

Resident population provided with water supply

(3)

|

thousand inhabitants

|

24,689

|

24,446

|

24,193

|

|

|

|

Resident population provided with sewage collection

(3)

|

thousand inhabitants

|

21,207

|

20,957

|

20,637

|

|

|

|

Positive perception of customer satisfaction

(4)

|

%

|

82

|

75

|

80

|

89

|

89

|

|

Operational

|

|

Water connections

|

thousands

|

8,654

|

8,420

|

8,210

|

7,888

|

7,679

|

|

Sewage connections

|

thousands

|

7,091

|

6,861

|

6,660

|

6,340

|

6,128

|

|

Water network extension

(5)

|

km

|

73,015

|

71,705

|

70,800

|

69,619

|

67,647

|

|

Sewage network extension

(5)

|

km

|

50,097

|

48,774

|

47,992

|

47,103

|

45,778

|

|

WTP – Water treatment plants

|

units

|

237

|

235

|

235

|

232

|

214

|

|

Wells

|

units

|

1,093

|

1,085

|

1,055

|

1,083

|

1,079

|

|

STP - Sewage treatment plants

|

units

|

548

|

539

|

524

|

509

|

502

|

|

Water Billed Loss Index

(6)

|

%

|

20.8

|

16.4

|

21.3

|

24.4

|

25.7

|

|

Water Metered Loss Index

(7)

|

%

|

31.8

|

28.5

|

29.8

|

31.2

|

32.1

|

|

Water loss per connection

(8)

|

liters per connection per day

|

308

|

258

|

319

|

372

|

392

|

|

Water Meter

ratio

(9)

|

%

|

99.97

|

99.97

|

99.97

|

99.97

|

99.97

|

|

Volume of water produced

|

millions of m

3

|

2,696

|

2,466

|

2,840

|

3,053

|

3,059

|

|

Volume of water metered on retail market

|

millions of m

3

|

1,465

|

1,399

|

1,573

|

1,629

|

1,601

|

|

Volume of water billed on the wholesale market

|

millions of m

3

|

227

|

216

|

247

|

299

|

298

|

|

Volume of water billed on the retail market

|

millions of m

3

|

1,763

|

1,698

|

1,812

|

1,835

|

1,796

|

|

Volume of sewage billed

|

millions of m

3

|

1,552

|

1,481

|

1,562

|

1,579

|

1,535

|

|

Headcount

(10)

|

units

|

14,137

|

14,223

|

14,753

|

15,015

|

15,019

|

|

Operating productivity

|

Connections per employee

|

1,114

|

1,074

|

1,008

|

948

|

919

|

|

Financial

|

|

Gross revenues

|

R$ millions

|

14,855.1

|

12,283.5

|

11,823.4

|

11,984.8

|

11,391.2

|

|

Net revenues

|

R$ millions

|

14,098.2

|

11,711.6

|

11,213.2

|

11,315.6

|

10,737.6

|

|

Adjusted EBITDA

(11)

|

R$ millions

|

4,571.5

|

3,974.3

|

2,918.7

|

4,006.6

|

3,605.0

|

|

Adjusted EBITDA Margin

|

% of net income

|

32.4

|

33.9

|

26.0

|

35.4

|

33.6

|

|

Adjusted EBITDA Margin before construction revenues and costs

|

% of net income

|

43.3

|

46.6

|

34.4

|

44.6

|

43.0

|

|

Operating result

(12)

|

R$ millions

|

3,429.6

|

3,044.0

|

1,910.7

|

3,138.8

|

2,843.3

|

|

Operating Margin

(12)

|

% of net income

|

24.3

|

26.0

|

17.0

|

27.7

|

26.5

|

|

Result (net income/loss)

|

R$ millions

|

2,947.1

|

536.3

|

903.0

|

1,923.6

|

1,911.9

|

|

Net Margin

|

% of net income

|

20.9

|

4.6

|

8.1

|

17.0

|

17.8

|

|

Net Debt by Adjusted EBITDA

(13)

|

multiple

|

2.2

|

2.9

|

3.1

|

1.9

|

1.9

|

|

Net debt to equity

(13)

|

%

|

65.4

|

83.7

|

68.1

|

59.3

|

61.8

|

|

Investment

(14)

|

R$ millions

|

3,877.7

|

3,481.8

|

3,210.6

|

2,716.0

|

2,535.6

|

(1)

99% or more.

(2) For methodological reasons, it includes a variation margin of plus or minus 2 percentage points.

(3) From 2016 on, the demographic data shown herein started to take into account “The Projected Population and Domiciles or the Municipalities of the State of São Paulo: 2010-2050”, prepared by the State Data Analysis System Foundation, as well as the new methodology used for determining the service and coverage indicators discussed in the chapter “Strategy and Vision of the Future.” Data were not recalculated for the years 2012 and 2013.

(4) Survey carried out in 2016 by Praxian Consultoria Ltda. (5,928 interviewees across the entire operating base with a margin of error of 1.3% and a reliability interval of 95%).

(5) Includes water mains, branch collectors, interceptors and outfalls. Register base updated in December 2016.

(6)

Includes real (or physical) loss and apparent (or nonphysical) loss. The percentage of water loss represents the resulting ratio between the (i) Billed Volume Lost and the (ii) Volume of Water Produced. The Billed Volume Lost corresponds to: Volume of Water Produced MINUS Billed Volume MINUS Volume of uses. The Volume of Uses corresponds to: water used in regular maintenance of pipelines and water reservoirs; water used in municipalities, for example in firefighting; and water supplied to irregular settlements.

(7)

Includes real (or physical) loss and apparent (or nonphysical) loss. The percentage of water loss represents the resulting ratio between the (i) Measured Volume Lost and the (ii) Volume of Water Produced. The Measured Volume Lost corresponds to: Volume of Water Produced MINUS Measured Volume MINUS Volume of Uses. The Volume of Uses corresponds to: water used in regular maintenance of pipelines and water reservoirs; water used in municipalities, for example in firefighting; and water supplied to irregular settlements.

(8)

Calculated by dividing the Measured Volume Lost a year by the average amount of active water connections, divided by the number of days in the year.

(9) Connections with

Water Meter

/ Total Connections.

(10) Internal headcount. Does not include those assigned to other entities. Employees with permanent disability are no longer considered as from 2016.

(11) Adjusted EBITDA corresponds to net earnings before: (i) depreciation and amortization expenses (ii) income tax and social contribution (federal revenue taxes); (iii) financial income and (iv) other operating expenses, net.

(12) Does not include financial revenues and expenses.

(13) Net debt encompasses the debt, less cash and cash equivalents.

(14) Does not include financial commitments assumed in program agreements (R$155 million, R$65 million, R$116 million, R$177 million and R$6 million, in 2012, 2013, 2014, 2015 and 2016, respectively)

MODERN MANAGEMENT, ETHICS AND INTEGRITY

For state-owned companies, 2016 particularlly stands out because of the impact of the opening discussions for adapting to Law No. 13303/16 (The State-Owned Companies Law) and State Decree No. 62349/16. Created to provide greater legal security while enhancing the role of the control bodies, the Law provides for changes in the current management rules, including regulations on tenders and contracts, in addition to mandatory adoption of corporate governance practices.

As a joint-stock corporation listed on the Novo Mercado segment of the BM&FBovespa and shares traded on the New York Stock Exchange since 2002, SABESP benefits from the fact of already having a consolidated corporate governance structure which facilitates its adaptation to the new rules and regulations.

Throughout 2016, the Company sponsored events to study and debate the adaptation measures required in order to be legally compliant. The primary measures involve changes to the bylaws, adjustment to the governance structure, such as setting up a Statutory Appointment Committee, management assessment and the creation of policy for operations with related parties, in addition to drawing up Internal Regulations on Bidding Procedures.

Among the innovations introduced by the State-Owned Companies Law and its provisions, some relate to the

Code of Ethics and Conduct

. SABESP’s Code of Ethics and Conduct, launched in 2003 and updated in 2014, represents its key benchmark on principles and values, and applies to the organization as a whole, including the Board of Directors, in accordance with the new legal system. It sets out the bases for the Company’s relationship with its various stakeholders, being available at www.sabesp.com.br.

The Ethics and Conduct Committee is responsible for the appropriateness, timeliness, promotion and application of the Code. An important mechanism for its actions is the Internal Whistleblower Channel, which centralizes all complaints received by the Ombudsman, the Customer Service Unit, e-mail, phone, post office box, mail, or personally delivered to the Audit Superintendence, which is the unit that controls the Channel.

In 2016, 154 incidents were recorded, of which 65% were verified, while 35% are still under investigation. Of the total, 17% involved inappropriate behavior, harassment, discrimination, persecution and unfair treatment. In the case of all complaints considered pertinent, penalties were imposed on 64 own and outsourced employees: 6 warnings, 7 suspensions and 51 redundancies. The outcomes of the investigations into the complaints are forwarded to the Audit Committee and the Ethics and Conduct Committee.

The State-owned Companies Law also makes it mandatory to set up a Statutory Audit Committee consisting of an independent majority. The Audit Committee at SABESP has existed for 10 years, consisting of 3 independent directors who meet every fifteen days.

To find out more about the corporate governance structure of SABESP go to www.sabesp.com.br/investidores, “

Governança Corporativa

” section.

Anti-corruption

SABESP launched its Integrity Program in 2015, initially with aim of implementing the set of anticorruption measures, especially those aimed at preventing, detecting and remediating crimes against the government, in compliance with Law 12846/2013 (the Anti-Corruption Law) and the US Foreign Corrupt Practices Act (FCPA).

In 2016, the Integrity Program was reshuffled to ensure compliance with Law 13303/2016, and currently consists of a set of internal integrity mechanisms and procedures involving monitoring and encouraging complaints about irregularities, in addition to the effective application of the codes of ethics and conduct, policies and guidelines for the purpose of detecting and putting right deviations, frauds, irregularities and illegal acts.

The Program is currently structured on seven pillars: Senior Management’s Commitment; Functional Structuring; Values and Conduct and the Whistleblower Channel; Relation with Third Parties; Governance and Internal Controls; Risk Management; Training and Communication.

Also in 2016, the institutional policies on Internal Audits and Compliance were reformulated, based on the “Three Lines of Defense in Effective Risk Management and Control” model recommended by The Institute of Internal Auditors – IIA.

The purpose of the Institutional Policy on Compliance, in addition to setting out the guidelines, principles and competences and disseminating the Program at all levels within the company, is to consolidate the three lines of defense model within the internal control structure and to ensure that the functional compliance area created in 2016 operates independently in carrying out its responsibilities.

In addition to the internal practices, SABESP sits on the Committee on Anti-corruption and Compliance of the Pinheiros/SP Chapter of the Brazilian Bar association (OAB) and integrates the UN Global Compact’s Anti-corruption Working Group and the Instituto Ethos Integrity Committee, having staged in 2016 a gathering of specialists in anti-corruption specialists to debate control measures and ways of working together.

Within the scope of the state government, SABESP is directly involved in the actions of the government’s internal affairs department and coordinates a working group consisting of government-

controlled (private) from the State Departments of Sanitation and Water Resources and Energy and Mining, and whose purpose is to set up mutual cooperation for planning, developing and implementing compliance programs within the State of São Paulo.

During the year, the Program mapped 112 actions as compliance practices which were allocated priority following the analysis of corporate corruption and fraud and new legal requirements. The evaluation of these actions showed that, in relation to the 2015 evaluation, there was growth of 20% in compliance.

Internal controls

Internal controls have been evaluated in a structured and systematic manner since 2005, benchmarking with the parameters of the Committee of Sponsoring Organizations of the Treadway Commission (COSO) of 2013 and the Control Objectives for Information and Related Technology (COBIT).

The internal controls evaluation process takes place once a year, taking into account both the occasional existence of risks associated with the preparation and disclosure of financial statements, and possible significant changes to information technology processes and systems. The controls are tested by the Audit Superintendence, an independent unit of the Company, and include the procedures for adapting the accounting ledgers; the preparation of the financial statements in accordance with the official rules; and proper authorization of transactions involving the acquisition, use and disposal of the Company’s assets.

Management’s

assessment

of the effectiveness of internal controls did not identify any shortcomings considered material in 2016, as has been the case in previous years.

External Audit

SABESP respects the principles that protect the independence of the external auditors with regard to not auditing their own work, not holding managerial functions and not acting on behalf of their client. Deloitte Touche Tohmatsu Auditores Independentes served as SABESP’s auditors from the review of the quarterly information - ITR – of September 30, 2012, until the review of the quarterly information - ITR – of March 31, 2016. During this period, they audited the financial statements and reviewed the quarterly information and finance projects.

KPMG Auditores Independentes has served as SABESP’s auditors since the review of the quarterly information - ITR – of June 30, 2016. During this period, they have audited financial statements and reviewed the quarterly information.

In 2016, the Company paid R$2.0 million for these services, of which 93.0% refers to auditing of financial statements. Among SABESP’s affiliates, KPMG Auditores Independentes audits Águas de Castilho S.A. and Águas de Andradina S.A. During its period of service to the Company, Deloitte Touche Tohmatsu Auditores Independentes audited the company SESAMM – Serviços de Saneamento de Mogi Mirim S.A. During the period of their service to the Company, the auditors did not provide any services not involving external auditing.

Management Compensation

In 2016, the compensation of the directors, members of the fiscal council and officers, in gross values, including benefits and legal charges, was approximately R$4.4 million. This amount includes around R$494.2 thousand referring to officers’ variable compensation, and it should be remembered that variable compensation is not allowed to directors and members of the fiscal council, pursuant to State Decree 58265/12 ratified by the shareholders’ meeting of April 2013.

Under the Brazilian corporate law, the compensation of the directors, members of the fiscal council and officers is fixed, in an aggregate amount, by the shareholders’ meeting. In SABESP, the compensation policy for board members and officers is fixed in accordance with the guidelines of the government of São Paulo, always subject to approval by the shareholders’ meeting.

STRATEGY AND VISION OF THE FUTURE

SABESP does not view sustainability as mere rhetoric. Instead, it understands it is a prerequisite for a business to exist. It reflects results in the social, environmental and economic areas in the Company, through the universal distribution of quality water and the expansion of sewage collection and treatment, improving the life quality and the health of the population, in addition to contributing to a healthier environment. At the economic level, a sound business in a regulated environment results in profitability which, in turn, leads to greater investments in sanitation and the subsequent economic development of the regions served.

The Company’s main market is the Metropolitan Region of São Paulo (RMSP), which has approximately 21 million inhabitants, accounting for nearly half the population of the State of São Paulo and one the world’s largest agglomerations. Located at the furthest edge of the Alto Tietê basin, the RMSP’s supply per capita is similar to the semi-arid regions of Northeastern Brazil. While the United Nations (UN) affirms that, ideally, the minimum needed for comfort supply is 1.5 million liters per capita, the RMSP’s supply is ten times lower, with an annual average of approximately 150 thousand liters of water per inhabitant.

SABESP’s strategies and guidelines consider inputs to be the study of scenarios, risks and opportunities.

Based on international standards and Brazilian technical standards, specifically COSO - ERM - The Committee of Sponsoring Organizations of the Treadway Commission “Enterprise Risk Management - Integrated Framework” and ABNT standard NBR ISO 31.000 – Risk Management – Principles and Guidelines, the risk management process is divided into four categories: strategic, financial, operational and compliance. The key risks to which the Company is exposed are described in section 4.1 of the Reference Form.

To achieve our vision of being a global benchmark in the provision of sustainable, competitive and innovative sanitation services, focused on our customers, we reformulated our strategic guidelines. They are: water security, service excellence, sustainability, stakeholder engagement, innovation and technology, appreciation of people and expansion of the sewage treatment network. Our future objectives, according to these guidelines, will be to:

Ensure the availability of water in our area of operations and to continue expanding sewage collection and treatment

, using good, cost-effective technology, so as to contribute to the goal of universal availability and to provide quality services and products. Our aim is to maintain universal coverage in water supply, with high levels of quality and availability, with some 815,000 new water

connections by 2021. The Company also intends to raise sewage collection and coverage, with approximately 1.2 million new connections by the year 2021.

Improve the Company’s management

through the introduction of an ERP system expected to go live this year and a CRM system to replace the current commercial and management information systems. In addition, the project to improve the Company’s management model based on the Management Excellence Model (MEG) of Fundação Nacional da Qualidade (National Quality Foundation) was initiated at the end of 2016. The benefits expected from these projects include strengthening management, greater support in decision making, increased efficiency of internal processes and operations, and increased productivity.

Promote SABESP’s growth with economic and financial balance in an environmentally adequate and social justice

; and to apply the principles of financial growth and sustainability to the business, defining goals and responsibilities. One goal to be pursued is to give water its economic value by restructuring the tariff calculation model.

Encourage the creation, adoption and dissemination of solutions focusing on value creation

, seeking to enhance the management of assets and to continue to reduce water losses and operating costs. We can achieve this by investing in technological research and development and automation, integrated planning and improved processes. In 2016, SABESP invested approximately R$11.9 million in research, development and innovation, both with its own funds or funds raised through fund-raising entities or from third parties. To learn more, see the chapter “Expansion of Infrastructure and Recovery of Water Resources.”

Stimulate the growth of our professionals through opportunities and recognition,

increasing their job satisfaction and wellbeing, so as to maintain their commitment and productivity. To motivate, retain and attract people by providing opportunities for professional and personal development, continuous access to operational, technological and managerial knowledge applicable to the business

.

Balance of Targets

The year 2016 also reflected the realignment of the investments needed to tackle the water crisis, prioritizing actions that minimize its effects.

The collected sewage treatment index reached 79%, compared to the target of 86%. Although lower than the established target, the index achieved is higher than the index registered in 2015 (78%), tending towards the expansion of service provision.

The sewage collection index reached 87%, slightly below the target of 88% for the period, maintaining the progress in sewage collection service in relation to the previous year (86%).

The pace of implementation of new sewage connections was maintained, with 236.6 thousand new connections, a level very close to the proposed target (242 thousand connections), and which points to the resumption of the planned course, since it exceeds by ten thousand units the connections implemented in 2015. The target of 177 thousand new water connections for 2016 was exceeded, with 200.2 thousand new connections in the period.

With regard to the loss ratio, the end of the water crisis, which until the end of 2015 imposed the management of pressures in water distribution networks, led to an increase in indicators in 2016. This increase is expected to continue in the coming months, since the indicators are calculated using the annual volume moving average.

In 2016, the Company made progress in its strategic planning, completing the revision of its targets for the next five years. In this process, the collected sewage treatment indicator applied until December 2016, which considered the treated volume in relation to the volume of sewage collected, was replaced by the “Index of Economies Connected to Sewage Treatment”, which represents the connection of consumer units to sewage treatment.

Additionally, as of this year, SABESP will begin to disclose coverage and service indicators, considering the concession areas of the services or serviceable areas. A serviceable area is the urbanized area defined by mutual consent with the Municipal Governments for the provision of services. The coverage index represents the availability of the service with public water or sewage networks, and the service index represents the connection of the property to the public network.

The coverage index is calculated as the ratio of homes connected to the public supply or sewage collection networks, plus the homes for which these networks are already available but not yet connected, known as “feasible,” to the total homes existing in the area of provision of services contracted with the municipal governments (servable areas). Within this universe, the service index is calculated as the ratio of homes connected to the networks to the total homes of serviceable areas.

The principal changes regarding the indicators reported by SABESP until 2016 include the definition of the area that is considered the denominator of the calculation formula, whose classification was changed from “urban area,” as defined by the municipalities, to “serviceable area,” and the introduction of the coverage index. Additionally, the Company now uses the most recent demographic and home estimates released by the State Data Analysis System Foundation – Seade, for the period from 2010 to 2050.

The following table shows the Company’s achievements in 2016, based on the new set of indicators, and the targets for the period 2017-2021, to be supported by investments of R$13.9 billion. Further details on the planned investments can be seen in the Financial and Economic Management chapter

.

Achievements in 2016 and Targets for 2017-2021

|

|

Achieved

(1)

|

|

Targets

|

|

|

2016

|

2016

|

2017

|

2018

|

2019

|

2020

|

2021

|

|

Water supply service (%)

(1)

|

Tends toward universal coverage

|

-

|

Tends toward universal coverage

|

|

Sewage collection service (%)

(2)

|

82

|

-

|

83

|

84

|

85

|

86

|

87

|

|

Water supply coverage (%)

(3)

|

Tends toward universal coverage

|

-

|

Tends toward universal coverage

|

|

Sewage collection service (%)

|

89

|

-

|

90

|

91

|

91

|

92

|

93

|

|

Index of economies connected to sewage treatment (%)

|

74

|

-

|

75

|

76

|

77

|

80

|

83

|

|

New water connections (thousands)

|

200.2

|

172

|

185

|

168

|

164

|

155

|

143

|

|

New sewage connections (thousands)

|

236.6

|

242

|

200

|

226

|

235

|

240

|

234

|

|

Micro-measured water losses index (%)

|

31.8

|

28.4

|

31.7

|

31.3

|

30.6

|

29.9

|

29.3

|

(1)

95% or more

(2)

The value realized in 2016 presented herein was calculated in accordance with the new methodology, and it differs from the value presented in the Panel of Indicators.

(3)

98% or more

In addition, the Company defined some indicators that are in line with its organizational strategy, reflecting economic, social and environmental performance, and which are included in the Company’s Profit Sharing Program.

INFRASTRUCTURE AND PLANNING FOR THE FUTURE OF SUPPLY

The supply of water, though available to everyone, is a service that demands constant monitoring of demographic and geographic growth of the 367 cities in which SABESP operates. In 2016, the Company provided 200 thousand new connections.

This service aims at the constant expansion of the supply infrastructure, through the structuring of programs directed to the three regions served: the Metropolitan Region of São Paulo (RMSP), the Coastal region and the Interior of the State of São Paulo. At the same time, in regions such as the RMSP and the Coastal region, where the occurrence of irregular areas is high, and where the Company is legally prevented from acting, agreements with the judiciary and the municipal government have allowed for greater supply availability and guarantee of the rights of hundreds of families.

In the RMSP, after facing two years of the most serious water crisis ever recorded, the year 2016 was marked by a period of recovery of the main systems that supply the metropolitan region, where 67% of the population served by the Company are concentrated.

Although the natural contribution (inflow) to the sources was 88% of the historical average throughout 2016, the adoption of rational consumption habits acquired by the population during the water crisis contributed significantly to lower water withdrawal from the supply sources, consequently increasing inventories.

Per capita consumption in 2016 was 129 liters a day, 24% lower than the average of 169 liters per inhabitant/day registered in 2013, before the onset of the water crisis. Another factor likely to influence the decrease in consumption may be related to the Brazilian economic downturn, basically impacting the industrial and commercial sectors.

As a result, the average monthly production in 2016 for the RMSP was 58.5 m³/s. That is: 15% lower compared to the average 69.1 m³/s produced in 2013. In the years of crisis, the averages produced were 52.0 m³/s in 2015 and 62.2 m³/s in 2014.

In March 2016, due to the increase in rainfall and the predictability of the water level in the reservoirs, the Company requested the Sanitation and Energy Regulatory Agency of the State of São Paulo (ARSESP) to cancel the Program for Encouraging Reduction in Water Consumption and Contingency Tariff. ARSESP granted the request, and the Bonus Program and the Contingency Tariff

terminated in May 2016. Even with the end of the economic incentives, the population continued to save water.

In December 2016, the global reservoir index reached 1.2 trillion liters, or 77.6% of the total capacity, if the technical reserve is considered. In February 2017, with increased rainfall, the set of supply sources reached 1.5 trillion liters, surpassing the total volume reached in 2013.

Water intake from the Cantareira System is granted to SABESP by the ANA and the DAEE. The grant in force, renewed in 2004 for ten years, would expire in August 2014. However, due to the water crisis, it was extended to the end of October 2015 and, later on, until May 2017.

In February 2016, the Company was authorized by the National Water Agency (ANA) and the Department of Water and Electricity of the State of São Paulo (DAEE) to extract 23 m³/s from the Cantareira System, a significant increase when compared to 13.5 m³/s authorized during the majority of the months of 2015.

Over the year, the volume authorized to be extracted increased gradually, reaching 31 m³/s for the period between December 2016 and May 2017. Since the beginning of the crisis, the flow of water authorized to be extracted from the Cantareira System started to be granted in accordance with rainfall level, affluence of water, level of water supply sources and requests made by the Company. In February 2017, the ANA and the DAEE disclosed the base document to negotiate the granting that will be effective for the next ten years.

The recovery of water supply sources with the return of rain is no guarantee of a smooth future, given the possibility of new extreme climate events in a complex supply region as the RMSP.

In addition to being located in the spring region of the Alto Tietê basin, the RMSP records one of the highest population densities in the planet – more than 20 million people. The region has been suffering with intense and disorganized occupancy of soil for decades, including environmental protection areas, where the main water supply sources are located, a situation that further compromises the quantity and quality of the already low volume of water supply.

Given this complex scenario for urban supply, SABESP started “importing” water outside the Alto Tietê basin by means of the construction of the Cantareira System more than four decades ago and continues with the planning, execution of works and improvement of programs in order to increase water security in the region.

The robust infrastructure already installed, a result of structuring investments made in the 1995-2014 period by means of the Metropolitan Water Program – PMA, and the set of works and

emergency actions allowed, during 2014 and 2015, the transfer of flows between the production systems of more than 10m³/s.

Since the recent drought period, the new risk scenario imposed by the severe drought has demanded strategic repositioning from the Company in order to strengthen water security in the metropolis. Thus, the long-term planning conducted by SABESP started to take into account the effects of extreme climate events.

During 2016, the Company focused on preparing the Review and Update of the RMSP Master Plan for Water Supply, for a horizon of up to 2045. These reviews and updates occur, on average, at every five years, seeking adjustments as a result of population increase, rearrangement of the population distribution across the territory and consumption behavior of the population.

For this new planning, which is still being prepared, studies and projections of water availability from the production systems that are based on monthly historical series of natural flows of the period from January 1930 to December 2015 enable determining the joint behavior of the production systems in different risk scenarios.

As in the Cantareira System, the search for water at increasingly longer distances, at basis neighboring the Alto Tietê basin, is a reality to be tackled in the RMSP.

Initiated in April 2014, the

São Lourenço Production System

ended 2016 with more than half of the works already executed. It is expected to start operating in the first half of 2018. The new production system will have capacity to provide up to 6 m³/s of drinking water for up to two million people. However, as SABESP’s water supply system across the RMSP is integrated, the increased supply will indirectly benefit the entire population served in the metropolis.

The

interconnection of the Jaguarí – Atibainha dams

, which will connect the Paraíba do Sul basin to the Cantareira System, will allow the transfer of an average flow of 5.13 m³/s of raw water. Initiated in February 2016, it is expected to start assisted operation in the second half of 2017. The total investment contracted amounts to R$555 million.

At the estimated cost of R$170 million, the

transposition of water of the Itapanhaú River

, in the Serra do Mar mountain range, will allow the reversion of 2 m³/s on average from Ribeirão Sertãozinho (which forms the Itapanhaú River) to the Biritiba reservoir, which is part of the Alto Tietê Production System (SPAT). It is expected to be concluded in 2018

.

Metropolitan Water Program (PMA)

The three major works reported above complement the interventions undertaken during the 2014/2015 crisis and give sequence to the work of strengthening the metropolitan water infrastructure initiated in mid-90’s, with the Metropolitan Water Program, which is responsible for the regular supply in all regulated areas of the Great São Paulo region. One of the PMA highlights was the Alto Tietê public-private partnership (PPP), which, in 2011, increased the production of water of this system by 5 m³/s. Additionally, the PMA also enabled increased treatment capacity for the Guarapiranga, Rio Grande, Alto and Baixo Cotia systems. In 2016, the program demanded investments of R$410 million, in addition to the amounts invested by the São Lourenço PPP. This program is financed with own funds, as well as funds from Caixa Econômica Federal savings bank and the National Bank for Economic and Social Development.

Over the last decades, the water treatment capacity has outpaced the demand in the RMSP. Between 1995 and 2016, while the set of metropolitan urban population increased by nearly 29%, water production capacity increased by 32.5% (from 57.2 m³/s to the current 75.8 m³/s

).

Recovery of urban water supply sources

In order to assure the availability of drinking water, structural actions to increase water supply are complemented by initiatives focused on preserving water resources. Since 2009, SABESP, in partnership with the Municipal Government of the Capital City, has been developing the

Water Supply Sources Program

, which is focused on recovering two of the major dams of the Great São Paulo: Billings and Guarapiranga. The actions are funded by the Federal Government, the Government of the State of São Paulo, the Municipal Government and the World Bank. Thus, it has been possible to expand the sewage collection infrastructure and improve precarious allotments and housing complexes installed in sub-basin areas of the two water supply sources. In 2016, the amount invested was R$39 million.

Pró-Billings

is another program that has been expanding the sanitary sewage system, with the installation of an infrastructure that carries sewer from part of the inhabitants of the Billings basis for treatment. The interventions of this Program are funded by SABESP, JICA (Japan International Cooperation Agency) and BNDES. Due to the water crisis, the program did not advance sufficiently in 2016, but it is expected to gain momentum in 2017 as the works resume.

A third initiative within the scope of the actions taken to recover the metropolitan water supply sources arose with the implementation of the

Nossa Guarapiranga

(Our Guarapiranga) Program

, at the end of 2011. The Program is intended to improve the quality of the water in the dam by removing waste and macrophytes, which are water plants that block water catchment. In 2016, nearly 221 m³

of waste and 28 thousand m³ macrophytes were removed from the water supply source, favoring depollution of the water and multiple uses of the dam, which, in addition to being a source for public supply, is used for leisure, fishing and water sports practice purposes

.

Supply to the coastal area and interior of the State

After the RMSP, the

Metropolitan Region of Baixada Santista

(RMBS) is considered the most complex area for water supply. In addition to temperature peaks, during the summer, the region is also visited by a large number of tourists, overloading the supply system.

The increase in supply security in periods of high demand is based on the integration of supply systems, allowing better supply in some regions by transferring water from one city to another. Thus, the structure enables balancing the supply in accordance with the consumption needs of fixed and floating populations of approximately 3 million people.

Drawing on funds from SABESP and Caixa Econômica Federal, in 2016 the Company invested R$25 million in the region. Among other actions, the integrated system was reinforced by the beginning of operations of the Melvi Treated Water Reservation Center, located in Praia Grande, which increased from 20 million reserved liters to 45 million reserved liters. The structure is part of the Mambu-Branco production system, opened in 2013, in Itanhaém. As it is part of the integrated system, the structure increases water security in the nine municipalities of the RMBS.

SABESP is in charge of serving 329 municipalities in the interior of the State. In 2016, with the regularized supply in the majority of the areas served, the aim of the actions taken was to tackle non-recurring situations. Overall, the Company invested R$53 million in own funds and funds from Caixa Econômica Federal.

Fighting water loss

The major investments and actions to increase water security, including the search for water at increasingly longer distances, would have been in vain if the Company had not made efforts to reduce the water loss in its distribution network. In Brazil, only 63.3 out of 100 liters produced reach the end consumer, according to data from the 2015 SNIS. In São Paulo, this index of total losses has been gradually reduced over the last years in the cities served by SABESP – from 41% in 2004 to 31.8% in 2016, on average.

As a priority pursued for over two decades, this work gained momentum in 2009 with the implementation of the Corporate Waste Reduction Program executed with the technological

partnership of the JICA

. In force for eight years, R$3.3 billion (current amounts) have been invested in the program, of which R$505 million only in 2016.

Although the 31.8% losses for 2016 are at a level similar to those seen in 2012

1

, progress on this front is evident when we consider the physical loss ratio (leakages) of 20.8% in 2016, which is close to the figure for Barcelona (19%) and lower than in Chicago (24%) or London (28%).

Total losses are the sum of physical losses and apparent losses (billings), which account for the difference of 10% and are the result of the use of illegal connections, fraud and inaccurate measurement by water meters, for which the Company receives no payment.

In the other cities mentioned above, apparent losses are practically non-existent. It is also important to note that since this loss ratio is a percentage of production, it is affected by consumption and can be inaccurate. Since the start of the Program, the ratio was reduced from 34.1%, in 2008, to 31.8% in 2016, which means that total losses have been cut by 3.6m³/s.

Using own funds and funds from Caixa Econômica Federal and JICA, our target is to invest R$6.3 billion (current values) between 2009 and 2020, by which time we hope to reduce the ratio of physical losses in our area to 19.4% (target under review), a level similar to that of the United Kingdom.

Measures to prevent water theft

In 2016, SABESP uncovered some 26 thousand cases of theft of water in the RMSP and the Bragantina region (

located up north of the metropolitan region)

, representing the loss of approximately 3.8 billion liters, which would be enough to supply about 380 thousand people for a month.

If we compare 2016 with 2014, there was a significant rise in the number of cases of water theft: 66%. This increase is the result of more thorough inspections of properties where irregular water connections are suspected – last year our 70 anti-fraud teams carried out some 240 thousand inspections. An amount of R$35.3 million was recovered in 2016 from the frauds the teams found.

The great majority of these frauds were found in private homes. Tampering with water meters (54%) and clandestine connections (41%) were the main types of irregularity. We should emphasize, however, that fraud on commercial premises causes a much greater loss of water, because of the

type of consumption. The inspections are undertaken jointly with the State Public Security Department. In 2016, SABESP and the Civil Police carried out 35 joint operations, in cases where the culprits impede our inspectors, or when they sell the water obtained illegally to homes, traders and industries. 552 police reports were filed.

1

It should be noted that the reduction of water pressure in the networks was an essential measure to deal with the water crisis, and was responsible for a large part of the reduction in losses in the two-year period 2014-2015. In 2016, with the recovery of the water sources, the pressure was returned to normal so as to ensure improved supplies for the population. This adjustment resulted in the ratios returning to levels similar to those seen before the crisis broke.

Expansion of access in informal areas

SABESP has been taking steps to increase supplies to informal areas. Although we are prohibited by law from supplying communities of this sort, agreements entered into with the municipality and the courts has enabled us to provide access to water mains to more regions of Greater São Paulo. The aim is to provide good quality water to some 400 thousand people in approximately 160 thousand properties. As well as improving social and health conditions for low-income families, the work helps reduce losses from leakage because clandestine connections, using precariously installed hosepipes, are replaced by the SABESP network.

Rational use, education and reuse

Initiatives aimed at sustainability included measures for the efficient and responsible use of water, spreading the message that water resources are finite. The water crisis of 2014-2015 underlined the importance of these initiatives. Among these actions, we highlight the Rational Water Use Program – PURA, which promotes structural adjustments in public buildings in order to reduce losses and reinforce responsible consumption. The program was initiated 20 years ago, and by 2016 it had been implemented in 6,399 buildings throughout the state, including state schools, prisons and hospitals.

Technology for the reuse of waste treated in ETEs has been adopted by the most advanced systems worldwide. It is one of the most efficient ways of consuming water sustainably, and leads to major savings in the amount of raw water needed to be drawn from natural sources, and to a greater amount of treated water being available to supply the population. Aquapolo Ambiental, a project introduced at the end of 2012 under a partnership between SABESP and Odebrecht Ambiental, is the largest undertaking for the production of water for reuse by industry in South America, and the fifth largest in the world. The plant treats the waste generated in the ABC ETE.

Approximately one million cubic meters per month are supplied to companies in the Capuava Petrochemical Hub, in São Paulo’s ABC neighboring region, for use in cooling towers, steam generators and boilers and for other industrial purposes. We expect Aquapolo to reach peak production of 1 m³/s in the next few years. At the same time, SABESP produces water for reuse at the Barueri, Jesus Neto, Parque Novo Mundo and São Miguel ETEs to supply urban requirements, such as washing streets, yards and monuments, unblocking sewage pipes, and so on. In 2016 these four ETEs supplied approximately 1.7 million m³

.

Water quality

A guarantee that the water supplied to the population meets strict safety and potability standards is provided by 16 quality control laboratories, 14 of which have been certified for ISO 17.025 by the National Institute of Metrology, Quality and Technology (Inmetro). Located in various parts of the State, they carry out an average of 64 thousand analyses of samples taken from water at every stage from the source to the point of consumption. Basic control parameters include turbidity, color, chlorine content, coliforms and thermotolerant bacteria.

The results are sent to the Sanitary Surveillance departments of the municipalities served and are printed on customers’ water bills, in accordance with Federal Decree No. 5440/05. They are also emailed to the Ministry of Health each month. Customers are sent an annual summary of the analyses. The source, quantity and results of the samples are also available in summary form on the SABESP website.

There was technological progress in the quality analysis procedure in 2016, with X-rays being used for the first time to detect metals such as arsenic, cadmium, chromium, lead, silver, mercury and selenium in coagulants, and other products used to treat water, thus eliminating the risk of contamination. The test for identifying these metals is covered in Ministry of Health Ordinance No. 2.914, and SABESP already has this test in place using a different method. The new technology, however, represents a major advance. Called Total X-Ray Reflection Fluorescence (TXRF), it is more versatile, making the preparation of the samples easier and using equipment that is more sensitive to the presence of these elements.

EXPANSION OF INFRASTRUCTURE AND RECOVERY OF WATER RESOURCES

São Paulo is the state with the lowest percentage of people without adequate water supplies or sewage facilities

2

. This is due largely to the fact that SABESP has maintained its average level of investment in infrastructure.

According to a Report issued in February 2016 by the Ministry of Cities, SABESP accounted for 38% of the total resources used in sanitation by Brazilian state companies between 2011 and 2015.

Of total investment in sanitation in Brazil during the same period, SABESP was responsible for 28%

3

. After the two-year period 2014-2015, when our efforts and investments were concentrated on handling the water crisis, progress on works for expanding collection, removal and treatment in our area of operations resumed its normal rate. Of the R$3.9 billion invested by the Company during the year, R$1.2 billion was allocated to expanding the collection and sewage treatment infrastructure.

In 2016, the average sewage collection ratio in all the municipalities served by the Company was 87%, while 79% of the volume of sewage collected was treated. Although these ratios are not ideal, and there is much still to be done, they are significantly better than in most of the rest of the country, where only 58% of urban sewage is collected, and of this only 74% is properly treated. In round numbers, according to the Ministry of Cities, approximately 100 million Brazilians are without sewage collection.

Metropolitan Region of São Paulo (RMSP)

In view of its size and the complex challenges facing sanitation operations, the RMSP requires concentrated efforts to revitalize the Tietê river over time, and to improve the quality of life of the people who live in the metropolis.

This is the challenge facing the Tietê Project, Brazil’s largest environmental sanitation program, involving 34 municipalities in Greater São Paulo in the expansion and improvement of the system for collecting, transporting and treating sewage.

2

Atlas of Social Vulnerability in

Brazilian Municipalities

(2015).

Institute of Applied Economic Research

(Ipea)

3

“Diagnosis of Water and Sewage

Services”,

based on

data

from the National Information

System

on Sanitation

(SNIS) for 2015.

Starting in 1992, when 70% of sewage was collected and only 24% of that was treated, the Tietê Project is now in its third phase. The goal of collecting 87% of sewage has been reached. Simultaneously, the projects seek to increase the percentage of treatment of sewage collected from current 68% to 84% in RMSP.