Current Report Filing (8-k)

April 18 2017 - 1:27PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

and Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 5, 2017

CARDIFF INTERNATIONAL, INC.

(Exact name of Registrant as specified

in its charter)

|

Florida

|

000-49709

|

84-1044583

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No

.)

|

401 E. Las Olas Blvd. Suite 1400

Ft. Lauderdale, FL 33301

(Address of principal executive offices,

including zip code)

(844) 628-2100

(Registrant's telephone number, including

area code)

_________________________________________________________

(Former name or former address, if changed

since last report)

Check the appropriate box below if the 8-K filing is intended to

simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

|

|

o

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

o

|

re-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

|

Completion of Acquisition or Disposition of Assets, Change

in Directors

Item 2.01 Completion of Acquisition or Disposition of Assets

Cardiff International, Inc. (OTCQB: CDIF) and American Cycle

Finance (Private; “American Cycle”) today announced they have signed a definitive merger agreement under which American

Cycle will merge into Cardiff International as its subsidiary, American Cycle Finance, Inc., in an all-stock transaction valued

at approximately $5 million.

Cardiff’s total assets will increase to $15 million including

the $7 million in acquired American Cycle assets. This market expanding merger provides entry into attractive markets with strong

demographics includes 204 dealers throughout America. In 2016 American Cycle reported $6.5 million in original loans; a loan portfolio

of $7 million in assets; losses of less than 1.6%; revenue of $1.3 million.

American Cycle (formally, “Ride Today Acceptance, LLC”

was founded in January, 2015, in Beverly, Massachusetts.

American Cycle capitalizes on a unique and profitable financing

opportunity in the U.S. sub-prime motorcycle financing market. American Cycle has spent the last two years building a financial

infrastructure and expanding its dealer footprint. As of January 1st, 2017, American Cycle has 204 dealers nationwide. Unlike the

subprime auto industry, American Cycle provides customers two major advantages over a subprime auto loan: 1.) favorable payment

terms; 2.) assets with a slower depreciation rate.

In connection with the closing of the acquisitions, on the effective

date of the signed Forward Acquisition Agreement, a Preferred “K” Class of stock was established with a value of $0.25

per share ("American Cycle’s Preferred “K” Class Stock) as consideration. The Preferred “K”

Class of stock has a par value $0.001 per share. The preferred share was adjusted as a result of the authorization and declaration

of a special distribution to American Cycle’s stockholders at $0.25 per share with a conversion rate of 1 to 1.25 Common

Stock with a Lock-Up/Leak-Out provision limiting the sale of stock for 6 months after which conversions and sales are limited to

25% of their portfolio per year, pursuant to the terms of the Acquisition Agreement.

Pending the results of the independent audit, and unanimous

debtholder participation, CDIF will issue 9,607,840 shares of CDIF Preferred “K” Shares to American Cycle’s shareholders

as Stock Consideration as agreed to in the signed Forward Acquisition Agreement. Based on the price of CDIF’s Common stock

at $0.25 per share, the acquisition consideration represents an approximate value of $2,401,960. Upon completion of the independent

audit any changes will be announced in an amended 8K within the required 71 day period.

On April 5, 2017, CDIF’s Board of Directors approved retaining

current founders to serve as senior management of American Cycle.

There are no family relationships of our directors or executive

officers.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Cardiff International, Inc.

|

|

|

|

|

|

By:

/s/ Daniel Thompson

|

|

|

Daniel Thompson

|

|

|

Title:

Chairman

|

Dated: April 6, 2017

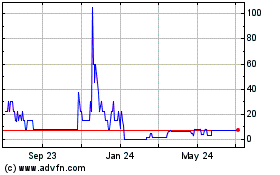

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

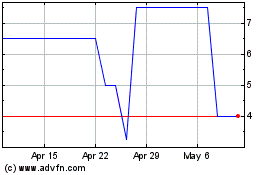

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Apr 2023 to Apr 2024