Wells Fargo Announces Support for PayPal Wallet for In-Store Transactions

April 18 2017 - 9:00AM

Business Wire

Millions of Wells Fargo customers to be

provided new seamless “tap and pay” digital payment capability

Wells Fargo & Company (NYSE:WFC) announced today that Wells

Fargo customers will soon be able to use PayPal (NASDAQ:PYPL) to

conveniently and securely make purchases with their mobile devices

at participating merchants whose payment terminals are set up to

accept near-field communication (NFC) payments. Currently, Wells

Fargo customers can pay for purchases online and on mobile at

millions of merchants where PayPal is accepted. This agreement will

leverage the companies’ collective mobile leadership, and allow

customers to use a Wells Fargo Debit or Credit Card to use PayPal

to make NFC payments using an Android phone.

“We’re looking to enable payments for our customers’

mobile-driven lives, and this upcoming capability allows us to

further engage the millions of Wells Fargo customers who use their

debit and credit cards on PayPal to seamlessly make mobile and

online, and now in-store, purchases,” said Jim Smith, head of

Virtual Channels. “New mobile payment experiences like the one we

announced today create unique value propositions for Wells Fargo

customers who use PayPal.”

Mobile banking is the fastest growing channel in Wells Fargo’s

history, with more than 20 million active customers. Android

customers are the most active, logging in an average of 16 sessions

per month.

“Wells Fargo is a financial services leader with a laser focus

on making customers’ commerce experiences secure and convenient,”

said Gary Marino, Chief Commercial Officer, PayPal. “We’re thrilled

to name them as a launch partner, and continue to collaborate on

the delivery of truly innovative mobile and digital payment

experiences that add value for our joint customers.”

Survey data from the Federal Reserve highlights the fact that

mobile devices are changing the way consumers make payments; 22

percent of all mobile phone owners reported having made a mobile

payment in the 12 months prior to the survey, up from 17 percent in

2013 and 15 percent in 2012. These statistics are reflected in the

growth of Wells Fargo’s fastest growing channel – mobile banking –

which is growing at twice the rate of its online channel.

“Our relationship with PayPal is broad and deep,” said Danny

Peltz, head of Treasury, Merchant and Payment Solutions. “From

processing their first international Automated Clearing House (ACH)

transaction, to providing them with Treasury solutions, our

partnership continues to deliver innovative payment solutions for

our customers.”

When a customer makes a payment with PayPal using their Wells

Fargo cards, all transactions are monitored with Wells Fargo risk

and fraud detection systems. Wells Fargo card purchases also are

protected by Zero Liability, which means customers are not

responsible for promptly reporting unauthorized transactions.

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a diversified,

community-based financial services company with $1.9 trillion in

assets. Founded in 1852 and headquartered in San Francisco, Wells

Fargo provides banking, insurance, investments, mortgage, and

consumer and commercial finance through more than 8,600 locations,

13,000 ATMs, the internet (wellsfargo.com) and mobile banking, and

has offices in 42 countries and territories to support customers

who conduct business in the global economy. With approximately

269,000 team members, Wells Fargo serves one in three households in

the United States. Wells Fargo & Company was ranked No. 27 on

Fortune’s 2016 rankings of America’s largest corporations. Wells

Fargo’s vision is to satisfy our customers’ financial needs and

help them succeed financially. News, insights and perspectives from

Wells Fargo are also available at Wells Fargo Stories.

About PayPal

Fueled by a fundamental belief that having access to financial

services creates opportunity, PayPal (Nasdaq: PYPL) is committed to

democratizing financial services and empowering people and

businesses to join and thrive in the global economy. Our open

digital payments platform gives PayPal's nearly 200 million active

account holders the confidence to connect and transact in new and

powerful ways, whether they are online, on a mobile device, in an

app, or in person. Through a combination of technological

innovation and strategic partnerships, PayPal creates better

ways to manage and move money, and offers choice and flexibility

when sending payments, paying or getting paid. Available in more

than 200 markets around the world, the PayPal platform, including

Braintree, Venmo and Xoom, enables consumers and merchants to

receive money in more than 100 currencies, withdraw funds in 56

currencies and hold balances in their PayPal accounts in 25

currencies. For more information on PayPal,

visit https://www.paypal.com/about. For PYPL financial

information, visit https://investor.PayPal-corp.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170418005565/en/

Wells Fargo & CompanyMediaJennifer Langan,

213-253-3452jennifer.l.langan@wellsfargo.comorHilary O’Byrne,

415-715-4958hilary.obyrne@wellsfargo.com

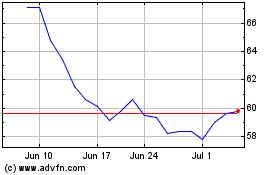

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

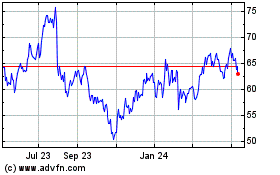

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Apr 2023 to Apr 2024