UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant

☑

Filed by a Party other than the Registrant

☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☑

|

|

Definitive Proxy Statement

|

|

☐

|

|

Definitive Additional Materials

|

|

☐

|

|

Soliciting Material Pursuant to §240.14a-12

|

REAL INDUSTRY, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

☑

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

DATED APRIL [1

7

], 2017

17 State Street, Suite 3811

New York, NY 10004

Dear Stockholder:

On behalf of the Board of Directors and senior management of Real Industry, Inc. (“we” or the “Company”), you are cordially invited to attend the 2017 Annual Meeting of Stockholders of the Company (the “Annual Meeting”), which will be held at the DoubleTree Cleveland East hotel located at 3663 Park East Drive, Beachwood, Ohio 44122, adjacent to the headquarter offices of our Real Alloy subsidiary, on May 18, 2017, beginning at 10:00 a.m. Eastern Time. The accompanying Notice of Annual Meeting of Stockholders and proxy statement are designed to answer your questions and provide you with important information regarding our Board of Directors and senior management, and provide you with information about the items of business that will be acted upon at the Annual Meeting.

During the past year, our Company underwent significant changes. At the corporate level, we appointed a new Chief Executive Officer, who has upgraded our executive leadership team, liquidated our Cosmedicine subsidiary, and lowered our cost structure. Our new leadership team continues to evaluate further M&A opportunities to unlock the value of our considerable tax assets.

At the Board level, in August 2016, we separated the positions of Chairman of the Board and Chief Executive Officer, and in April 2017, we have temporarily lowered Board compensation. We have revised our policy on director qualifications and have begun a process to expand the Board over time as we execute our corporate strategy. We are proposing a new Board nominee for election at the Annual Meeting.

A cyclical downturn in the second half of 2016 hurt the North American operations of Real Alloy, our principal operating subsidiary, even as our European operation maintained steady performance throughout the year. We are disappointed in our financial results for 2016. We worked hard for our stockholders and continue to do so. Despite this adversity, Real Alloy also completed its first acquisition under our ownership in November 2016 and entered into an expanded credit facility in March 2017. We discuss these developments, changes we have implemented to date and further plans for the future in a new section of this proxy statement, entitled “

Recent Developments

” at page [12], which we strongly encourage you to read.

Our Board of Directors has determined that the matters to be considered at the Annual Meeting are in the best interests of the Company and its stockholders. For the reasons set forth in the proxy statement, the Board of Directors strongly recommends that you vote (i) “

FOR

” each of the director nominees specified under Proposal 1; (ii) “

FOR

” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017 under Proposal 2; and (iii) “

FOR

” the approval of, on an advisory basis, the compensation of our named executive officers under Proposal 3. All of these proposals will be listed in the proxy card included with the enclosed proxy statement that you receive for the Annual Meeting.

As we have discussed in prior proxy statements, the Company has a Rights Plan that was implemented to protect our valuable tax assets – our federal net operating loss tax carryforwards (“NOLs”) – which currently exceed $900 million. In connection with the reincorporation of the Company in Delaware in 2014, our stockholders approved both the reincorporation of the Company and the adoption of the Company’s Rights Plan and other existing policies.

The Rights Plan expires in November 2017. Upon the expiration of the Rights Plan, in light of the value of our NOL assets and their significance to our corporate strategy, our Board of Directors will evaluate whether the Rights Plan should be extended or a new rights agreement should be negotiated. We intend to recommend any such new stockholder rights

plan, plan amendment or alternative protecti

on of our NOL assets at the Company’s 2018 annual meeting of stockholders for your vote.

If you are able to join us, we encourage you to attend the Annual Meeting in person. If you are unable to attend, it is important your shares be represented and voted at the Annual Meeting. We urge you to read the enclosed proxy statement and then sign, date and return the enclosed proxy card (or follow the instructions in the enclosed proxy card to vote by telephone or via the Internet) at your earliest convenience.

If you need assistance voting, please contact our proxy solicitor, Morrow Sodali, LLC (“Morrow Sodali”), by calling 800-662-5200. Banks and brokerage firms should call Morrow Sodali at 203-658-9400.

On behalf of the Board of Directors, we look forward to greeting in person as many of our stockholders as possible.

Sincerely,

William K. Hall

Chairman of the Board

April [17], 2017

17 State Street, Suite 3811

New York, NY 10004

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 18, 2017

The 2017 Annual Meeting of Stockholders of Real Industry, Inc. (the “Annual Meeting”), a Delaware corporation (“Real Industry” or the “Company”), will be held at the DoubleTree Cleveland East hotel located at 3663 Park East Drive, Beachwood, Ohio 44122, which is adjacent to the headquarter offices of our Real Alloy subsidiary, on May 18, 2017, beginning at 10:00 a.m. Eastern Time, for the following purposes:

|

|

1.

|

To elect the following seven directors to the Board of Directors, each to hold such office until the next annual meeting of stockholders or until a successor has been qualified and elected: Peter C.B. Bynoe, Patrick Deconinck, William Hall, Patrick E. Lamb, Raj Maheshwari, Joseph T. McIntosh and Kyle Ross;

|

|

|

2.

|

To ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017;

|

|

|

3.

|

To approve, by advisory vote, the compensation of our named executive officers, as described in the proxy statement accompanying this notice;

and

|

|

|

4.

|

To transact such other business as may properly come before the Annual Meeting, and any adjournment or postponement thereof.

|

Our Board of Directors recommends that you vote “

FOR

” the election of each of the director nominees; “

FOR

” the ratification of the selection of our independent registered public accounting firm; and “

FOR

” the approval, by advisory vote, of the compensation of our named executive officers.

Only stockholders of record at the close of business on April 12, 2017 (the “Record Date”) will be entitled to notice of, and to vote at, the Annual Meeting. Please vote in one of the following ways:

|

|

•

|

Vote by Telephone: You can vote your shares by telephone by calling the toll-free number indicated on your proxy card on a touch-tone telephone 24 hours a day. Easy-to-follow voice prompts enable you to vote your shares and confirm that your instructions have been properly recorded. If you are a beneficial owner, or you hold your shares in “street name,” please check your voting instruction card or contact your bank, broker or nominee to determine whether you will be able to vote by telephone.

|

|

|

•

|

Vote by Internet: You can also vote via the Internet by following the instructions on your proxy card. The website address for Internet voting is indicated on your proxy card. Internet voting is available 24 hours a day. If you are a beneficial owner, or you hold your shares in “street name,” please check your voting instruction card or contact your bank, broker or nominee to determine whether you will be able to vote via the Internet.

|

|

|

•

|

Vote by Mail: If you choose to vote by mail, complete, sign, date and return your proxy card in the postage-paid envelope provided. Please promptly mail your proxy card to ensure that it is received prior to the Annual Meeting.

|

Your vote is very important.

Whether or not you plan to attend the Annual Meeting, you are urged to read the enclosed proxy statement and then vote your proxy card promptly by telephone, via the Internet, or by completing, signing, dating and returning the enclosed proxy card in the postage-paid envelope provided. If you are the beneficial owner, or you hold your shares in “street name,” please follow the voting instructions provided by your bank, broker, or other nominee to direct them to vote your shares on your behalf.

If you decid

e to attend the Annual Meeting, you will be able to vote in person, even if you have previously submitted your proxy. However, in order to vote your shares in person at the Annual Meeting, you must be a stockholder of record on the Record Date or hold a le

gal proxy from your bank, broker or other holder of record permitting you to vote at the Annual Meeting.

If you have any questions or need assistance in voting your shares of Real Industry common stock, please contact our proxy solicitor Morrow Sodali, LLC (“Morrow Sodali”) by calling 800-662-5200. Banks and brokerage firms should call Morrow Sodali at 203-658-9400.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING TO BE HELD ON MAY 18, 2017

The proxy statement, the proxy card and related proxy materials for this Annual Meeting and Real Industry’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016 can be obtained free of charge at the Company’s website at

www.realindustryinc.com

, or at the Securities and Exchange Commission’s website at

https://www.sec.gov

.

Only the latest validly executed proxy that you submit will be counted. To obtain directions to the Annual Meeting, contact Morrow Sodali at 800-662-5200.

By Order of the Board of Directors,

Kelly G. Howard

Corporate Secretary

New York, NY

April [__], 2017

REAL INDUSTRY, INC.

17 State Street, Suite 3811

New York, NY 10004

PROXY STATEMENT

FOR THE 2017

annual meeting

OF STOCKHOLDERS

Our Board of Directors is soliciting proxies to be voted at our 2017 annual meeting of stockholders (the “Annual Meeting”) on May 18, 2017, at 10:00 a.m. Eastern Time, for the purposes set forth in the attached Notice of Annual Meeting of Stockholders (the “Notice”). This proxy statement and the proxies solicited hereby are being first sent or delivered to stockholders on or about April [20], 2017.

As used in this proxy statement, the terms “Real Industry,” “Company,” “we,” “us” and “our” refer to Real Industry, Inc., a Delaware corporation, and the terms “Board of Directors” and the “Board” refer to the Board of Directors of Real Industry.

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why did I receive these proxy materials from Real Industry?

The Board of Directors has made these materials available to you on the Internet or has delivered printed versions of these materials to you by mail in connection with the solicitation by the Board of Directors of proxies for use at the Annual Meeting, which will be held on May 18, 2017, at 10:00 a.m. Eastern Time, at the DoubleTree Cleveland East hotel located at 3663 Park East Drive, Beachwood, Ohio 44122, which is adjacent to the headquarter offices of our Real Alloy subsidiary. We made these materials available to stockholders beginning on or about April [17], 2017 on the Securities and Exchange Commission’s (“SEC” or the “Commission”) website,

https://www.sec.gov

, and the Company’s website,

www.realindustryinc.com

. We will begin mailing the proxy statement and the proxies solicited hereby to stockholders beginning on or about April [20], 2017. Our stockholders are invited to attend the Annual Meeting and are requested to vote on the proposals described in this proxy statement using the instructions on the proxy card.

Who is entitled to vote?

Stockholders who own shares of our common stock of record or beneficially at the close of business on April 12, 2017 (the “Record Date”) are entitled to vote on matters that come before the Annual Meeting. As of the Record Date, we had 29,800,022 shares of common stock outstanding and entitled to vote at the Annual Meeting. Each share of common stock is entitled to one vote.

What is included in these proxy materials?

These materials include:

|

|

•

|

This proxy statement; and

|

|

|

•

|

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, which includes our audited consolidated financial statements.

|

If you were mailed a full set of proxy materials or requested printed versions of these materials by mail, these materials also include the proxy card for the Annual Meeting.

What am I voting on at the Annual Meeting?

Stockholders will be voting on the following proposals at the Annual Meeting:

|

|

•

|

Proposal 1—the election of the following seven directors to serve until the next annual meeting of stockholders or until their successors have been qualified and elected: Peter C.B. Bynoe, Patrick Deconinck, William Hall, Patrick E. Lamb, Raj Maheshwari, Joseph McIntosh and Kyle Ross;

|

|

|

•

|

Proposal 2—the ratification of the selection of Ernst & Young LLP (“EY”) as our independent registered public accounting firm for the fiscal year ending December 31, 2017; and

|

|

|

•

|

Proposal 3—the approval, by advisory vote, of the compensation of our named executive officers as described in this proxy statement.

|

We may also transact such other business as may properly come before the Annual Meeting.

1

What constitutes a quorum for the Annual Meeting?

The presence of the owners of a majority of the shares eligible to vote at the Annual Meeting is required in order to hold the Annual Meeting and conduct business. Presence may be in person or by proxy. You will be considered part of the quorum if you voted by telephone, via the Internet or by properly submitting a proxy card or voting instruction form by mail, or if you are present and vote at the Annual Meeting. Under the General Corporation Law of the State of Delaware (the “DGCL”), at the Annual Meeting, both the shares associated with withheld votes, abstentions and broker non-votes will be counted as present and entitled to vote and therefore, will count for purposes of determining whether a quorum is present at the Annual Meeting.

How does the Board recommend that I vote?

The Board recommends that you vote your shares (i) “

FOR

” each of the director nominees specified under Proposal 1; (ii) “

FOR

” the ratification of the appointment of EY as our independent registered public accounting firm for the fiscal year ending December 31, 2017 under Proposal 2; and (iii) “

FOR

” approval, by advisory vote, of the compensation of our named executive officers under Proposal

3.

How do I vote for the Board’s recommended nominees and the various other proposals?

Only stockholders of record at the close of business on the Record Date will be entitled to notice of, and to vote at, the Annual Meeting. Please vote in one of the following ways:

|

|

•

|

Vote by Telephone: You can vote your shares by telephone by calling the toll-free number indicated on your proxy card on a touch-tone telephone 24 hours a day. Easy-to-follow voice prompts enable you to vote your shares and confirm that your instructions have been properly recorded. If you are a beneficial owner, or you hold your shares in “street name,” please check your voting instruction card or contact your bank, broker or nominee to determine whether you will be able to vote by telephone.

|

|

|

•

|

Vote by Internet: You can also vote via the Internet by following the instructions on your proxy card. The website address for Internet voting is indicated on your proxy card. Internet voting is available 24 hours a day. If you are a beneficial owner, or you hold your shares in “street name,” please check your voting instruction card or contact your bank, broker or nominee to determine whether you will be able to vote via the Internet.

|

|

|

•

|

Vote by Mail: If you choose to vote by mail, complete, sign, date and return your proxy card in the postage-paid envelope provided. Please promptly mail your proxy card to ensure that it is received prior to the Annual Meeting.

|

By submitting a proxy, you are legally authorizing another person to vote your shares on your behalf. We urge you to promptly vote your proxy “

FOR

” each of the Board’s nominees and the other proposals recommended by the Board by telephone, via the Internet, or by completing, signing, dating and returning the enclosed proxy card in the postage-paid envelope. If you vote your proxy by telephone, via the Internet, or submit your executed proxy card by mail, but you do not indicate how your shares are to be voted, then your shares will be voted in accordance with the Board’s recommendations set forth in this proxy statement.

What if I hold my shares in “street name”?

If you hold your shares in “street name,” through a bank, broker, nominee or other holder of record (

i.e.,

a “custodian”), your custodian is considered the stockholder of record for purposes of voting at the Annual Meeting. Your custodian is required to vote your shares on your behalf in accordance with your instructions. If you do not give instructions to your custodian, your custodian is permitted to vote your shares with respect to “routine” matters. The “routine” matters at the Annual Meeting are the ratification of the appointment of EY as our independent registered public accounting firm under Proposal 2. However, if you do not give instructions to your custodian, your custodian will

NOT

be permitted to vote your shares with respect to “non-routine” matters. Proposals 1 and 3 at the Annual Meeting are considered non-routine matters. Accordingly, if you do not give your custodian specific instructions on Proposals 1 or 3, then your shares will be treated as “broker non-votes” and will not be voted on the proposal(s) for which you did not provide instructions. When the vote is tabulated for any particular matter, broker non-votes, if any, will only be counted for purposes of determining whether a quorum is present. Accordingly, we urge you to promptly give instructions to your custodian to vote “

FOR

” each of the Board’s director nominees in Proposal 1, and “

FOR

” Proposals 2 and 3 by using the voting instruction card provided to you by your custodian. You will be given the option of voting by telephone, via the Internet, by mail or in person. Please note that if you intend to vote your street name shares in person at the Annual Meeting, you must provide a legal proxy from your custodian at the Annual Meeting.

2

What is required to approve each proposal?

|

|

•

|

Proposal 1: Directors are elected by a plurality of votes cast at the Annual Meeting. Therefore, the seven nominees who receive the most votes will be elected. Any shares not voted (whether by withheld vote, broker non-vote or otherwise) are not counted in determining the outcome of the election of directors. Stockholders may not cumulate votes.

|

|

|

•

|

Proposal 2: The ratification of EY as our independent registered public accounting firm for the fiscal year ending December 31, 2017 will be approved if the votes cast favoring the proposal exceed the votes cast opposing it. Any shares not voted (whether by abstention or otherwise) are not counted in determining the outcome of this proposal. The proposed amendment is a “routine” item upon which brokerage firms may vote in their discretion on behalf of their clients if such clients have not furnished voting instructions.

|

|

|

•

|

Proposal 3: The compensation of our named executive officers will be approved, by advisory vote, if the votes cast favoring the proposal exceeds the votes cast opposing it. Any shares not voted (whether by abstention, broker non-vote or otherwise) are not counted in determining the outcome of this proposal. However, because this vote is advisory, the outcome of this vote will not be binding on the Board. The Board will review and consider the voting results of this Proposal 3 in making future decisions regarding the compensation of the Company’s named executive officers.

|

Other Matters: Approval of any unscheduled matter, such as a matter incident to the conduct of the Annual Meeting, would require the affirmative vote of a majority of the votes cast. Any shares not voted (whether by abstention, broker non-vote, or otherwise) are not counted in determining the outcome of the vote.

Can I change my vote?

You can change your vote by revoking your proxy at any time before it is exercised at the Annual Meeting in one of four ways:

|

|

•

|

vote again by telephone or via the Internet;

|

|

|

•

|

complete, sign, date and return the enclosed proxy card with a later date before the Annual Meeting;

|

|

|

•

|

vote in person at the Annual Meeting; or

|

|

|

•

|

notify the Corporate Secretary, Kelly G. Howard, in writing before the Annual Meeting, with a date later than your submitted proxy, that you are revoking your proxy.

|

Only the latest validly executed proxy that you submit will be counted.

How can I attend the Annual Meeting?

You are invited to attend the Annual Meeting only if you were a stockholder as of the close of business on the Record Date or if you hold a valid proxy for the Annual Meeting. In addition, if you are a stockholder of record (owning shares of common stock in your own name), prior to your being admitted to the Annual Meeting, your name will be verified against a list of registered stockholders on the Record Date. If you are not a stockholder of record but hold shares through a bank, broker or nominee (in “street name”), you must provide proof of beneficial ownership on the Record Date, such as a recent account statement or a copy of the voting instruction card provided by your bank, broker or nominee. Both record and beneficial stockholders should bring photo identification for entrance to the Annual Meeting.

Why did I receive only one set of proxy materials although there are multiple stockholders at my address?

If one address is shared by two or more stockholders, companies and intermediaries (such as brokers) are permitted to use a delivery practice called “householding,” pursuant to which only one set of proxy materials is sent to that address but a separate proxy card is included for each stockholder. This reduces printing and postage costs. Once you have received notice from the Company or your broker that it will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you provide contrary instructions. If you share an address with another stockholder and have received only one set of voting materials, you may write or call us to request a separate copy of these materials at no cost to you. Similarly, if you share an address with another stockholder and have received multiple copies of our proxy materials, you may write or call us to request future delivery of a single copy of these materials. The address and telephone number of the Company is: ATTN: Corporate Secretary, Real Industry, Inc., 17 State Street, Suite 3811, New York, NY 10004, (805) 435-1255. If you are a beneficial owner of shares held in “street name,” you can request or cancel “householding” by contacting your bank, broker, or nominee.

3

Where can I find the voting results of the Annual Meeting?

We intend to announce preliminary voting results at the Annual Meeting and will publish final results in a Form 8-K after the Annual Meeting.

What is the deadline for submitting proposals for next year’s annual meeting or to nominate individuals to serve as directors?

You may submit proposals, including director nominations, for consideration at future stockholder meetings only if you comply with the requirements of the proxy rules established by the SEC and our Third Amended and Restated Bylaws.

Stockholders who wish to submit proposals for inclusion in the Company’s proxy statement for the 2018 annual meeting of stockholders, pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), must submit their proposals so that they are received at our principal executive offices no later than the close of business on December [21], 2017, which is 120 calendar days prior to the anniversary of this year’s proxy mailing date. A stockholder who wishes to submit a proposal under Rule 14a-8 must qualify as an “eligible” stockholder and meet other requirements of the SEC.

Pursuant to the Company’s Third Amended and Restated Bylaws, if a stockholder wishes to submit a proposal that is not intended to be included in our proxy statement under Rule 14a-8 of the Exchange Act, or wishes to nominate an individual for election to the Board, the stockholder must provide timely notice to the Company. To be timely, the stockholder proposal or nomination must be mailed and received by, or delivered to, the Corporate Secretary of the Company not later than February 17, 2018 or, if the date of the 2018 annual meeting of stockholders is more than 30 days earlier or later than May 18, 2018, then not later than ten days following the date that notice of the 2018 annual meeting of stockholders is first given. To be in proper form, a stockholder’s notice must include the specified information concerning the proposal as described in the Third Amended and Restated Bylaws. A copy of the Third Amended and Restated Bylaws may be obtained from the Corporate Secretary by written request, and also is available on our corporate website at

www.realindustryinc.com

.

Nominations for director candidates for consideration by the Board’s Nominating and Governance Committee should include the information specified in our Third Amended and Restated Bylaws, which includes, among other matters, as to each person whom the stockholder proposes to nominate: (A) the name, age, business address and residence address of the person; (B) the principal occupation or employment of the person; (C) the class or series and number of shares of capital stock of the Company that are owned beneficially or of record by the person; and (D) any other information relating to the person that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for the election of directors pursuant to Section 14 of the Exchange Act, and the rules and regulations promulgated thereunder.

Stockholder proposals and nominations must be in writing and should be directed to our Corporate Secretary at our principal executive offices: Real Industry, Inc., 17 State Street, Suite 3811, New York, NY 10004.

How may I communicate with the Board of Directors or the independent directors on the Board?

You may contact any member of the Board of Directors by writing to the member c/o Real Industry, Inc., 17 State Street, Suite 3811, New York, NY 10004. Board members may also be contacted via email through investor relations at

investor.relations@realindustryinc.com

. Each communication should specify the applicable director or directors to be contacted as well as the general topic of the communication. Our Corporate Secretary will be primarily responsible for collecting, organizing and monitoring communications from stockholders and forwarding such communications to the intended recipients where appropriate. We generally will not forward to the directors a stockholder communication that is determined to be primarily commercial in nature, that relates to an improper or irrelevant topic, or that requests general information about Real Industry. Concerns about accounting or auditing matters or communications intended for independent directors should be sent to the attention of the Chair of the Audit Committee at

investor.relations@realindustryinc.com

. Our directors may at any time review a log of all correspondence received by Real Industry that is addressed to the independent members of the Board and request copies of any such correspondence.

4

Whom do I contact with additional questions?

We have retained Morrow Sodali to act as proxy solicitor. If you have additional questions or need assistance voting your shares of common stock, you should contact them at:

470 West Avenue

Stamford, Connecticut 06902

Stockholders Call Toll Free: (800) 662-5200

Banks and Brokers Call Collect: (203) 658-9400

5

PROPOSAL 1: ELECTION OF DIRECTORS

Seven directors are to be elected at the Annual Meeting. All directors are elected annually and hold office until the next annual meeting of stockholders, and until their successors are duly qualified and elected, or until their earlier death, resignation or removal.

The Nominating and Governance Committee has recommended and our Board of Directors has selected, qualified and approved the following persons as nominees for election at the Annual Meeting: Peter C.B. Bynoe, Patrick Deconinck, William Hall, Patrick E. Lamb, Raj Maheshwari, Joseph T. McIntosh and Kyle Ross. Each of Messrs. Bynoe, Deconinck, Hall, Lamb, Maheshwari and Ross currently serves on the Board, and (excluding Mr. Ross) was elected by the Company’s stockholders at the last annual meeting. Mr. Ross was appointed to the Board upon his appointment as the Company’s Chief Executive Officer on April 5, 2017.

Each nominee for election has consented to be nominated, named as a nominee in this proxy statement and to serve if elected, and we do not know of any reason why any nominee would be unable to serve as a director.

If any nominee is unable to serve, the shares represented by all valid proxies will be voted for the election of such other person as the Board may nominate. The proxies solicited by this proxy statement may not be voted for more than seven nominees.

The Board recommends that you use the enclosed proxy card (or follow the directions set forth in the proxy card to vote by telephone or via the Internet) to vote “

FOR

” each of the Board’s seven director nominees.

Background Information on Director Nominees

Set forth below is certain information, as of April 12, 2017, regarding each director nominee, including information regarding the experience, qualifications, attributes or skills of each nominee and a statement of why the Board determined that the person should serve on the Board.

Peter C.B. Bynoe

(Age 66): Mr. Bynoe has served as a director of Real Industry since July 2013, and currently serves as Chairman of the Compensation Committee and as a member of the Audit Committee. Mr. Bynoe is currently a Managing Director of Equity Group Investments, a private equity firm based in Chicago, Illinois, where he has served since October 2014. From September 2013 to October 2014, Mr. Bynoe served as the Chief Executive Officer of Rewards Network, Inc., a provider of credit card loyalty and rewards programs. Prior to Rewards Network, Mr. Bynoe served, from January 2009 to August 2013, as a partner and Chief Operating Officer of Loop Capital LLC, a full-service investment banking firm based in Chicago. He joined Loop Capital as a Managing Director in February 2008. As Chief Operating Officer, Mr. Bynoe oversaw the firm’s mergers and acquisitions practice in the utility and power sector. Mr. Bynoe also served from January 2009 to December 2016 as a Senior Counsel in the Chicago office of the international law firm DLA Piper US LLP. From March 1995 until December 2007, Mr. Bynoe was a senior Partner at DLA Piper US LLP and served on its Executive Committee. Mr. Bynoe has also been a principal of Telemat Ltd., a consulting and project management firm, since 1982. Since 2004, Mr. Bynoe has been a director of Covanta Holding Corporation (“Covanta”) (NYSE: CVA), an internationally recognized owner of energy-from-waste and power generation projects, and he presently serves on Covanta’s Nominating and Governance Committee and as chairman of its Compensation Committee. Since 2007, Mr. Bynoe has been a director of Frontier Communications Corporation (formerly known as Citizens Communication Corporation) (NASDAQ: FTR), a telephone, television and internet service provider, where he serves as the chairman of its Nominating and Governance Committee and as a member of its Compensation Committee, and he was formerly a director of Rewards Network Inc. from 2003 to May 2008. Mr. Bynoe served as the Executive Director of the Illinois Sports Facilities Authority, a joint venture of the City of Chicago and State of Illinois created to develop the new Comiskey Park for the Chicago White Sox and was Managing General Partner of the National Basketball Association’s Denver Nuggets. Mr. Bynoe also served as a consultant to the Atlanta Fulton County Recreation Authority and the Atlanta Committee to Organize the Olympic Games in preparation for the 1996 Summer Olympic Games. Mr. Bynoe holds Juris Doctor, Master of Business Administration and Bachelor of Arts degrees from Harvard University and is a member of the Illinois Bar and a registered real estate broker.

The Board will benefit from Mr. Bynoe’s extensive legal and financial expertise, his background in infrastructure projects, his public sector service and his extensive knowledge of public policy issues. Mr. Bynoe’s service as a board member for other public and private companies will also enable him to provide valuable insight and perspective on governance matters, mergers and acquisitions activity and the utilization of net operating loss carryforwards, a strategy effectively implemented by Covanta during the period that Mr. Bynoe served on the Covanta board of directors.

6

Patrick Deconinck

(Age 63): Mr. Deconinck has served as a director of Real Industry since May 2015, and currently serves as the Chairman of the Operations Committee, and as a me

mber of the Compensation Committee. Mr. Deconinck retired from the 3M Company (“3M”) in February 2015, after 38 years of service. Most recently, he served as 3M’s Senior Vice President-West Europe from 2011 to February 2015, with overall responsibility for

3M’s West Europe business. 3M’s West Europe business accounted for approximately 20% of 3M’s total revenues and Mr. Deconinck oversaw approximately 16,000 employees in 16 countries. During this period, Mr. Deconinck orchestrated the restructuring of 3M’s

European supply chain organization. From 2005 to 2011, Mr. Deconinck was Vice President and General Manager of 3M’s Industrial Adhesives & Tapes Division where he provided global leadership for 3M’s largest operating unit. Mr. Deconinck holds an Acceptance

degree in Applied Sciences from Catholic University of Leuven (Belgium) and is fluent in English, Flemish, French and German.

The Board will benefit from Mr. Deconinck’s global executive experience, including leadership positions in the United States and Europe, and responsibility for global profitability. Mr. Deconinck has a record of setting strategic direction and driving operational execution to deliver quarterly and annual targets, including growth through organic innovation, mergers and acquisitions integration, and Lean Six Sigma driven operational excellence.

William Hall

(Age 73): Mr. Hall has served as a director of Real Industry since May 2015, and currently serves on both the Operations Committee and Compensation Committee. Mr. Hall became our Chairman of the Board in August 2016. Mr. Hall has served as the General Partner of Procyon Advisors LLP, a Chicago-based private equity firm providing consulting and growth capital for healthcare services companies, since 2006 following the sale of Procyon Technologies, Inc. (“Procyon Technologies”). Mr. Hall has over thirty years of senior operating executive experience at Procyon Technologies (aerospace actuation components), Eagle Industries (capital goods), Fruit of the Loom (consumer goods) (NYSE: FOL), Cummins Inc. (industrial power equipment) (NYSE:CMI), and Falcon Building Products, Inc. (specialty building products) (NYSE: FBP) where Mr. Hall, as Chief Executive Officer, completed an initial public offering and later completed a leveraged buyout to take the company private.

Mr. Hall is currently a member of the board of directors of Stericycle, Inc. (NASDAQ: SRCL) and serves as the chairman of its Compensation Committee and formerly served as a member of its Audit Committee. From 2002 to April 2016, Mr. Hall served as a member of the board of directors of W. W. Grainger, Inc. (NYSE: GWW), serving, most recently, on both its Audit Committee as a financial expert, and its Governance Committee. Mr. Hall has previously served as a member of the board of directors of Actuant Corporation (NYSE: ATU), serving on both its Audit and Governance Committees.

Mr. Hall volunteers as an Adjunct Professor of graduate and undergraduate courses in entrepreneurial leadership of the College of Engineering and the Ross School of Business at the University of Michigan. Mr. Hall also serves as a member of the Executive Committee at the Rush University Medical Center in Chicago and as an advisory board member at the Depression Center, the Zell Lurie Institute and the Center for Entrepreneurial Leadership at the University of Michigan. During the 1970s, Mr. Hall served as a professor at the University of Michigan, the European Institute of Business Administration and the Harvard Business School. Mr. Hall holds degrees in aeronautical engineering (B.S.E.), mathematical statistics (M.S.) and business administration (M.B.A. and Ph.D.), all from the University of Michigan.

The Board will benefit from Mr. Hall’s extensive operational management, broad industrial background, capital raising and merger and acquisition experience, and financial expertise. Mr. Hall’s service as a board member for other public and private companies will also enable him to provide valuable insight and perspective on governance matters, mergers and acquisitions activity and global business initiatives.

7

Patrick E. Lamb

(Age 57): Mr. Lamb has served as a director of Real Industry since April 2011, and currently serves as the Chairman of the Audit Committee, and a member of both the Nominating and Governance

Committee and the Operations Committee. Mr. Lamb has over twenty

-five

years of chief financial officer experience in various public, public subsidiary and private entities, specifically in the financial services industry, including banking, commercial fina

nce, commercial and residential real estate, debt and equity capital markets, and insurance. He also has experience in mergers, divestitures and acquisitions, financing and securitization structures and public accounting, as well as marketing and informati

on technology. Most recently, Mr. Lamb served as the Chief Financial Officer for the Los Angeles Clippers of the National Basketball Association from July 2007 until January 2015. From 2004 to July 2007, Mr. Lamb served as the Senior Vice President, Treasu

rer, Chief Financial Officer and Chief Accounting Officer of Fremont General Corporation (“Fremont”). Prior to that, Mr. Lamb served as Vice President-Finance for Fremont and as the Chief Financial Officer of Fremont Financial Corporation, a subsidiary of

Fremont. Before joining Fremont, Mr. Lamb worked at Ernst & Whinney (now Ernst & Young), serving primarily the financial services industries in various audit and consulting engagements. Mr. Lamb holds Bachelor of Science and Master in Accountancy degrees f

rom the Marriott School of Management at Brigham Young University. Mr. Lamb also serves on two advisory boards for the Marriott School of Management at Brigham Young University and is also involved in various community and educational organizations.

The Board will benefit from Mr. Lamb’s considerable experience as a chief financial officer for over twenty years as well as his valuable insight into management on a multitude of strategic, governance, regulatory, compliance, public policy and operating issues.

Raj Maheshwari

(Age 54): Mr. Maheshwari has served as a director of Real Industry since July 2013, and currently serves as a member of both the Audit Committee and the Nominating and Governance Committee. Since 2005, Mr. Maheshwari has been Managing Director of Charlestown Capital Advisors, LLC, a private merchant banking company specializing in financial advisory/merchant banking services (including mergers and acquisitions advisory) to public and private market emerging companies. Mr. Maheshwari, at Charlestown Capital, has advised on numerous merger and acquisition transactions in the steel industry. In 2011, Charlestown Capital led the successful reorganization of Meruelo Maddux Properties (subsequently renamed EVOQ Properties), a commercial real estate company based in Los Angeles under Chapter 11 of the U.S. Bankruptcy Code. Other clients have included Esmark, Inc., Akela Pharmaceuticals, LTS Lohmann, Artevea Digital, among other emerging companies, in their mergers and acquisitions activities. From 1999 to 2005, Mr. Maheshwari was a Portfolio Manager and Managing Director at Weiss Peck and Greer Investments and its successor parent company Robeco Investment Management. From 1996 to 1999, Mr. Maheshwari was a Vice President of Research at Robert Fleming, Inc., where he helped run a $250 million (approximately) equity arbitrage portfolio. Mr. Maheshwari holds a Bachelor of Science degree in Mathematics and Computer Sciences from the State University of New York at Albany and a Master of Business Administration degree from New York University.

The Board will benefit from Mr. Maheshwari’s considerable investing experience in both public and private securities, as well as expertise in identifying and closing value enhancing strategic transactions and in capital allocation analyses of growth opportunities.

Joseph T. McIntosh

(Age 47): Mr. McIntosh has served as a Managing Director with Equity Group Investments since January 2017, where he focuses on sourcing, evaluating and executing new investments, as well as monitoring and advising on existing investments. Prior to joining EGI, Mr. McIntosh served as Vice Chairman of Consumer and Retail Investment Banking Coverage and Managing Director in the Investment Banking Division of Deutsche Bank Securities since September 2014. Mr. McIntosh was a Managing Director in the Corporate and Investment Banking division of Bank of America from 2009 to September 2014, which he joined in 2009 as a result of Bank of America’s acquisition of Merrill Lynch, where he worked since 1997. Over the years, Mr. McIntosh has advised on a number of M&A and financing transactions for numerous Fortune 500 companies. Mr. McIntosh received his Juris Doctorate from Northwestern University School of Law and a Bachelor of Business Administration degree in Accounting from the University of Iowa.

The Board will benefit from Mr. McIntosh’s over twenty years of experience in investment banking, including his hands-on transactional and investment identification, structuring, and advising, work experiences. Mr. McIntosh has a lengthy and distinguished deal record, working on all sides of transactions and investments and advising public company boards on such activities. Further, Mr. McIntosh qualifies as an audit committee financial expert.

8

Kyle Ross

(Ag

e 40): Mr. Ross has served as the Company’s Chief Executive Officer since April 5, 2017. From August 2016 to April 2017, Mr. Ross served as the Company’s President, Interim Chief Executive Officer and Chief Investment Officer. Previously, Mr. Ross served a

s the Chief Financial Officer of Real Industry from March 2011 until August 2016, and as Secretary of Real Industry from May 2015 until December 2016. Mr. Ross was part of the management team that sponsored Fremont General Corporation’s (“Fremont”), a pred

ecessor to our Company, reorganization process and emergence from bankruptcy. Prior to participating in the Fremont bankruptcy, Mr. Ross was a co-founder of Signature Capital Partners, LLC, a special situations investment firm formed in 2004. Mr. Ross was

directly involved in all of Signature Capital’s investment activity, including playing active roles in structuring, underwriting, overseeing portfolio companies, and managing the exit of transactions. Mr. Ross began his career as an investment banker where

he was directly involved in more than 20 transactions, including both healthy and distressed mergers and acquisitions, capital raises, and debt restructurings. He was also responsible for managing the firm’s analyst and associate staff. Mr. Ross holds a B

achelor of Science degree and a Bachelor of Arts degree from the Haas School of Business and the College of Letters and Science, respectively, at the University of California, Berkeley.

The Board will benefit from Mr. Ross’s strategic, transactional and investment banking experience, his deep understanding of the Company’s business, assets and opportunities, as well as his focus on communicating with our stockholders.

Director Nominee Qualifications and Attributes

The following table identifies the areas of expertise, experience, qualifications, skills or attributes that the Nominating and Governance Committee of the Board reviews for each potential director nominee. Further, the table below provides the Board’s assessment of the qualifications of each of the Board members standing for re-election, as well as Mr. McIntosh as a nominee, which led to the Board’s conclusion that such individual should be named as a nominee. This information supplements the biographical information provided above.

|

Experience, Qualification, Skill, or Attribute

|

|

Bynoe

|

|

Deconinck

|

|

Hall

|

|

Lamb

|

|

Maheshwari

|

|

McIntosh

|

|

Ross

|

|

Professional standing in chosen field

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

Mergers and acquisitions

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

Audit Committee financial expert (actual or potential)

|

|

X

|

|

|

|

X

|

|

X

|

|

|

|

X

|

|

|

|

Public company experience (current or past)

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

Leadership and team building skills

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

Specific skills/knowledge:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

Income taxes

|

|

|

|

|

|

|

|

X

|

|

|

|

X

|

|

X

|

|

Operations

|

|

X

|

|

X

|

|

X

|

|

X

|

|

|

|

|

|

X

|

|

Integration of acquisitions

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

Public affairs

|

|

X

|

|

X

|

|

X

|

|

X

|

|

|

|

X

|

|

|

|

Human resources

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

|

|

Governance

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

Stockholder

|

|

X

|

|

X

|

|

X

|

|

X

|

|

X

|

|

|

|

X

|

Vote Required

The seven candidates receiving the highest number of affirmative votes will be elected as our directors. Shares associated with withhold votes and broker non-votes will not be counted as votes cast and, therefore, will not have an effect on this proposal. Further, the failure to vote, either by proxy or in person, will not have an effect on this proposal, assuming the quorum requirements for the Annual Meeting have been met. Unless instructions to the contrary are specified, the proxy holders will vote the proxies received by them “

FOR

” the nominees listed above.

Recommendation of the Board of Directors

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE SEVEN DIRECTOR NOMINEES LISTED ABOVE.

9

PROPOSAL 2: RATIFY THE

SELECTION OF OUR

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Company’s independent auditor for the year ended December 31, 2016 was Ernst & Young LLP , an independent registered public accounting firm. The Audit Committee and the Board have selected EY as the independent registered public accounting firm to audit the financial statements of the Company for the fiscal year ending December 31, 2017. The Board is submitting the appointment of EY to the stockholders for ratification as a matter of good corporate governance.

In the event that the stockholders fail to ratify the appointment of EY, the Audit Committee will reconsider its selection of audit firms, but may decide not to change its selection. Even if the appointment is ratified, the Audit Committee may appoint a different independent registered public accounting firm at any time if it determines that such a change would be in the best interest of the Company’s stockholders.

A representative of EY is expected to attend the Annual Meeting, and that representative will have an opportunity to make a statement if he or she desires to do so and is expected to be available to respond to appropriate questions from stockholders.

Please see “

Audit Information

” for a discussion of the fees paid by the Company to EY, for the fiscal years ended December 31, 2016 and 2015.

Vote Required

This proposal will be approved if the votes cast for the proposal exceed the votes cast against it. Shares associated with abstentions will not be counted as votes cast and, therefore, will not have an effect on this proposal. Further, the failure to vote, either by proxy or in person, will not have an effect on this proposal, assuming the quorum requirements for the Annual Meeting have been met. Unless instructions to the contrary are specified, the proxy holders will vote the proxies received by them “

FOR

” this proposal.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE RATIFICATION OF THE SELECTION OF EY AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2017.

10

PROPOSAL 3: ADVISORY VOTE REGARDING EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act added Section 14A to the Exchange Act, which requires that we provide stockholders with the opportunity to vote to approve, on an advisory basis, the compensation of our named executive officers. Commonly known as a “say-on-pay” vote, this proposal gives our stockholders the opportunity to express their views on our executive compensation policies and programs and the compensation paid to the named executive officers.

The Company’s current policy, upon the recommendation of our stockholders, is to provide stockholders with an opportunity to approve, on an advisory basis, the compensation of the named executive officers each year at the annual meeting of stockholders. Therefore, it is expected that the next such vote will occur at the 2018 annual meeting of stockholders.

In the Compensation Discussion and Analysis (“CD&A”) section of this proxy statement, we describe how the Company, the Compensation Committee and the Board view basic compensation, bonus, equity opportunities and goals of our named executive officers. We are asking our stockholders to indicate their support for the compensation of our named executive officers as described in this proxy statement by approving the following resolution at the Annual Meeting:

“RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation paid to the named executive officers, as disclosed in the Company’s proxy statement for the 2017 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation tables and accompanying narrative disclosure.”

The Board of Directors recommends a vote “

FOR

” approval of the advisory resolution because it believes that the Company’s executive compensation policies and practices are effective in achieving the Company’s goals of rewarding sustained financial and operating performance, aligning the executives’ interests with those of the stockholders, and attracting, retaining, motivating and rewarding highly talented executives. We strongly encourage stockholders to read “

Executive Officers

,” “

Executive Compensation

,” “

Compensation Committee

,” “

Recent Developments

” and the CD&A sections of this proxy statement, including the tabular and narrative disclosures regarding executive compensation, for details about our executive compensation policies and programs and information about the 2016 compensation of our named executive officers and changes implemented for 2017.

The vote on this proposal is advisory and therefore not binding on the Company, the Board of Directors or the Compensation Committee. However, the Board of Directors and the Compensation Committee will review and consider the voting results in future decisions regarding executive compensation.

Vote Required

This proposal will be approved if the votes cast for the proposal exceed the votes cast against it. Shares associated with abstentions and broker non-votes will not be counted as votes cast and, therefore, will not have an effect on this proposal. Further, the failure to vote, either by proxy or in person, will not have an effect on this proposal, assuming the quorum requirements for the Annual Meeting have been met. Unless instructions to the contrary are specified, the proxy holders will vote the proxies received by them “

FOR

” this proposal.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ADVISORY RESOLUTION APPROVING THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT.

11

RECENT DEVELOPMENTS

Overview

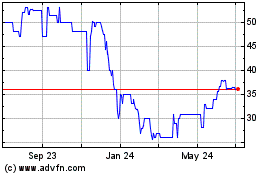

Our Annual Report on Form 10-K for the year ended December 31, 2016 details the financial performance and operating results for both the Company and Real Alloy. As previously reported, Real Alloy experienced a decline in financial performance driven primarily by lower volumes and tighter scrap spreads in its Real Alloy North America (“RANA”) segment, while its Real Alloy Europe (“RAEU”) segment delivered consistent performance from a Segment Adjusted EBITDA perspective on a comparable twelve month basis. To date, the indicators suggest another solid financial performance for RAEU this year.

We partially offset the financial impact of the cyclical decline in RANA through productivity gains, reductions of selling, general and administrative (“SG&A”) expenses at the corporate and subsidiary level, and a series of plant level reductions in operating costs and capital expenditures. Despite these efforts, lower volumes and tighter scrap spreads resulted in RANA’s lowest Segment Adjusted EBITDA over a six month period (quarters three and four) since 2009. In contrast, RAEU, which sells more prime-based alloys than RANA, experienced quite different market dynamics during the second half of the year and even though volumes were lower due in part to its customers taking a longer holiday season compared to 2015, the segment delivered its highest Segment Adjusted EBITDA performance in five years. RAEU also benefitted from a favorable product mix and consistent flow of scrap at stable margins. Ultimately, RANA’s results in 2016 led to a noncash $61.8 million goodwill impairment charge, which was a significant factor in our reporting a net loss of $102.6 million for the year. Initial indicators for RANA’s business in 2017, however, show improved performance compared to the second half of 2016 due to positive developments in the pricing environment, as well as our cost reduction and other focused operational measures.

For a reconciliation of Segment Adjusted EBITDA and net loss, the most directly comparable measure under GAAP, please see “

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures

” in our Annual Report on Form 10-K for the year ended December 31, 2016.As detailed below, we have strengthened our corporate leadership team and internal resources, streamlined and downsized our corporate structure. We believe these changes will allow us to operate our business more efficiently, while positioning the Company for improved financial performance.

We are also engaged in additional communications with our stockholders and business partners, including current and potential financing sources, suppliers, customers and credit rating agencies, to ensure their understanding of Real Alloy’s business and Real Industry at the corporate level.

Our Board and executive leadership team are aggressively pursuing alternatives to unlock the long-term value of our considerable tax assets and to improve the financial contribution of our major operating subsidiary as the aluminum recycling industry starts to recover from the current cyclical decline.

Management and Operational Developments

Management Changes

On April 5, 2017, the Board appointed Kyle Ross as President and Chief Executive Officer of the Company, as well as a member of the Board of Directors. Previously, Mr. Ross had served as

President, Interim Chief Executive Officer and Chief Investment Officer since August 2016 when he was appointed to succeed Craig Bouchard, who resigned as

Chief Executive Officer and Chairman of the Board

on August 19, 2016. Additionally, Mr. Ross had served in various leadership positions at the Company, including Chief Financial Officer since March 2011 and Executive Vice President since June 2010.

Following Mr. Ross’s appointment as Interim Chief Executive Officer, during the third and fourth quarters of 2016, we took a number of steps to enhance the Company’s management team, strengthen our internal capabilities, streamline our corporate functions and reduce outside general and administrative expense. We also appointed a new Chief Financial Officer (“CFO”) in September 2016, Michael J. Hobey, who was formerly the CFO of Real Alloy, and a new General Counsel in December 2016, Kelly G. Howard, who had previously worked as external counsel to the Company.

Corporate Streamlining

Concurrent with the new executive positions, the Company has further built out our internal strategic and analytical team and has transitioned the Real Industry corporate support functions to the finance and accounting, human resources, information technology and other corporate personnel of our Real Alloy operating subsidiary. Upon the March 2017 expiration of the lease for the Company’s headquarters space in Sherman Oaks, California, the Company transferred its principal executive offices to its New York office.

12

I

n

September 2016, with authorization from the Board, management initiated a process to sell our Cosmedicine, LLC subsidiary (“Cosmedicine”) or liquidate its assets. After review of available options, in December 2016, management

determined to pursue a wind down of Cosmedicine and is in the process of liquidating its assets.

Real Alloy Updates

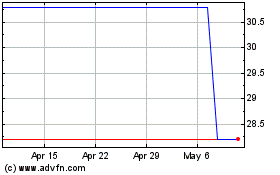

Real Alloy has undergone changes in the past year, including the completion of building out various administrative departments as part of the separation with Aleris, as well as, in November 2016, completing its first acquisition as one of our subsidiaries, with the purchase of certain assets of Beck Aluminum Alloys (“Beck Alloys”), a privately-held operator of three secondary aluminum recycling facilities in the U.S., and acquisition of a significant minority equity ownership interest in a broker/distributor of prime aluminum and primary based alloys that is affiliated with Beck Alloys.

In March 2017, Real Alloy and certain of its U.S. and Canadian subsidiaries entered into a new $110 million senior secured revolving asset-based credit facility with Bank of America, N.A. (the “ABL Facility”), which refinanced and terminated the revolving credit facility that Real Alloy entered into in February 2015 upon the Company’s acquisition of Real Alloy. The ABL facility has U.S. and Canadian sub-facilities, and the borrowing base is based on the eligible accounts receivable and eligible inventory of the Real Alloy business in the United States, Mexico and Canada. The ABL Agreement is intended to provide improved pricing, advance rates and more flexible operational, intercompany and transactional covenants for Real Alloy with additional borrowing capacity compared to the prior facility, based principally on the accounts receivable of Real Alloy’s Mexican operations. The proceeds of the ABL Facility will be used primarily for working capital and general corporate purposes.

Executive Compensation Changes

The CD&A section of this proxy details the Company’s compensation practices, philosophy and payout, focusing on fiscal year 2016. As discussed in CD&A, in 2016, as well as in prior years, the annual non-equity incentive awards for the Company’s management team have been determined by two financial performance measures: (1) the Company’s and Real Alloy’s actual Adjusted EBITDA compared to financial performance targets set by the Board for Adjusted EBITDA (weighted 80%) and (2) productivity and Six Sigma efficiency improvements measured through operational cost savings and other margin enhancements (weighted 20%). For 2017, after conferring with its compensation consultant and Company management, the Compensation Committee recommended, and the Board approved, a shift in the elements for the

2017 annual incentive plan for the Company’s executives, including the replacement of the prior year’s productivity initiatives target with a free cash flow target. Furthermore, for the Real Industry team, in order to underscore and compensate for the Company’s accomplishment not only of operational goals, but also strategic goals, 45% of the 2017 incentive plan payout will be based on the Adjusted EBITDA performance of Real Industry and Real Alloy (consolidated), 20% will be based on Real Alloy’s free cash flow, and 35% of the corporate performance metric will be determined by the Compensation Committee’s judgment of management’s progress towards positioning the Company to monetize its NOLs in 2018 and beyond.

Board Review and Changes

With the resignation of Mr. Bouchard, William Hall was appointed our Chairman of the Board in August 2016. Mr. Hall is an experienced senior operating executive and public company director. With Mr. Hall’s guidance, in addition to the Company’s enhanced focus on operational improvements, strategic execution, and corporate streamlining, the entire Board has begun a further review of the Company’s corporate governance and evolutionary needs.

With this, we are paying particular attention to the size and composition of the Board, along with the mix of experience and skillsets of Board members. In conjunction with this ongoing review, the Board is considering succession plans for its Board members, as well as near-term and long-term needs.

Revised Director Qualification Policy

T

he Nominating and Governance Committee will evaluate each individual candidate for the Board in the context of the overall composition of the Board and the best interests of the Company and its security holders, with the objective of recommending a group of candidates for election and re-election that can collectively best seek to increase stockholder value at an acceptable level of risk, as well as effectively govern the business and affairs of the Company. The Committee will continually evaluate members and candidates for the Board against the Company’s current and projected strategic needs.

13

As part of the aforementioned analysis, as of January 1, 2017, the Nominating and Governance Committee approved, and the Board adopted, an updated

policy on director qualifications. The Nominating and Governance

Committee believes that the Board, as a whole, requires directors who collectively are able to assist management with a focus on the following key aspects of the business:

|

|

•

|

the development and integration of future M&A activity,

|

|

|

•

|

the current and future business operations of Real Alloy,

|

|

|

•

|

the utilization of the tax NOL assets of the Company, and

|

|

|

•

|

continued strong corporate governance.

|

As a result, the

Nominating and Governance

Committee believes that the Board, in the aggregate, should have the following competencies:

|

|

•

|

judgment, skill, integrity, leadership and reputation;

|

|

|

•

|

understanding of elements relevant to the success of a publicly traded corporation, including stockholder relations and communication, and a knowledge of the investor community;

|

|

|

•

|

knowledge of the Company’s industry and understanding of its business;

|

|

|

•

|

significant board, executive or senior management experience, particularly in the markets and industries in which the Company operates;

|

|

|

•

|

strong educational and successful professional background;

|

|

|

•

|

independence from management;

|

|

|

•

|

desire to be aligned financially with the stockholders;

|

|

|

•

|

ability to serve the long-term interests of the Company’s stockholders;

|

|

|

•

|

ability to help the Board work as a collective body;

|

|

|

•

|

prior experience with merger and acquisition transactions, capital raising, and complex capital structures; and

|

|

|

•

|

financial literacy, including ability to understand financial statements and understand how to utilize NOLs.

|

Director Change and New Nominee

In April 2017, director Philip G. Tinkler announced to the Board that he would decline to seek re-election to the Board at the Annual Meeting in order to attend to his increasing professional commitments. Mr. Tinkler has served on the Board since August 2012, and he currently serves as Chairman of the Nominating & Governance Committee and on the Audit Committee. As a result of Mr. Tinkler’s increasing professional commitments, the Nominating and Governance Committee, in consultation with the other members of the Board and Company management, focused on addressing the Board’s near-term needs to support of its M&A strategy in the areas of identifying and executing financing and M&A opportunities. The Nominating and Governance Committee recommended, and the Board nominated, Joseph McIntosh as a nominee for election to the Board because of his over twenty years of investment banking experience in counseling on sourcing, funding and closing M&A opportunities and capital-raising transactions. For more information on Mr. McIntosh, please refer to “

Background Information on Director Nominees

” on page [8].

Adjustment to Board Compensation

In April 2017, in order to maximize the Board’s alignment with the Company’s stockholders, the Board unanimously adopted a policy to reduce the amount of director and committee chairperson fees payable in cash, or in restricted stock units in lieu of cash fees, to Board members by 20% for the balance of 2017 and until further review.

Plan for NOL Asset Protection

In 2007, the Company adopted a stockholder rights plan (the “Rights Plan”) in order to protect our valuable tax NOLs. This Rights Plan was approved by our stockholders in 2014 in connection with the reincorporation of the Company in Delaware in 2014, and the approval of both the reincorporation and the adoption of the Company’s Rights Plan and other existing policies.

The Rights Plan operates in concert with certain provisions of our Amended and Restated Bylaws that impose limitations on any persons who own, or as a result of a transaction would own, 4.9% or more of our common stock in order to reduce the risk that any change in ownership might limit our ability to utilize the NOLs under Section 382 of the Internal Revenue Code of 1986, as amended (the “Tax Code”).

This Rights Plan is similar to the stockholder rights plans of other companies who wish to protect their tax assets, and provides that if an individual or entity exceeds 5% beneficial ownership, directly or indirectly, of our securities without Board approval, the Board may trigger the outstanding rights that attach to each share of our common stock to acquire shares of our

Series A Junior

14

Participating Preferred Stock

. Triggering such rights would likely result in a significant purchase of Series A Preferred Shares by our stockholders. The effect of such a dilutive issuance would be to prevent an unapproved acquisition of an ownership inter

est in the Company at a level that could cause a shift in our equity ownership under Section 382 of the

Tax

Code, and thus could result in a reduction in the value of our NOLs without our consent.

In November 2017, our Rights Plan expires. Upon its expiration, given the value of our NOL assets and their significance to our corporate strategy, our Board will evaluate whether the Rights Plan should be extended or a new rights agreement should be negotiated. We intend to recommend any such new stockholder rights plan, plan amendment or alternative protection of our NOL assets at the Company’s 2018 annual meeting of stockholders for your ratification.

15

CORPORATE GOVERNANCE AND BOARD MATTERS

Director Independence

Based on information supplied to it by the directors in March 2017, the Board determined that each of Messrs. Bynoe, Deconinck, Hall, Lamb, Maheshwari and outgoing director Philip G. Tinkler, as well as nominee Mr. McIntosh, were “independent” under the rules of the NASDAQ Stock Market. The Board made such determinations based on the fact that such directors have not had, and currently do not have, any material relationship with the Company or its affiliates or any executive officer of the Company or their affiliates that would impair their independence, including, without limitation, any commercial, industrial, banking, consulting, legal, accounting, charitable or familial relationship. In addition, the Board considered any business relationships that the directors may have outside of the Company, including those described herein, and determined that such relationships would not impair their independence.

Meetings and Committees of the Board

In 2016, the Board of Directors had four standing committees: the Audit Committee, the Compensation Committee, the Nominating and Governance Committee and the Operations Committee.

During 2016, the Board of Directors and the various committees of the Board held the following number of meetings: Board of Directors — 19; Audit Committee — 9; Compensation Committee — 10; Nominating and Governance Committee — 4; and Operations Committee — 3. During 2016, no director attended fewer than 75% of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings of any committees of the Board held while such director was serving on the Board or such committee. Each of the Audit Committee, the Compensation Committee, the Nominating and Governance Committee and the Operations Committee has a written charter that is reviewed annually and revised as appropriate. A copy of each committee’s charter is available on the “Governance” page of our corporate website at

www.realindustryinc.com

or a copy may be obtained without charge upon request by writing to the following address: Corporate Secretary, Real Industry, Inc., 17 State Street, Suite 3811, New York, NY 10004.

Audit Committee

The current members of the Audit Committee are Messrs. Lamb (Chairman), Bynoe, Maheshwari and Tinkler. Mr. Tinkler will serve on the Audit Committee until the conclusion of his Board service at the 2017 Annual Meeting. If Mr. McIntosh is elected by the stockholders, the Board intends that the Audit Committee will be comprised of Messrs. Lamb (Chairman), Maheshwari and McIntosh. Each of Messrs. Lamb, Bynoe, Maheshwari, Tinkler and McIntosh is “independent” under the rules of the NASDAQ Stock Market and Rule 10A-3 under the Exchange Act. The Board has determined that each of Messrs. Lamb, Bynoe and Tinkler satisfies, and if elected Mr. McIntosh will satisfy, the criteria for classification as an “audit committee financial expert” as set forth in the applicable rules of the Commission.