Continued Strong Performance

Equity LifeStyle Properties, Inc. (NYSE: ELS) (referred to

herein as “we,” “us,” and “our”) today announced results for the

quarter ended March 31, 2017. All per share results are

reported on a fully diluted basis unless otherwise noted.

Financial Results for the Quarter Ended March 31,

2017

For the quarter ended March 31, 2017, total revenues

increased $12.3 million, or 5.6 percent, to $232.4 million compared

to $220.1 million for the same period in 2016. Net income available

for Common Stockholders increased $6.3 million, or $0.05 per Common

Share, to $56.9 million, or $0.65 per Common Share, compared to

$50.6 million, or $0.60 per Common Share, for the same period in

2016.

Non-GAAP Financial Measures and Portfolio Performance

For the quarter ended March 31, 2017, Funds from Operations

(“FFO”) available for Common Stock and OP Unit holders increased

$8.5 million, or $0.08 per Common Share, to $93.1 million or $1.00

per Common Share, compared to $84.6 million, or $0.92 per Common

Share, for the same period in 2016.

For the quarter ended March 31, 2017 Normalized Funds from

Operations (“Normalized FFO”) available for Common Stock and OP

Unit holders increased $8.4 million, or $0.08 per Common Share, to

$93.2 million, or $1.00 per Common Share, compared to $84.8

million, or $0.92 per Common Share, for the same period in

2016.

For the quarter ended March 31, 2017, property operating

revenues, excluding deferrals, increased $14.6 million to $222.0

million compared to $207.4 million for the same period in 2016. For

the quarter ended March 31, 2017, income from property

operations, excluding deferrals and property management, increased

$8.4 million to $135.6 million compared to $127.2 million for the

same period in 2016.

For the quarter ended March 31, 2017, Core property

operating revenues, excluding deferrals, increased approximately

4.3 percent and Core income from property operations, excluding

deferrals and property management, increased approximately 3.8

percent compared to the same period in 2016.

Balance Sheet Activity

During the quarter, we paid off one loan of approximately $21.1

million using available cash, with an interest rate of 5.76% per

annum, secured by one manufactured home community.

About Equity LifeStyle Properties

We are a self-administered, self-managed real estate investment

trust (“REIT”) with headquarters in Chicago.

As of April 17, 2017, we own or have an interest in 391

quality properties in 32 states and British Columbia consisting of

146,626 sites.

For additional information, please contact our Investor

Relations Department at (800) 247-5279 or at

investor_relations@equitylifestyle.com.

Conference Call

A live webcast of our conference call discussing these results

will take place tomorrow, Tuesday, April 18, 2017, at 10:00 a.m.

Central Time. Please visit the Investor Information section at

www.equitylifestyleproperties.com for the link. A replay of the

webcast will be available for two weeks at this site.

Reporting Calendar

Quarterly financial results and related earnings conference

calls for the next three quarters are expected to occur as

follows:

Release Date Earnings Call Second

Quarter 2017 Monday, July 17, 2017 Tuesday, July 18, 2017 10:00

a.m. CT Third Quarter 2017 Monday, October 16, 2017 Tuesday,

October 17, 2017 10:00 a.m. CT Fourth Quarter 2017 Monday, January

29, 2018 Tuesday, January 30, 2018 10:00 a.m. CT

Forward-Looking Statements

In addition to historical information, this press release

includes certain “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995. When used,

words such as "anticipate," "expect," "believe," "project,"

"intend," "may be" and "will be" and similar words or phrases, or

the negative thereof, unless the context requires otherwise, are

intended to identify forward-looking statements and may include

without limitation, information regarding our expectations, goals

or intentions regarding the future, and the expected effect of our

acquisitions. These forward-looking statements are subject to

numerous assumptions, risks and uncertainties, including, but not

limited to:

- our ability to control costs, real

estate market conditions, the actual rate of decline in customers,

the actual use of sites by customers and our success in acquiring

new customers at our properties (including those that we may

acquire);

- our ability to maintain historical or

increase future rental rates and occupancy with respect to

properties currently owned or that we may acquire;

- our ability to retain and attract

customers renewing, upgrading and entering right-to-use

contracts;

- our assumptions about rental and home

sales markets;

- our assumptions and guidance concerning

2017 estimated net income, FFO and Normalized FFO;

- our ability to manage counterparty

risk;

- in the age-qualified properties, home

sales results could be impacted by the ability of potential home

buyers to sell their existing residences as well as by financial,

credit and capital markets volatility;

- results from home sales and occupancy

will continue to be impacted by local economic conditions, lack of

affordable manufactured home financing and competition from

alternative housing options including site-built single-family

housing;

- impact of government intervention to

stabilize site-built single-family housing and not manufactured

housing;

- effective integration of recent

acquisitions and our estimates regarding the future performance of

recent acquisitions;

- the completion of future transactions

in their entirety, if any, and timing and effective integration

with respect thereto;

- unanticipated costs or unforeseen

liabilities associated with recent acquisitions;

- ability to obtain financing or

refinance existing debt on favorable terms or at all;

- the effect of interest rates;

- the dilutive effects of issuing

additional securities;

- the effect of accounting for the entry

of contracts with customers representing a right-to-use the

properties under the Codification Topic "Revenue Recognition";

- the outcome of pending or future

lawsuits or actions brought against us, including those disclosed

in our filings with the Securities and Exchange Commission;

and

- other risks indicated from time to time

in our filings with the Securities and Exchange Commission.

For further information on these and other factors that could

impact us and the statements contained herein, refer to our filings

with the Securities and Exchange Commission, including “Risk

Factors” in our most recent Annual Report on Form 10-K and

subsequent quarterly reports.

These forward-looking statements are based on management's

present expectations and beliefs about future events. As with any

projection or forecast, these statements are inherently susceptible

to uncertainty and changes in circumstances. We are under no

obligation to, and expressly disclaim any obligation to, update or

alter our forward-looking statements whether as a result of such

changes, new information, subsequent events or otherwise.

Investor Information

Equity Research Coverage (1) Robert W.

Baird & Company BMO Capital Markets

Green Street Advisors Drew T. Babin Paul Adornato Ryan

Burke/Ryan Lumb 215-553-7816 212-885-4170 949-640-8780

dbabin@rwbaird.com

paul.adornato@bmo.com

rburke@greenstreetadvisors.com

rlumb@greenstreetadvisors.com

Cantor Fitzgerald Citi Research Gaurav Mehta Michael

Bilerman/ Nick Joseph

Wells Fargo Securities 212-915-1221

212-816-1383 Todd Stender

gmehta@cantor.com

michael.bilerman@citi.com

562-637-1371

nicholas.joseph@citi.com

todd.stender@wellsfargo.com

Bank of America Merrill

LynchGlobal Research

Evercore ISI Jeffrey Spector Steve Sakwa/ Gwen Clark

646-855-1363 212-446-5600

jeff.spector@baml.com

steve.sakwa@evercoreisi.com

gwen.clark@evercoreisi.com

______________________

1.

Any opinions, estimates or forecasts

regarding our performance made by these analysts or agencies do not

represent our opinions, forecasts or predictions. We do not by

reference to these firms imply our endorsement of or concurrence

with such information, conclusions or recommendations.

Financial Highlights

(In millions, except Stock and OP Units

outstanding and per share data, unaudited)

As of and for the Three Months Ended

March 31,2017

December 31,2016

September 30,2016

June 30,2016

March 31,2016

Operating Information Total revenues $ 232.4 $ 214.0 $ 226.2

$ 210.1 $ 220.1 Net income $ 63.1 $ 42.4 $ 46.8 $ 40.8 $ 57.2 Net

income available for Common Stockholders $ 56.9 $ 37.0 $ 41.0 $

35.5 $ 50.6 Adjusted EBITDA (1) $ 118.9 $ 101.4 $ 103.4 $ 95.9 $

111.3 FFO available for Common Stock and OP Unit holders(1)(2) $

93.1 $ 72.5 $ 76.9 $ 68.9 $ 84.6 Normalized FFO available for

Common Stock and OP Unit holders(1)(2) $ 93.2 $ 75.2 $ 77.2 $ 69.3

$ 84.8 Funds available for distribution (FAD) available for Common

Stock and OP Unit holders(1)(2) $ 86.0 $ 65.8 $ 67.2 $ 58.4 $ 77.4

Stock Outstanding (In thousands)

and Per Share Data

Common Stock and OP Units, end of the period 92,780 92,699 92,507

92,499 91,802 Weighted average Common Stock and OP Unit outstanding

- fully diluted 93,011 92,965 92,910 92,264 92,041 Net income per

Common Share - fully diluted $ 0.65 $ 0.43 $ 0.48 $ 0.42 $ 0.60 FFO

per Common Share - fully diluted $ 1.00 $ 0.78 $ 0.83 $ 0.75 $ 0.92

Normalized FFO per Common Share - fully diluted $ 1.00 $ 0.81 $

0.83 $ 0.75 $ 0.92 Dividends per Common Share $ 0.488 $ 0.425 $

0.425 $ 0.425 $ 0.425

Balance Sheet Total assets $

3,471 $ 3,479 $ 3,470 $ 3,486 $ 3,415 Total liabilities $ 2,371 $

2,397 $ 2,396 $ 2,420 $ 2,400

Market Capitalization

Total debt $ 2,078 $ 2,110 $ 2,111 $ 2,134 $ 2,125 Total market

capitalization (3) $ 9,364 $ 8,930 $ 9,387 $ 9,675 $ 8,938

Ratios Total debt / total market capitalization 22.2 % 23.6

% 22.5 % 22.1 % 23.8 % Total debt + preferred stock / total market

capitalization 23.6 % 25.2 % 23.9 % 23.5 % 25.3 % Total debt /

Adjusted EBITDA (4) 5.0 5.1 5.2 5.3 5.4 Interest coverage (5) 4.2

4.1 4.1 4.0 4.0 Fixed charges + preferred distributions coverage

(6) 3.8 3.7 3.6 3.5 3.5 ______________________ 1. See

Non-GAAP Financial Measure Definitions and Other Terms at the end

of the supplemental information for definitions of Adjusted EBITDA,

FFO, Normalized FFO and FAD; and reconciliation of Adjusted EBITDA.

2. See page 7 for a reconciliation of Net income available for

Common Stockholders to non-GAAP financial measures FFO available

for Common Stock and OP Unit holders, Normalized FFO available for

Common Stock and OP Unit holders and FAD available for Common Stock

and OP Unit holders. 3. See page 16 for market capitalization

calculation as of March 31, 2017. 4. Represents trailing twelve

months Adjusted EBITDA. We believe trailing twelve months Adjusted

EBITDA provides additional information for determining our ability

to meet future debt service requirements. 5. Interest coverage is

calculated by dividing trailing twelve months Adjusted EBITDA by

the interest expense incurred during the same period. 6. See

Non-GAAP Financial Measure Definitions and Other Terms at the end

of the supplemental information for a definition of fixed charges.

This ratio is calculated by dividing trailing twelve months

Adjusted EBITDA by the sum of fixed charges and preferred stock

dividends during the same period.

Balance Sheet

(In thousands, except share and per

share data)

March 31, 2017

December 31, 2016

(unaudited) Assets Investment in real estate: Land $

1,163,987 $ 1,163,987 Land improvements 2,903,564 2,893,759

Buildings and other depreciable property 635,248 627,590

4,702,799 4,685,336 Accumulated depreciation (1,429,999 )

(1,399,531 ) Net investment in real estate 3,272,800 3,285,805 Cash

73,248 56,340 Notes receivable, net 34,239 34,520 Investment in

unconsolidated joint ventures 19,187 19,369 Deferred commission

expense 31,357 31,375 Escrow deposits, goodwill, and other assets,

net (1) 40,210 51,578

Total Assets $

3,471,041 $ 3,478,987

Liabilities and Equity Liabilities: Mortgage notes payable $

1,859,890 $ 1,891,900 Term loan 199,431 199,379 Accrued expenses

and accounts payable (1) 85,554 89,864 Deferred revenue – upfront

payments from right-to-use contracts 82,264 81,484 Deferred revenue

– right-to-use annual payments 13,316 9,817 Accrued interest

payable 8,212 8,379 Rents and other customer payments received in

advance and security deposits 77,398 76,906 Distributions payable

45,230 39,411

Total Liabilities 2,371,295

2,397,140 Equity: Stockholders’ Equity: Preferred

stock, $0.01 par value, 9,945,539 shares authorized as of March 31,

2017 and December 31, 2016; none issued and outstanding. — — 6.75%

Series C Cumulative Redeemable Perpetual Preferred Stock, $0.01 par

value, 54,461 shares authorized and 54,458 issued and outstanding

as of March 31, 2017 and December 31, 2016 at liquidation value

136,144 136,144 Common stock, $0.01 par value, 200,000,000 shares

authorized as of March 31, 2017 and December 31, 2016; 86,841,775

and 85,529,386 shares issued and outstanding as of March 31, 2017

and December 31, 2016, respectively 866 854 Paid-in capital

1,117,628 1,103,048 Distributions in excess of accumulated earnings

(216,724 ) (231,276 ) Accumulated other comprehensive loss (1 )

(227 ) Total Stockholders’ Equity 1,037,913 1,008,543

Non-controlling interests – Common OP Units 61,833 73,304

Total Equity 1,099,746 1,081,847

Total Liabilities and Equity $ 3,471,041

$ 3,478,987 ______________________ 1.

As of December 31, 2016, Escrow deposits, goodwill, and

other assets, net includes insurance receivable of approximately

$10.9 million, and Accrued expenses and accounts payable includes

approximately $13.3 million litigation settlement payable related

to resolution of the California lawsuits. These amounts were

received and paid during the first quarter of 2017.

Consolidated Income Statement

(In thousands, unaudited)

Quarters Ended March 31, 2017

2016 Revenues: Community base rental income $ 120,692

$ 114,076 Rental home income 3,605 3,545 Resort base rental income

61,068 55,434 Right-to-use annual payments 11,252 11,054

Right-to-use contracts current period, gross 3,206 2,532

Right-to-use contract upfront payments, deferred, net (775 ) (302 )

Utility and other income 22,126 20,793 Gross revenues from home

sales 7,027 8,214 Brokered resale revenue and ancillary services

revenues, net 1,661 1,418 Interest income 1,770 1,660 Income from

other investments, net 757 1,723 Total revenues

232,389 220,147

Expenses: Property operating and

maintenance 68,054 62,954 Rental home operating and maintenance

1,551 1,525 Real estate taxes 14,037 13,198 Sales and marketing,

gross 2,690 2,493 Right-to-use contract commissions, deferred, net

(84 ) 104 Property management 12,560 11,763 Depreciation on real

estate assets and rental homes 30,109 28,656 Amortization of

in-place leases 1,032 335 Cost of home sales 7,119 8,281 Home

selling expenses 925 834 General and administrative 7,373 7,407

Property rights initiatives and other 219 654 Interest and related

amortization 24,879 25,634 Total expenses 170,464

163,838 Income before equity in income of

unconsolidated joint ventures 61,925 56,309 Equity in income of

unconsolidated joint ventures 1,150 881 Consolidated

net income 63,075 57,190 Income allocated to

non-controlling interest-Common OP Units (3,890 ) (4,310 ) Series C

Redeemable Perpetual Preferred Stock Dividends (2,297 ) (2,297 )

Net income available for Common Stockholders $

56,888 $ 50,583

Non-GAAP Financial Measures

First Quarter 2017 - Selected Non-GAAP

Financial Measures

(In millions, except per share data,

unaudited)

Quarter Ended

March 31,2017

Income from property operations, excluding deferrals and property

management - 2017 Core (1) $ 132.0 Income from property operations,

excluding deferrals and property management - Acquisitions (2) 3.6

Property management and general and administrative (excluding

transaction costs) (19.8 ) Other income and expenses 4.6 Financing

costs and other (27.2 )

Normalized FFO available for Common

Stock and OP Unit holders (3) 93.2 Transaction

costs (0.1 )

FFO available for Common Stock and OP

Unit holders (3)

$ 93.1 Normalized FFO per Common Share

- fully diluted $ 1.00 FFO per Common Share - fully diluted $ 1.00

Normalized FFO available for Common Stock and OP

Unit holders (3) $ 93.2 Non-revenue

producing improvements to real estate (7.2 )

FAD available for

Common Stock and OP Unit holders (3) $

86.0 Weighted average Common Stock and OP

Units - fully diluted 93.0 ___________________ 1. See

Non-GAAP Financial Measure Definitions and Other Terms at the end

of the supplemental information for definitions of non-GAAP

financial measures Income from property operations, excluding

deferrals and property management, and Core, and reconciliation of

income from property operations, excluding deferrals and property

management to income before equity in income of unconsolidated

joint ventures. See page 9 for details of the 2017 Core Income from

Property Operations, excluding deferrals and property management.

2. See Non-GAAP Financial Measure Definitions and Other Terms at

the end of the supplemental information for a definition of

Acquisition properties. See page 10 for details of the Income from

Property Operations, excluding deferrals and property management

for the Acquisitions. 3. See page 7 for a reconciliation of Net

income available for Common Stockholders to non-GAAP financial

measures FFO available for Common Stock and OP Unit holders,

Normalized FFO available for Common Stock and OP Unit holders and

FAD available for Common Stock and OP Unit holders. See definitions

of non-GAAP financial measures of FFO, Normalized FFO and FAD and

Non-revenue producing improvements in Non-GAAP Financial Measure

Definitions and Other Terms at the end of the supplemental

information.

Reconciliation of Net Income to

Non-GAAP Financial Measures

(In thousands, except per share data,

unaudited)

Quarters Ended March 31, 2017

2016 Net income available for Common Stockholders

$ 56,888 $ 50,583 Income allocated to

Common OP Units 3,890 4,310 Right-to-use contract upfront payments,

deferred, net (1) 775 302 Right-to-use contract commissions,

deferred, net (2) (84 ) 104 Depreciation on real estate assets

27,452 26,008 Depreciation on rental homes 2,657 2,647 Amortization

of in-place leases 1,032 335 Depreciation on unconsolidated joint

ventures 447 290

FFO available for Common Stock

and OP Unit holders (3) 93,057 84,579

Transaction costs (4) 104 200

Normalized FFO

available for Common Stock and OP Unit holders(3)

93,161 84,779 Non-revenue producing improvements to

real estate (7,160 ) (7,337 )

FAD available for Common Stock and

OP Unit holders (3) $ 86,001

$ 77,442 Net income available per

Common Share - Basic $ 0.66 $ 0.60

Net income available per Common Share - Fully Diluted

$ 0.65 $ 0.60 FFO per Common

Share & OP Units-Basic $ 1.00 $

0.92 FFO per Common Share & OP Units-Fully

Diluted $ 1.00 $ 0.92

Normalized FFO per Common Share & OP Units-Basic

$ 1.01 $ 0.93 Normalized FFO per

Common Share & OP Units-Fully Diluted $ 1.00

$ 0.92 Average Common Stock - Basic 86,048

84,321 Average Common Stock and OP Units - Basic 92,636 91,529

Average Common Stock and OP Units - Fully Diluted 93,011 92,041

_____________________________ 1. We are required by GAAP to

defer, over the estimated customer life, recognition of

non-refundable upfront payments from sales of new and upgrade

right-to-use contracts. For 2017, the customer life is estimated to

be 40 years and is based upon our experience operating the

membership platform since 2008. The amount shown represents the

deferral of a substantial portion of current period upgrade sales,

offset by amortization of prior period sales. 2. We are required by

GAAP to defer recognition of commissions paid related to the entry

of right-to-use contracts. The deferred commissions will be

amortized using the same method as used for the related

non-refundable upfront payments from the entry of right-to-use

contracts and upgrade sales. The amount shown represents the

deferral of a substantial portion of current period commissions on

those contracts, offset by the amortization of prior period

commissions. 3. See Non-GAAP Financial Measure Definitions and

Other Terms at the end of the supplemental information for non-GAAP

financial measure definitions of FFO, Normalized FFO and FAD and

for a definition of Non-revenue producing improvements. 4. Included

in general and administrative on the Consolidated Income Statement

on page 4.

Consolidated Income from Property

Operations (1)

(In millions, except home site and

occupancy figures, unaudited)

Quarters Ended March 31, 2017

2016 Community base rental income (2) $ 120.7 $ 114.1 Rental

home income 3.6 3.5 Resort base rental income (3) 61.1 55.4

Right-to-use annual payments 11.3 11.1 Right-to-use contracts

current period, gross 3.2 2.5 Utility and other income 22.1

20.8 Property operating revenues 222.0 207.4 Property

operating, maintenance and real estate taxes 82.1 76.2 Rental home

operating and maintenance 1.6 1.5 Sales and marketing, gross 2.7

2.5 Property operating expenses 86.4 80.2

Income from property operations, excluding deferrals and

property management (1) $ 135.6

$ 127.2 Manufactured home site

figures and occupancy averages: Total sites 70,992 70,114

Occupied sites 66,641 65,153 Occupancy % 93.9 % 92.9 % Monthly base

rent per site $ 604 $ 584

Resort base rental income:

Annual $ 32.1 $ 30.0 Seasonal 18.5 16.2 Transient 10.5 9.2

Total resort base rental income $ 61.1 $ 55.4

_________________________ 1. See page 4 for the Consolidated

Income Statement and see Non-GAAP Financial Measure Definitions and

Other Terms at the end of the supplemental information for non-GAAP

measure definitions and reconciliation of Income from property

operations, excluding deferrals and property management. 2. See the

manufactured home site figures and occupancy averages below within

this table. 3. See resort base rental income detail included below

within this table.

2017 Core Income from Property

Operations (1)

(In millions, except home site and

occupancy figures, unaudited)

Quarters Ended March 31, % 2017

2016 Change (2) Community base rental

income (3) $ 119.6 $ 114.1 4.8 % Rental home income 3.6 3.5 1.7 %

Resort base rental income (4) 56.9 55.2 3.0 % Right-to-use annual

payments 11.3 11.1 1.8 % Right-to-use contracts current period,

gross 3.2 2.5 26.6 % Utility and other income 21.6 20.8

4.2 % Property operating revenues 216.2 207.2 4.3 %

Property operating, maintenance and real estate taxes 79.9 76.0 5.1

% Rental home operating and maintenance 1.6 1.5 1.7 % Sales and

marketing, gross 2.7 2.5 7.9 % Property operating

expenses 84.2 80.0 5.2 %

Income from property

operations, excluding deferrals and property management

(1) $ 132.0 $ 127.2

3.8 % Occupied sites (5)

65,867 65,278 Core manufactured home site

figures and occupancy averages: Total sites 69,972 69,986

Occupied sites 65,753 65,153 Occupancy % 94.0 % 93.1 % Monthly base

rent per site $ 606 $ 584

Resort base rental income:

Annual $ 31.3 $ 29.9 4.6 % Seasonal 16.4 16.1 1.4 % Transient 9.2

9.2 0.5 % Total resort base rental income $ 56.9

$ 55.2 3.0 % ___________________________ 1.

See Non-GAAP Financial Measure Definitions and Other Terms at the

end of the supplemental information for definitions of non-GAAP

measures Income from property operations, excluding deferrals and

property management, and Core. 2. Calculations prepared using

actual results without rounding. 3. See the Core manufactured home

site figures and occupancy averages included below within this

table. 4. See resort base rental income detail included below

within this table. 5. Occupied sites as of the end of the period

shown. Occupied sites have increased by 141 from 65,726 at December

31, 2016.

Acquisitions - Income from Property

Operations (1)

(In millions, unaudited)

QuarterEnded

March 31,2017

Community base rental income $ 1.1 Resort base rental income 4.2

Utility income and other property income 0.5 Property operating

revenues 5.8 Property operating expenses 2.2

Income from

property operations, excluding deferrals and property

management $ 3.6 ______________________ 1.

See Non-GAAP Financial Measure Definitions and Other Terms at the

end of the supplemental information for a definition of

Acquisitions.

Income from Rental Home

Operations

(In millions, except occupied rentals,

unaudited)

Quarters Ended March 31, 2017

2016 Manufactured homes: New home $ 6.6 $ 6.1 Used

home 5.8 6.4 Rental operations revenues (1) 12.4 12.5 Rental

operations expense 1.6 1.5 Income from rental operations,

before depreciation 10.8 11.0 Depreciation on rental homes 2.7

2.6

Income from rental operations, after depreciation

$ 8.1 $ 8.4 Occupied

rentals: (2) New 2,467 2,247 Used 2,297 2,716

Total occupied rental sites 4,764 4,963

As of March 31, 2017 March 31, 2016

Cost basis in rental homes: (3) Gross

Net ofDepreciation

Gross

Net ofDepreciation

New $ 128.3 $ 99.8 $ 115.6 $ 92.3 Used 50.0 21.6 56.5

33.6 Total rental homes $ 178.3 $ 121.4 $

172.1 $ 125.9 __________________________ 1. For the

quarters ended March 31, 2017 and 2016, approximately $8.8 million

and $9.0 million, respectively, of the rental operations revenue

are included in the Community base rental income in the

Consolidated Income from Property Operations table on page 8. The

remainder of the rental operations revenue is included in the

Rental home income in the Consolidated Income from Property

Operations table on page 8. 2. Occupied rentals as of the end of

the period shown in our Core portfolio. Included in the quarters

ended March 31, 2017 and 2016 are 228 and 131 homes rented through

our ECHO joint venture, respectively. For the three months ended

March 31, 2017 and 2016, the rental home investment associated with

our ECHO joint venture totals approximately $8.0 million and $4.3

million, respectively. 3. Includes both occupied and unoccupied

rental homes. New home cost basis does not include the costs

associated with our ECHO joint venture. At March 31, 2017 and 2016,

our investment in the ECHO joint venture was approximately $15.3

million and $15.4 million, respectively.

Total Sites and Home Sales

(In thousands, except sites and home

sale volumes, unaudited)

Summary of Total Sites as of March 31, 2017

Sites Community sites 71,000 Resort sites: Annuals 26,600

Seasonal 11,200 Transient 10,500 Membership (1) 24,100 Joint

Ventures (2) 3,200

Total 146,600 Home Sales

- Select Data Quarters Ended March

31, 2017 2016 Total New Home Sales Volume (3) 120

121 New Home Sales Volume - ECHO joint venture 37 34 New Home Sales

Gross Revenues(3) $ 4,943 $ 5,399 Total Used Home Sales

Volume (3) 285 311 Used Home Sales Gross Revenues(3) $ 2,084 $

2,815 Brokered Home Resales Volume 168 186 Brokered Home

Resale Revenues, net $ 242 $ 279 __________________________ 1.

Sites primarily utilized by approximately 105,300 members.

Includes approximately 5,700 sites rented on an annual basis. 2.

Joint venture income is included in the Equity in income from

unconsolidated joint ventures in the Consolidated Income Statement

on page 4. 3. Total new home sales volume includes home sales from

our ECHO joint venture. New home sales gross revenues does not

include the revenues associated with our ECHO joint venture.

2017 Guidance - Selected Financial

Data (1)

Our guidance acknowledges the existence of

volatile economic conditions, which may impact our current guidance

assumptions. Factors impacting 2017 guidance include, but are not

limited to the following: (i) the mix of site usage within the

portfolio; (ii) yield management on our short-term resort sites;

(iii) scheduled or implemented rate increases on community and

resort sites; (iv) scheduled or implemented rate increases in

annual payments under right-to-use contracts; (v) occupancy

changes; (vi) our ability to retain and attract customers renewing

or entering right-to-use contracts; (vii) our ability to integrate

and operate recent acquisitions in accordance with our estimates;

(viii) completion of pending transactions in their entirety and on

assumed schedule; (ix) ongoing legal matters and related fees; and

(x) costs to restore property operations and potential revenues

losses following storms or other unplanned events.

(In millions, except per share data,

unaudited)

Quarter Ended Year Ended June 30, 2017

December 31, 2017 Income from property operations,

excluding deferrals and property management - 2017 Core (2) $ 117.9

$ 498.1 Income from property operations - Acquisitions (3) 1.5 8.4

Property management and general and administrative (21.1 ) (80.7 )

Other income and expenses 3.3 13.5 Financing costs and other (27.1

) (108.3 )

Normalized FFO available for Common Stock and

OP Unit holders (4) 74.5 331.0 Transaction

costs — (0.1 )

FFO available for Common Stock and

OP Unit holders (4) 74.5 330.9

Depreciation on real estate and other (28.7 ) (113.2 ) Depreciation

on rental homes (2.6 ) (10.6 ) Deferral of right-to-use contract

sales revenue and commission, net 0.4 (3.4 ) Income allocated to

non-controlling interest-Common OP Units (2.8 ) (13.0 )

Net income available for Common Stockholders $

40.8 $ 190.7

Net income per Common Share - fully diluted (5) $0.44 -

$0.50 $2.14 - $2.24 FFO per Common Share - fully diluted $0.77 -

$0.83 $3.50 - $3.60 Normalized FFO per Common Share - fully diluted

$0.77 - $0.83 $3.51 - $3.61 Weighted average Common Stock

outstanding - fully diluted 93.1 93.1

_____________________________________ 1. Each line item

represents the mid-point of a range of possible outcomes and

reflects management’s estimate of the most likely outcome. Actual

Normalized FFO available for Common Stock and OP Unit holders,

Normalized FFO per Common Share, FFO available for Common Stock and

OP Unit holders, FFO per Common Share, Net income available for

Common Stockholders and Net income per Common Share could vary

materially from amounts presented above if any of our assumptions

is incorrect. 2. See page 14 for 2017 Core Guidance Assumptions.

Amount represents 2016 income from property operations, excluding

deferrals and property management, from the 2017 Core properties of

$113.0 million multiplied by an estimated growth rate of 4.4% and

$476.1 million multiplied by an estimated growth rate of 4.6% for

the quarter ended June 30, 2017 and the year ended December 31,

2017, respectively. 3. See page 14 for the 2017 Assumptions

regarding the Acquisition properties. 4. See Non-GAAP Financial

Measure Definitions and Other Terms at the end of the supplemental

information for definitions of Normalized FFO and FFO. 5. Net

income per fully diluted Common Share is calculated before Income

allocated to non-controlling interest-Common OP Units.

2017 Core Guidance Assumptions

(1)

(In millions, unaudited)

QuarterEnded

SecondQuarter 2017

Year Ended

2017

June 30, 2016

GrowthFactors (2)

December 31,2016

GrowthFactors (2)

Community base rental income $ 115.2 4.6 % $ 462.3 4.5 % Rental

home income 3.5 0.2 % 14.1 0.3 % Resort base rental income (3) 44.2

5.7 % 196.8 4.5 % Right-to-use annual payments 11.2 1.2 % 45.0 0.5

% Right-to-use contracts current period, gross 3.1 11.2 % 12.3 1.7

% Utility and other income 19.4 (0.1 )% 80.9 (1.0 )%

Property operating revenues 196.6 4.2 % 811.4 3.6 % Property

operating, maintenance, and real estate taxes 79.1 4.0 % 317.3 2.3

% Rental home operating and maintenance 1.6 1.6 % 6.9 (5.8 )% Sales

and marketing, gross 2.9 4.4 % 11.1 3.8 % Property

operating expenses 83.6 4.0 % 335.3 2.2 %

Income

from property operations, excluding deferrals and property

management $ 113.0 4.4 %

$ 476.1 4.6 % Resort

base rental income: Annual $ 30.1 5.4 % $ 122.3 5.2 % Seasonal

3.9 3.0 % 30.2 2.1 % Transient 10.2 7.5 % 44.3 4.3 %

Total resort base rental income

$ 44.2

5.7 % $ 196.8 4.5

%

2017 Assumptions Regarding Acquisition

Properties (1)

(In millions, unaudited)

Quarter Ended

Year Ended June 30, 2017 (4)

December 31,2017

(4)

Community base rental income $ 1.2 $ 4.6 Resort base rental income

2.4 11.5 Utility income and other property income 0.2 1.3

Property operating revenues 3.8 17.4 Property operating,

maintenance, and real estate taxes 2.3 9.0 Property

operating expenses

Income from property

operations, excluding deferrals and property management

$ 1.5 $ 8.4

_____________________________________ 1. See Non-GAAP

Financial Measure Definitions and Other Terms at the end of the

supplemental information for a definition of Core and Acquisition

properties. 2. Management’s estimate of the growth of property

operations in the 2017 Core Properties compared to actual 2016

performance. Represents our estimate of the mid-point of a range of

possible outcomes. Calculations prepared using actual results

without rounding. Actual growth could vary materially from amounts

presented above if any of our assumptions is incorrect. 3. See

Resort base rental income table included below within this table.

4. Each line item represents our estimate of the mid-point of a

possible range of outcomes and reflects management’s best estimate

of the most likely outcome for the Acquisition properties. Actual

income from property operations for the Acquisition properties

could vary materially from amounts presented above if any of our

assumptions is incorrect.

Right-To-Use Memberships - Select

Data

(In thousands, except member count,

number of Thousand Trails Camping Pass, number of annuals and

number of upgrades, unaudited)

Year Ended December 31, 2013

2014 2015 2016

2017 (1) Member Count (2) 98,277 96,130 102,413

104,728 105,500 Thousand Trails Camping Pass (TTC)

Origination (3) 15,607 18,187 25,544 29,576 30,100 TTC Sales 9,289

10,014 11,877 12,856 13,100 RV Dealer TTC Activations 6,318 8,173

13,667 16,720 17,000 Number of annuals (4) 4,830 5,142 5,470 5,756

6,000 Number of upgrade sales (5) 2,999 2,978 2,687 2,477 2,600

Right-to-use annual payments (6) $ 47,967 $ 44,860 $ 44,441

$ 45,036 $ 45,300 Resort base rental income from annuals $ 11,148 $

12,491 $ 13,821 $ 15,413 $ 16,800 Resort base rental income from

seasonals/transients $ 12,692 $ 13,894 $ 15,795 $ 17,344 $ 17,800

Upgrade contract initiations (7) $ 13,815 $ 13,892 $ 12,783 $

12,312 $ 12,500 Utility and other income $ 2,293 $ 2,455 $ 2,430 $

2,442 $ 2,400 ________________________________ 1. Guidance

estimate. Each line item represents our estimate of the mid-point

of a possible range of outcomes and reflects management’s best

estimate of the most likely outcome. Actual figures could vary

materially from amounts presented above if any of our assumptions

is incorrect. 2. Members have entered into right-to-use contracts

with us that entitle them to use certain properties on a continuous

basis for up to 21 days. 3. TTCs allow access to any of five

geographic areas in the United States. 4. Members who rent a

specific site for an entire year in connection with their

right-to-use contract. 5. Existing customers that have upgraded

agreements are eligible for longer stays, can make earlier

reservations, may receive discounts on rental units, and may have

access to additional properties. Upgrades require a non-refundable

upfront payment. 6. The year ended December 31, 2013 includes $2.1

million of revenue recognized related to our right-to-use annual

memberships activated through our dealer program. During the third

quarter of 2013, we changed the accounting treatment of revenues

and expenses associated with the RV dealer program to recognize as

revenue only the cash received from members generated by the

program. 7. Revenues associated with contract upgrades, included in

Right-to-use contracts current period, gross, on our Consolidated

Income Statement on page 4.

Market Capitalization

(In millions, except share and OP Unit

data, unaudited)

Capital Structure as of March 31, 2017

TotalCommonStock/Units

% of

TotalCommonStock/Units

Total % of Total

% of

TotalMarketCapitalization

Secured Debt $ 1,878 90.4 % Unsecured Debt 200 9.6 %

Total Debt (1) $ 2,078 100.0

% 22.2 % Common Stock 86,841,775 93.6 %

OP Units 5,938,204 6.4 % Total Common Stock and OP Units

92,779,979 100.0 % Common Stock price at March 31, 2017 $ 77.06

Fair Value of Common Stock $ 7,150 98.1 % Perpetual Preferred Stock

136 1.9 %

Total Equity $ 7,286

100.0 % 77.8 % Total Market

Capitalization $ 9,364 100.0 %

Perpetual Preferred Stock as of March 31, 2017

Series

CallableDate

OutstandingStock

LiquidationValue

AnnualDividend

PerShare

AnnualDividendValue

6.75% Series C 9/7/2017 54,458 $ 136 $ 168.8 $ 9.2

_________________ 1. Excludes deferred financing costs of

approximately $18.4 million.

Debt Maturity Schedule

Debt Maturity Schedule as of

March 31, 2017

(In thousands, unaudited)

Year

SecuredDebt

WeightedAverageInterestRate

UnsecuredDebt

WeightedAverageInterestRate

Total Debt

% ofTotalDebt

WeightedAverageInterestRate

2017 13,177 6.00 % — — 13,177 0.64 % 6.00 % 2018 198,222

5.97 % — — 198,222 9.56 % 5.97 % 2019 200,167 6.27 % — — 200,167

9.66 % 6.27 % 2020 121,283 6.13 % 200,000 2.39 % 321,283 15.50 %

3.80 % 2021 189,525 5.01 % — — 189,525 9.14 % 5.01 % 2022 149,310

4.59 % — — 149,310 7.20 % 4.59 % 2023 110,645 5.11 % — — 110,645

5.34 % 5.11 % 2024 — — % — — — — % — % 2025 107,236 3.45 % — —

107,236 5.17 % 3.45 % 2026 — — % — — — — % — % Thereafter 783,303

4.27 % — — 783,303 37.79 % 4.27 %

Total $ 1,872,868 4.90 %

$ 200,000 2.39 % $

2,072,868 100.0 % 4.66 %

Note Premiums 4,809 —

4,809

Total Debt 1,877,677 200,000

2,077,677 Deferred Financing Costs

(17,787 ) (569 ) (18,356

) Total Debt, net 1,859,890

4.94 % (1) 199,431 2.50

% $ 2,059,321 4.71 %

(1) Average Years to Maturity 11.0

2.8 10.2 ______________________ 1. Reflects

effective interest rate including amortization of note premiums and

amortization of deferred loan cost for secured and total debt and

stated interest rate for unsecured debt.

Non-GAAP Financial

Measures Definitions and Other Terms

This document contains certain non-GAAP measures used by

management that we believe are helpful in understanding our

business, as further discussed in the paragraphs below. We believe

investors should review Funds from Operations (“FFO”), Normalized

Funds from Operations (“Normalized FFO”), Funds Available for

Distribution (“FAD”) and Adjusted Earnings Before Interest, Tax,

Depreciation and Amortization (“Adjusted EBITDA”), along with GAAP

net income and cash flow from operating activities, investing

activities and financing activities, when evaluating an equity

REIT’s operating performance. Our definitions and calculations of

these non-GAAP financial and operating measures and other terms may

differ from the definitions and methodologies used by other REITs

and, accordingly, may not be comparable. These non-GAAP financial

and operating measures do not represent cash generated from

operating activities in accordance with GAAP, nor do they represent

cash available to pay distributions and should not be considered as

an alternative to net income, determined in accordance with GAAP,

as an indication of our financial performance, or to cash flow from

operating activities, determined in accordance with GAAP, as a

measure of our liquidity, nor is it indicative of funds available

to fund our cash needs, including our ability to make cash

distributions.

FUNDS FROM OPERATIONS (FFO). We define FFO as net income,

computed in accordance with GAAP, excluding gains and actual or

estimated losses from sales of properties, plus real estate related

depreciation and amortization, impairments, if any, and after

adjustments for unconsolidated partnerships and joint ventures.

Adjustments for unconsolidated partnerships and joint ventures are

calculated to reflect FFO on the same basis. We compute FFO in

accordance with our interpretation of standards established by the

National Association of Real Estate Investment Trusts (“NAREIT”),

which may not be comparable to FFO reported by other REITs that do

not define the term in accordance with the current NAREIT

definition or that interpret the current NAREIT definition

differently than we do. We receive up-front non-refundable payments

from the entry of right-to-use contracts. In accordance with GAAP,

the upfront non-refundable payments and related commissions are

deferred and amortized over the estimated customer life. Although

the NAREIT definition of FFO does not address the treatment of

non-refundable right-to-use payments, we believe that it is

appropriate to adjust for the impact of the deferral activity in

our calculation of FFO.

We believe FFO, as defined by the Board of Governors of NAREIT,

is generally a measure of performance for an equity REIT. While FFO

is a relevant and widely used measure of operating performance for

equity REITs, it does not represent cash flow from operations or

net income as defined by GAAP, and it should not be considered as

an alternative to these indicators in evaluating liquidity or

operating performance.

NORMALIZED FUNDS FROM OPERATIONS (NORMALIZED FFO). We

define Normalized FFO as FFO excluding the following non-operating

income and expense items: a) the financial impact of contingent

consideration; b) gains and losses from early debt extinguishment,

including prepayment penalties and defeasance costs; c) property

acquisition and other transaction costs related to mergers and

acquisitions; and d) other miscellaneous non-comparable items.

Normalized FFO presented herein is not necessarily comparable to

Normalized FFO presented by other real estate companies due to the

fact that not all real estate companies use the same methodology

for computing this amount.

FUNDS AVAILABLE FOR DISTRIBUTION (FAD). We define FAD as

Normalized FFO less non-revenue producing capital expenditures.

We believe that FFO, Normalized FFO and FAD are helpful to

investors as supplemental measures of the performance of an equity

REIT. We believe that by excluding the effect of depreciation,

amortization, impairments, if any, and actual or estimated gains or

losses from sales of real estate, all of which are based on

historical costs and which may be of limited relevance in

evaluating current performance, FFO can facilitate comparisons of

operating performance between periods and among other equity REITs.

We further believe that Normalized FFO provides useful information

to investors, analysts and our management because it allows them to

compare our operating performance to the operating performance of

other real estate companies and between periods on a consistent

basis without having to account for differences not related to our

operations. For example, we believe that excluding the early

extinguishment of debt, property acquisition and other transaction

costs related to mergers and acquisitions from Normalized FFO

allows investors, analysts and our management to assess the

sustainability of operating performance in future periods because

these costs do not affect the future operations of the properties.

In some cases, we provide information about identified non-cash

components of FFO and Normalized FFO because it allows investors,

analysts and our management to assess the impact of those

items.

INCOME FROM PROPERTY OPERATIONS, EXCLUDING DEFERRALS AND

PROPERTY MANAGEMENT. We define Income from property operations,

excluding deferrals and property management as rental income,

utility income and right-to-use income less property operating and

maintenance expenses, real estate tax, sales and marketing

expenses, property management and the GAAP deferral of right-to-use

contract upfront payments and related commissions, net. We believe

that this non-GAAP financial measure is helpful to investors and

analysts as a measure of the operating results of our manufactured

home and RV communities.

The following table reconciles Income before equity in income of

unconsolidated joint ventures to Income from property operations

(amounts in thousands):

Quarters Ended March 31, 2017

2016 Income before equity in income of unconsolidated joint

ventures $ 61,925 $ 56,309 Right-to-use upfront payments, deferred,

net 775 302 Gross revenues from home sales (7,027 ) (8,214 )

Brokered resale revenues and ancillary services revenues, net

(1,661 ) (1,418 ) Interest income (1,770 ) (1,660 ) Income from

other investments, net (757 ) (1,723 ) Right-to-use contract

commissions, deferred, net (84 ) 104 Property management 12,560

11,763 Depreciation on real estate and rental homes 30,109 28,656

Amortization of in-place leases 1,032 335 Cost of homes sales 7,119

8,281 Home selling expenses 925 834 General and administrative

7,373 7,407 Property rights initiatives and other 219 654 Interest

and related amortization 24,879 25,634 Income from

property operations, excluding deferrals and property management

135,617 127,264 Right-to-use contracts, deferred and sales and

marketing, deferred, net (691 ) (406 ) Property management (12,560

) (11,763 ) Income from property operations $ 122,366 $

115,095

EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION

(EBITDA) AND ADJUSTED EBITDA. EBITDA is defined as net income

or loss before interest income and expense, income taxes,

depreciation and amortization. We define Adjusted EBITDA as EBITDA

excluding the following non-operating income and expense items: a)

the financial impact of contingent consideration; b) gains and

losses from early debt extinguishment, including prepayment

penalties and defeasance costs; c) property acquisition and other

transaction costs related to mergers and acquisitions; d) GAAP

deferral of right-to-use contract upfront payments and related

commissions, net; e) impairments, if any; and f) other

miscellaneous non-comparable items. EBITDA and Adjusted EBITDA

provide us with an understanding of one aspect of earnings before

the impact of investing and financing charges. We believe that

EBITDA and Adjusted EBITDA may be useful to an investor in

evaluating our operating performance and liquidity because the

measures are widely used to measure a company’s operating

performance and they are used by rating agencies and other parties,

including lenders, to evaluate our creditworthiness.

The following table reconciles Consolidated net income to EBITDA

and Adjusted EBITDA (amounts in thousands):

Quarters Ended March 31, 2017

2016 Consolidated net income $ 63,075 $ 57,190 Interest

Income (1,770 ) (1,660 ) Depreciation on real estate assets and

rental homes 30,109 28,656 Amortization of in-place leases 1,032

335 Depreciation on corporate assets 289 279 Depreciation on

unconsolidated joint ventures 447 290

Interest and related amortization

24,879 25,634 EBITDA 118,061 110,724 Right-to-use

contract upfront payments, deferred, net 775 302 Right-to-use

contract commissions, deferred, net (84 ) 104 Transaction costs 104

200 Adjusted EBITDA $ 118,856 $ 111,330

CORE. The Core properties include properties we owned and

operated during all of 2016 and 2017. We believe Core is a measure

that is useful to investors for annual comparison as it removes the

fluctuations associated with acquisitions, dispositions and

significant transactions or unique situations.

ACQUISITIONS. The Acquisition properties include all

properties that were not owned and operated in 2016 and 2017. This

includes, but is not limited to, four properties acquired during

2016 and Tropical Palms RV Resort.

NON-REVENUE PRODUCING IMPROVEMENTS. Represents capital

expenditures that will not directly result in increased revenue or

expense savings and are primarily comprised of common area

improvements, furniture, and mechanical improvements.

FIXED CHARGES. Fixed charges consist of interest expense,

amortization of note premiums and debt issuance costs.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170417005643/en/

Equity LifeStyle Properties, Inc.Paul Seavey, 800-247-5279

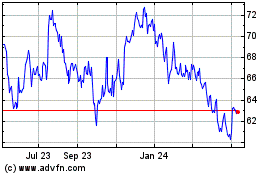

Equity Lifestyle Propert... (NYSE:ELS)

Historical Stock Chart

From Mar 2024 to Apr 2024

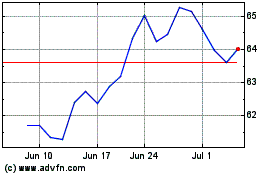

Equity Lifestyle Propert... (NYSE:ELS)

Historical Stock Chart

From Apr 2023 to Apr 2024