SCHEDULE 14A INFORMATION

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to Rule 14a11(c) or Rule 14a-12

|

DUCOMMUN INCORPORATED

(Name of Registrant as

Specified in Its Charter)

(Name of Person(s) Filing Proxy

Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and

state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

Ducommun Incorporated

Additional Proxy Solicitation Materials

The following

information is being shared by Ducommun Incorporated (the “Company”) with holders of its common stock beginning on April 17, 2017 in response to a recommendation by Institutional Shareholder Services (“ISS”).

ISS has recommended that its clients withhold votes from Richard A. Baldridge, one of our current Audit Committee members, when its clients vote in connection

with our upcoming annual meeting on May 3, 2017. ISS suggests that the Audit Committee failed to provide sufficient oversight over the Company’s financial reporting process during the past year due to the existence of a material weakness

related to the annual accounting for income taxes, which has been disclosed in our Annual Report on Form

10-K

(“Form 10-K”)

for the year ended

December 31, 2016. ISS interprets disclosure of this weakness to mean that the Audit Committee did not fully remediate the previous material weakness related to income taxes that was originally identified in our 2014 Form

10-K

that was declared to be remediated as of December 31, 2015.

The members of our Board of Directors and our

management strongly disagree with the recommendation of ISS. Our Board of Directors and management are committed to maintaining a strong and sustainable internal control environment as evidenced by the remediation in 2015 and 2016 of four material

weaknesses in internal controls, including those related to income taxes. In fact, it is due to the strengthened internal controls that we learned about the $1.6 million error which was the result of incorrectly recording the income taxes

associated with the impairment of the Structural Systems goodwill during the fourth quarter of 2015. This resulted in a revision to the 2015 financial statements and not a restatement as discussed in our 2016 Form

10-K.

We would like to share with you facts about the oversight that the Audit Committee has provided and the

Company’s decision to continue monitoring the internal controls over financial reporting related to income taxes and not to declare the issue remediated until there has been a sustained period of operating effectiveness.

The scope of our material weakness is limited to our controls related to the quarterly and annual accounting and disclosures for income taxes.

Remediation of Prior Year Material Weaknesses

We

entered 2015 with four material weaknesses that we previously identified and disclosed in our 2014 Form

10-K.

In 2015 and 2016 we implemented changes to improve our internal controls over financial reporting

and by the end of 2016 we had remediated all four of the material weaknesses originally identified in 2014. However, in the fourth quarter of 2016, while operating the improved controls to prepare and review the 2016 income tax provision, management

identified a $1.6 million error that was the result of incorrectly recording the income taxes associated with the impairment of the Structural Systems goodwill at December 31, 2015. While management believes that our current internal

controls over financial reporting related to income taxes are adequately designed, management and the Audit Committee determined that, given identification of this tax issue, a longer sustained period of operating effectiveness was required in order

to conclude that the controls are operating effectively.

In order to address the material weakness related to income taxes first described in our 2014 Form

10-K,

we implemented numerous control enhancements during 2015 including the engagement of third party tax advisors to assist with our methodology of estimating and reconciling tax entries and new controls and

improvements to existing controls over income tax accounts, including the reconciliation of current and deferred tax asset and liability accounts. In addition, during 2016 we hired a new tax director and a tax manager, both of whom have significant

skills and experience in preparing income tax provisions and disclosures in accordance with U.S. generally accepted accounting principles.

We expect the

remedial actions described above will have had sufficient time to function during 2017 to allow management to conclude that the material weakness has been satisfactorily remediated and that the controls implemented are operating effectively.

However, we cannot make any assurances that such actions will be completed during 2017. Until the controls described above have had sufficient time for management to conclude that they are operating effectively, the material weakness described above

may continue to exist.

Our audited 2014, 2015 and 2016 financial statements were fairly presented.

In our 2014, 2015 and 2016 Forms

10-K,

we noted that notwithstanding the material weaknesses, the consolidated

financial statements fairly presented, in all material respects, our financial position, results of operations and cash flows in conformity with U.S. generally accepted accounting principles.

PwC’s opinion on the Company’s consolidated financial statements was unaffected.

Our 2016 Form

10-K

included the following statement by PricewaterhouseCoopers LLP (“PwC”): “We

considered this material weakness in determining the nature, timing, and extent of audit tests applied in our audit of the 2016 consolidated financial statements, and our opinion regarding the effectiveness of the Company’s internal control

over financial reporting does not affect our opinion on those consolidated financial statements.”

We have been transparent about our approach to

our remediation plans and progress, and we have taken affirmative steps to enhance our internal controls.

In our 2014, 2015 and 2016 Forms

10-K,

we disclosed that we were implementing controls to address the material weaknesses and strengthen our overall internal control environment. In fact, as mentioned above, it is due to the strengthened internal

controls that we learned about the $1.6 million error that was the result of incorrectly recording income taxes and a related deferred tax asset. Therefore, the new controls appear to be working adequately. However, given the newly identified

issue, we determined that a sustained period of operating effectiveness is required in order to conclude that the controls are operating effectively.

While we made significant improvements in the internal controls through December 31, 2016, we continue to evaluate the effectiveness of our new

internal controls to be able to confirm that a sustainable, controlled process is fully in place.

Our Audit Committee has been vigilant in its oversight of the Company’s financial reporting process

generally and the remediation process specifically.

Our 2017 proxy statement discloses that the Audit Committee met eight times during 2016. The Audit

Committee has met two times thus far in 2017. During the course of these meetings, the Audit Committee devoted considerable time to oversight of our ongoing financial reporting process and the remediation of the material weaknesses in internal

controls over financial reporting. During those meetings, management and the Audit Committee discussed, among other topics, the accounting function’s structure, processes, information management systems, staffing and skills. The Audit Committee

also received regular reports on the status of the remediation of the previously discussed material weaknesses, as well as the design and ongoing testing of our internal control over financial reporting.

Audit Committee member Richard A. Baldridge is eminently qualified and should be

re-elected.

Our 2017 proxy statement contains detailed information about the qualifications of all of our directors. Our Audit Committee members are Richard A. Baldridge,

Jay L. Haberland and Robert C. Ducommun. Mr. Haberland is the Chairman of the Audit Committee.

Our Board of Directors has determined that all

members of the Audit Committee are “financially literate” in accordance with New York Stock Exchange listing standards and that Mr. Haberland is an “audit committee financial expert” within the meaning of SEC regulations.

ISS recommended that its clients withhold votes against Mr. Baldridge and not other members of the Audit Committee simply because Mr. Baldridge

is the only Audit Committee member who is up for

re-election

at our 2017 Annual Meeting of Shareholders. Mr. Baldridge is an independent and extremely qualified member of our Audit Committee. He is the

President and Chief Operating Officer of ViaSat, Inc. Mr. Baldridge was previously the Executive Vice President and Chief Financial Officer of ViaSat, Inc. and a senior executive of Hughes Information Systems. As the President and Chief

Operating Officer of a leading provider of satellite communications systems and services and secure networking systems, Mr. Baldridge contributes to the Board broad operational and financial experience and an understanding of the defense

markets served by our business.

In summary, our shareholders are fortunate to have such a talented, dedicated, globally experienced and thoughtful

individual such as Mr. Baldridge to serve as one of our directors.

Another leading proxy advisory firm recommended that its clients vote

“For” all of our director nominees.

Another leading

proxy advisory firm – Glass Lewis & Co. (“Glass Lewis”)

– recommended that its clients vote “For” all of our director nominees who are standing for

re-election

at this Annual Meeting of Shareholders. Glass Lewis was satisfied that the Audit Committee

has taken appropriate action to address the control deficiencies in light of the disclosures we included in our 2016 Form

10-K

and summarized above. We agree.

We strongly urge you to vote “For” all of our director nominees and “For” all of the other proposals included in our 2017 proxy statement

in accordance with our Board of Directors’ recommendations.

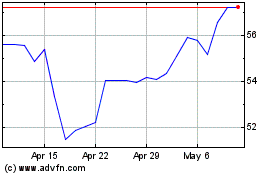

Ducommun (NYSE:DCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

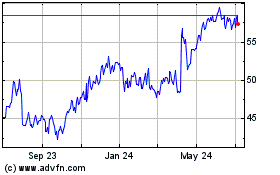

Ducommun (NYSE:DCO)

Historical Stock Chart

From Apr 2023 to Apr 2024