SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No.

)

|

|

|

|

|

Filed by the Registrant

|

|

☒

|

|

Filed by a Party other than the Registrant

|

|

☐

|

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to § 240.14a-12

|

Aptevo Therapeutics Inc.

(Name of Registrant as Specified In

Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

Title of each class of securities to which transaction applies:

Aggregate number of securities to which transaction

applies:

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing

fee is calculated and state how it was determined):

Proposed maximum aggregate value of transaction:

Total fee paid:

|

☐

|

Fee paid previously with preliminary materials.

|

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

Amount Previously Paid:

Form, Schedule or Registration Statement No.:

Filing Party:

Date Filed:

APTEVO THERAPEUTICS INC.

2401 4th Ave. Suite 1050

Seattle,

Washington 98121

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 31, 2017

Dear

Aptevo Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Aptevo Therapeutics Inc., a Delaware

corporation (the “

Company

”). The meeting will be held on Wednesday, May 31, 2017 at 9:00 a.m. PDT, at World Trade Center Seattle located at 2200 Alaskan Way, Seattle, WA 98121 for the following purposes:

1.

To elect the Board’s nominees, Zsolt Harsanyi, Ph.D. and Barbara Lopez Kunz, to

the Board of Directors to hold office until the 2020 Annual Meeting of Stockholders.

2.

To approve the amendment and restatement of the Company’s 2016 Stock Incentive

Plan to, among other things, increase the number of authorized shares issuable by 1,275,000 shares.

3.

To ratify the selection by the Audit Committee of the Board of Directors of

Ernst & Young LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2017.

|

4

.

|

To conduct any other business properly brought before the meeting.

|

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Annual Meeting is March 31, 2017. Only stockholders of record at the close of business on that date may vote at

the meeting or any adjournment thereof.

|

|

|

By Order of the Board of Directors

|

|

|

|

/s/ Shawnte Mitchell

|

|

Secretary, Vice President and General Counsel

|

Seattle, WA

April 14, 2017

|

|

|

|

|

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and

return the proxy mailed to you, or vote over the telephone or the internet as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. Even if you have voted by proxy, you may still vote in person

if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

|

|

|

APTEVO THERAPEUTICS INC.

2401 4th Ave. Suite 1050

Seattle,

Washington 98121

PROXY STATEMENT

FOR THE 2017 ANNUAL MEETING OF STOCKHOLDERS

To be held on May 31, 2017

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receive a notice regarding the availability of proxy materials on the internet?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy

materials over the internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (the “Notice”) because the Board of Directors (the “Board”) of Aptevo Therapeutics Inc. (sometimes referred to as the

“Company,” “Aptevo,” “we,” “us” or “our”) is soliciting your proxy to vote at the 2017 Annual Meeting of Stockholders (the “Annual Meeting”), including at any adjournments or postponements

of the meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the

internet or to request a printed copy may be found in the Notice.

We intend to mail the Notice on or about April 14, 2017 to all

stockholders of record entitled to vote at the Annual Meeting.

Will I receive any other proxy materials by mail?

We may send you a proxy card, along with a second Notice, on or after April 24, 2017.

How do I attend the Annual Meeting?

The meeting will be held on Wednesday, May 31, 2017 at 9:00 a.m. PDT at World Trade Center Seattle located at 2200 Alaskan Way, Seattle,

WA 98121. For directions to the Annual Meeting, please call us at 206-859-6628. Information on how to vote in person at the Annual Meeting is discussed below.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on March 31, 2017 will be entitled to vote at the Annual Meeting. On this record

date, there were 21,003,766 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on March 31, 2017 your shares were registered directly in your name with the Company’s transfer agent, Broadridge Financial

Solutions, Inc., then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on March 31, 2017 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar

organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes

of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the

stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

1.

What am I voting on?

There are three matters scheduled for a vote:

|

|

•

|

|

Election of two directors;

|

|

|

•

|

|

Approval of the amendment and restatement of the Company’s 2016 Stock Incentive Plan to, among other

things, increase the number of authorized shares issuable by 1,275,000 shares; and

|

|

|

•

|

|

Ratification of selection by the Audit Committee of the Board of Directors of Ernst & Young LLP as

independent registered public accounting firm of the Company for the year ending December 31, 2017.

|

What if another matter is

properly brought before the meeting?

The Board of Directors knows of no other matters that will be presented for consideration at the

Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote

“For” all the nominees to the Board of Directors or you may “Withhold” your vote for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from

voting.

The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Annual Meeting, vote by proxy over the telephone, or vote by proxy through

the internet or vote by proxy using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend

the meeting and vote in person even if you have already voted by proxy.

|

|

•

|

|

To vote in person, come to the Annual Meeting and we will give you a ballot when you arrive.

|

|

|

•

|

|

To vote using the proxy card, simply complete, sign and date the proxy card that may be delivered and return

it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

|

|

|

•

|

|

To vote over the telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded

instructions. You will be asked to provide the company number and control number from the Notice. Your telephone vote must be received by 11:59 p.m. EST on May 30, 2017 to be counted.

|

|

|

•

|

|

To vote through the internet, go to http://www.proxyvote.com to complete an electronic proxy card. You will be

asked to provide the company number and control number from the Notice. Your internet vote must be received by 11:59 p.m. EST on May 30, 2017 to be counted.

|

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a Notice

containing voting instructions from that organization rather than from the Company. Simply follow the voting instructions in the Notice to ensure that your vote is counted. To vote in person at the Annual Meeting, you must obtain a valid proxy from

your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

Internet proxy voting may be provided to allow you to vote your shares online, with

procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and

telephone companies.

2.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of March 31, 2017.

What happens if I do not vote?

Stockholder of

Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your proxy card by telephone,

through the internet, or in person at the Annual Meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or

Bank

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of

whether your broker or nominee will still be able to vote your shares depends on whether the particular proposal is a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to

matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of various national and regional securities exchanges, “non-routine” matters are matters

that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive

compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. Accordingly, your broker or nominee may not vote your shares on Proposals 1 or 2 without

your instructions, but may vote your shares on Proposal 3 even in the absence of your instruction.

What if I return a proxy card or otherwise vote but

do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your

shares will be voted, as applicable, “For” the election of all two nominees for director; “For” the approval of the amendment and restatement of the Company’s 2016 Stock Incentive Plan to, among other things, increase the

number of authorized shares issuable by 1,275,000 shares; and “For” the ratification of selection by the Audit Committee of the Board of Directors of Ernst & Young LLP as independent registered public accounting firm of the

Company for the year ending December 31, 2017. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors, employees and The Proxy Advisory

Group, LLC may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. The Proxy Advisory Group, LLC will assist in the

solicitation of proxies and related advice and informational support, for a services fee, plus customary disbursements, which are not expected to exceed $14,000 in total. We may also reimburse brokerage firms, banks and other agents for the cost of

forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting

instructions on the Notices to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you

may revoke your proxy in any one of the following ways:

|

|

•

|

|

You may submit another properly completed proxy card with a later date.

|

|

|

•

|

|

You may grant a subsequent proxy by telephone or through the internet.

|

3.

|

|

•

|

|

You may send a timely written notice that you are revoking your proxy to Aptevo’s Corporate Secretary at

2401 4th Ave. Suite 1050, Seattle, Washington 98121.

|

|

|

•

|

|

You may attend the Annual Meeting and vote in person. Simply attending the meeting will not, by itself, revoke

your proxy.

|

Your most current proxy card or telephone or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals and director nominations due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 15, 2017, to

Aptevo’s Corporate Secretary at 2401 4th Ave. Suite 1050, Seattle, Washington 98121. A proposal must satisfy the rules and regulations of the SEC and the additional requirements of our bylaws to be eligible for inclusion in the proxy statement

for that meeting. A stockholder may present a proposal that is a proper subject for consideration at an annual meeting, even if the proposal is not submitted by the deadline for inclusion in the proxy statement. To do so, the stockholder must comply

with the procedures set forth in the company’s bylaws. The bylaws require that a stockholder who intends to present a proposal at an annual meeting of stockholders submit the proposal to the Corporate Secretary not fewer than 90 and not more

than 120 days before the anniversary of the date of the previous year’s annual meeting. Therefore, to be eligible for consideration at the 2018 annual meeting, such a proposal and any nominations for director must be received by the Corporate

Secretary between January 31, 2018 and March 2, 2018; provided however, that if our 2018 Annual Meeting of Stockholders is held before May 1, 2018 or after July 30, 2018, then the proposal must be received no earlier than the

close of business of the 120

th

day prior to such meeting and not later than the close of business on the later of the 90

th

day prior to such

meeting or the 10

th

day following the day on which public announcement of the date of such meeting is first made. This advance notice period is intended to allow stockholders an opportunity to

consider all business and nominees expected to be considered at the meeting. Any such proposal received after this date may be considered untimely and may be excluded.

How are votes counted?

Votes will be

counted by the inspector of election appointed for the meeting, who will separately count, for the proposal to elect directors, votes “For,” “Withhold” and broker non-votes and with respect to other proposals, votes

“For” and “Against,” abstentions and, if applicable, broker non-votes. Abstentions will be counted towards the vote total for each of Proposals 2 and 3 and will have the same effect as “Against” votes. Broker non-votes

have no effect and will not be counted towards the vote total for any proposal.

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee

holding the shares as to how to vote on matters deemed to be “non-routine,” the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”

How many votes are needed to approve each proposal?

For the election of directors, the two nominees receiving the most “For” votes from the holders of shares present in person or

represented by proxy and entitled to vote on the election of directors will be elected. Only votes “For” or “Withheld” will affect the outcome. Broker non-votes will have no effect.

To be approved, Proposal No. 2, approval of the amendment and restatement of the Company’s 2016 Stock Incentive Plan to, among other

things, increase the number of authorized shares issuable by 1,275,000 shares must receive “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter. If you mark your

proxy to “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect.

4.

To be approved, Proposal No. 3, ratification of the selection of Ernst & Young LLP

as the Company’s independent registered public accounting firm for the year ending December 31, 2017, must receive “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to

vote on the matter. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect.

What is the quorum requirement?

A

quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the meeting in person or represented by proxy. On the record

date, there were 21,003,766 shares outstanding and entitled to vote. Thus, the holders of 10,501,884 shares must be present in person or represented by proxy at the meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or

other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the meeting in person or represented by

proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on

Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a

Form 8-K

to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

5.

P

ROPOSAL

1

E

LECTION

O

F

D

IRECTORS

Aptevo’s Board of Directors is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number

of directors, and each class has a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by

an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified.

The Board presently has seven members. There are two directors in the class whose term of office expires in 2017. Each of the nominees listed

below is currently a director of the Company and was previously elected by Emergent BioSolutions Inc. (“Emergent”) as the sole stockholder of Aptevo. If elected at the Annual Meeting, each of these nominees would serve until the 2020

annual meeting and until his or her successor has been duly elected and qualified, or, if sooner, until the director’s death, resignation or removal. It is the Company’s practice that directors and nominees for director attend our annual

stockholder meetings. Because we completed our spin-off from Emergent in August 2016, we did not hold an annual meeting of stockholders in 2016.

Directors are elected by a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on

the election of directors. Accordingly, the two nominees receiving the highest number of affirmative votes will be elected.

The following

is a brief biography of each nominee and each director whose term will continue after the Annual Meeting, as of May 31, 2017.

|

|

|

|

|

|

|

N

AME

|

|

A

GE

|

|

P

RINCIPAL

O

CCUPATION

/

P

OSITION

H

ELD

W

ITH

THE

C

OMPANY

|

|

|

|

|

|

Fuad El-Hibri

|

|

58

|

|

Chairman

|

|

Marvin L. White

|

|

55

|

|

Director, Chief Executive Officer

|

|

Daniel J. Abdun-Nabi

|

|

62

|

|

Director

|

|

Grady Grant, III

|

|

61

|

|

Director

|

|

Zsolt Harsanyi, Ph.D.

|

|

73

|

|

Director

|

|

Barbara Lopez Kunz

|

|

59

|

|

Director

|

|

John E. Niederhuber, M.D.

|

|

78

|

|

Lead Independent Director

|

N

OMINEES

FOR

E

LECTION

FOR

A

T

HREE

-

YEAR

T

ERM

E

XPIRING

AT

THE

2020 A

NNUAL

M

EETING

Zsolt Harsanyi, Ph.D.

Mr. Harsanyi has served as a member of our Board since August 2016, following our spin-off from Emergent, a

biopharmaceutical company. Mr. Harsanyi has served on the board of directors of Emergent since August 2004 and as chairman of the board of N-Gene Research Laboratories, Inc., a privately-held biotechnology company, since March 2011. Prior to

that, Mr. Harsanyi served as chief executive officer and chairman of the board of directors of Exponential Biotherapies Inc., a private biotechnology company, from December 2004 to February 2011. Mr. Harsanyi served as president of Porton

International plc, or Porton International, a pharmaceutical and vaccine company, from January 1983 to December 2004. Mr. Harsanyi was a founder of Dynport Vaccine Company LLC in September 1996. Prior to joining Porton International,

Mr. Harsanyi was vice president of corporate finance at E.F. Hutton, Inc. Previously, Mr. Harsanyi directed the first assessment of biotechnology for the U.S. Congress’ Office of Technology Assessment, served as a consultant to the

President’s Commission for the Study of Ethical Problems in Medicine and Biomedical and Behavioral Research and was on the faculties of Microbiology and Genetics at Cornell Medical College. Mr. Harsanyi received his bachelor degree from

Amherst College and his Ph.D. in genetics from Albert Einstein College of Medicine. The Board believes Mr. Harsanyi is qualified to serve on Aptevo’s Board because of his industry experience, including his senior executive and financial

positions and his experience as audit committee chair of various public company board of directors.

Barbara Lopez Kunz

Ms. Kunz has served as a member of our Board since August 2016, following our spin-off from Emergent. Ms. Kunz is currently the Global Chief Executive of the Drug Information Association, a private health care products company. From

January 2007 to March 2013, she worked as President of Health and Life Sciences at Battelle Memorial Institute, a private nonprofit applied science and technology development company. From August 2003 to December 2007, she worked as Senior VP/GM for

Thermo Fisher Scientific’s Fisher

6.

Biosciences and led the Latin America regional business from January 2000 to July 2003 at Uniqema, a private company acquired by Croda International plc in 2006. Ms. Kunz earned bachelor

degrees in both biology and chemistry from Thiel College, an MBA from Cleveland State University and an MS in polymer science from the University of Akron. The Board believes that Ms. Kunz is qualified to serve on Aptevo’s Board because of

her extensive leadership experience, her business acumen and knowledge of the healthcare industry.

T

HE

B

OARD

O

F

D

IRECTORS

R

ECOMMENDS

A V

OTE

I

N

F

AVOR

O

F

E

ACH

N

AMED

N

OMINEE

.

D

IRECTORS

C

ONTINUING

IN

O

FFICE

U

NTIL

THE

2018 A

NNUAL

M

EETING

Daniel J. Abdun-Nabi

Mr. Abdun-Nabi has served as a member of our Board since August 2016, following our spin-off from Emergent.

Mr. Abdun-Nabi is the President and Chief Executive Officer of Emergent, a position he has held since April 2012. He has also served as a director of Emergent since May 2009. From May 2007 to March 2012, Mr. Abdun-Nabi served as

Emergent’s president and chief operating officer. Mr. Abdun-Nabi previously served as Emergent’s corporate secretary from December 2004 to January 2008, Emergent’s senior vice president, corporate affairs and general counsel from

December 2004 to April 2007 and Emergent’s vice president and general counsel from May 2004 to December 2004. Mr. Abdun-Nabi served as general counsel for IGEN International, Inc., a biotechnology company, and its successor BioVeris

Corporation, from September 1999 to May 2004. Prior to joining IGEN, Mr. Abdun-Nabi served as senior vice president, legal affairs, general counsel and secretary of North American Vaccine, Inc., a private vaccine company acquired by Baxter

International Inc. in 2000. Mr. Abdun-Nabi earned a bachelor degree in political science from the University of Massachusetts Amherst, a J.D. from the University of San Diego School of Law and an LLM from Georgetown University Law Center. The

Board believes that Mr. Abdun-Nabi is qualified to serve on Aptevo’s Board because of his extensive experience and knowledge of the biotechnology industry and Aptevo products.

Grady Grant, III

Mr. Grant has served as a member of our Board since August 2016, following our spin-off from Emergent.

Mr. Grant is the Vice President of Medical Sales for Mead Johnson Nutrition, a public company focused on pediatric nutrition. He has held this position since December 2011, preceded by 30 years of service at Eli Lilly and Company which includes

his service as Vice President of Sales Neuroscience from January 2006 to December 2011. Mr. Grant earned a bachelor degree in pharmaceutical science from Temple University. The Board believes that Mr. Grant is qualified to serve on

Aptevo’s Board because of his knowledge of the pharmaceutical industry and marketed products.

D

IRECTORS

C

ONTINUING

IN

O

FFICE

U

NTIL

THE

2019 A

NNUAL

M

EETING

Fuad El-Hibri

Mr. El-Hibri has served as the Chairman of our Board since August 2016, following our spin-off from Emergent.

Mr. El-Hibri is the founder and Executive Chairman of the board of directors of Emergent. Mr. El-Hibri has served as the executive chairman of Emergent’s board of directors since April 2012. From June 2004 to March 2012,

Mr. El-Hibri served as chief executive officer and chairman of Emergent’s board of directors. Mr. El-Hibri previously served as president of Emergent from March 2006 to April 2007. Mr. El-Hibri served as chief executive officer

and chairman of the board of directors of BioPort Corporation, or BioPort, from May 1998 until June 2004, when, as a result of Emergent’s corporate reorganization, BioPort became a wholly-owned subsidiary of Emergent and was subsequently

renamed Emergent BioDefense Operations Lansing Inc. Mr. El-Hibri is chairman of East West Resources Corporation, a venture capital and business consulting firm, a position he has held since June 1990. He served as president of East West

Resources from September 1990 to January 2004. Mr. El-Hibri earned a bachelor degree with honors in economics from Stanford University and a masters degree in public and private management from Yale University. Mr. El-Hibri brings an

important perspective to Aptevo and the Board believes Mr. El-Hibri is qualified to serve on Aptevo’s Board due to his experience in the biotechnology industry, his familiarity with the Aptevo technology and his overall business acumen.

Marvin L. White

Mr. White has served as our President, Chief Executive Officer and as a member of our Board since

August 2016, following our spin-off from Emergent. Mr. White served as a director of Emergent from June 2010, until his resignation from the Emergent board of directors in May 2016. Since April 2014, Mr. White has served as president and

chief executive officer of The MLW Advisory Group, LLC, a management advisory company targeting the needs of healthcare and related companies. From 2008 to March 2014, Mr. White served as system vice president and chief financial officer of St.

Vincent Health, and was responsible for finance, materials management, accounting, patient financial services and managed care for all 19 hospitals and 36 joint ventures. Prior

7.

to joining St. Vincent Health in 2008, Mr. White was executive director and chief financial officer of LillyUSA, a subsidiary of Eli Lilly and Company, where he also held leadership

positions in Corporate Finance and Investment Banking in the Corporate Strategy Group. He serves on the boards of CoLucid Pharmaceuticals, Inc., a public pharmaceutical company, WP Glimcher Inc., a public retail real estate investment trust, and

OneAmerica Financial Insurance Partners, Inc., a private insurance and financial services company. Mr. White earned a bachelor degree from Wilberforce University and his MBA degree from Indiana University. Mr. White’s tenure as chief

executive officer of Aptevo and director of Emergent provides valuable management and leadership experience. In addition, Mr. White provides crucial insight to the Board on company strategic planning and operations. For these reasons, the Board

believes Mr. White is qualified to serve on Aptevo’s Board.

John E. Niederhuber, M.D.

Dr. Niederhuber has served on

our Board and as our lead independent director since August 2016, following our spin-off from Emergent. Dr. Niederhuber is the founder, Executive Vice President, and Chief Executive Officer of the Inova Translational Medicine Institute, a

not-for-profit genomics research institute. Dr. Niederhuber served as a director of Emergent from August 2010, until his resignation from the Emergent board of directors in May 2016. He previously served as the director of the National Cancer

Institute (NCI), the National Institutes of Health from 2006 to 2010. Dr. Niederhuber joined the Inova Health System in August 2010 as Executive Vice President and CEO of the Inova Translational Medicine Institute. Dr. Niederhuber is also

an adjunct professor of surgery and oncology at the Johns Hopkins University School of Medicine. He currently serves on the board of directors of PierianDX, a private genomics analytics company. Prior to joining NCI, Dr. Niederhuber was

Director of the University of Wisconsin Comprehensive Cancer Center and professor of surgery and oncology (member of the McArdle Laboratory) at the University of Wisconsin School of Medicine from 1997 to 2005. He chaired the Department of Surgery at

Stanford University School of Medicine from 1991 to 1997 and held professorships at the Johns Hopkins University School of Medicine from 1987 to 1991 and at the University of Michigan from 1973 to 1987. Mr. Niederhuber earned a bachelor of

science from Bethany College and his M.D. from The Ohio State University School of Medicine. The Board believes that Dr. Niederhuber is qualified to serve on Aptevo’s Board because he provides valuable insights to the Board through his

experience in the field of oncology and in the business of healthcare.

INFORMATION REGARDING THE BOARD

OF DIRECTORS AND CORPORATE GOVERNANCE

I

NDEPENDENCE

OF

T

HE

B

OARD

OF

D

IRECTORS

As required under the NASDAQ Stock Market (“NASDAQ”)

listing standards, a majority of the members of a listed company’s Board of Directors must qualify as “independent,” as affirmatively determined by the Board of Directors. The Board consults with the Company’s counsel to ensure

that the Board’s determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of NASDAQ, as in effect from

time to time.

Consistent with these considerations, after review of all relevant identified transactions or relationships between each

director, or any of his or her family members, and the Company, its senior management and its independent auditors, the Board has affirmatively determined that the following four directors, representing a majority of the members of the Board, are

independent directors within the meaning of the applicable NASDAQ listing standards: Mr. Grant, Mr. Harsanyi, Ms. Kunz and Dr. Niederhuber. In making this determination, the Board found that none of these directors had a material

or other disqualifying relationship with the Company.

B

OARD

L

EADERSHIP

S

TRUCTURE

Our corporate governance guidelines provide the Board flexibility in determining its leadership structure. The Board has decided to

keep separate the positions of chief executive officer and chairman of the Board. The Board believes this separate governance structure is optimal because it enables Mr. White to focus his entire energy on running the company while affording us

the benefits of additional leadership and other contributions from Mr. El-Hibri.

Our corporate governance guidelines provide that in

the event the chairman of the Board is not an independent director, a majority of the Board’s independent directors may appoint an independent director, who has been nominated by a majority of our independent directors, to serve as lead

director. Because Mr. El-Hibri is not an independent director, our independent directors appointed Dr. Niederhuber as lead director in August 2016. The lead director serves as the presiding director at all executive sessions of the

non-management or independent directors, facilitates communications between Mr. El-Hibri and other members of the Board, determines the need for special

8.

meetings of the Board and consults with Mr. El-Hibri on matters relating to corporate governance and Board performance.

R

OLE

OF

THE

B

OARD

IN

R

ISK

O

VERSIGHT

Our Board is actively engaged in oversight of risks Aptevo faces and consideration of the appropriate

responses to those risks. The Audit Committee periodically discusses risk management, including guidelines and policies to govern the process by which Aptevo’s exposure to risk is handled, with senior management. The Audit Committee also

reviews and comments on a periodic risk assessment performed by management. After the Audit Committee performs its review and comment function, it reports any significant findings to the Board. The Board is responsible for oversight of Aptevo’s

risk management programs and, in performing this function, will receive periodic risk assessment and mitigation initiatives for information and approval as necessary.

M

EETINGS

OF

T

HE

B

OARD

OF

D

IRECTORS

Our corporate governance guidelines provide that the directors are responsible for attending Board meetings and meetings of

committees on which they serve. The Board of Directors met four (4) times during 2016. Each Board member attended 75% or more of the aggregate number of meetings of the Board and of the committees on which she or he served, held during the

portion of 2016 for which she or he was a director or committee member.

9.

I

NFORMATION

R

EGARDING

C

OMMITTEES

OF

THE

B

OARD

OF

D

IRECTORS

The Board has two committees: an

Audit Committee and a Compensation Committee. The following table provides membership and meeting information for 2016 for each of the Board committees:

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

|

|

Audit

|

|

|

|

Compensation

|

|

|

|

|

|

|

|

|

|

|

|

Fuad El-Hibri

|

|

|

|

|

|

|

|

|

|

Marvin L. White

|

|

|

|

|

|

|

|

|

|

Daniel J. Abdun-Nabi

|

|

|

|

|

|

|

|

|

|

Grady Grant, III

|

|

|

|

X

|

|

|

|

X

|

|

Zsolt Harsanyi, Ph.D.*

|

|

|

|

X

|

|

|

|

|

|

Barbara Lopez Kunz

|

|

|

|

X

|

|

|

|

X

|

|

John E. Niederhuber, M.D.*

|

|

|

|

|

|

|

|

X

|

|

Total meetings in 2016

|

|

|

|

2

|

|

|

|

2

|

Below is a description of each committee of the Board of Directors.

Each of the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its

responsibilities. The Board of Directors has determined that each member of each committee meets the applicable NASDAQ rules and regulations regarding “independence” and each member is free of any relationship that would impair his or her

individual exercise of independent judgment with regard to the Company.

Audit Committee

The Audit Committee of the Board of Directors was established by the Board in accordance with Section 3(a)(58)(A) of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), to oversee the Company’s corporate accounting and financial reporting processes and audits of its financial statements. For this purpose, the Audit Committee performs several

functions, including (1) appointing, approving the compensation of and assessing the independence of our independent registered public accounting firm; (2) overseeing the work of our independent registered public accounting firm;

(3) reviewing and discussing with management and the independent registered public accounting firm our annual and quarterly financial statements and related disclosures; (4) monitoring our internal control over financial reporting,

disclosure controls and procedures and code of business conduct and ethics; (5) overseeing our internal audit function; (6) assisting the board in overseeing our compliance with legal and regulatory requirements; (7) periodically

discussing our risk management policies, and reviewing and commenting on a periodic risk assessment by management; (8) establishing policies regarding hiring employees from our independent registered public accounting firm and procedures for

the receipt and retention of accounting related complaints and concerns; (9) meeting independently with our internal auditing staff, independent registered public accounting firm and management; (10) reviewing and approving or ratifying

any related party transactions; and (11) preparing audit committee reports required by SEC rules.

The Audit Committee is composed of

three directors: Mr. Grant, Ms. Kunz and Mr. Harsanyi. The Audit Committee met twice during 2016. The Board has adopted a written Audit Committee charter that is available to stockholders on the Company’s website at

http://media.corporate-ir.net/media_files/IROL/25/254374/Corporate%20Governance/Aptevo%20Audit%20Committee%20Charter.pdf.

The

Board of Directors reviews the NASDAQ listing standards definition of independence for Audit Committee members on an annual basis and has determined that all members of the Company’s Audit Committee are independent (as independence is currently

defined in Rule 5605(c)(2)(A)(i) and (ii) of the NASDAQ listing standards).

The Board of Directors has also determined that

Mr. Harsanyi qualifies as an “audit committee financial expert,” as defined in applicable SEC rules. The Board made a qualitative assessment of Mr. Harsanyi’s level of knowledge and experience based on a number of factors,

including serving as vice president of corporate finance of E.F. Hutton, serving as chief executive officer and chairman of the board of directors of Exponential Biotherapies Inc. and serving as chair of the audit committee of other public company

board of directors. The Board of Directors has

10.

determined that this simultaneous service does not impair Mr. Harsanyi’s ability to effectively serve on the Company’s Audit Committee.

Compensation Committee

The Compensation Committee is composed of three directors: Mr. Grant, Ms. Kunz and Dr. Niederhuber. All members of the

Company’s Compensation Committee are independent (as independence is currently defined in Rule 5605(a)(2) of the NASDAQ listing standards). The Compensation Committee met twice during 2016. The Board has adopted a written Compensation Committee

charter that is available to stockholders on the Company’s website at

http://media.corporate-ir.net/media_files/IROL/25/254374/Corporate%20Governance/Aptevo%20Comp%20 Committee%20Charter.pdf

The Compensation Committee of the Board of Directors acts on behalf of the Board to review, recommend for adoption and oversee the

Company’s compensation strategy, policies, plans and programs, including (1) annually reviewing and approving corporate goals and objectives relevant to the compensation of our executive officers; (2) determining the compensation of

our chief executive officer; (3) reviewing and approving the compensation of our other named executive officers; (4) overseeing the evaluation of our senior executives; (5) overseeing and administering our cash and equity incentive

plans; and (6) preparing the compensation committee report, if required by SEC rules.

Compensation Committee Processes and Procedures

The Compensation Committee meets as often as it deems necessary in order to perform its responsibilities. The agenda for each

meeting is usually developed by the Chair of the Compensation Committee, in consultation with the Chief Executive Officer, the General Counsel and head of Human Resources and Willis Towers Watson

.

The Compensation Committee meets regularly in

executive session. From time to time, various members of management and other employees as well as outside advisors or consultants may be invited by the Compensation Committee to make presentations, to provide financial or other background

information or advice or to otherwise participate in Compensation Committee meetings. The Compensation Committee shall review and approve, or recommend for approval by the Board, the compensation of the Company’s Chief Executive Officer and the

Company’s other executive officers, including salary, bonus and incentive compensation levels; deferred compensation; executive perquisites; equity compensation (including awards to induce employment); severance arrangements; change-in-control

benefits and other forms of executive officer compensation. The Chief Executive Officer may not participate in, or be present during, any deliberations or determinations of the Compensation Committee regarding his compensation or individual

performance objectives. Under the charter, the Compensation Committee has the authority to obtain, at the expense of the Company, advice and assistance from compensation consultants and internal and external legal, accounting or other advisors and

other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties and the authority to conduct or authorize investigations into any matters within the scope of its responsibilities as it

shall deem appropriate, including the authority to request any officer, employee or advisor of the Company to meet with the Compensation Committee. The Compensation Committee has direct responsibility for the oversight of the work of any consultants

or advisers engaged for the purpose of advising the Committee. In particular, the Compensation Committee has the sole authority to retain, in its sole discretion, compensation consultants to assist in its evaluation of executive and director

compensation, including the authority to approve the consultant’s reasonable fees and other retention terms. Under the charter, the Compensation Committee may select, or receive advice from, a compensation consultant, legal counsel or other

adviser to the compensation committee, other than in-house legal counsel and certain other types of advisers, only after taking into consideration six factors, prescribed by the SEC and NASDAQ, that bear upon the adviser’s independence.

During 2016, after taking into consideration the six factors prescribed by the SEC and NASDAQ, the Compensation Committee engaged Willis

Towers Watson as compensation consultants

.

Willis Towers Watson formerly provided executive compensation advisory support for Emergent and given their historical consulting relationship with Emergent as well as experience with spin-offs and

IPOs, they were uniquely qualified to support us. The Compensation Committee requested that Willis Towers Watson

:

|

|

•

|

|

evaluate the efficacy of the Company’s existing compensation strategy and practices in supporting and

reinforcing the Company’s long-term strategic goals; and

|

11.

|

|

•

|

|

assist in refining the Company’s compensation strategy and in developing and implementing an executive

compensation program to execute that strategy.

|

As part of its engagement, Willis Towers Watson was requested by the

Compensation Committee to develop a comparative group of companies and to perform analyses of competitive performance and compensation levels for that group. The scope of services provided included to provide recommendations for Aptevo’s 2017

peer group, review compensation philosophy and guiding principles in support of executive pay program design considerations, conduct competitive assessment for Aptevo’s top executives, review the Board compensation and provide recommendations

for 2017 and review and confirm long-term incentive grant guideline recommendations for 2017.

Director Nominations

We do not have a standing nominating committee, though we intend to form a nominating and corporate governance committee in the near future.

Accordingly, pursuant to Rule 5605(e)(1)(A) of the NASDAQ rules, until such committee is formed, director nominees are selected, or recommended for our board’s selection, by a majority of the independent directors. We believe that the

independent directors have satisfactorily carried out the responsibility of properly selecting or approving director nominees without the formation of a standing nominating committee. The directors who currently participate in the consideration and

recommendation of director nominees are Mr. Grant, Mr. Harsanyi, Ms. Kunz and Dr. Niederhuber. In accordance with Rule 5605(e)(1)(A) of the NASDAQ rules, all such directors are independent. As we do not have a standing nominating

committee, we do not have a nominating committee charter in place, although we intend to adopt a charter if and when the committee is formed.

S

TOCKHOLDER

C

OMMUNICATIONS

W

ITH

T

HE

B

OARD

O

F

D

IRECTORS

Our Board will give appropriate attention to written communications that are submitted by stockholders and other interested parties and will

respond if and as appropriate. The lead director, with the assistance of Aptevo’s Corporate Secretary, will be primarily responsible for monitoring communications from stockholders and other interested parties and for providing copies or

summaries to the other directors as the lead director considers appropriate.

Communications will be forwarded to all directors if they

relate to important substantive matters and include suggestions or comments that the lead director considers to be important for the directors to know. In general, communications relating to corporate governance and corporate strategy are more

likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which Aptevo receives repetitive or duplicative communications.

Stockholders and other interested parties who wish to send communications on any topic to the Board, lead director or independent directors as

a group should address such communications to the Board, Lead Director or Independent Directors, as applicable, c/o Corporate Secretary, Aptevo Therapeutics Inc., 2401 4th Ave., Suite 1050, Seattle, Washington 98121. The Corporate Secretary will

review all such correspondence and forward to the Board, lead director or independent directors a summary and/or copies of any such correspondence that deals with the functions of the Board or its committees or that he otherwise determines requires

their attention.

C

ODE

OF

E

THICS

The Company has adopted the Aptevo Therapeutics Inc. Code of Conduct and Business Ethics that applies to all officers, directors and

employees. The Code of Conduct and Business Ethics is available on the Company’s website at

http://media.corporate-ir.net/media_files/IROL/25/254374/Corporate%20Governance/APTEVO%20Code%20of%20Conduct%20(September%202016).pdf.

If the

Company makes any substantive amendments to the Code of Conduct and Business Ethics or grants any waiver from a provision of the Code to any executive officer or director, the Company will promptly disclose the nature of the amendment or waiver on

its website.

12.

PROPOSAL 2

APPROVAL OF THE AMENDMENT AND RESTATEMENT OF

OUR 2016 STOCK INCENTIVE PLAN

The Board of Directors is requesting that the stockholders approve our 2016 Stock Incentive Plan, as amended and restated (the “Amended

Plan”). The 2016 Stock Incentive Plan was originally approved by Emergent as the sole stockholder prior to the spin-off on July 29, 2016.

The

proposed amendment and restatement of the 2016 Stock Incentive Plan includes the following material changes:

|

|

•

|

|

increases the aggregate number of shares of our common stock authorized for issuance under the 2016 Stock

Incentive Plan by 1,275,000;

|

|

|

•

|

|

provides that no award granting on or after the date of this annual meeting may vest (or, if applicable, be

exercisable) until at least twelve (12) months following the date of grant, provided that up to 5% of the share reserve may be subject to awards granted after the date of the Annual Meeting that do not meet such requirements;

|

|

|

•

|

|

provides that no dividends or dividend equivalents can be paid prior to the vesting of the related award;

|

|

|

•

|

|

provides that shares used to satisfy tax withholding obligations with respect to all award types will not

return to the share pool to be granted pursuant to new awards;

|

|

|

•

|

|

with respect to awards granted on or after the date of the Annual Meeting that vest based on the attainment of

performance goals, any acceleration of vesting and/or exercisability will be calculated based on actual performance (or target if actual performance cannot be calculated) and pro-rated based on the fractional performance period; and

|

|

|

•

|

|

with respect to awards granted on or after the date of the Annual Meeting, vesting may be accelerated only on

a change in control or upon the participant’s death or disability.

|

As of February 26, 2017, there were 55,253

shares available for grant under the 2016 Stock Incentive Plan. As of February 26, 2017, stock options to purchase approximately 2,515,209 shares were outstanding and awards other than stock options covering aggregate of 1,921,796 shares were

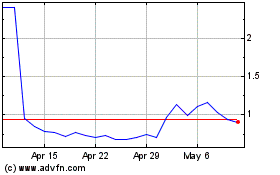

outstanding. The weighted-average exercise price of all stock options outstanding as of February 26, 2017 was $2.46, and the weighted-average remaining term of such stock options was 6.852 years. As of February 26, 2017, the closing price

of our common stock as reported on the NASDAQ Global Market was $1.96 per share, a total of 20,918,290 shares of our common stock were outstanding.

Why the Board of Directors Believes You Should Vote for the Amended Plan

|

|

•

|

|

Attracting and retaining talent

. A talented, motivated and effective management team and workforce

are essential to the Company’s continued progress. Equity compensation is an important component of total compensation at the Company. If the Amended Plan is approved, our ability to offer competitive compensation packages to attract new talent

and to retain our best performers will continue.

|

|

|

•

|

|

Avoiding disruption in compensation programs

. In connection with our spinoff from Emergent in August

2016, each Aptevo employee who was an employee as of June 30, 2016 was granted an “inspiration” restricted stock unit award with an aggregate value equal to 40% of his or her base salary. The number of shares subject to each such

“inspiration” restricted stock unit award would be equal to such aggregate value, divided by the then current fair market value. When these grants were promised to employees, it was expected that our initial trading price would have been

significantly higher than the actual trading price of our stock on the day of the grant. As a result of the lower trading price, the number of shares granted was significantly higher than had been expected. The total number of shares issued as an

“inspiration” restricted stock unit award was 2,115,772. Prior to the effectiveness of the Amended Plan, as of February 26, 2017, an aggregate of 5,906,639 shares of common stock were subject to previously issued grants under all of

our equity plans and only 233,589 of the 3,066,500 shares of common stock authorized

|

13.

|

|

under the 2016 Stock Incentive Plan remained available for future issuance. The Board estimates that by approving the Amended Plan, we will have a sufficient number of shares of common stock to

cover awards under for approximately one to two years, depending primarily on our growth and share price. If the Amended Plan is not approved, it will likely create a barrier to hiring and retaining the best talent and it will be necessary to

replace components of compensation previously awarded in equity with cash, or with other instruments that may not necessarily align employee interests with those of stockholders as well as equity awards would have. Additionally, replacing equity

with cash will increase cash compensation expense and be a drain on cash flow that could be better utilized for other purposes.

|

|

|

•

|

|

The Company recognizes that equity compensation awards dilute stockholder equity and must be used

judiciously

. Our equity compensation practices are designed to be in line with industry norms, and we believe our historical share usage has been responsible and mindful of stockholder interests while providing sufficient flexibility to attract

and retain the best talent in a time when we most needed to attract and retain talent. Since August 2016, our average burn rate (total shares used for equity compensation awards each year divided by weighted average outstanding shares for the

year) was 12.7%. The Company’s dilution level or “overhang” (shares subject to equity compensation awards outstanding at fiscal year-end or available to be used for equity compensation, divided by fully diluted shares

outstanding) at the end of fiscal year 2016 was 22.64%. While the “inspiration” awards resulted in higher than expected share usage, moving forward we expect to work to achieve target dilution and annual burn rate levels more in line

with industry norms.

|

Key Plan Features Representing Corporate Governance Best Practices

The Amended Plan includes provisions that are designed to protect our stockholders’ interests and to reflect corporate governance best

practices including:

|

|

•

|

|

Repricing is not allowed

. The Amended Plan prohibits the repricing of outstanding stock options and

stock appreciation rights and the cancellation of any outstanding stock options or stock appreciation rights that have an exercise or strike price greater than the then-current fair market value of our common stock in exchange for cash or other

stock awards under the Amended Plan without prior stockholder approval.

|

|

|

•

|

|

Restrictions on payment of dividends and dividend equivalents

. The Amended Plan provides that dividends

and dividend equivalents shall not be paid in respect of shares of Common Stock covered by a stock award until such shares of common stock vest.

|

|

|

•

|

|

No liberal share recycling

. The Amended Plan does not provide for “liberal” share recycling.

For example, shares withheld on net exercises of options, shares withheld to meet tax obligations and shares repurchased by the Company using stock option proceeds do not return to the plan to be granted pursuant to future awards.

|

|

|

•

|

|

Awards subject to forfeiture/clawback

. In accepting an Award under the Amended Plan, a participant

agrees to be bound by any clawback policy the Company adopts in the future.

|

|

|

•

|

|

No liberal change in control definition

. The change in control definition in the Amended Plan is not a

“liberal” definition (for example, it does not provide for a change in control upon merely the signing of a definitive change in control agreement). A change in control transaction must actually occur in order for the change in control

provisions in the Amended Plan to be triggered.

|

|

|

•

|

|

No requirement for single trigger vesting in plan

. The Amended Plan does not require that the vesting

of all awards be accelerated on a change in control.

|

|

|

•

|

|

No discounted stock options or stock appreciation rights

. All stock options and stock appreciation

rights granted under the Amended Plan must have an exercise or strike price equal to or greater than the fair market value of our common stock on the date the stock option or stock appreciation right is granted.

|

|

|

•

|

|

Administration by independent committee

. The Amended Plan is administered by the members of our

Compensation Committee, all of whom are “non-employee directors” within the meaning of Rule 16b-3

|

14.

|

|

under the Exchange Act and “independent” within the meaning of the NASDAQ listing standards. In addition, all of the members of our Compensation Committee, which has been delegated

certain authorities with respect to awards that are intended to qualify as “performance-based compensation” under Section 162(m) of the Code, are “outside directors” within the meaning of Section 162(m) of the Code.

|

|

|

•

|

|

Material amendments require stockholder approval

. Consistent with NASDAQ rules, the Amended

requires stockholder approval of any material revisions to the Amended Plan. In addition, certain other amendments to the Amended Plan require stockholder approval.

|

|

|

•

|

|

Limit on non-employee director aggregate compensation

. In any calendar year, the sum of the cash

compensation paid to any non-employee director for service as a director and the value of awards under the Amended Plan made to such non-employee director (calculated based on grant date fair value for financial reporting purposes) may not exceed

$1,000,000.

|

Performance-Based Awards and Section 162(m)

Approval of the Amended Plan by our stockholders will also constitute approval of terms and conditions set forth therein that will permit us

to grant stock options, stock appreciation rights and performance-based awards under the Amended Plan that may qualify as “performance-based compensation” within the meaning of Section 162(m) of the Code. Section 162(m) of the

Code disallows a deduction to any publicly held corporation and its affiliates for certain compensation paid to “covered employees” in a taxable year to the extent that compensation to a covered employee exceeds $1 million. However, some

kinds of compensation, including qualified “performance-based compensation,” are not subject to this deduction limitation. For compensation awarded under a plan to qualify as “performance-based compensation” under

Section 162(m) of the Code, among other things, the following terms must be disclosed to and approved by the stockholders before the compensation is paid: (i) a description of the employees eligible to receive such awards; (ii) a

per-person limit on the number of shares subject to stock options, stock appreciation rights and performance-based stock awards; and (iii) a description of the business criteria upon which the performance goals for performance-based awards may

be granted (or become vested or exercisable). Accordingly, we are requesting that our stockholders approve the Amended Plan, which includes terms and conditions regarding eligibility for awards, annual per-person limits on awards and the business

criteria for performance-based awards granted under the Amended Plan (as described in the summary below).

We believe it is in the best

interests of our company and our stockholders to preserve the ability to grant “performance-based compensation” under Section 162(m) of the Code. However, in certain circumstances, we may determine to grant compensation to covered

employees that is not intended to qualify as “performance-based compensation” for purposes of Section 162(m) of the Code. Moreover, even if we grant compensation that is intended to qualify as “performance-based

compensation” for purposes of Section 162(m) of the Code, we cannot guarantee that such compensation ultimately will be deductible by us.

Stockholder Approval

If this Proposal 2

is approved by our stockholders, the Amended Plan will become effective as of the date of the Annual Meeting. In the event that our stockholders do not approve this Proposal 2, the Amended Plan will not become effective and the 2016 Stock Incentive

Plan will continue to be effective in accordance with its current terms.

Description of the Amended Plan

The material features of the Amended Plan are described below. The following description of the Amended Plan is a summary only and is

qualified in its entirety by reference to the complete text of the Amended Plan. Stockholders are urged to read the actual text of the Amended Plan, hereby attached to this proxy statement as Exhibit A, in its entirety.

Purpose

The purpose of the

Amended Plan is to advance the interests of the Company’s stockholders by enhancing the Company’s ability to attract, retain and motivate persons who are expected to make important contributions to the

15.

Company and by providing such persons with equity ownership opportunities and performance-based incentives that are intended to better align the interests of such persons with those of the

Company’s stockholders.

Types of Awards

The Amended Plan provides for the grant of incentive stock options, nonstatutory stock options, stock appreciation rights (“SARs”),

awards of restricted stock, restricted stock units, other stock-based awards, and cash-based awards.

Shares Available for Awards

Subject to adjustment for certain changes in our capitalization, the share reserve will not exceed 7,236,892 shares, which is the sum

of (i) 1,275,000 new shares,

plus

(ii) the 3,066,500 shares originally reserved under the 2016 Stock Incentive Plan, any or all of which may be granted pursuant to incentive stock options plus (iii) 2,895,392 shares, which is

the number of shares of common stock subject to awards to be granted under the Company’s Converted Equity Awards Incentive Plan which awards expire, terminate or are otherwise surrendered, canceled or forfeited.

For purposes of counting the number of shares available for the grant of awards under the Amended Plan under this and under the sublimits

described below:

|

|

•

|

|

all shares of common stock covered by SARs will be counted against the number of shares available for the

grant of awards under the Amended, except that (i) SARs that may be settled only in cash will not be so counted and (ii) if the Company grants an SAR in tandem with an option for the same number of shares of Common Stock and provides that

only one such award may be exercised (a “Tandem SAR”), only the shares covered by the option, and not the shares covered by the Tandem SAR, will be so counted, and the expiration of one in connection with the other’s exercise will not

restore shares to the Amended Plan;

|

|

|

•

|

|

if any award (i) expires or is terminated, surrendered or cancelled without having been fully exercised

or is forfeited in whole or in part (including as the result of shares of common stock subject to the award being repurchased by the Company at the original issuance price pursuant to a contractual repurchase right) or (ii) results in any

common stock not being issued (including as a result of a SAR that was settleable either in cash or in stock actually being settled in cash), the unused common stock covered by the award will again be available for the grant of awards, except that

(A) in the case of incentive stock options, the foregoing shall be subject to any limitations under the Internal Revenue Code, (B) in the case of the exercise of a SAR, the number of shares counted against the shares available under the

Amended Plan will be the full number of shares subject to the SAR multiplied by the percentage of the SAR actually exercised, regardless of the number of shares actually used to settle such SAR upon exercise and (C) the shares covered by a

Tandem SAR will not again become available for grant upon the expiration or termination of such Tandem SAR;

|

|

|

•

|

|

shares of common stock delivered (either by actual delivery, attestation, or net exercise) to the Company by a

participant to (i) purchase shares of common stock upon the exercise of an award or (ii) satisfy tax withholding obligations with respect to awards (including shares retained from the award creating the tax obligation) will not be added

back to the number of shares available for the future grant of awards; and

|

|

|

•

|

|

shares of common stock repurchased by the Company on the open market using the proceeds from the exercise of

an award shall not increase the number of shares available for future grant of awards.

|

Eligibility

All of our approximately 118 employees, 6 non-employee directors and 18 consultants as of December 31, 2016 are eligible to

participate in the Amended Plan and may receive all types of awards other than incentive stock options. Incentive stock options may be granted under the Amended Plan only to employees. We have not historically generally granted awards to our

consultants.

Section 162(m) Limit

Subject to adjustment pursuant to the capitalization adjustment provisions of the Amended Plan, the maximum number of shares of common stock

with respect to which awards may be granted to any participant under the

16.

Amended Plan is 1,000,000 per calendar year. For purposes of this limit on the maximum number of shares that may be awarded to any participant, the combination of an option in tandem with a

stock appreciation right will be treated as a single award. In addition, under the Amended Plan, awards can provide for cash payments of up to $2,000,000 per calendar year per individual.

Non-Employee Director Compensation Limit

Under the Amended Plan, in any calendar year, the sum of cash compensation paid to any non-employee director for service as a director and the

value of awards under the Amended Plan made to such non-employee director (calculated based on the grant date fair value for financial reporting purposes) may not exceed $1,000,000.

17.

Administration and Certain Restrictions

The Amended Plan will be administered by the Board or a committee to which it delegates authority (either such entity, the “Plan

Administrator”). The Plan Administrator will have authority to grant awards and to adopt, amend and repeal such administrative rules, guidelines and practices relating to the Amended Plan as it deems advisable. The Plan Administrator may

construe and interpret the terms of the Amended Plan and any award agreements entered into under the Amended Plan, and may correct any defect, supply any omission or reconcile any inconsistency in the Amended Plan or any award. All actions and

decisions by the Plan Administrator with respect to the Amended Plan and any awards shall be made in the Plan Administrator’s discretion and shall be final and binding on all persons having or claiming any interest in the Amended Plan or in any

award.

Notwithstanding any other provision of the Amended Plan, no award granted on or after the date of this annual meeting may vest

(or, if applicable, be exercisable) until at least twelve (12) months following the date of grant of the award; provided, however, that up to 5% of the share reserve may be subject to awards granted on or after the date of this annual meeting

that do not meet such vesting (and, if applicable, exercisability) requirements.

Notwithstanding any other provision of the Amended Plan,

dividends or dividend equivalents may be paid or credited, as applicable, with respect to any shares of common stock subject to an award, as determined by the Plan Administrator and contained in the applicable award agreement; provided, however,

with respect to an award granted on or after the date of this annual meeting: (i) no dividends or dividend equivalents may be paid with respect to any such shares before the date such shares have vested under the terms of such award agreement,

(ii) any dividends or dividend equivalents that are credited with respect to any such shares will be subject to all of the terms and conditions applicable to such shares under the terms of such award agreement (including, but not limited to,

any vesting conditions), and (iii) any dividends or dividend equivalents that are credited with respect to any such shares will be forfeited to the Company on the date, if any, such shares are forfeited to or repurchased by the Company due to a

failure to meet any vesting conditions under the terms of such award agreement.

Subject to any requirements of applicable law, the Plan

Administrator may delegate to one or more officers of the Company the power to grant awards (subject to any limitations under the Amended Plan) to employees or officers of the Company and to exercise such other powers under the Amended Plan as the

Plan Administrator may determine, provided that the Plan Administrator will fix the terms of awards to be granted by such officers, the maximum number of shares subject to awards that the officers may grant, and the time period in which such awards

may be granted; and provided further, that no officer will be authorized to grant awards to any officer or executive officer.

Repricing;

Cancellation and Re-Grant of Stock Awards

Unless such action is approved by the Company’s stockholders, the Company may not,

outside certain limited change in control related-contexts: (1) amend any outstanding option granted under the Amended Plan to provide an exercise price per share that is lower than the then-current exercise price per share of such outstanding

option, (2) cancel any outstanding option (whether or not granted under the Amended Plan) and grant in substitution therefor new awards under the Amended Plan, (3) cancel in exchange for a cash payment any outstanding option with an

exercise price per share above the then-current fair market value of the common stock (valued in the manner determined by (or in a manner approved by) the Board), or (4) take any other action under the Amended Plan that constitutes a

“repricing” within the meaning of the rules of the NASDAQ Stock Market.

Stock Options