FCC's TV Airwaves Auction Drew $19.8 Billion, Led by T-Mobile -- Update

April 13 2017 - 6:21PM

Dow Jones News

By Ryan Knutson, Drew FitzGerald and Shalini Ramachandran

T-Mobile US Inc., Dish Network Corp. and Comcast Corp. were

among the top buyers in the U.S. government's wireless airwaves

auction, which drew $19.8 billion in bids.

The results, announced Thursday, showed that T-Mobile was the

biggest spender at $8 billion. It was followed by Dish, which spent

$6.2 billion, and Comcast with $1.7 billion.

Verizon Communications Inc. and AT&T Inc., the nation's

largest wireless carriers by subscribers, largely sat out the

auction, which was run by the Federal Communications Commission and

began last year. AT&T offered $910 million for the licenses,

while Verizon declined to bid.

Verizon's absence, and the strong showing from companies like

Comcast that don't currently operate cellular networks, is a sign

of the changing telecommunications landscape. Verizon has said it

believes wireless airwaves, known as spectrum, have become too

expensive, and it would rather invest in technology to improve

coverage than buy fresh airwaves.

AT&T said in 2014 that it planned to spend at least $9

billion in the auction, but it recently won a government contract

to build a wireless network for public safety that comes with a

large swath of airwaves. It has also indicated interest in other

sectors like entertainment with its $85 billion deal to acquire

media company Time Warner Inc. An AT&T spokesman declined to

comment on the auction.

It wasn't immediately clear what Comcast and Dish plan to do

with the airwaves. Comcast said earlier this month it would start

selling cellphone service to its home internet customers, and the

service runs off the back of Verizon's network. Dish has been

amassing a trove of wireless airwaves for years that it has yet to

put to use.

The auction's conclusion also means the telecom sector can

resume deal talks after April 27, since participants were

prohibited from such discussions as a safeguard against bidding

collusion. Many analysts think T-Mobile could be an attractive

merger candidate for another wireless carrier like Sprint Corp. or

a cable provider like Comcast.

The complex reverse auction invited television broadcasters to

sell their airwaves with opening prices provided by the government.

Those bids fell until the agency got the licenses it needed at the

lowest possible price. Then, the FCC sold those airwaves to

companies that wanted them for cellular service.

The FCC said more than $10 billion would go to 175 TV stations

that are selling their licenses. Two New Jersey public broadcasting

stations sold licenses for $332 million. WWTO-TV, a Chicago

religious station owned by Trinity Broadcasting Network, went for

$304 million.

Other big sellers were 21st Century Fox, which sold $350 million

of licenses, and Sinclair Broadcast Group Inc., which sold $313

million.

In previous years, spectrum acquisitions have been prudent

investments. In 2006, Comcast was among the cable companies that

bought a chunk of airwaves for $2.37 billion. In 2011, those

companies sold the airwaves to Verizon for $3.6 billion and the

rights to resell Verizon's network under their own brands, which

Comcast is using as the foundation of its new wireless service.

Dish, which spent more than $10 billion in the previous auction

in 2015, must start building its network soon or face FCC

penalties. One option is for it to sell airwaves to, or merge with,

a wireless carrier, which could put the spectrum to use faster. In

February, Dish Chief Executive Charlie Ergen said he expected to

see merger talks pick up after the auction.

Selling the airwaves Dish acquired in this year's auction might

be more complicated, however. The FCC sale included one tier that

could be bought by anyone and a "reserve" tier of low-band airwaves

was set aside for companies that didn't already own a significant

amount of them.

The rule largely prevented AT&T and Verizon from bidding on

the reserve tier and also restricts most sales by the winning

bidders to AT&T or Verizon.

Even though Verizon didn't buy any airwaves, the company said it

was confident in its network position.

The airwaves are particularly important for T-Mobile, which

until recently held almost no low-band frequencies. As a result,

its network has suffered in buildings and rural areas.

AT&T and Verizon have more recently spent billions of

dollars securing rights to higher-frequency airwaves that they hope

will be useful in ultra-fast networks still being developed.

Write to Ryan Knutson at ryan.knutson@wsj.com, Drew FitzGerald

at andrew.fitzgerald@wsj.com and Shalini Ramachandran at

shalini.ramachandran@wsj.com

(END) Dow Jones Newswires

April 13, 2017 18:06 ET (22:06 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

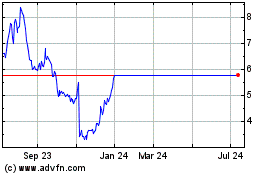

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Mar 2024 to Apr 2024

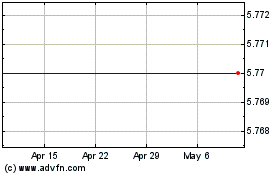

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Apr 2023 to Apr 2024