Current Report Filing (8-k)

April 13 2017 - 5:15PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 8, 2017

WERNER ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

NEBRASKA

|

0-14690

|

47-0648386

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

14507 FRONTIER ROAD

POST OFFICE BOX 45308

OMAHA, NEBRASKA

|

|

68145-0308

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(402) 895-6640

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

ITEM 5.02.

|

DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

|

Compensatory Arrangements of Certain Officers

On February 8, 2017, the Compensation Committee (the “Committee”) of the Board of Directors of Werner Enterprises, Inc. (the “Company”) approved a performance-based cash bonus program (Annual Incentive Plan or “AIP”). Cash performance awards under the AIP are subject to the terms and conditions for Performance Awards in the Company’s Amended and Restated Equity Plan, as amended and restated on May 14, 2013 (the “Plan”). The AIP is funded based on the achievement of an earnings before interest, taxes, depreciation and amortization threshold.

The target AIP payouts are expressed as a percentage of the executive's base salary (100% of base salary for Mr. Leathers, 70% for Mr. Nordlund, and 60% for the other named executive officers). Each executive can earn from 0% to 200% of their target payout based on the attainment of certain performance goals. The Committee approved the performance goals for the 2017 fiscal year for the AIP. The performance measures and weighting are: (i) operating income

–

55%, (ii) revenues, excluding fuel surcharge revenues

–

25%, and (iii) individual performance

–

20%.

On February 8, 2017, the Committee also approved grants of Restricted Stock (“RS”) and Performance Stock (“PS”) to the named executive officers of the Company as provided in the table below. Each RS and PS represents one share of the Company's common stock. The RS vests in four equal installments on each of the first four anniversaries from the grant date. The PS only vests if the Company meets specified performance objectives related to diluted earnings per share for a two-year period, beginning with the 2017 fiscal year and ending on December 31, 2018. All earned PS will cliff vest in one installment on the third anniversary from the grant date.

The 2017 RS and PS awards were granted to the following named executive officers (amounts in equivalent shares):

|

|

|

|

|

|

|

|

|

|

|

Named Executive Officer

|

|

RS (#)

|

|

PS (#) *

|

|

Derek J. Leathers

President and Chief Executive Officer

|

|

24,062

|

|

|

24,169

|

|

|

|

|

|

|

|

|

H. Marty Nordlund

Senior Executive Vice President and Chief Operating Officer

|

|

9,255

|

|

|

9,296

|

|

|

|

|

|

|

|

|

John J. Steele

Executive Vice President, Treasurer and Chief Financial Officer

|

|

4,627

|

|

|

4,648

|

|

|

|

|

|

|

|

|

Jim S. Schelble

Executive Vice President and Chief Administrative Officer

|

|

4,627

|

|

|

4,648

|

|

|

|

|

|

|

|

|

James L. Johnson

Executive Vice President, Chief Accounting Officer and Corporate Secretary

|

|

4,627

|

|

|

4,648

|

|

|

_____________

|

|

|

|

|

|

* PS amounts are presented at the target level of performance. Actual vesting ranges between 0% and 200% of the target, depending on actual performance, and has a total shareholder return (“TSR”) modifier that can cap the vesting at 150% based on the Company's TSR for the three-year period ending December 31, 2019.

|

The foregoing descriptions are not complete descriptions of all the rights and obligations and are qualified in their entirety by reference to the Plan filed as Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2013, which is incorporated by reference herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

WERNER ENTERPRISES, INC.

|

|

|

|

|

|

Date:

February 14, 2017

|

By:

|

|

/s/ John J. Steele

|

|

|

|

|

John J. Steele

|

|

|

|

|

Executive Vice President, Treasurer and

Chief Financial Officer

|

|

|

|

|

|

Date:

February 14, 2017

|

By:

|

|

/s/ James L. Johnson

|

|

|

|

|

James L. Johnson

|

|

|

|

|

Executive Vice President, Chief Accounting

Officer and Corporate Secretary

|

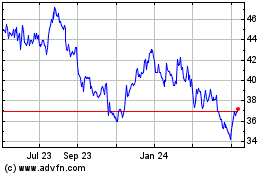

Werner Enterprises (NASDAQ:WERN)

Historical Stock Chart

From Mar 2024 to Apr 2024

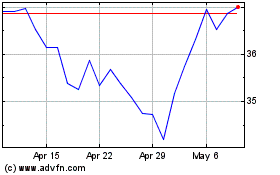

Werner Enterprises (NASDAQ:WERN)

Historical Stock Chart

From Apr 2023 to Apr 2024