QuickLinks

-- Click here to rapidly navigate through this document

As filed with the Securities and Exchange Commission on April 13, 2017

Registration No. 333-217183

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM F-10

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SILVER WHEATON CORP.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

Ontario, Canada

(Province or other jurisdiction of

incorporation or organization)

|

|

1041

(Primary Standard Industrial

Classification Code Number,

if applicable)

|

|

Not Applicable

(I.R.S. Employer

Identification No., if applicable)

|

Suite 3500

1021 West Hastings Street

Vancouver, British Columbia

V6E 0C3 Canada

(604) 684-9648

(Address and telephone number of Registrant's principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

(302)738-6680

(Name, address (including zip code) and telephone number (including

area code) of agent for service in the United States)

|

|

|

|

|

|

Curt Bernardi

Silver Wheaton Corp.

Suite 3500

1021 West Hastings Street

Vancouver, British Columbia

V6E 0C3 Canada

(604) 639-9498

|

|

Mark Bennett

Cassels Brock & Blackwell LLP

Suite 2200, HSBC Building

885 West Georgia Street

Vancouver, British Columbia

V6C 3E8 Canada

(604) 691-6100

|

|

Andrew Foley

Paul, Weiss, Rifkind, Wharton & Garrison LLP

1285 Avenue of the Americas

New York, New York

10019-6064 United States

(212) 373-3000

|

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration Statement.

Province of British Columbia, Canada

(Principal jurisdiction regulating this offering)

It is proposed that this filing shall become effective (check appropriate box below):

|

|

|

|

|

|

|

|

|

A.

|

|

ý

|

|

|

|

upon filing with the Commission pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada).

|

|

B.

|

|

o

|

|

|

|

at some future date (check the appropriate box below):

|

|

|

|

1.

|

|

o

|

|

pursuant to Rule 467(b) on ( ) at

( ) (designate a time not sooner than 7 calendar days after filing).

|

|

|

|

2.

|

|

o

|

|

pursuant to Rule 467(b) on ( ) at

( ) (designate a time 7 calendar days or sooner after filing) because the securities regulatory

authority in the review jurisdiction has issued a receipt or notification of clearance on ( ).

|

|

|

|

3.

|

|

o

|

|

pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of

clearance has been issued with respect hereto.

|

|

|

|

4.

|

|

o

|

|

after the filing of the next amendment to this Form (if preliminary material is being filed).

|

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction's shelf prospectus offering procedures, check

the following box.

ý

PART 1

INFORMATION REQUIRED TO BE DELIVERED

TO OFFEREES OR PURCHASERS

I-1

SHORT FORM BASE SHELF PROSPECTUS

US$2,000,000,000

Common Shares

Preferred Shares

Debt Securities

Subscription Receipts

Units

Warrants

Silver Wheaton Corp. ("

Silver Wheaton

" or the "

Corporation

") may offer and sell

from time to time common shares (the "

Common Shares

"), preferred shares (the "

Preferred

Shares

"), debt securities (the "

Debt Securities

"), subscription receipts

(the "

Subscription Receipts

"), units (the "

Units

") and warrants

(the "

Warrants

") (all of the foregoing, collectively, the "

Securities

") or any combination

thereof in one or more series or issuances up to an aggregate total offering price of US$2,000,000,000 (or the equivalent thereof in other currencies) during the 25 month period that

this short form base shelf prospectus (the "

Prospectus

"), including any amendments thereto, remains effective. The Securities may be offered

separately or together or in any combination, and as separate series, in amounts, at prices and on terms to be determined based on market conditions at the time of sale and set forth in an

accompanying shelf prospectus supplement (a "

Prospectus Supplement

").

Silver Wheaton is permitted, under a multijurisdictional disclosure system adopted by the securities regulatory authorities in Canada and the United States, to prepare

this Prospectus in accordance with Canadian disclosure requirements. Prospective investors in the United States should be aware that such requirements are different from those of the

United States. Silver Wheaton prepares its financial statements, which are incorporated by reference herein, in accordance with International Financial Reporting Standards as issued by the

International Accounting Standards Board ("IFRS") and they are subject to Canadian auditing and auditor independence standards and thus may not be comparable to financial statements of

United States companies.

The enforcement by investors of civil liabilities under the United States federal securities laws may be affected adversely by the fact that the Corporation is

incorporated under the laws of Ontario, Canada, that some or all of its officers and directors may be residents of a foreign country, that some or all of the experts named in this Prospectus may be,

and the underwriters, dealers or agents named in any Prospectus Supplement may be, residents of a foreign country, and a substantial portion of the assets of the Corporation and said persons may be

located outside of the United States. See "Enforceability of Certain Civil Liabilities".

NEITHER THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (THE "SEC") NOR ANY STATE SECURITIES REGULATOR HAS APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON

THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Prospective investors should be aware that the acquisition of the Securities may have tax consequences in Canada and the United States. Such consequences may not be

described fully herein or in any applicable Prospectus Supplement. Prospective investors should read the tax discussion contained in this Prospectus under the heading "Certain Federal Income Tax

Considerations" as well as the tax discussion contained in the applicable Prospectus Supplement with respect to a particular offering of Securities.

Silver

Wheaton will provide the specific terms of any offering of Securities, including the specific terms of the Securities with respect to a particular offering and the terms of such offering, in

one or more Prospectus Supplements. All applicable information permitted under applicable laws to be omitted from this Prospectus that has been omitted will be contained in one or more Prospectus

Supplements that will be delivered to purchasers together with this Prospectus. Each Prospectus Supplement will be incorporated by reference into this Prospectus for the purposes of securities

legislation as of the date of the Prospectus Supplement and only for the purposes of the distribution of the Securities to which the Prospectus Supplement pertains. Prospective investors should read

this Prospectus and any applicable Prospectus Supplement carefully before investing in any Securities issued pursuant to this Prospectus.

No underwriter has been involved in the preparation of this Prospectus or performed any review of the contents of this Prospectus.

This

Prospectus constitutes a public offering of these Securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such Securities.

The Corporation may offer and sell Securities to, or through, underwriters or dealers and may also offer and sell certain Securities directly to other purchasers or through agents pursuant to

exemptions from registration or qualification under applicable securities laws. A Prospectus Supplement relating to each issue of Securities offered pursuant to this Prospectus will set forth the

names of any underwriters, dealers or agents involved in the offering and sale of such Securities and will set forth the terms of the offering of such Securities, the method of distribution of such

Securities including, to the extent applicable, the proceeds to the Corporation, if any, and any fees, discounts or any other compensation payable to underwriters, dealers or agents and any other

material terms of the plan of distribution.

In connection with any offering of Securities, except as otherwise set out in a Prospectus Supplement relating to a particular offering of Securities, the underwriters or

dealers may over-allot or effect transactions which stabilize

or maintain the market price of the Securities offered at a level above that which might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any

time.

However, no underwriter or dealer involved in an "at-the-market distribution", as defined in Canadian National

Instrument 44-102 —

Shelf Distributions

("

NI 44-102

"), no affiliate of such an underwriter or dealer and no person or company acting jointly or in concert with such an underwriter or

dealer will over-allot Securities in connection with such distribution or effect any other transactions that are intended to stabilize or maintain the market price of the Securities. See "Plan of

Distribution".

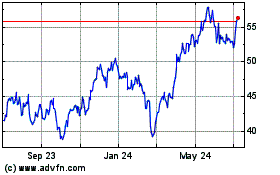

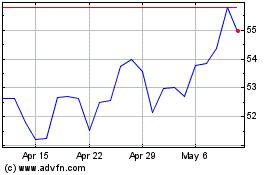

The

outstanding Common Shares are listed and posted for trading on the Toronto Stock Exchange (the "

TSX

") and are listed on the New York

Stock Exchange (the "

NYSE

") under the symbol "SLW". On April 12, 2017, the last trading day prior to the date of this Prospectus, the

closing price of the Common Shares on the TSX was C$29.02 and on the NYSE was US$21.87.

Unless otherwise specified in the applicable Prospectus Supplement, the Preferred

Shares, Debt Securities, Subscription Receipts, Units and Warrants will not be listed on any securities exchange. Consequently, unless otherwise specified in the applicable Prospectus Supplement,

there is no market through which such Securities may be sold and purchasers may not be able to resell any such Securities purchased under this Prospectus. This may affect the pricing of such

Securities in the secondary market, the transparency and availability of trading prices, the liquidity of such Securities and the extent of issuer regulation.

The

Corporation's head office is located at Suite 3500 – 1021 West Hastings Street, Vancouver, British Columbia, V6E 0C3 and its registered office

is located at Suite 2100, 40 King Street West, Toronto, Ontario, M5H 3C2.

Eduardo

Luna and Charles Jeannes, each being a director of the Corporation, reside outside Canada. Mr. Luna and Mr. Jeannes have each appointed Cassels Brock &

Blackwell LLP, Suite 2100, 40 King Street West, Toronto, Ontario M5H 3C2, as his agent for service of process in Canada. Prospective investors are advised that it may not

be possible for investors to enforce judgments obtained in Canada against Mr. Luna or Mr. Jeannes, even though they have each appointed an agent for service of process.

Investing in the Securities involves significant risks. The risks outlined in this Prospectus and in the documents incorporated by reference herein, including the applicable

Prospectus Supplement, should be carefully reviewed and considered by prospective investors in connection with any investment in Securities. See "Cautionary Note Regarding Forward-Looking Information"

and "Risk Factors".

Silver

Wheaton has filed an undertaking with each of the securities regulatory authorities in each of the provinces of Canada that it will not distribute Securities that, at the time of distribution,

are novel specified derivatives or novel asset-backed securities, without first pre-clearing with the applicable regulator, the disclosure to be contained in the Prospectus Supplement pertaining to

the distribution of such Securities.

All dollar amounts in this Prospectus are in United States dollars, unless otherwise indicated. See "Currency Presentation and Exchange Rate

Information".

Where required by statute, regulation or policy, and where Securities are offered in currencies other than Canadian dollars, appropriate disclosure of foreign

exchange rates applicable to such Securities will be included in the Prospectus Supplement describing such Securities.

TABLE OF CONTENTS

|

|

|

|

|

|

Page

|

|

ABOUT THIS PROSPECTUS

|

|

2

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INFORMATION

|

|

2

|

|

AVAILABLE INFORMATION

|

|

6

|

|

CAUTIONARY NOTE TO UNITED STATES INVESTORS REGARDING PRESENTATION OF MINERAL RESERVE AND MINERAL RESOURCE ESTIMATES

|

|

7

|

|

FINANCIAL INFORMATION

|

|

8

|

|

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

|

|

8

|

|

DOCUMENTS INCORPORATED BY REFERENCE

|

|

8

|

|

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

|

|

9

|

|

THE CORPORATION

|

|

10

|

|

CONSOLIDATED CAPITALIZATION

|

|

10

|

|

USE OF PROCEEDS

|

|

10

|

|

EARNINGS COVERAGE RATIO

|

|

10

|

|

PLAN OF DISTRIBUTION

|

|

10

|

|

DESCRIPTION OF SECURITIES

|

|

11

|

|

CERTAIN FEDERAL INCOME TAX CONSIDERATIONS

|

|

22

|

|

PRIOR SALES

|

|

22

|

|

MARKET FOR SECURITIES

|

|

22

|

|

RISK FACTORS

|

|

23

|

|

INTERESTS OF EXPERTS

|

|

37

|

|

LEGAL MATTERS

|

|

38

|

|

ENFORCEABILITY OF CERTAIN CIVIL LIABILITIES

|

|

38

|

1

ABOUT THIS PROSPECTUS

Unless the context otherwise requires, all references to Silver Wheaton or the Corporation include direct and indirect subsidiaries of

Silver Wheaton Corp. Silver Wheaton is a registered trademark of Silver Wheaton Corp. in Canada, the United States and certain other jurisdictions.

Readers

should rely only on the information contained or incorporated by reference in this Prospectus and any applicable Prospectus Supplement. The Corporation has not authorized anyone

to provide readers with different information. The Corporation is not making an offer to sell or seeking an offer to buy the Securities in any jurisdiction where the offer or sale is not permitted.

Readers should not assume that the information contained in this Prospectus and any applicable Prospectus Supplement is accurate as of any date other than the date on the front of such documents,

regardless of the time of delivery of this Prospectus and any applicable Prospectus Supplement or of any sale of the Securities. Information contained on the Corporation's website should not be deemed

to be a part of this Prospectus or incorporated by reference herein and should not be relied upon by prospective investors for the purpose of determining whether to invest in the Securities.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INFORMATION

The information included and incorporated by reference herein contains "forward-looking statements" within the meaning of the

United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation (collectively, "forward-looking

statements"). Forward-looking statements, which are all statements other than statements of historical fact, include, but are not limited to, statements with respect to:

-

•

-

proposed name change from Silver Wheaton Corp. to Wheaton Precious Metals Corp.;

-

•

-

the acquisition of Los Filos by Leagold Mining Corporation;

-

•

-

future payments by Silver Wheaton in accordance with early deposit precious metal purchase agreements, including any acceleration of

payments, estimated throughput and exploration potential;

-

•

-

projected increases to the Corporation's production and cash flow profile;

-

•

-

the expansion and exploration potential at the Salobo, San Dimas and Peñasquito mines;

-

•

-

projected changes to the Corporation's production mix;

-

•

-

anticipated increases in total throughput;

-

•

-

the effect of the Servicio de Adminitración Tributaria ("

SAT

") legal

claim on Primero Mining Corp.'s ("

Primero

") business, financial condition, results of operations and cash flows for 2010-2014 and 2015-2019;

-

•

-

the impact on Primero of the unionized employee strike at the San Dimas mine;

-

•

-

the ability of Primero to continue as a going concern;

-

•

-

the guarantee of Primero's revolving credit facility (the "

Primero Facility

");

-

•

-

the estimated future production;

-

•

-

the future price of commodities;

-

•

-

the estimation of mineral reserves and mineral resources;

-

•

-

the realization of mineral reserve estimates;

-

•

-

the timing and amount of estimated future production (including 2017 and average attributable annual production over the next

five years);

-

•

-

the costs of future production;

-

•

-

reserve determination;

-

•

-

estimated reserve conversion rates and produced but not yet delivered ounces;

2

-

•

-

any statements as to future dividends, the ability to fund outstanding commitments and the ability to continue to acquire accretive

precious metal stream interests;

-

•

-

confidence in the Corporation's business structure;

-

•

-

the Corporation's position relating to any dispute with the Canada Revenue Agency

(the "

CRA

") and the Corporation's intention to defend reassessments issued by the CRA; the impact of potential taxes, penalties and interest

payable to the CRA; possible audits for taxation years subsequent to 2013; estimates as to amounts that may be reassessed by the CRA in respect of taxation years subsequent to 2010; amounts that may

be payable in respect of penalties and interest; the Corporation's intention to file future tax returns in a manner consistent with previous filings; that the CRA will continue to accept the

Corporation's posting security for amounts sought by the CRA under the Reassessments (as defined herein) or will accept posting security for any other amounts that may be sought by the CRA

under other notices of reassessment; the length of time it would take to resolve any dispute with the CRA or an objection to a reassessment; and assessments of the impact and resolution of various tax

matters, including outstanding audits, proceedings with the CRA and proceedings before the courts; and

-

•

-

assessments of the impact and resolution of various legal and tax matters, including but not limited to outstanding

class actions.

Generally,

these forward-looking statements can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "projects", "intends", "anticipates" or "does not anticipate", or "believes", "potential", or variations of such words and phrases or statements that certain

actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward-looking

statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of

the Corporation to be materially different from those expressed or implied by such forward-looking statements, including but not limited to:

-

•

-

any decision to not proceed with the proposed name change from Silver Wheaton Corp. to Wheaton Precious Metals Corp., the failure to

receive shareholder approval for such name change or delays in implementing the proposed name change;

-

•

-

that the acquisition of Los Filos will not be completed;

-

•

-

risks related to the satisfaction of each party's obligations in accordance with the terms of the precious metal purchase agreements,

including any acceleration of payments, estimated throughput and exploration potential;

-

•

-

fluctuations in the price of commodities;

-

•

-

risks related to the mining operations from which the Corporation purchases silver or gold (the "

Mining

Operations

") including risks related to fluctuations in the price of the primary commodities mined at such operations, actual results of mining and exploration activities,

environmental, economic and political risks of the jurisdictions in which the Mining Operations are located, and changes in project parameters as plans continue to be refined;

-

•

-

absence of control over the Mining Operations and having to rely on the accuracy of the public disclosure and other information the

Corporation receives from the owners and operators of the Mining Operations as the basis for its analyses, forecasts and assessments relating to its own business;

-

•

-

Primero not being able to defend the validity of the Advance Pricing Agreement (the "

2012

APA

") issued by the SAT in 2012, being unable to pay taxes in Mexico based on realized silver prices or the SAT proceedings or actions otherwise have an adverse impact on the

business, financial condition or results of operation of Primero;

-

•

-

Primero not being able to continue as a going concern;

-

•

-

Primero not being able to obtain a satisfactory resolution of the unionized employee strike at the San Dimas mine within

three months;

3

-

•

-

Primero not being able to secure additional funding, resume San Dimas mine operations to normal operating capacity, reduce cash

outflows or have a successful outcome to a strategic review process;

-

•

-

Primero failing to make required payments or otherwise defaulting under the Primero Facility and the Corporation having to meet its

guarantee obligations;

-

•

-

differences in the interpretation or application of tax laws and regulations or accounting policies and rules, and the Corporation's

interpretation of, or compliance with, tax laws and regulations or accounting policies and rules, is found to be incorrect or the tax impact to the Corporation's business operations is materially

different than currently contemplated;

-

•

-

any challenge by the CRA of the Corporation's tax filings is successful and the potential negative impact to the Corporation's

previous and future tax filings;

-

•

-

the Corporation's business or ability to enter into precious metal purchase agreements is materially impacted as a result of any CRA

reassessment;

-

•

-

any reassessment of the Corporation's tax filings and the continuation or timing of any such process is outside the Corporation's

control;

-

•

-

any requirement to pay reassessed tax;

-

•

-

the Corporation is not assessed taxes on its foreign subsidiary's income on the same basis that the Corporation pays taxes on its

Canadian income, if taxable in Canada;

-

•

-

interest and penalties associated with a CRA reassessment having an adverse impact on the Corporation's financial position;

-

•

-

litigation risk associated with a challenge to the Corporation's tax filings;

-

•

-

credit and liquidity risks;

-

•

-

indebtedness and guarantees risks;

-

•

-

hedging risk;

-

•

-

competition in the mining industry;

-

•

-

risks related to the Corporation's acquisition strategy;

-

•

-

risks related to the market price of the Common Shares;

-

•

-

equity price risks related to the Corporation's holding of long-term investments in other exploration and mining companies;

-

•

-

risks related to the declaration, timing and payment of dividends;

-

•

-

the ability of the Corporation and the Mining Operations to retain key management employees or procure the services of skilled and

experienced personnel;

-

•

-

litigation risk associated with outstanding legal matters;

-

•

-

risks related to claims and legal proceedings against the Corporation or the Mining Operations;

-

•

-

risks relating to unknown defects and impairments;

-

•

-

risks relating to security over underlying assets;

-

•

-

risks related to ensuring the security and safety of information systems, including cyber security risks;

-

•

-

risks related to the adequacy of internal control over financial reporting;

-

•

-

risks related to governmental regulations;

-

•

-

risks related to international operations of the Corporation and the Mining Operations;

-

•

-

risks relating to exploration, development and operations at the Mining Operations;

4

-

•

-

risks related to the ability of the companies with which the Corporation has precious metal purchase agreements to perform their

obligations under those precious metal purchase agreements in the event of a material adverse effect on the results of operations, financial condition, cash flows or business of such companies;

-

•

-

risks related to environmental regulation and climate change;

-

•

-

the ability of the Corporation and the Mining Operations to obtain and maintain necessary licenses, permits, approvals

and rulings;

-

•

-

the ability of the Corporation and the Mining Operations to comply with applicable laws, regulations and permitting requirements;

-

•

-

lack of suitable infrastructure and employees to support the Mining Operations;

-

•

-

uncertainty in the accuracy of mineral reserve and mineral resource estimates;

-

•

-

inability to replace and expand mineral reserves;

-

•

-

risks relating to production estimates from Mining Operations, including anticipated timing of the commencement of production by

certain Mining Operations;

-

•

-

uncertainties related to title and indigenous rights with respect to the mineral properties of the Mining Operations;

-

•

-

fluctuation in the commodity prices other than silver or gold;

-

•

-

the ability of the Corporation and the Mining Operations to obtain adequate financing;

-

•

-

the ability of Mining Operations to complete permitting, construction, development and expansion;

-

•

-

challenges related to global financial conditions;

-

•

-

risks relating to future sales or the issuance of equity securities; and

-

•

-

other risks disclosed under the heading "Risk Factors" in this Prospectus and in the documents incorporated by reference herein.

Forward-looking

statements are based on assumptions management currently believes to be reasonable including, but not

limited to:

-

•

-

the receipt of shareholder approval for the proposed name change from Silver Wheaton Corp. to Wheaton Precious Metals Corp.;

-

•

-

that the acquisition of Los Filos will be completed;

-

•

-

the satisfaction of each party's obligations in accordance with the precious metal purchase agreements;

-

•

-

no material adverse change in the market price of commodities;

-

•

-

that the Mining Operations will continue to operate and the mining projects will be completed in accordance with public statements and

achieve their stated production estimates;

-

•

-

the continuing ability to fund or obtain funding for outstanding commitments;

-

•

-

that Primero is able to obtain a satisfactory resolution of the unionized employee strike at the San Dimas mine within

three months;

-

•

-

that Primero is able to continue as a going concern;

-

•

-

that Primero will make all required payments and not be in default under the Primero Facility;

-

•

-

the Corporation's ability to source and obtain accretive precious metal stream interests;

-

•

-

expectations regarding the resolution of legal and tax matters, including the ongoing class action litigation and CRA audit involving

the Corporation;

5

-

•

-

that the Corporation will be successful in challenging any reassessment by the CRA;

-

•

-

the Corporation has properly considered the application of Canadian tax law to its structure and operations;

-

•

-

the Corporation will continue to be permitted to post security for amounts sought by the CRA under notices of reassessment;

-

•

-

the Corporation has filed its tax returns and paid applicable taxes in compliance with Canadian tax law;

-

•

-

the Corporation will not change its business as a result of any CRA reassessment;

-

•

-

the Corporation's ability to enter into new precious metal purchase agreements will not be impacted by any CRA reassessment;

-

•

-

expectations and assumptions concerning prevailing tax laws and the potential amount that could be reassessed as additional tax,

penalties and interest by the CRA;

-

•

-

any foreign subsidiary income, if taxable in Canada, would be subject to the same or similar tax calculations as the Corporation's

Canadian income, including the Corporation's position, in respect of precious metal purchase agreements with upfront payments paid in the form of a deposit, that the estimates of income subject to tax

is based on the cost of precious metal acquired under such precious metal purchase agreements being equal to the market value of such precious metal;

-

•

-

the estimate of the recoverable amount for any precious metal purchase agreement with an indicator of impairment; and

-

•

-

other assumptions and factors as set out herein.

Although

the Corporation has attempted to identify important factors that could cause actual results, level of activity, performance or achievements to differ materially from those

contained in forward-looking statements, there may be other factors that cause results, level of activity, performance or achievements not to be as anticipated, estimated or intended. There can be no

assurance that forward-looking statements will prove to be accurate and even if events or results described in the forward-looking statements are realized or substantially realized, there can be no

assurance that they will have the expected consequences to, or effects on, the Corporation. Accordingly, readers should not place undue reliance on forward-looking statements and are cautioned that

actual outcomes may vary. The forward-looking statements included and incorporated by reference in this Prospectus are for the purpose of providing investors with information to assist them in

understanding the Corporation's expected financial and operational performance and may not be appropriate for other purposes. Any forward-looking statement speaks only as of the date on which it is

made. The Corporation does not undertake to update any forward-looking statements that are included or incorporated by reference herein, except in accordance with applicable securities laws.

AVAILABLE INFORMATION

The Corporation is subject to the informational requirements of the United States Securities Exchange Act of 1934

(the "

Exchange Act

") and applicable Canadian requirements and, in accordance therewith, files reports and other information with the SEC and with

securities regulatory authorities in Canada. Under the multijurisdictional disclosure system adopted by the United States and Canada, such reports and other information may be prepared in

accordance with Canadian disclosure requirements, which requirements are different from those of the United States. As a foreign private issuer, the Corporation is exempt from the rules under

the Exchange Act prescribing the furnishing and content of proxy statements, and the Corporation's officers, directors and principal shareholders are exempt from the reporting and short-swing profit

recovery provisions contained in Section 16 of the Exchange Act. Reports and other information filed by the Corporation with, or furnished to, the SEC may be inspected and copied at the public

reference facilities maintained by the SEC in the SEC's public reference room at 100 F Street, N.E., Washington, D.C., 20549 by paying a fee. Prospective investors may call the

SEC at 1-800-SEC-0330 or access its website at www.sec.gov for further information regarding the public reference facilities. The SEC also maintains a website that contains reports and

6

other

information regarding registrants that file electronically with the SEC. The address of the website is www.sec.gov.

The

Corporation has filed with the SEC a registration statement (the "

Registration Statement

") on Form F-10 under the

U.S. Securities Act with respect to the Securities. This Prospectus, including the documents incorporated by reference herein, which forms a part of the Registration Statement, does not

contain all of the information set forth in the Registration Statement, certain parts of which are contained in the exhibits to the Registration Statement as permitted by the rules and regulations of

the SEC. For further information with respect to the Corporation and the Securities, reference is made to the Registration Statement and the exhibits thereto. Statements contained in this Prospectus,

including the documents incorporated by reference herein, as to the contents of certain documents are not necessarily complete and, in each instance, reference is made to the copy of the document

filed as an exhibit to the Registration Statement. Each such statement is qualified in its entirety by such reference. The Registration Statement can be found on EDGAR at the SEC's website:

www.sec.gov.

CAUTIONARY NOTE TO UNITED STATES INVESTORS REGARDING PRESENTATION OF MINERAL RESERVE AND MINERAL RESOURCE ESTIMATES

This Prospectus, including the documents incorporated by reference herein, has been prepared in accordance with the requirements of the

securities laws in effect in Canada, which differ from the requirements of United States securities laws. The terms "mineral reserve", "proven mineral reserve" and "probable mineral reserve"

are Canadian mining terms defined in accordance with Canadian National Instrument 43-101 —

Standards of Disclosure for Mineral

Projects

("

NI 43-101

") and the Canadian Institute of Mining, Metallurgy and Petroleum

(the "

CIM

") —

CIM Definition Standards on Mineral Resources and Mineral

Reserves

, adopted by the CIM Council, as amended. These definitions differ from the definitions in Industry Guide 7 ("

SEC Industry Guide

7

") under the U.S. Securities Act of 1933, as amended (the "

U.S. Securities Act

"). Under

U.S. standards, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the

time the reserve determination is made. Also, under SEC Industry Guide 7 standards, a "final" or "bankable" feasibility study is required to report reserves, the three-year historical average

price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In

addition, the terms "mineral resource", "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" are defined in and required to be disclosed by

NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC.

Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves. "Inferred mineral resources" have a great amount of

uncertainty as to their existence and as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category.

Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or

any part of an inferred mineral resource exists or is economically or legally mineable. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Disclosure of

"contained ounces" in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC

standards as in place tonnage and grade without reference to unit measures.

Accordingly,

information contained in this Prospectus and the documents incorporated by reference herein that describes the Corporation's mineral deposits may not be comparable to

similar information made public by U.S. companies subject to reporting and disclosure requirements under the United States federal securities laws and the rules and regulations

thereunder.

See

"Description of the Business — Technical Information" in the Annual Information Form (as defined herein), which is incorporated by

reference herein, for a description of certain of the mining terms used in this Prospectus and the documents incorporated by reference herein.

7

FINANCIAL INFORMATION

Unless otherwise indicated, all financial information included and incorporated by reference in this Prospectus is determined using

IFRS, which differs from United States generally accepted accounting principles.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

The financial statements of the Corporation incorporated by reference in this Prospectus are reported in United States dollars.

All dollar amounts referenced, unless otherwise indicated, are expressed in United States dollars and are referred to as "United States dollars" or "US$". Canadian dollars are referred

to as "Canadian dollars" or "C$".

The

high, low and closing noon spot rates for Canadian dollars in terms of the United States dollar for each of the two years in the period ended December 31, 2016, as

quoted by the Bank of Canada, were as follows:

|

|

|

|

|

|

|

|

|

|

|

Year ended December 31

|

|

|

|

2016

|

|

2015

|

|

|

High

|

|

C$

|

1.4589

|

|

C$

|

1.3990

|

|

|

Low

|

|

C$

|

1.2544

|

|

C$

|

1.1728

|

|

|

Closing

|

|

C$

|

1.3427

|

|

C$

|

1.3840

|

|

On

April 12, 2017, the noon spot rate for Canadian dollars in terms of the United States dollar, as quoted by the Bank of Canada, was US$1.00 = C$1.3302.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this Prospectus from documents filed with the securities

commissions or similar authorities in each of the provinces of Canada and filed with, or furnished to, the SEC

. Copies of the documents incorporated herein by reference may be

obtained on request without charge from the Corporate Secretary of the Corporation at Suite 3500 – 1021 West Hastings Street, Vancouver, British

Columbia, V6E 0C3, telephone (604) 684-9648, and are also available electronically at www.sedar.com or in the United States through EDGAR at the website of the SEC at www.sec.gov.

The filings of the Corporation through the System for Electronic Document Analysis and Retrieval ("

SEDAR

") and EDGAR are not incorporated by reference

in this Prospectus except as specifically set out herein.

The

following documents, filed by the Corporation with the securities commissions or similar authorities in each of the provinces of Canada, are specifically incorporated by reference

into, and form an integral part of, this Prospectus:

-

(a)

-

the

annual information form (the "

Annual Information Form

") of the Corporation for the year ended

December 31, 2016 dated March 31, 2017;

-

(b)

-

the

audited consolidated financial statements of the Corporation as at and for the years ended December 31, 2016 and 2015, together with the

independent registered public accounting firm's report thereon and the notes thereto (the "

Annual Financial Statements

");

-

(c)

-

management's

discussion and analysis of the Corporation for the year ended December 31, 2016;

-

(d)

-

the

management information circular of the Corporation dated March 21, 2017 prepared in connection with the annual and special meeting of

shareholders of the Corporation to be held on May 10, 2017; and

-

(e)

-

the

material change report of the Corporation dated March 23, 2017 with respect to the Corporation's proposed name change.

Any

document of the type referred to in section 11.1 of Form 44-101F1 of National

Instrument 44-101 —

Short Form Prospectus Distributions

filed by the Corporation with the securities

commissions or similar regulatory authorities in the applicable provinces of Canada after the date of this Prospectus and prior to the date that is 25 months from the date hereof shall be

deemed to be incorporated by reference in this Prospectus.

In addition,

8

any document filed by the Corporation with, or furnished by the Corporation to, the SEC pursuant to the Exchange Act, subsequent to the date of this Prospectus and prior to the date that is

25 months from the date hereof shall be deemed to be incorporated by reference into the registration statement of which this Prospectus forms a part (in the case of any Report on

Form 6-K, if and to the extent provided in such report).

To the extent that any document or information incorporated by reference into this Prospectus is included

in a report that is filed with or furnished to the SEC, such document or information shall also be deemed to be incorporated by reference as an exhibit to the Registration Statement of which this

Prospectus forms a part.

Any statement contained in this Prospectus or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or

superseded, for purposes of this Prospectus, to the extent that a statement contained herein or in any other subsequently filed document that also is, or is deemed to be, incorporated by reference

herein modifies, replaces or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Prospectus. The

modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The

making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue

statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it

was made.

A

Prospectus Supplement containing the specific terms of an offering of Securities will be delivered to purchasers of such Securities together with this Prospectus and will be deemed to

be incorporated by reference into this Prospectus as of the date of such Prospectus Supplement, but only for the purposes of the offering of Securities covered by that Prospectus Supplement.

Upon

a new annual information form and the related annual financial statements being filed by the Corporation with the applicable securities commissions or similar regulatory authorities

during the currency of this Prospectus, the previous annual information form, the previous annual financial statements and all interim financial statements (and related management's discussion

and analysis in the interim reports for such periods), material change reports and management information circulars filed prior to the commencement of the Corporation's financial year in which the new

annual information form is filed shall be deemed no longer to be incorporated into this Prospectus for purposes of further offers and sales of Securities hereunder. Upon interim consolidated financial

statements and the accompanying management's discussion and analysis being filed by the Corporation with the applicable securities regulatory authorities during the period that this Prospectus is

effective, the previous interim consolidated financial statements and the accompanying management's discussion and analysis filed shall no longer be deemed to be incorporated into this Prospectus for

purposes of future offers and sales of Securities under this Prospectus. In addition, upon a new management information circular for the annual meeting of shareholders being filed by the Corporation

with the applicable securities regulatory authorities during the period that this Prospectus is effective, the previous management information circular filed in respect of the prior annual meeting of

shareholders shall no longer be deemed to be incorporated into this Prospectus for purposes of future offers and sales of Securities under this Prospectus.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

The following documents have been, or will be, filed with the SEC as part of the Registration Statement of which this Prospectus

forms a part: (1) the documents listed under "Documents Incorporated by Reference"; (2) the consent of Deloitte LLP; (3) the consent of Cassels Brock &

Blackwell LLP; (4) powers of attorney from certain of the Corporation's directors and officers (included in the Registration Statement); (5) the consents of the "qualified

persons" and other persons referred to in this Prospectus under "Interests of Experts"; and (6) the form of debt indenture. A copy of the form of warrant agreement, subscription receipt

agreement, or statement of eligibility of trustee on Form T-1, as applicable, will be filed by post-effective amendment or by incorporation by reference to documents filed or furnished with the

SEC under the Exchange Act.

9

THE CORPORATION

Silver Wheaton is a mining company which generates its revenue primarily from the sale of silver and gold. To date, the Corporation has

entered into 19 long-term purchase agreements and two early deposit long-term purchase agreements associated with silver and/or gold, relating to 30 different mining assets, whereby

Silver Wheaton acquires silver and gold production from the counterparties for a per ounce cash payment at or below the prevailing market price. The primary drivers of the Corporation's financial

results are the volume of silver and gold production at the various mines to which the precious metal purchase agreements relate and the price of silver and gold realized by Silver Wheaton

upon sale.

The

Corporation is actively pursuing future growth opportunities, primarily by way of entering into additional long-term precious metal purchase agreements. There is no assurance,

however, that any potential transaction will be successfully completed.

For

a further description of the business of the Corporation, see the sections entitled "Corporate Structure" and "Description of the Business" in the Annual Information Form.

CONSOLIDATED CAPITALIZATION

There have been no material changes in the share and loan capital of the Corporation, on a consolidated basis, since the date of the

Annual Financial Statements, which are incorporated by reference in this Prospectus.

The

applicable Prospectus Supplement will describe any material change, and the effect of such material change, on the Corporation's share and loan capitalization that will result from

the issuance of Securities pursuant to such Prospectus Supplement.

USE OF PROCEEDS

The net proceeds to Silver Wheaton from any offering of Securities, the proposed use of those proceeds and the specific business

objectives which the Corporation expects to accomplish with such proceeds will be set forth in the applicable Prospectus Supplement relating to that offering of Securities.

There

may be circumstances where, on the basis of results obtained or for other sound business reasons, a re-allocation of funds may be necessary or prudent. Accordingly, management will

have broad discretion in the application of the proceeds of an offering of Securities. The actual amount that we spend in connection with each intended use of proceeds may vary significantly from the

amounts specified in the applicable Prospectus Supplement and will depend on a number of factors, including those referred to under "Risk Factors" and any other factors set forth in the applicable

Prospectus Supplement. The Corporation may invest funds which it does not immediately use. Such investments may include short-term marketable investment grade securities. The Corporation may, from

time to time, issue securities (including debt securities) other than pursuant to this Prospectus. See "Risk Factors".

EARNINGS COVERAGE RATIO

Earnings coverage ratios will be provided as required in the applicable Prospectus Supplement with respect to the issuance of Debt

Securities pursuant to this Prospectus.

PLAN OF DISTRIBUTION

The Corporation may, from time to time, during the 25-month period that this Prospectus remains valid, offer for sale and issue

Securities. The Corporation may issue and sell up to US$2,000,000,000, in the aggregate, of Securities.

The

Corporation may offer and sell Securities directly to one or more purchasers, through agents, or through underwriters or dealers designated by us from time to time. Each Prospectus

Supplement will set forth the terms of the offering, including the name or names of any underwriters, dealers or agents and any fees or compensation payable to them in connection with the offering and

sale of a particular series or issue of

10

Securities,

the public offering price or prices of the Securities and the proceeds to the Corporation from the sale of the Securities.

The

Securities may be sold, from time to time in one or more transactions at a fixed price or prices which may be changed or at market prices prevailing at the time of sale, at prices

related to such prevailing market prices or at negotiated prices, including in transactions that are deemed to be "at-the-market distributions" as defined in NI 44-102, including sales made

directly on the TSX, NYSE or other existing trading markets for the Securities. The prices at which the Securities may be offered may vary as between purchasers and during the period of distribution.

If, in connection with the offering of Securities at a fixed price or prices, the underwriters have made a

bona fide

effort to sell all of the

Securities at the initial offering price fixed in the applicable Prospectus Supplement, the public offering price may be decreased and thereafter further changed, from time to time, to an amount not

greater than the initial public offering price fixed in such Prospectus Supplement, in which case the compensation realized by the underwriters will be decreased by the amount that the aggregate price

paid by purchasers for the Securities is less than the gross proceeds paid by the underwriters to the Corporation.

Underwriters,

dealers and agents who participate in the distribution of the Securities may be entitled under agreements to be entered into with the Corporation to indemnification by the

Corporation against certain liabilities, including liabilities under the U.S. Securities Act and Canadian securities legislation, or to contribution with respect to payments which such

underwriters, dealers or agents may be required to make in respect thereof. Such underwriters, dealers and agents may be customers of, engage in transactions with, or perform services for, the

Corporation in the ordinary course of business.

In

connection with any offering of Securities, other than an "at-the-market distribution", the underwriters may over-allot or effect transactions which stabilize or maintain the market

price of the Securities offered at a level above that which might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time. No underwriter or dealer

involved in an "at the market distribution", as defined in NI 44-102, no affiliate of such an underwriter or dealer and no person acting jointly or in concert with such an underwriter or dealer

will over allot Securities in connection with such distribution or effect any other transactions that are intended to stabilize or maintain the market price of the Securities.

Unless

otherwise specified in the applicable Prospectus Supplement, the Corporation does not intend to list any of the Securities other than the Common Shares on any securities exchange.

Unless otherwise specified in the applicable Prospectus Supplement, the Preferred Shares, Debt Securities, Subscription Receipts, Units and Warrants will not be listed on any securities exchange.

Consequently, unless otherwise specified in the applicable Prospectus Supplement, there is no market through which the Preferred Shares, Debt Securities, Subscription Receipts, Units and Warrants may

be sold and purchasers may not be able to resell any such Securities purchased under this Prospectus. This may affect the pricing of the Preferred Shares, Debt Securities, Subscription Receipts, Units

and Warrants in the secondary market, the transparency and availability of trading prices, the liquidity of such Securities and the extent of issuer regulation. No assurances can be given that a

market for trading in Securities of any series or issue will develop or as to the liquidity of any such market, whether or not the Securities are listed on a securities exchange.

DESCRIPTION OF SECURITIES

Common Shares

The authorized share capital of the Corporation consists of an unlimited number of Common Shares. As of the date of this Prospectus,

there are an aggregate of 441,517,017 Common Shares issued and outstanding. In addition, as of the date of this Prospectus, there were 4,507,450 Common Shares issuable upon the exercise

of outstanding stock options, 311,041 Common Shares issuable upon the vesting of restricted share units and 10,000,000 outstanding Warrants. The Common Shares may be offered separately

or together with other Securities, as the case may be.

11

Holders

of Common Shares are entitled to receive notice of any meetings of shareholders of the Corporation, to attend and to cast one vote per Common Share at all such meetings. Holders

of Common Shares do not have cumulative voting rights with respect to the election of directors and, accordingly, holders of a majority of the Common Shares entitled to vote in any election of

directors may elect all directors standing for election. In 2014, the Corporation adopted advance notice provisions for the nomination of directors which apply in circumstances where director

nominations are made by shareholders of the Corporation, other than in connection with (i) the requisition of a shareholders' meeting, or (ii) a shareholder proposal, in each case made

pursuant to the

Business Corporations Act

(Ontario). The advance notice provisions fix a deadline by which holders of record of Common Shares must

submit director nominations to the Corporation prior to any annual or special meeting of shareholders and sets forth the information that a shareholder must include in the notice to the Corporation.

Holders

of Common Shares are entitled to receive on a pro rata basis such dividends, if any, as and when declared by the Corporation's Board of Directors at its discretion from

funds legally available therefor and upon the liquidation, dissolution or winding up of the Corporation, are entitled to receive on a pro rata basis the net assets of the Corporation after

payment of debts and other liabilities, in each case subject to the rights, privileges, restrictions and conditions attaching to any other series or class of shares ranking senior in priority to or on

a pro rata basis with the holders of Common Shares with respect to dividends or liquidation. Although the articles of the Corporation provide for the potential issuance of Preferred Shares,

there is currently no other series or class of shares outstanding which ranks senior in priority to the Common Shares. The Common Shares do not carry any pre-emptive, subscription, redemption or

conversion rights, nor do they contain any sinking or purchase fund provisions. The Common Shares do not carry any provisions permitting or restricting the issuance of additional securities or other

material restrictions, nor do they contain any provisions requiring a securityholder to contribute additional capital.

Preferred Shares

The authorized share capital of the Corporation consists of an unlimited number of Preferred Shares. As of the date of this Prospectus,

there are no Preferred Shares issued and outstanding. The Preferred Shares may be offered separately or together with other Securities, as the case may be.

The

Preferred Shares may, at any time or from time to time, be issued in one or more series. The Corporation's Board of Directors shall fix before issue, the number of, the consideration

per share of, the designation of, and the provisions attaching to the shares of each series. Except as required by law or as otherwise determined by the Corporation's Board of Directors in respect of

a series of shares, the holder of a Preferred Share shall not be entitled to vote at meetings of shareholders. The Preferred Shares of each series rank on a priority with the Preferred Shares of every

other series and are entitled to preference over the Common Shares and any other shares ranking subordinate to the Preferred Shares with respect to priority and payment of dividends and distribution

of assets in the event of liquidation, dissolution or winding-up of the Corporation. The Preferred Shares do not carry any provisions permitting or restricting the issuance of additional securities or

other material restrictions, nor do they contain any provisions requiring a securityholder to contribute additional capital.

Debt Securities

In this section describing the Debt Securities, the term "Corporation" refers only to Silver Wheaton Corp. without any of its

subsidiaries.

As

of the date of this Prospectus, there are no Debt Securities outstanding. The following description sets forth certain general terms and provisions of Debt Securities that may be

issued hereunder and is not intended to be complete. The Debt Securities may be offered separately or together with other Securities, as the case may be. The specific terms of Debt Securities,

including the extent to which the general terms described in this section apply to those Debt Securities, will be set forth in the applicable Prospectus Supplement.

The

Debt Securities will be issued in one or more series under an indenture (the "

Indenture

") to be entered into between the

Corporation and one or more trustees (the "

Trustee

") that will be named in a Prospectus Supplement for a series of Debt Securities. To the extent

applicable, the Indenture will be subject to and

12

governed

by the

United States Trust Indenture Act of 1939

, as amended. A copy of the form of the Indenture to be entered into has been filed with

the SEC as an exhibit to the registration statement of which this Prospectus forms a part and will be filed with the securities commissions or similar authorities in each of the provinces of

Canada when it is entered into. The description of certain provisions of the Indenture in this section do not purport to be complete and are subject to, and are qualified in their entirety by

reference to, the provisions of the Indenture. Terms used in this summary that are not otherwise defined herein have the meaning ascribed to them in the Indenture.

The

Corporation may issue Debt Securities and incur additional indebtedness other than through the offering of Debt Securities pursuant to this Prospectus.

General

The Indenture does not limit the aggregate principal amount of Debt Securities which the Corporation may issue under the Indenture and

does not limit the amount of other indebtedness that the Corporation may incur. The Indenture provides that the Corporation may issue Debt Securities from time to time in one or more series which may

be denominated and payable in United States dollars, Canadian dollars or any other currency. Unless otherwise indicated in the applicable Prospectus Supplement, the Indenture also permits the

Corporation, without the consent of the holders of any Debt Securities, to increase the principal amount of any series of Debt Securities the Corporation has previously issued under the Indenture and

to issue such increased principal amount.

The

particular terms relating to Debt Securities offered by a Prospectus Supplement (the "

Offered Securities

") will be described in

the related Prospectus Supplement. This description may include, but may not be limited to, any of the following, if applicable:

-

•

-

the specific designation of the Offered Securities; any limit on the aggregate principal amount of the Offered Securities; the date or

dates, if any, on which the Offered Securities will mature and the portion (if less than all of the principal amount) of the Offered Securities to be payable upon declaration of acceleration

of maturity;

-

•

-

the rate or rates (whether fixed or variable) at which the Offered Securities will bear interest, if any, the date or dates from which

any such interest will accrue and on which any such interest will be payable and the record dates for any interest payable on the Offered Securities that are in registered form;

-

•

-

the terms and conditions under which the Corporation may be obligated to redeem, repay or purchase the Offered Securities pursuant to

any sinking fund or analogous provisions or otherwise;

-

•

-

the terms and conditions upon which the Corporation may redeem the Offered Securities, in whole or in part, at its option;

-

•

-

the covenants applicable to the Offered Securities;

-

•

-

the terms and conditions for any conversion or exchange of the Offered Securities for any other securities;

-

•

-

whether the Offered Securities will be issuable in registered form or bearer form or both, and, if issuable in bearer form, the

restrictions as to the offer, sale and delivery of the Offered Securities which are in bearer form and as to exchanges between registered form and bearer form;

-

•

-

whether the Offered Securities will be issuable in the form of registered global securities ("

Global

Securities

"), and, if so, the identity of the depositary for such registered Global Securities;

-

•

-

the denominations in which registered Offered Securities will be issuable, if other than denominations of US$2,000 and integral

multiples of US$1,000 and the denominations in which bearer Offered Securities will be issuable, if other than US$5,000;

-

•

-

each office or agency where payments on the Offered Securities will be made (if other than the offices or agencies described

under the heading "Payment" below) and each office or agency where the Offered Securities may be presented for registration of transfer or exchange;

13

-

•

-

if other than United States dollars, the currency in which the Offered Securities are denominated or the currency in which the

Corporation will make payments on the Offered Securities;

-

•

-

any index, formula or other method used to determine the amount of payments of principal of (and premium, if any) or interest,

if any, on the Offered Securities; and

-

•

-

any other terms of the Offered Securities which apply solely to the Offered Securities, or terms described herein as generally

applicable to the Debt Securities which are not to apply to the Offered Securities.

Unless

otherwise indicated in the applicable Prospectus Supplement:

-

•

-

holders may not tender Debt Securities to the Corporation for repurchase; and

-

•

-

the rate or rates of interest on the Debt Securities will not increase if the Corporation becomes involved in a highly leveraged

transaction or the Corporation is acquired by another entity.

The

Corporation may issue Debt Securities under the Indenture bearing no interest or interest at a rate below the prevailing market rate at the time of issuance and, in such

circumstances, the Corporation may offer and sell those Debt Securities at a discount below their stated principal amount. The Corporation will describe in the applicable Prospectus Supplement any

Canadian and U.S. federal income tax consequences and other special considerations applicable to any discounted Debt Securities or other Debt Securities offered and sold at par which are

treated as having been issued at a discount for Canadian and/or U.S. federal income tax purposes.

Any

Debt Securities issued by the Corporation will be direct, unconditional and unsecured obligations of the Corporation and will rank equally among themselves and with all of the

Corporation's other unsecured, unsubordinated obligations, except to the extent prescribed by law. Debt Securities issued by the Corporation will be structurally subordinated to all existing and

future liabilities, including trade payables and other indebtedness, of the Corporation's subsidiaries. The Corporation will agree to provide to the Trustee (i) annual reports containing

audited financial statements and (ii) quarterly reports for the first three quarters of each fiscal year containing unaudited financial information.

Form, Denomination, Exchange and Transfer

Unless otherwise indicated in the applicable Prospectus Supplement, the Corporation will issue Debt Securities only in fully registered

form without coupons, and in denominations of US$2,000 and integral multiples of US$1,000. Debt Securities may be presented for exchange and registered Debt Securities may be presented for

registration of transfer in the manner to be set forth in the Indenture and in the applicable Prospectus Supplement, without service charges. The Corporation may, however, require payment sufficient

to cover any taxes or other governmental charges due in connection with the exchange or transfer. The Corporation will appoint the Trustee as security registrar. Bearer Debt Securities and the coupons

applicable to bearer Debt Securities thereto will be transferable by delivery.

Payment

Unless otherwise indicated in the applicable Prospectus Supplement, the Corporation will make payments on registered Debt Securities

(other than Global Securities) at the office or agency of the Trustee, except that the Corporation may choose to pay interest (a) by check mailed to the

address of the person entitled to such payment as specified in the security register, or (b) by wire transfer to an account maintained by the person entitled to such payment as specified in the

security register. Unless otherwise indicated in the applicable Prospectus Supplement, the Corporation will pay any interest due on registered Debt Securities to the persons in whose name such

registered Securities are registered on the day or days specified in the applicable Prospectus Supplement.

Registered Global Securities

Unless otherwise indicated in the applicable Prospectus Supplement, registered Debt Securities of a series will be issued in global

form that will be deposited with, or on behalf of, a depositary (the "

Depositary

") identified in the Prospectus Supplement. Global Securities

will be registered in the name of the Depositary, and the Debt Securities included in the Global Securities may not be transferred to the name of any other direct

14

holder

unless the special circumstances described below occur. Any person wishing to own Debt Securities issued in the form of Global Securities must do so indirectly by virtue of an account with a

broker, bank or other financial institution that, in turn, has an account with the Depositary.

The

Corporation's obligations under the Indenture, as well as the obligations of the Trustee and those of any third parties employed by the Corporation or the

Trustee, run only to persons who are registered as holders of Debt Securities. For example, once the Corporation makes payment to the registered holder, the Corporation has no further responsibility

for the payment even if that holder is legally required to pass the payment along to an investor but does not do so. As an indirect holder, an investor's rights relating to a Global Security will be

governed by the account rules of the investor's financial institution and of the Depositary, as well as general laws relating to debt securities transfers.

An

investor should be aware that when Debt Securities are issued in the form of Global Securities:

-

•

-

the investor cannot have Debt Securities registered in his or her own name;

-

•

-

the investor cannot receive physical certificates for his or her interest in the Debt Securities;

-

•

-

the investor must look to his or her own bank, brokerage firm or other financial institution for payments on the Debt Securities and

protection of his or her legal rights relating to the Debt Securities;

-

•

-

the investor may not be able to sell interests in the Debt Securities to some insurance companies and other institutions that are

required by law to hold the physical certificates of Debt Securities that they own;

-

•

-

the Depositary's policies will govern payments, transfers, exchange and other matters relating to the investor's interest in the

Global Security; the Corporation and the Trustee will have no responsibility for any aspect of the Depositary's actions or for its records of ownership interests in the Global Security; the

Corporation and the Trustee also do not supervise the Depositary in any way; and

-

•

-

the Depositary will usually require that interests in a Global Security be purchased or sold within its system using

same-day funds.

In

a few special situations described below, a Global Security will terminate and interests in it will be exchanged for physical certificates representing Debt

Securities. After that exchange, an investor may choose whether to hold Debt Securities directly or indirectly through an account at its bank, brokerage firm or other financial institution. Investors

must consult their own banks, brokers or other

financial institutions to find out how to have their interests in Debt Securities transferred into their own names, so that they will be registered holders of the Debt Securities represented by each

Global Security.

The

special situations for termination of a Global Security are:

-

•

-

when the Depositary notifies the Corporation that it is unwilling, unable or no longer qualified to continue as Depositary (unless a

replacement Depositary is named); and

-

•

-

when and if the Corporation decides to terminate a Global Security.

The

Prospectus Supplement may list situations for terminating a Global Security that would apply only to the particular series of Debt Securities covered by the Prospectus Supplement.

When a Global Security terminates, the Depositary (and not the Corporation or the Trustee) will be responsible for deciding the names of the institutions that will be the initial

direct holders.

15

Events of Default

Unless otherwise indicated in the applicable Prospectus Supplement, the term "Event of Default" with respect to Debt Securities of any

series means any of the following:

-

(a)

-

default

in the payment of the principal of (or any premium on) any Debt Security of that series at its Maturity;

-

(b)

-

default

in the payment of any interest on any Debt Security of that series when it becomes due and payable, and continuance of such default for a period of

30 days;

-

(c)

-

default

in the deposit of any sinking fund payment, when the same becomes due by the terms of the Debt Securities of that series;

-

(d)

-

default

in the performance, or breach, of any other covenant or agreement of the Corporation in the Indenture in respect of the Debt Securities of that

series (other than a covenant or agreement for which default or breach is specifically dealt with elsewhere in the Indenture), where such default or breach continues for a period of 90 days

after written notice thereof to the Corporation by the Trustee or the holders of at least 25 per cent in principal amount of all outstanding Debt Securities affected thereby;

-

(e)

-

certain

events of bankruptcy, insolvency or reorganization; or

-

(f)

-

any