As filed with the Securities and Exchange Commission on April 13, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Globus Maritime

Limited

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of registrant’s name into

English)

|

Republic of the Marshall Islands

|

66-0757368

|

(State or other jurisdiction of incorporation

or

organization)

|

(I.R.S. Employer Identification Number)

|

128 Vouliagmenis Avenue, 3rd Floor

166 74 Glyfada

Athens, Greece

+30 210 960 8300

(Address and telephone

number of Registrant’s principal executive offices)

Watson Farley &

Williams LLP

250 West 55

th

Street, 31

st

Floor

New York, New York 10019

(Name, address, and telephone

number of agent for service)

with copies to:

Steven J. Hollander, Esq.

Watson Farley & Williams LLP

250 West 55

th

Street, 31

st

Floor

New York, New York 10019

(212) 922-2200 (Telephone)

(212) 922-1512 (Facsimile)

Approximate date of commencement of proposed sale to the public: From

time to time after this registration statement becomes effective as determined by market conditions and other factors.

If the only securities being registered on

this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

¨

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box.

x

If this Form is filed

to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a registration

statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with

the Commission pursuant to Rule 462I under the Securities Act, check the following box.

¨

If this Form is a post-effective

amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

¨

CALCULATION OF REGISTRATION FEE

|

Title

of Each Class of

Securities

to be Registered

|

|

Amount

to

be

Registered

|

|

|

Proposed Maximum

Offering Price Per

Share

|

|

|

Proposed

Maximum

Aggregate

Offering

Price

|

|

|

Amount of

Registration

Fee

|

|

|

Secondary Offering

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares, par value $0.004

|

|

|

4,000,000

|

|

|

$

|

3.27

|

(1)

|

|

$

|

13,080,000

|

(1)

|

|

$

|

1,516

|

|

|

Common Shares, par value $0.004 per share, underlying common stock purchase

warrants (2)

|

|

|

32,380,017

|

|

|

$

|

3.27

|

|

|

$

|

105,882,656

|

(3)

|

|

$

|

12,272

|

(2)

|

|

|

1.

|

Estimated solely for the purpose of calculating the registration

fee in accordance with Rule 457(c) under the Securities Act of 1933, as amended. The

price per share and proposed maximum aggregate offering price are based on the average

of the high and low sale prices of the registrant’s common shares on April 12, 2017,

as reported on the Nasdaq Capital Market.

|

|

|

2.

|

Represents common stock issuable upon the exercise (at a price

of $1.60 per share) of outstanding warrants.

|

|

|

3.

|

Estimated solely for the purpose of computing the amount of the

registration fee for the shares of common stock issuable upon exercise of warrants to

be registered in accordance with Rule 457(g) under the Securities Act, based

upon the higher of (i) the price at which the warrants may be exercised or (ii) the Market

Price of the common stock.

|

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment

which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a)

of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange

Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus

is not complete and may be changed. This prospectus is not an offer to sell these securities and it is not soliciting an offer

to buy or sell these securities in any jurisdiction where the offer or sale is not permitted. These securities may not be sold

until the registration statement filed with the Securities and Exchange Commission is effective.

Subject to completion, dated

April 13, 2017

PROSPECTUS

36,380,017

Common Shares

offered by

the Selling Shareholders

The Selling Shareholders listed herein (the

“Selling Shareholders”) or any of their pledgees, donees, transferees or successors in interest, may sell in one or

more offerings pursuant to this prospectus up to 36,380,017 of our common shares, 4 million of which are issued and outstanding

on the date hereof and 32,380,017 of which are issuable upon the exercise of warrants (which if all exercised would result in

gross proceeds to the Company of approximately $51.8 million).

The Selling Shareholders or any of their pledgees,

donees, transferees or successors in interest may sell any or all of these common shares on any stock exchange, market or trading

facility on which the shares are traded or in privately negotiated transactions at fixed prices that may be changed, at market

prices prevailing at the time of sale or at negotiated prices. Information on the Selling Shareholders and the times and manners

in which they or any of their pledgees, donees, transferees or successors in interest may offer and sell our common shares is

described under the sections entitled “Selling Shareholders”, “The Offering”, and “Plan of Distribution”

in this prospectus. We will not receive any of the proceeds from the sale of our common shares by the Selling Shareholders.

Our common shares are listed on

the Nasdaq Capital Market under the symbol “GLBS.” The opening sales price of our common stock on the Nasdaq

Capital Market as of April 12, 2017 was $3.27 per share. There were 27,628,789 of

our common shares outstanding as of April 12, 2017.

An investment in these securities is

speculative and involves a high degree of risk. See the section entitled “Risk Factors” which begins on page

3 of this prospectus, and other risk factors contained in any applicable prospectus supplement and in the documents incorporated

by reference herein and therein.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful

or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is April 13,

2017

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

As permitted under the

rules of the Securities and Exchange Commission, or the Commission, this prospectus incorporates important business information

about us that is contained in documents that we have previously filed with the Commission but that are not included in or delivered

with this prospectus. You may obtain copies of these documents, without charge, from the website maintained by the Commission

at www.sec.gov, as well as other sources. You may also obtain copies of the incorporated documents, without charge, upon written

or oral request to Globus Maritime Limited, 128 Vouliagmenis Avenue, 3rd Floor, 166 74 Glyfada, Athens, Greece, or by telephone

at +30 210 960 8300. See “Where You Can Find Additional Information.”

You should rely only

on the information contained or incorporated by reference in this prospectus. Neither we nor the Selling Shareholders authorize

any person to provide information other than that provided in this prospectus and the documents incorporated by reference. Neither

we nor the Selling Shareholders are making an offer to sell common shares in any state or other jurisdiction where the offer or

sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other

than the date on the front of this prospectus regardless of its time of delivery, and you should not consider any information

in this prospectus or in the documents incorporated by reference herein to be investment, legal or tax advice. We encourage you

to consult your own counsel, accountant and other advisors for legal, tax, business, financial and related advice regarding an

investment in our securities.

Unless otherwise indicated

or unless the context requires otherwise, all references in this prospectus to “Globus,” the “Company,”

“we,” “us,” “our,” or similar references, mean Globus Maritime Limited and, where applicable,

its consolidated subsidiaries. In addition, we use the term deadweight, or dwt, in describing the size of vessels. Dwt expressed

in metric tons, each of which is equivalent to 1,000 kilograms, refers to the maximum weight of cargo and supplies that a vessel

can carry. To the extent the Selling Shareholders transfer our common shares or our warrants and the shares are not unrestricted,

we may add the recipients of those common shares and warrants as Selling Shareholders via a prospectus supplement or post-effective

amendment. Any references to the “Selling Shareholders” shall be deemed to be references to each such additional Selling

Shareholders.

ENFORCEABILITY OF CIVIL LIABILITIES

We are a Marshall Islands

company, and our principal executive office is located outside of the United States, in Greece. Most of our directors, officers

and the experts named in this registration statement and prospectus reside outside the United States. In addition, a substantial

portion of our assets and the assets of certain of our directors, officers and experts are located outside of the United States.

As a result, you may have difficulty serving legal process within the United States upon us or any of these persons. You may also

have difficulty enforcing, both in and outside the United States, judgments you may obtain in United States courts against us

or these persons.

CAUTIONARY STATEMENT REGARDING FORWARD

LOOKING STATEMENTS

This prospectus includes

“forward-looking statements,” as defined by U.S. federal securities laws, with respect to our financial condition,

results of operations and business and our expectations or beliefs concerning future events. Forward-looking statements provide

our current expectations or forecasts of future events. Forward-looking statements include statements about our expectations,

beliefs, plans, objectives, intentions, assumptions and other statements that are not historical facts or that are not present

facts or conditions. Forward-looking statements and information can generally be identified by the use of forward-looking terminology

or words, such as “anticipate,” “approximately,” “believe,” “continue,” “estimate,”

“expect,” “forecast,” “intend,” “may,” “ongoing,” “pending,”

“perceive,” “plan,” “potential,” “predict,” “project,” “seeks,”

“should,” “views” or similar words or phrases or variations thereon, or the negatives of those words or

phrases, or statements that events, conditions or results “can,” “will,” “may,” “must,”

“would,” “could” or “should” occur or be achieved and similar expressions in connection with

any discussion, expectation or projection of future operating or financial performance, costs, regulations, events or trends.

The absence of these words does not necessarily mean that a statement is not forward-looking. Forward-looking statements and information

are based on management’s current expectations and assumptions, which are inherently subject to uncertainties, risks and

changes in circumstances that are difficult to predict.

All forward-looking statements

involve risks and uncertainties. The occurrence of the events described, and the achievement of the expected results, depend on

many events, some or all of which are not predictable or within our control. Actual results may differ materially from expected

results.

In addition, important

factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements

include:

|

|

·

|

general dry

bulk shipping market conditions, including fluctuations in charterhire rates and vessel

values;

|

|

|

·

|

the strength

of world economies;

|

|

|

·

|

the stability

of Europe and the Euro;

|

|

|

·

|

fluctuations

in interest rates and foreign exchange rates;

|

|

|

·

|

changes in

demand in the dry bulk shipping industry, including the market for our vessels;

|

|

|

·

|

changes in

our operating expenses, including bunker prices, dry docking and insurance costs;

|

|

|

·

|

changes in

governmental rules and regulations or actions taken by regulatory authorities;

|

|

|

·

|

potential liability

from pending or future litigation;

|

|

|

·

|

general domestic

and international political conditions;

|

|

|

·

|

potential disruption

of shipping routes due to accidents or political events;

|

|

|

·

|

the availability

of financing and refinancing;

|

|

|

·

|

our ability

to meet requirements for additional capital and financing to grow our business;

|

|

|

·

|

vessel breakdowns

and instances of off-hire;

|

|

|

·

|

potential exposure

or loss from investment in derivative instruments;

|

|

|

·

|

potential conflicts

of interest involving our Chief Executive Officer, his family and other members of our

senior management;

|

|

|

·

|

our ability

to complete acquisition transactions as planned; and

|

|

|

·

|

other important

factors described in “Risk Factors” and in other places incorporated by reference.

|

We have based these statements

on assumptions and analyses formed by applying our experience and perception of historical trends, current conditions, expected

future developments and other factors we believe are appropriate in the circumstances. All future written and verbal forward-looking

statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements

contained or referred to in this section. We undertake no obligation, and specifically decline any obligation, except as required

by law, to publicly update or revise any forward-looking statements, whether as a result of new information, future events or

otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this prospectus might

not occur.

See the sections entitled

“Risk Factors” of this prospectus and in our Annual Report on Form 20-F for the year ended December 31, 2016,

which is incorporated herein by reference, for a more complete discussion of these risks and uncertainties and for other risks

and uncertainties. These factors and the other risk factors described in this prospectus are not necessarily all of the important

factors that could cause actual results or developments to differ materially from those expressed in any of our forward-looking

statements. Other unknown or unpredictable factors also could harm our results. Consequently, there can be no assurance that actual

results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected

consequences to, or effects on, us. Given these uncertainties, prospective investors are cautioned not to place undue reliance

on such forward-looking statements.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

As required by the Securities

Act, we filed a registration statement relating to the securities offered by this prospectus with the Commission. This prospectus

is a part of that registration statement, which includes additional information.

Government Filings

We file annual and special

reports with the Commission. You may read and copy any document that we file and obtain copies at prescribed rates from the Commission’s

Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public

Reference Room by calling 1 (800) SEC-0330. The Commission maintains a website (http://www.sec.gov) that contains reports,

proxy and information statements and other information regarding issuers that file electronically with the Commission. Our filings

are also available on our website at http://www.globusmaritime.gr. The information on our website, however, is not, and should

not be deemed to be, a part of this prospectus.

This prospectus and any

applicable prospectus supplement are part of a registration statement that we filed with the Commission and do not contain all

of the information in the registration statement. The full registration statement may be obtained from the Commission or us, as

indicated below. Documents establishing the terms of the offered securities are filed as exhibits to the registration statement.

Statements in this prospectus or any applicable prospectus supplement about these documents are summaries and each statement is

qualified in all respects by reference to the document to which it refers. You should refer to the actual documents for a more

complete description of the relevant matters. You may inspect a copy of the registration statement at the Commission’s Public

Reference Room in Washington, D.C., as well as through the Commission’s website.

Information Incorporated by Reference

The Commission allows

us to “incorporate by reference” information that we file with it. This means that we can disclose important information

to you by referring you to those filed documents. The information incorporated by reference is considered to be a part of this

prospectus, and certain information that we file later with the Commission prior to the termination of this offering will also

be considered to be part of this prospectus and will automatically update and supersede previously filed information, including

information contained in this document.

The following documents,

filed with or furnished to the SEC, are specifically incorporated by reference and form an integral part of this prospectus:

We are also incorporating

by reference all subsequent Annual Reports on Form 20-F that we file with the Commission and certain reports on Form 6-K that

we furnish to the Commission after the date of this prospectus (if they state that they are incorporated by reference into this

prospectus) until we file a post-effective amendment indicating that the offering of the securities made by this prospectus has

been terminated. In all cases, you should rely on the later information over different information included in this prospectus

or the applicable prospectus supplement.

You should rely only

on the information contained or incorporated by reference in this prospectus and any applicable prospectus supplement. We have

not, and any underwriters have not, authorized any other person to provide you with different information. If anyone provides

you with different or inconsistent information, you should not rely on it. We are not, and any underwriters are not, making an

offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information

appearing in this prospectus and any applicable prospectus supplement as well as the information we previously filed or furnished

with the Commission and incorporated by reference, is accurate as of the dates on the front cover of those documents only. Our

business, financial condition and results of operations and prospects may have changed since those dates.

You may request a free copy of the above mentioned

filing or any subsequent filing we incorporate by reference to this prospectus by writing or telephoning us at the following address:

Globus Maritime Limited

c/o Globus Shipmanagement Corp.

128 Vouliagmenis Avenue

3rd Floor

166 74 Glyfada

Athens, Greece

+30 210 960 8300

Information provided by the Company

We will furnish holders

of our common shares with Annual Reports containing audited financial statements and a report by our independent registered public

accounting firm. The audited financial statements will be prepared in accordance with International Financial Reporting Standards.

As a “foreign private issuer,” we are exempt from the rules under the Exchange Act prescribing the furnishing and

content of proxy statements to shareholders. While we furnish proxy statements to shareholders in accordance with the rules of

the Nasdaq Capital Market, those proxy statements do not conform to Schedule 14A of the proxy rules promulgated under the Exchange

Act. In addition, as a “foreign private issuer,” our officers and directors are exempt from the rules under the Exchange

Act relating to short swing profit reporting and liability.

PROSPECTUS SUMMARY

This summary highlights

information that appears later in this prospectus and is qualified in its entirety by the more detailed information and financial

statements included or incorporated by reference elsewhere in this prospectus. This summary may not contain all of the information

that may be important to you. As an investor or prospective investor, you should carefully review the entire prospectus, including

the section of this prospectus entitled “Risk Factors” and the more detailed information that appears later in this

prospectus before making an investment in our common shares.

Our Business

Our Company

We are an integrated

dry bulk shipping company, providing marine transportation services on a worldwide basis. We own, operate and manage a fleet of

dry bulk vessels that transport iron ore, coal, grain, steel products, cement, alumina and other dry bulk cargoes internationally.

Our Manager also provides ship-management consulting services regarding vessels that we do not own. We intend to grow our fleet

through timely and selective acquisitions of modern vessels in a manner that we believe will provide an attractive return on equity

and will be accretive to our earnings and cash flow based on anticipated market rates at the time of purchase. There is no guarantee

however, that we will be able to find suitable vessels to purchase or that such vessels will provide an attractive return on equity

or be accretive to our earnings and cash flow.

Our operations are managed

by our Athens, Greece-based wholly owned subsidiary, Globus Shipmanagement Corp., which we refer to as our Manager, which provides

in-house commercial and technical management for our vessels. Our Manager has entered into a ship management agreement with each

of our wholly owned vessel-owning subsidiaries to provide services that include managing day-to-day vessel operations, such as

supervising the crewing, supplying, maintaining of vessels and other services, and has also entered into a consultancy agreement

with another ship-management company to consult for such ship-management company

We originally incorporated as Globus Maritime

Limited on July 26, 2006 pursuant to the Companies (Jersey) Law 1991 (as amended), and began operations in September 2006. On

November 24, 2010, we redomiciled into the Marshall Islands. Our common shares trade on the NASDAQ Global Market under the ticker

“GLBS.”

The following table presents information concerning our vessels,

each of which is owned by a wholly owned subsidiary of Globus Maritime Limited. We use the term deadweight ton, or “dwt,”

in describing the size of vessels. Deadweight ton or “dwt” is a unit of a vessel’s capacity for cargo, fuel

oil, stores and crew, measured in metric tons. A vessel’s dwt or total deadweight is the total weight the vessel can carry

when loaded to a particular line.

|

Vessel

|

|

Year

Built

|

|

Flag

|

|

Direct

Owner

|

|

Shipyard

|

|

Vessel Type

|

|

Delivery

Date

|

|

Carrying

Capacity

(dwt)

|

|

m/v

Sun Globe

|

|

2007

|

|

Malta

|

|

Longevity Maritime Limited

|

|

Tsuneishi Cebu

|

|

Supramax

|

|

September 2011

|

|

58,790

|

|

m/v River Globe

|

|

2007

|

|

Marshall Islands

|

|

Devocean Maritime Ltd.

|

|

Yangzhou Dayang

|

|

Supramax

|

|

December 2007

|

|

53,627

|

|

m/v Sky Globe

|

|

2009

|

|

Marshall Islands

|

|

Domina Maritime Ltd.

|

|

Taizhou Kouan

|

|

Supramax

|

|

May 2010

|

|

56,855

|

|

m/v Star Globe

|

|

2010

|

|

Marshall Islands

|

|

Dulac Maritime S.A.

|

|

Taizhou Kouan

|

|

Supramax

|

|

May 2010

|

|

56,867

|

|

m/v Moon Globe

|

|

2005

|

|

Marshall Islands

|

|

Artful Shipholding S.A.

|

|

Hudong-Zhonghua

|

|

Panamax

|

|

June 2011

|

|

74,432

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total:

|

|

300,571

|

Corporate Information

Our executive office

is located at the office of our Manager at 128 Vouliagmenis Avenue, 3rd Floor, 166 74 Glyfada, Athens, Greece. Our telephone number

is +30 210 960 8300. Our registered agent in the Marshall Islands is The Trust Company of the Marshall Islands, Inc. and our registered

address in the Marshall Islands is Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Marshall Islands MH96960. We

maintain our website at www.globusmaritime.gr. Information that is available on or accessed through our website does not constitute

part of, and is not incorporated by reference into, this registration statement on Form F-3.

Recent and Other Developments

On February 8, 2017,

we entered into a Share and Warrant Purchase Agreement (the “SPA”) pursuant to which we sold for $5 million an aggregate

of 5 million of our common shares, par value $0.004 per share and warrants (the “Warrants”) to purchase 25 million

of our common shares at a price of $1.60 per share (subject to adjustment as more fully described herein in “Description

of Capital Stock - Description of the Warrants”) to a number of investors in a private placement. These securities were

issued in transactions exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”).

On February 9, 2017 we

entered into a registration rights agreement with the Purchasers providing them with certain rights relating to registration under

the Securities Act of the Shares and the common shares underlying the Warrants.

In connection with the

closing of the private placement, we also entered into two loan amendment agreements (each, a “Loan Amendment Agreement”)

with each of two of our lenders.

One loan amendment agreement

was entered into by the Company with Firment Trading Limited, a Marshall Islands corporation (“Firment”), a related

party to us (it is an affiliate of our chairman), and the lender of the then outstanding loan in the principal amount of $18,523,787

to the Company (the “Firment Credit Facility”), pursuant to which Firment released (the “Firment Loan Amendment”)

an amount equal to $16,885,000 (but to have an amount equal to $1,638,787 remain outstanding, and to continue to accrue under

the Firment Credit Facility as though it were principal) of the Firment Credit Facility and the Company issued to Firment Shipping

Inc., an affiliate of Firment 16,885,000 common shares (the “Firment Shares”) and a warrant to purchase 6,230,580

common shares at a price of $1.60 per share (subject to adjustment as more fully described herein in “Description of Capital

Stock - Description of the Warrants”) (the “Firment Warrant”, together with Firment Shares, the “Firment

Securities”). Subsequent to the closing of the February 2017 private placement, Globus repaid the outstanding amount on

the Firment Credit Facility in its entirety.

The other loan amendment

agreement was entered into by the Company with Silaner Investments Limited, a Cyprus company (“Silaner”), a related

party to us (it is an affiliate of our chairman), and the lender of the then outstanding loan in the principal amount of $3,189,048

to the Company (the “Silaner Credit Facility”), pursuant to which Silaner agreed to release (the “Silaner Loan

Amendment”) an amount equal to the outstanding principal of $3,115,000 (but to have an amount equal to the accrued and unpaid

interest of $74,048 remain outstanding, and to continue to accrue under the Silaner Credit Facility as though it were principal)

of the Silaner Credit Facility and the Company issued to Firment Shipping Inc., an affiliate of Silaner 3,115,000 common shares

(the “Silaner Shares”) and a warrant to purchase 1,149,437 common shares at a price of $1.60 per share (subject to

adjustment as more fully described herein in “Description of Capital Stock - Description of the Warrants”) (the “Silaner

Warrant”, together with the Silaner Shares, the “Silaner Securities”). Subsequent to the closing of the February

2017 private placement, Globus repaid the outstanding amount on the Silaner Credit Facility in its entirety.

The Warrants, the Firment

Warrant and the Silaner Warrant are each exercisable for 24 months after their respective issuance. We refer to the entry into

the Loan Amendment Agreements and Registration Rights Agreements and the issuances of the 5 million common shares, the Warrants,

Firment Securities, and the Silaner Securities as the “February 2017 Transactions.”

In this Registration

Statement, we are registering for resale (a) 4 million common shares sold in the Private Placement, (b) the 25 million common

shares issuable upon exercise of the Warrants, and (c) 7,380,017 common shares issuable upon exercise of the Firment Warrant and

Silaner Warrant. As of the date hereof, none of the warrants have been exercised.

Under the terms of the

warrants, all Selling Shareholders (other than Firment Shipping Inc., which has no such restriction in its warrants) may not exercise

their warrants to the extent such exercise would cause such Selling Shareholder, together with its affiliates and attribution

parties, to beneficially own a number of common shares which would exceed 4.99% (which may be increased upon no less than 61 days’

notice, but not to exceed 9.99%) of our then outstanding common shares immediately following such exercise, excluding for purposes

of such determination common shares issuable upon exercise of the warrants which have not been exercised. This provision does

not limit a Selling Shareholder from acquiring up to 4.99% of our common shares, selling all of their common shares, and re-acquiring

up to 4.99% of our common shares. We refer to this as the “Blocker Provision”.

The Warrants, Firment

Warrant, and Silaner Warrant all contain a provision whereby the warrant’s holder has the right to a cashless exercise if,

six months after their issuance, a registration statement covering their resale is not effective. If for any reason we are unable

to keep such a registration statement active and our share price is higher than the $1.60 exercise price, we could be required

to issue shares without receiving cash consideration.

In March 2017, we reached

an agreement in principle with DVB Bank SE (which remain subject to definite documentation) to amend the DVB Loan Agreement, including

amendments to relax or waive certain covenants for the period from April 1, 2017 to April 1, 2018 (the “Restructuring period”).

The amendments with respect to the Restructuring Period will be subject to a $1.7 million prepayment by September 2017, which

is the aggregated amount of two quarterly installments for each tranche, and another $1.7 million would be deferred to the balloon

payment of each tranche.

In March 2017, we reached

an agreement in principle with HSH Nordbank AG to amend the HSH Loan Agreement (which remain subject to definite documentation)

including amendments to relax or waive certain covenants of the original loan agreement until April 15, 2018. The Company will

pay in September 2017 $1 million for repayment of debt and the four scheduled principal installments due within 2017, each amounting

to $693,595, will be deferred to the balloon payment. In addition, the Company has undertaken the liability to raise new equity

of at least $1,800,000.

The Offering

Our selling shareholders

named in the table located on page 7 of this prospectus (the “Selling Shareholders”) are offering an aggregate of

36,380,017 common shares, 4 million of which are currently issued and outstanding and 32,380,017 of which are issuable upon the

exercise of currently outstanding warrants, subject to the terms and limitations contained within the Warrants. See “Description

of Capital Stock - Description of the Warrants” on page 10 of this prospectus. We will not receive any proceeds

upon the sale of common shares by the Selling Shareholders, but we will receive the exercise price of $1.60 each time a Warrant

is exercised for cash. See “Use of Proceeds” on page 5 of this prospectus.

RISK FACTORS

Investing in our common

shares involves a high degree of risk. You should carefully consider the risks set forth below and the discussion of risks under

the heading “Item 3. Key Information—D. Risk Factors” in our Annual Report on Form 20-F for the year ended December 31,

2016, filed with the Commission on April 11, 2017, and the other documents that are incorporated by reference in this prospectus.

Please see the section of this prospectus entitled “Incorporation by Reference of Certain Documents.” Any of the following

risks could materially and adversely affect our business, financial condition, results of operations or cash flows. In such a

case, you may lose all or part of your original investment.

Risks Related to this Offering

Our shareholders were significantly diluted

by virtue of the February 2017 transactions and it is unclear whether the full ramification of those transactions have been reflected

in our stock price.

As described above under

the caption “Recent and Other Developments”, in February 2017 we issued in the aggregate 25 million common shares

and warrants to issue an additional 32,380,017 common shares in exchange for $20 million of debt cancellation and $5 million in

cash. Prior to such issuance, a total of 2,627,674 common shares were issued and outstanding. Our share price has not proportionately

decreased to reflect the additional number of common shares that are issued and issuable pursuant to exercise of the Warrants,

and it remains to be seen how the market will perceive this change in our increased number of shares. If the market views these

transactions negatively, our share price could substantially depreciate.

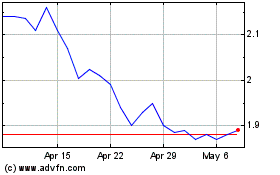

Our stock price has been volatile and no assurance can be

made that it will not substantially depreciate.

As you can see from

our stock price history contained within this prospectus under the caption “Per Share Market Information”, our

stock price has been volatile recently. The closing price of our common shares within the past 18 months has ranged from a

low of $0.30 on January 29, 2016 to a peak of $14.23 on November 16, 2016. Adjusting for the 4:1 stock split we effected on

October 20, 2016, this represents a 1085% increase from January 29, 2016. Our opening stock price as of April 12, 2017 was

$3.27. We can offer no comfort or assurance that our stock price will stop being volatile or not substantially

depreciate.

Our existing shareholders will be diluted each time our outstanding

warrants are exercised.

As of April 12, 2017,

our warrant holders had the right to purchase an aggregate of 32,380,017 common shares. The number of common shares issuable upon

exercise and price of exercise are subject to adjustment as more fully described in “Description of Capital Stock - Description

of the Warrants”. We expect the exercise of such outstanding warrants to dilute the value of our shares.

A substantial number

of common shares are being offered by this prospectus, and we cannot predict if and when the purchasers may sell such shares in

the public markets. Furthermore, in the future, we may issue additional common shares or other equity or debt securities convertible

into common shares in connection with a financing, acquisition, litigation settlement, employee arrangements, or otherwise. Any

such issuance could result in substantial dilution to our existing shareholders and could cause our stock price to decline.

The sale of a substantial amount of our

common shares, including resale of the common shares issuable upon the exercise of the Warrants held by the Selling Shareholders,

in the public market could adversely affect the prevailing market price of our common shares.

The Selling Stockholders

hold outstanding warrants to purchase an aggregate of 32,380,017 common shares at an exercise price of $1.60 per share and 4 million

shares. Both the number of common shares issuable upon exercise of the warrants and the exercise price are subject to adjustment

as more fully described in “Description of Capital Stock - Description of the Warrants”. Sales of substantial amounts

of our common shares in the public market, or the perception that such sales might occur, could adversely affect the market price

of our common shares, and the market value of our other securities.

A substantial number

of common shares are being offered by this prospectus, and we cannot predict if and when the Selling Shareholders may sell such

shares in the public markets. Furthermore, in the future, we may issue additional common shares or other equity or debt securities

convertible into common shares in connection with a financing, acquisition, litigation settlement, employee arrangements, or otherwise.

Any such issuance could result in substantial dilution to our existing shareholders and could cause our stock price to decline.

Certain shareholders hold registration

rights, which may have an adverse effect on the market price of our common shares.

In connection with the

February 8, 2017 transactions, we issued to Firment Shipping Inc. 20 million common shares and warrants to purchase 7,380,017

common shares. Firment Shipping Inc. has the right to register those common shares for resale pursuant to a registration rights

agreement we entered into with its affiliate, Firment Trading Limited. The resale of those common shares in addition to the offer

and sale of the other securities included in this registration statement and prospectus may have an adverse effect on the market

price of our common shares.

Our warrants could have cashless exercise

at our expense if, six months after the warrants were issued, the underlying common shares issuable upon exercise of the warrants

are not registered for sale pursuant to an effective registration statement.

The Warrants, Firment

Warrant, and Silaner Warrant all contain a provision whereby the warrant’s holder has the right to a cashless exercise if,

six months after their issuance, a registration statement covering their resale is not effective. If for any reason we are unable

to keep such a registration statement active and our share price is higher than the $1.60 exercise price, we could be required

to issue shares without receiving cash consideration. As 32,380,017 common shares are issuable upon exercise of the warrants,

this could mean that we issue all such shares but do not receive $51,808,027.20 (which is the $1.60 exercise price multiplied

by 32,380,017), which would dilute our shareholders and likely decrease our share price.

If we are unable to deliver common shares

free of restrictive legends where required by the Share Purchase Agreement and the warrants, we must make whole any purchaser

who loses money by purchasing common shares on the market to complete a trade.

The warrants and SPA

require us, within the later of (a) five full trading days of the exercise of a warrant and (b) three full trading days after

receipt of the purchase price for such exercised warrants, to issue common shares, which, where called for in the warrants and

the SPA, must be free of restrictive legends. We are similarly obligated, where called for pursuant to the terms of the SPA, to

remove restrictive legends from 4 million common shares issued to purchasers in the February 2017 Transactions that are being

registered in this prospectus. If we are unable to deliver proof that the above has occurred when required and if a warrant or

shareholder has traded the common shares that we have failed to deliver unlegended, penalty provisions of the SPA and warrants

require us to make whole any warrant holder or shareholder who loses money by purchasing shares on the common market to complete

its trade. Depending on our share price during this time and the number of shares to which the payments relate, we could be required

to pay a substantial sum.

USE OF PROCEEDS

This prospectus registers

for resale 36,380,017 common shares, of which:

|

|

·

|

4

million have already been issued to the Selling Shareholders, and we will not receive

any proceeds from sales of common shares by the Selling Shareholders.

|

|

|

·

|

Up

to 32,380,017 million are issuable upon the exercise of warrants (upon the conditions

further described in “Description of Capital Stock - Description of the Warrants”).

We will receive $1.60 each time a warrant is exercised (up to a total of approximately

$51.8 million), but we will not receive any proceeds from the sales of these common shares

by the Selling Shareholders.

|

We intend to use any

proceeds received from the exercise of the warrants for working capital and general corporate purposes. We will incur all costs

associated with this registration statement and prospectus (other than underwriting discounts and commissions and any transfer

taxes), which we anticipate to be approximately $50,000.

PER SHARE MARKET PRICE INFORMATION

Since April 11, 2016

our common shares have traded on the Nasdaq Capital Market under the symbol “GLBS”. Prior to April 11, 2016, our common

shares traded on the Nasdaq Global Select Market. You should carefully review the high and low prices of our common shares in

the tables for the months, quarters and years indicated under the heading Item 9. “The Offer and Listing” in

our annual report on Form 20-F for the year ended December 31, 2016, which is incorporated by reference herein.

On October 20, 2016,

we effected a four to one reverse stock split which reduced number of outstanding common shares from 10,510,741 to 2,627,674 shares

(adjustments were made based on fractional shares). The share prices below have been adjusted to reflect the stock split.

The table below sets

forth the high and low prices for each of the periods indicated for our common shares as reported, from April 11, 2016 onwards,

by the NASDAQ Capital Market, and prior to April 11, 2016, from the Nasdaq Global Select Market.

|

Period Ended

|

|

High

|

|

|

Low

|

|

|

|

|

|

|

|

|

|

|

Monthly

|

|

|

|

|

|

|

|

|

|

April 2017

(through and including April 12, 2017)

|

|

$

|

4.96

|

|

|

$

|

3.05

|

|

|

March 2017

|

|

$

|

6.74

|

|

|

$

|

4.32

|

|

|

February 2017

|

|

$

|

9.70

|

|

|

$

|

7.10

|

|

|

January 2017

|

|

$

|

10.77

|

|

|

$

|

3.07

|

|

|

December 2016

|

|

$

|

7.67

|

|

|

$

|

4.08

|

|

|

November 2016

|

|

$

|

14.23

|

|

|

$

|

1.74

|

|

|

October 2016

|

|

$

|

2.84

|

|

|

$

|

1.66

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarterly

|

|

|

|

|

|

|

|

|

|

First Quarter 2017

|

|

$

|

10.77

|

|

|

$

|

3.07

|

|

|

Fourth Quarter 2016

|

|

$

|

14.23

|

|

|

$

|

1.66

|

|

|

Third Quarter 2016

|

|

$

|

3.28

|

|

|

$

|

1.64

|

|

|

Second Quarter 2016

|

|

$

|

5.16

|

|

|

$

|

1.00

|

|

|

First Quarter 2016

|

|

$

|

0.88

|

|

|

$

|

0.24

|

|

|

Fourth Quarter 2015

|

|

$

|

3.96

|

|

|

$

|

0.60

|

|

|

Third Quarter 2015

|

|

$

|

6.32

|

|

|

$

|

3.88

|

|

|

Second Quarter 2015

|

|

$

|

7.60

|

|

|

$

|

4.56

|

|

|

First Quarter 2015

|

|

$

|

10.16

|

|

|

$

|

4.80

|

|

|

|

|

|

|

|

|

|

|

|

|

Yearly

|

|

|

|

|

|

|

|

|

|

2016

|

|

$

|

7.09

|

|

|

$

|

0.20

|

|

|

2015

|

|

$

|

10.16

|

|

|

$

|

0.60

|

|

|

2014

|

|

$

|

17.76

|

|

|

$

|

8.88

|

|

|

2013

|

|

$

|

16.84

|

|

|

$

|

6.80

|

|

|

2012

|

|

$

|

23.08

|

|

|

$

|

5.92

|

|

CAPITALIZATION

The following table sets

forth our capitalization table as of December 31, 2016, on

|

|

·

|

An as Adjusted basis, as of February 9, 2017, to

give effect to the completion of the February 2017 Transactions. In the February

2017 Transactions, an aggregate of 5 million common shares and warrants to purchase

25 million common shares were issued to purchasers for a total of $5 million, and

20

million common shares and warrants to purchase 7,380,017 common shares were issued

to Firment Shipping Inc., an affiliate of two of our lenders (each of which is a

related party to us) in exchange for an aggregate of $20 million in debt

cancellation (an amount of $0.55 million of outstanding debt as of December 31, 2016 was settled in cash). We have assumed no

exercise of

the

warrants

in

the

adjusted

figures below.

|

|

|

|

As of Dec 31,

2016

|

|

|

|

|

Actual

|

|

|

As Adjusted

|

|

|

|

|

(dollars in thousands except

per share

and share data)

|

|

|

Capitalization:

|

|

|

|

|

|

|

|

|

|

Total debt (including

current portion)

|

|

$

|

65,572

|

|

|

$

|

45,022

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred shares, $0.001 par value; 100,000,000 shares authorized, none

issued, actual and as adjusted

|

|

|

—

|

|

|

|

—

|

|

|

Common shares, $0.004 par value; 500,000,000 shares authorized,

2,627,674 shares issued and outstanding actual, 27,627,674 shares issued and outstanding as adjusted (assuming no exercise

of the warrants)

|

|

$

|

10

|

|

|

$

|

111

|

|

|

Additional paid-in capital

|

|

$

|

110,004

|

|

|

$

|

134,903

|

|

|

Accumulated deficit

|

|

$

|

(89,254

|

)

|

|

$

|

(89,254

|

)

|

|

Total shareholders’ equity

|

|

$

|

20,760

|

|

|

$

|

45,760

|

|

|

|

|

|

|

|

|

|

|

|

|

Total capitalization

|

|

$

|

86,332

|

|

|

$

|

90,782

|

|

Other than the adjustments

described above, there have been no significant adjustments to our capitalization since December 31, 2016. This table should be

read in conjunction with the consolidated financial statements and related notes included in our annual report for the year ended

December 31, 2016, on Form 20-F filed with the Commission on April 11, 2017 and incorporated by reference herein.

SELLING SHAREHOLDERS

Based solely upon information

furnished to us by the Selling Shareholders, the following table sets forth information with respect to the beneficial ownership

of our common shares held as of the date of this prospectus (or to be held, as noted below) by the Selling Shareholders. The Selling

Shareholders are offering an aggregate of up to 36,380,017 of our common shares, 4 million of which are outstanding and 32,380,017

of which may be issued upon exercise of warrants that were acquired in private transactions. The Selling Shareholders may sell

some, all or none of their shares covered by this prospectus. The Selling Shareholders may also transfer their warrants. We may

update this table by filing a prospectus supplement in the event the Selling Shareholders transfer their warrants.

Under the terms of the

warrants, all Selling Shareholders (other than Firment Shipping Inc., which has no such restriction in its warrants) may not exercise

their warrants to the extent such exercise would cause such Selling Shareholder, together with its affiliates and attribution

parties, to beneficially own a number of common shares which would exceed 4.99% (which may be increased upon no less than 61 days’

notice, but not to exceed 9.99%) of our then outstanding common shares following such exercise, excluding for purposes of such

determination common shares issuable upon exercise of the warrants which have not been exercised. We refer to this as the “Blocker

Provision”.

The Blocker Provision

does not limit a Selling Shareholder from acquiring up to 4.99% of our common shares, selling all of their common shares, and

re-acquiring up to 4.99% of our common shares. Until the warrants expire or the selling shareholders each exercise and sell all

of their common shares, the calculation of the number of common shares issuable to any Selling Shareholder at any given point

in time will change based upon the total number of common shares outstanding. Accordingly, the table below assumes that the Blocker

Provision does not exist, with the effect that beneficial ownership of the Selling Shareholders is presented (for purposes of

disclosure in this prospectus only) on a fully as exercised basis:

|

Selling Shareholders

|

|

Common

Shares

Prior to the

Offering(1)

|

|

|

Percentage

of Class

(2)

|

|

|

Total

Common

Shares

Offered

Hereby

|

|

|

Percentage

of the

Class

Following

the

Offering (3)

|

|

|

Xanthe Holdings Ltd. (4)

|

|

|

5,750,000

|

(5)

|

|

|

17.2

|

%

|

|

|

5,750,000

|

|

|

|

0

|

%

|

|

JTT Investments Ltd. (6)

|

|

|

6,750,000

|

(7)

|

|

|

20.3

|

%

|

|

|

6,750,000

|

|

|

|

0

|

%

|

|

Aizac Investment Corp. (8)

|

|

|

6,000,000

|

(9)

|

|

|

18.4

|

%

|

|

|

6,000,000

|

|

|

|

0

|

%

|

|

Robelle Holding Co. (10)

|

|

|

10,500,000

|

(11)

|

|

|

28.9

|

%

|

|

|

10,500,000

|

|

|

|

0

|

%

|

|

Firment Shipping Inc. (12)

|

|

|

27,380,017

|

(13)

|

|

|

78.2

|

%

|

|

|

7,380,017

|

|

|

|

57.1

|

%

|

|

|

(1)

|

These figures assume full exercise of each Selling Shareholder’s

warrants (as though the Blocker Provisions were not in effect).

|

|

|

(2)

|

These percentages assume full exercise of each Selling Shareholder’s

warrants (as though the Blocker Provisions did not exist) and without exercise of any

other Selling Shareholder’s warrants.

|

|

|

(3)

|

Assumes that the Selling Shareholder sells all of its common shares

offered hereby.

|

|

|

(4)

|

Xanthe Holdings Ltd. is a British Virgin Islands company with

address at c/o Palm Grove House, P.O. Box 438, Road Town, Tortola, British Virgin Islands.

|

|

|

(5)

|

These 5,750,000 common shares consist of (a) 125,000 common shares

currently issued and (b) 5,625,000 common shares issuable upon exercise of the Selling

Shareholder’s warrant, and assumes that the Blocker Provisions are not in effect.

|

|

|

(6)

|

JTT Investments Ltd. is a British Virgin Islands company with

address at JTT Investments Ltd., Craigmuir Chambers, P.O. Box 71, Road Town, Tortola,

VG1110, British Virgin Islands.

|

|

|

(7)

|

These 6,750,000 common shares consist of (a) 1,125,000 common

shares currently issued and (b) 5,625,000 common shares issuable upon exercise of the

Selling Shareholder’s warrant, and assumes that the Blocker Provisions are not

in effect. On April 10, 2017, JTT Investments Ltd. started the process to transfer 300,000 of its issued common shares, but such transfer

has not yet completed. These 300,000 common shares remain subject to this prospectus unless and until the trade is completed.

|

|

|

(8)

|

Aizac Investment Corp. is a Marshall Islands corporation with

address at Aizac Investment Corp., 10 Skouze Street, 18536, Piraeus, Greece.

|

|

|

(9)

|

These 6,000,000 common shares consist of (a) 1,000,000 common

shares currently issued and (b) 5,000,000 common shares issuable upon exercise of the

Selling Shareholder’s warrant, and assumes that the Blocker Provisions are not

in effect.

|

|

|

(10)

|

Robelle Holding Co. is a Marshall Islands corporation beneficially

owned by Konstantina Feidaki with address at Pallazo Tukelan, Riva Antonio Caccia 3,

6900 Lugano, Switzerland.

|

|

|

(11)

|

These 10,500,000 common shares consist of (a) 1,750,000 common

shares currently issued and (b) 8,750,000 common shares issuable upon exercise of the

Selling Shareholder’s warrant, and assumes that the Blocker Provisions are not

in effect.

|

|

|

(12)

|

Firment Shipping Inc. is a Marshall Islands corporation with

address at 17 Ifigenias street, 2007 Strovolos, Nicosia, Cyprus. Firment Shipping Inc.

is our majority shareholder and is 100% owned by our Chairman Georgios Feidakis. Georgios

Feidakis is the father of our Chief Executive Officer Athanasios Feidakis. The 27,380,017

figure does not include an additional 1,141,517 common shares that Georgios Feidakis

is deemed to own through his control of Firment Trading Limited.

|

|

|

(13)

|

These 27,380,017 common shares consist of 20,000,000 common shares

and 7,380,017 common shares issuable upon exercise of the Firment Warrant and Silaner

Warrant. The only shares being registered in this prospectus are the 7,380,017 common

shares issuable upon exercise of the Firment Warrant and Silaner Warrant. The Firment

Warrant and Silaner Warrant do not contain the Blocker Provision.

|

PLAN OF DISTRIBUTION

The Selling Shareholders

may sell our common shares through underwriters, through agents, to dealers, in private transactions, at market prices prevailing

at the time of sale, at prices related to the prevailing market prices, or at negotiated prices.

In addition, the Selling

Shareholders may sell our common shares included in this prospectus through:

|

|

·

|

a

block trade in which a broker-dealer may resell a portion of the block, as principal,

in order to facilitate the transaction;

|

|

|

·

|

purchases

by a broker-dealer, as principal, and resale by the broker-dealer for its account;

|

|

|

·

|

ordinary

brokerage transactions and transactions in which a broker solicits purchasers; or

|

|

|

·

|

trading

plans entered into by the Selling Shareholders pursuant to Rule 10b5-1 under the Securities

Exchange Act of 1934, as amended, or the Exchange Act, that are in place at the time

of an offering pursuant to this prospectus and any applicable prospectus supplement hereto

that provide for periodic sales of their securities on the basis of parameters described

in such trading plans.

|

In addition, the Selling

Shareholders may enter into option or other types of transactions that require us or them to deliver our securities to a broker-dealer,

who will then resell or transfer the securities under this prospectus. The Selling Shareholders may enter into hedging transactions

with respect to our securities. For example, any Selling Shareholder may:

|

|

·

|

enter

into transactions involving short sales of our common shares by broker-dealers;

|

|

|

·

|

sell

common shares short and deliver the shares to close out short positions;

|

|

|

·

|

enter

into option or other types of transactions that require the Selling Shareholders to deliver

common shares to a broker-dealer, who will then resell or transfer the common shares

under this prospectus; or

|

|

|

·

|

loan

or pledge the common shares to a broker-dealer, who may sell the loaned shares or, in

the event of default, sell the pledged shares.

|

The Selling Shareholders

may also sell shares under Rule 144 under the Securities Act, if available, rather than under this prospectus.

The Selling Shareholders

may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties

in privately negotiated transactions. If the applicable prospectus supplement indicates, in connection with those derivatives,

the third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including in short

sale transactions. If so, the third party may use securities pledged by the Selling Shareholders or borrowed from the Selling

Shareholders or others to settle those sales or to close out any related open borrowings of stock, and may use securities received

from the Selling Shareholders in settlement of those derivatives to close out any related open borrowings of stock. The third

party in such sale transactions will be an underwriter and will be identified in the applicable prospectus supplement (or a post-effective

amendment). In addition, the Selling Shareholders may otherwise loan or pledge securities to a financial institution or other

third party that in turn may sell the securities short using this prospectus. Such financial institution or other third party

may transfer its economic short position to investors in our securities or in connection with a concurrent offering of other securities.

The Selling Shareholders

and any broker-dealers or other persons acting on our behalf or on the behalf of the Selling Shareholders that participate with

the Selling Shareholders in the distribution of the securities may be deemed to be underwriters and any commissions received or

profit realized by them on the resale of the securities may be deemed to be underwriting discounts and commissions under the Securities

Act of 1933, as amended, or the Securities Act. As a result, we have informed the Selling Shareholders, that Regulation M, promulgated

under the Exchange Act, may apply to sales by the Selling Shareholders in the market. The Selling Shareholders may agree to indemnify

any broker, dealer or agent that participates in transactions involving the sale of our common shares against certain liabilities,

including liabilities arising under the Securities Act.

At the time that any

particular offering of securities is made, to the extent required by the Securities Act, a prospectus supplement will be distributed,

setting forth the terms of the offering, including the aggregate number of securities being offered, the purchase price of the

securities, the initial offering price of the securities, the names of any underwriters, dealers or agents, any discounts, commissions

and other items constituting compensation from us and any discounts, commissions or concessions allowed or re-allowed or paid

to dealers. Furthermore, the Selling Shareholders may agree, subject to certain exemptions, that for a certain period from the

date of the prospectus supplement under which the securities are offered, they will not, without the prior written consent of

an underwriter, offer, sell, contract to sell, pledge or otherwise dispose of any of our common shares or any securities convertible

into or exchangeable for our common shares. However, an underwriter, in its sole discretion, may release any of the securities

subject to these lock-up agreements at any time without notice. We expect an underwriter to exclude from these lock-up agreements

securities exercised and/or sold pursuant to trading plans entered into by any Selling Shareholders pursuant to Rule 10b5-1 under

the Exchange Act, that are in place at the time of an offering pursuant to this prospectus and any applicable prospectus supplement

hereto that provide for periodic sales of the Selling Shareholders’ securities on the basis of parameters described in such

trading plans.

Underwriters or agents

could make sales in privately negotiated transactions and/or any other method permitted by law, including sales deemed to be an

at-the-market offering as defined in Rule 415 promulgated under the Securities Act, which includes sales made directly on or through

the Nasdaq Capital Market, the existing trading market for our common shares, or sales made to or through a market maker other

than on an exchange.

As a result of requirements

of the Financial Industry Regulatory Authority, or FINRA, formerly the National Association of Securities Dealers, Inc., the maximum

commission or discount to be received by any FINRA member or independent broker/dealer may not be greater than eight percent (8%) of

the gross proceeds received by the Selling Shareholders for the sale of any securities being registered pursuant to Rule 415 promulgated

by the Commission under the Securities Act. If more than 5% of the net proceeds of any offering of common shares made under this

prospectus will be received by a FINRA member participating in the offering or affiliates or associated persons of such a FINRA

member, the offering will be conducted in accordance with FINRA Rule 5121.

Each Selling Shareholder

represented and warranted to us that it acquired the securities subject to this registration statement with no intent to distribute

the securities.

DESCRIPTION OF CAPITAL STOCK

We refer you to “Item

10. Additional Information B. Memorandum and Articles of Association” contained within our Annual Report on Form 20-F for

the year ended December 31, 2016, which was filed on April 11, 2017 and is incorporated by reference into this prospectus, for

the description of our capital stock.

Transfer Agent

The registrar and transfer agent for our common

shares is Computershare Inc.

Share History

February 2017 Transaction

On February 8, 2017,

we entered into the SPA pursuant to which we sold for $5 million an aggregate of 5 million of our common shares, par value $0.004

per share and Warrants to purchase 25 million of our common shares at a price of $1.60 per share (subject to adjustment as more

fully described herein in “Description of Capital Stock - Description of the Warrants”) to a number of investors in

a private placement. These securities were issued in transactions exempt from registration under the Securities Act.

On February 9, 2017 we

entered into a registration rights agreement with the Purchasers providing them with certain rights relating to registration under

the Securities Act of the Shares and the common shares underlying the Warrants.

In connection with the

closing of the private placement, we also entered into two Loan Amendment Agreements with two lenders.

One loan amendment agreement

was entered into by the Company with Firment, a related party to us (it is an affiliate of our chairman), and the lender of the

outstanding loan in the principal amount of $18,523,787 to the Company, pursuant to which Firment released an amount equal to

$16,885,000 (but to have an amount equal to $1,638,787 remain outstanding, and to continue to accrue under the Firment Credit

Facility as though it were principal) of the Firment Credit Facility and the Company issued to Firment Shipping Inc., an affiliate

of Firment 16,885,000 common shares and a warrant to purchase 6,230,580 common shares at a price of $1.60 per share (subject to

adjustment as more fully described herein in “Description of Capital Stock - Description of the Warrants”). Subsequent

to the closing of the February 2017 private placement, Globus repaid the outstanding amount on the Firment Credit Facility in

its entirety.

The other loan amendment

agreement was entered into by the Company with Silaner, a related party to us (it is an affiliate of our chairman), and the lender

of the outstanding loan in the principal amount of $3,189,048 to the Company, pursuant to which Silaner agreed to release an amount

equal to the outstanding principal of $3,115,000 (but to have an amount equal to the accrued and unpaid interest of $74,048 remain

outstanding, and to continue to accrue under the Silaner Credit Facility as though it were principal) of the Silaner Credit Facility

and the Company issued to Firment Shipping Inc., an affiliate of Silaner 3,115,000 common shares and a warrant to purchase 1,149,437

common shares at a price of $1.60 per share (subject to adjustment as more fully described herein in “Description of Capital

Stock - Description of the Warrants”). Subsequent to the closing of the February 2017 private placement, Globus repaid the

outstanding amount on the Silaner Credit Facility in its entirety.

The Warrants, the Firment

Warrant and the Silaner Warrant are each exercisable for 24 months after their respective issuance. We refer to the entry into

the Loan Amendment Agreements and Registration Rights Agreements and the issuances of the 5 million common shares, the Warrants,

Firment Securities, and the Silaner Securities as the “February 2017 Transactions”.

In this Registration

Statement, we are registering for resale (a) 4 million common shares sold in the Private Placement, (b) the 25 million common

shares issuable upon exercise of the Warrants, and (c) 7,380,017 common shares issuable upon exercise of the Firment Warrant and

Silaner Warrant. As of the date hereof, none of the warrants have been exercised.

On October 20, 2016,

we effected a four to one reverse stock split which reduced number of outstanding common shares from 10,510,741 to approximately

2,627,674 shares (adjustments were made based on fractional shares).

In March 2016, as part

of a settlement with one our lenders, outstanding indebtedness of $15.65 million was released in exchange for $6.86 million of

sale proceeds from the sale of the shares of Kelty Marine Ltd. (the owner of

m/v Energy Globe)

plus overdue interest of

$40,708.

In May 2015, the Company

entered into a Memorandum of Agreement for the sale of

m/v

Tiara Globe

for a sale price of $5.5 million. The book

value of the

m/v

Tiara Globe

as of March 31, 2015 was $13.3 million. The

m/v

Tiara Globe

was delivered

on July 10, 2015, and caused the weighted average age of the fleet to be reduced by 1.7 years. Of the $5.3 million in net proceeds

for the

m/v

Tiara Globe,

approximately $5.0 million were used to pay down existing debt and $0.3 million were used

for general corporate purposes.

Description of the Warrants

The Warrants underlying

25 million of the common shares being registered in this prospectus were issued on February 9, 2017 and have an exercise price

of $1.60 per share. Both the number of shares issuable and the exercise price are subject to adjustments under customary conditions

including share dividends and stock splits, as provided under the terms of the Warrants.

Under the terms of the

Warrants issued pursuant to the SPA, a Selling Shareholder may not exercise the Warrants to the extent such exercise would cause

such Selling Shareholder, together with its affiliates and attribution parties, to beneficially own a number of our common shares

which would exceed 4.99% (which may be increased upon no less than 61 days’ notice, but not to exceed 9.99%) of our then

outstanding common shares following such exercise, excluding for purposes of such determination common shares issuable upon exercise

of the Warrants which have not been exercised. This provision does not limit a Selling Shareholder from acquiring up to 4.99%

of our common shares, selling all of their common shares, and re-acquiring up to 4.99% of our common shares. We refer to this

as the “Blocker Provisions”.

The Warrants were immediately

exercisable upon their issuance and will expire two years after their issuance (February 9, 2019).

The Firment Warrant and

Silaner Warrant, both of which are held by Firment Shipping Inc., together grant Firment Shipping Inc. the right to purchase 7,380,017

common shares at an exercise price of $1.60 per share. Both the number of shares issuable and the exercise price are subject to

adjustments under customary conditions including share dividends and stock splits, as provided under the terms of the Firment

Warrant and Silaner Warrant. The Firment Warrant and Silaner Warrant were immediately exercisable upon their issuance and will

expire two years after their issuance (February 8, 2019). The Firment Warrant and Silaner Warrant contain substantially similar

provisions as the Warrants, but do not contain the Blocker Provisions.

The Warrants, Firment

Warrant, and Silaner Warrant all contain a penalty provision whereby the warrant’s holder has the right to a cashless exercise

if, six months after their issuance, a registration statement covering their resale is not effective. If for any reason we are

unable to keep such a registration statement active and our share price is higher than the $1.60 exercise price, we could be required

to issue shares without receiving cash consideration.

The warrants and SPA