Securities Registration (section 12(b)) (8-a12b)

April 12 2017 - 10:50AM

Edgar (US Regulatory)

As filed with the Securities and Exchange

Commission on April 12, 2017

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-A

For Registration of Certain Classes of Securities

Pursuant to Section 12(b) or 12(g) of the

Securities Exchange Act of 1934

TICC Capital Corp.

(Exact name of registrant as specified

in its charter)

|

Maryland

|

20-0188736

|

|

(State of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

8 Sound Shore Drive, Suite 255

Greenwich, CT

|

06830

|

|

(Address of principal executive offices)

|

(Zip Code)

|

If this Form relates to the registration of a class of securities

pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General Instruction A.(c), check the following box.

x

If this Form relates to the registration of a class of securities

pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d), check the following box.

¨

Securities Act registration statement file number to which this

form relates: 333-202672

Securities to be registered pursuant to Section 12(b) of the

Act:

Title of each class

to be so registered

|

Name of each exchange on

which each class is to be registered

|

|

6.50% Notes due 2024

|

The NASDAQ Stock Market LLC

|

Securities to be registered pursuant to Section 12(g) of the

Act:

None

(Title of class)

INFORMATION REQUIRED IN REGISTRATION STATEMENT

|

|

Item 1.

|

Description of the Registrant's Securities to be Registered

|

This Form 8-A is being

filed in connection with TICC Capital Corp.’s, a Maryland corporation (the “

Registrant

”), offering

of its 6.50% Notes due 2024 (the “

Notes

”). The Notes are expected to be listed on the NASDAQ Global Select

Market and to trade thereon within 30 days of the original issue date under the trading symbol “TICCL.” As of April

12, 2017, the Registrant had sold and issued $64,370,225 in aggregate principal amount of the Notes.

The description of

the Notes is incorporated herein by reference to (i) the information set forth under the heading “Description of Our Debt

Securities” in the Registrant’s prospectus included in Pre-Effective Amendment No. 3 to its Registration Statement

on Form N-2 (Registration No. 333-202672) as filed with the Securities and Exchange Commission (the “

SEC

”)

on January 11, 2017 under the Securities Act of 1933, as amended (the “

Securities Act

”), and (ii) the

information under the headings “Summary of the Specific Terms of the Notes and the Offering” and “Description

of the Notes” in the Registrant’s prospectus supplement dated April 4, 2017, as filed with the SEC on April 5, 2017

pursuant to Rule 497 under the Securities Act. The foregoing prospectus and prospectus supplement are incorporated herein

by reference.

Pursuant to the Instructions as to exhibits

for registration statements on Form 8-A, the documents listed below are filed as exhibits to this Registration Statement:

|

Number

|

|

Exhibit

|

|

4.1

|

|

Form of Base Indenture (Filed as Exhibit d.4 to the Registrant’s Pre-Effective Amendment No. 2 to its Registration Statement on Form N-2 (File No. 333-183605), as filed on January 11, 2013 with the SEC, and incorporated herein by reference).

|

|

|

|

|

4.2

|

|

Form of First Supplemental Indenture relating to the 6.50% Notes due 2024, by and between the Registrant and U.S. Bank National Association, as trustee (Filed as Exhibit d.6 to the Registrant’s Post-Effective Amendment No. 1 to its Registration Statement on Form N-2 (File No. 333-202672), filed on April 12, 2017 with the SEC, and incorporated herein by reference).

|

|

|

|

|

4.3

|

|

Form of Global Note with respect to the 6.50% Notes due 2024 (incorporated by reference to Exhibit 4.2 hereto, and Exhibit A therein).

|

SIGNATURE

Pursuant to the requirements

of Section 12 of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this Registration Statement to

be signed on its behalf by the undersigned, thereto duly authorized.

Date: April 12, 2017

TICC Capital Corp.

By:

/s/ Jonathan H. Cohen

Name: Jonathan H. Cohen

Title: Chief Executive Officer

EXHIBIT INDEX

|

Number

|

|

Exhibit

|

|

4.1

|

|

Form of Base Indenture (Filed as Exhibit d.4 to the Registrant’s Pre-Effective Amendment No. 2 to its Registration Statement on Form N-2 (File No. 333-183605), as filed on January 11, 2013 with the SEC, and incorporated herein by reference).

|

|

|

|

|

4.2

|

|

Form of First Supplemental Indenture relating to the 6.50% Notes due 2024, by and between the Registrant and U.S. Bank National Association, as trustee (Filed as Exhibit d.6 to the Registrant’s Post-Effective Amendment No. 1 to its Registration Statement on Form N-2 (File No. 333-202672), filed on April 12, 2017 with the SEC, and incorporated herein by reference).

|

|

|

|

|

4.3

|

|

Form of Global Note with respect to the 6.50% Notes due 2024 (incorporated by reference to Exhibit 4.2 hereto, and Exhibit A therein).

|

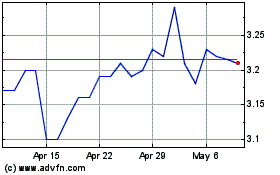

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

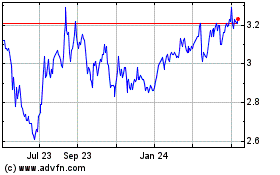

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Apr 2023 to Apr 2024