Invesco Ltd. Announces March 31, 2017 Assets Under Management and Extension of Foreign Exchange Hedges

April 11 2017 - 4:15PM

PR Newswire (US)

ATLANTA, April 11, 2017 /PRNewswire/ -- Invesco Ltd.

(NYSE: IVZ) today reported preliminary month-end assets under

management (AUM) of $834.8 billion, a

decrease of 0.2% month over month. The decrease was driven by lower

Money Market AUM and net long-term outflows, partially offset by

favorable market returns, inflows into PowerShares QQQs and foreign

exchange. FX increased AUM by $0.6

billion. Preliminary average total AUM for the quarter

through March 31st were

$829.8 billion, and preliminary

average active AUM for the quarter through March 31st were $678.4 billion.

Additionally on March 30, Invesco

extended its hedge of approximately 75% of the GBP-based operating

income for each quarter by a half year, through June 30, 2018. This hedge is in the form of

purchased put option contracts set at a strike level of

$1.250 based on the average daily

foreign exchange rate for the applicable time period.

|

Total Assets Under

Management

|

|

(in

billions)

|

Total

|

Equity

|

Fixed

Income

|

Balanced

|

Money

Market

|

Alternatives

|

|

March 31,

2017(a)

|

$834.8

|

$381.8

|

$203.8

|

$48.9

|

$73.1(b)

|

$127.2

|

|

February 28,

2017

|

$836.8

|

$379.6

|

$203.2

|

$48.6

|

$78.0

|

$127.4

|

|

January 31,

2017

|

$825.3

|

$371.3

|

$201.9

|

$47.9

|

$79.4

|

$124.8

|

|

December 31,

2016

|

$812.9

|

$364.1

|

$201.7

|

$46.8

|

$78.3

|

$122.0

|

|

Active

(c)

|

|

(in

billions)

|

Total

|

Equity

|

Fixed

Income

|

Balanced

|

Money

Market

|

Alternatives

|

|

March 31,

2017(a)

|

$680.5

|

$280.6

|

$158.7

|

$48.9

|

$73.1(b)

|

$119.2

|

|

February 28,

2017

|

$682.2

|

$279.9

|

$158.0

|

$48.6

|

$78.0

|

$117.7

|

|

January 31,

2017

|

$675.9

|

$275.8

|

$157.6

|

$47.9

|

$79.4

|

$115.2

|

|

December 31,

2016

|

$668.5

|

$270.6

|

$160.0

|

$46.8

|

$78.3

|

$112.8

|

|

Passive

(c)

|

|

(in

billions)

|

Total

|

Equity

|

Fixed

Income

|

Balanced

|

Money

Market

|

Alternatives

|

|

March 31,

2017(a)

|

$154.3

|

$101.2

|

$45.1

|

$0.0

|

$0.0(b)

|

$8.0

|

|

February 28,

2017

|

$154.6

|

$99.7

|

$45.2

|

$0.0

|

$0.0

|

$9.7

|

|

January 31,

2017

|

$149.4

|

$95.5

|

$44.3

|

$0.0

|

$0.0

|

$9.6

|

|

December 31,

2016

|

$144.4

|

$93.5

|

$41.7

|

$0.0

|

$0.0

|

$9.2

|

|

|

(a) Preliminary –

subject to adjustment.

|

|

(b) Preliminary -

ending money market AUM include $65.2 billion in institutional

money market AUM and $7.9 billion in retail money market

AUM.

|

|

(c) Passive AUM

include ETF's, UIT's, non-fee earning leverage, foreign exchange

overlays and other passive mandates. Active AUM are total AUM

less passive AUM.

|

About Invesco Ltd.

Invesco is an independent

investment management firm dedicated to delivering an investment

experience that helps people get more out of life. NYSE: IVZ;

www.invesco.com.

To view the original version on PR Newswire,

visit:http://www.prnewswire.com/news-releases/invesco-ltd-announces-march-31-2017-assets-under-management-and-extension-of-foreign-exchange-hedges-300438164.html

SOURCE Invesco Ltd.

Copyright 2017 PR Newswire

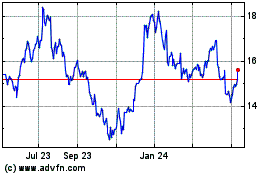

Invesco (NYSE:IVZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

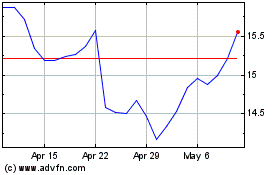

Invesco (NYSE:IVZ)

Historical Stock Chart

From Apr 2023 to Apr 2024